The Monetary Policy Framework

Earlier this week, the Treasurer and I released an updated Statement on the Conduct of Monetary Policy. These statements – the first of which was released in 1996 – record the common understanding between the Reserve Bank and the Government on key aspects of Australia’s monetary and central banking policy framework. They also set out agreed arrangements that promote the transparency and accountability of the Bank.

Over recent times, there has been quite a lot of public commentary in Australia and elsewhere about monetary policy frameworks. As you would expect, we are always studying the various arguments and have followed the recent debate carefully.

Our view is that a flexible medium-term inflation target remains the right monetary policy framework for Australia. This was reaffirmed in the new Statement on the Conduct of Monetary Policy, which has also been endorsed by the Reserve Bank Board. The goal remains for CPI inflation to average between 2 and 3 per cent over time.

The current framework was introduced in the early 1990s and has served Australia well. It provides the community with a reasonable degree of certainty about how the average level of prices is likely to change over the medium term. This helps people when making decisions about their savings and investments. Low and stable inflation remains an important precondition for strong and sustainable growth in employment and incomes.

It is worth emphasising that ever since the adoption of the current framework, the Reserve Bank has been a proponent of what is known as flexible inflation targeting. We have not seen our job as always keeping inflation tightly in a narrow range. We have not been what some have called ‘inflation nutters’. We have had a more balanced perspective, recognising that some degree of variability in inflation from year to year is both inevitable and appropriate.

In particular, a flexible medium-term target is the best way for us to deliver low and stable inflation in a way that contributes to our other broad responsibilities, including employment and preserving financial stability. We want to ensure that we deliver an average rate of inflation in Australia of between 2 and 3 per cent over time. It is in the public interest that we do this. It is also in the public interest that we pursue this objective in a way that promotes good employment outcomes for the country and preserves financial stability. In this way, we can best contribute to the economic prosperity and welfare of the Australian people as required by the Reserve Bank Act.

Our judgement, then, is that a flexible medium-term inflation target remains the right monetary policy framework for Australia. While there are arguments for other types of arrangements, none of them is sufficiently strong to move away from the current framework, which has helped promote stability and confidence in the Australian economy.

So the new Statement on the Conduct of Monetary Policy represents continuity with the previous Statement. The main drafting change is to make the link between monetary policy and financial stability a little more direct. In the previous Statement, monetary policy and financial stability were dealt with in separate parts of the document. Yet, over the years, financial stability considerations have been a factor in our monetary policy deliberations. Recently, for example, we have considered that a very quick return of inflation to the 2 to 3 per cent range at the cost of a material deterioration in the health of private sector balance sheets was unlikely to be in the public interest. The revised drafting recognises that our inflation target is pursued in the context of the Bank’s broader objectives, including financial stability.

Recent Economic Developments

I would now like to turn to the recent economic data.

Our economy continues its transition following the boom in commodity prices and mining investment. According to the latest national account, GDP increased by 3.3 per cent over the year to June. This was a better outcome than was widely expected a year ago. It is also a little above most estimates of trend growth in our economy. Partly reflecting this above-trend growth, the unemployment rate has declined by around ½ percentage point over the past year. Again, this is a better outcome than was thought likely a year ago.

As is always the case, these aggregate outcomes mask significant variation across industries and regions. Those parts of the economy that benefited most from the resources boom are now experiencing difficult conditions, while other areas are doing considerably better. In these other areas, business conditions have improved, employment has increased and there are some signs of a modest pick-up in private investment.

Overall, the economy is adjusting reasonably well to the unwinding of the biggest mining investment boom in more than a century. This is a significant achievement. We are managing this adjustment partly because of the flexibility of the exchange rate and the flexibility of wages and through the support provided by monetary policy.

The story on income growth has been less positive, with growth in nominal GDP being disappointing. Over the past five years, nominal GDP has increased at an average rate of around 3 per cent per year. To put this number in context, between 2000 and 2007, nominal GDP grew at an average rate of 7½ per cent per year. This is quite a change. It goes some way to explaining the sense of disappointment in parts of the community about recent economic outcomes.

The main reason for the weak income growth over recent times is the large fall in the prices received for our exports. Since the September quarter 2011, export prices have fallen by around one-third. This fall, though, does need to be kept in perspective. Export prices remain considerably higher than they were in the 1990s and early 2000s, relative to the price of our imports. And of course, some of the fall in prices is because of increased production from Australia. So while we are receiving lower prices for our exports, we are selling more.

The recent news on commodity prices has been a bit more positive than it has been for a while. Over the past couple of months, the prices of some of our key exports have risen, partly in response to production cutbacks by high-cost producers elsewhere in the world. While it is difficult to predict the future, if these increases were to be sustained then we could look forward to the drag on national income from falling commodity prices coming to an end.

A second factor that has weighed on growth in nominal GDP is the slow rate of wage increases. This is a common experience across most industrialised countries at present, even those with strong employment growth. In Australia, the current rate of wage growth is the slowest in around two decades. It is part of the adjustment following the resources boom. Importantly, it means that many more people have jobs than would otherwise have been the case.

The low wage growth and lower commodity prices have meant that CPI inflation has been quite low over recent times. Inflation has also been held down by increased competition in parts of retailing and cost reductions in some supply chains. Slow growth in rents has also played a role.

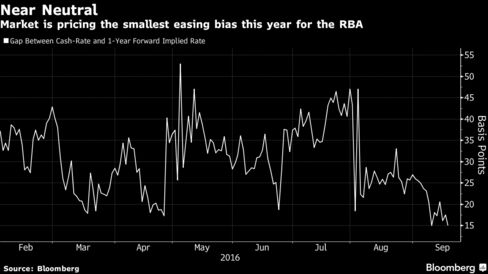

The low inflation outcomes have provided scope for monetary policy to provide additional support to demand. The Reserve Bank Board decided to reduce the cash rate by 25 basis points in May and again in August this year. Lending rates have come down as a result. Deposit rates have, of course, also come down. The Board is very conscious that this means lower interest income for savers. Overall though, our judgement is that this easing in monetary policy is supporting jobs and economic activity in Australia, and thus improving the prospects for sustainable growth and inflation outcomes consistent with the medium-term target.

Looking forward, we expect the economy to continue to be supported by low interest rates and the depreciation of the exchange rate since early 2013. Importantly, the drag from the fall in mining investment will also come to an end. While mining investment still has some way to fall, our estimate is that around three-quarters of the total decline is now behind us.

Inflation is expected to remain low for some time, but then to gradually pick up as labour market conditions strengthen further.

One issue that has attracted a lot of attention of late is the housing market. The construction cycle has a bit more momentum than we expected earlier. This is adding to the supply of housing in the country, which partly explains the slow growth in rents. The rate at which established housing prices are increasing has also moderated, although there remain some pockets where prices are increasing briskly. Credit growth and turnover in the housing market are also lower than they were a year ago. Under APRA’s guidance, lending standards have also been tightened. Overall, then, the situation is somewhat more comfortable than it was a year ago, although we continue to watch things carefully.

If I could now turn to the international environment.

The overall picture is as it has been for some time. The global economy is continuing to expand, but at a rate a little below average. Growth in global trade and investment is subdued. Inflation is also generally low and below most central bank targets. And interest rates in many countries are still very low.

One issue that continues to attract a lot of attention is the global monetary environment.

As we have talked about on previous occasions, at the global level there has been a very heavy reliance on monetary policy to stimulate growth. Some central banks have taken extraordinary actions, including large-scale money creation and setting negative policy interest rates. This has had global ramifications. While these actions have generally not been taken with the direct intention of influencing exchange rates, they have, inevitably, affected international capital flows and exchange rates. We have seen the effects here in Australia. The monetary expansion elsewhere and the low rates on offer overseas have meant that foreign investors have found Australian assets, with their relatively higher returns, attractive. In this way, what is happening elsewhere affects us here in Australia.

In the past 24 hours, there have been much-anticipated policy meetings by the Bank of Japan and by the Federal Reserve in the United States. These meetings followed a reassessment in markets about the potential for further stimulus from some major central banks, which saw bond yields rise from their historically low levels. In the event, the Bank of Japan and the Federal Reserve did not make material changes to their policy stances. In both cases, policy remains highly accommodative. The Federal Reserve’s statement did note, though, that the case for an increase in the federal funds rate had strengthened.

Another area that continues to be watched closely is the unfolding transition in the economy of our largest trading partner, China.

As we have discussed previously, growth in China has slowed as China too makes a difficult economic transition: in its case, from growth being driven by large investments in industrial capacity and property to a more consumption-focused and service-based economy. China is also dealing with the consequences of a large build-up of debt in the private and state-owned business sectors. Overall, the latest available data suggest that there has not been a major interruption to growth, although this is partly because the economy is being supported by fiscal policy, including expenditure on infrastructure. So the Chinese authorities face a difficult trade-off: measures to address industrial overcapacity and high debt levels are necessary over the longer term, but are not helpful in the short term. We all have a strong interest in them managing this trade-off smoothly.