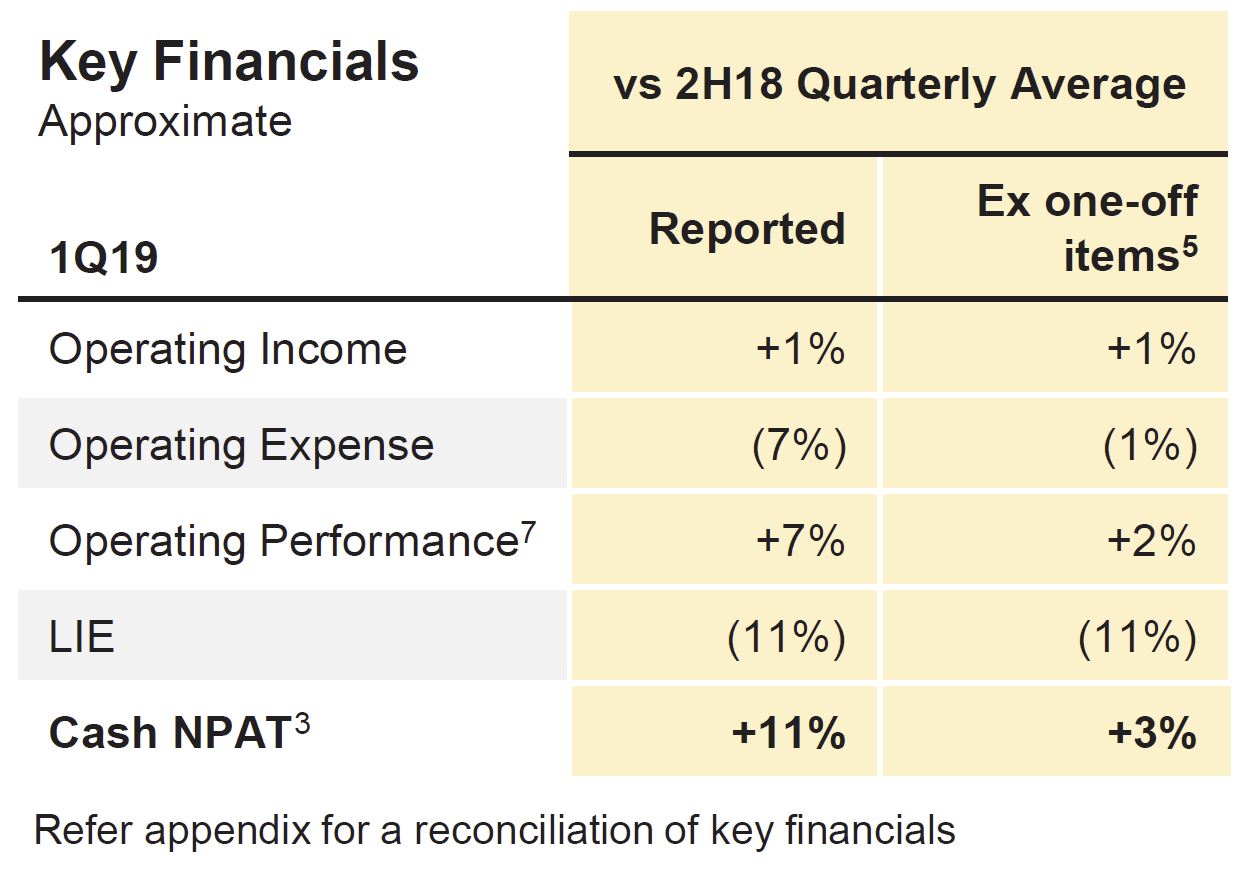

CBA released their 1Q19 trading update today. Their unaudited statutory net profit was approximately $2.45bn in the quarter and unaudited cash net profit was approximately $2.50bn in the quarter, both rounded to the nearest $50 million. The cash basis is used by management to present a clear view of the Group’s operating results. CBA did not include any further customer remediation charges in the quarter.

Their operating Income up 1%, with higher other banking income offsetting flat net interest income. But the Group Net Interest Margin was lower in the quarter due to higher funding costs (including basis risk which arises from the spread between the 3 month bank bill swap rate and 3 month overnight index swap rate; and replicating portfolio) and home loan price competition.

Their operating Income up 1%, with higher other banking income offsetting flat net interest income. But the Group Net Interest Margin was lower in the quarter due to higher funding costs (including basis risk which arises from the spread between the 3 month bank bill swap rate and 3 month overnight index swap rate; and replicating portfolio) and home loan price competition.

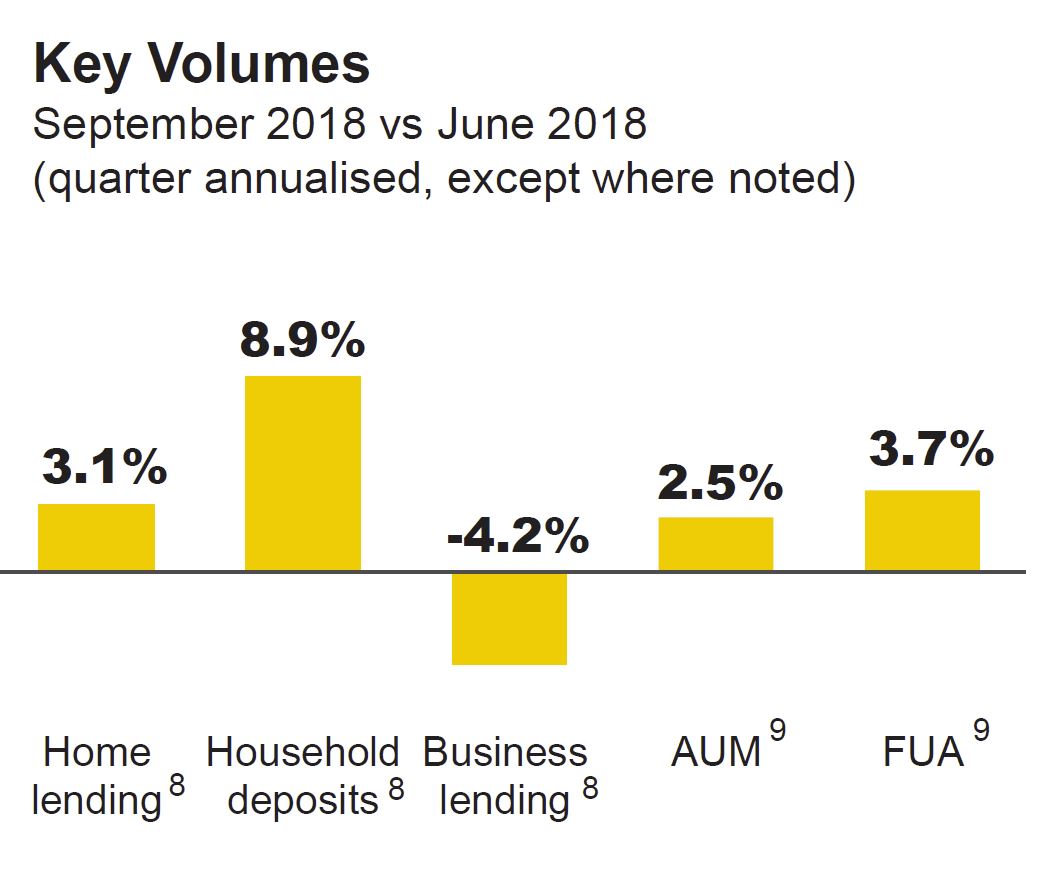

Volume growth included 8.9% quarter annualised growth in household deposits. Home lending growth of 3.1% was below system growth of 3.6% (both quarter annualised). Business lending reflected continued portfolio optimisation in the institutional book.

Volume growth included 8.9% quarter annualised growth in household deposits. Home lending growth of 3.1% was below system growth of 3.6% (both quarter annualised). Business lending reflected continued portfolio optimisation in the institutional book.

Operating Expenses ex one-off items were down 1% due to timing of investment spend and software impairments in the comparative period.

Operating Expenses ex one-off items were down 1% due to timing of investment spend and software impairments in the comparative period.

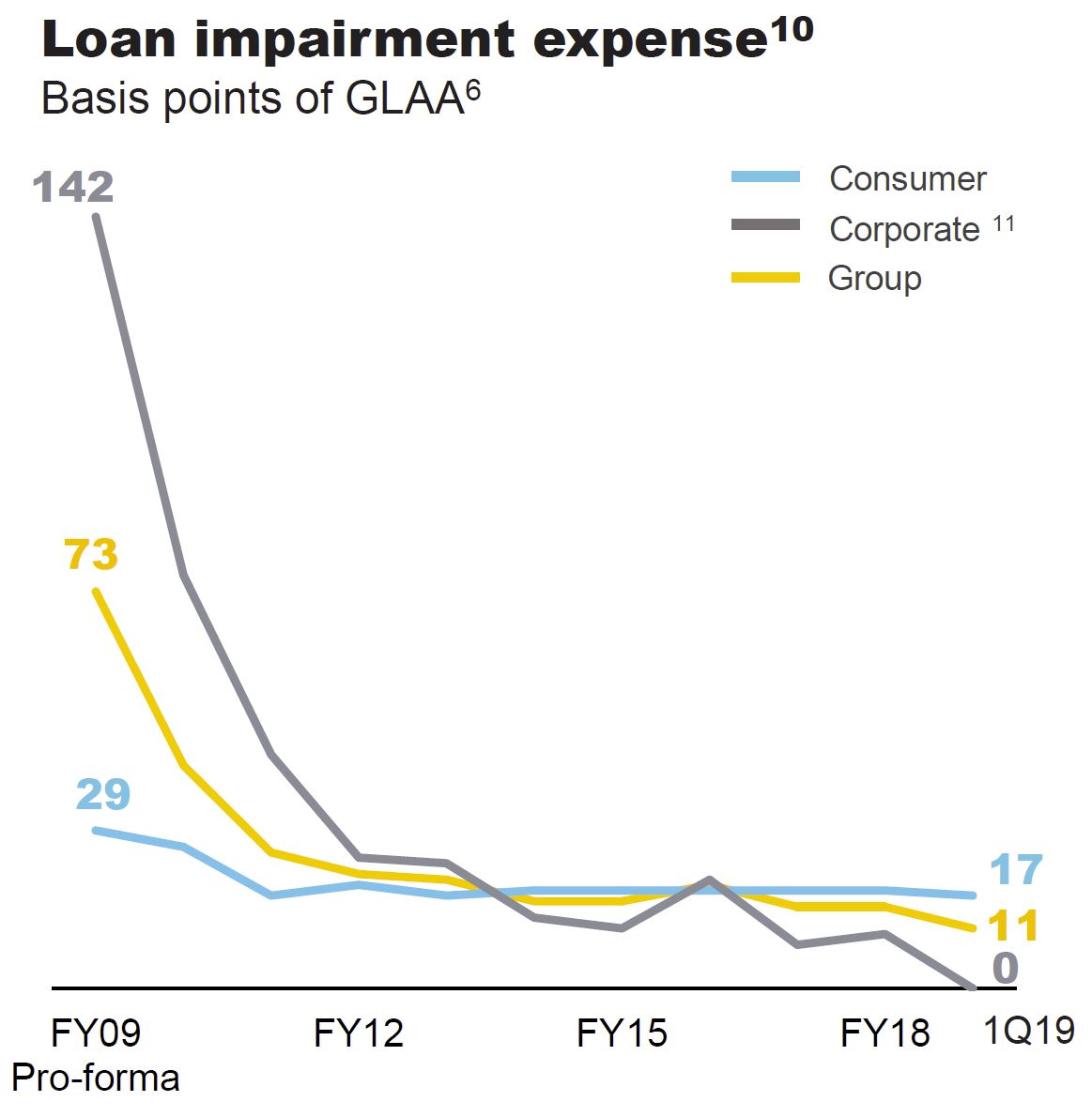

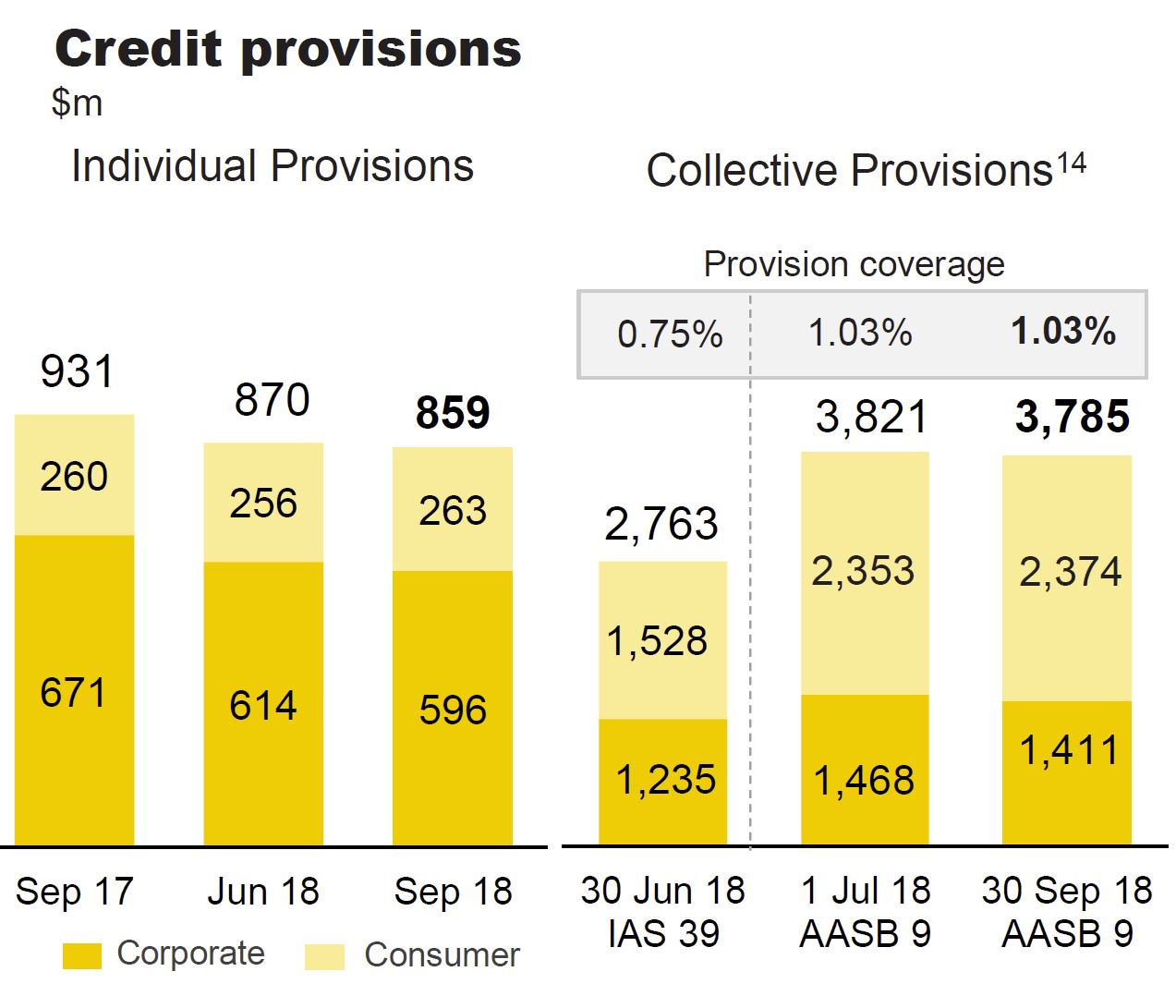

Loan Impairment Expense (LIE) were $216 million in the quarter or 11bpts of GLAA and equated to 11 basis points of Gross Loans and Acceptances, compared to 15 basis points in FY18. Low corporate LIE reflected some single name improvements, sound portfolio credit quality and continued IB&M portfolio optimisation.

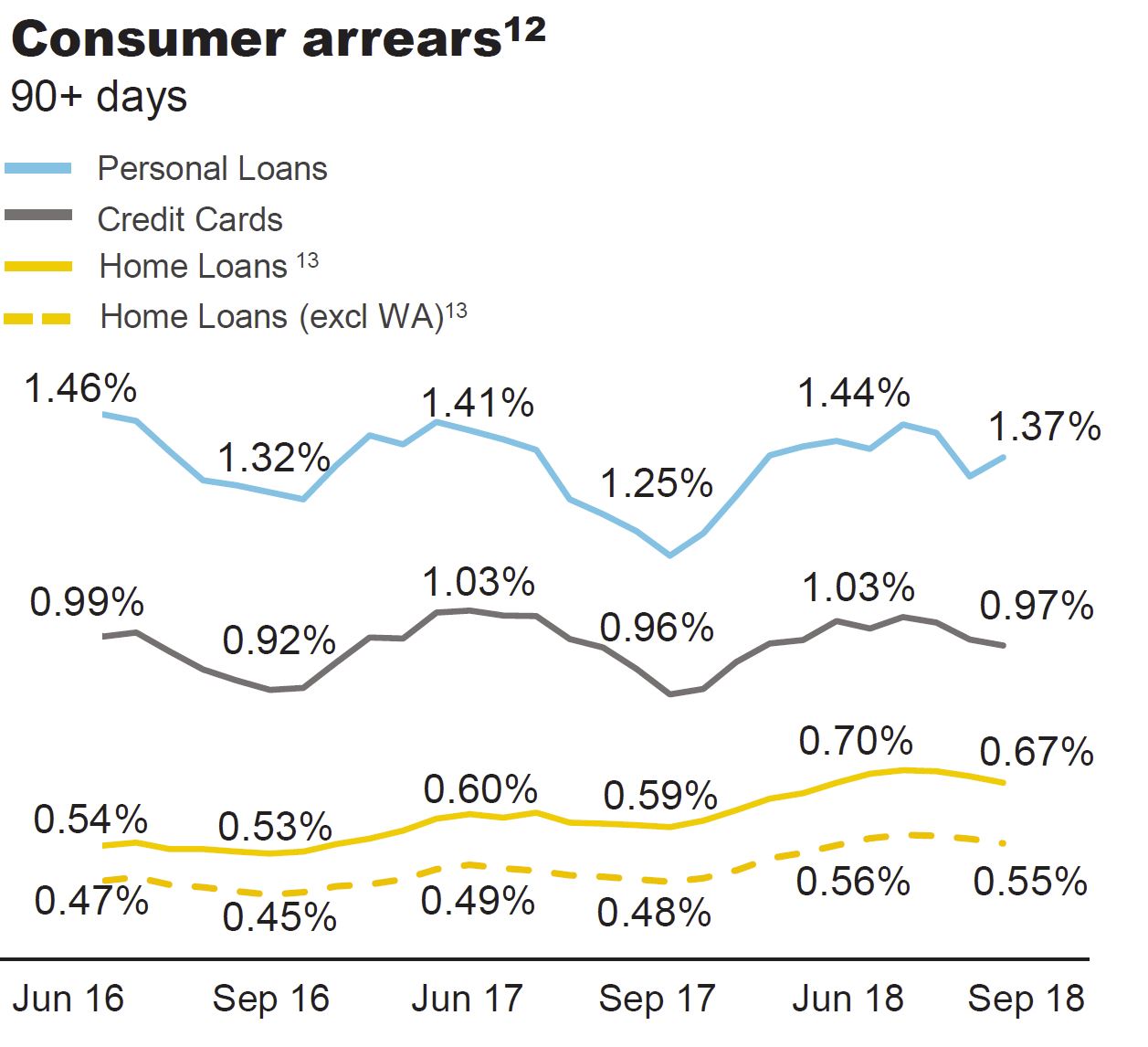

Consumer arrears were seasonally lower in the quarter. Whilst there was a moderate improvement in home loan arrears, some households continued to experience difficulties with rising essential costs and limited income growth.

Consumer arrears were seasonally lower in the quarter. Whilst there was a moderate improvement in home loan arrears, some households continued to experience difficulties with rising essential costs and limited income growth.

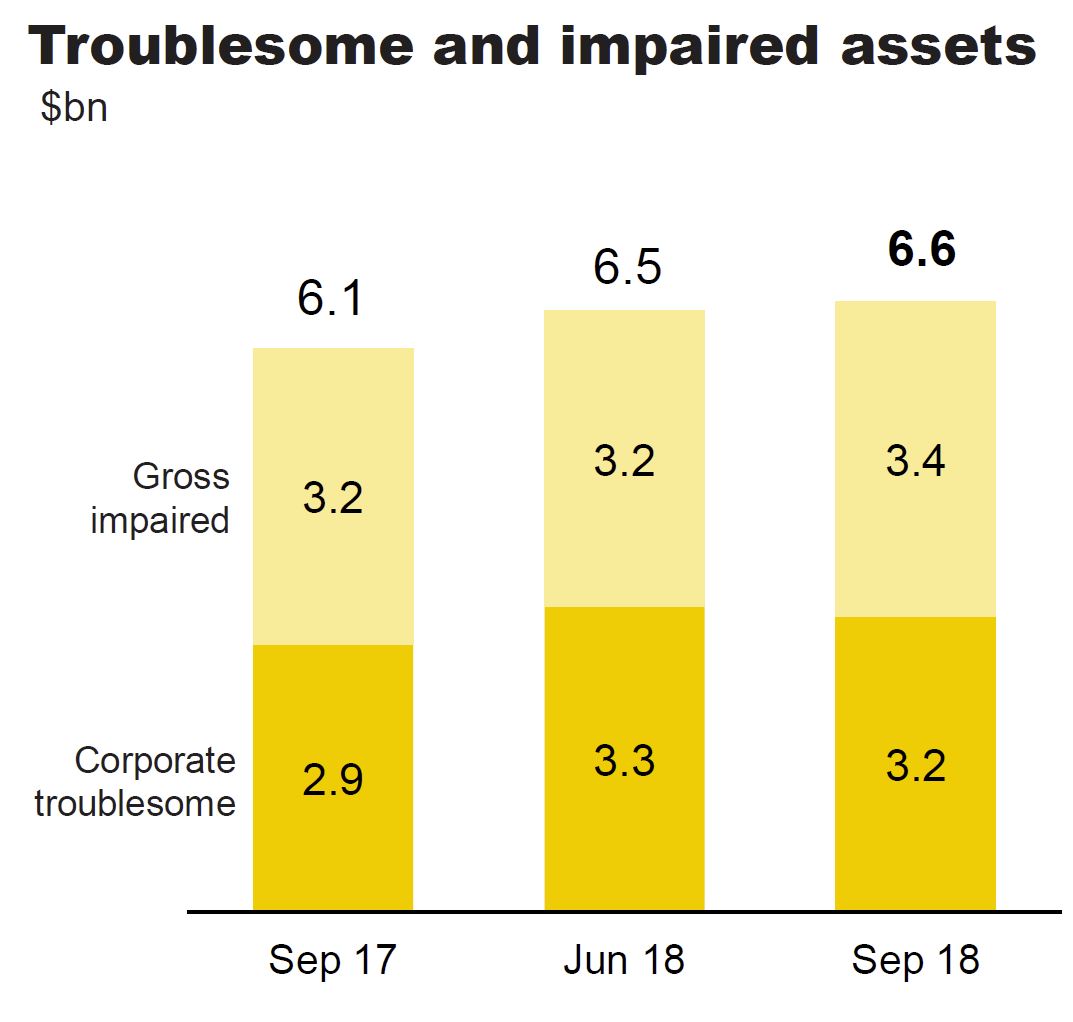

Troublesome and impaired assets increased from $6.5 billion at June 2018 to $6.6 billion in September, driven by an increase in home loan impaired assets and a small number of individual corporate impairments.

Troublesome and impaired assets increased from $6.5 billion at June 2018 to $6.6 billion in September, driven by an increase in home loan impaired assets and a small number of individual corporate impairments.

Troublesome exposures were broadly stable in the quarter.

Troublesome exposures were broadly stable in the quarter.

The Group adopted AASB 9 from 1 July 2018 resulting in a $1.06 billion increase to collective provisions and a 28 bpt increase in collective provision coverage to 1.03% (collective provisions to credit risk weighted assets).

Total Provisions were broadly stable in the quarter.

Total Provisions were broadly stable in the quarter.

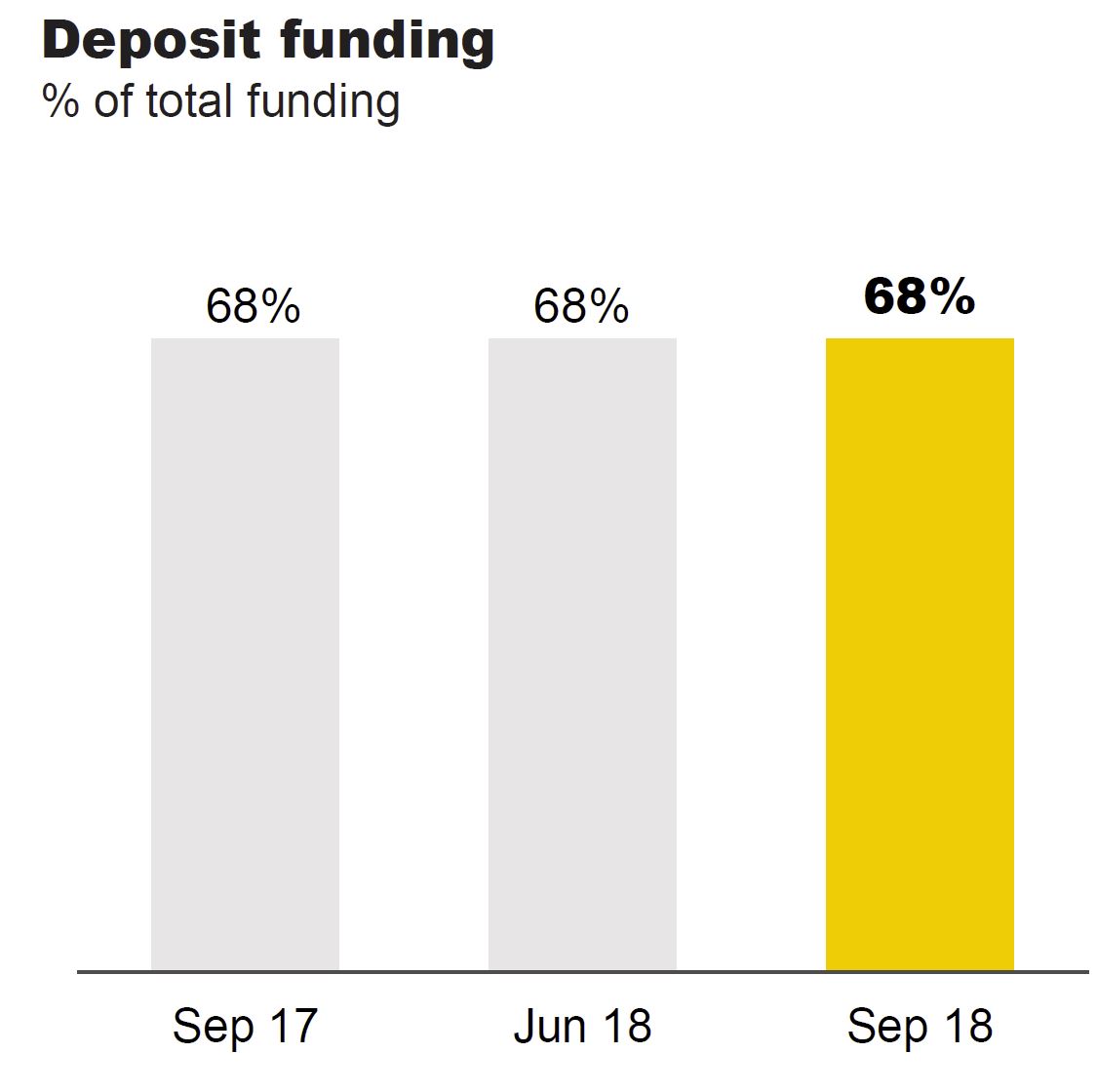

Customer deposit funding remained at 68%.

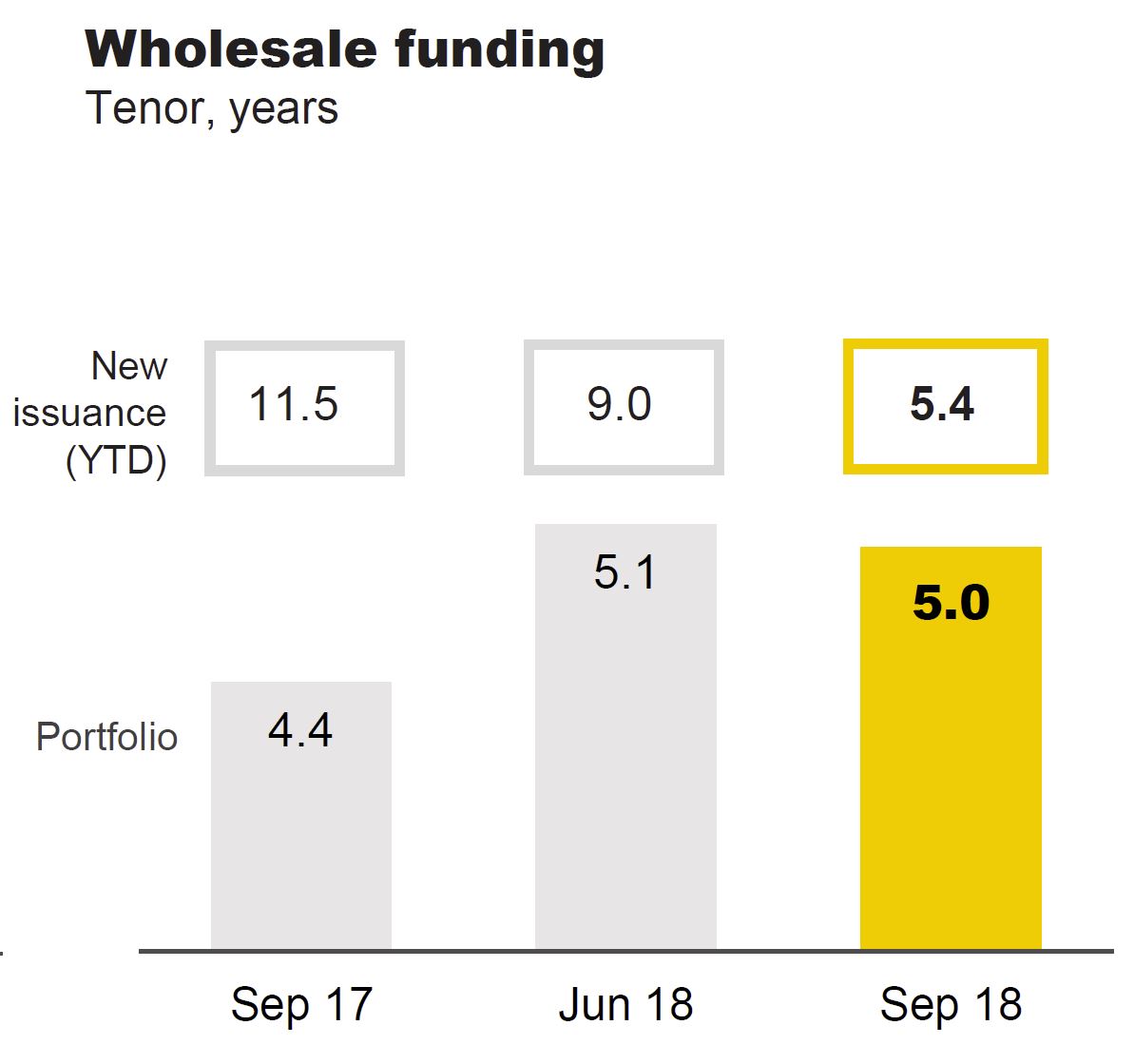

The average tenor of the long term wholesale funding portfolio at 5.0 years.

The average tenor of the long term wholesale funding portfolio at 5.0 years.

The Group issued $8.8 billion of long term funding in the quarter.

The Group issued $8.8 billion of long term funding in the quarter.

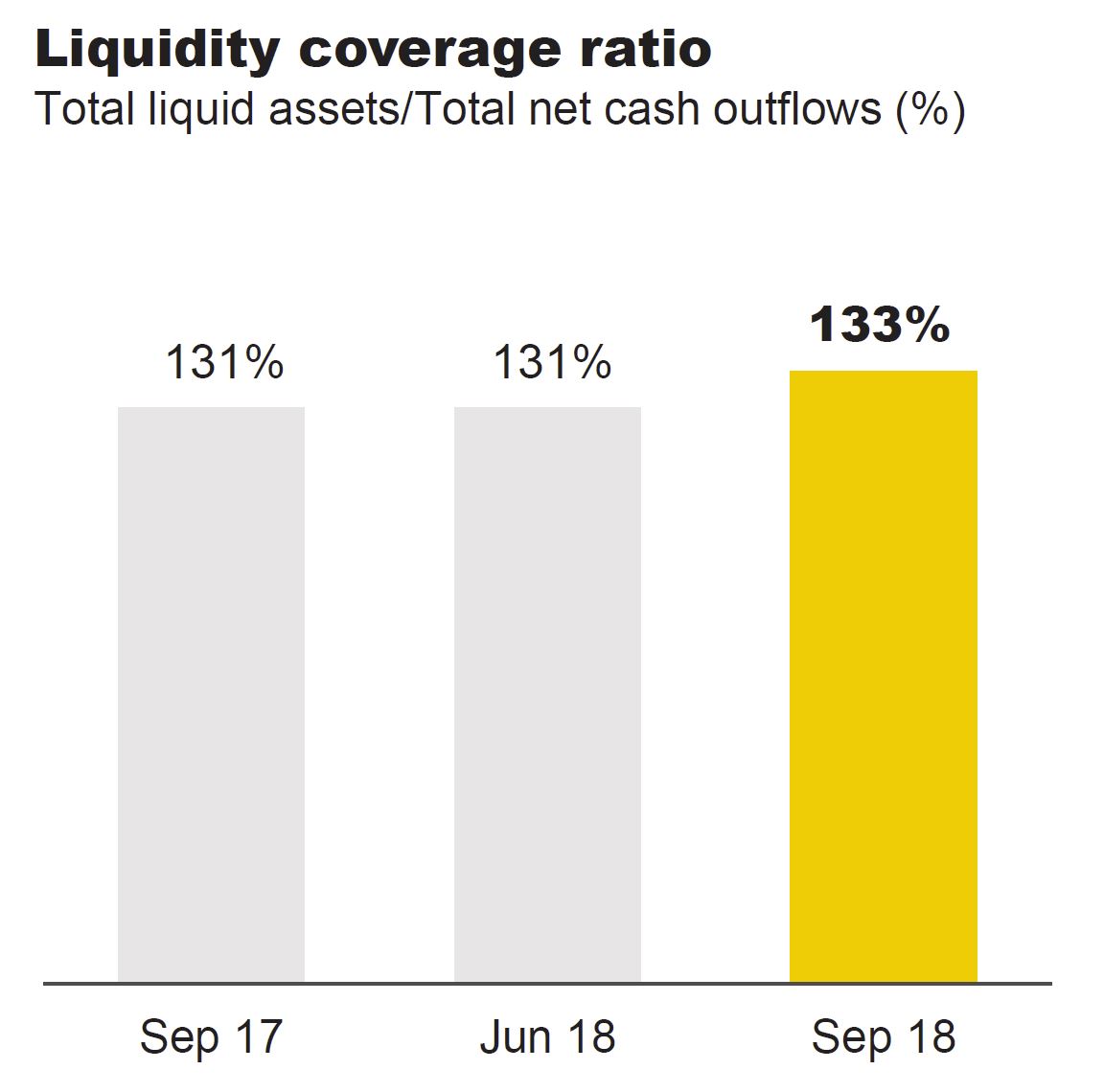

The Liquidity Coverage Ratio (LCR) was 133% at September 2018, up from 131% at June 2018.

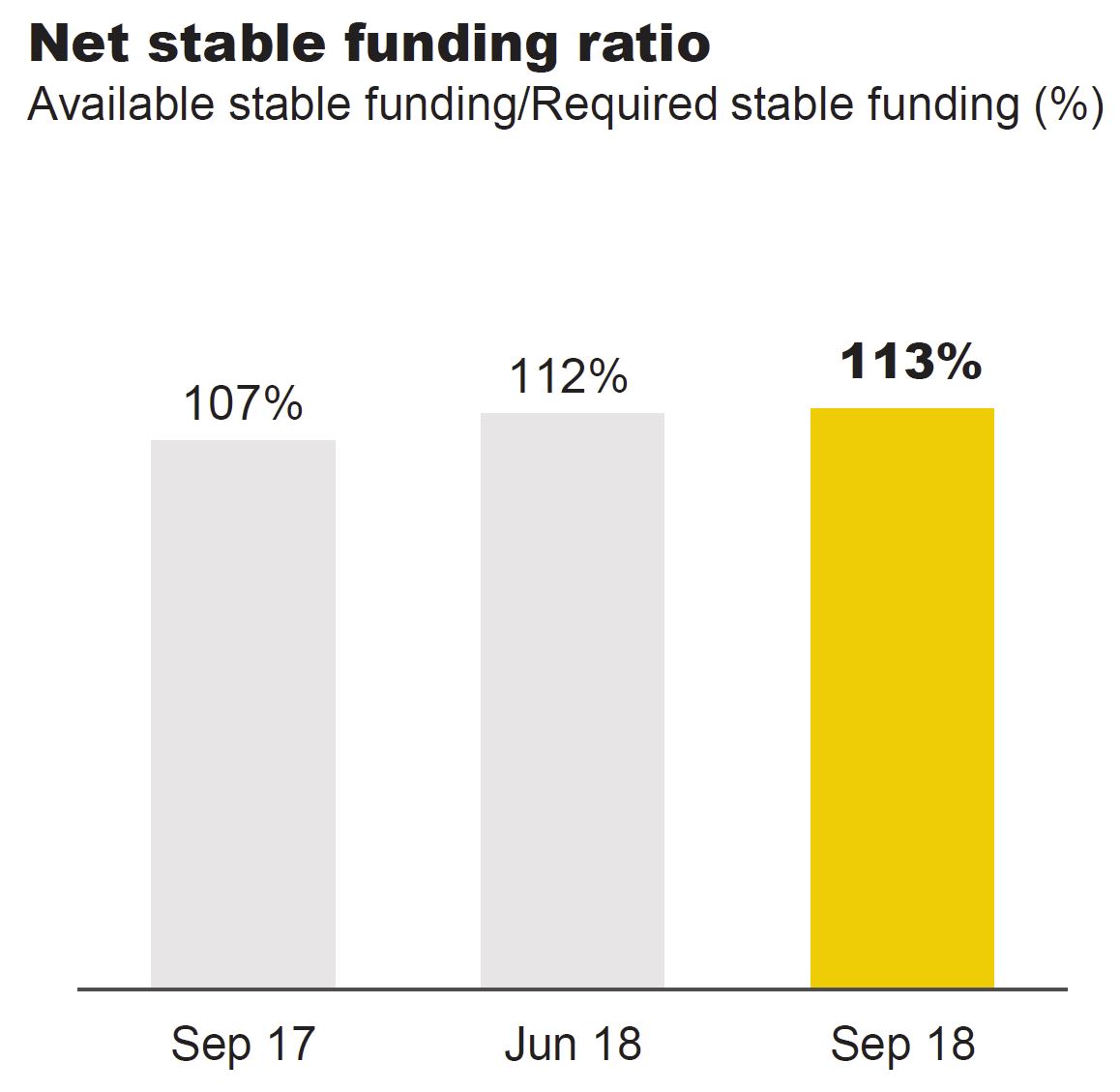

The Net Stable Funding Ratio (NSFR) was 113% at September 2018, up from 112% at June 2018.

The Net Stable Funding Ratio (NSFR) was 113% at September 2018, up from 112% at June 2018.

The Group’s Leverage Ratio remained relatively stable across the quarter at 5.5% on an APRA basis and 6.2% on an internationally comparable basis.

The Group’s Leverage Ratio remained relatively stable across the quarter at 5.5% on an APRA basis and 6.2% on an internationally comparable basis.

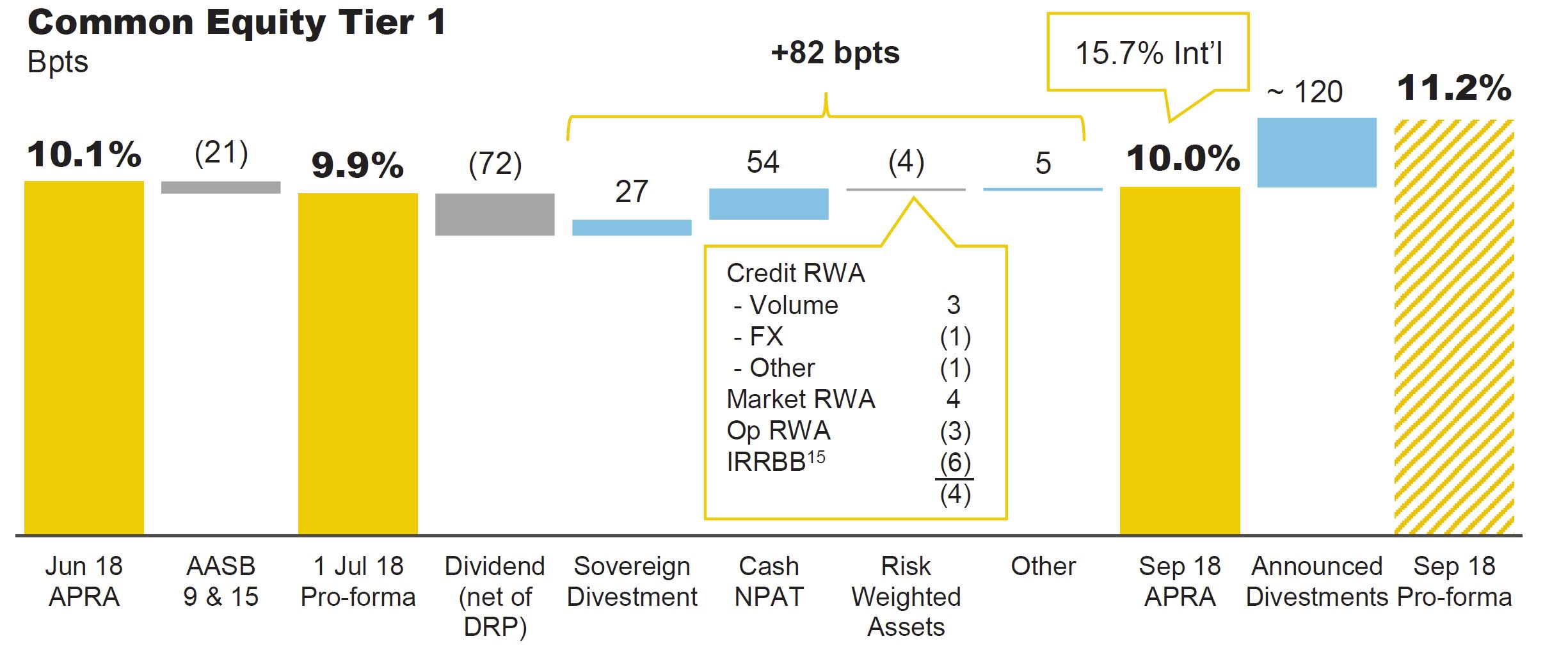

The Common Equity Tier 1 (CET1) APRA ratio was 10.0% as at 30 September 2018. After allowing for the impact of the implementation of AASB 9 and 15 on 1 July 2018, and the 2018 final dividend (which included the issuance of shares in respect of the Dividend Reinvestment Plan), CET1 increased 82 bptsin the quarter. This was driven by a combination of capital generated from earnings and the benefit from the sale of the Group’s New Zealand life insurance operations.

CBA has previously announced the divestment of a number of businesses as part of its strategy to build a simpler, better bank. These divestments are subject to various conditions, regulatory approvals and timings, and include the sale of the bank’s global asset management business, Colonial First State Global Asset Management (CFSGAM, expected completion mid calendar year 2019) and the sales of its Australian life insurance business (“CommInsureLife”), its non-controlling investment in BoCommLife and its 80% interest in the Indonesian life insurance business, PT Commonwealth Life (all expected to complete in the first half of calendar year 2019). Collectively, these divestments will provide an uplift to CET1 of approximately 120 bpts, resulting in a 30 September 2018 pro-forma CET1 ratio of 11.2%.

CBA has previously announced the divestment of a number of businesses as part of its strategy to build a simpler, better bank. These divestments are subject to various conditions, regulatory approvals and timings, and include the sale of the bank’s global asset management business, Colonial First State Global Asset Management (CFSGAM, expected completion mid calendar year 2019) and the sales of its Australian life insurance business (“CommInsureLife”), its non-controlling investment in BoCommLife and its 80% interest in the Indonesian life insurance business, PT Commonwealth Life (all expected to complete in the first half of calendar year 2019). Collectively, these divestments will provide an uplift to CET1 of approximately 120 bpts, resulting in a 30 September 2018 pro-forma CET1 ratio of 11.2%.

In June 2018, CBA announced its commitment to the demerger of NewCo, which includes Colonial First State, Count Financial, Financial Wisdom, Aussie Home Loans and CBA’s minority shareholdings in ASX-listed companies CountPlusand Mortgage Choice. The demerger process is expected to be completed by late calendar year 2019, subject to shareholder and regulatory approvals. CFSGAM will no longer form part of NewCo, following the recent announcement of an agreement to sell this business to Mitsubishi UFJ Trust and Banking Corporation.