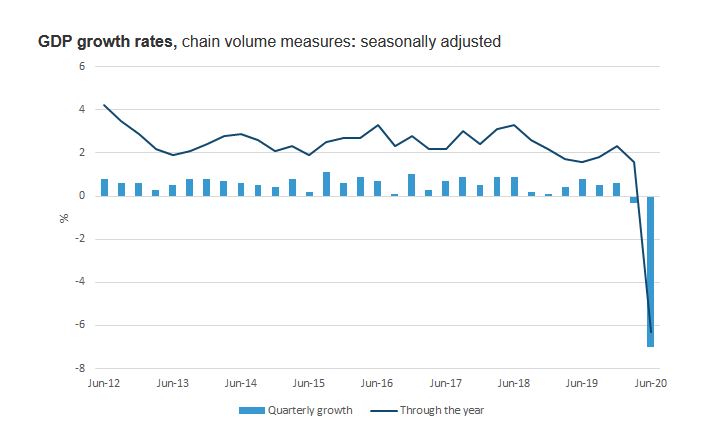

Well, now we know, according to official data Australian households are faring worse than the broader economy and are mired in recession. The Australia’s economy slowed in the final three months of last year, growing 0.2%, easing from an upwardly revised 0.3% in the prior quarter, and below expectations. From a year earlier, the economy grew 1.5% and this annual result was the weakest, outside the pandemic, since the final quarter of 2000 and below the decade average of 2.4%.

Wednesday’s data showed government spending and private business investment were the main drivers of growth, outpacing household consumption. Government spending was driven by “benefits for households, with more spending on medical products and services and higher employee expenses across commonwealth departments,” the ABS, said. A referendum for an Indigenous advisory body to Parliament “held during the quarter also contributed to the rise in employee expenses.”

The more important per capita measure, (activity divided by population) showed that the per capita recession deepened as higher rates and rising living costs dragged on household spending, despite record migration for a fourth consecutive quarter. In per person terms, GDP fell 0.3% from the third quarter and was 1% lower than a year earlier, the deepest downturn, also outside of the Covid-era, since 1991. Real per capita household final consumption plunged by 2.5% in 2023,

Inflation continued to impact most goods and services. The consumer price index rose 0.6 per cent in the December quarter and was up 4.1 per cent in the past 12 months. This was the smallest quarterly rise since March quarter 2021. Insurance got more expensive, as higher insurance premiums sent prices up 3.8 per cent. Increased tobacco taxes saw the price of cigarettes up 7.0 per cent.

Wage reviews pushed wage growth higher. The wage price index rose 0.9 per cent during the quarter and 4.2 per cent over the year. This was the highest recorded annual growth since the March quarter 2009. Public sector wages grew 1.3 per cent on the back of new workplace agreements, including those for teachers and nurses.

The labour market started to slow. Job vacancies fell slightly by 0.7 per cent during the quarter but remained high. The unemployment rate inched up reaching 3.9 per cent in the month of December, as participation rates stayed close to record highs.

Labour productivity rose again. We worked similar hours to last quarter, with the amount of time we spent at work remaining historically high. Overall labour productivity rose 0.5 per cent during the quarter, which was the second successive quarterly rise following a period of falling labour productivity. While the increase pushed labour productivity back to late 2019 levels, the RBA has warned that growth must be sustained at an annual rate of about 1 per cent to prevent current rates of wage growth from fuelling high inflation. NAB group chief economist Alan Oster said the strength of the underlying pace of productivity growth remained uncertain.

One of the biggest pressures on household budgets is personal income tax, which ate up a record 16.5 per cent of earnings over the past year as wage inflation pushed workers into higher tax brackets. Because tax brackets are not indexed to inflation, increases in nominal wages lead to increases in average taxes, since a greater proportion of a worker’s pay is pushed into the highest bracket applicable to them.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/