More finance is not the answer to driving growth harder. This was the essence of a striking keynote by Dr Andreas Dombret, Member of the Executive Board of the Deutsche Bundesbank, at the Harvard Law School Symposium on Building the Financial System of the 21st Century: An Agenda for Europe and the US. He argues that new approaches to monetary policy are required and we need to move beyond finance-led growth emerged as the dominant political strategy in the 1980s.

2016 marks the 30th anniversary of the Program on International Financial Systems. That’s about the age when young people begin to realise that smoking, drinking and working late hours won’t leave their physique unscathed. Bad habits, happily ignored in younger years, catch up with them eventually. Some of us probably know what I am talking about.

You could say that today’s global economy has reached a similar point in its life. But it would be 38 today, having turned 30 back in 2008 when the financial crisis was raging. At that time, the global economy did realise that excess was detrimental to its long-term health. Now the world economy is eight years older – but is it also eight years wiser? In other words, have we cut back enough on our bad habits to thrive for another four or five decades? Or are we still leading a life of excess that will prove costly for tomorrow’s financial health?

In my remarks today, I will argue that we have not yet done enough to adapt. For the global economy to become healthy and prosperous again – and to stay that way – we need to adapt our policy habits. We have to move towards a more sustainable mix: fewer painkillers, less wine, more healing and greater abstinence.

2. Stricken by two illnesses at once

Our subject, the world economy, is still struggling to adapt to the new realities of being “thirtysomething”. It is stricken by two illnesses simultaneously.

The first is the result of the excessive lifestyle it led before the crisis. I’m referring to the overblown financial system and the extreme leveraging, which created a lasting liability in the shape of mountains of debt. It was this excessive leveraging which paved the way to the financial crisis. During the crisis itself, it was plain to see that leverage levels needed to be lowered, especially in the financial sector. But precious little headway has been made in this regard, leaving us with an unstable financial system.1

The second ailment is that global economic growth has been stubbornly stagnant over the past seven years.2 Most policy responses to the crisis have sought to put output levels and growth back on track. Yet growth has been stuck in the doldrums in most advanced countries.

Thus, the global economy has been stricken by both stagnating growth and excessive levels of debt. These twin illnesses are very difficult to treat – especially so given that it is not entirely clear what exactly is behind the growth problem. Is it the unhealthy lifestyle of excessive finance, or is it another, more fundamental condition? Or could it be a more complex complaint in which stifling debt and low growth fuel each other in a vicious circle?

3. Financial painkillers aren’t the cure

How are we supposed to treat these twin illnesses? Finance-led growth emerged as the dominant political strategy in the 1980s. That meant financial deregulation was high on the agenda to foster financial development, and monetary policy was used to counter financial turmoil.

In fact, monetary policy created a high degree of stability during the spell known as the “Great Moderation”, which ran from the 1980s until 2007. This episode was characterised by gratifyingly low volatility in growth and inflation rates. That outcome can still be regarded as a good thing. And many attribute it, at least in part, to systematic monetary policymaking by central banks. This, however, came at a price. Monetary expansion drove liquidity levels higher, which in turn facilitated balance sheet expansion and excessive risk-taking.

In the words of Ben Bernanke, “for the most part, financial stability did not figure prominently in monetary policy discussions during [the Great Moderation].”

Given this experience, a doctor treating a patient with these symptoms would stop prescribing painkillers. But as it turned out, the monetary “medication” actually started to be expanded in 2008. First via ultra-low interest rates, then through quantitative easing, followed, more recently, by even more monetary measures aimed at kick-starting inflation and the economy.

The liquidity provided stabilised the financial system, but it also inflated asset prices. The aftermath of the expansionary monetary policymaking before the crisis should serve as a reminder not to make the same mistake twice. Providing an endless flow of liquidity as a kind of painkiller does nothing to tackle the root cause of the economic challenges we are facing.

The second painkiller frequently administered to support financial development in the pre-crisis era was deregulation and a “light touch” in regulation and supervision. The idea behind this approach was that lenience would fuel increased investment. Unfortunately, it inflated the credit bubble.

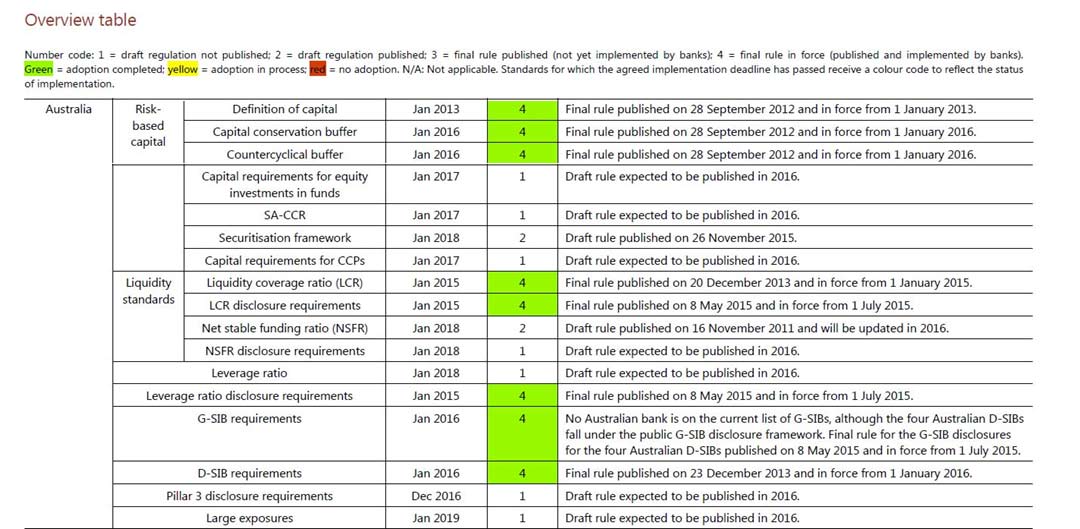

Solid regulation and responsible supervision is the key to limiting future bubbles. Yes, we’ve already achieved a great deal since the crisis – Basel III and TLAC at the global level; Dodd-Frank in the US; the banking union in the euro area. And some are saying we’ve already gone too far. The evidence, however, tells a different story: it is higher standards that strengthen credit intermediation and economic development. That’s something worth remembering in the face of what are, intuitively, compelling claims about capital costs. These claims have been discredited by the experience gained during the crisis and by empirical evidence.

In sum, these policies did not constitute a sustainable lifestyle, nor did they deliver a systematic cure. Rather, they turned out to be painkillers. So the big question I’m asking myself is this: should we carry on treating the symptoms by taking more and more painkillers – or should we look for a fundamental change of lifestyle that might cure the underlying problems?

4. Finance is no panacea for growth

Put differently, do we need to treat the global economy with more monetary and financial stimulus? And, more fundamentally, do we need more finance to fix our economy?

For over three decades, the simple answer was “the more, the better”. And scientific evidence supported this intuition. Studies showed that financial development corresponded strongly with economic growth. Politically, there was a clear preference for finance-led growth. Thus, deregulation was high on the agenda.

I won’t remind you where all this led. We just need to remember the tremendous costs for banks and for society at large that followed the burst of the last credit bubble.

Moreover, recent scientific evidence based on historical data reveals that there is indeed such a thing as too much finance. Financial depth starts having a negative effect on output growth when credit to the private sector reaches 100 per cent of GDP. Most advanced countries far exceeded this level prior to the financial crisis – and continue to do so.

Thus, the diagnosis for advanced economies like the EU und the US is that increasing financial intermediation is beneficial, but only up to a point. This point has been exceeded in most developed economies.

5. What’s the right medicine? Fewer painkillers, a better cure

What’s the takeaway from all this? It’s that more finance is not the solution to our current problems.

Sticking to the simple “more finance, more growth” trajectory isn’t a sustainable solution. That would run the risk of focusing on what is currently our most pressing problem – lifting growth expectations – at the expense of our long-term – and fundamental – goal of achieving a stable financial system. And by doing that, we would also sacrifice sustainable growth.

Most doctors would probably agree that a sophisticated course of treatment aimed at the patient’s long-term wellbeing is better than a box of painkillers every week. But ask them what exactly they would prescribe, and the result will probably be rather like asking several economists for macroeconomic policy advice. You might end up with more treatment plans than you have doctors – or patients for that matter.

What we need is less, and better finance – finance that serves the real economy and sustainable development. How do we achieve that? There are several angles to that question, but the ones I would like to emphasise are financial regulation and supervision, and monetary policy.

As I said earlier, providing a flow of liquidity as a monetary painkiller does nothing to tackle the root causes of the economic challenges we are facing. In the absence of economic progress on the structural front, monetary easing is not the key to a sustainable economy. It does, however, affect financial stability, given that it can fuel bubbles. Therefore, we need to look for an exit strategy. It is important for central banks to think hard about how they intend to achieve an exit as soon as economic conditions make it viable to do so.

From a more general angle, integrating financial stability considerations into monetary policy while maintaining the primacy of the price stability goal will be a key challenge for the future. I welcome the fact that central banks are moving in that direction.

Rock-solid regulation and responsible supervision is likewise indispensable for a stable financial system. Over and above the progress we have made since the crisis erupted, there are three more steps we need to take. First, we must credibly implement the agreed reforms – for example, the new bail-in instruments need to be credible so that politicians do not pre-empt the bail-in during times of crisis. Zombie banks should not be kept alive for political reasons. Uncertainty over the bail-in instruments will only exacerbate market uncertainty.

Second, supervision must be steadfast. Either banks are capable of managing their risks adequately, or supervisors must force them to do so – or, ultimately, they must take disciplinary measures. As such, it is up to a supervisor to increase an individual institution’s capital requirements, if need be. At the same time, however, we must be careful that risky activities do not move to unregulated areas.

Finally, we must not discontinue our reform efforts prematurely. We need to put an end to the privileged treatment of sovereign exposures. We must regulate shadow banking. And we must finalise Basel III in a sound manner. Yes, there has been a commitment to not raise capital requirements significantly on average, as the Basel Committee and the G20 have clarified. But several German banks, for example, have already lifted their regulatory equity by more than 100 per cent between December 2010 and June 2015 – that’s an increase from 58 billion to 118 billion euros. So we have already achieved a substantial increase in capital. But make no mistake: high-risk portfolios will end up with higher requirements. Moreover, a pledge to not significantly increase capital requirements certainly doesn’t mean that requirements will fall back to their low pre-crisis levels.

The bottom line is this: we must not lapse back into bad old habits when we’re finalising, implementing and enforcing the reforms aimed at restoring financial stability. Financial intermediation is important for our advanced economies. But if it’s not or insufficiently regulated, it can do more harm than good. That should be borne in mind in each and every decision we take.

But talking about rules and their enforcement is one thing – they will only lead to better finance if banks and investors change their behaviour accordingly. Banks, especially European ones, have to adapt their business models. They need to set themselves sustainable profit targets which do not undermine ethical behaviour.

Without a doubt, such financial policies need to be complemented by fundamental economic policy reforms. But I’m certain that sound financial and monetary policy will be a cornerstone of a stable financial system that serves the development of the real economy over the long term.

6. Conclusion

Esteemed colleagues

We are facing two challenges simultaneously: to reanimate economic growth, and to build a sustainable financial system that is fit for the 21st century.

I am convinced that our policies need to set their sights on a long-term solution – a lasting cure, if you will, not an endless supply of painkillers. We should not turn a blind eye to the short-term challenges we face, of course. But what we must do is refrain from solutions that encourage excessive indebtedness. Finance will be an important ingredient in the cure for growth – but it will need to be of a better quality, not a greater quantity.