We review the latest Westpac results, and look in detail at their mortgage lending standards.

Category: Company Results

Westpac Drops Profit 24%

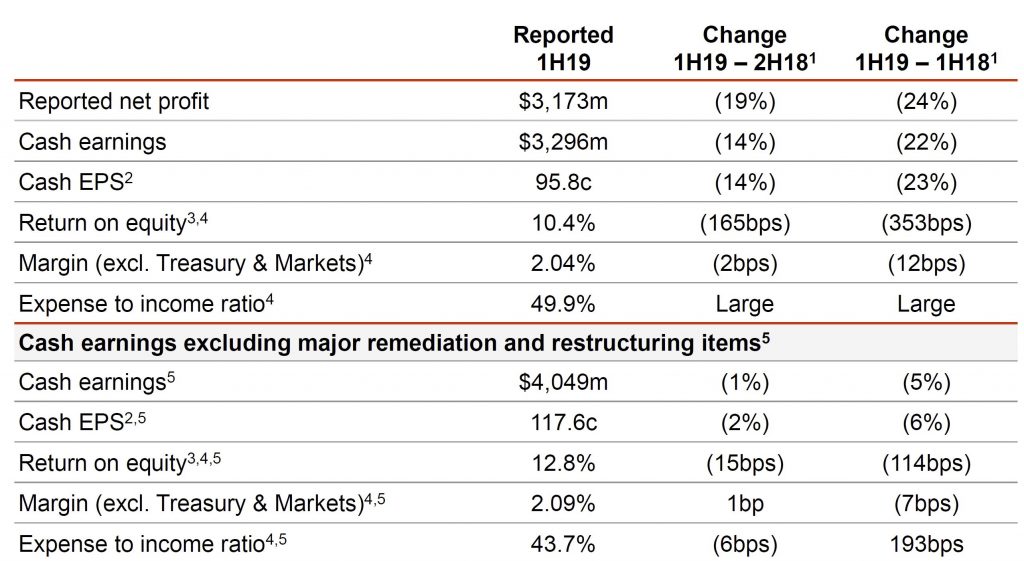

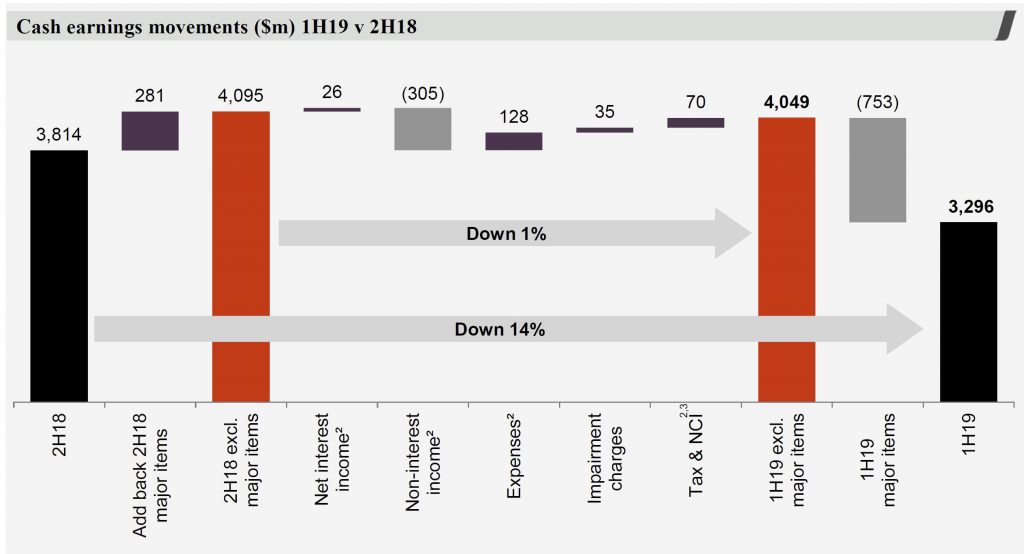

Westpac released their 1H19 results today and declared a statutory net profit of $3,173 million, down 24%. It would have been worse, but for lower than expected provisioning at $0.33 billion. Revenue was weaker than expected as they were hit by slower mortgage lending and weaker treasury. Margin is under pressure, but customer remediation costs continue to rise.

Cash earnings were $3,296 million, down 22% and cash earnings per share at 95.8 cents was down 23%.

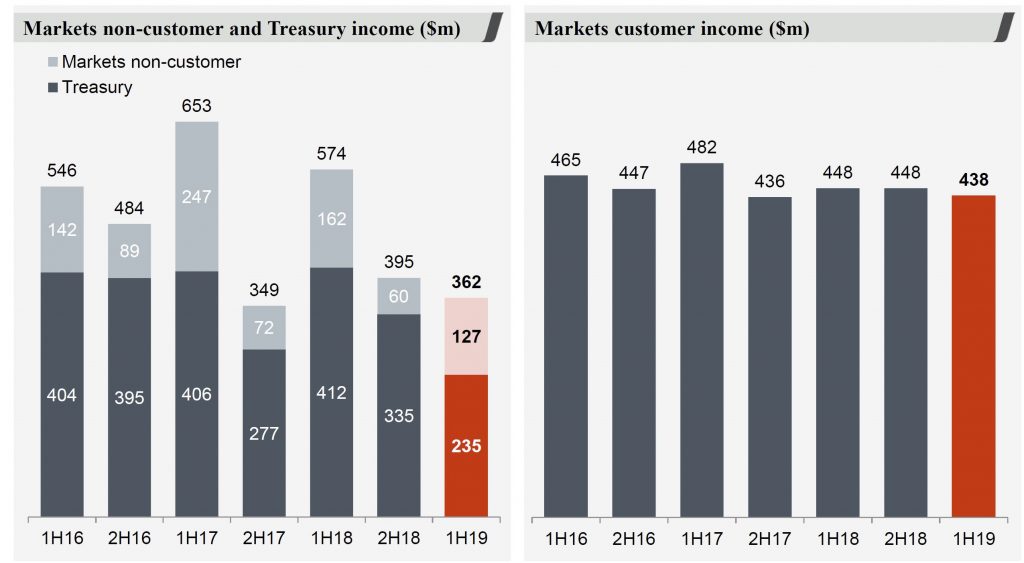

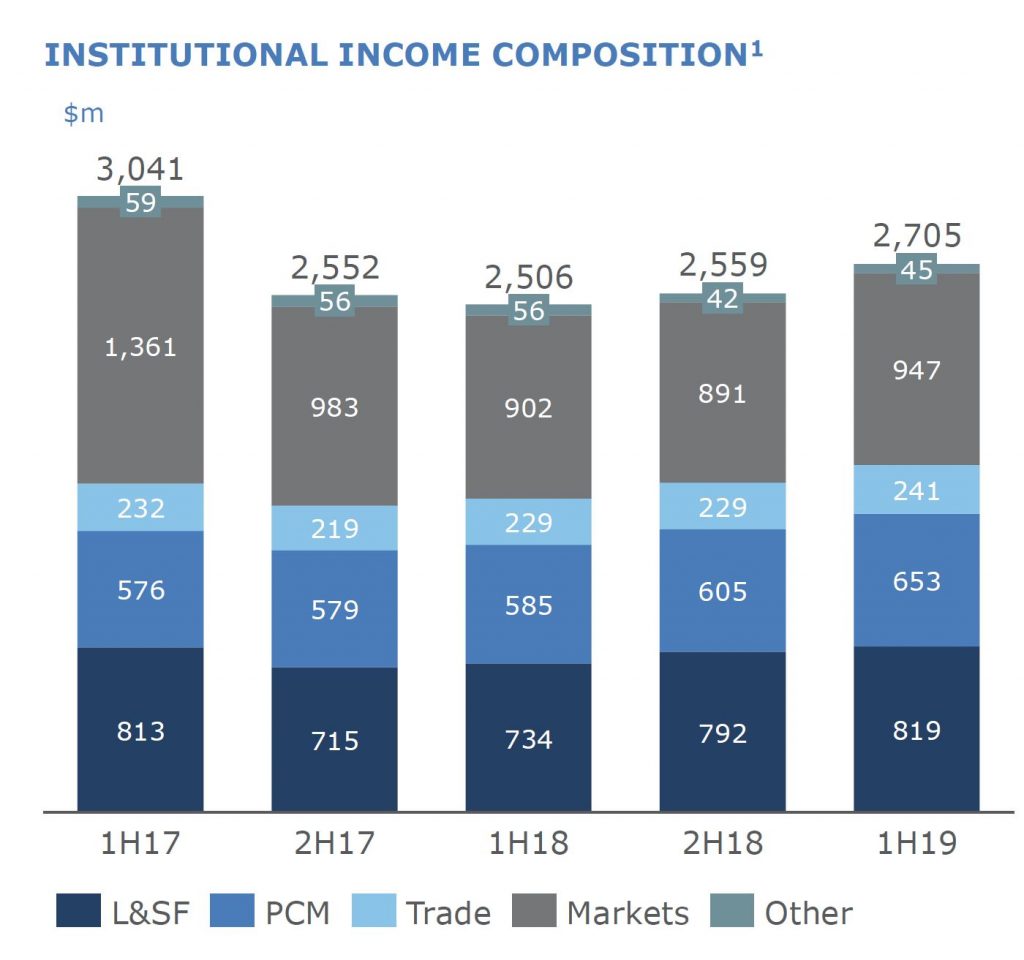

Market and Treasury Income was down 5% this half excluding derivative valuation adjustments.

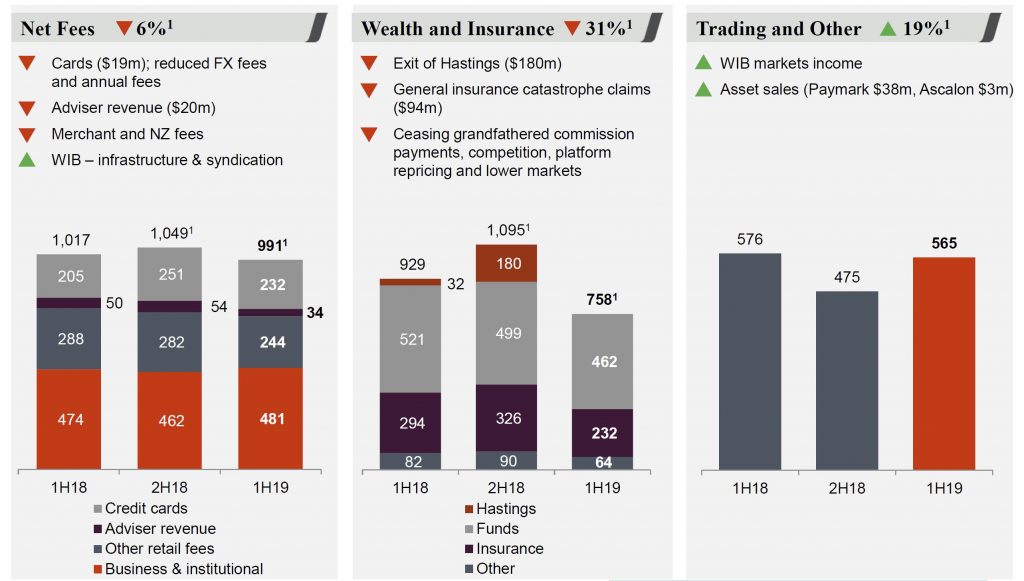

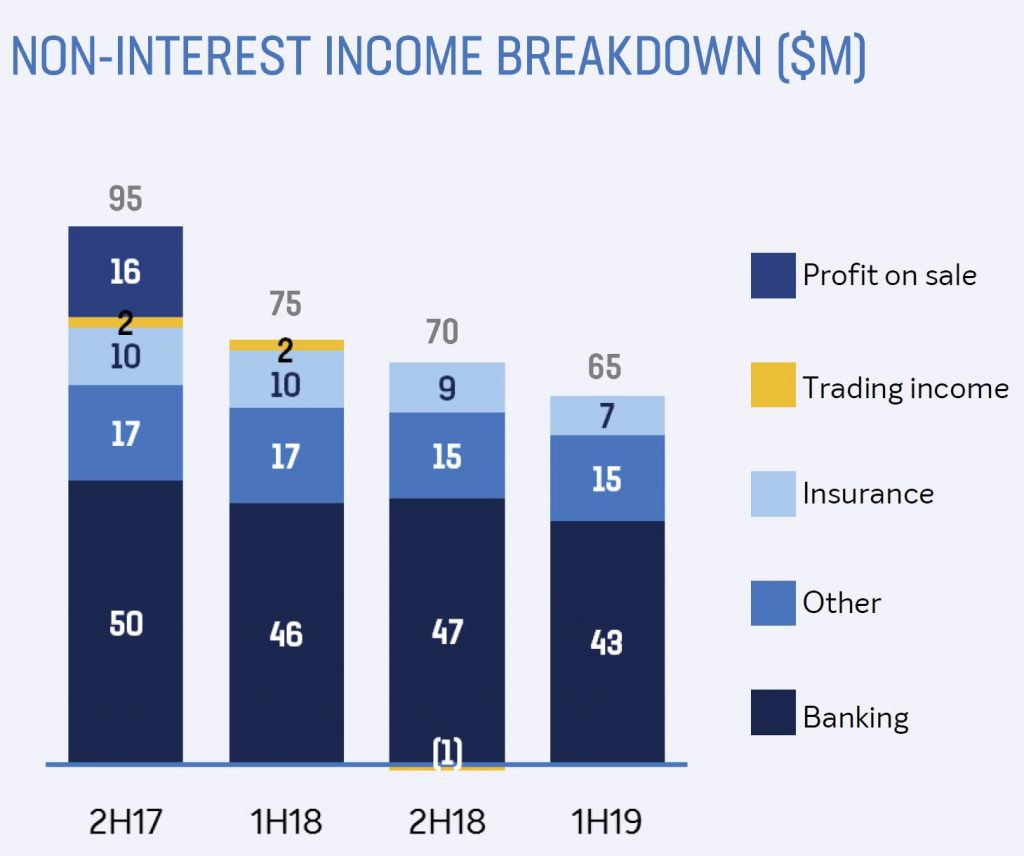

Non-interest income was down 30%, or 12% excluding major items (including provisions for estimated customer refunds, payments and associated costs, along with restructuring costs associated with resetting the Group’s wealth strategy).

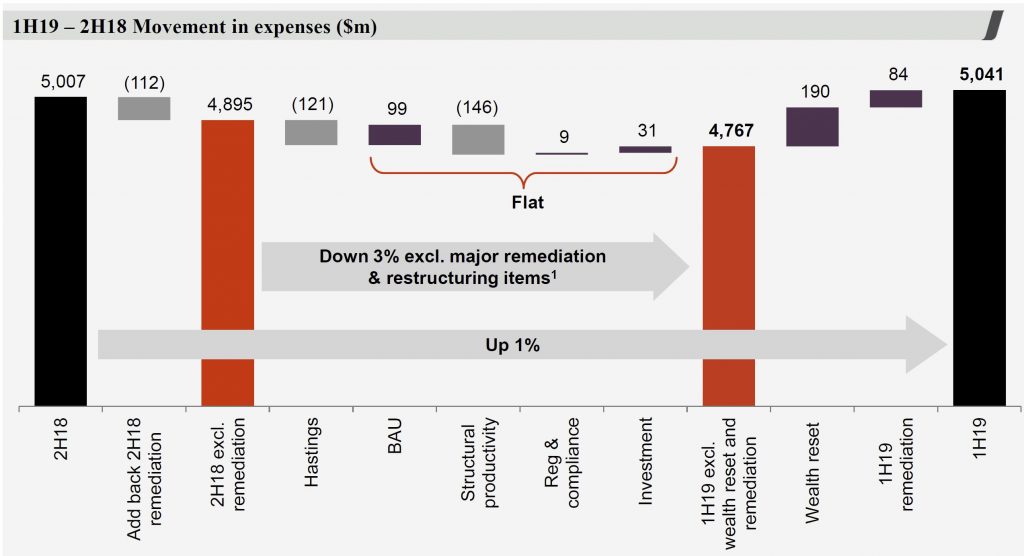

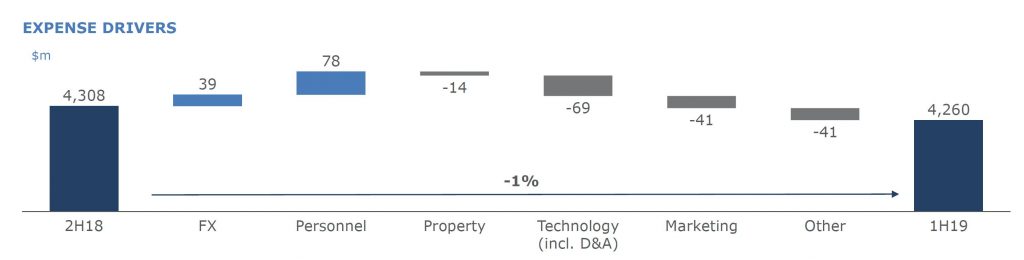

They claim there was a focus on expense management, though overall expenses were 1% higher.

Cash earnings, excluding major remediation and restructuring items of $753 million (after tax), was down 5%.

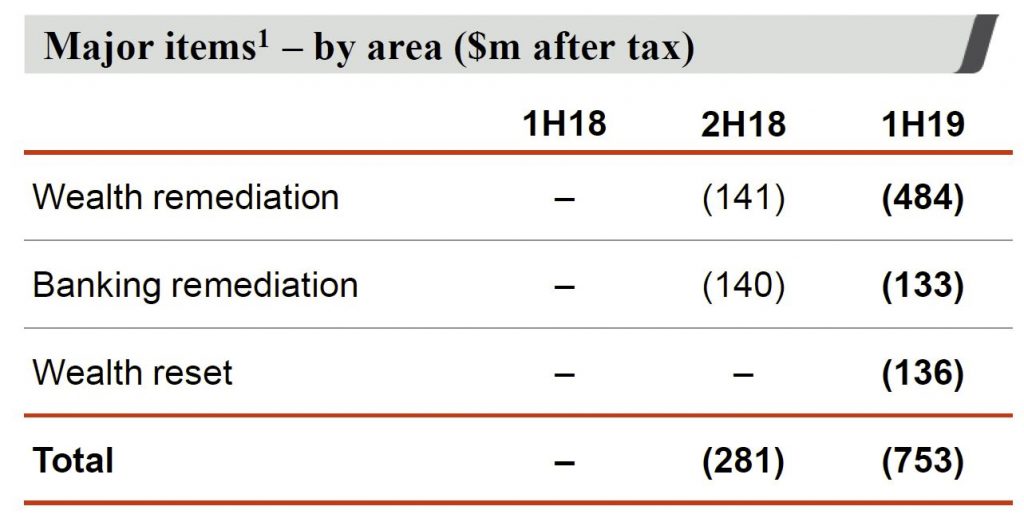

Westpac has provisioned $1,445 million pre-tax in total over the past three years to work on its customer remediation programs, including $1,249 million for customer refunds. $896 million pre-tax in provisions were made this half ($617 million post-tax). They have more than 400 employees working directly on remediation projects and over the past 18 months, they have repaid around $200 million to customers.

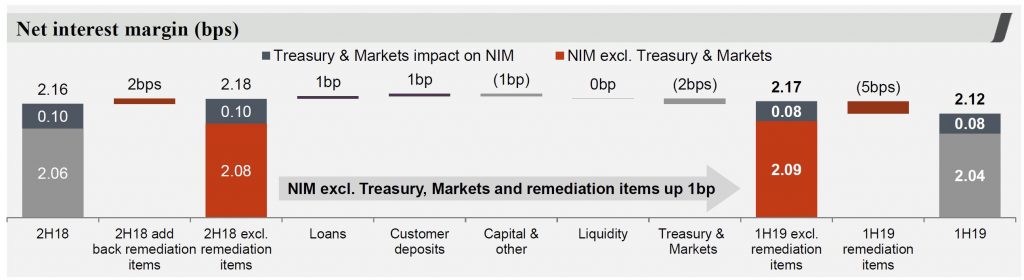

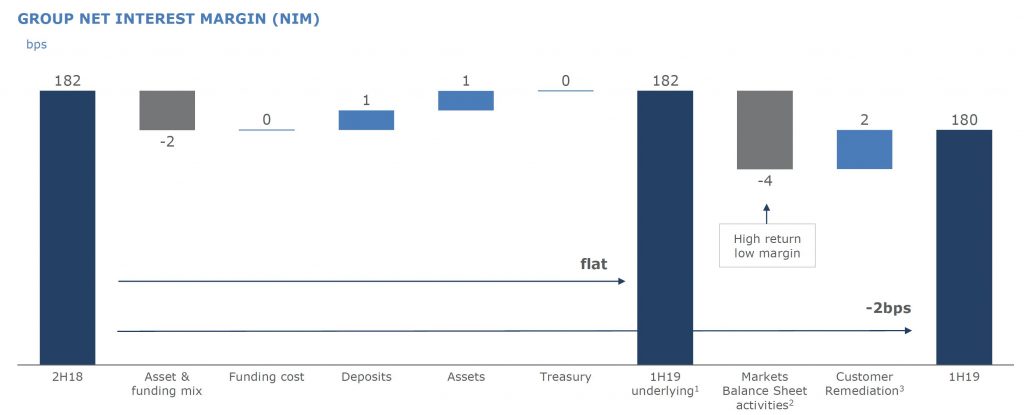

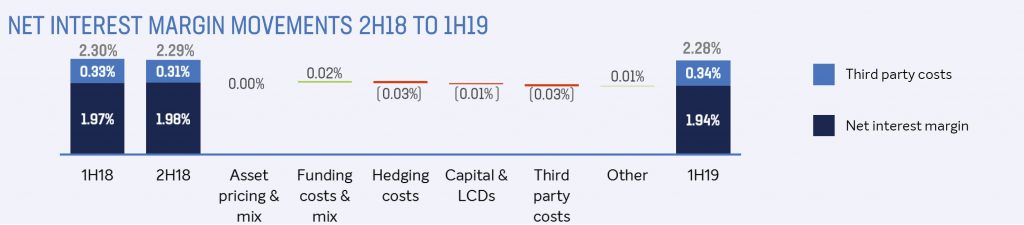

The bank’s net interest margin (excluding Treasury & Markets) was down 12 basis points from 1H18 due to provisions for customer refunds and higher short-term funding costs. There was also a 4bps decrease in Treasury & Markets primarily from Treasury interest rate risk management.

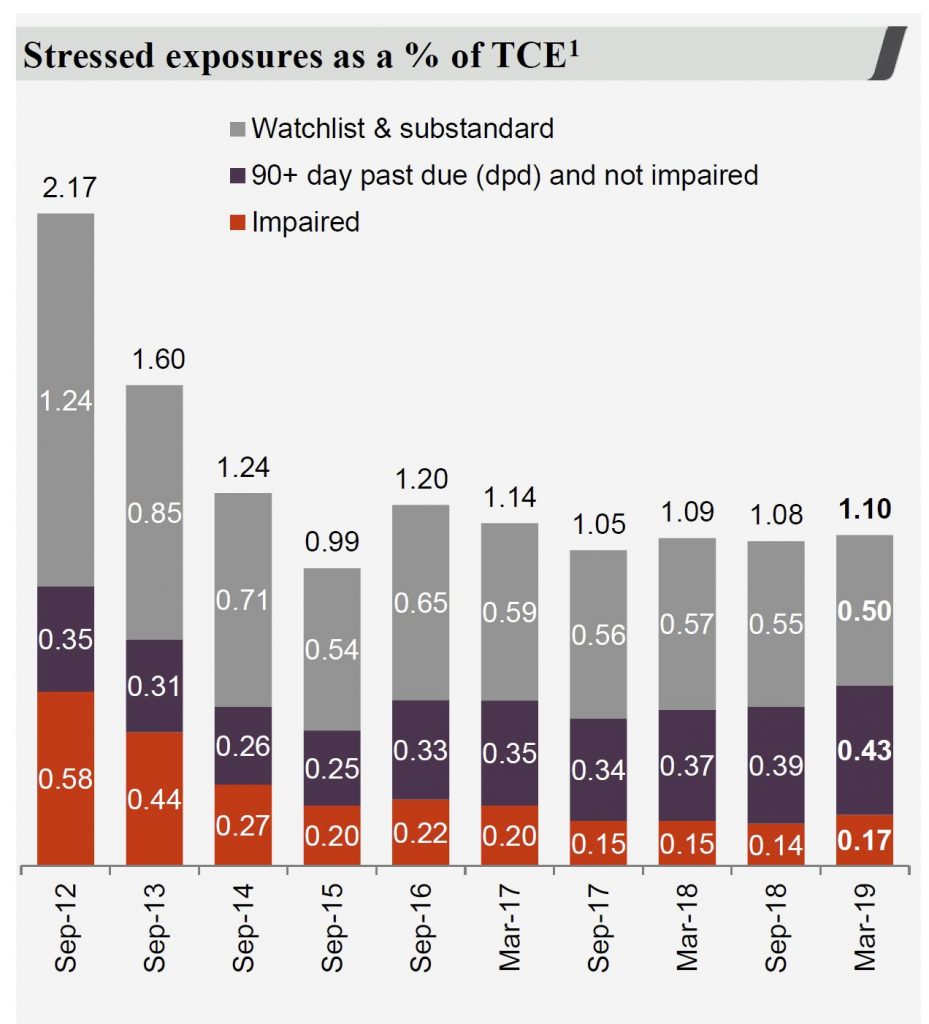

There was a rise in 90 day plus past due and impaired, with stressed exposures rising from 1.08% to 1.10% from the previous half.

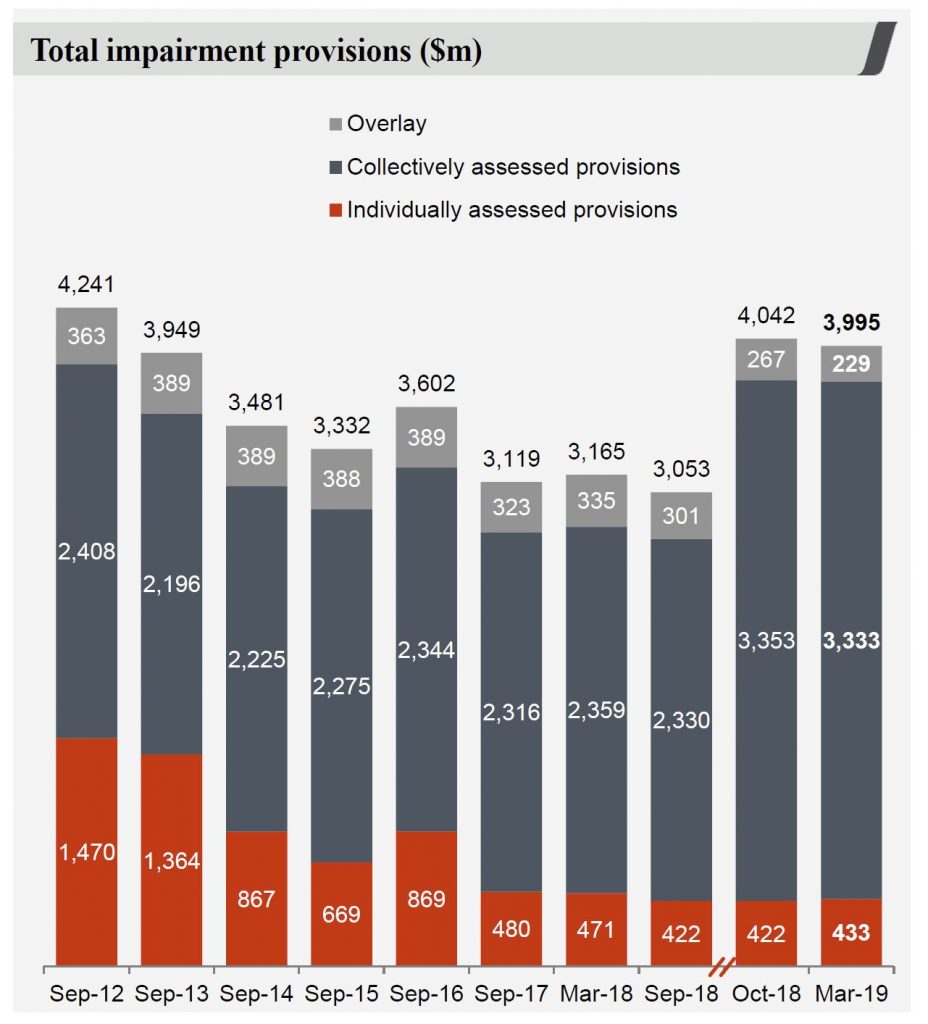

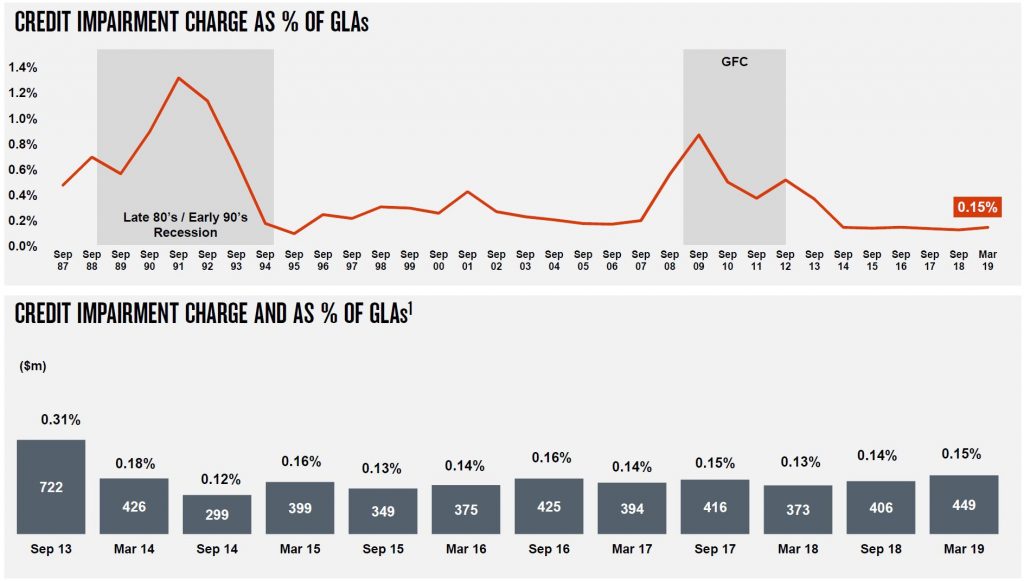

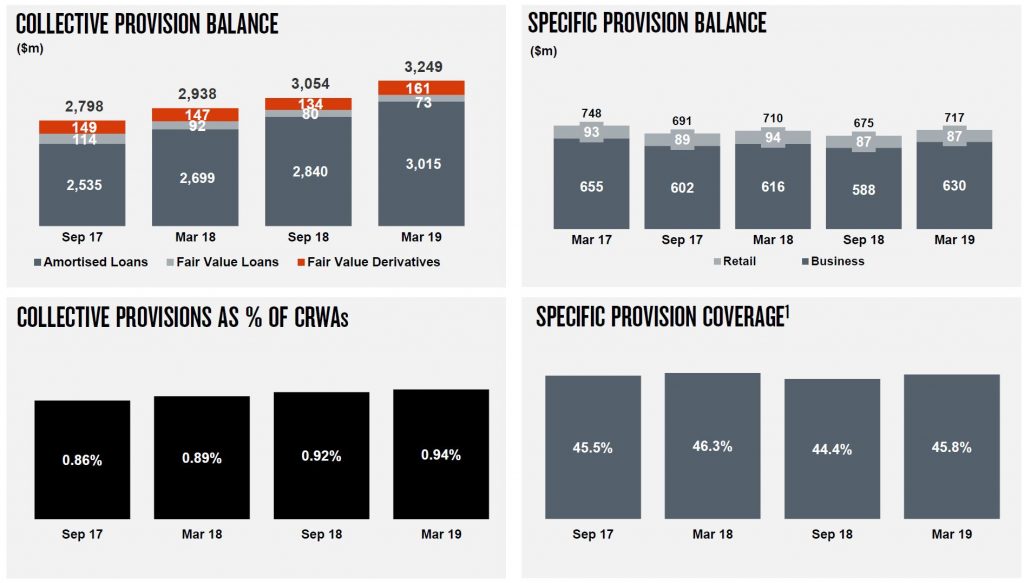

Total impairment provisions fell slightly from Oct 18, despite individually assesses provisions slightly higher. The economic overlay was weirdly reduced (despite the weaker economy!).

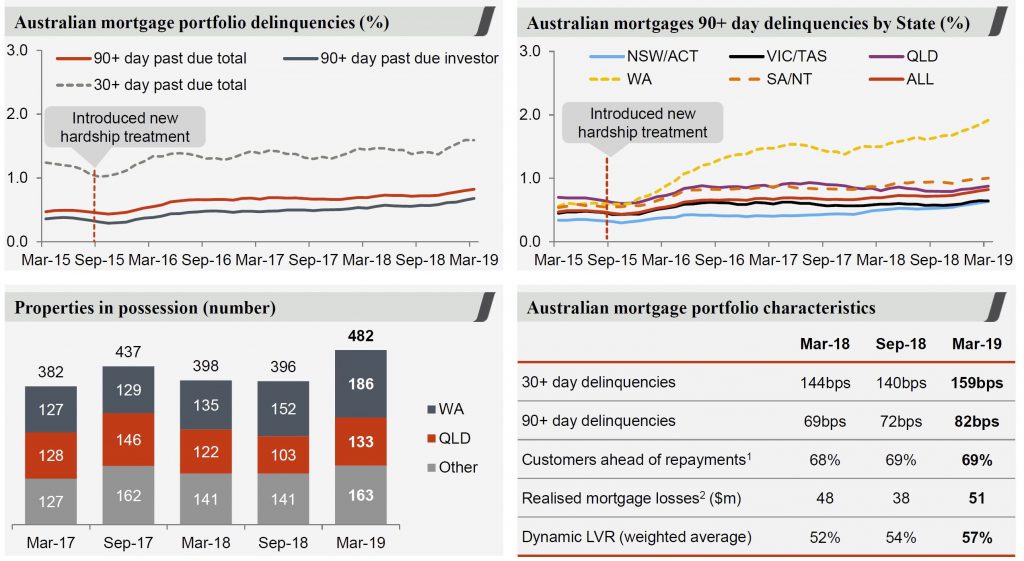

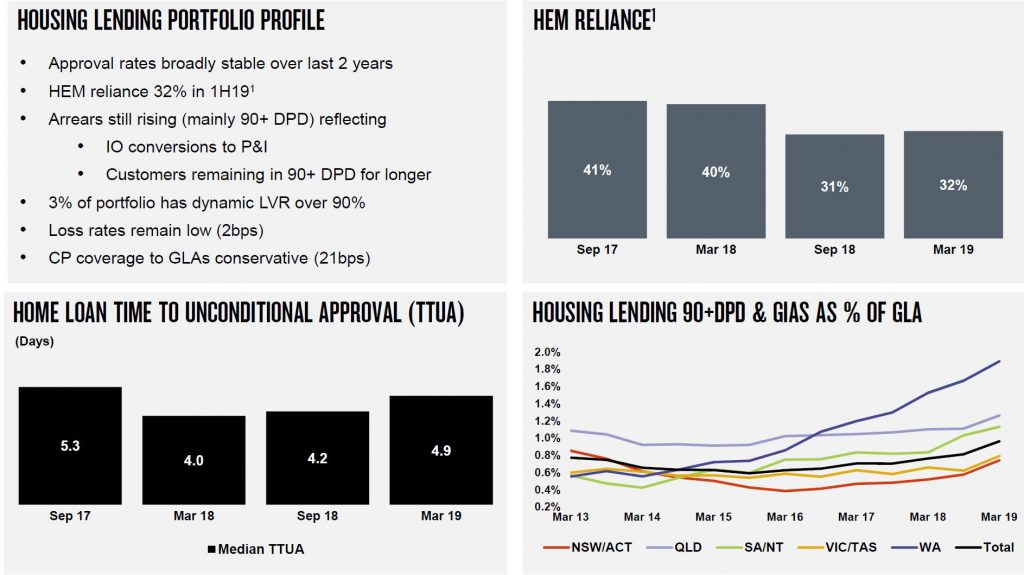

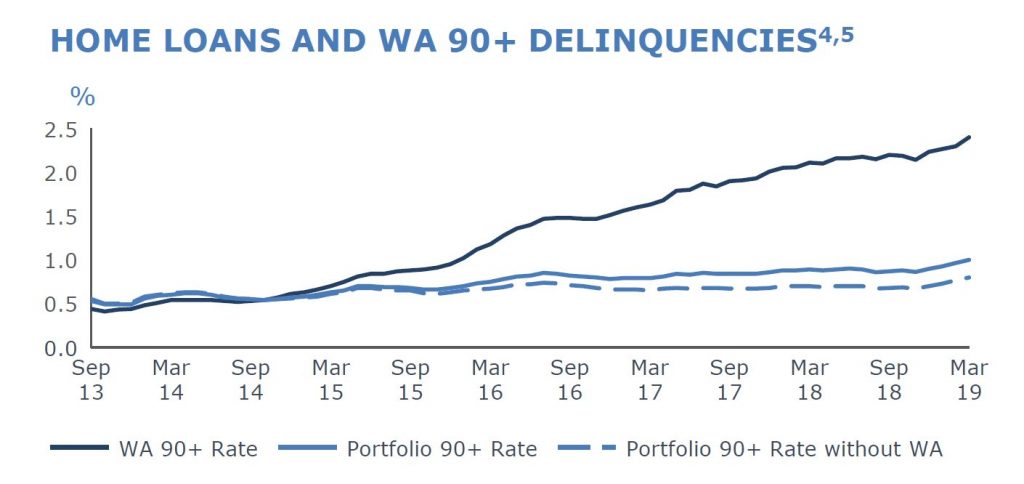

Mortgage delinquency in Australia continued to rise (as expected), with 482 properties in possession, compared with 396 last time (most were in WA or QLD). Past Due 90 days rose in most states, but WA lifted the most, and continues to reflect the weaker conditions in the west. They also called out rising delinquencies in NSW, a rise in P&I loans and longer cure times, together with the RAMs portfolio which has a higher delinquency profile. Total losses are at 2 basis points, which is low.

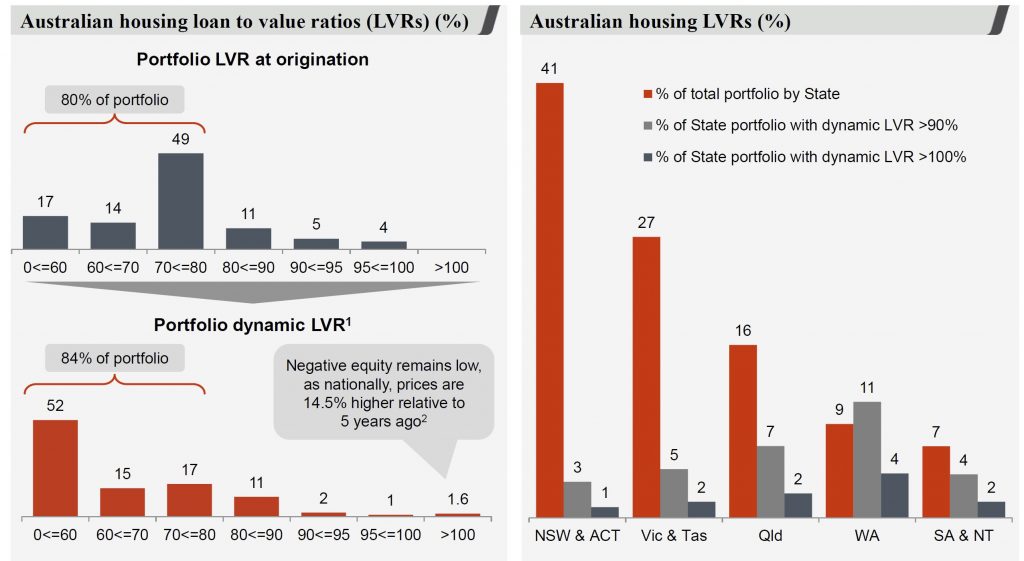

There was a rise in 100%+ LVR’s but is a small proportion of total book, based on data from Australian Property Monitor (but date not disclosed).

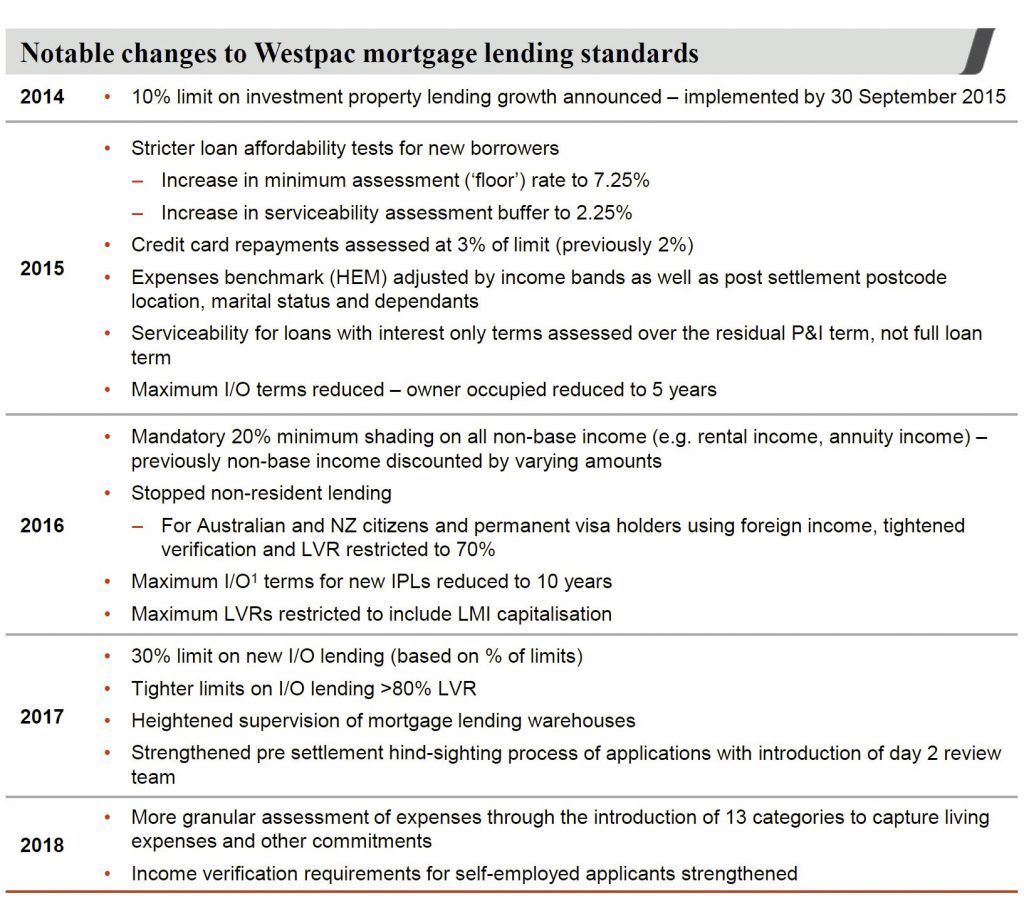

They have tightened lending standards significantly, and 62% of the portfolio were originated after the tightening. However, 19% of loans date from 2012-2014 and there are higher risks here.

90+ day delinquencies were 75 basis points for interest only loans, compared to Principal and interest rates were 83 basis points.

They made much of the better quality of new mortgage lending, but this begs the question about the back book in our view.

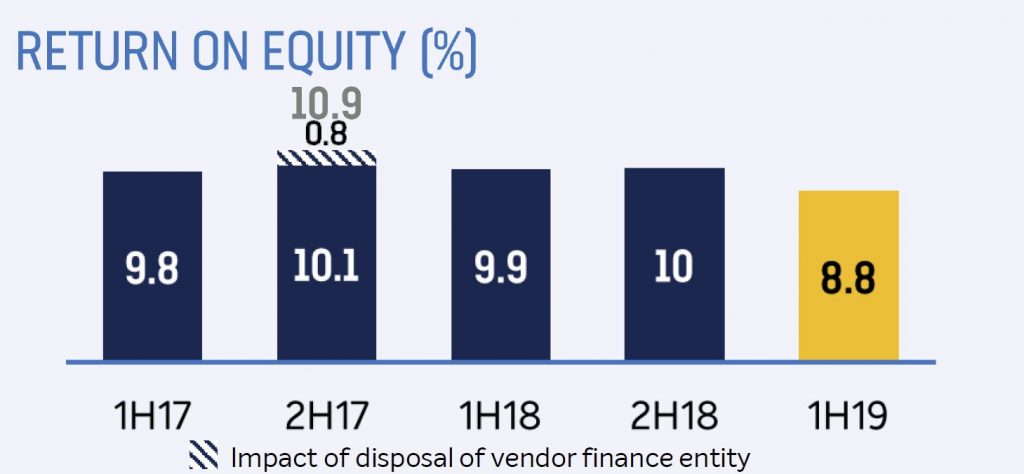

The banks return on equity (ROE) was 10.4%, and down 3.5 percentage points or excluding major remediation and restructuring items was, 12.8%.

They declared an interim fully franked dividend of 94 cents per share, which is unchanged

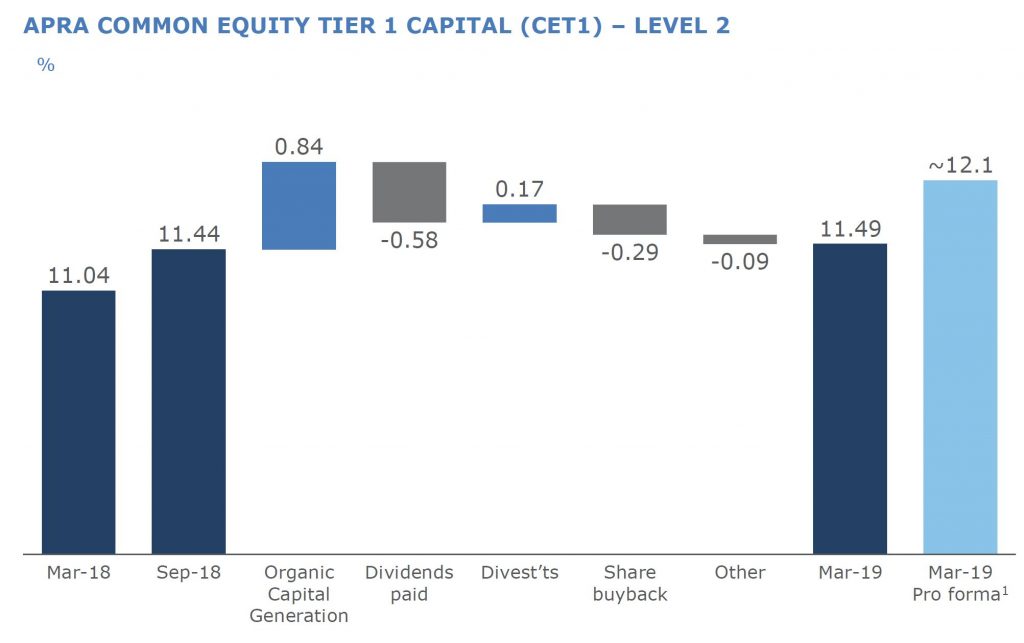

Their common equity Tier 1 capital ratio (CET1) of 10.64% is above APRA’s unquestionably strong benchmark

They foresee ongoing weakness in the Australian economy with subdued GDP growth this year expected to hold at around 2.2%. Consumers were being more cautious in the face of flat wages growth and a continuing soft housing market. They expect system credit growth to moderate, with pressure on margins to continue. But they expect credit quality to remain in good shape.

NAB 1H19 Cuts Dividend, Mortgage Arrears Rise

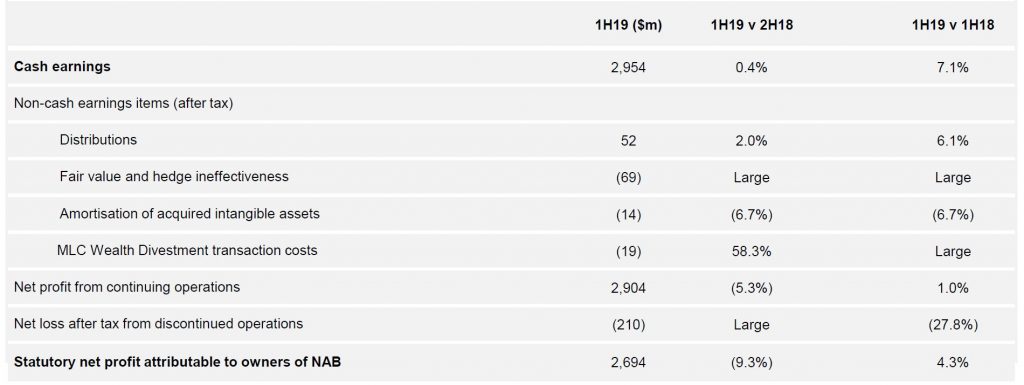

NAB reported their IH2019 results today. The statutory net profit in 1H19 was $2,694 million dollars, which is 9.3% lower compared with the 2H18, but 4.3% higher than 1H18.

Significantly they dropped the dividend to 83 cents per share, a drop of 16.2% compared with 1H18 – this was more than was anticipated by the market. But this is still an annualised dividend of circa 6.4%, compared with CBA and ANZ who are around 5.7%. This will help NAB build capital.

The cash ROE excluding restructuring and customer remediation was down 60 basis points to 13%, compared to ANZ’s 11.7%.

There were a number of one-offs which impacted the cash earnings, (their preferred measure) of $2,954 million, which is up 0.4% from 2H18, and 7.1% from 1H18.

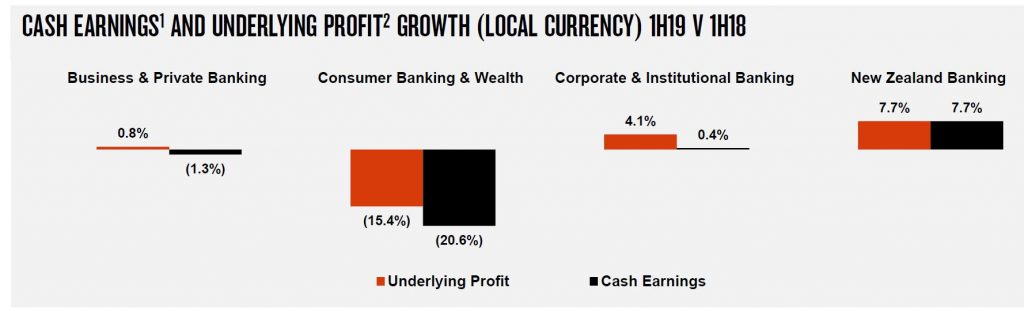

Consumer Banking dropped cash earnings by 20.6%.

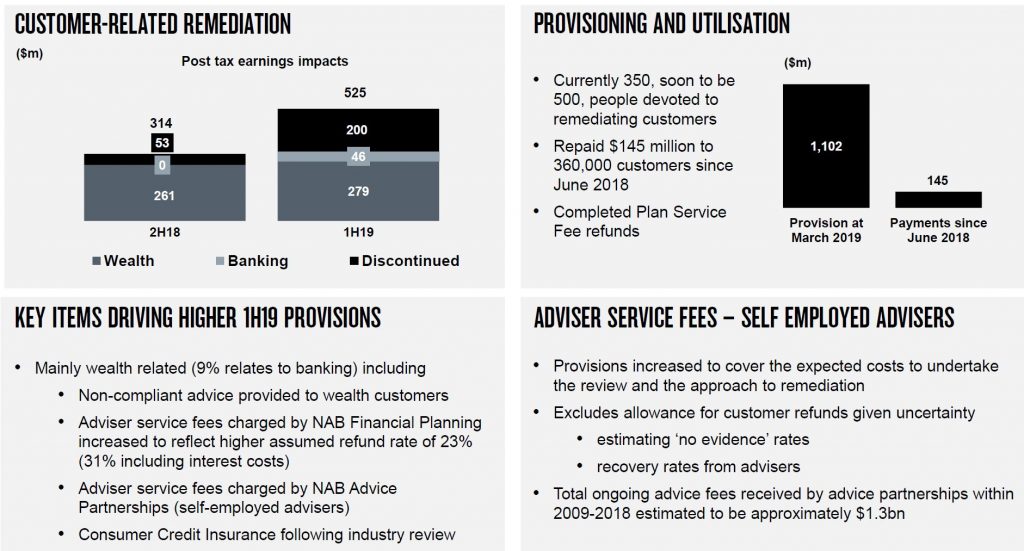

Customer remediation provisions stood at $1,102 million, and they plan to have 500 people devoted to this activity.

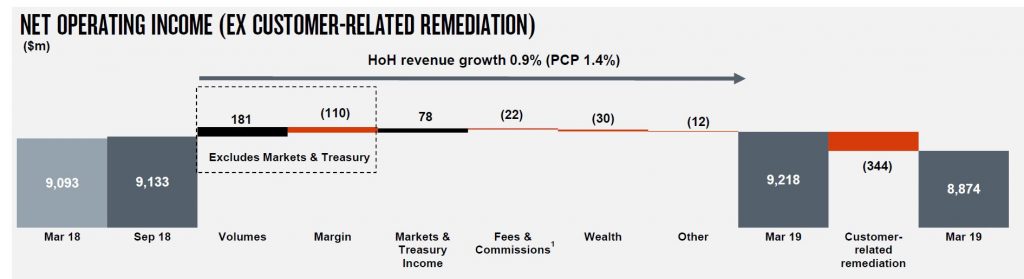

Overall income was higher, thanks to volume, but offset by margin compression of $110 million, a fall in fees and commissions, down $22 million and a customer remediation charge of $334 million, to give a net lower income of $8,874 million.

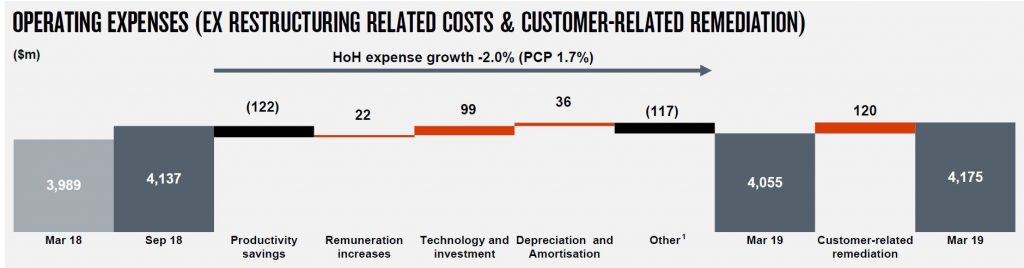

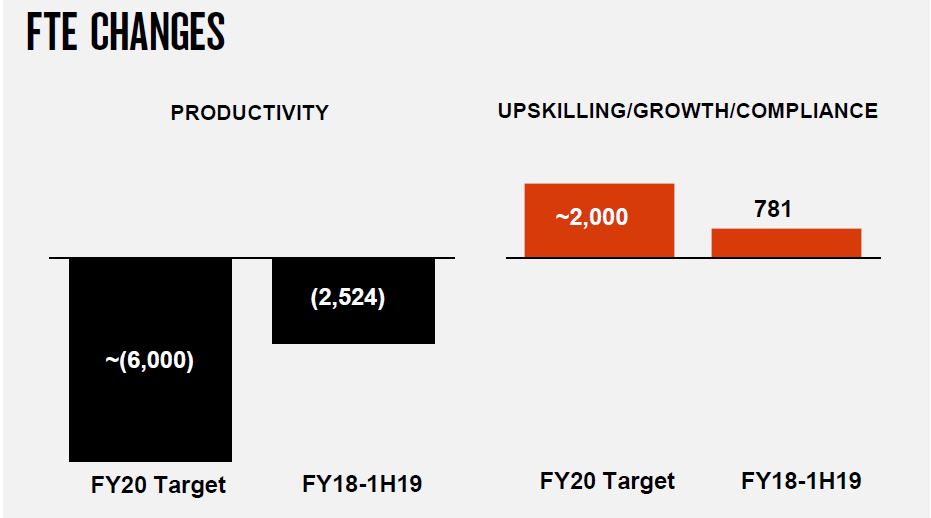

Operating expenses were flat(ish), but total FTE rose from 33,283 in 2H18 to 33,790 in 1H19.

They said that the banks is midway through its 3 year transformation program with additional investment target of $1.5bn, and that cost savings and FTE reduction are broadly on track.

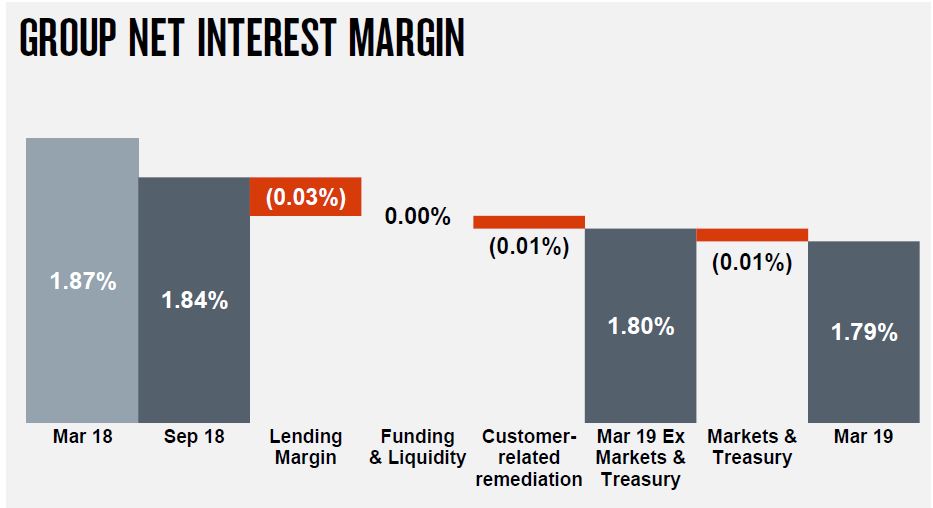

Group net interest margin fell 7 basis points. Of course NAB delayed their Australian mortgage book repricing, and clearly this cost. Corporate and Institutional helped support the result. The subsequent mortgage repricing may help ahead.

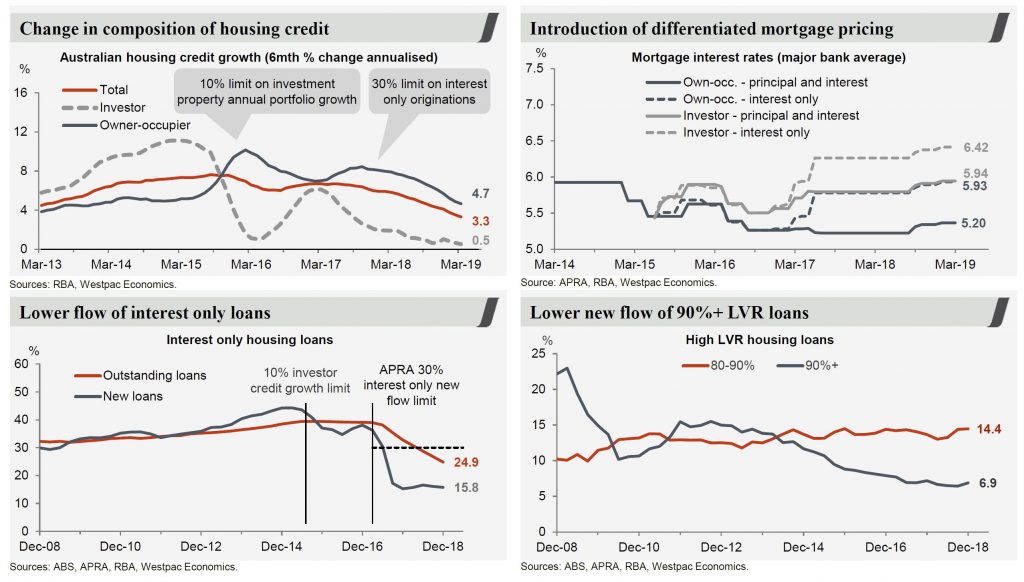

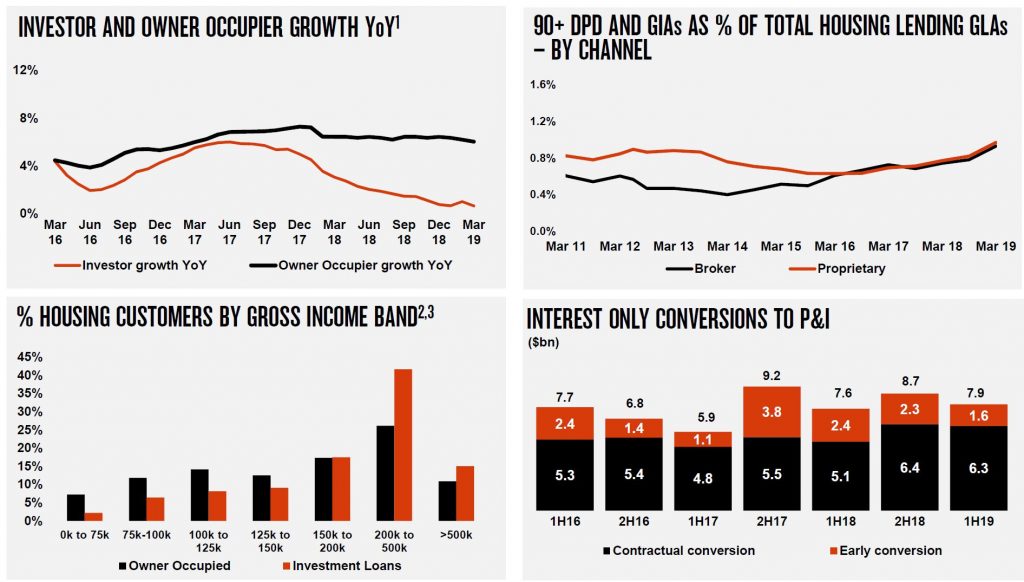

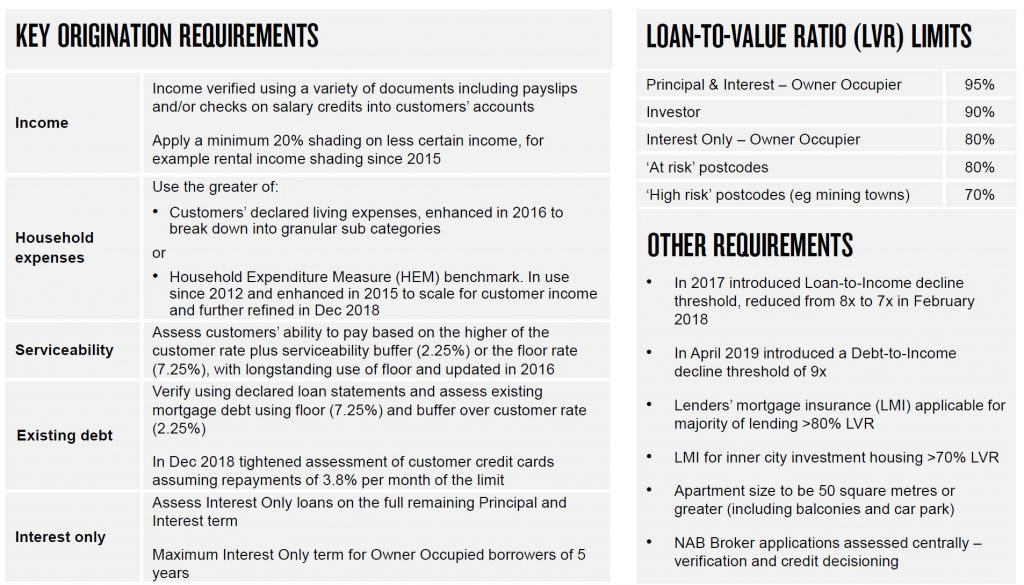

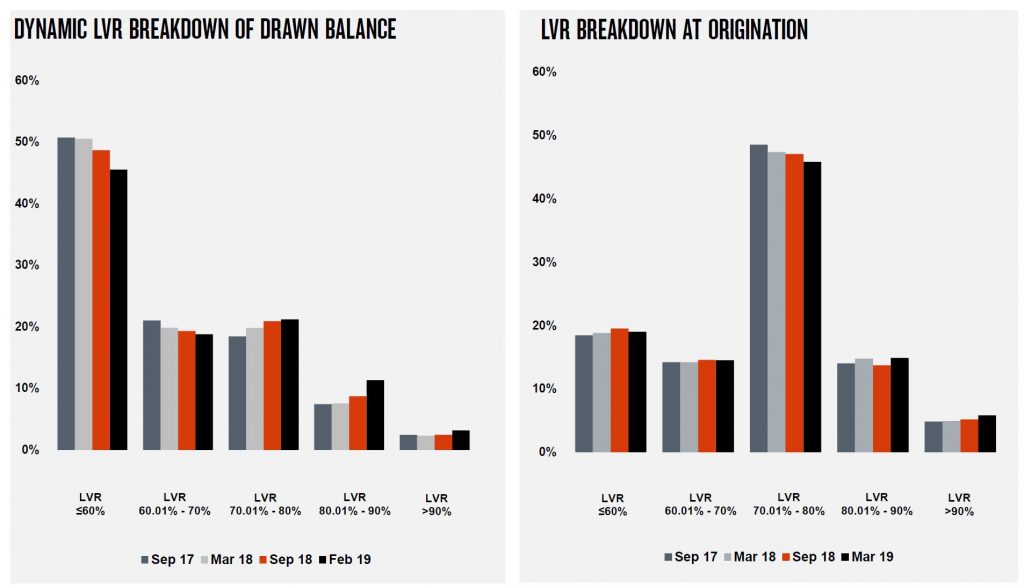

Home lending in Australia shows that approvals rates have remained stable over the past 2 years, and that reliance on HEM has fallen to 32% in March 19, compared with 41% in September 2017.

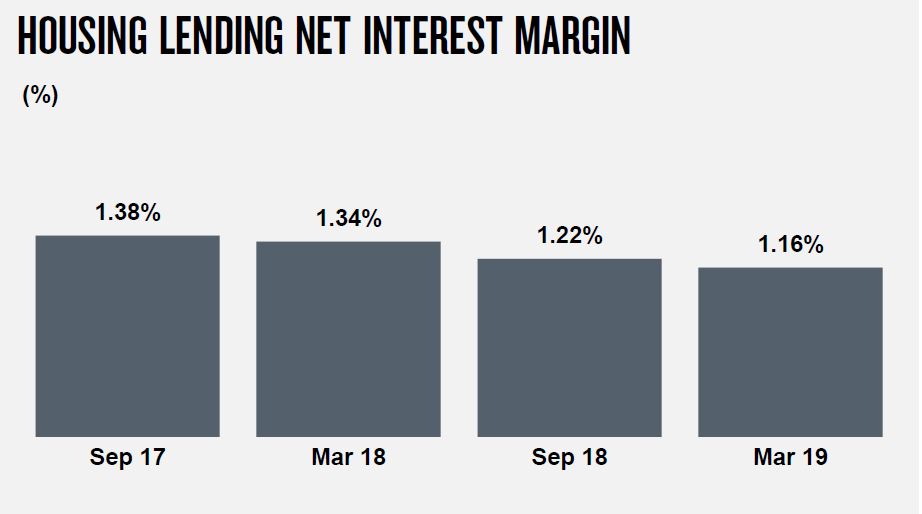

Net interest margin across Australian home loans fell 6 basis points from Sep 18 to Mar 19, and continues the slide from 2017.

Loan growth slowed, especially investor lending, and defaults are similar in both proprietary and broker channels now

They implemented Comprehensive Credit Reporting (CCR) for mortgages in February 2019 (first major bank to reach this milestone).

Lending standards have become tighter.

LVR Bands still include loans above 80% (and rising).

Default are rising, with 90 day+ defaults partly attributed to the conversion of interest only loans to P&I. WA has the highest levels, but other states also rose.

Group credit impairments rose to 0.15% of GLA’s.

The group provisions are higher, as are the specific provision balances.

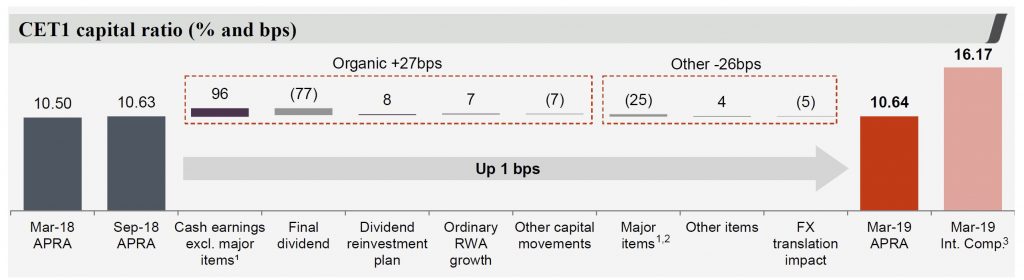

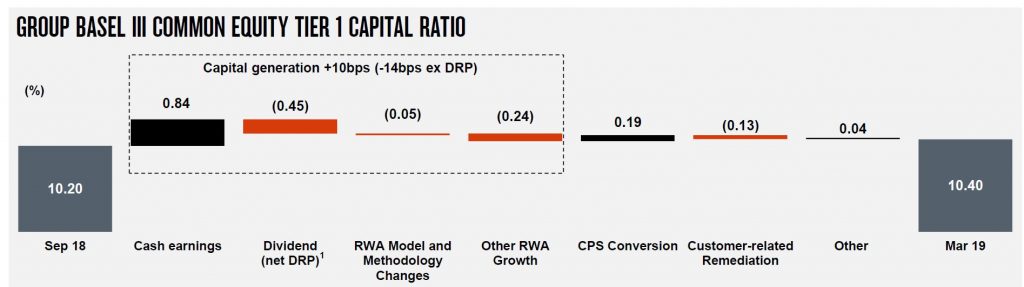

The CET1 ratio is 10.40, up from 10.20 in Sep 18, and they say they are on track for “unquestionably strong”.

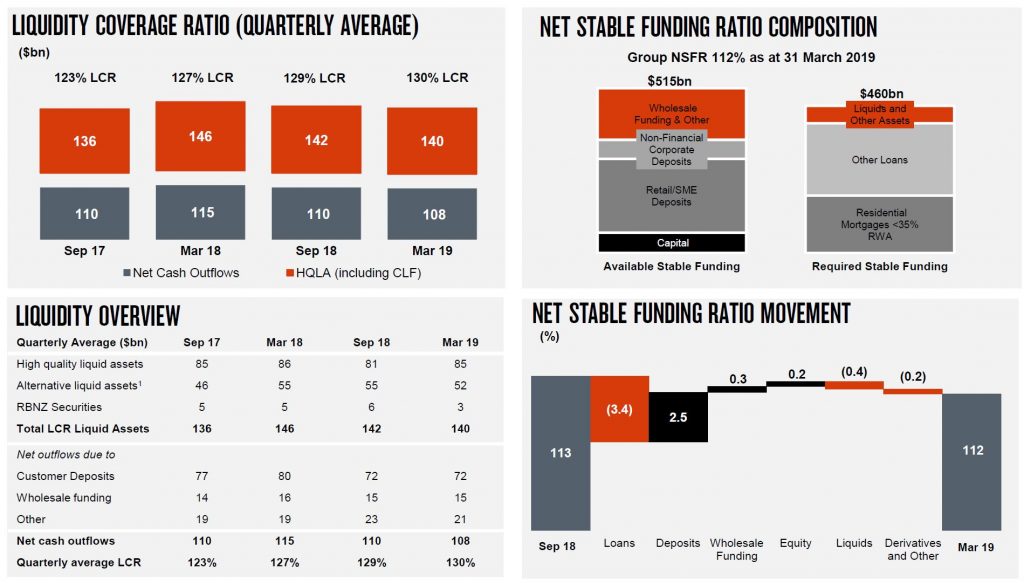

The LCR and NSFR remain strong.

So the underlying franchise still looks in reasonable shape, but the weakening housing sector needs to be watched.

ANZ Raises Concerns About Mortgage Stress

From the ABC.

On Radio Nation PM Programme this evening.

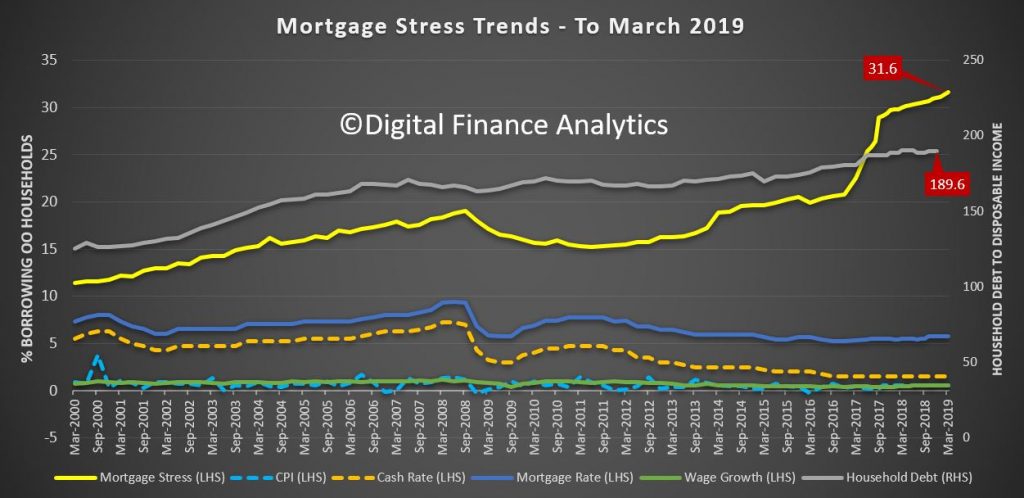

It was just weeks ago that mention of rising mortgage defaults was met with some sniggers and jeers, with many in the industry pointing to what are still actually very low rates of arrears overall.

So you can imagine the surprise when the boss of one of Australia’s big four banks conceded today that he too was worried about home owners keeping up with their repayments.

If that’s not scary enough, according to the ANZ, as many as 5 per cent of homes slumped into negative equity in March, where the value of what they owe the bank is more than what their home is worth, putting even more pressure on borrowers.

It begs the question: is the worst of the house price falls now over, or is there worse to come?

I discuss the latest data.

ANZ 1H19 Result Points To Subdued Credit Growth, Intense Competition And Increased Compliance Costs

ANZ reported their 1H19 results today. Their “shrink to greatness strategy” did work to an extent, but their results were flattered by higher than expected Institutional performance, which offset the pressure on the Australian retail bank from lower mortgage growth and margins, and higher customer remediation costs. They are well capitalised, which is a good thing, given the higher and building mortgage delinquency. They foresee tough times ahead. Tricky times to be a banker.

The results are also muddied by the many business exits and restatements and a significant reduction in staff. But among the big four, they are probably the best placed, but will be hit if mortgage delinquency continues to rise (as we suspect they will) as the Australian economy stalls.

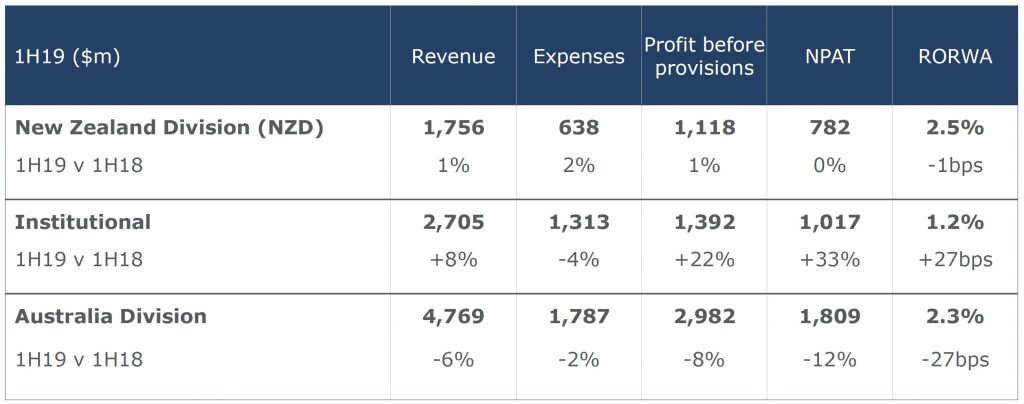

They announced a Statutory Profit after tax for the Half Year ended 31 March 2019 of $3.17 billion, down 5% on the prior comparable period.

Cash Profit for its continuing operations was $3.56 billion, up 2%. The return on equity was 12% compared with 11.9% 1H18, while the return on average assets fell 2 basis points from 0.79% in 1H18 to 0.77% 1H19.

Institutional delivered a higher than expected income (but that may not be sustainable), while other sectors were under more pressure. Institutional profit was up 33%.

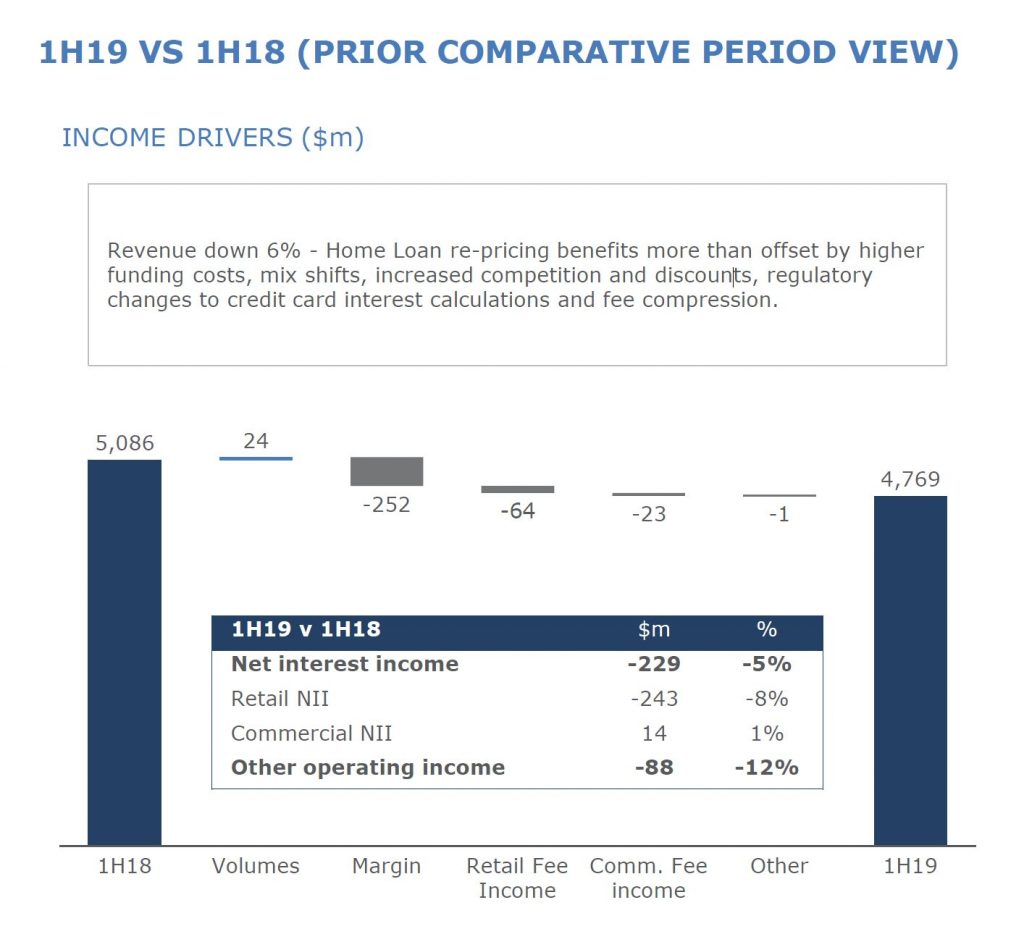

Slower credit demand put pressure on the retail bank, through lower volume growth and reduced fee income. Australian revenue was down 6% as home loan repricing benefit was more than offset by higher funding, increased competition, discounts and regulatory changes.

Net interest margin (continuing operations), dropped 2 basis points from 2H18, impacted by funding and asset mix, and markets. Customer remediation added 2 basis points, weirdly. Management, in their briefing said that underlying NIM pressures will persist into 2H19.

ANZ’s programme of asset sales and restructure benefited the business, and staff (FTE) fell 5% from 41,580 1H18 to 39,359 1H19. Costs were cut as a result, reducing the cost of running the bank by approximately $300 million and they absorbed ~$550m inflation.

However the customer remediation programme is up to $926m ($657m post tax) since 1H17, $698m on Balance Sheet at 31 March 2019. They are currently resolving issues with more than 2.6m customers across retail a commercial lines.

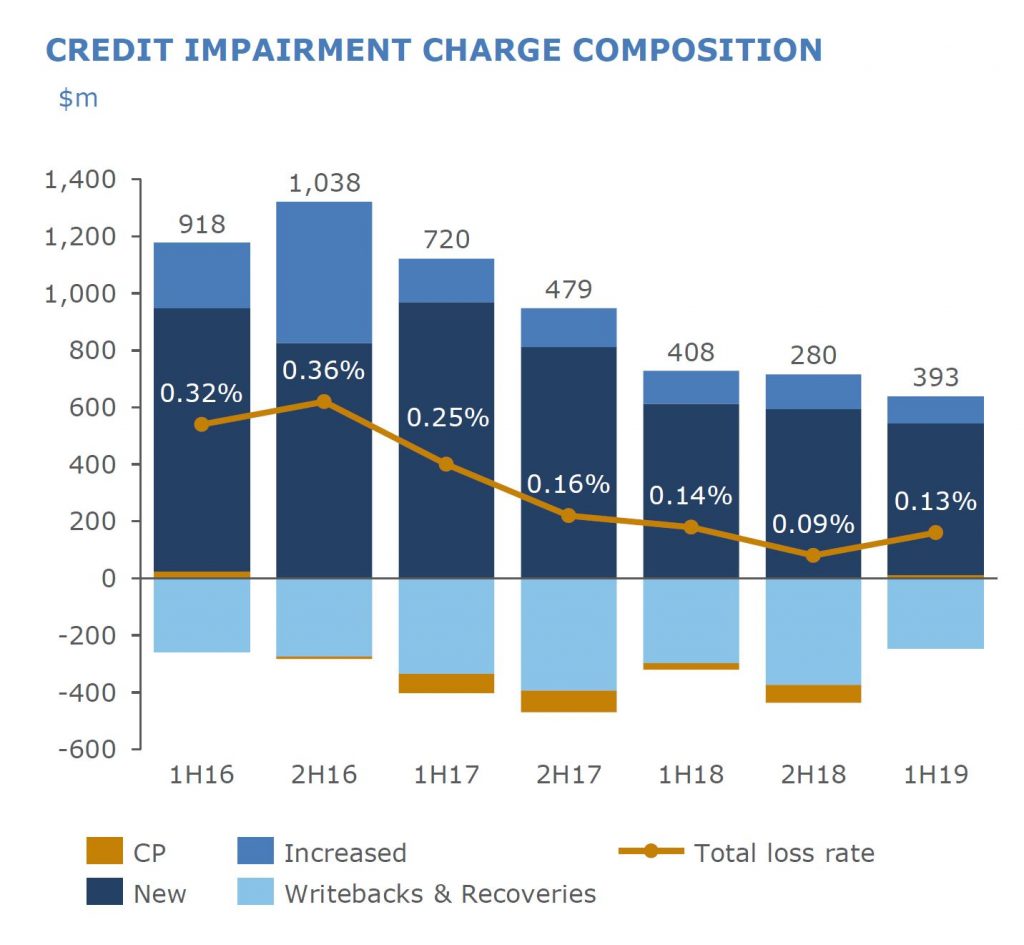

The total provision charge for the half was $393 million, down 4% from this time last year. The Group Loss rate decreased marginally to 13bps for the half (from 14bps in the first half of 2018). New Impaired assets declined to $890 million, down 8% compared to this time last year with Gross Impaired Assets broadly flat over the same period.

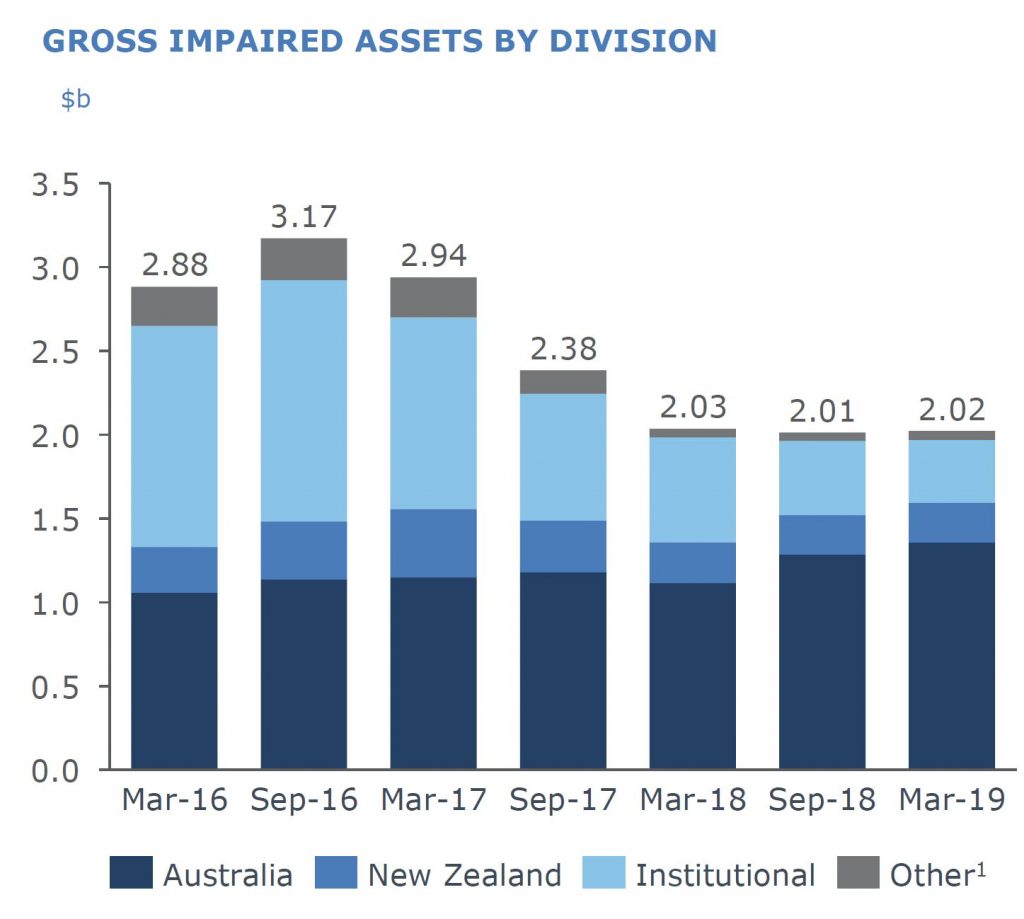

Australian gross impairments have rise from a low of March 2018, offset by lower provisions from Institutional.

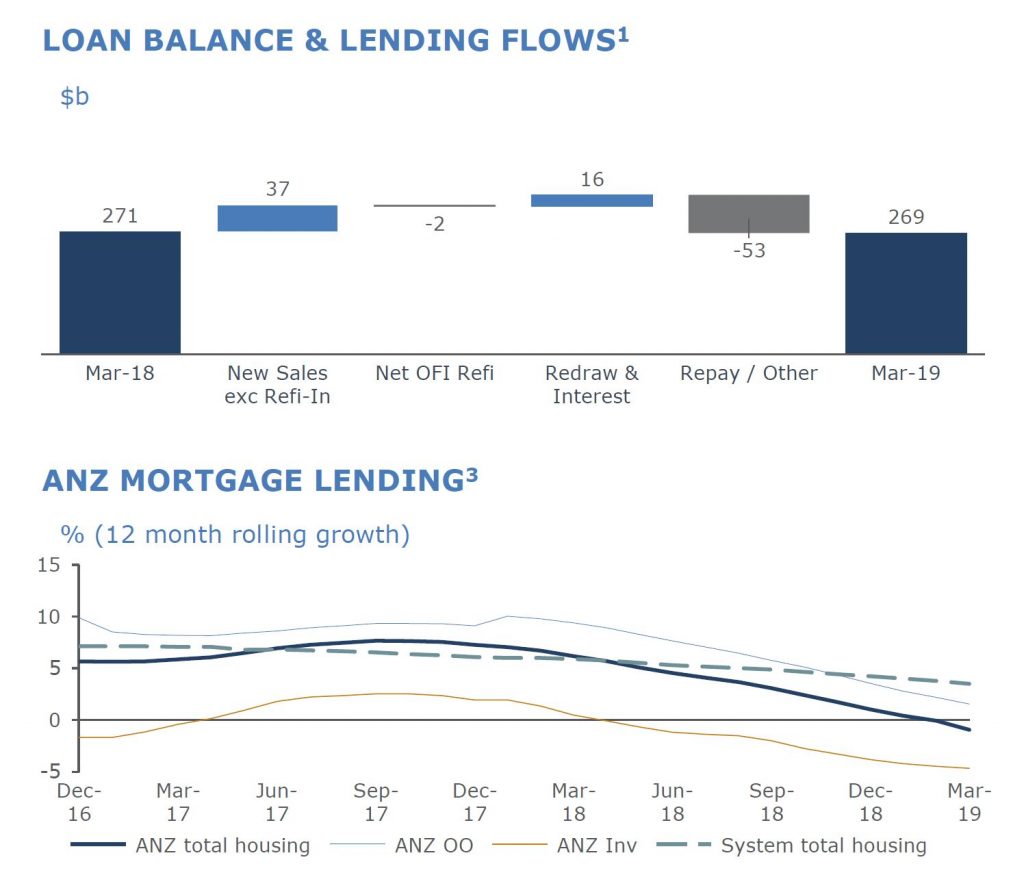

Mortgage arrears in Australia rose quite significantly, despite below system mortgage growth by ANZ. In their briefing, ANZ said its Australian mortgage book will shrink further 2H19, because their strategies which are aimed at improving momentum in this business will take time to flow through.

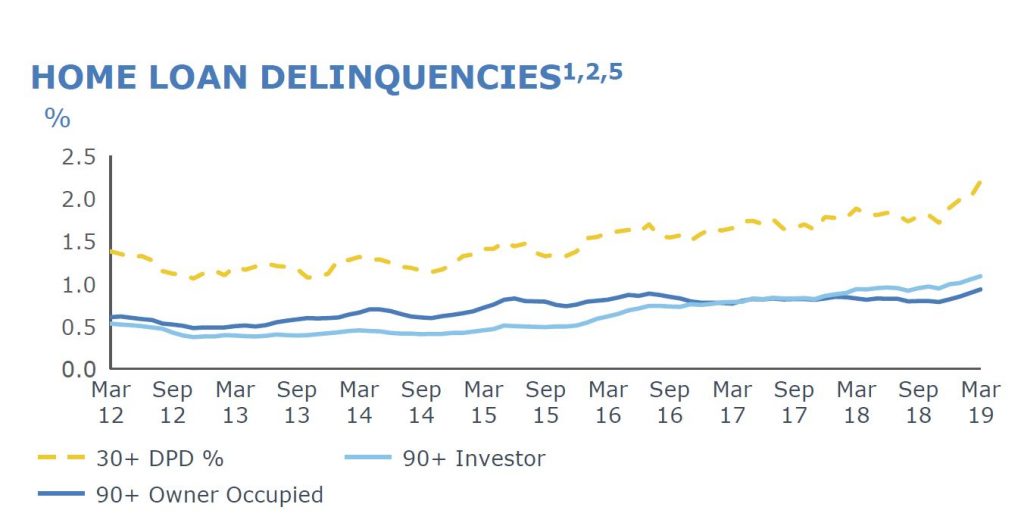

30 day and 90 delinquencies (missed payments) are rising, with property investors higher than owner occupied borrowers. 90+ day past due is at 100 basis point compared with 89 basis points prior, as well as the hike in 30+ day past due.

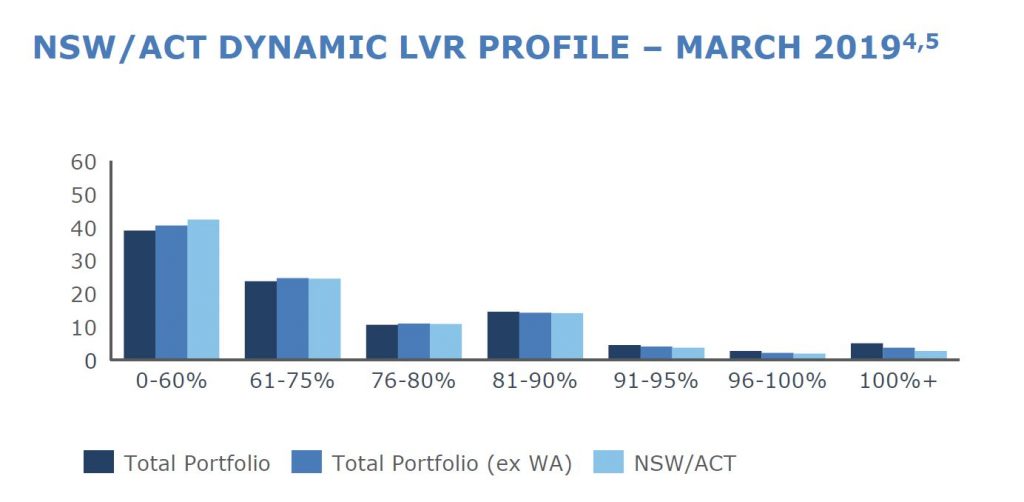

WA delinquency comprise 30% of 90 day plus delinquency, despite being just 13% of the portfolio, and 65% of losses come from WA. Whereas NSW/ACT makes up 32% of the portfolio but 23% of 90 day plus past due.

The NSW “dynamic LVR” includes 8.2% of loans above 90% (but note they say “valuations updated to February 2019 where available”, so this is understated in my view – what share of the portfolio is marked to market?. Given falling prices in NSW, more loans will drop into negative equity. And remember this is LOANS not HOUSEHOLDS. Losses in Australian mortgages housing was 4 basis points in 1H19, up from 2 basis points prior.

In the briefing, they attributed the rise in mortgage delinquencies to:

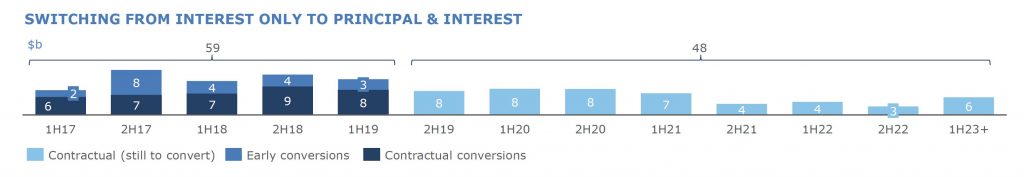

- the shift from interest-only to principal and interest loans, demanding higher repayments

- subdued wage growth putting more financial pressure on households

- the trend in falling house prices

- a longer cure time-frame, as delinquencies are now taking a longer time to cure thanks to extended property sale time-frames

- the “denominator effect” of lower loan growth and shrinking mortgage book

None of this is going to change anytime soon.

Switching from IO to PI will continue.

ANZ’s Common Equity Tier 1 Capital Ratio increased to 11.5%, up 45 basis points (bps). Return on Equity increased 13 bps to 12.0% with Cash Earnings per Share up 5% to 124.8 cents.

The Group’s funding and liquidity position remained strong with the Liquidity Coverage Ratio at 137% and Net Stable Funding Ratio at 115%.

The Interim Dividend is 80 cents per share, fully franked. This equates to $2.27 billion to be paid to shareholders. The 3.7% reduction in shares due to the completion of the $3 billion buy-back assisted.

The CEO said :

Retail banking in Australia will remain under pressure for the foreseeable future with subdued credit growth, intense competition and increased compliance costs impacting earnings.

“New Zealand is performing well, however it is starting to share similar characteristics with the Australian market due to strong competition and a slowing Auckland housing market. The major concern in New Zealand remains the impact of the proposed capital changes on the broader economy.

“Institutional banking is performing well and positioned to provide positive earnings diversification, which will partially offset the headwinds in other parts of the Group

Westpac Reveals $357m Profit Hit Over Advice Fees

Westpac has provided an update on accounting provisions for remediation associated with authorised representatives in relation to certain ongoing advice service fees.

This follows the group’s 25 March 2019 ASX announcement on remediation provisions, where it announced an increase in provisions for its salaried planners and indicated that assessments were underway in relation to authorised representatives. Authorised representatives are advisers who maintain direct relationships with their customers for financial planning services, while operating under the Magnitude and Securitor advice licenses.

Westpac said these advisers received ongoing advice service fees from their customers of approximately $966 million between 2008 and 2018. Based on the information currently available, Westpac today said that its cash earnings in First Half 2019 will be reduced by $357 million for accounting provisions associated with this matter.

The $510 million provision (pre-tax) is based on a range of accounting assumptions relating to potential payments of $297 million (pre-tax), interest costs of $138 million (pre-tax) and $75 million (pre-tax) in remediation program costs.

That part of the current estimated provision which relates to potential payments represents around 31 per cent of the ongoing advice service fees collected over the period which compares to 28 per cent estimated for salaried planners.

Westpac said it will continue to work with current and prior authorised representatives and their customers to determine where a payment should be provided. The final cost of remediation will not be known until all relevant information is available and payments have been made. The bank is yet to finalise its remediation approach, which may change following industry and regulator discussions.

“While it is disappointing that we have needed to make these provisions, I said at the end of last year that our priority was to deal with any outstanding issues and process payments as quickly as possible,” Westpac CEO Mr Brian Hartzer said.

“As part of our ‘get it right put it right’ initiative we are fixing issues and are determined to ensure that they don’t reoccur.”

Bank Of Queensland 1H19 Profit Down

The 2019 half year results from BOQ today really underscores the pressures on the banks – especially regional ones – as home lending slows, and competition for the remaining business rises. And they see similar pressures ahead.

Banking is no longer the cash generating machine it use to be. Expect more loan repricing ahead to try and stablise the business. Their shares were lower. The dividend was cut.

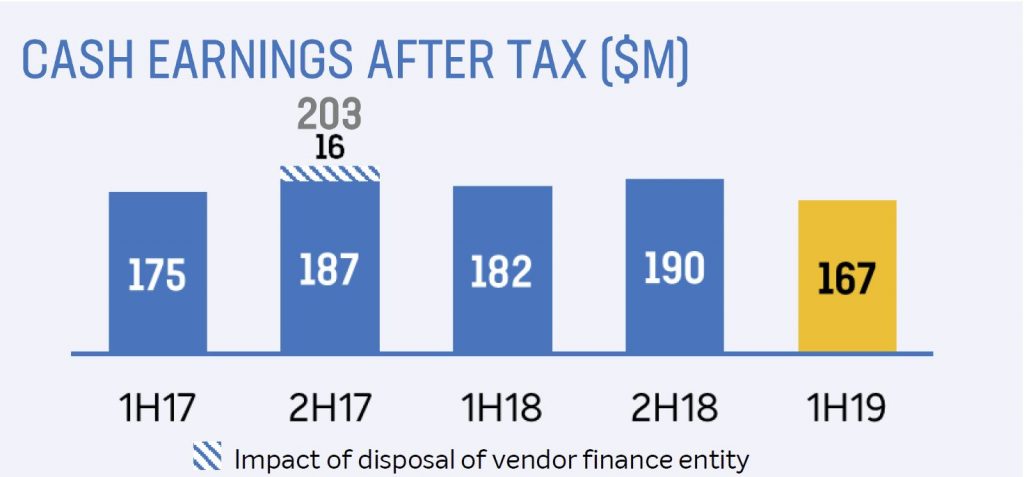

Their cash earnings after tax of $167 million, down 8% compared with 1H18, and 12% down on 2H18. This was pretty much as expected.

Their statutory net profit after tax of $156 million, down 10% on 1H18, or 4% down on 2H18.

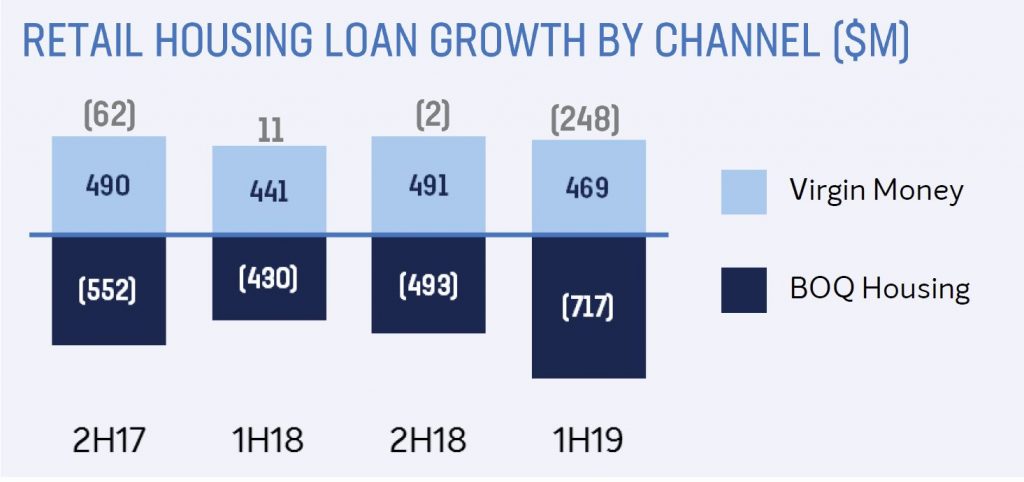

Gross loan growth was 2% in a slowing market, with housing growth through Virgin Money and BOQ Specialist, offset by contraction in branch network.

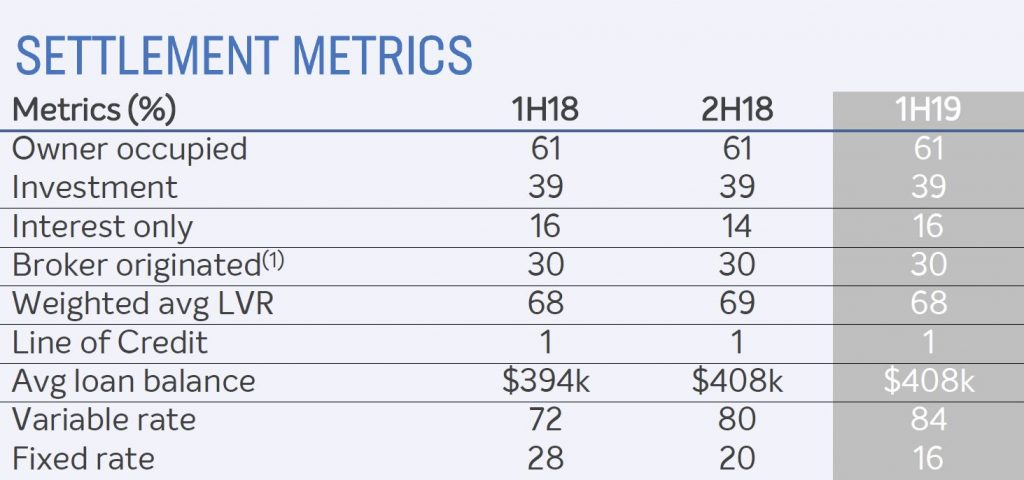

Home lending settlements included 39% investment lending (higher than the current industry average), 30% via brokers, and 16% interest only lending.

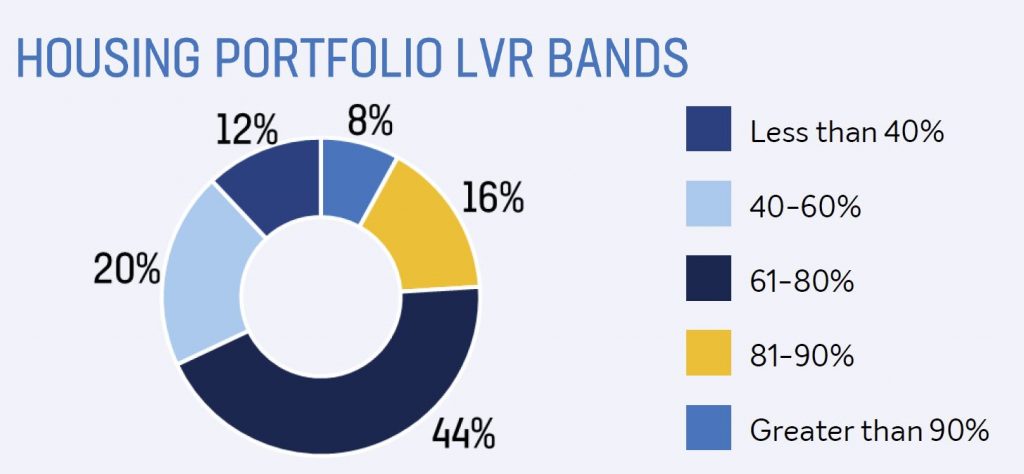

Home Lending LVR’s included 24% above 81% LVR in portfolio. Could become a problem is home prices go on falling.

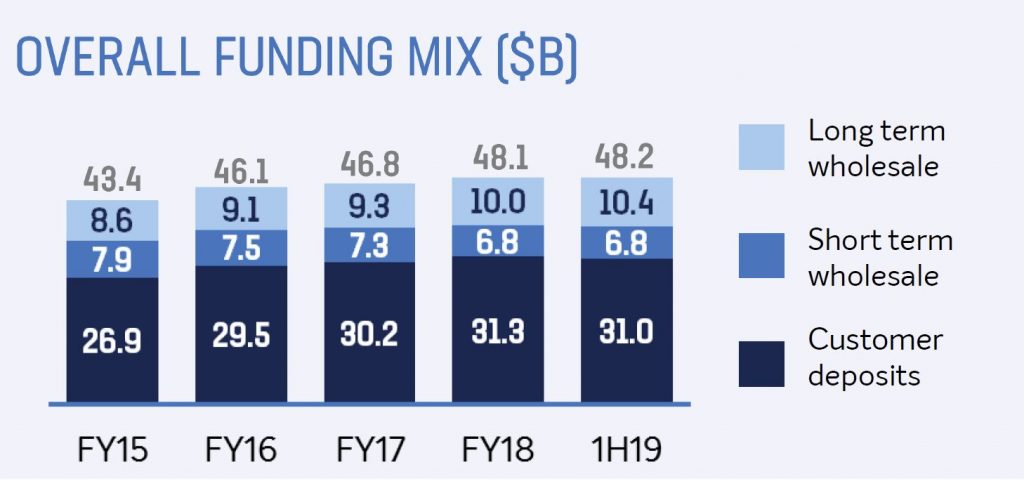

Customer deposits contracted, driven by a reduction in higher cost Term deposits, with a deposit to loan ratio of 68%

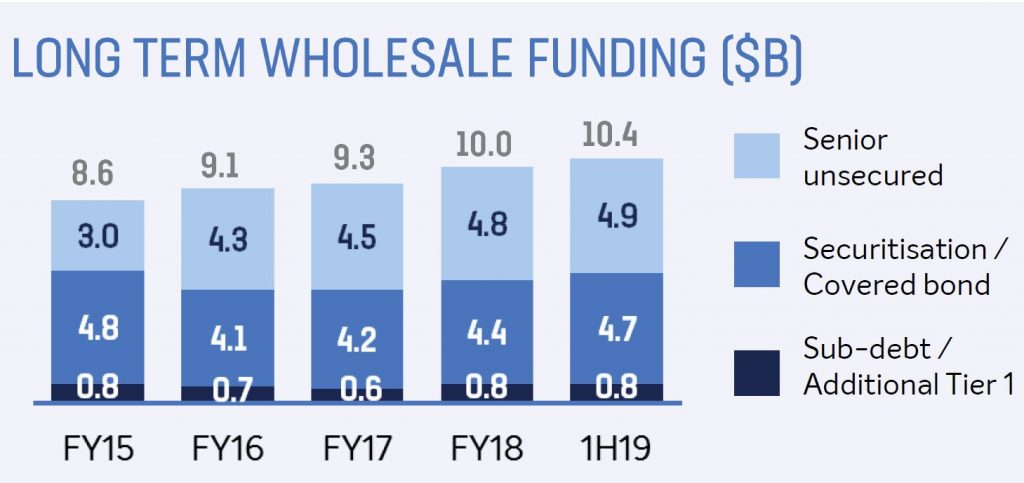

They took advantage of more favourable conditions for long term wholesale issuance

Net interest income was $215m, down 5% compared with 1H18 for the retail banks, and $216m, up 4% for the business bank.

Net Interest Margin was down 4 basis points to 1.94%

Non interest income was lower at $65m compared with $75m 1H18.

Their cost to income ratio was up 190 bps to 49.5%; They expect amortisation to increase with ongoing investment, plus rising regulatory & compliance costs expected going forward. In fact BOQ took a further $3m below the line for regulatory and compliance spend and $1m for legacy costs.

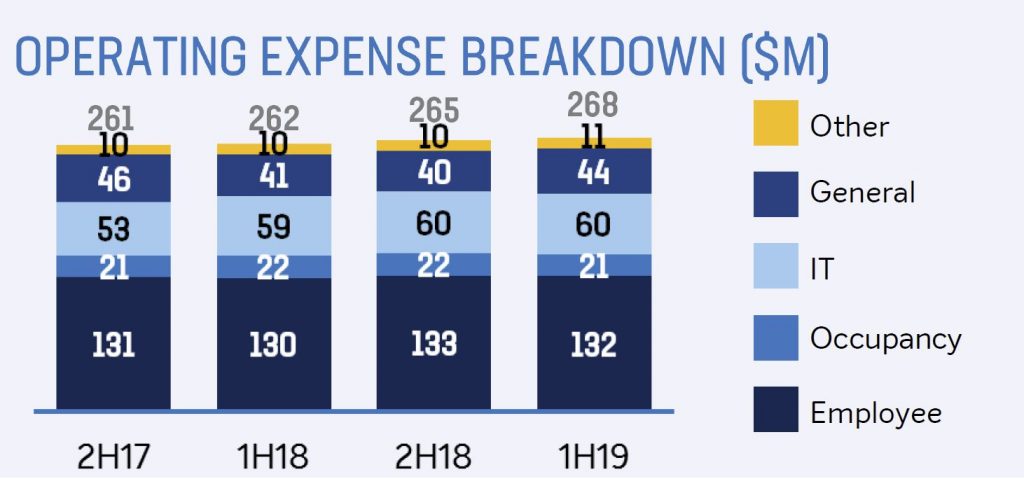

Operating expense growth was 2% to $268m and they expect higher costs ahead, with an additional $10m for regulatory costs.

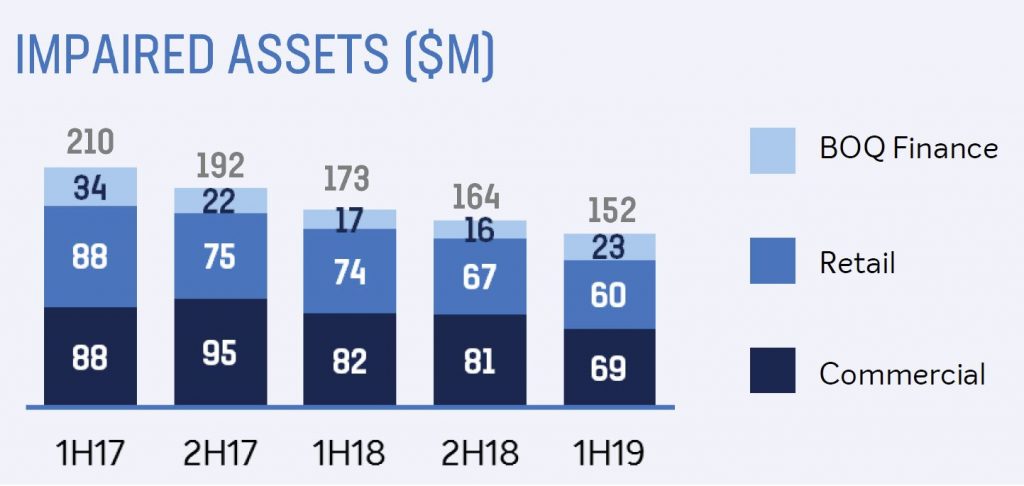

Impaired assets were down to $152m 1H19.

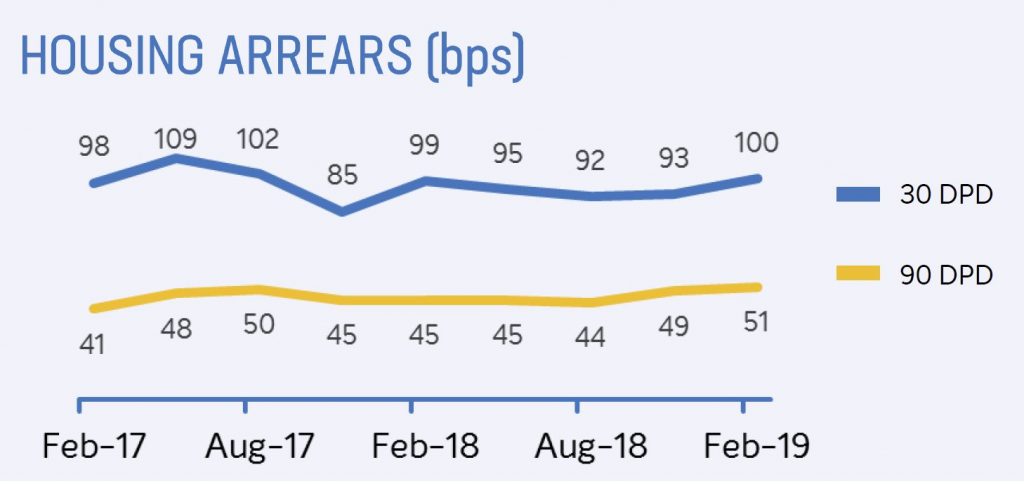

They reported a loan impairment expense of $30 million or 13 basis points of gross loans. There was an uptick in housing arrears.

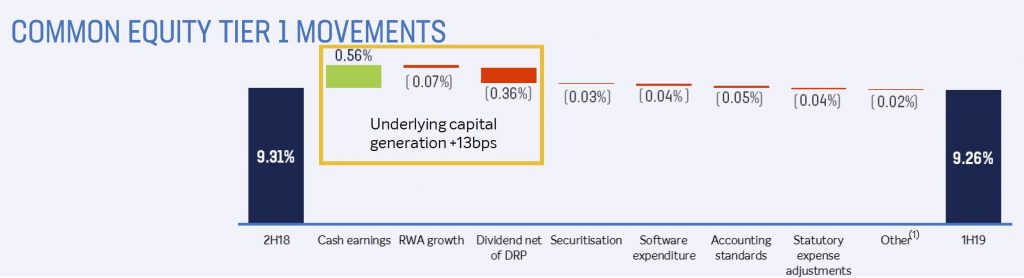

Common Equity Tier 1 (CET1) capital ratio of 9.26%, down from 9.31% 2H18.

The basic earnings per share down 10% to 41.8 cents on 1H18, but 13% down on 2H18.

Their return on average ordinary equity was down 110 bps to 8.8%

The fully franked interim dividend was 34 cents per ordinary share, down from 38 cents.

Westpac Takes A Profit Hit On Remediation

Westpac says its cash earnings in first half 2019 have been reduced by an estimated $260m due to its customer remediation programs.

Cash earnings of customer remediation provisions for the full year of 2017 and the full year of 2018 were $118m and $281m respectively, so the newly released figure shows a sharp increase.

The key remediation items include:

• Customer refunds associated with certain ongoing advice service fees charged by the group’s salaried financial planners

• Refunds for certain consumer and business customers that had interest only loans that did not automatically switch to principal and interest loans when required

Westpac CEO Brian Hartzer said, “As part of our ‘get it right put it right’ initiative we are determined to fix these issues and stop these errors occurring again. We will continue to review our products and services to ensure they deliver the right outcomes for customers, and if necessary, make further provisions.”

Westpac will commence remediation in the group’s second half 2019 for customers of authorised representatives still operating under BT Financial Group’s licences.

Work is also underway to determine the extent of the services provided by authorised representatives who are no longer operating under BTFG’s licences, including those who have left the industry.

According to a statement from the bank, this remediation program is more challenging, because many of the authorised representatives’ files have been difficult to access.

Westpac said:

• Total fees received by authorised representatives in 2008 to 2018 were approximately $966m

• Within this total, fees received from customers by authorised representatives still operating under BTFG’s licences in the period 2008 to 2018 were approximately $437m

• For customers of authorised representatives, Westpac has not yet been able to finalise a reliable estimate of the proportion of fees that may need to be refunded

• Interest on refunded fees and additional costs to implement this program will also need to be considered when determining any remediation provisions

‘Weakest reporting season in 4 years’: UBS

Around 17 per cent of Aussie large cap companies downgraded guidance this reporting season as cost pressures weighed on major financial institutions and industrials, via InvestorDaily.

In its final analysis of the February 2019 reporting season, UBS Global Research notes that EPS revisions for the market ex-resources and ex-financials were the weakest since 2010.

“In aggregate, ASX 100 FY19 earnings expectations were revised down 0.1 per cent through reporting season, with the strong performance of the market in February entirely driven by an expansion in the PE multiple,” the report said.

“FY19 EPS revisions for the Resources were resilient at +6.6 per cent. However, the Industrials ex-Financials were much weaker, with EPS revised down 2.8 per cent, the weakest reporting season since 2010. The 1.9 per cent downward revision to Financials EPS was also the weakest since 2011.”

The main upside surprise this reporting season came from better-than-expected capital management, according to UBS, that estimates that around 21 per cent of ASX 100 companies delivered larger than expected dividends.

However, the report flagged cost pressures as the main downside this season.

“Pockets of cost pressure were the key downside surprise, particularly among insurance and other financials, which have experienced growth in remediation, restructuring and compliance charges related to the royal commission (in addition to revenue headwinds), as well as a mixed bag of Industrials, namely gaming (Crown Resorts and Tabcorp), health care (Ansell and CSL) and materials (Boral, Brambles and James Hardie). Some modest cost pressure also appears to be emerging for the Resources. Companies affected include Alumina, Northern Star Resources and Oil Search,” the report said

In its ‘Reporting Season Progress Update’, UBS flagged that analysts were less optimistic on the outlook than company guidance implied.

“However, as reporting season progressed, companies downgraded guidance significantly to the weakest February reporting season in four years,” the bank said.

UBS estimates that 15 per cent of large cap companies upgraded guidance, while 17 per cent downgraded guidance.

“Among large cap companies that upgraded guidance, Ansell, Computershare, Goodman Group, South 32 and Worley Parsons were well received by the market.

“Among large cap companies that downgraded guidance, AMP, Coles Group, REA Group, Scentre Group, Suncorp, Unibail-Rodamco-Westfield, Woolworths, and Whitehaven Coal were not received well.”

“The biggest large cap positive surprises, in our view, have come from Cleanaway Waste Management, Fortescue Metals Group, Goodman Group, Insurance Australia Group, Magellan Financial Group and Ramsay Health Care.

Negative surprises have, in our view, come from AMP, Bendigo and Adelaide Bank, Crown Resorts, ResMed, Unibail-Rodamco-Westfield and Woolworths.”

YBR in trading halt, flags loss

YBR told the market on Friday it will incur a statutory after-tax loss for the six months to 31 December 2018, via Financial Standard.

The results include a material non-cash impairment charge on the carrying value of the wealth management and lending business and various other assets across the group, it said.

However, the impairment will not affect the net present value of the group’s net trail commission receivable from its underlying mortgage book or book of insurance premiums under management, but will be applied against goodwill and intangible and other assets.

The charge results from assessing goodwill and other intangibles in light of recent events, including the Royal Commission, YBR said.”It is a non-cash balance sheet adjustment and has no impact on the underlying operations of the business.”

One of the Royal Commission’s final recommendations is to ban lenders paying trail commission to mortgage brokers and other commissions for new loans.

This should be enacted within two or three years, Commissioner Kenneth Hayne said. “The borrower, not the lender, should pay the mortgage broker a fee for acting in connection with home lending.”

YBR expects the audited half-year report to be lodged before the Corporations Act deadline of 15 March 2019.

It last traded at 5.4 cents per share, plunging from about 14 cents compared to a year ago, down more than 61%.