The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Author: Martin North

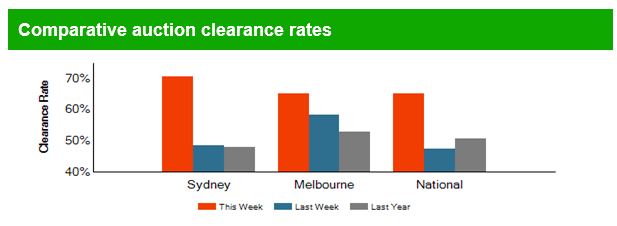

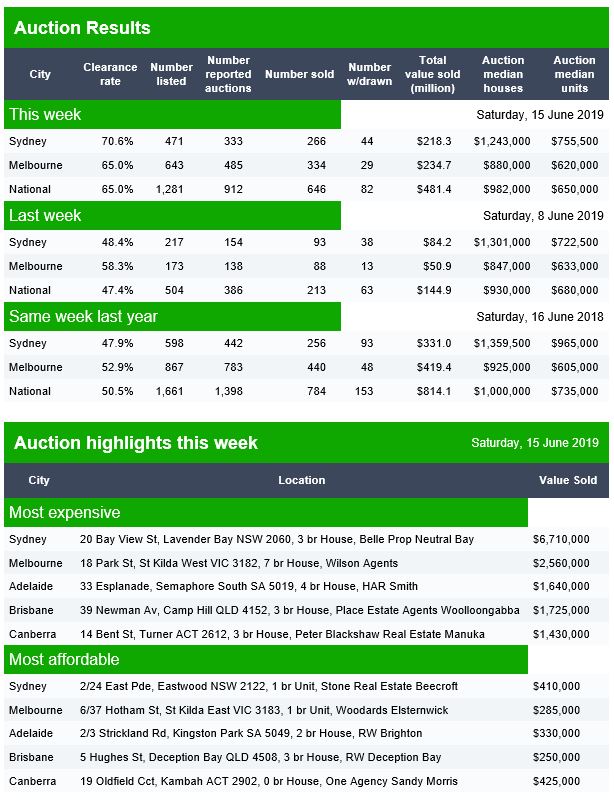

Auction Results 15 Jun 2019

Domain have released their preliminary results for today.

The final result last week settled at 47.4%, on low volumes thanks to the long weekend.

This week, the volume is higher at 1,281 listed for auction though still lower than a year ago, when 1,661 were listed. The final clearance will settle lower.

Canberra listed 29, reported 27 and sold 12 with 4 withdrawn giving a Domain clearance of 44%.

Adelaide listed 65, reported 24 and sold 15, with 6 withdrawn giving a Domain clearance of 50%

Brisbane listed 73, reported 43 and sold 19, with 3 withdrawn giving a Domain clearance of 41%.

APRA Goes Back To The Future On Bank Capital

A Few Quick Updates On The DFA Eco-System

We discuss recent enhancements to the DFA web presence and social media.

ANZ Complies With ASIC Court Enforceable Undertaking

Australia and New Zealand Banking Group Limited (ANZ) has complied with the Court Enforceable Undertaking (CEU) entered into with ASIC in March 2018 regarding ANZ’s fees for no service conduct for its Prime Access service.

On 31 May 2019, ASIC received an audited attestation from ANZ signed by Mr Michael Norfolk, Managing Director Private Banking and Advice, and an independent expert report from Ernst & Young (EY).

ASIC is satisfied with the audited attestation and the independent expert report. Compliance with the obligations under the CEU is now finalised, save for the payment of some remaining refunds due to clients, to be completed by mid-July 2019.

ANZ has attested to the following as required under the CEU:

- the changes to ANZ’s systems, controls and processes that have been implemented in response to the fees for no service conduct;

- subject to (c), that ANZ has provided documented annual reviews to Prime Access customers who were entitled to such reviews in the period from January 2014 to March 2018;

- in the 1,410 instances where documented annual reviews were found to have not been provided, ANZ is in the process of refunding those customers (with remediation expected to be complete by mid-July 2019); and

- that ANZ now has systems, controls and processes that seek to ensure documented annual reviews are being provided, and that instances of non-delivery are detected and remediated.

ASIC is aware that ANZ has announced it will no longer offer the Prime Access service to new customers and will phase it out for current customers over the next 18 months. ASIC will monitor the phasing out of Prime Access.

APRA Imposes Conditions on AMP Super

APRA says it has issued directions and additional licence conditions to AMP Superannuation Limited and N.M. Superannuation Proprietary Limited (collectively AMP Super).

APRA has imposed the directions and additional licence conditions to address a range of concerns regarding AMP Super’s compliance with the Superannuation Industry (Supervision) Act 1993 (SIS Act). The action arises from issues identified during APRA’s ongoing prudential supervision of AMP Super, along with matters that emerged during the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

The new directions and conditions are designed to deliver enhanced member outcomes by requiring AMP Super to make significant changes to its business practices. Areas identified for improvement include conflicts of interest management, governance and risk management practices, breach remediation processes, addressing poor risk culture and strengthening accountability mechanisms. The directions also require AMP Super to renew and strengthen its board.

Additionally, APRA requires AMP Super to engage an external expert to report on remediation and compliance with the new directions and conditions.

This is the second time APRA has used the broader directions power that was granted in April following the passage of the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No 1) Bill 2019. It also demonstrates APRA’s commitment to embedding the “constructively tough” enforcement appetite outlined in April’s new Enforcement Approach

The RBA’s Marching Orders No Longer Realistic?

A somewhat obscure fact about the marching orders for Australia’s Reserve Bank is that, usually, when a government is elected or re-elected or a new governor takes office, the official agreement between the government and the Reserve Bank changes.

There have been seven such agreements so far, each signed by the federal treasurer and bank governor of the time, and each entitled “Statement on the Conduct of Monetary Policy”.

The first was signed by treasurer Peter Costello and incoming governor Ian Macfarlane in 1996, the second when Costello reappointed Macfarlane in 2003, and the third when Costello appointed Glenn Stevens in 2006.

The fourth was between new treasurer Wayne Swan and Stevens on Labor’s election in 2007, and the fifth between Swan and Stevens on Labor’s reelection in 2010.

The sixth was between incoming treasurer Joe Hockey and Stevens on the Coaition’s election in 2013, and the most recent one between treasurer Scott Morrison and incoming governor Philip Lowe in 2016.

The current agreement begins this way:

The Statement on the Conduct of Monetary Policy (the Statement) has recorded the common understanding of the Governor, as Chair of the Reserve Bank Board, and the Government on key aspects of Australia’s monetary and central banking policy framework since 1996.

For nearly a quarter of a century, as the statement goes on to note, there has been a core component of how monetary policy is conducted:

The centrepiece of the Statement is the inflation targeting framework, which has formed the basis of Australia’s monetary policy framework since the early 1990s.

But over the years, there have been tweaks. One was this change between the 2013 and 2016 statements.

2013:

Low inflation assists business and households in making sound investment decisions…

2016:

Effective management of inflation to provide greater certainty and to guide expectations assists businesses and households in making sound investment decisions…

The change from “low inflation” to “effective management of inflation” sounds subtle, but was no accident. It gave the Reserve Bank extra wiggle room around the inflation target.

And boy, did it come in handy.

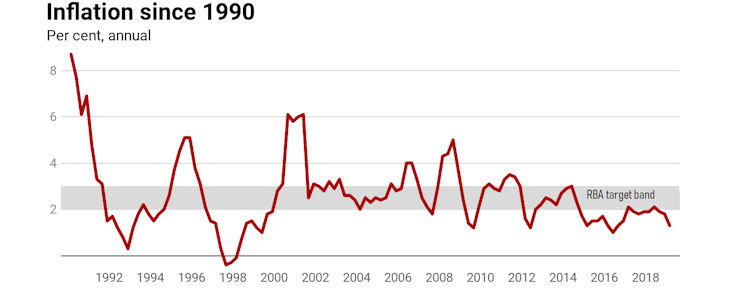

The target that’s rarely met

The big question about the agreement is whether the next one (between Frydenberg and Lowe on the Coalition’s reelection) will tweak the target again, change it completely, or do something in between.

Because it presumably can’t remain the same.

One reason to think it will change, perhaps significantly, is the bank’s utter inability to even get particularly close to its target inflation band of 2-3%, let alone to get within tit, “on average, over time” as required by the agreement.

You might not think this matters too much. But it does.

The inflation target is crucial in setting stable expectations for consumers, businesses and markets.

Don’t just take my word for it.

Here is what the previous Reserve Bank governor, Glenn Stevens, said in his last official speech before handing over to Philip Lowe in August 2016:

From 1993 to 2016, a period of 23 years, the average rate of inflation has been 2.5% – as measured by the CPI, and adjusting for the introduction of the goods and services tax in 2000. When we began to articulate the target in the early 1990s and talked about achieving “2–3%, on average, over the cycle”, this is the sort of thing we meant. I recall very well how much scepticism we encountered at the time. But the objective has been delivered.

As I pointed out last month, expectations about price movements depend on Australians believing that the bank will do what it says it will do.

Once people lose faith in the bank’s commitment to or ability to achieve the target, inflation expectations become unmoored. People react to what they think what might happen rather than what they are told will happen. This is what led to Australia’s wage-price spirals in the 1970s and 1980s, and to Japan’s lost decades of deflation.

Three possible outcomes

One possibility is the same statement, word for word. It would be meant to signal that the bank and the government think things are under control.

A second possibility is a tweak that further emphasises the “flexible” nature of the target, along the lines Lowe mentioned in his speech at this month’s Reserve Bank board board dinner in Sydney. It would provide more cover for the bank’s inability to hit its target.

A third option would be to add some discussion of the importance of fiscal policy – government spending and tax policy – as a complement to the Reserve Bank’s work on monetary policy. Lowe is keen to mention that he is keen on it, every chance he gets.

But that would put the government under implicit pressure to run budget deficits at times like those we are in rather than surpluses. It’s hard to see the Morrison government signing up for that, given its repeated talk during the election about the importance of being “responsible”.

Or something more

At the more radical end of the spectrum would be a genuinely new framework for monetary policy.

In the United States, which has also missed its inflation target, though by not as much as Australia, there has been much discussion of moving to a “nominal GDP target”. The range mentioned is 5-6% a year.

Advocates of this include former US Treasury secretary Larry Summers, who outlined his rationale in a Brookings Institution report in mid-2018.

ANU economist and former Reserve Bank board member Warwick McKibbin championed the idea along with economists John Quiggin, Danny Price and then Senator Nick Xenophon in the leadup to the 2016 agreement between Morrison and Lowe.

Nominal GDP is gross domestic product before adjustment for prices. In countries subject to big changes in export prices such as Australia, it can provide a better guide to changes in income.

When nominal GDP is strong (as it is when minerals prices are high) consumer spending is likely to be strong – perhaps too strong. When it is weak (as it is when minerals prices collapse) consumer spending is likely to be weak and in need of support.

But don’t get your hopes up

Given the natural caution of the bank and of this government, we should probably expect something at the modest end of the spectrum – even if something like a nominal GDP target would make sense.

Perhaps what’s most important isn’t what the statement says, but that it says something and that the Reserve Bank sticks to it. It will lose an awful lot of credibility if it sticks to nothing.

In the words of Nobel Laureate Bob Dylan: “they may call you doctor, they may call you chief, but you’re gonna have to serve somebody … it may be the devil or it may be the Lord, but you’re gonna have to serve somebody.”

Author: Richard Holden, Professor of Economics, UNSW

The Good-News Bad-News On Unemployment

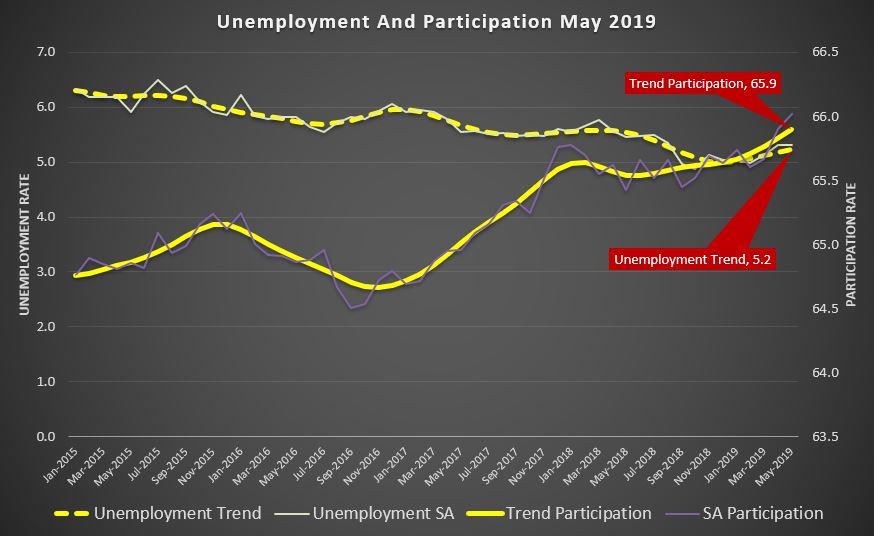

We look at the latest data from the ABS. Its a mixed bag!

Trend Unemployment Steady at 5.1 per cent

The trend unemployment rate remained steady at 5.1 per cent, for the third consecutive month. The seasonally adjusted unemployment rate remained steady at 5.2 per cent in May 2019 . But the moving parts are not so hot.

Underemployment was up, to 8.6%, while the total hours worked fell, -0.3%. There was a rise in jobs by 42,300, mainly part-time employment, which helps to explain the rising underemployment. But the results are muddied by ABS sample rotation AND temporary work associated with the election, so watch next month….

Australia’s trend participation rate increased to 65.9 per cent in May 2019, a new high, according to the latest information released by the Australian Bureau of Statistics (ABS).

ABS Chief Economist Bruce Hockman said: “Australia’s participation in the labour force continues to rise with the participation rate up 0.4 percentage points over the past year to an all-time high of 65.9 per cent.”

“The participation rate for people aged 15-64 also climbed to a record rate of 78.4 per cent, with a record 74.3 per cent of people in this age group employed,” Mr Hockman said.

The trend unemployment rate remained steady at 5.1 per cent, for the third consecutive month.

Employment and hours

In May 2019, trend monthly employment increased by around 28,000 persons. Both full-time and part-time employment increased by 14,000 persons.

Over the past year, trend employment increased by 333,000 persons (2.7 per cent) which was above the average annual growth over the past 20 years (2.0 per cent).

The trend monthly hours worked increased by 0.2 per cent in May 2019 and by 2.5 per cent over the past year. This was above the 20 year average year-on-year growth of 1.7 per cent.

Underemployment and underutilisation

The trend monthly underemployment rate rose slightly to 8.5 per cent in May, returning to the same level as May 2018. The trend underutilisation rate decreased by 0.3 percentage points over the year.

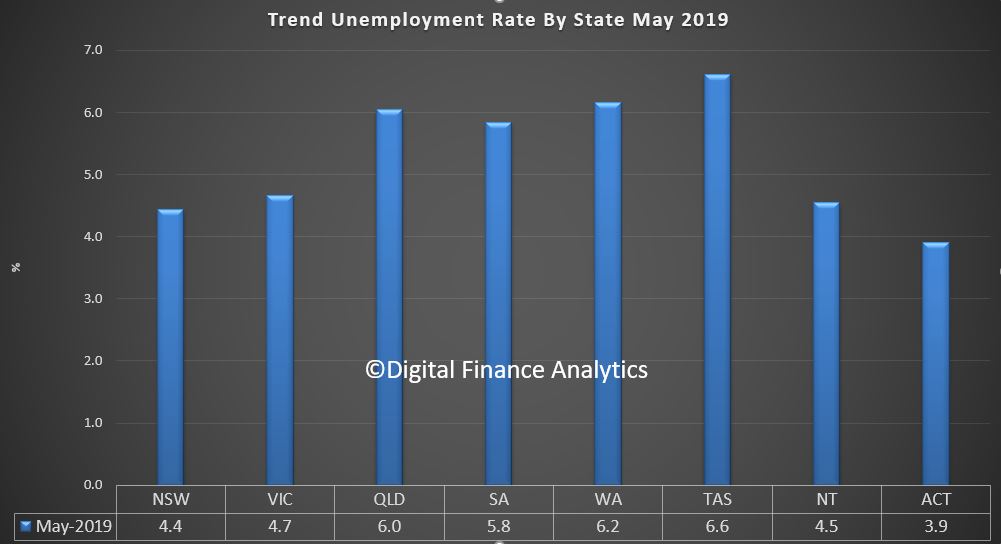

States and territories trend unemployment rate

The trend unemployment rate increased by 0.1 percentage points in the Australian Capital Territory, and remained steady in all other states and territories.

“Over the year, unemployment rates fell in New South Wales, Victoria, Queensland and Western Australia, and increased in South Australia, Tasmania, the Northern Territory and the Australian Capital Territory,” Mr Hockman said.

Seasonally adjusted data

The seasonally adjusted unemployment rate remained steady at 5.2 per cent in May 2019, while the underemployment rate increased by less than 0.1 percentage points to 8.6 per cent. The seasonally adjusted participation rate increased by 0.1 percentage points to 66.0 per cent, and the number of persons employed increased by around 42,000.

The net movement of employed persons in both trend and seasonally adjusted terms is underpinned by around 300,000 people entering and leaving employment in the month.

HashChing executive team departs, new CEO steps in

The founder and the executive team of online mortgage marketplace HashChing have all left the company, with a new interim CEO taking the helm, via The Adviser.

The founder and CEO of HashChing, Mandeep Sodhi, along with the key members of the executive team – including chief operating officer Siobhan Hayden and chief technology officer Vajira Amarasekera – all left the company at the end of May.

The fintech, which was officially launched by friends Atul Narang and Mandeep Sodhi in 2015 (before Mr Narang left the company in 2017), is an online platform that has pre-negotiated home loan deals that a consumer can access via a mortgage broker.

It had been increasingly looking at new ways to fund its growth and was recently looking to raise funds via a crowdfunding exercise, following its failure to raise $5 million last year via the same means.

In 2018, the mortgage marketplace also sought financial assistance from Jobs for NSW in the form of a $700,000 loan to create new jobs and allow the company to invest in the resources required to continue “expanding rapidly”.

While the company appeared to be operating as usual last month (when it announced it was introducing a deposit-free home loan product), HashChing has since seen a mass exodus of its entire leadership team.

None of the former members of the executive team were available to comment about the reasons for their departure – but out-of-office emails show that Mr Sodhi and Ms Hayden both ceased working at Hashching on 21 May 2019.

Future vision for the platform

A new interim CEO, Arun Maharaj, has now stepped in to head up HashChing and take it through a new “growth stage”.

HashChing will now focus on becoming a “one-stop digital platform” for all intermediated financial services, as part of a revamped strategy under the new executive leadership.

It is also now looking to a new product strategy to expand the platform’s business into brokering small-to-medium enterprise (SME) lending.

Sapien Ventures, together with the company’s second-largest institutional investor, Heworth Capital, will provide funding for the business at it expands to generate “convincing traction figures”, before going to the wider market for fresh growth capital later this year.

HashChing’s largest venture investor, Victor Jiang of Sapien Ventures, commented on the platform’s new strategy: “In the aftermath of the banking royal commission, the need to support the financing of SMEs through non-traditional channels has increased significantly. Coupled with the proliferation and increasing market adoption of fintech platform businesses, we believe that the time is now ripe for HashChing to enter into SME and commercial lending.”

“Through its online rating and ranking algorithms that help connect its customer with the most qualified financial service provider, HashChing has the potential to become the ultimate destination of choice for a range of intermediated financial services. In other words, the ‘Uberization’ of everything from personal mortgages, through to financial advice and SME lending,” he said.

Noting the departure of the original executive team, Mr Jiang commented: “As a board, we are very grateful for their tremendous contributions in getting the business to this point. Now with new capabilities, we look forward to seeing the business reach a new level of growth and expansion, as it is set to capitalise on a range of differentiated market opportunities.”

The new CEO, Mr Maharaj, added: “It’s time for a proven marketplace platform like HashChing to diversify its offerings and to think beyond the previous boundaries,” he said.

“This is an opportunity to evolve an emerging business like HashChing during its next phase of growth, to transition and position the platform into a global enterprise with multiple revenue streams.

“The scalability of such platforms are limitless, as has been demonstrated numerous times globally. I am thrilled to be taking on this challenge at this time and am excited to be part of this growth journey,” he said.

Mr Maharaj was formerly the CEO of stockbroker and wealth management firm BBY, before its collapse in May 2015 when 10 group companies were placed into external administration.