Fitch says that competitive lending, high house prices and low interest rates did not benefit residential mortgage performance in 4Q14, with the delinquencies in the Dinkum RMBS index increasing by 7bp to 1.15%. However, overall performance was better than a year earlier when the 30+ days delinquency ratio was 1.21%.

Fitch believes that in the current low-interest rate environment, rising unemployment will be a key driver of mortgage performance in 2015, as indicated by the 90+ days arrears increase by 3bp to 0.50% despite the strong housing market.

Self-employed and non-conforming borrowers continue to benefit from the strong Australian economy, appreciating housing market and competitive lending environment. Low-documentation (low-doc) loans are usually provided to self-employed borrowers and tend to experience four to five times the level of full-documentation (full-doc) loan delinquencies. The low-doc Dinkum Index worsened by 14bp down to 4.91%, which is better in relative terms compared to the 7bp decrease among full-doc loans.

Non-conforming loans, which are usually provided to borrowers that have an adverse credit history or do not conform to Lenders Mortgage Insurer’s (LMI) standards, continue to show strong resilience with 30+ days arrears improving to 6.70% in December 2014, down from 6.85% in September 2014. Repayment rates in the non-conforming segment have increased to pre-2008 levels, driven by refinancing in the currently competitive lending environment.

Australian house prices gained 7.9% year-on-year at December 2014. This was predominantly driven by increases in Sydney and Melbourne’s property prices. High property prices have benefited LMI claims as it reduced the likelihood of a principal shortfall on defaulted loans. In 4Q14, the Dinkum LMI payment ratio was 95.2%, compared to 93.6% in 3Q14, with an average 4Q14 LMI claim of AUD71,498, below the average cumulative LMI claim of AUD73,097.

A stable Australian economy, low interest rates, and appreciating housing market have assisted mortgage performance. Fitch expects the current rate of property price growth to be unsustainable in the long term, unless household income increases. The agency believes unemployment rate and house prices are key drivers of 90+ days arrears in the current low interest rate environment. The agency expects that the seasonal Christmas spending will be offset by the February 2015 interest-rate cut and the temporary reduction in petrol prices, in turn resulting in stable 1Q15 arrears.

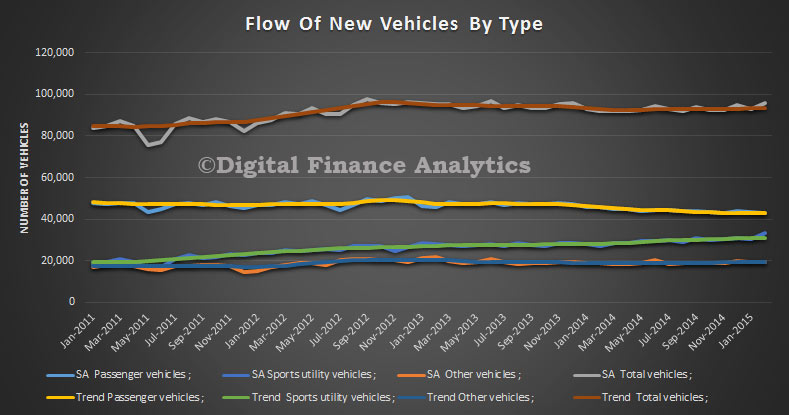

Five of the eight states and territories experienced an increase in new motor vehicle sales when comparing February 2015 with January 2015 in trend terms. Tasmania recorded the largest percentage increase (1.7%), followed by Queensland (0.6%) and both Victoria and South Australia (0.3%). Over the same period, Western Australia, the Northern Territory and the Australian Capital Territory all recorded decreases in sales of 0.3%.

Five of the eight states and territories experienced an increase in new motor vehicle sales when comparing February 2015 with January 2015 in trend terms. Tasmania recorded the largest percentage increase (1.7%), followed by Queensland (0.6%) and both Victoria and South Australia (0.3%). Over the same period, Western Australia, the Northern Territory and the Australian Capital Territory all recorded decreases in sales of 0.3%.