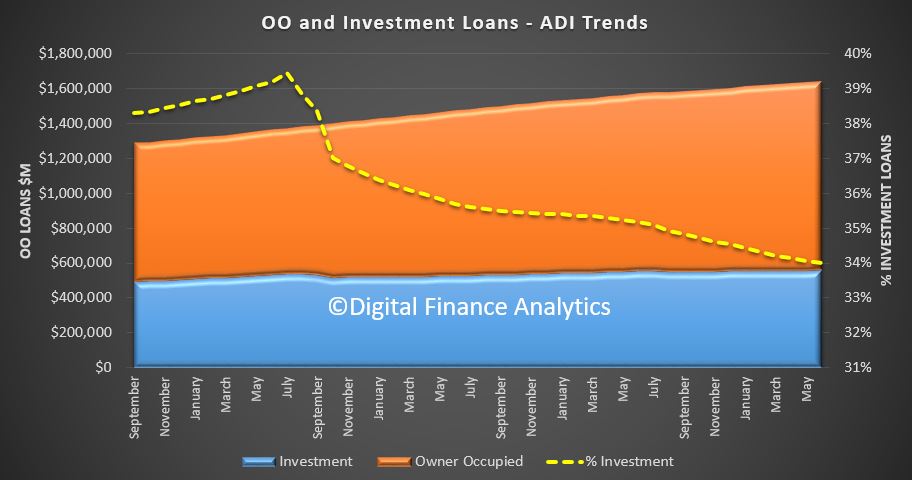

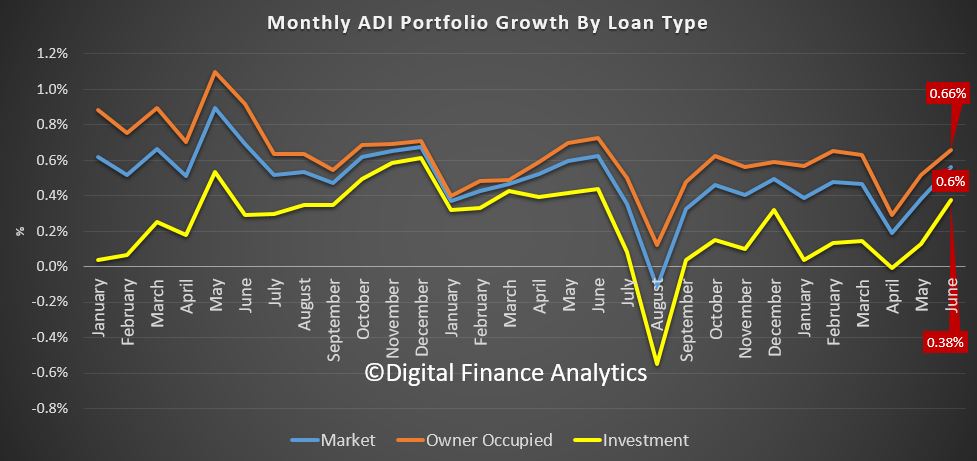

The latest data from APRA, the monthly banking stats to June 2018 show that the banks are still busy lending for home loans. Total balances rose in the month by $9.2 billion, to $1.64 trillion. Within that lending for owner occupied housing rose $7.1 billion, up 0.68% to $1.08 trillion and lending for investment property rose 0.38% to $558 billion. Investment lending comprised 34% of the portfolio, and fell slightly as a result.

The trend growth, over the months is accelerating. Total credit is still growing at an annualised rate of 6.7%, scary, when incomes and cpi are circa 2% and we have some of the highest debt to income ratios globally.

The trend growth, over the months is accelerating. Total credit is still growing at an annualised rate of 6.7%, scary, when incomes and cpi are circa 2% and we have some of the highest debt to income ratios globally.

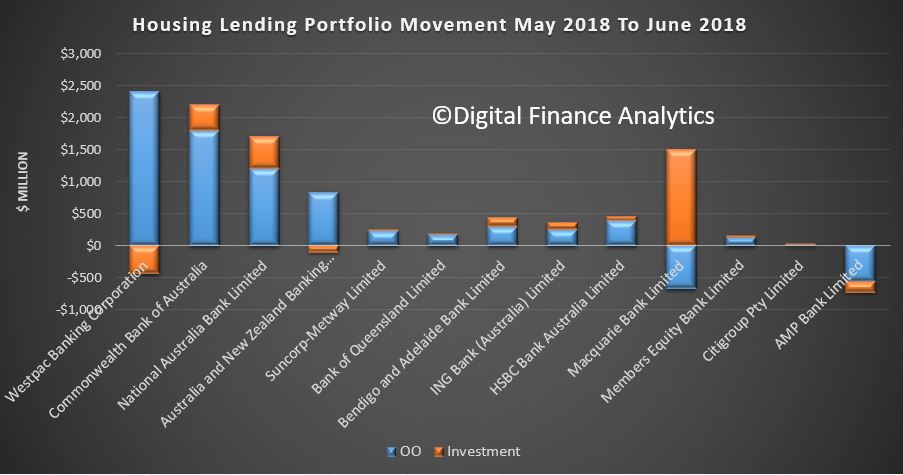

Looking at the individual lenders portfolio movements, we see that Westpac have been focusing on owner occupied lending growth, while their investor balances fell a little, a similar pattern to the ANZ. On the other hand, both CBA and NAB grew their investor loan books, having given up share in recent months. But Macquarie bank lifted their investor loan book significantly.

Looking at the individual lenders portfolio movements, we see that Westpac have been focusing on owner occupied lending growth, while their investor balances fell a little, a similar pattern to the ANZ. On the other hand, both CBA and NAB grew their investor loan books, having given up share in recent months. But Macquarie bank lifted their investor loan book significantly.

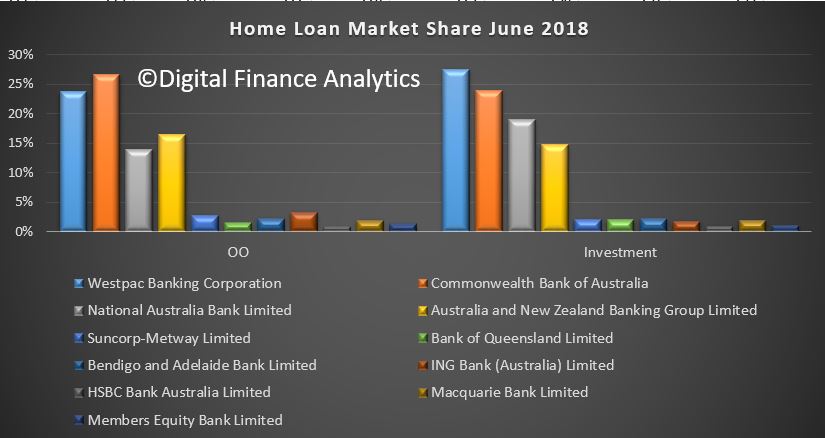

Overall shares did not move that much in the month, with CBA still the largest owner occupied lender, and Westpac the largest investment loan lender.

Overall shares did not move that much in the month, with CBA still the largest owner occupied lender, and Westpac the largest investment loan lender.

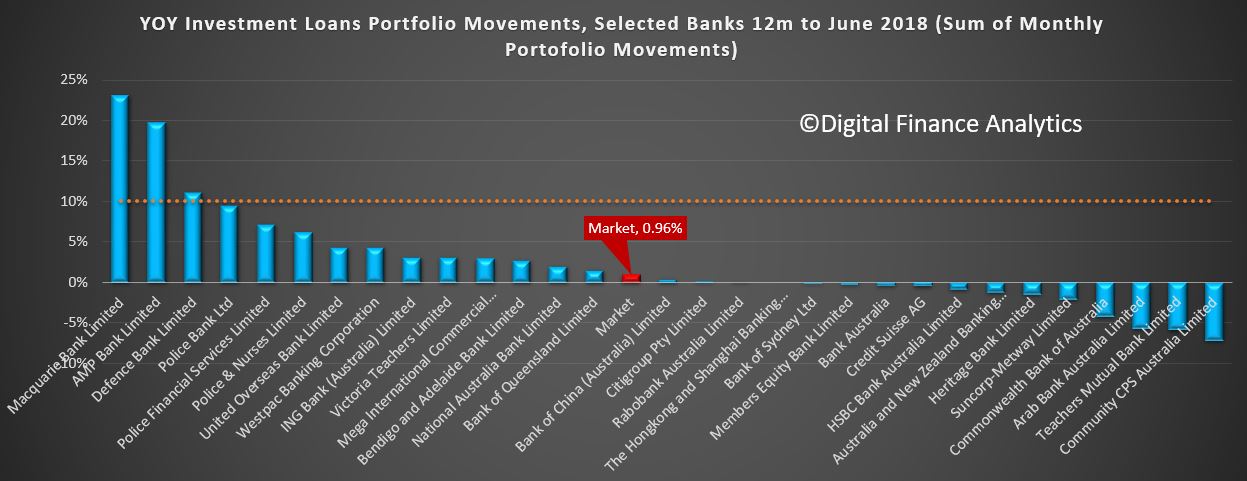

We also updated our annual portfolio movements for investor lending (despite the APRA 10% speed limit no longer being relevant). We see that Macquarie shows the strongest growth in investor lending, alongside AMP Bank, and some of the smaller players. The market annual effective growth rate is 0.96%. ANZ and CBA are in negative territory across the last 12 months.

We also updated our annual portfolio movements for investor lending (despite the APRA 10% speed limit no longer being relevant). We see that Macquarie shows the strongest growth in investor lending, alongside AMP Bank, and some of the smaller players. The market annual effective growth rate is 0.96%. ANZ and CBA are in negative territory across the last 12 months.

So in summary, home lending is alive and well, which given the current falls in home prices is a concern – but many households are refinancing to lower cost loans, taking advantage of the wide range of deals out there, for some. But investment lending remains in the doldrums, if a little off its lows.

So in summary, home lending is alive and well, which given the current falls in home prices is a concern – but many households are refinancing to lower cost loans, taking advantage of the wide range of deals out there, for some. But investment lending remains in the doldrums, if a little off its lows.

Clearly the regulators are betting that income growth will snap back up, allowing for households to service their massive debt burden, but as prices fall for the straight 10th month, and all else being equal its hard to see an easy way out from the debt bomb, as rates rise in the months ahead.