Welcome to the Property Imperative weekly to 10th November 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Loads more data this week, all pointing to the impact that tighter credit conditions are having on the economy – that is unless you are the RBA, which seems to see everything as just fine and missing the debt bomb elephant in the room.

Watch the video, listen to the podcast or read the transcript.

And by the way you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

We start with the latest lending stats from the ABS. Further evidence of the lending slow down came through in spades in their housing finance statistics to September 2018. Looking at the trend flows first, new lending for owner occupation fell 1.7% compared with last month, to $13.78 billion. Investment lending flows fell 0.8%, to $8.96 billion, and owner occupied refinanced loans were flat at $6.24 billion. Refinanced loans as a proportion of all flows rose to 20.8% and we continue to see this sector of the market the main battleground for lenders who are trying to attract lower risk existing borrowers with keen rates. Investment loans, were 39.4% of all new loans, up again from last month as owner occupied lending demand eases.

Looking at all the categories of loans month on month, we see lending for owner occupied construction down 1.2%, lending for the purchase of new dwellings down 2.2%, lending for the purchase of other existing dwellings down 1.7%, while investment lending for the construction of new property fell 2.5%, investment property for individuals fell 0.6% and investment lending for other entities, such as self-managed super funds, dropped 2.2%. As a result, total flows were down 1.1% compared with last month.

First time buyers were also down in number in September, falling by 8.8% to 8,693 new loans. This was 18% of all loans, up from 17.8% last month. As we highlighted in our recent post “Mortgage Lending Enters the Danger Zone”, household debt is still rising, home prices are falling creating a negative wealth effect, and this will drive prices lower still.

Yet according to the RBA’s latest statement on Monetary policy, all is well, as they continue to paint a picture of underlying momentum in the economy based on jobs growth, low unemployment, and a prospect of wages growth, but still down the track. “GDP growth is running above 3 per cent. The unemployment rate has declined noticeably, reaching 5 per cent in the month of September. GDP growth is now expected to be around 3½ per cent on average over 2018 and 2019, but to ease in the latter part of the forecast period as production of some resource commodities stabilises at high levels”. They of course left the cash rate unchanged on Tuesday.

They are now forecasting an unemployment rate down to 4¾ per cent by the end of 2020. That would normally be a catalyst for wage rises, but we are not so sure that logic works any more given the international evidence, and the different employment structures (e.g. gig economy, part-time work, zero hours’ contracts etc.).

GDP was helped by strong terms of trade thanks to higher commodity prices. “Global energy demand has supported oil, liquefied natural gas (LNG) and thermal coal prices, while ongoing strong demand for steel in China and, increasingly, India, has supported the prices of iron ore and coking coal; supply disruptions have also boosted coking coal prices in recent quarters. But later they warn of a potential slow down.

They argue that the housing slowing down, which is apparent in most areas across the country is inconsequential, and the housing debt burden (high by any standards), is manageable. But we note the debt ratio is as high as ever it’s been, the household savings ratio is falling, and household wealth is declining thanks to falling prices now. This could well crimp consumption down the track. And that has supported GDP growth for years.

So overall, they say the positives outweigh the negatives, and the next few quarters are looking fine, but we believe there are a number of clouds on the horizon. These include further interest rate rises in the USA, flowing through to higher funding costs in Australia for many mortgage holders, the risks from China slowing, and possibility that wages growth will remain stuck in neutral. High household debt remains a significant burden. Yet they cannot see the elephant!

So whilst the RBA still suggest the cash rate may rise higher later, we think there is a significant chance they will have to cut further, to levels never seen before. Our read is there are significant risks in their outlook, and they are mostly on the downside. But then the RBA does have a habit of wearing rose-tinted glasses.

In fact, there is panic in the air as tightening credit spills over into falling home prices and potentially impacts the broader economy. Indeed, the AFR reported today that Treasurer Josh Frydenberg has urged banks to ease their lending clampdown for the public good as the government seeks to head off a royal commission-inspired credit crunch just as the housing market hits the skids. He expressed concern that lending across the board – for homebuyers, small business and borrowers – could tighten further after Commissioner Kenneth Hayne releases his final report by February 1.

The early reappointment of Australian Prudential Regulation Authority chairman Wayne Byres sends a message that is both poorly timed and off-key, given the important questions that have been raised by the royal commission. See out post “Shock Announcement Collapses Confidence And Trust In Australia’s Financial System”. Commissioner Ken Hayne’s interim report was so incendiary that it’s easy to forget it only covered the first two-thirds of the commission’s hearings.

The Reserve Bank of Australia and Treasury have also privately cautioned the Morrison government that any regulatory response to the financial services Royal Commission must be careful to avoid putting the brakes on lending to home buyers and business.

This is remarkable given the high debt ratios and mortgage stress, and is one of the “un-natural acts” we have been warning about. Let’s be clear, the Royal Commission has shone a light on poor practice, but APRA had already been applying belated pressure on the banks for loose lending, especially to investors and we have been in a long-term forced upswing thanks to poor Government policy, and weak supervision. This is now being pulled back, finally, but to BLAME the Royal Commission for this outcome is nonsense. It’s the same category as the exaggerated claims that Labor’s negative gearing reforms would hit existing investment property holders. It is just not true.

I discussed the underlying trends in the housing sector and why this is not just a bubble, but a structural crisis, in an interview I did with Alex Saunders from Nugget’s News. We explored the question of whether housing is in a bubble, micro-markets, and the expectations for the future trajectory of home prices given tighter lending conditions. And where might block chain fit in? You can watch the programme on YouTube.

I also discussed the latest results from our Mortgage Stress surveys. Having crossed the 1 million Rubicon last month, across Australia, more than 1,008,000 households are estimated to be now in mortgage stress (last month 1,003,000). This equates to 30.7% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead. We discussed these results in our post “October Mortgage Stress Update”.

It’s also worth noting that the ABS data this week on costs of living showed that many households seeing their costs rise way faster than the official CPI data. Most households would not be at all surprised.

We now know that the Royal Commission will be interrogating the major banks and the regulators in the final series of hearings, and there are some hard questions to be asked, about poor culture, behaviour standards and practice. Yet we noted that the 300 or so documents released this week from a range of players, are following “party lines”. The major banks are arguing in their submissions that no significant changes to structure or regulation are required, some of the smaller players argue they are at a competitive disadvantage thanks to the current industry structure and regulation and the mortgage broker sector argues that no significant changes are required to remuneration and conflict of interest rules. On the other hand, consumer groups stress the current issues of poor selling, advice and supervision.

And the submissions from the industry also lay bare more of the criminal activity, fraud, and worse, which has beset the sector. We still believe significant change is required, and you can watch our segment on this “Our Royal Commission Submission”. The regulators need a shake-up as well. So the question is, will the Royal Commissioner stand firm, or wilt under the pressure from so many stakeholders. I hope he can see the elephant in the room!

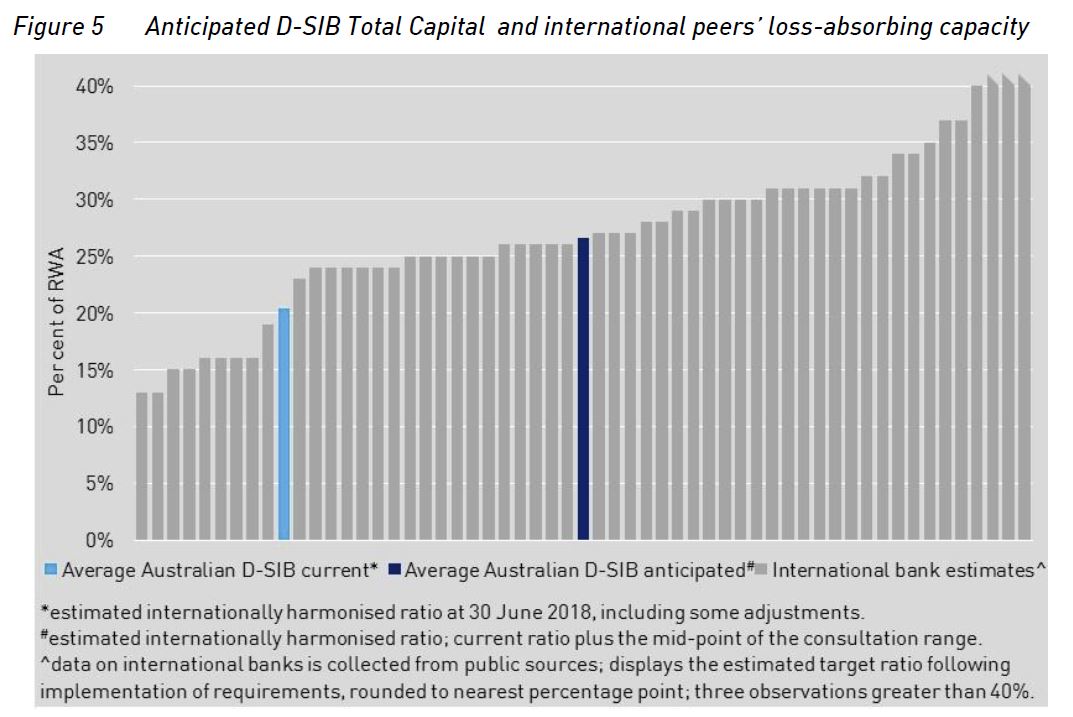

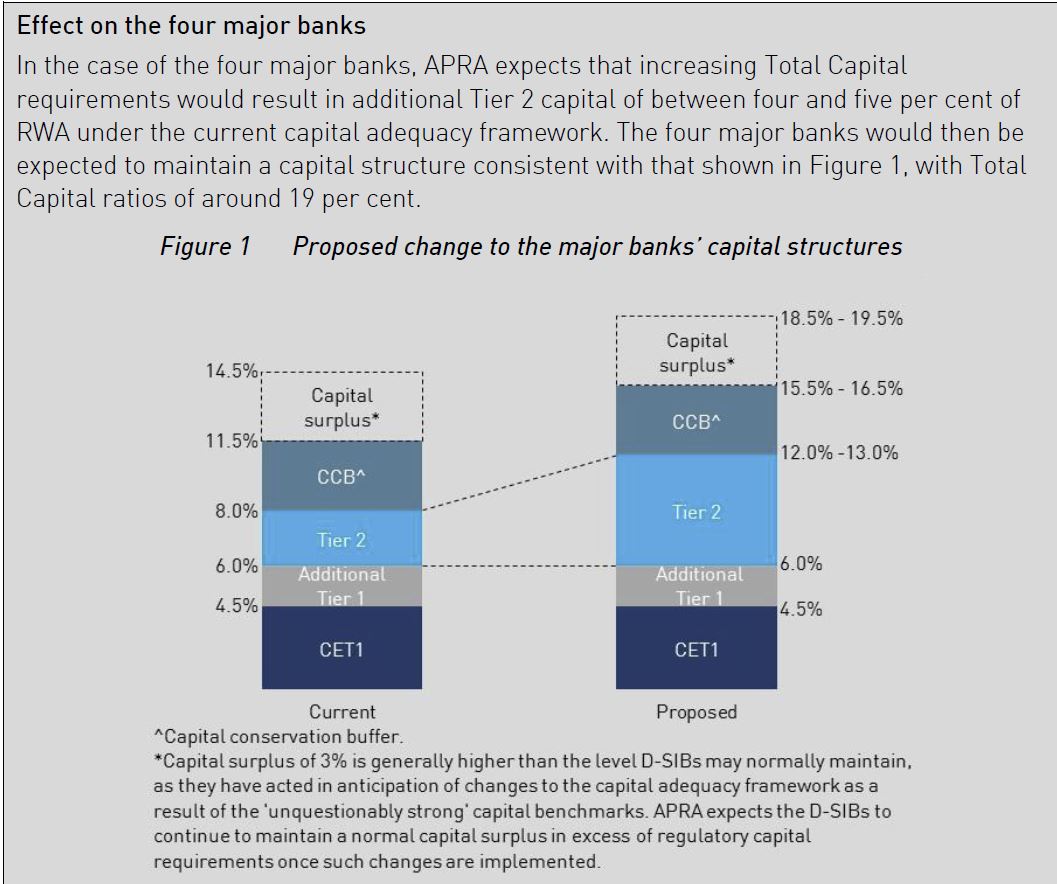

And talking of regulators, APRA released a paper this week on Loss-Absorbing Capacity of ADI’s. It shows that currently major Australian banks are at the lower end of Total Capital compared with international peers. As a result of proposed changes, major banks (Domestic systemically important banks in Australia, D-SIBs) will see their funding costs rise – incrementally over four years – by up to five basis points based on current pricing. This is intended to build in more financial resilience by lifting the capital requirements, centred on tier 2. Other banks may also be impacted to an extent.

If the D-SIBs were to maintain an additional four to five percentage points of Total Capital they would have ratios more in line with their international peers. But not in the top 25%, and the banks overseas are also lifting capital higher… so some tail chasing here! Is this “unquestionably strong”? “The aim of these proposals and resolution planning more broadly is to ensure that the failure of a financial institutions can be resolved in an orderly fashion, which protects the interests of beneficiaries and minimises disruption to the financial system,” APRA Chairman Mr Byres said. Written submissions are open to 8 February 2019.

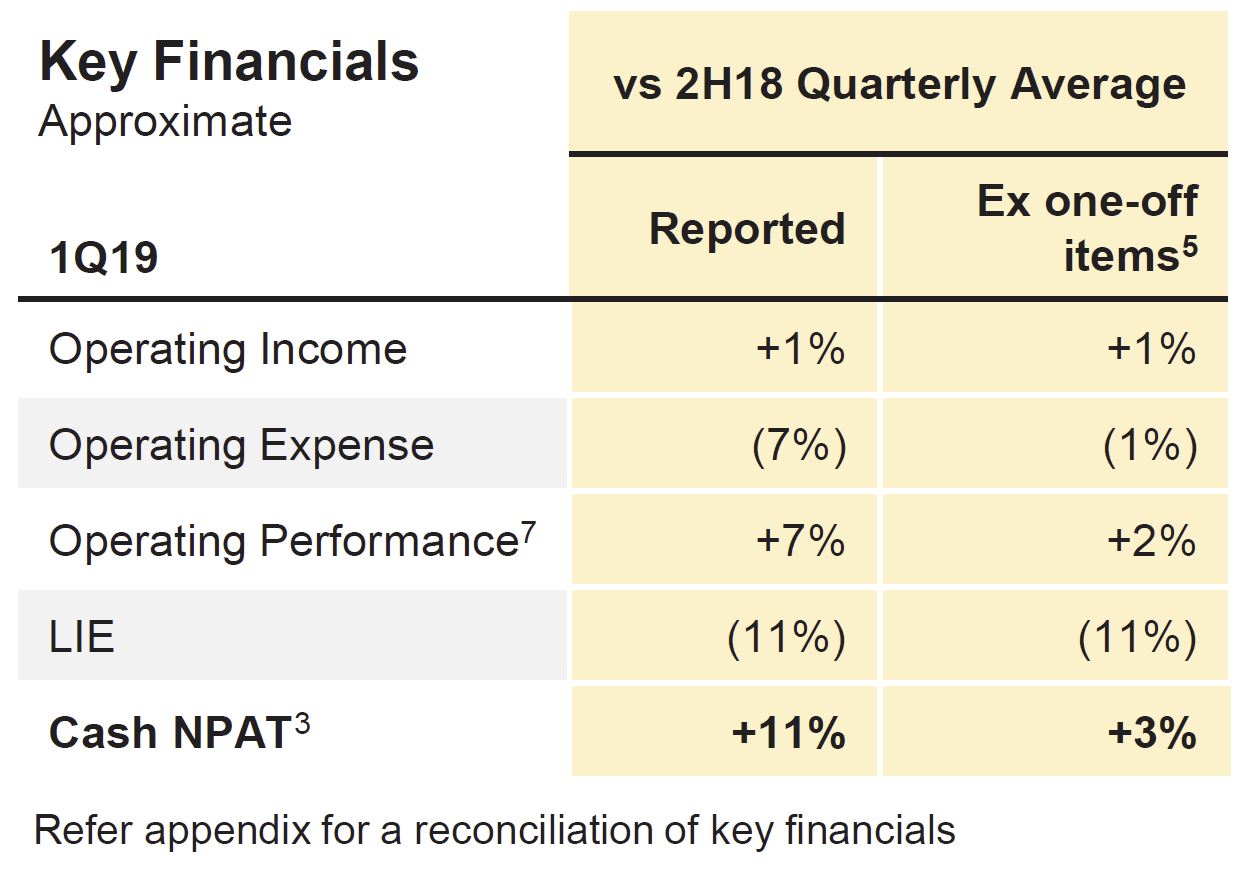

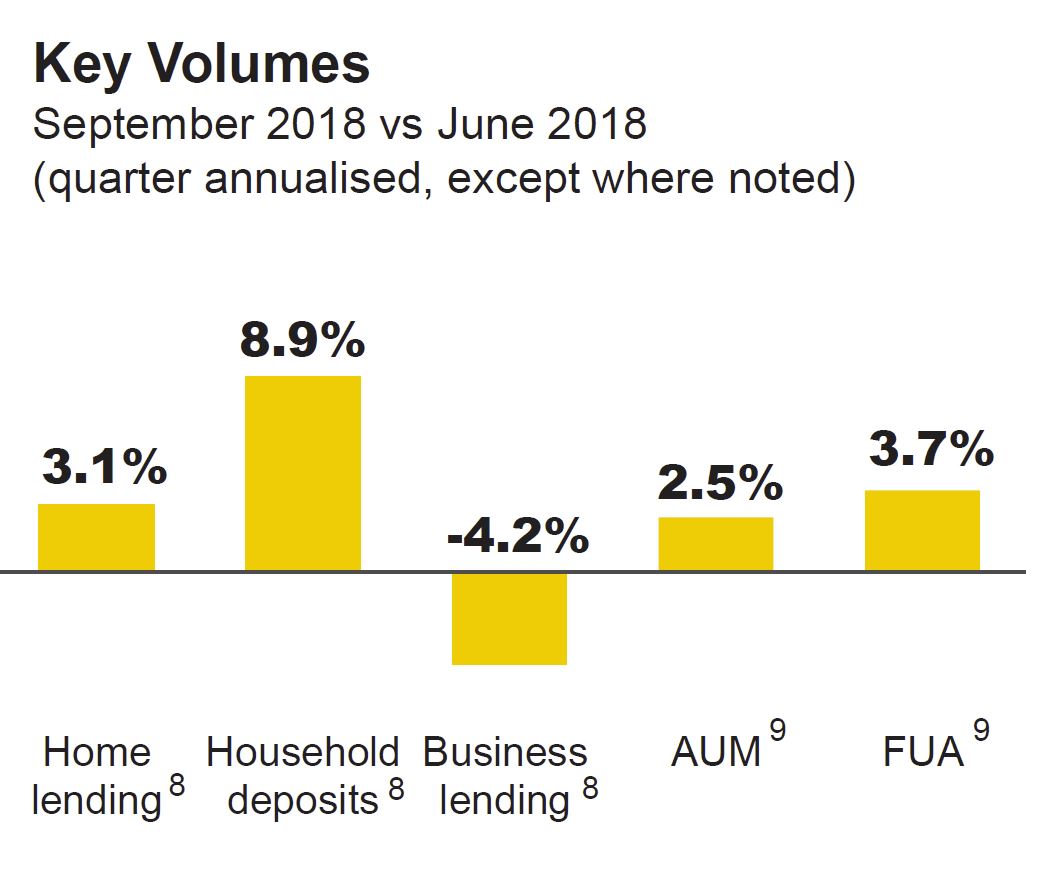

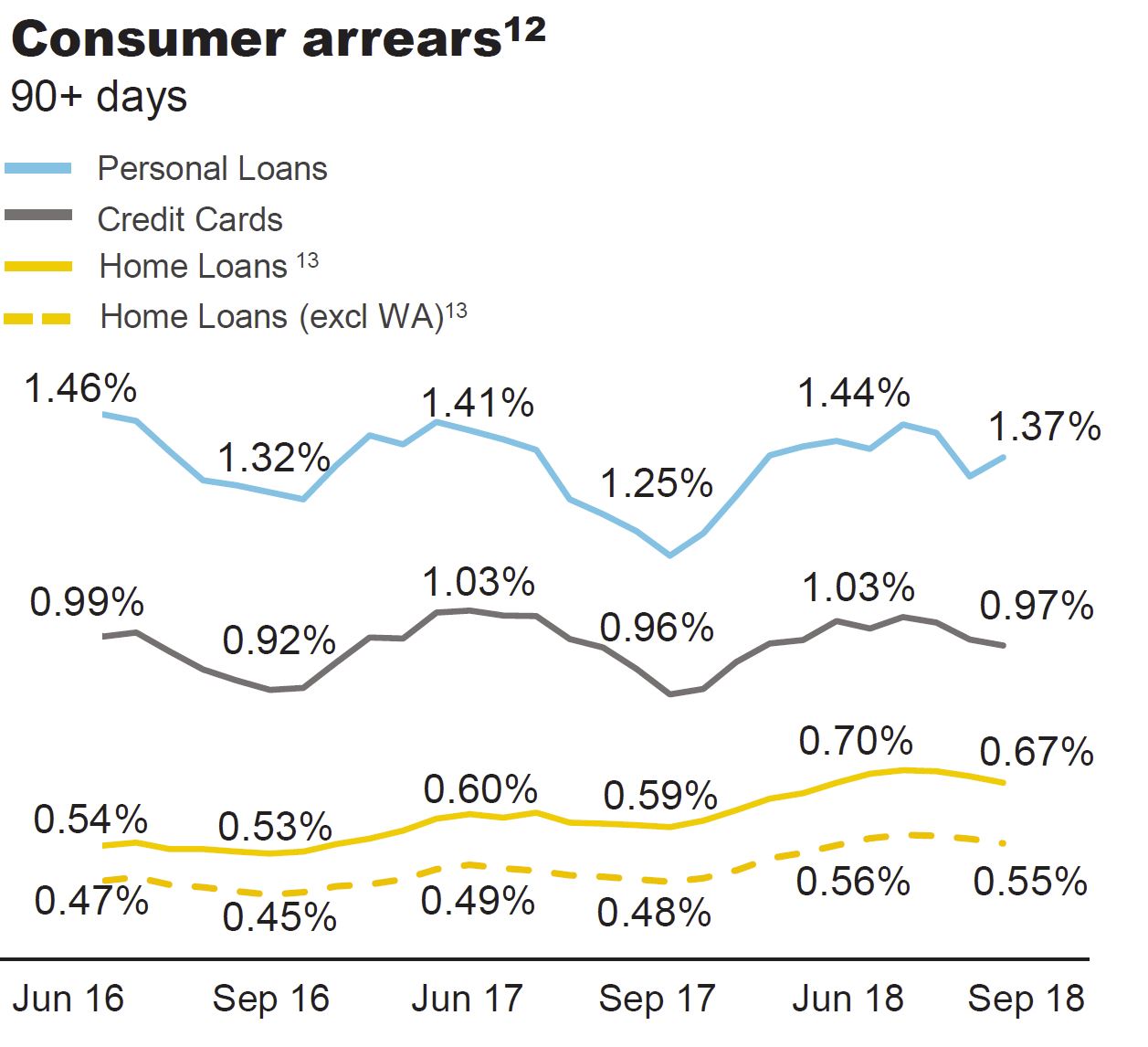

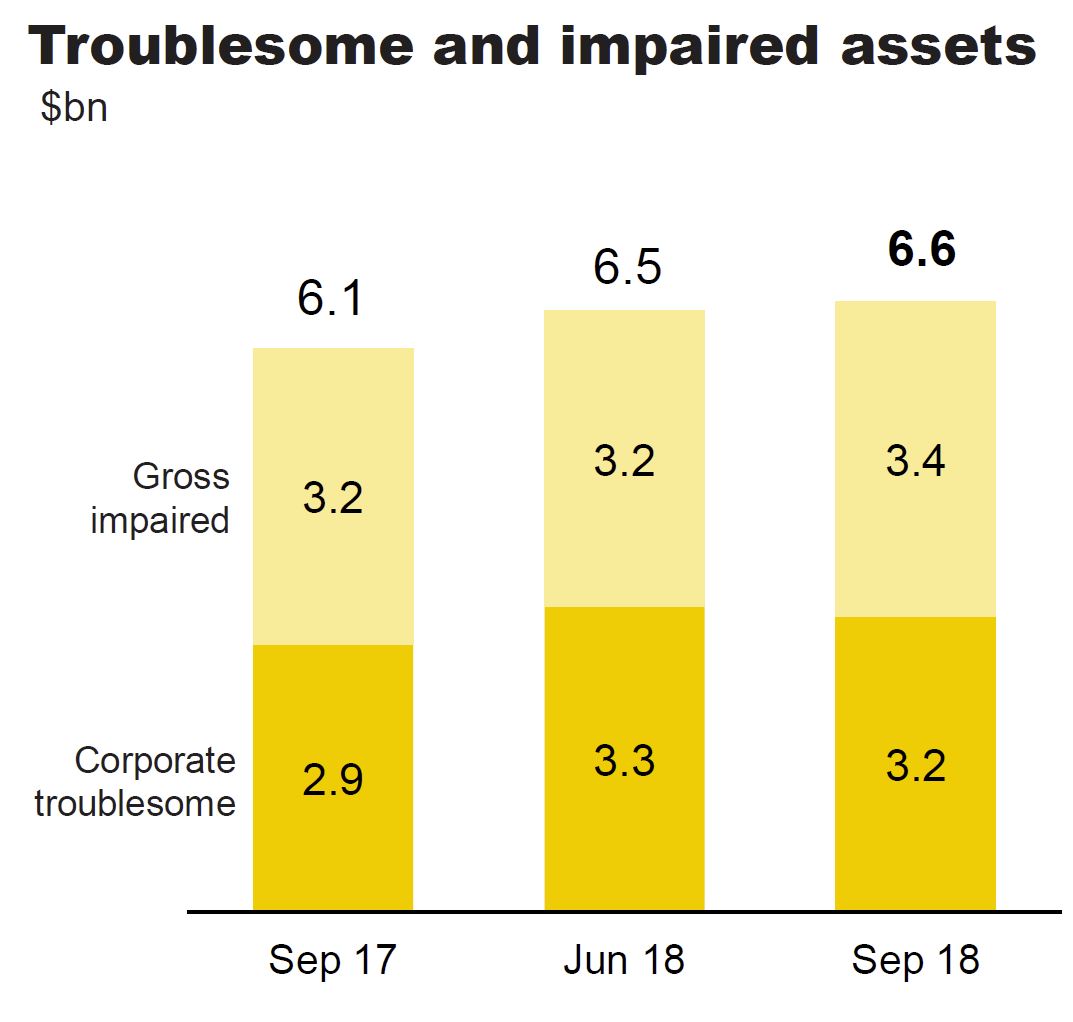

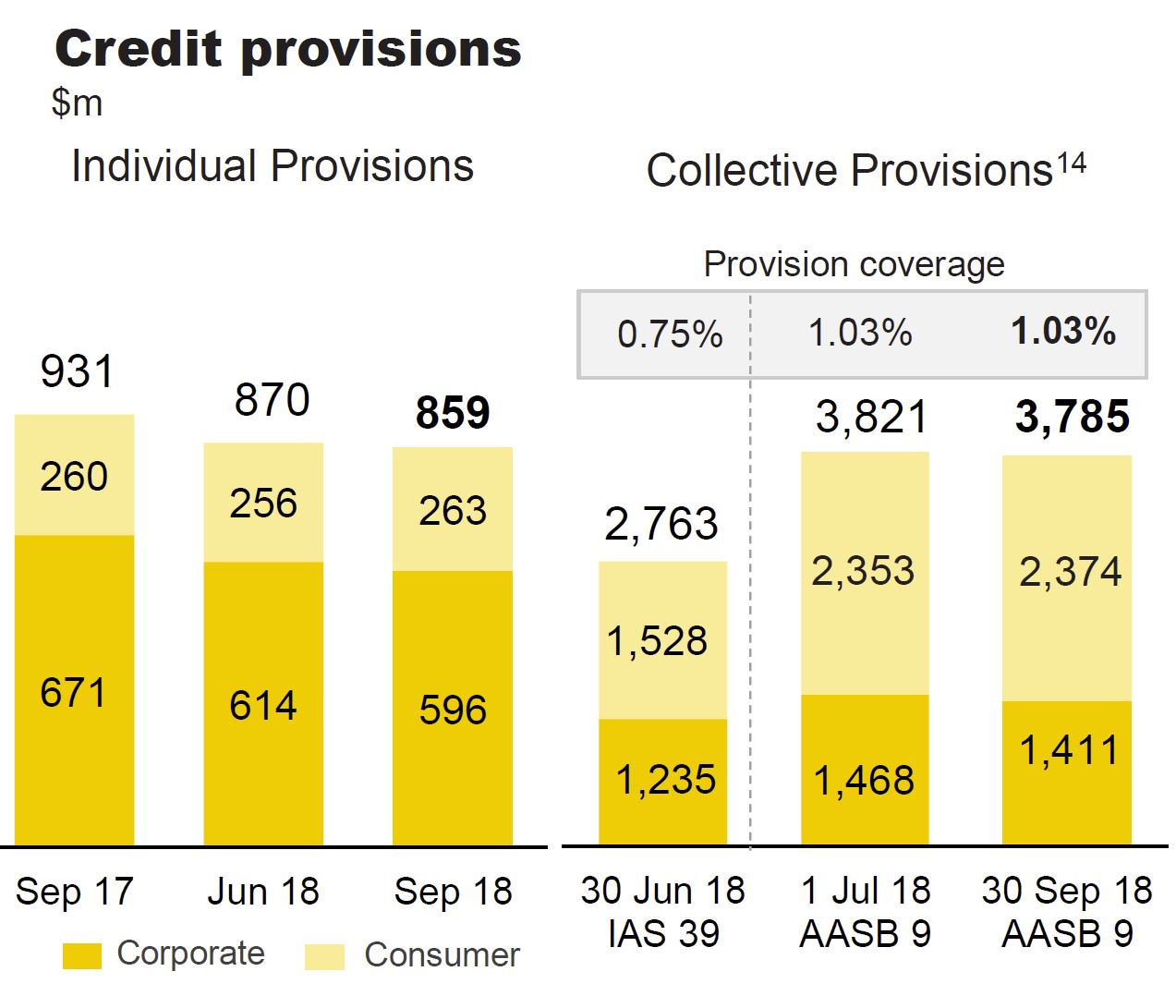

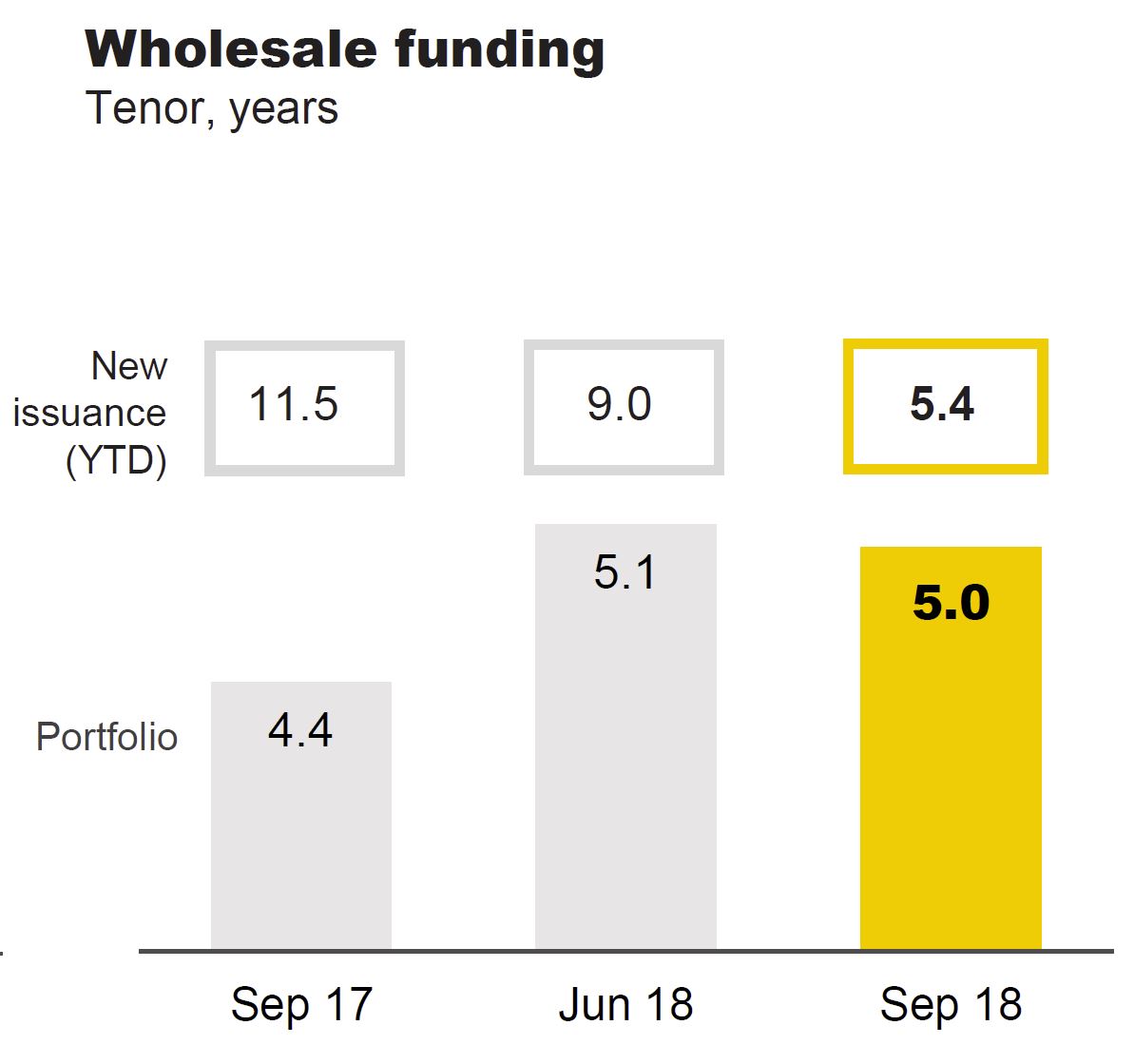

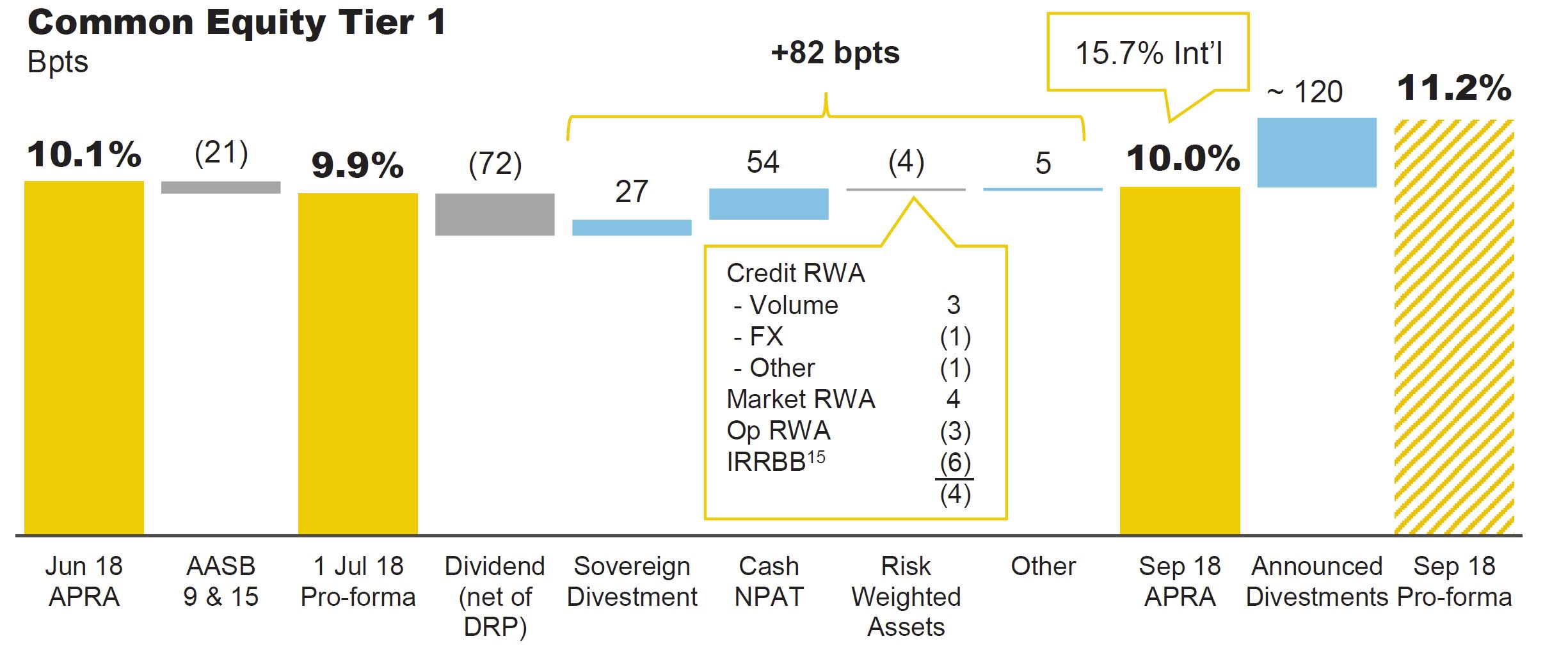

The Bank reporting season revealed weaker profits, pressure on net interest margins, a rise in 90+ mortgage delinquencies, and more provisions for customer remediation. Yet, the banks managed to tweak their provisions to maintain capital levels. The earnings of Australia’s four major banks are likely to fall further in the near term due to slowing credit growth, especially in the residential mortgage segment, and further remediation and compliance costs associated with inquiries into the financial sector, including the Royal Commission, says Fitch Ratings. They said “Slower growth puts pressure on the banks to increase lending margins to maintain profitability. However, intense regulatory and public scrutiny of the sector, as well as strong competition, may make it difficult for the banks to reprice loans and pass on the recent increase in wholesale funding costs, as evidenced from the latest financial results. Net interest margins are therefore unlikely to improve in the short term”.

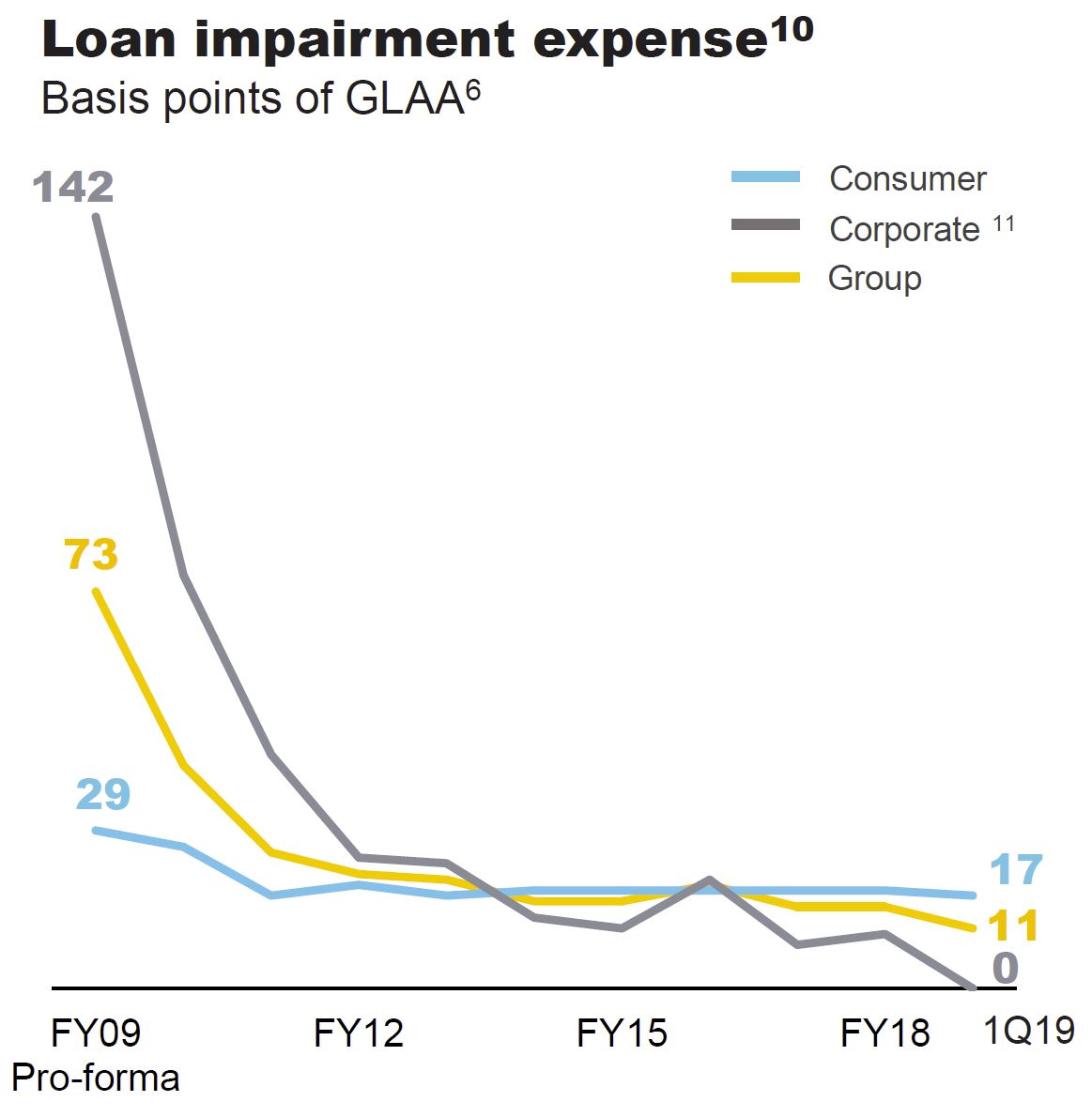

Jonathon Mott from UBS, one analyst I rate very highly, said: (1) ‘Underlying’ revenue fell -1.3% (h/h); (2) NIM was down 7bp to 199bp; (3) Average Interest Earning assets grew just 1.4% as the banks further tightened underwriting and continued to run off low yielding institutional assets; (4) Fee income and markets revenue were weaker; (5) ‘Underlying’ costs rose 1.9% (h/h) given ongoing investment, compliance and regulatory spend, which more than offset productivity savings; (6) This left ‘Underlying’ Pre-Provision Profits down 3.6% (h/h); (7) Credit impairment charges fell to just 11bp – the lowest ever recorded.

Oh and NAB this week finally moved to protect their Net Interest Margin, saying it would be changing the special offer on its base variable rate, available for new owner occupier principal and interest customers, from 3.69 per cent to 3.87 per cent. The change, which comes into effect from this Friday, November 9, reduces the discount on the advertised rate from 48 basis points to 30 basis points. It will only affect new customers taking out the product. The announcement comes nearly two months after the fourth-largest lender said it would not join the rest of the Big Four in raising mortgage rates in a bid to “rebuild trust” with customers.

So to property. Home prices are still falling according to the CoreLogic index, with year to date declines on average of 6.12% in Sydney, 4.79% in Melbourne and 3.5% in Perth. Brisbane is up 0.04% and Adelaide up 1.7% making a 5 capital average fall of 5%. In fact, the rate of decline appears to be accelerating.

Macquarie has joined the bearish view of home prices, saying they now expect national dwelling prices to fall for at least another 12 months, with a peak-to-trough correction of around 10 per cent. They expect prices in Sydney and Melbourne to fall by 15-20 per cent. They suggest it is a housing correction rather than being the result of a macro correction, in that falls have so far been orderly, with little evidence of distressed selling, even among investors affected by changes in prudential policy and lending standards. A disorderly housing price correction is unlikely, absent a major global economic downturn. They see declines, even a 20 per cent peak-to-trough decline would merely take prices back to April/May 2015 levels. They see no evidence of a severe credit curtailment, which is interesting. We do not agree.

The number of properties coming on the market continues to skyrocket, as more are forced to sell, or are confronted with the fear of not getting out, as the Sydney listings shows from Domain. There are more than 27,000 listed which seems to be some sort of record, our property Insider Edwin Almeida is tracking the results.

CoreLogic says the weighted average clearance rate saw further softening last week, with only 42.7 per cent of homes successful at auction. There were 1,541 auctions held across the combined capital cities, having decreased from the 2,928 auctions held over the week prior when a higher 47 per cent cleared. Both volumes and clearance rates continue to track lower each week when compared to the same period last year (2,046 auctions, 61.5 per cent).

In Melbourne, final results saw the clearance rate fall last week, with 45.7 per cent of the 266 auctions successful, down from the 48.6 per cent across a significantly higher 1,709 auctions over the week prior.

Across Sydney, the final auction clearance rate came in at 42.6 per cent across a slightly higher volume of auctions week-on-week, with 813 held, up from 798 the previous week when 45.3 per cent cleared. Sydney’s final clearance rate last week was not only the lowest seen this year, but the lowest the city has seen since December 2008.

The only capital city to see more than 50 per cent of auctions successful last week was Adelaide (50.8 per cent), however this was lower than the prior week’s 57.6 per cent. Brisbane saw the lowest clearance rate, with only 30 per cent of homes selling.

Geelong recorded the highest clearance rate of all the non-capital city regions, with 57.1 per cent of auctions reporting as successful, while the Sunshine Coast region had the highest volume of auctions (55).

This week, the number of auctions scheduled to take place across the combined capital cities is expected to rise, with 2,276 currently being tracked by CoreLogic, increasing from the 1,541 auctions held last week, although lower than results from one year ago (2,907). Across Melbourne, auction activity is expected to rise considerably after the slowdown seen preceding the Melbourne Cup festivities last week, with the city set to host 1,074 auctions this week, up from the 266 auctions held last week. In Sydney, 817 homes are scheduled to go to auction this week, increasing slightly from the 813 auctions held last week. Across the smaller auction markets, the number of homes scheduled for auction this week is lower than last week across all cities.

So to the markets, where the ASX 100 fell 0.09% on Friday to 4,874, whilst the ASX 200 Financials rose 0.23% to end at 5,911 and the local fear index rose 1.45% to 14.09.

AMP bumped along the bottom at 2.67, up 2.30 on Friday, ANZ moved up to 27.13, or 0.3%, the Bank of Queensland rose 0.61% to end at 9.92, while Bendigo and Adelaide Bank rose 0.57% to 10.55. CBA rose 0.47% on Friday to 70.95 while Mortgage Insurer Genworth was up 2.2% to 2.32. Macquarie recovered to 123.64 up 0.45%. National Australia Bank slid 0.12% to end the week at 24.90, Suncorp was up 0.64% to 14.08, and Westpac was up 0.07% to 27.70.

The Aussie, which reacted positively to the US mid-terms, ended the week at 72.25, but was down 0.44% on Friday. The Aussie Bitcoin rate was 8,566, down 0.54% and the Aussie Spot Gold fell 0.71% to 1,674.

Across to the US markets. U.S. stocks were lower after the close on Friday, as losses in the Technology, Basic Materials and Industrials sectors led shares lower. At the close in NYSE, the Dow Jones Industrial Average fell 0.77%, while the S&P 500 index fell 0.92% to 2,781, and the NASDAQ Composite index fell 1.65% to 7,407. The CBOE Volatility Index, which measures the implied volatility of S&P 500 options, was up 3.83% to 17.36. Gold Futures for December delivery was down 1.30% or 15.90 to $1210.30 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in December fell 1.37% or 0.83 to hit $59.84 a barrel. The US has just become the largest oil producer. Generally, a 20% drop from high close to low close defines a bear market. We are entering that territory!

Banks were off, with the S&P500 Financials down 0.93% to 449.49. On the whole, consumer discretionary stocks are slightly outpacing the S&P 500 since early October. The outlier might be Apple, which is actually a tech stock but obviously can have a huge impact on shopping season. The stock has made it back a bit after falling below $200 a share last week, but remains a long way from recent highs of around $230 as investors continue to debate what the company’s holiday quarter guidance and decision to stop reporting iPhone unit sales might mean moving forward. It ended at 204.5, though down 1.93 on the day.

A weakening Chinese economy helped affirm the bearish narrative of slower global growth. The FED kept the cash rate on hold, but the narrative confirms the view that further hikes are likely, with the 3-month bond rate flat at 2.36, and the 10-year rate back a little off its highs, down 1.44% to 3.19. The Fed said it expects “further, gradual increases” in rates as the economy continues to thrive. It’s a bit hard to understand any panic about these words, because they didn’t tell investors anything that most didn’t already know.

The European Commission tangled with Italy over the Italian government’s budget forecasts, which the EC said looked too optimistic on deficits. Moving west, debate raged about whether a Brexit deal might be getting close, and the U.K. government is holding meetings on the issue this weekend, media reports said. A Brexit breakthrough, if it comes, might give European markets a boost. But it’s unclear how close it might be. Deutsche Bank was down 1.75% on Friday to 8.97, and we are watching this as a bellwether for more trouble ahead.

Bitcoin was down 1.45% to 6,415.

So to conclude, the big debt question still remains the elephant in the room, and many are choosing to look past it, though as interest rates continue to push higher in the US, this will be harder to do. Locally, we expect more unnatural acts to try and keep the credit balloon in the air, but we believe that tighter standards are set to lurk in the shadows, meaning that the stage is set for more home price falls ahead.

Finally, a quick reminder, our next live Q&A session is now scheduled for November 20th at 8 pm Sydney time. You can schedule a reminder by using the YouTube Link and join in the live discussion, or send in questions beforehand. If previous sessions are any guide, it should be a lively event!