Today’s video post discusses the implications of the latest official lending data and announced rate rises.

Month: August 2018

Credit Momentum Eases – RBA

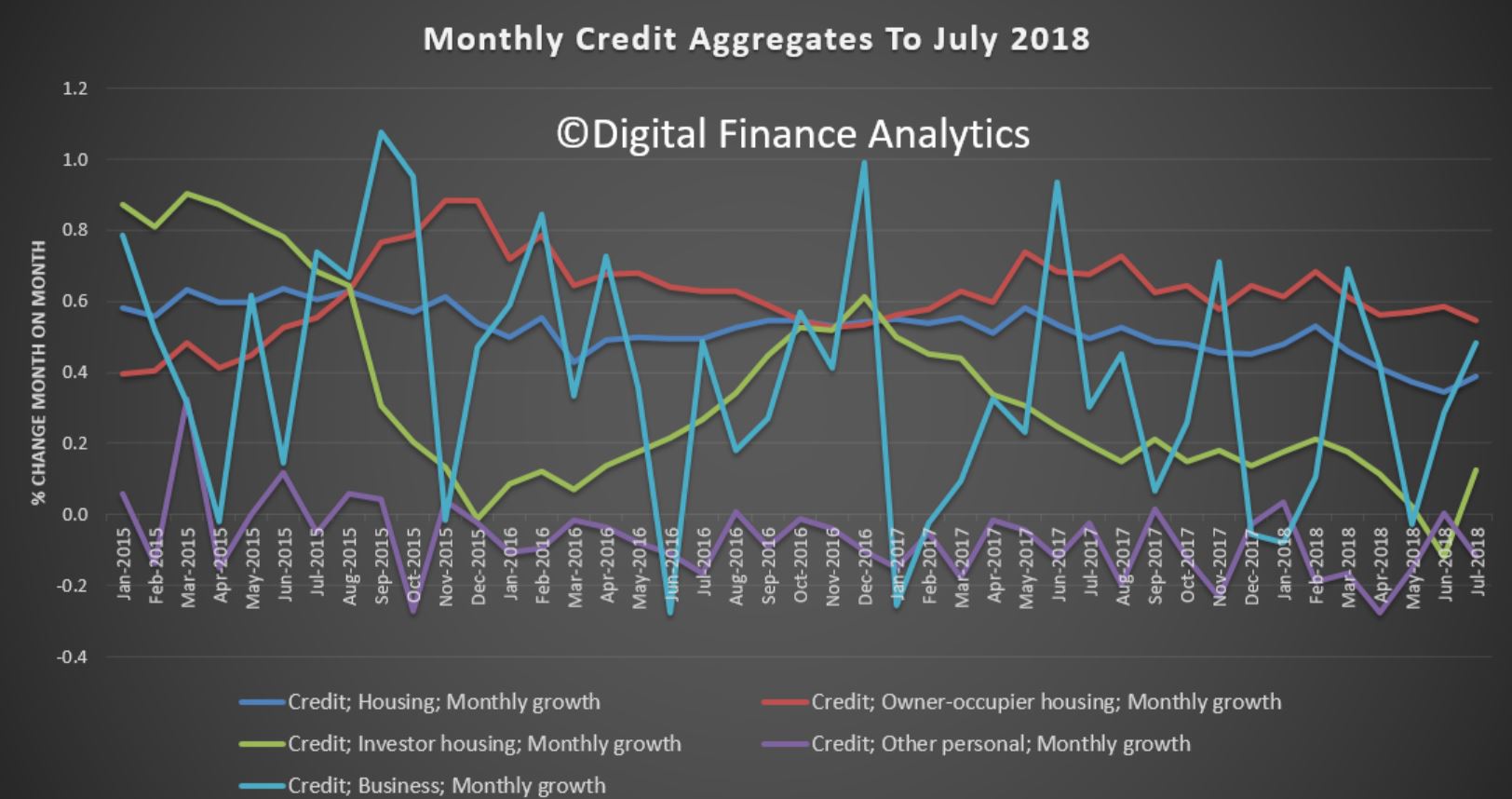

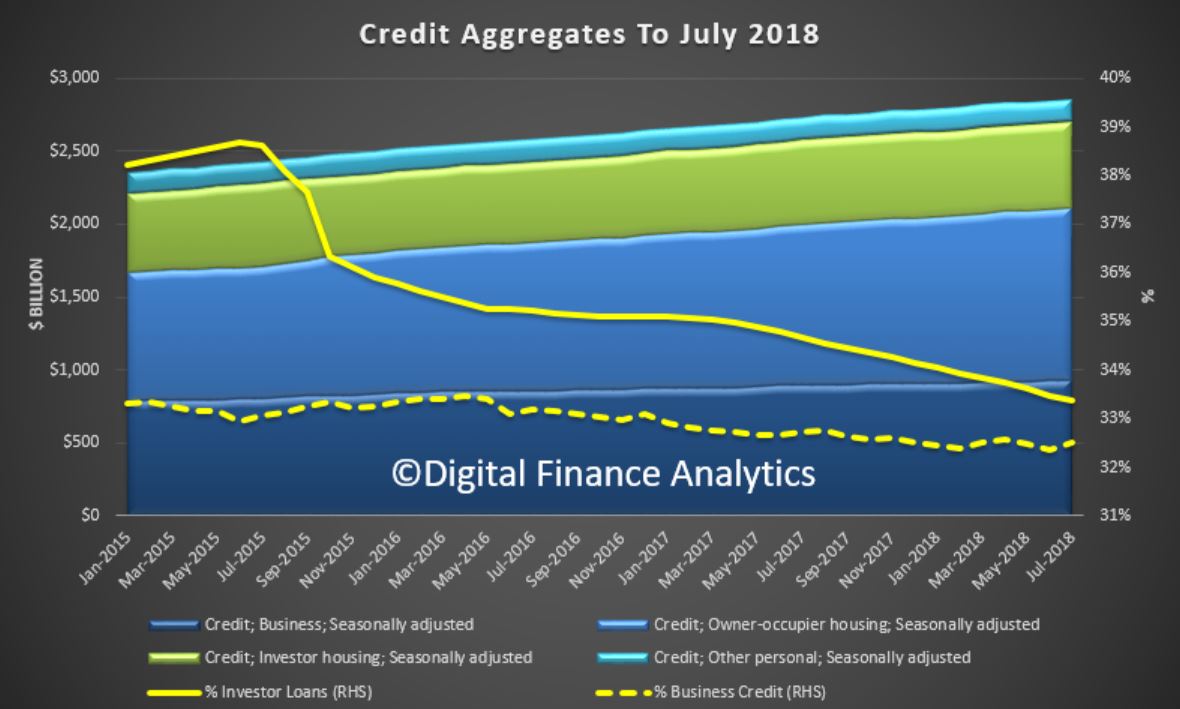

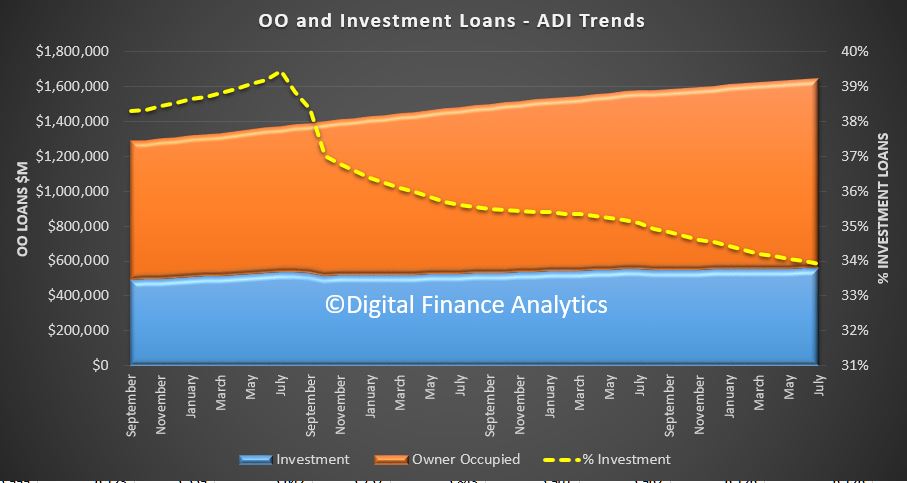

The monthly RBA credit aggregates for July are out today. Total credit for housing rose 0.2% in the month, to $1.77 trillion, with owner occupied credit up 0.5% to $1.18 trillion and investment lending down 0.1% to $593 billion. Investment housing credit fell to 33.4% of the portfolio, and business credit was 32.5%.

Interestingly the RBA’s seasonally adjusted numbers lifted credit growth from the non-adjusted set, but we are skeptical of these adjustments, given the current abnormal conditions in the market (especially taking into account the APRA data today).

Interestingly the RBA’s seasonally adjusted numbers lifted credit growth from the non-adjusted set, but we are skeptical of these adjustments, given the current abnormal conditions in the market (especially taking into account the APRA data today).

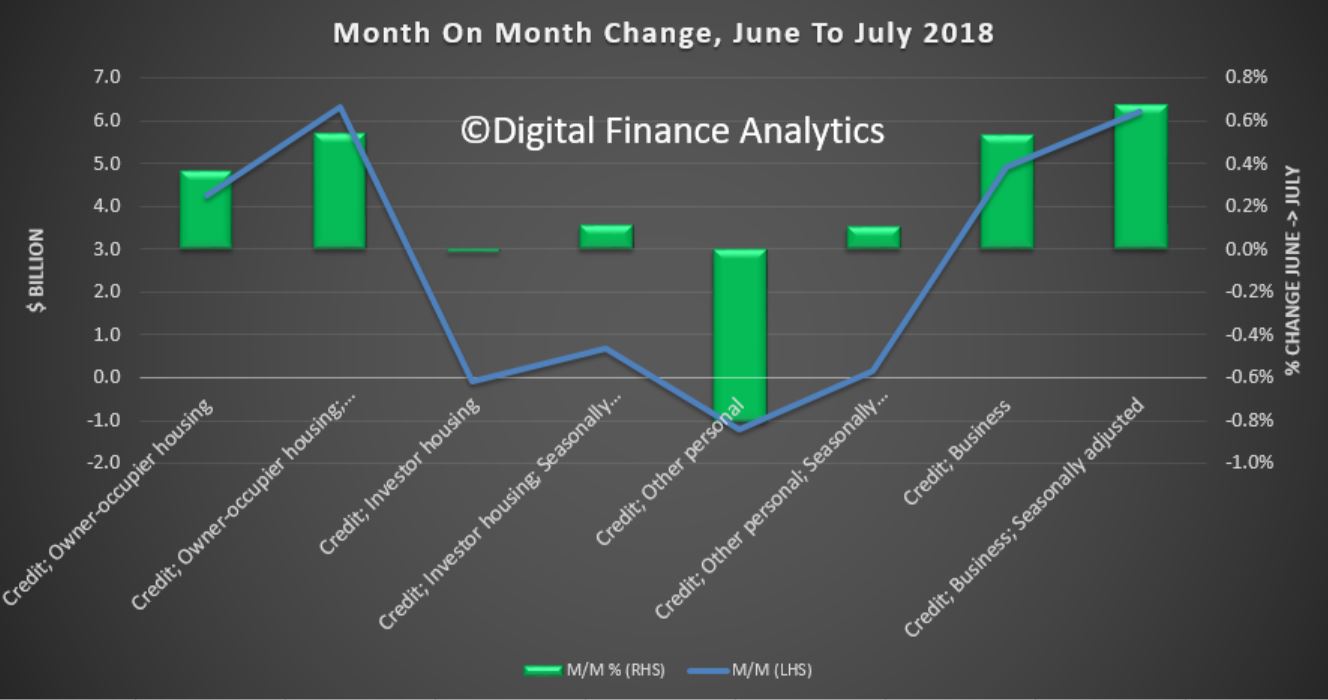

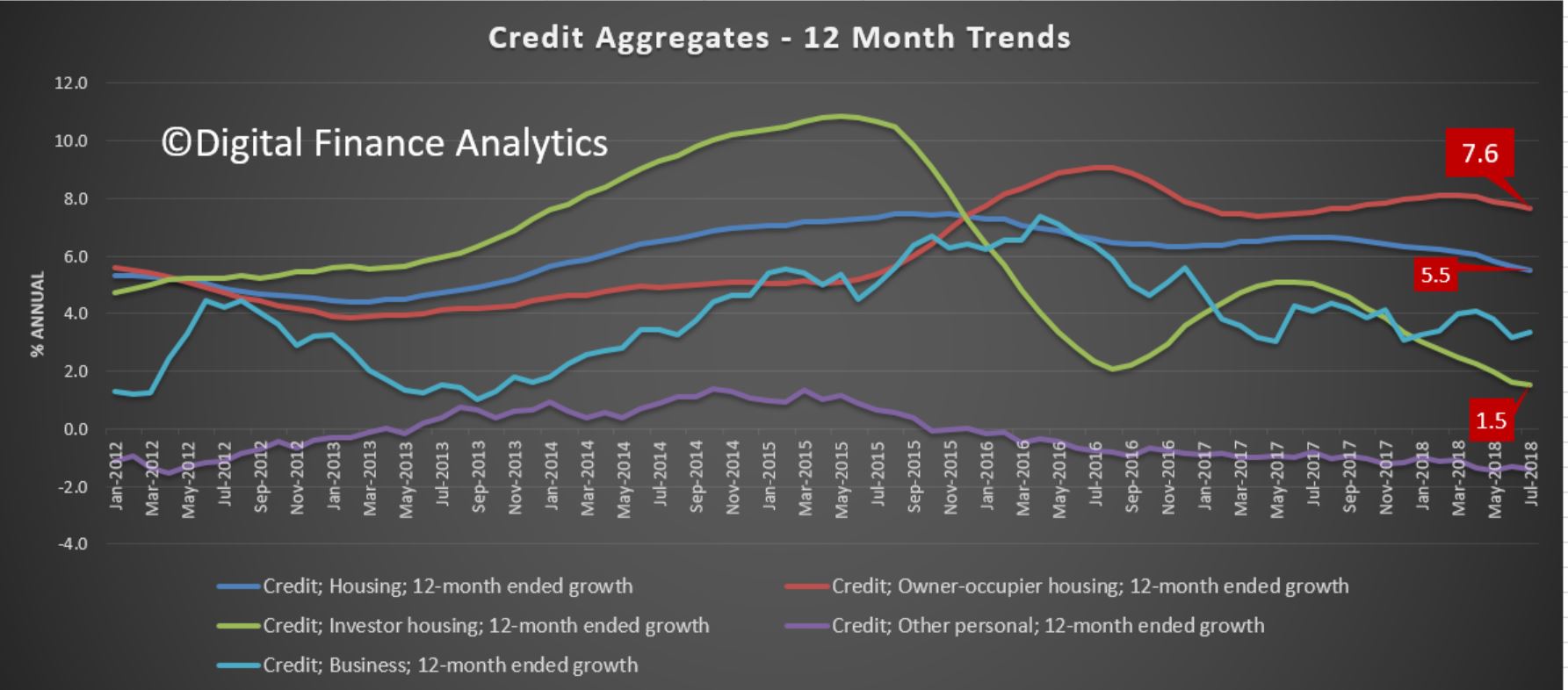

That said, the trends tell the story, with the noisy monthly chart

That said, the trends tell the story, with the noisy monthly chart

less easy to read than the annual charts. Owner occupied housing is growing at 7.6%, investment housing at 1.5% and overall housing at 5.5%.

We still see some growth in the non-bank sector, and this month the RBA reported NO switching between investment and owner occupied loans.

We still see some growth in the non-bank sector, and this month the RBA reported NO switching between investment and owner occupied loans.

So overall, the credit tightening continues to bite and investors are at the sharp end. No reason to think this will change, as it is driven by more responsible lending practices.

More Lenders Hike Mortgage Rates

Now Westpac has broken the dam, others are following, as expected. More will follow, especially late on a Friday afternoon…

Both regional banks, Suncorp and Adelaide Banks said that “challenging” market conditions have forced them to hike rates on variable rate mortgages across both owner-occupied and investor mortgage products by as much as 40 basis points.

Both regional banks, Suncorp and Adelaide Banks said that “challenging” market conditions have forced them to hike rates on variable rate mortgages across both owner-occupied and investor mortgage products by as much as 40 basis points.

Suncorp says rates on all variable rate home and small business loans will rise by 17 basis points and 10 basis points respectively, from September 14.

Adelaide Bank says rates for eight products across its range of principal and interest and interest-only owner-occupied and investor products will apply from September 7. Specifically, principal and interest-owner occupied and investment variable loans will be increasing by 12 basis points, interest-only owner occupied and residential investment loans will rise by 35 basis points and 40 basis and interest-only investment loans settled before January 1 will be increased by 12 basis points.

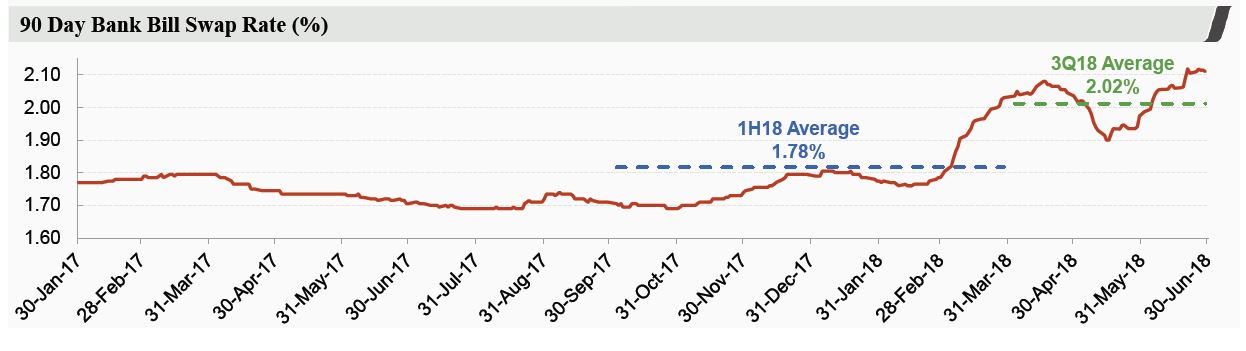

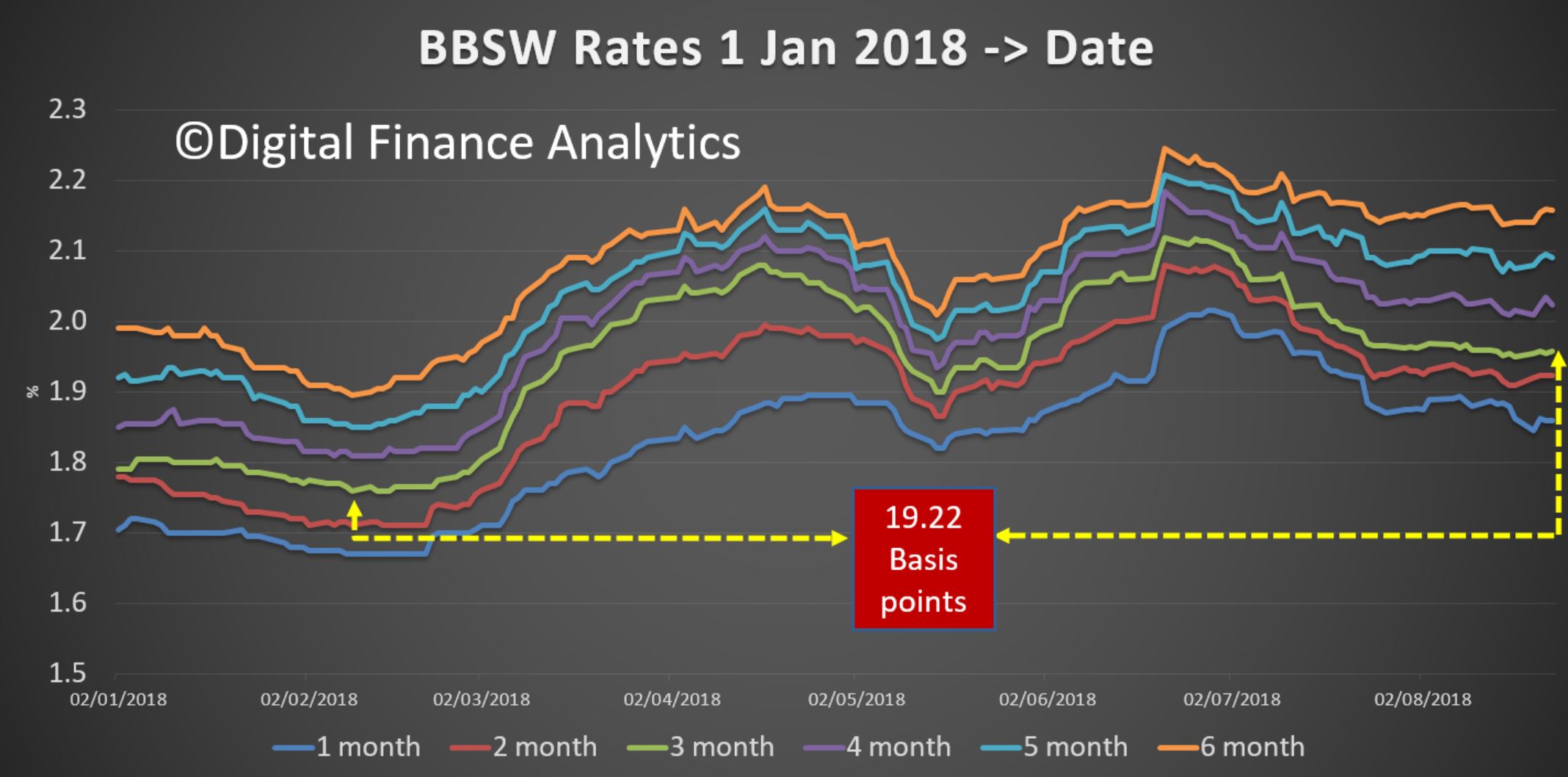

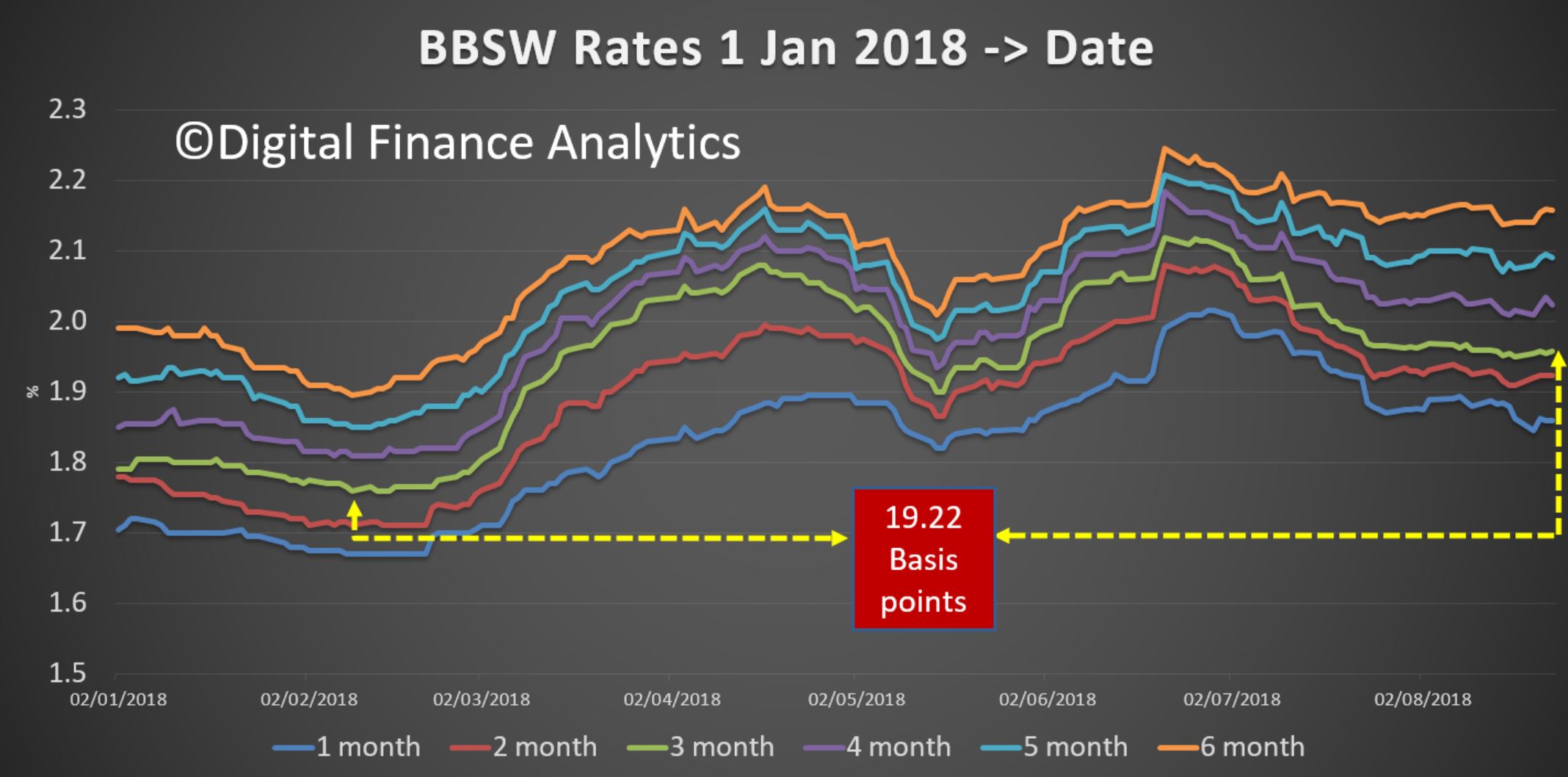

Lets be clear about what is happening here. Funding costs are indeed rising, as we show from the latest BBSW.

In addition some of the smaller lenders are lifting some deposit rates to try and source funding.

In addition some of the smaller lenders are lifting some deposit rates to try and source funding.

But the real story is the they are also running deep discounted rates to attract new borrowers, (especially low risk, low LVR loans) and are funding these by repricing the back book. This is partly a story of mortgage prisoners, and partly a desperate quest for any mortgage book growth they are capture. Without it, bank profits are cactus.

Once again customer loyalty is being penalised, not rewarded. Those who can shop around may save, but those who cannot (thanks to tighter lending standards, or time, or both) will be forced to pay more.

Investment Lending Crashes

APRA has released their monthly banking stats to the end of July 2018 today. As expected from our survey data, gross investment mortgage lending balances fell last month. Expect more ahead.

Total loans outstanding for all residential property – owner occupied and investment rose by 0.24% to $1.64 trillion, which would be an annual rate of 2.9%. Within that lending for owner occupation rose by 0.38% to $1.09 trillion while lending for investment loans fell 0.25% to $557.4 billion. As a result the proportion of loans for investment purposes fell to 33.9%, the lowest for years.

The monthly movements underscore the changes, (and remember the August 2017 drop was a blip created by loan reclassification at CBA from their residential books).

The monthly movements underscore the changes, (and remember the August 2017 drop was a blip created by loan reclassification at CBA from their residential books).

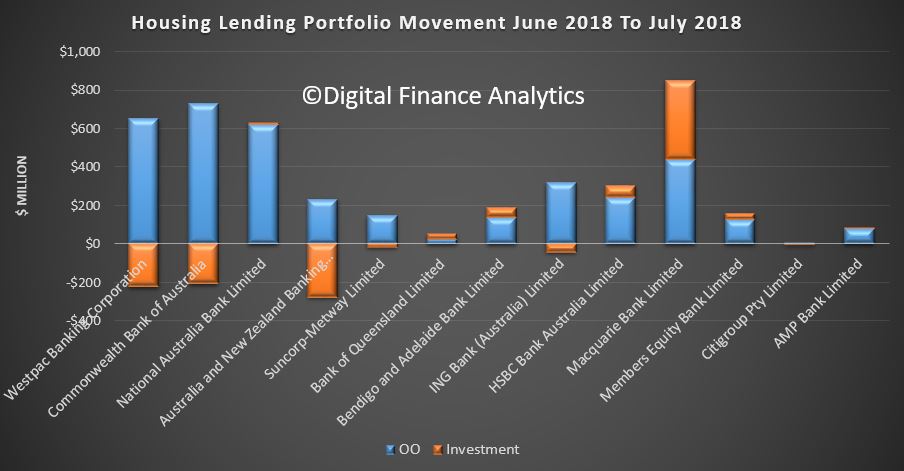

![]() The monthly portfolio movements by lender really tell the story, with investor loan balances at Westpac, CBA and ANZ all falling, while NAB grew just a tad. Macquarie, HSBC. Bendigo Bank and Bank of Queensland grew their books, highlighting a shift towards some of the smaller lenders. Suncorp balances fell a little too.

The monthly portfolio movements by lender really tell the story, with investor loan balances at Westpac, CBA and ANZ all falling, while NAB grew just a tad. Macquarie, HSBC. Bendigo Bank and Bank of Queensland grew their books, highlighting a shift towards some of the smaller lenders. Suncorp balances fell a little too.

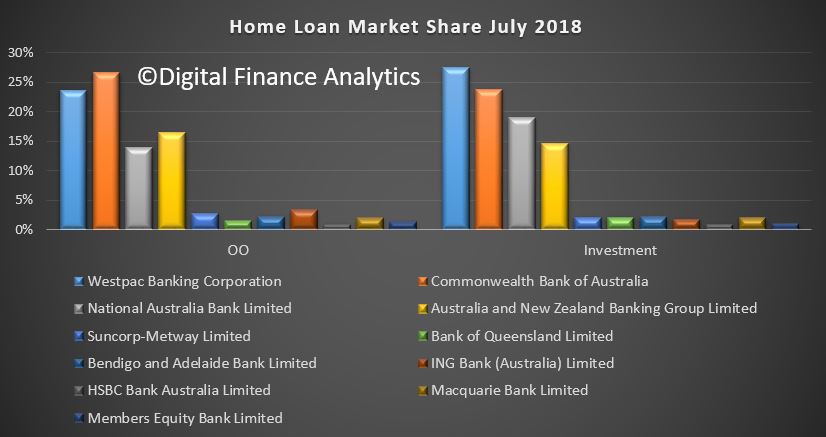

The overall portfolios by lender continue to show CBA the largest owner occupied lender, and Westpac the largest investor lender.

The overall portfolios by lender continue to show CBA the largest owner occupied lender, and Westpac the largest investor lender.

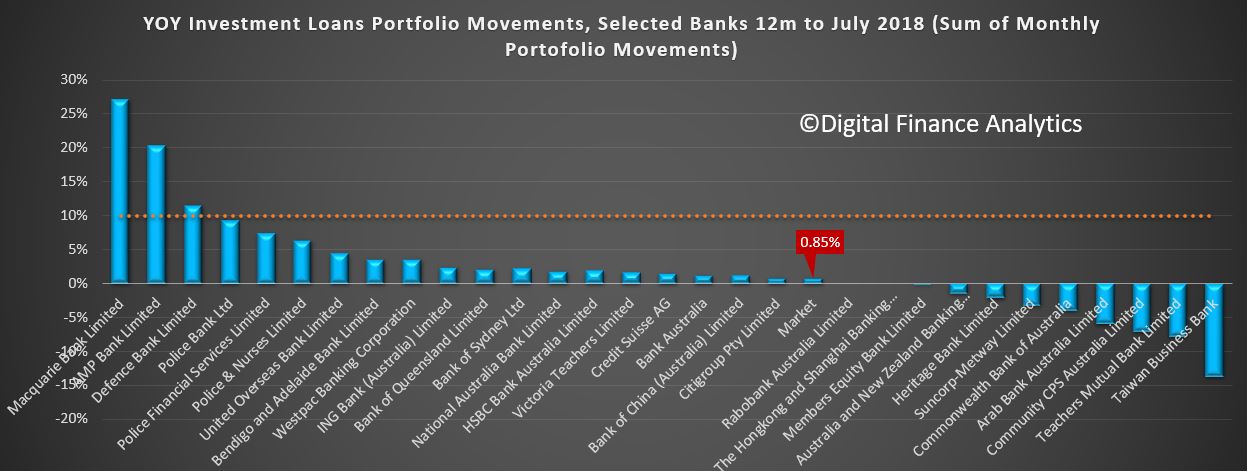

Analysis of the 12 month portfolio movements also reveals the some of the smaller players, and Macquarie have grown their portfolios faster than the majors, and Westpac had the strongest growth among the big four. Market growth continues to fall, at 0.85%.

Analysis of the 12 month portfolio movements also reveals the some of the smaller players, and Macquarie have grown their portfolios faster than the majors, and Westpac had the strongest growth among the big four. Market growth continues to fall, at 0.85%.

The tighter credit conditions are now biting – finally – which explains the recent spate of ultra-low rates on offer to lower risk new borrowers and those seeking to refinance who fall within the new criteria. But many are excluded, prisoners of higher rates as they do not fall within these now tighter (and rightly so) guidelines.

The tighter credit conditions are now biting – finally – which explains the recent spate of ultra-low rates on offer to lower risk new borrowers and those seeking to refinance who fall within the new criteria. But many are excluded, prisoners of higher rates as they do not fall within these now tighter (and rightly so) guidelines.

There will be howls of pain from the sector and calls to relax lending standards to “save” the economy, but these must be resisted at all costs. We must not return to the over lax lending of past days as this will simply build even bigger risks later. Time I fear to face the music.

Anyone now game enough to forecast a rise in home prices? I suspect not. We will see what the RBA data tells us about the non-bank sector, their data just came out. We will post on this soon….

I will be watching for a slowing in owner occupied growth, as confidence and sentiment ebbs away.

On The Front Line: Mortgage And Advice Industry

I discuss the latest developments in the property market with Chris Bates, Financial Adviser and Mortgage Broker.

Drawing from his direct experience in the market, we look at the current state of play.

Chris can be found at www.wealthful.com.au & www.theelephantintheroom.com.au, plus via LinkedIn

Super assets reach $2.7 trillion

Total superannuation assets reached $2.7 trillion at the end of the June 2018, up 7.9 per cent for the preceding 12 months, according to APR, via InvestorDaily.

APRA has released its quarterly superannuation performance statistics for the June 2018 quarter, revealing the Australian super sector has grown to $2,709.3 billion.

Total assets in the super sector increased by 7.9 per cent throughout the 12 months to 20 June 2018.

The $2.7 trillion super pool consisted of $631.6 billion in industry funds, $451.9 billion in public sector funds, $622.3 billion in retail funds, $56.1 billion in corporate superannuation, and $749.9 billion in SMSFs.

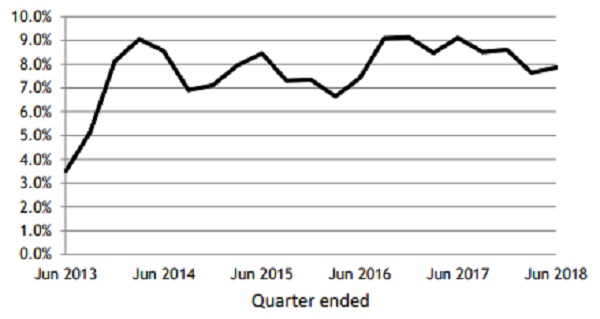

The annual industry-wide rate of return for entities with more than four members (i.e. non-SMSF money, equating to $1.76 trillion) was 7.6 per cent. The five-year average rate of return to June 2018 was 7.9 per cent (see below).

Source: APRA

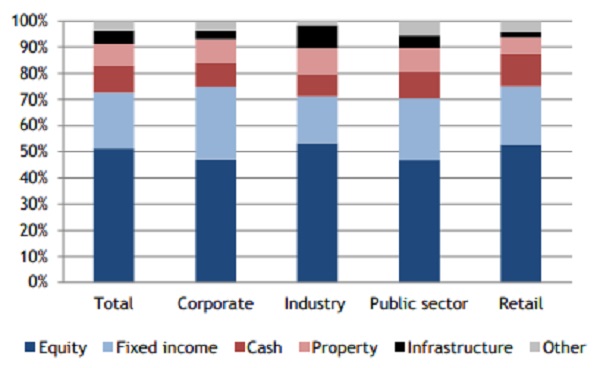

Total assets increased by 3.6 per cent of $65.9 billion over the June 2018 quarter. At the end of the quarter, 51.3 per cent of the $1.7 trillion in non-SMSF money was invested in equities; 31.5 per cent was invested in cash and fixed income; and property and infrastructure accounted for 13.5 per cent.

Asset allocation – June 2018

Source: APRA

Westpac Blinks

Westpac has announced it will lift mortgage rates on existing variable loans by 14 basis points. This was expected (I had said by September a few months back!). Others will follow now. More pain for households in a rising cost, flat income economy. More downward pressure on home prices.

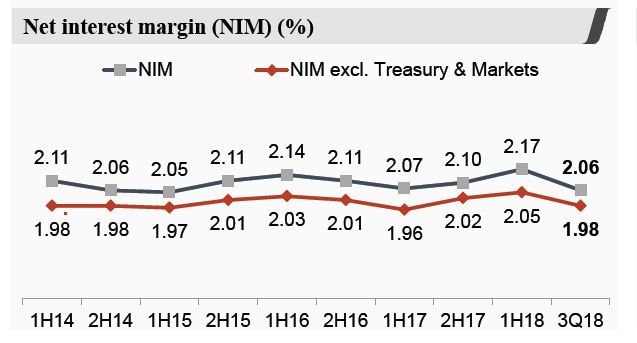

The BBSW stands 19 basis points above where it was in February.

Westpac last week had highlighted a margin problem, and showed the rise in funding, which has squeezed their margins. Expect more “great offers” to attract low risk new customers, at the expense of the back book.

Westpac last week had highlighted a margin problem, and showed the rise in funding, which has squeezed their margins. Expect more “great offers” to attract low risk new customers, at the expense of the back book.

Westpac chief executive Brian Hartzer says he didn’t “relish” having to make the decision to lift variable mortgage rates as higher wholesale funding costs fail to subside.

Following similar moves by several smaller lenders in recent months, Westpac today said variable interest rates for its owner occupied and residential investment property loans would rise 14 basis points due to the “sustained increase in wholesale funding costs” since February.

CEO Brian Hartzer told Westpac Wire it was a “difficult” decision but the bank had “come to the conclusion that what we’re looking at is a sustained increase in that key benchmark wholesale funding cost rate”.

“It’s now been elevated for over six months…reluctantly we came to the conclusion that needed to be reflected in our mortgage costs,” he said. He added that while conscious of the impact the interest rate change would have on consumers’ cost of living, some mortgage rates would remain below where they were three years ago and “from a credit point of view, no, I’m not concerned” about any impact on the bank’s mortgage book.

In an update to the Australian Securities Exchange last week, Westpac said funding costs had risen primarily due to the sharp increase in the bank bill swap rate (BBSW) since February. Compared to the first half, the BBSW was on average 24 basis points higher in the third quarter, the bank added.

Along with a lower contribution from the Group’s Treasury and other factors including changes in the mix of its mortgage portfolio, the higher funding costs dragged on the bank’s net interest margin, which fell to 2.06 per cent in the June quarter from 2.17 per cent in the first half to March 31.

Mr Hartzer said several factors had driven the increase in wholesale funding costs since February, including greater competition for funds from foreign banks that raise money in the domestic wholesale market. The Reserve Bank of Australia has also noted this rise in competition domestically, plus that the cost of raising funding in the United States and then converting it back into Australian dollars has also increased this year and “at times been well above the cost of raising funds domestically”.

RN Does The Refinance Problem

It’s being described as a “mortgage mirage”. It’s an offer from the bank that looks too good to be true and, as it turns out, for many it is; via ABC.

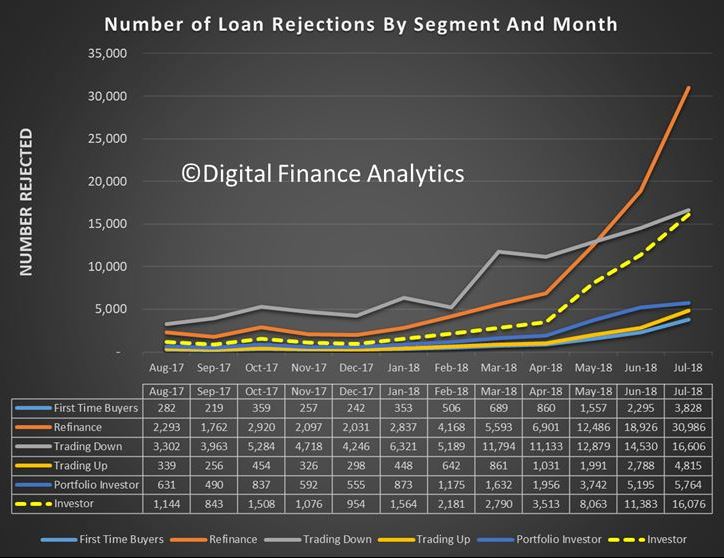

“About 40 per cent of people who tried to refinance were unable to do so,” Digital Finance Analytics principal Martin North said. “If you go back a year it was 5 per cent.”

Data from DFA and investment bank UBS show there has been a spike in the number of failed mortgage refinancing applications.

The reason this is occurring is that, while those applicants cleared the bar for their original loans, that bar has now become a lot higher, following years of banking reform and the fallout from the banking royal commission.

So, now, they simply don’t qualify for the same amount of debt they once did.

“When people took out the loans there was a lot of widespread fudging of the numbers,” chief investment officer with funds management firm, Forager Funds, Steve Johnson said.

“People were getting loans on the basis of a four person family having $30,000 a year of living costs living in Sydney.

“And it’s quite clearly impossible to live in Sydney on that much money a year.

“The biggest issue is that people have borrowed too much money relative to their income and that is a very difficult problem to unwind.”

But, Mr Johnson said, it is not just the banks that have messed up.

Thousands of Australians are either stuck with their current bank or need to move to a “shadow lender” due to tighter lending rules.

“I think the banks have done a lot of unconscionable things, and I think credit has been far too easy to come by, but there is also an element of personal responsibility here in terms of people saying, ‘well, the bank offered to lend me $1.5 million but I don’t really think that is a sensible amount of money for me to borrow’.”Mr North has calculated there are now close to one million Australians on the edge of mortgage stress – defined by Digital Finance Analytics as borrowers who are going further into debt or eating into savings because their expenses are greater than their income.

Given that, it’s understandable that when the big four banks advertise discounted mortgage rates, financially stressed-out households flock to the banks to bag a better deal.

“And then they’re stuck, because suddenly they find that that wonderfully alluring low rate that’s being hung out to them is inaccessible,” Mr North said.

He calls these borrowers “mortgage prisoners” because they go home empty-handed, trapped in a financial squeeze.

Royal commission behind loan approval lull

While Forager Funds’ Steve Johnson sympathises with these borrowers, he said he is not in the least bit surprised there has been a recent spike in the number of loan refinancing rejections.

“It’s a perfectly natural consequence of more conservative lending standards,” he observed.

“You just can’t have one of those things without the other.”

Mr Johnson said the banking royal commission is behind the loan approval lull.“It has accelerated it, and made it a lot more dramatic than it otherwise would have been,” he argued.

But it seems the royal commission has also inspired aggressive sales tactics and interest rate discounting from the banks – for the right customers.

“The banks are seeking out low risk, low LVR [loan to value ratio] borrowers, and are trying to hook them” Mr North said.

“Because without them they are pretty much out of profits.”

Big four play down 40 per cent figure

CBA, NAB and ANZ confirmed to RN Breakfast they had reached out to new customers with lower rates.

But how many of the moths drawn to this low interest rate light have been burned in the process by having their applications rejected?

CBA and NAB say they don’t have any data on that, but questioned the accuracy of Mr North’s figures.

ANZ did appear to have such a database and said: “We have seen a small increase in the number of unsuccessful applications for internal refinance since March, but it is much lower than the 40 per cent figure that has been referred to.”

Westpac responded to the ABC by saying that, “No matter the market appetite, we take our responsible lending obligations seriously, ensuring good outcomes for customers”.

Mr North said he sympathised with borrowers who have become ineligible for lower rate loans.

“The typical saving could be up to $150 a month,” he observed.

“They see this mirage of a lower rate opportunity and then it’s snatched away from them when they don’t actually meet the standards.”

Concerns for the rest of the economy

Mr Johnson wanted to use the new data to highlight how serious Australia’s record level of personal debt has become.

“We are in a position now where all those people owe extraordinary amounts of money to the bank and it’s not an easy situation to unwind or extract ourselves from,” he said.

Independent banking analyst Brett Le Mesurier warned there are also important implications for the economy. “There are certainly signs of deterioration,” he said.

“I suspect the issue is not so much their ability to service those loans, it’s more the other spending they don’t make anymore and the broader impact that has on the economy.

“I therefore expect that to push downward pressure on economic growth.”

As for the extent of Australian home loan stress?

The nation’s biggest lender said it simply isn’t an issue.

The Commonwealth Bank said it has seen a slight uptick in 90-day home loan arrears.

But, as noted in its recent results, the uptick in arrears rates reflected “pockets of stress as some households experienced difficulties with rising essential costs and limited income growth”.

ABC News Does The Refinance Problem

ASIC publishes a review of reverse mortgage lending

ASIC’s review of the reverse mortgage industry highlights that some taking a reverse mortgage could face financial difficulty later in life. This despite the fact that borrowers can never owe the bank more than the value of their property, and can remain in their home until they pass away or decide to move out

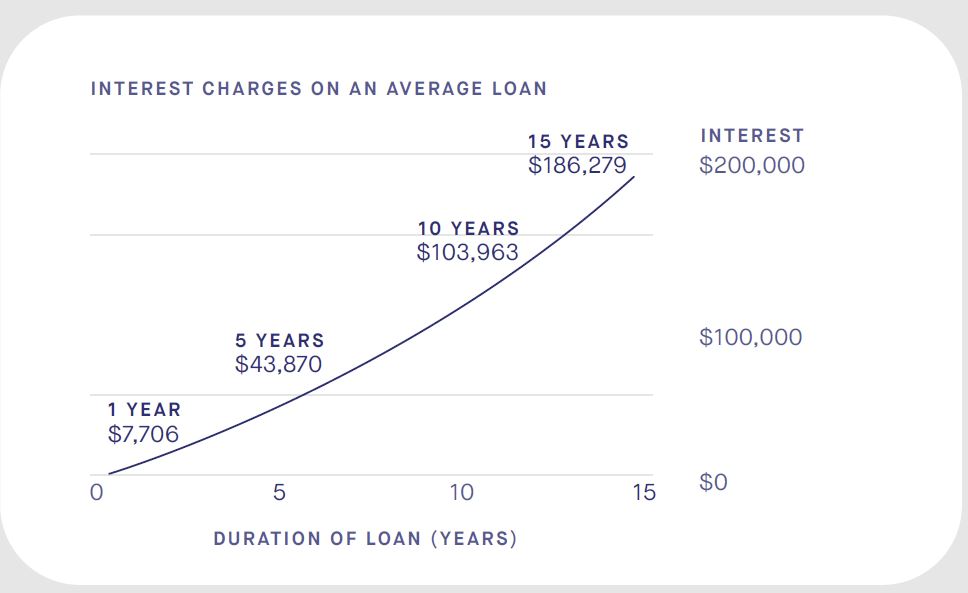

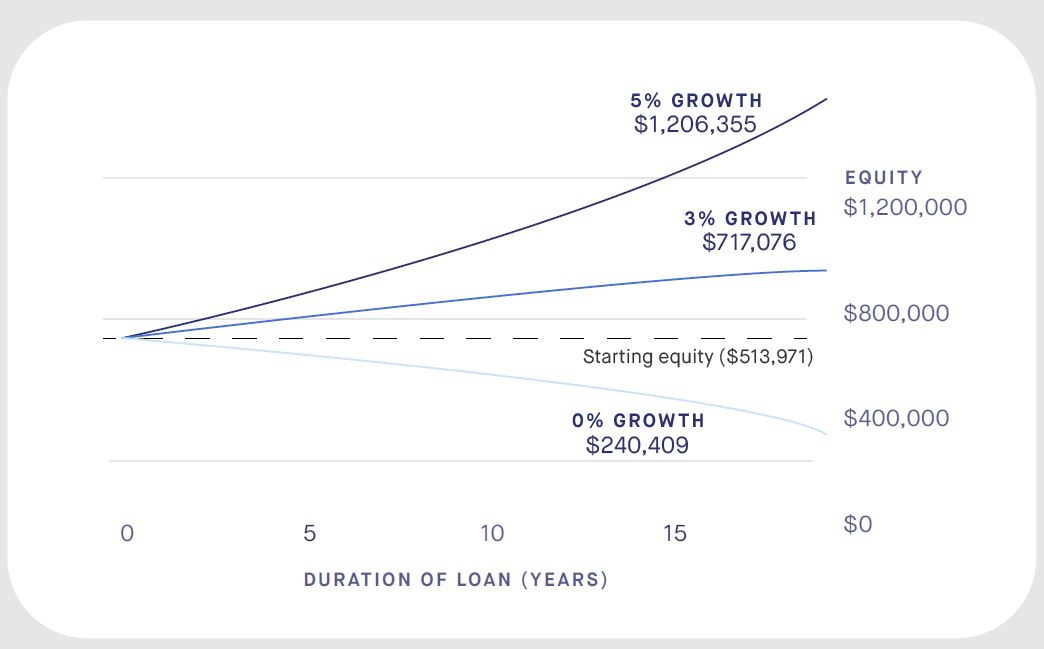

Thus, while this type of finance may assist older home owners (70% aged 55-85 own their own home), they face the dual risks of compounding effects on the original loan value as interest is rolled up…

Thus, while this type of finance may assist older home owners (70% aged 55-85 own their own home), they face the dual risks of compounding effects on the original loan value as interest is rolled up…

… and significant risks should home prices fall, leading to loss of all or most capital. 63% of borrowers may end up with less equity than the average upfront cost of aged care for one person by the time they reach 84.

… and significant risks should home prices fall, leading to loss of all or most capital. 63% of borrowers may end up with less equity than the average upfront cost of aged care for one person by the time they reach 84.

Plus there is limited competition, as just 2 credit licensees wrote 80% of the dollar value of new loans from 2013 to 2017.

Plus there is limited competition, as just 2 credit licensees wrote 80% of the dollar value of new loans from 2013 to 2017.

A review by ASIC has found that reverse mortgages are allowing older Australians to achieve their immediate financial goals – improving their lifestyles in retirement – but longer-term challenges exist.

For older Australians who own their home with few other assets, a reverse mortgage can allow them to draw on the wealth locked up in their homes, while they continue to live in their property.

ASIC reviewed data on 17,000 reverse mortgages, 111 consumer loan files, lender policies, procedures, and complaints. We also commissioned in-depth interviews with 30 borrowers and consulted over 30 industry and consumer stakeholders.

The review found borrowers had a poor understanding of the risks and future costs of their loan, and generally failed to consider how their loan could impact their ability to afford their possible future needs. Lenders have a clear role to play here and need to do more: for nearly all of the loan files we reviewed, the borrower’s long term needs or financial objectives were not adequately documented.

Importantly, under legal protections in place since 2012, borrowers can never owe the bank more than the value of their property, and can remain in their home until they pass away or decide to move out. However, depending on when a borrower obtains their loan, how much they borrow, and economic conditions (property prices and interest rates), they may not have enough equity remaining in the home for longer term needs (e.g. aged care).

ASIC Deputy Chair Peter Kell said “Reverse mortgage products can help many Australians achieve a better quality of life in retirement.”

“But our review shows that lenders and brokers need to make inquiries that would lead to a genuine conversation with customers about their possible future needs, not just a set of tick boxes on a form.”

ASIC’s report also finds that there is an opportunity for lenders to reduce the risk of elder abuse. Under the new Code of Banking Practice, recently approved by ASIC, banks will be required to take extra care with customers who may be vulnerable, including those who are experiencing elder abuse.

Consumers also had limited choices for finding a reverse mortgage. Several providers withdrew from the market after the global financial crisis. From 2013 to 2017, two credit licensees provided 80% of the dollar value of new loans from 2013 to 2017.

Background

Reverse mortgages are a credit product that allows older Australians to borrow using the equity in their home. The loan does not need to be repaid until a later time, typically when the borrower has vacated the property or passed away. They are a more expensive form of credit compared to standard variable owner occupier home loans; the interest rates are typically 2% higher and, as there are no repayments required, interest compounds.

Consumer demand for reverse mortgages has grown gradually since the global financial crisis, with the total exposure of ADIs to reverse mortgages increasing from $1.3 billion in March 2008 to $2.5 billion by December 2017.

ASIC commenced a review of lending practices and consumer outcomes in the reverse mortgage market to proactively examine issues that might emerge for older Australians.

As part of this review, we evaluated the effectiveness of enhanced responsible lending obligations for reverse mortgages which were introduced five years ago into the National Consumer Credit Protection Act 2009 (National Credit Act).

This review examined five brands, who collectively lent 99% of the dollar value of approved reverse mortgage loans in 2013-17. These brands were: Bankwest, Commonwealth Bank, Heartland Seniors Finance, Macquarie Bank and Westpac (comprising St George Bank, the Bank of Melbourne and BankSA). As of late 2017, Macquarie Bank and Westpac are no longer providing new reverse mortgages.

This project forms part of ASIC’s broader work for older Australians to help bring about positive changes for these consumers in credit and financial services: see REP 537 Building seniors’ financial capability report 2017 and REP 550 ASIC’s work for older Australians.

ASIC’s MoneySmart website has information for consumers about reverse mortgages. Consumers can also use MoneySmart’s reverse mortgage calculator to see how a reverse mortgage can impact the equity in their home.