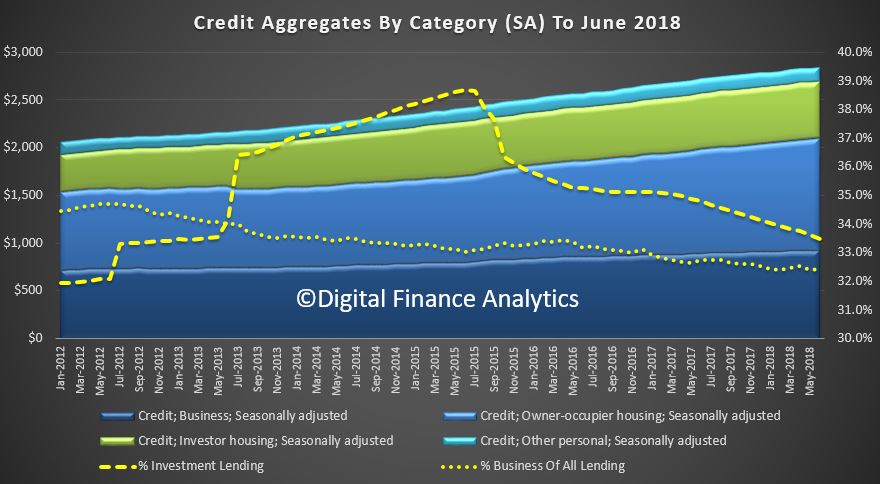

The RBA released their credit aggregates to June 2018 today. Overall credit grew 0.3% in the month to $2.84 trillion, up $9.7 billion. to a new record.

Within that, owner occupied housing lending rose 0.6% or $6.6 billion to $1.18 trillion, while investment lending fell $800 million, down 0.1% in seasonally adjusted terms, or rose $1 billion, up 0.2% in original terms. (I have no idea what adjustments the RBA makes, its not disclosed!).

Investment lending fell to 33.5% of the portfolio. Total lending for housing is a new record $1.77 trillion, and remember this is at a time when housing debt to income is knocking on the 200 door, and we are one of the most in debt nations on the planet. Least we forget, loans need to be repaid, eventually!

Business lending in seasonal terms rose 0.4%, up $4.1 billion to $921 billion, and fell to 32.2% of all lending – we see a continued fall in the proportion of lending to business, as opposed for housing, which is not good.

Business lending in seasonal terms rose 0.4%, up $4.1 billion to $921 billion, and fell to 32.2% of all lending – we see a continued fall in the proportion of lending to business, as opposed for housing, which is not good.

Personal credit rose $600 million, up 0.4% in original terms or fell $300 million in seasonally adjusted terms down 0.2%.

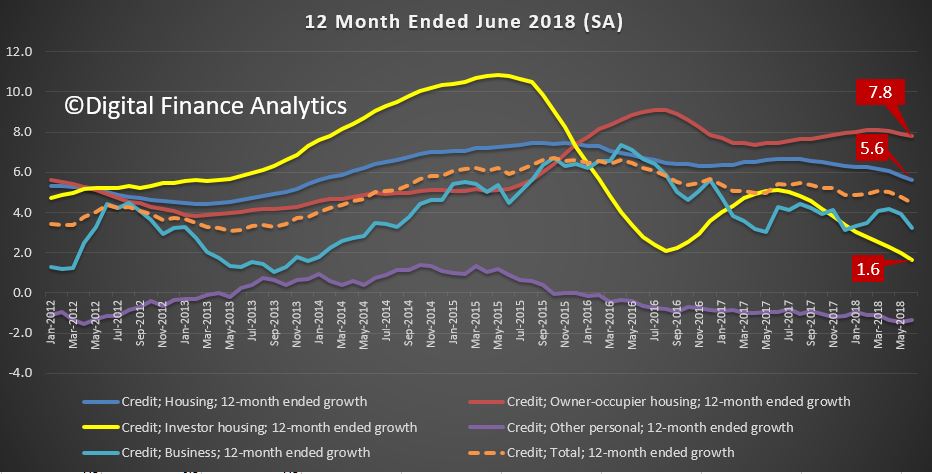

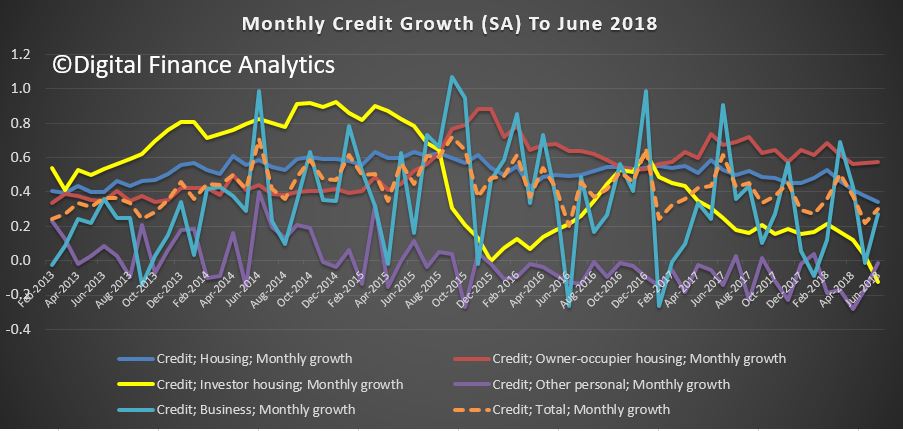

The monthly seasonally adjusted numbers highlight the slide in investor lending, and the stronger owner occupied lending.

The monthly seasonally adjusted numbers highlight the slide in investor lending, and the stronger owner occupied lending.

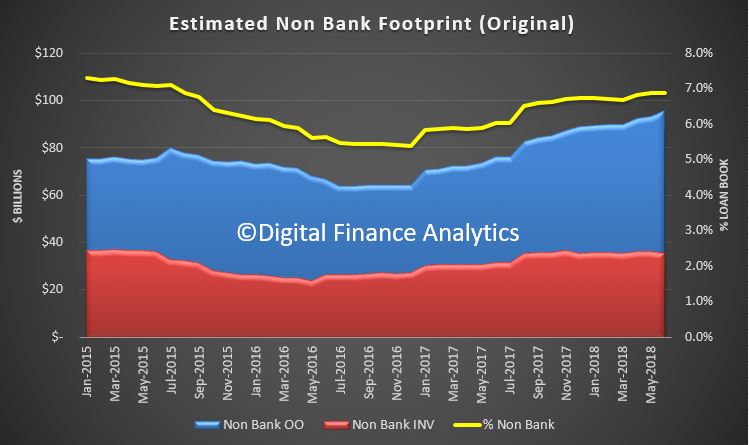

Finally, we also estimate the growth in on-bank lending, by taking the original RBA data, and comparing this with the ADI data from APRA also out today.

Finally, we also estimate the growth in on-bank lending, by taking the original RBA data, and comparing this with the ADI data from APRA also out today.

In essence, the relative share of home lending going to the non-banks is rising, to around 7% of all loans, and the bulk of the loans being written are for owner occupied borrowers.

A caveat here, as the non-bank segment of the data will always be a bit off, because there is less timely data captured from this small, but growing part of the market. Something which APRA needs to address.

So more of the old same old, same old, housing lending still growing way above inflation and wages, forcing housing debt higher, at the expense of business investment.

So more of the old same old, same old, housing lending still growing way above inflation and wages, forcing housing debt higher, at the expense of business investment.

We have not fundamentally addressed the credit elephant in the room. Despite all the noise.

Perhaps the regulators would like to tell us, how much debt is too much? We clearly have not hit their pain threshold yet, despite the rising financial stress in many households.