The Housing Industry Association (HIA) welcomed APRA’s removal of the 30% IO limit, but argues that banks are tightening beyond the APRA limits and still more credit is needed.

Actually, this is not really the case, rather it is reversion to more normal lending standards as defined by suitable lending.

The HIA are therefore advocating a loosening of standards back to the pre-royal commission and APRA conditions, where people got loans they could not afford and the industry was rife with poor practice and fraud. We should not aspire to return to such conditions again.

This is what they said:

“The removal of the restriction on interest-only lending is essential to addressing the concerning decline in credit growth for new housing,” said Tim Reardon, HIA Principal Economist.

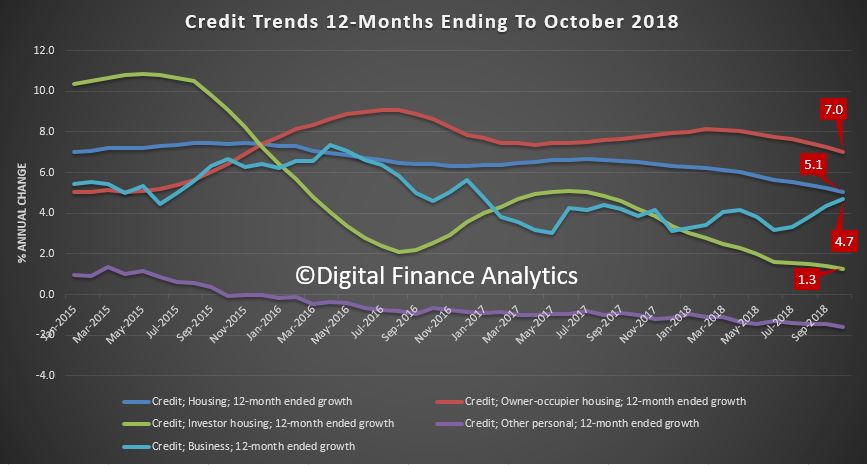

“Credit growth across the market is the lowest it has been since the 1983 recession.

“Credit growth to investors is the lowest on record.

“Today APRA announced it is lifting its 30 per cent cap on banks’ interest-only lending. This is a welcome development in Australia’s mortgage market, but much more needs to be done to ease the current credit squeeze.

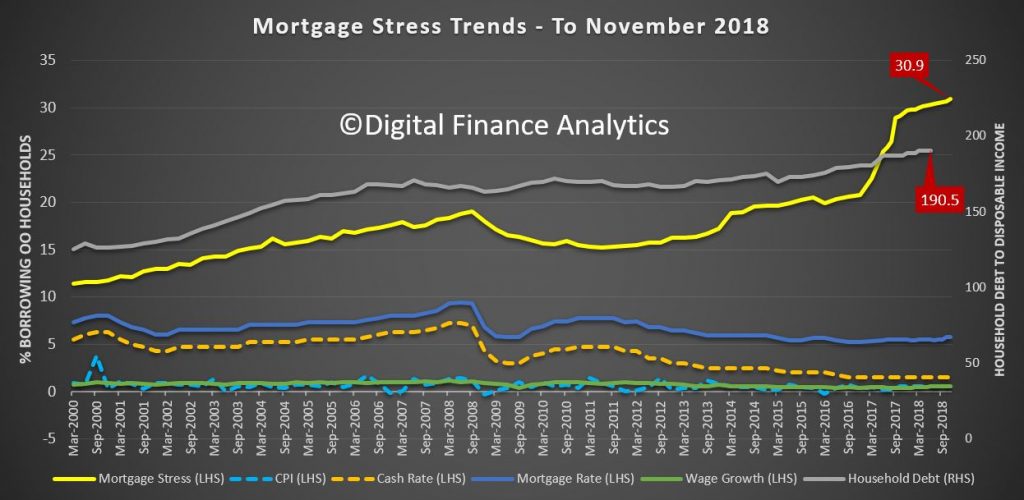

“APRA’s restrictions were designed to curb high-risk lending practices. Over the past 12 months ordinary home buyers have experienced significant constraints in accessing the appropriate level of finance to buy a home.

“The credit squeeze is happening at the behest of the banks’ own lending practices which have been tightened above and beyond APRA’s requirements.

“HIA research has found that the time taken to gain approval for a loan to build a new home has blown out from around two weeks to more than two months.

“HIA members are also reporting that almost half of loan applications are being rejected.

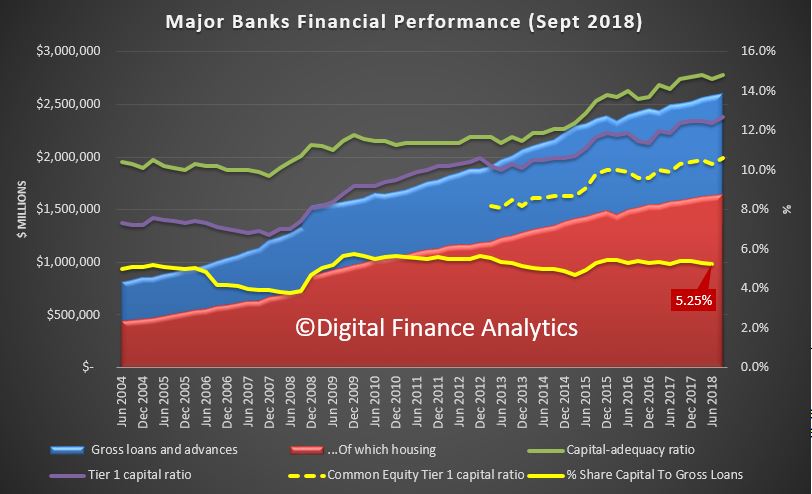

“APRA’s announcement sends an important message about the overall health and stability of the mortgage market which should be heeded by policy makers and lenders alike.

“With the Royal Commission scheduled to release recommendations early next year there is a risk that the credit squeeze may drag on into 2019. The residential construction sector is already cooling. Policy makers will need to proceed cautiously when responding to the Commission’s recommendations,” concluded Mr Reardon.