Mr Murray will join the AMP board as chairman after the AMP 2018 annual general meeting on Thursday 10 May, on or before 1 July 2018.

Current executive chairman Mike Wilkins will return to the position of acting chief executive officer on that date.

Mr Murray was the chair of the Financial System Inquiry, which reported to the government in December 2014. He was also the chief executive officer of CBA between 1992 and 2005.

Mike Wilkins said: “We’re delighted to welcome a person of David Murray’s outstanding calibre to the Chairman’s role. His appointment brings strong and experienced leadership to the company, strengthening our governance and our commitment to change.

“David has deep experience of financial services, particularly banking and wealth management, as well as the industry’s regulatory environment through his leadership of the Financial System Inquiry.”

“He brings a strong risk mindset and a clear appreciation of community expectations for AMP as well as the wider financial services industry. This is part of the reset that is necessary for the company and I look forward to working with David, the Board and management to rebuild public confidence in the company and to restore shareholder value,” he said.

David Murray said: “AMP employs almost 6,000 people many of whom are Australians serving its customers across wealth management, superannuation, financial advice, life insurance, asset management and banking.”

“It is a significant financial institution and needs to play a role within the Australian financial system which supports the building of trust and confidence in that system in the community. I look forward to working with the Board and executive management to support AMP’s people in achieving that outcome,” he said.

“As part of this, I am committed to meaningful board renewal but recognise the process must be measured so as to maintain the stability of AMP in the immediate future. Restoring trust and confidence is not easy and does not happen overnight, but I am confident this can be achieved,” Mr Murray said.

Tag: AMP

AMP Says Sorry; But Fees for No Service an “Old Issue”

AMP has published a 28 page response to the issues raised by the Royal Commission. They make the point that the fees for no service issue is old news. In addition, they down play the preparation of a Clayton Utz report into the issue and the firms misleading representations to ASIC.

They did unreservedly apologise for their financial advice failings relating to service delivery to customers and spoke about extensive action aims to ensure these issues “never happen again.”

They did unreservedly apologise for their financial advice failings relating to service delivery to customers and spoke about extensive action aims to ensure these issues “never happen again.”

Fees for no service is old news

The wealth management giant said fees for no service is an industry-wide issue and AMP has been the subject of an ongoing ASIC investigation since 2015. As part of the investigation, extensive details were disclosed to the regulator in October 2017, AMP said.

Fees for no service include instances where AMP charged fees due to an administrative error and through the practice of retaining fees during buy back arrangements known as “ring-fencing” and “the 90-day exception”.

“Between 2010 and 2016, of the 2417 register transactions that took place, 39 were Buyer Of Last Resort (BOLR) transactions which involved application of the 90-day exception,” the AMP submission said.”We have apologised to and refunded the fees to all customers impacted by the 90-day exception. The remediation totalled $850,000. To date, for the broader licensee fees for no service issue, we have remediated 15,712 customers, a total of $4.7 million.”

AMP acknowledged the process has been too slow and is committing additional resources to accelerate remediation.

The Clayton Utz report

AMP has reiterated to the Royal Commission that there is no evidence to suggest its board, including the former chairman and former chief executive, acted inappropriately in relation to the preparation of the a Clayton Utz report into fees for no service.

The board commissioned the report on 5 June 2017. It entailed interviews with 27 current and former employees, and a review of documents, AMP said.

“The report is an uncompromisingly direct 87-page review of the conduct of the advice business in relation to fee for no service matters,” AMP said.

“The board were not aware of the nature and extent of the interaction during the preparation of the report.”

There is also no evidence that Clayton Utz made any changes to the report that it did not agree with or that it did not stand behind the report.

“The extent of interaction between AMP and Clayton Utz has been overstated,” AMP said.

Misleading ASIC

AMP has accepted its communications to ASIC have been misleading. The communications regarded fees of certain customers not being switched off in connection with adviser buy-back arrangements and the 90-day exception.

“AMP accepts that any misrepresentation, even if inadvertent, to ASIC is unacceptable and must be corrected as soon as it becomes apparent. However, the number of separate misrepresentations referred to in the Royal Commission has been overstated,” it said.

“There were seven misrepresentations (in 12 communications). These were not new ‘news’. We had reported them in detail to ASIC in October 2017 and then to the Royal Commission.”

In terms of accountability, AMP pointed to its chief executive and chair stepping down; board directors taking a 25% pay cut for the remainder of 2018; and the strengthening of its advice governance framework in 2017 among other internal measures.

AMP’s Catherine Brenner Has Resigned As Chairman

AMP has announced that Catherine Brenner has resigned as Chairman.

Mr Wilkins will lead the company as Executive Chairman for an interim period while the process for selecting a Chairman, and appointment of an additional new non-executive director, is conducted. This will further strengthen governance and ensure stability while a measured process of board renewal is undertaken. Mr Wilkins will now lead the selection process for a new Chief Executive Officer, which is in progress.

AMP also announces that Group General Counsel and Company Secretary Brian Salter will leave the company. His outstanding deferred remuneration will be forfeited as a result of the Board exercising its discretion.

The Board has received advice from Philip Crutchfield QC, Tamieka Spencer Bruce of Counsel, and Tim Bednall of King & Wood Mallesons in relation to certain issues raised in the Royal Commission concerning the preparation of the Clayton Utz report on AMP’s fee for no service issue. The advice follows the establishment of the Board Committee chaired by Mr Wilkins to examine the issues relating to AMP’s advice business that have been raised in the Royal Commission.

Having considered and assessed the matters, the Board is satisfied that the former Chairman Catherine Brenner, former Chief Executive Officer Craig Meller and the other directors did not act inappropriately in relation to the preparation of the Clayton Utz report.

The Board, including the former Chairman, were unaware of and disappointed about the number of drafts and the extent of the Group General Counsel’s interaction with Clayton Utz during the preparation of the report. The Board commissioned and received the report. It was not a matter for the Board’s approval.

The Board announces the following further actions:

- Recognising collective governance accountability for the issues raised in the Royal Commission and for their impact on the reputation of AMP, the Board is reducing fees for all AMP Limited Board Directors by 25 per cent for the remainder of the 2018 calendar year; and

- The employment and remuneration consequences for the individuals within the business responsible for the fee for no service issue will be determined on finalisation of an ongoing external employment review, which is expected to complete shortly

Catherine Brenner said: “I am honoured to have been Chairman of AMP. I am deeply disappointed by the issues at hand and am particularly concerned for the impact they have had on our customers, employees, advisers and shareholders.

“As Chairman, I am accountable for governance. I have always sought to act in the best interests of the company and have been in discussions with the Board about the most appropriate course of action, including my resignation. The Board has now accepted my resignation as Chairman as a step towards restoring the trust and confidence in AMP.”

Mike Wilkins, Executive Chairman, AMP Limited said: “The Board acknowledges Catherine’s leadership and thanks her for her professionalism, integrity and dedication to the company over the past eight years. We will now begin a process of board renewal, including fast-tracking selection of a Chairman, and a new director. This process will help ensure stability and further strengthen governance.

“AMP respects the Royal Commission process. I can assure you that the evidence and submissions presented by Counsel Assisting are being treated extremely seriously by the Board. Appropriate steps are being taken to address the issues raised, and remediating our customers is being given utmost priority. On behalf of the Board, I reiterate our sincerest apology to our customers, and know we have significant work to do to rebuild their trust.”

AMP will be making a formal submission to the Royal Commission by Friday 4 May in response to the matters raised in closing submissions by Counsel Assisting the Royal Commission.

Shareholder class action looms for AMP

Global litigation firm Quinn Emanuel Urquhart & Sullivan is investigating a class action lawsuit against AMP for shareholder losses following revelations at the royal commission last week.

Giving evidence before the royal commission, AMP head of financial advice Jack Regan admitted his firm lied to ASIC on 20 separate occasions about its practice of providing ‘fees for no service’ to financial advice clients.

Quinn Emanuel has backing from global litigation funding firm Burford Capital for the potential class action.

The class action is open to shareholders who acquired shares between 24 May 2013 and 16 April 2018.

Quinn Emanuel partner Damian Scattini said: “The revelations of AMP’s misconduct are especially upsetting given the people who were hurt – the ordinary Mums and Dads who as shareholders gave AMP one of Australia’s largest shareholder registers, who have now lost their savings due to its dishonesty, and who as customers were charged for services AMP has admitted they never received, all so executives could make hefty bonuses.”

“QE has been investigating AMP’s precipitous share price fall even before the most recent revelations of misconduct, and having Burford, the world’s top litigation finance company, in place as our partner means we’re ready to move quickly on behalf of shareholders,” Mr Scattini said.

Burford managing director Craig Arnott said: “The conduct admitted at the Royal Commission is starkly at odds with AMP’s responsibilities and shareholders’ legitimate expectations, requiring redress so that AMP’s shareholders can recover the value that has been lost.

“Burford is glad to join forces with Quinn’s first-rate team so we can help deliver that result for shareholders, which we hope will be as swift as possible.”

AMP apologises unreservedly and acts to accelerate change

AMP says the company apologises unreservedly for the misconduct and failures in regulatory disclosures in the advice business as revealed in the Royal Commission.

The AMP Limited Board today announces the following actions to accelerate the necessary change within the organisation:

- The Board and the Chief Executive Officer, Craig Meller, have agreed that he will step down from his role with immediate effect.

- Mike Wilkins, a Non-Executive Director on the AMP Limited Board since September 2016 and a former CEO of IAG Limited, has been appointed as acting Chief Executive Officer until the search for the new CEO is completed.

- An immediate, comprehensive review of AMP’s regulatory reporting and governance processes will be undertaken. This work will be overseen by a retired judge or equivalent independent expert who will be appointed imminently.

- A Board Committee has been established to review the issues related to the advice business raised in the Royal Commission. The Committee is chaired by Mike Wilkins and will act with the assistance of external counsel, King & Wood Mallesons.

- The Group General Counsel, Brian Salter, has agreed to take leave while the review is undertaken. David Cullen, AMP General Counsel, Governance has been appointed as acting Group General Counsel.

AMP will be making a submission to the Royal Commission to respond to the issues raised. The submission will, among other matters, address the issue of the independence of the Clayton Utz report.

The Board will withdraw resolution four from its Notice of Meeting to the 2018 Annual General Meeting, which relates to an equity grant for the Chief Executive Officer.

The actions announced today build upon the existing program of work, instigated in 2017. The work underway includes:

- Customer remediation, with the program well progressed and 15,712 customers identified and $4.7 million fees refunded to date.

- An external review to ensure all fee for no service business practices have ceased. This review is now complete and has confirmed that the practices ceased in November 2016.

- An independent investigation into employee conduct. Based on the review’s findings, the Board will determine the employment and remuneration implications for any relevant individuals around the fee for no service matter.

- A review and complete overhaul of governance, systems and processes in the advice business.

- An enterprise-wide cultural audit conducted by an external consultant.

- An enterprise-wide review of risk governance, controls and culture also conducted by an external consultant.

AMP Chairman Catherine Brenner said: “AMP apologises unreservedly for the misconduct and failures in regulatory disclosures in our advice business. The Board is determined that we will meet these challenges head on, accelerating changes in both culture and performance at AMP.

“We have been driving much-needed change and improvement in our advice business, which has undergone significant leadership and governance renewal over the past year but we know we have much more to do to.”

Craig Meller said: “I am honoured to have been the CEO of AMP. I am personally devastated by the issues which have been raised publicly this week, particularly by the impact they have had on our customers, employees, planners and shareholders. This is not the AMP I know and these are not the actions our customers should expect from the company.

“I do not condone them or the misleading statements made to ASIC. However, as they occurred during my tenure as CEO, I believe that stepping down as CEO is an appropriate measure to begin the work that needs to be done to restore public and regulatory trust in AMP.”

Mike Wilkins – biography

Mike Wilkins was appointed to the AMP Limited Board and as a member of its Audit and Risk Committees in September 2016. In May 2017, he became Chairman of the Risk Committee. He was also appointed to the AMP Life Limited and The National Mutual Life Association of Australasia Limited Boards in October 2016.

Mike has more than 30 years’ experience in financial services in Australia and Asia in sectors such as life insurance and investment management. Mike has more than 20 years’ experience as CEO for ASX100 companies. Most recently, he served as Managing Director and CEO of Insurance Australia Group (IAG). He is the former Managing Director and CEO of Promina Group Limited and Tyndall Australia Limited.

Mike is a Fellow of Chartered Accountants Australia and New Zealand and is also a Fellow of the Australian Institute of Company Directors. Mike was made an Officer of the Order of Australia in 2017 for distinguished service to the insurance industry.

730 Does AMP, CBA At The Royal Commission

A segment broadcast 18 April 2018 discussing the issues raised in the inquiry, and shortcomings of the regulator.

More evidence of bankers behaving badly (on purpose) and regulators “asleep at the wheel”.

And remember the number of financial planners continues to increase..

Later in the evening, Matter of Fact went further into the structural issues arising.

More Cultural Badness From The Finance Sector.

Today we take a look at the latest from the Royal Commission into Financial Service Misconduct, which recommenced its hearings yesterday again, with a focus on the Financial Planning Sector.

Financial Advisers provide advice on a range of areas of consumer finance, investing, superannuation, retirement planning, estate planning, risk management, insurance and taxation.

ASIC says between 20 and 40% of the Australian adult population use or have used a Financial Planner. That means that around 2.3 million Australians over 18 received advice. A number of issues have surfaced in recent years, including charging fees for no service, or advice not provided in full, the provision of inappropriate financial advice, as well as improper conduct by financial advisors and the misappropriation of customer’s funds.

There has been massive growth in the number of financial advisers, to more than 25,000 up 41% from 2009. 5,822 Financial Advice licences were issued in Australia to firms able to offer advice. What you may not know is that the top five players in Financial Advice in Australia are the big four banks and AMP, who together have nearly 48% of the $4.6 billion dollars in annual revenue. 30% of advisers work for one of the major banks and 44% work for the top 10 organisations by revenue, so it is very concentrated. Then there is a long tail of smaller organisations with 78% operating a firm with less than 10 advisors. The average advice licence covers 34 individuals operating under it.

There have been a number of significant scandals relating to the provision of financial advice in recent years.

Townsville based Storm Financial encourage investors to borrow against their home to invest in indexed share funds, in a “one size fits all model” of advice. Storm collapsed in 2009 will losses of more than $3 billion dollars. Around 3,000 of its 14,000 clients had suffered significant losses. Many of the investors were retired or about to retire, and with limited assets and income. Some lost their family homes or had to postpone their retirement. The founders were found to have caused or permitted inappropriate advice to be given and had breech their duty of care under the corporations’ act. Specifically, the one size fits all model of advice failed to take into account individual circumstances which led to devastating consequences for the individual investors. They had focused too much on the profitability of the business as opposed to the best interests of individual investors. ASIC worked with a number of major players for customers who had made investments through Storm. CBA undertook to make $136 million dollars in compensation to many CBA customers who borrowed from the bank to invest through Storm and who had suffered financial losses. This is in addition to $132 million CBA paid under the Storm resolution scheme. ASIC looked at settlements distributed by Macquarie Bank to Storm investors leading to a revised agreement where the bank agreed to pay $82.5 million by way of compensation and costs. Bank of Queensland agreed to pay $17 million as compensation for Storm related losses.

The second scandal involved Commonwealth Financial Planning Limited. A whistle-blower revealed allegations of misconduct within CFL to ASIC in 2010. It was suggested that some advisers were encouraging investors to invest in high risk, but profit generating products which were not appropriate. Some were even switching products without the client’s permission. This also included forging client signatures. When the GFC hit in 2008, thousands of CFL clients, many of whom were nearing or in retirement, lost significant amounts as a result of this misconduct. More than $22 million was paid to clients in compensation for receiving inappropriate financial advice from two financial planning advisers. Later it became evident the misconduct was more widespread so CBA implemented a second programme of compensation relating to advice from advisers. Their Open Advice programme had conducted more than 8,600 assessments, of which more than 2,500 required compensations to a total of $37.6 million has been offered.

So turning to the hearings. First up was Peter Kell from ASIC who described the “Fee for no service” problem.

The Future of Financial Advice reforms (FOFA) has tightened the rules, but the fees can be significant. And as we will see, some players simply took the fees to bolster their profits.

Next up was AMP, and we heard over the next day or so of more than 20 occasions when AMP failed in their duty to notify ASIC of a number of potential breaches.

Despite the fact AMP was aware of a range of issues they simply allowed the practices to continue. There was an absence of monitoring activities, what AMP said it was going to do to ASIC, e.g. training for staff in new procedures was different from what they actually did. The issues had been occurring since 2009, and AMP acknowledge that on at least 20 occasions they made false and misleading statements to ASIC about potential breeches.

Worse, the Royal Commission revealed today that AMP’s law firm, Clayton Utz, removed outgoing chief executive Craig Meller’s name from a draft of a critical report about the business.

So once again we see the cultural norms in financial services driving poor behaviour, which may bolster profits but at the expense of their customers, and an apparent willingness to avoid the issues with the regulators. This is shameful, but not surprising.

So we see mismanagement again, and failure of regulation.

We suspect we will see more of the same in the day ahead. Frankly I am not surprised because the cultural norms we see displayed here are precisely the same as were observed in the previous lending related hearings. The quantum of change required within our financial services organisations is profound and I also believe the scope of the Royal Commission should be expanded to include the role and function of our regulators.

Multiple failures are clearly costing households dear. But then the companies seem willing to cop the settlements, and move on, without root cause analysis and fixing the problem. This is not acceptable behaviour in my book and is well below community expectations.

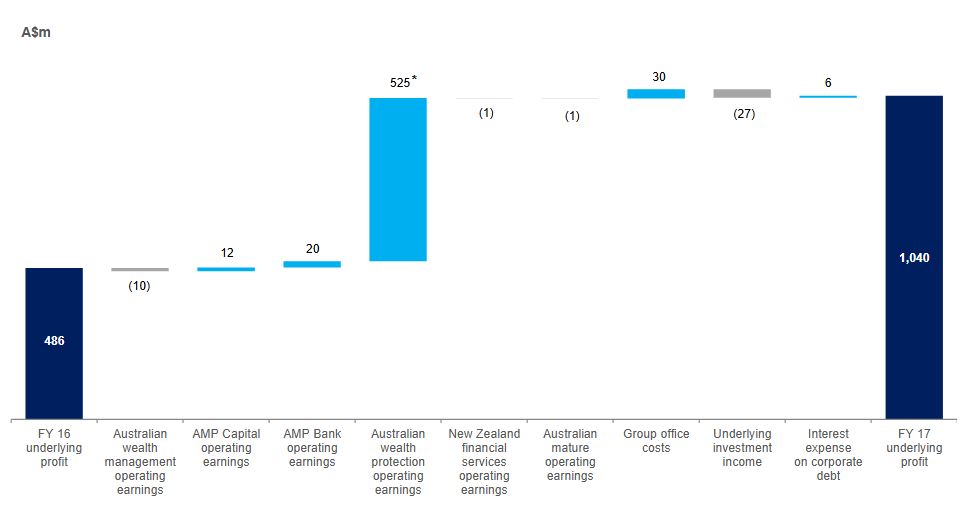

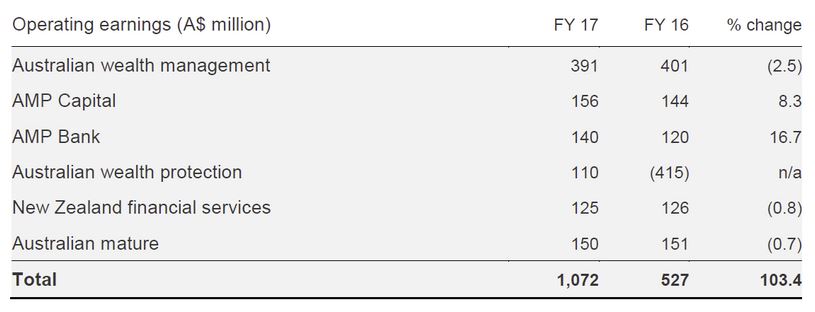

AMP Reports Strong Profit Growth

AMP released their FY17 results, and overall the business has improved results compared with last year. Underlying profit was $1,040 million compared with $486 million last year. Margin in the AMP Bank rose 3 basis points to 1.70%. Note that in FY 16 Australian wealth protection reported $415 million loss, following strengthening of best estimate assumptions. So the like for like comparison is difficult.

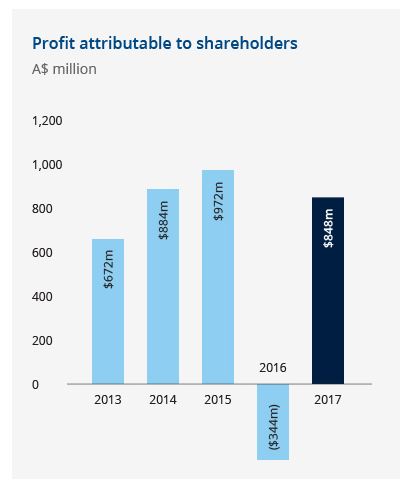

Net profit was $848 million compared with FY 16: -A$344 million.

Net profit was $848 million compared with FY 16: -A$344 million.

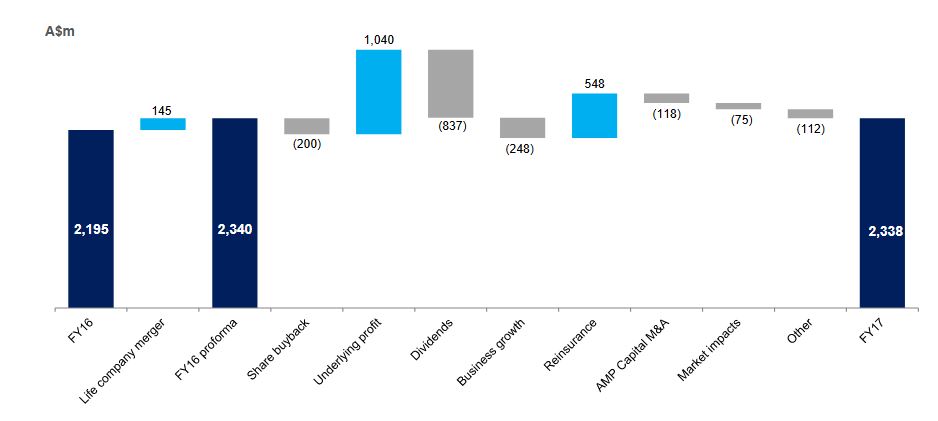

AMP’s capital position remains strong, with level 3 eligible capital resources $2,338 million above minimum regulatory requirements at 31 December 2017, up from $2,195 million at 31 December 2016.

AMP’s capital position remains strong, with level 3 eligible capital resources $2,338 million above minimum regulatory requirements at 31 December 2017, up from $2,195 million at 31 December 2016.

The capital position was strengthened by the second reinsurance program announced at 1H 17. Potential for capital management initiatives will be considered at the conclusion of the portfolio review of AMP’s manage for value businesses. AMP expects to provide a further update at or before its AGM.

The capital position was strengthened by the second reinsurance program announced at 1H 17. Potential for capital management initiatives will be considered at the conclusion of the portfolio review of AMP’s manage for value businesses. AMP expects to provide a further update at or before its AGM.

The final dividend has been maintained at 14.5 cents a share, franked at 90 per cent. The total FY 17 dividend is 29 cents a share and is within AMP’s stated target range of 70 to 90 per cent of underlying profit.

In 2017, AMP announced a strategy to manage its Australian wealth protection, New Zealand and Mature businesses for value and capital efficiency. The completion of a comprehensive reinsurance program of Australian wealth protection, released circa A$1 billion in capital to the group. Disciplined cost management has driven efficiency in New Zealand and Mature. To continue to realise value from these businesses, AMP is well progressed with a portfolio review with all alternatives being considered. As a result, AMP is in discussions with a number of interested parties. While the portfolio review is yet to be concluded, AMP expects to provide a further update at or before its AGM.

Here are the business unit splits.

Australian wealth management

Australian wealth management

Australian wealth management delivered a resilient performance during a period of high margin compression due to final transitions to MySuper. Operating earnings were 2.5 per cent lower at A$391 million. However, strong growth in net cashflows and 10 per cent growth in other revenue from Advice and SMSF demonstrates the underlying growth trajectory of the business.

Net cashflows increased 177 per cent on FY 16 to A$931 million, reflecting significant inflows from discretionary super contributions ahead of 1 July 2017 changes to non-concessional caps. The competitive strength of AMP’s corporate super platform also supported inflows, up A$436 million on FY 16 to A$717 million, with several mandate wins.

North, AMP’s flagship wrap platform, continued to perform with net flows of A$5.7 billion, up 14 per cent on FY 16 and up 28 per cent excluding a one-off significant transfer that occurred in FY 16. Assets under management rose 29 per cent to A$34.9 billion over the same period.

In 2017, AMP paid A$2.5 billion in pensions to support customers in their retirement.

AMP Capital

AMP Capital external net cashflows increased significantly to A$5.5 billion (FY 16: A$967 million), the highest since the establishment of AMP Capital in 2003. Cashflows reflect strong international investor interest in AMP Capital’s fixed income, real estate and infrastructure capabilities. External assets under management fees rose by 6 per cent to A$266 million.

Operating earnings increased 8 per cent on FY 16 to A$156 million driven by growth in fee income and particularly in real assets. Controllable costs increased 5 per cent reflecting investment in real asset capabilities, growth initiatives and international expansion. AMP Capital’s cost to income ratio of 61.5 per cent remains within the full-year target of 60 – 65 per cent.

Direct international institutional clients grew 46 per cent to 291 over the year, with AMP Capital managing A$12 billion in assets on their behalf. During the period, AMP Capital established a partnership with, and purchased a minority stake in, US real estate investor, PCCP. The partnership brings together AMP Capital’s Asian distribution capability with PCCP’s US-based investment expertise.

China Life AMP Asset Management[4] (CLAMP) continues to grow rapidly with AUM increasing 59 per cent to RMB 183.3 billion (A$36 billion) in FY 17, supported by the launch of 25 new products including diversified, equity and fixed income funds. Total AUM for China Life Pension Company, the pensions joint venture in which AMP owns a 19.99 per cent stake, grew 41 per cent to RMB 531 billion (A$104.3 billion).

At 31 December 2017, AMP Capital had A$4.2 billion of committed real asset capital available for investment, up A$700m from 30 June 2017. AMP Capital invested A$5.6 billion in new infrastructure and real estate assets in 2017.

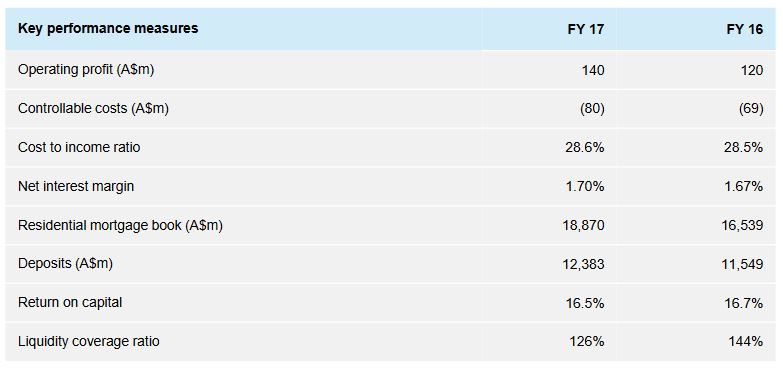

AMP Bank

AMP Bank operating earnings rose 17 per cent to A$140 million (FY 16: A$120 million). Performance was driven by a 14 per cent rise in residential lending to A$18.9 billion underpinned by a conservative credit policy. As expected, loan growth moderated in 2H 17 as the market adjusted to new regulatory requirements.

Controllable costs increased in FY 17, reflecting investment in people and technology to support growth, however, the cost to income ratio remained almost flat at 28.6 per cent (FY 16: 28.5 per cent).

Controllable costs increased in FY 17, reflecting investment in people and technology to support growth, however, the cost to income ratio remained almost flat at 28.6 per cent (FY 16: 28.5 per cent).

Australian wealth protection

Performance in wealth protection stabilised following strengthening of best estimate assumptions and completion of a comprehensive reinsurance program, which occurred in FY 17, effectively reinsuring 65 per cent of AMP’s retail life insurance portfolio. Operating earnings improved to A$110 million in FY 17, with experience largely in line with expectations. Profit margins decreased on FY 16 to A$99 million reflecting the assumption changes and reinsurance program. Focus remains on running an efficient and competitive business while maintaining high levels of customer service. In 2017, AMP paid A$1.1 billion in claims to support customers during their time of need.

New Zealand financial services

Operating earnings, down 1 per cent to A$125 million, reflect the depreciation of the New Zealand dollar relative to the Australian dollar. In NZ$ terms, operating earnings increased 1 per cent to NZ$135 million, driven by higher profit margins and disciplined focus on cost control. AMP New Zealand financial services continues to hold market-leading positions in wealth protection and wealth management, in addition to being one of the largest KiwiSaver providers with NZ$5.1 billion in AUM, an increase of 16 per cent on FY 16.

Australian mature

Operating earnings of A$150 million reflect expected portfolio run-off offset by improved investment markets and favourable annuity experience.

Financial Advice Conflicts Still Exists In Vertically Integrated Firms

An Australian Securities and Investments Commission (ASIC) review of financial advice provided by the five biggest vertically integrated financial institutions has identified areas where improvements are needed to the management of conflicts of interest. 68% of clients’ funds were invested in in-house products.

This highlights the problems in vertically integrated firms, something which the Productivity Commission is also looking at.

The review looked at the products that ANZ, CBA, NAB, Westpac and AMP financial advice licensees were recommending and at the quality of the advice provided on in-house products.

The review was part of a broader set of regulatory reviews of the wealth management and financial advice businesses of the largest banking and financial services institutions as part of ASIC’s Wealth Management Project.

The review found that, overall, 79% of the financial products on the firms’ approved products lists (APL) were external products and 21% were internal or ‘in-house’ products. However, 68% of clients’ funds were invested in in-house products.

The split between internal and external product sales varied across different licensees and across different types of financial products. For example, it was more pronounced for platforms compared to direct investments. However, in most cases there was a clear weighting in the products recommended by advisers towards in-house products.

ASIC noted that vertical integration can provide economies of scale and other benefits to both the customer and the financial institution. Consumers might choose advice from large vertically integrated firms because they seek that firm’s products due to factors such as convenience and access, and recommendations of ‘in-house’ products may be appropriate. Nonetheless, conflicts of interest are inherent in vertically integrated firms, and these firms still need to properly manage conflicts of interest in their advisory arms and ensure good quality advice.

ASIC will consult with the financial advice industry (and other relevant groups) on a proposal to introduce more transparent public reporting on approved product lists, including where client funds are invested, for advice licensees that are part of a vertically integrated business. ASIC noted that any such requirement is likely to cover vertically integrated firms beyond those included in this review. The introduction of reporting requirements would improve transparency around management of the conflicts of interests that are inherent in these businesses.

ASIC also examined a sample of files to test whether advice to switch to in-house products satisfied the ‘best interests’ requirements. ASIC found that in 75% of the advice files reviewed the advisers did not demonstrate compliance with the duty to act in the best interests of their clients. Further, 10% of the advice reviewed was likely to leave the customer in a significantly worse financial position. ASIC will ensure that appropriate customer remediation takes place.

Acting ASIC Chair Peter Kell said that ASIC is already working with the major financial institutions to address the issues that have been identified in the report on quality of advice and management of conflicts of interest.

‘There is ongoing work focusing on remediation where advice-related failures have led to poor customer outcomes, and the results of this review will feed into that work,’ said Mr Kell.

ASIC is already working with the institutions to improve compliance and advice quality through action such as:

- improvements to monitoring and supervision processes for financial advisers; and

- improvements to adviser recruitment processes and checks.

ASIC will continue to ban advisers with serious compliance failings.

ASIC highlighted that the findings from this review should be carefully examined by other vertically integrated firms. ‘While this review focused on five major financial services firms, the lessons should be considered by all vertically integrated firms in the financial services sector.’

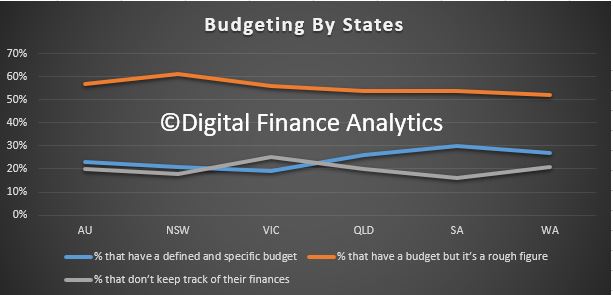

Do Households Budget?

Recent research by AMP has found three quarters of Australians will be starting the year without a defined and specified budget, which will make sticking to our new financial goals tricky.

Whilst around half of households do some rough calculations, one fifth do not track spending at all, and this is true across all age bands and states. Our own surveys suggest that half of all mortgage holders do not budget effectively.

Michael Christofides, Director of Retail Solutions at AMP Bank, said the findings are worrying as budgeting is a critical part to achieving financial security.

“Knowing what you earn, owe and spend gives your greater control over your money and lets you quickly identify areas where you could be saving.

“The problem is that many people mistakenly think they are too busy to budget.

“But perhaps this is because many of us are still using back of the envelope and time-consuming techniques to try and track our finances.”

According to AMP’s research, over a third of Aussies (34 per cent) believe budgeting is too much effort and almost one in five Aussies (19 per cent) say budgeting takes too much time.Even if we do start off the year with good intentions – sitting down and creating an initial budget – over a quarter (27 per cent) of us won’t end up sticking to it.

The research also showed that regularly checking our bank accounts (47 per cent), paper (28 per cent) and excel (20 per cent) were the main ways we keep track of our budgets.

Mr Christofides said, “In this era of smart banking applications, Aussies don’t need to be spending time hunched over an excel spreadsheet – not when an application or smart bank account can do all the work for you with far greater accuracy, giving you far greater control.”

So maybe this year, if we are to meet our financial New Year’s resolutions, we should look to use technology to help us. Not only will it take away the time and effort of budgeting, it will help us to achieve our financial goals and resolutions in 2018.