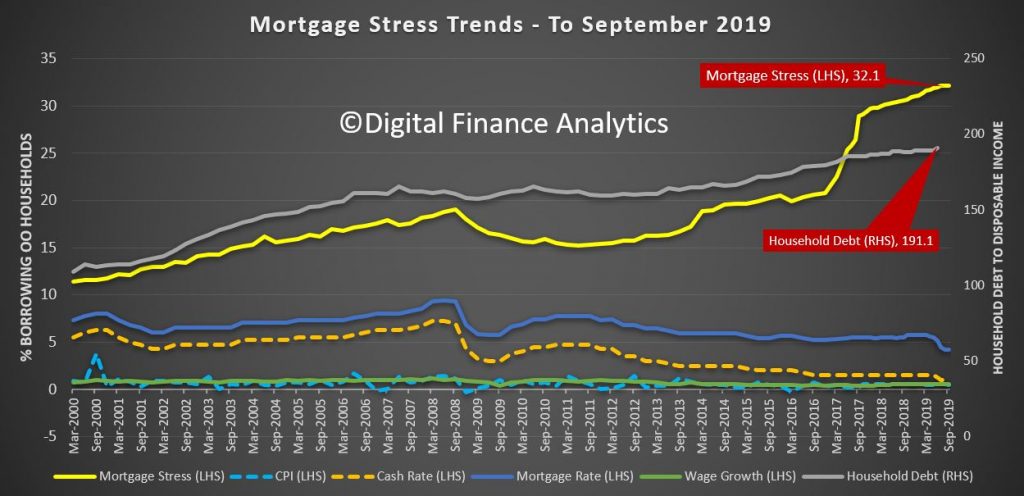

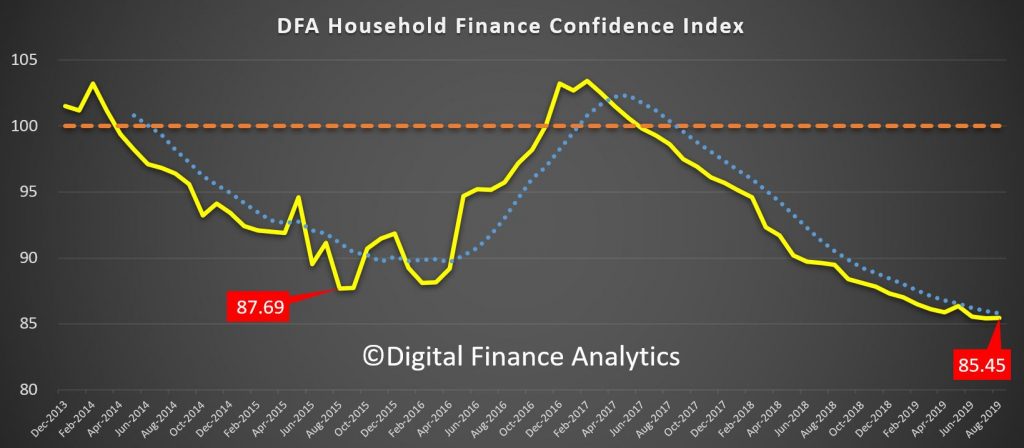

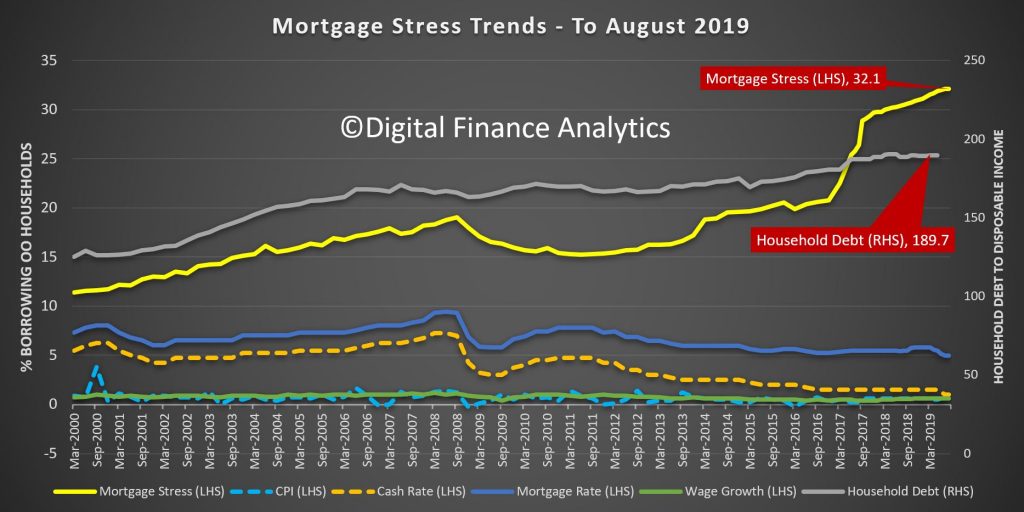

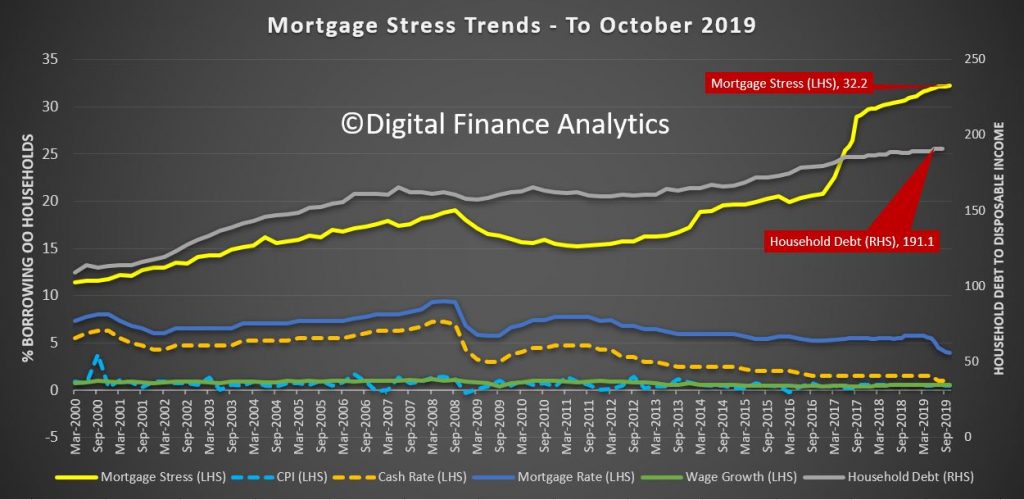

After talking a breather last month, thanks to rate cuts and tax refunds (minimal those these were in practice), the results from our surveys for October shows a further 7,000 household fell into stress taking the total to more than 1.07 million households or 32.2%

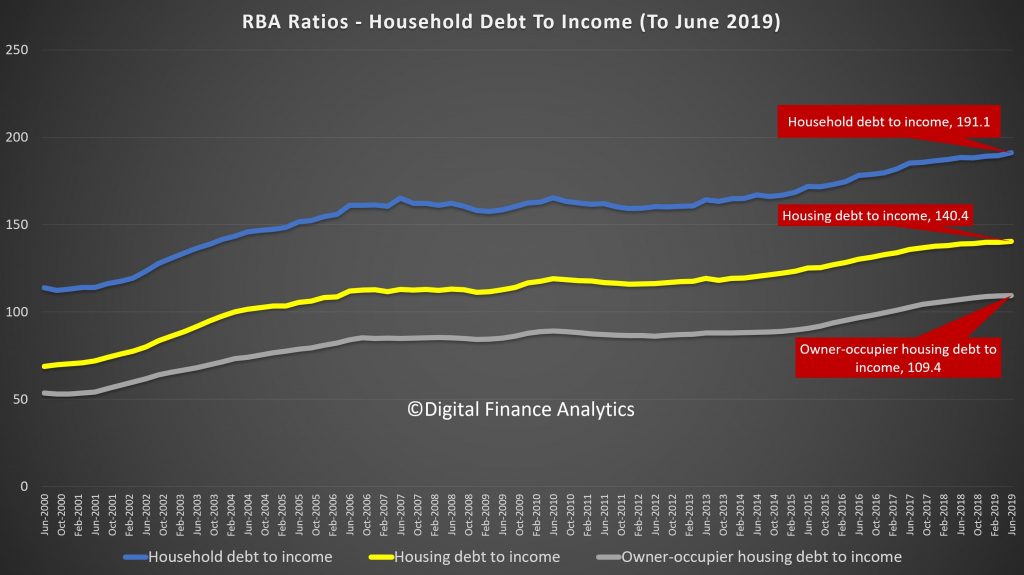

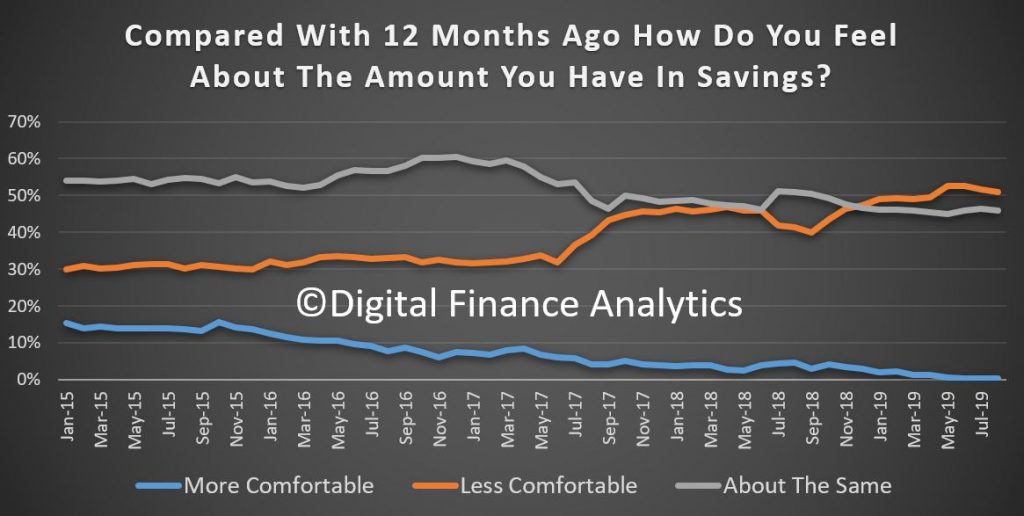

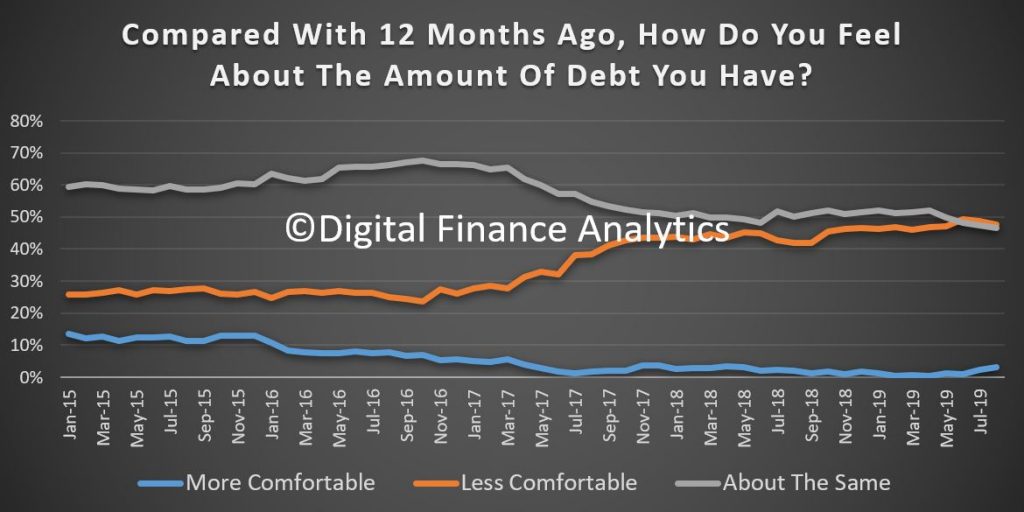

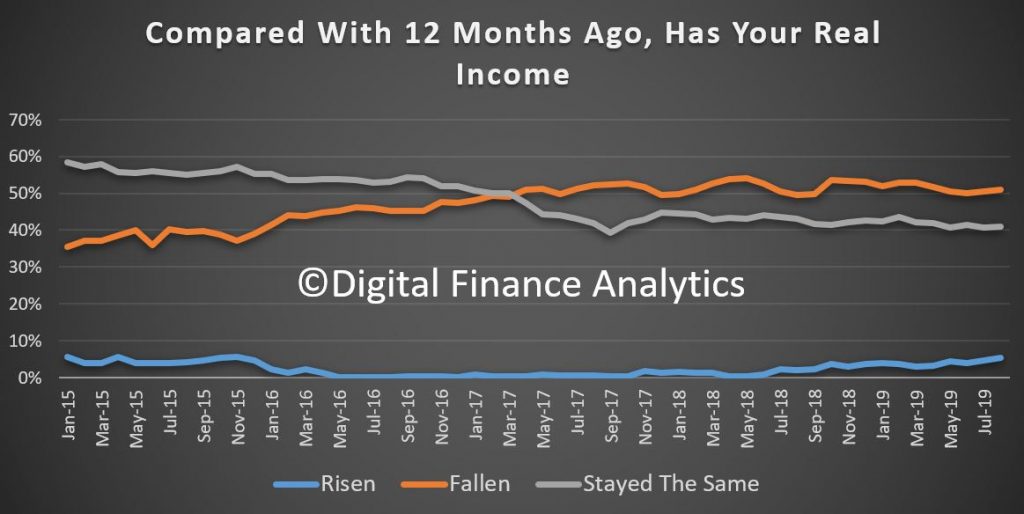

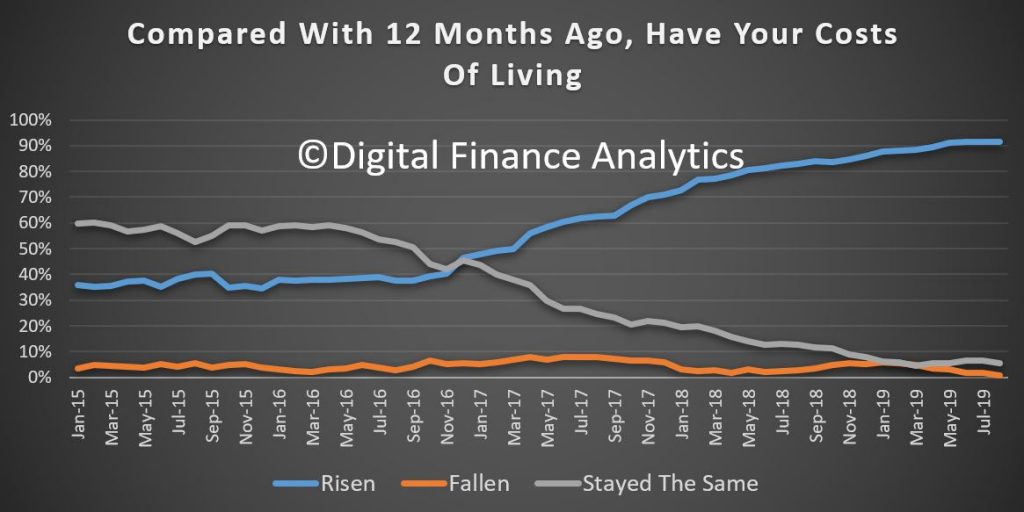

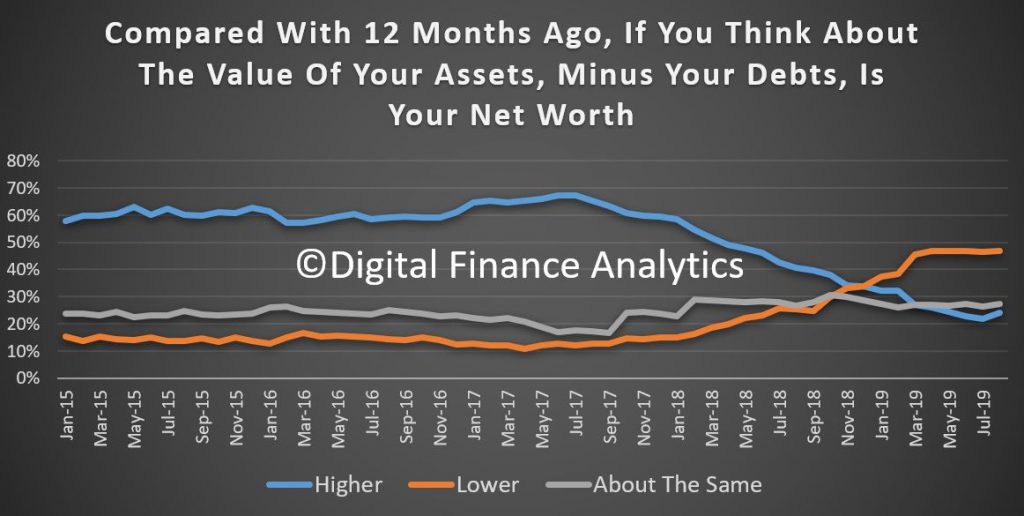

Household debt is at record highs, and while costs are still rising, incomes are not in real terms. There was a spate of refinancing which helped some households but the bulk of these were NOT in stress in the first place. The rejection rates for those in mortgage stress are and remain consistently higher.

Mortgage stress is assessed on a cash flow basis, where, based on our 52,000 household rolling annual survey we measure income and outgoings for households, including mortgage repayments. Where the cash flow is net negative, households are in stress. They are required to draw down on savings, put more on credit cards or hunker down – one reason the retail sales data yesterday at o.2% in September was so weak. Stress is based on current circumstances.

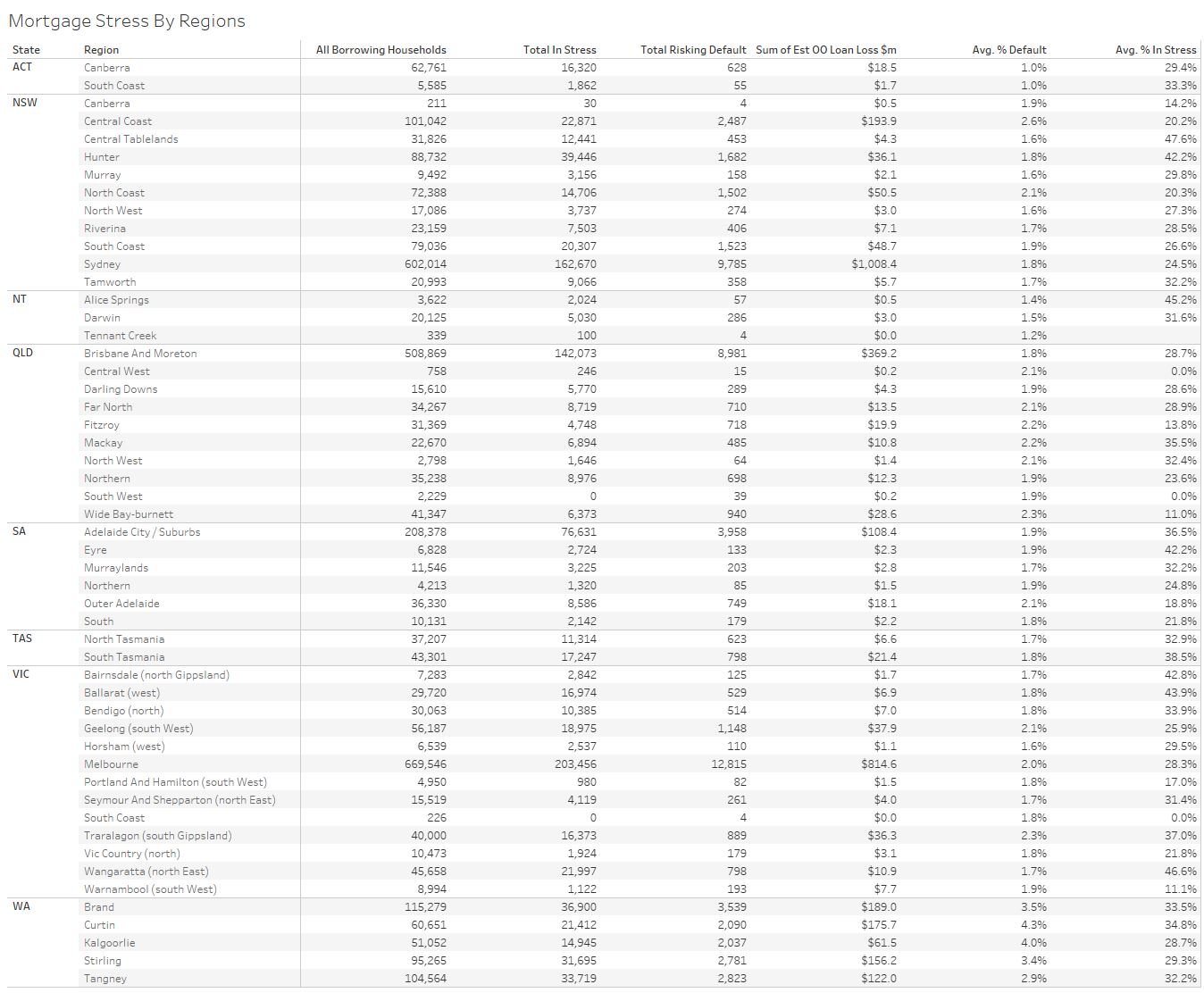

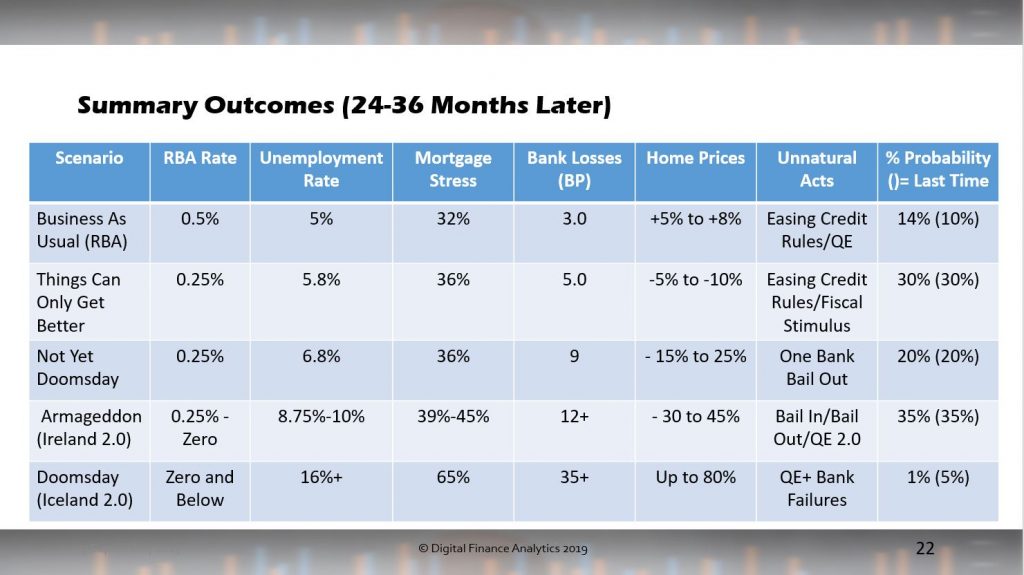

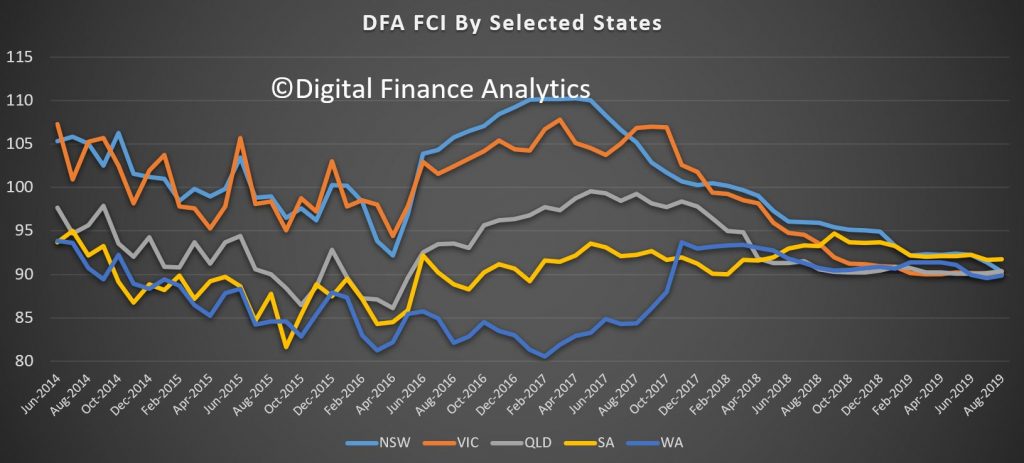

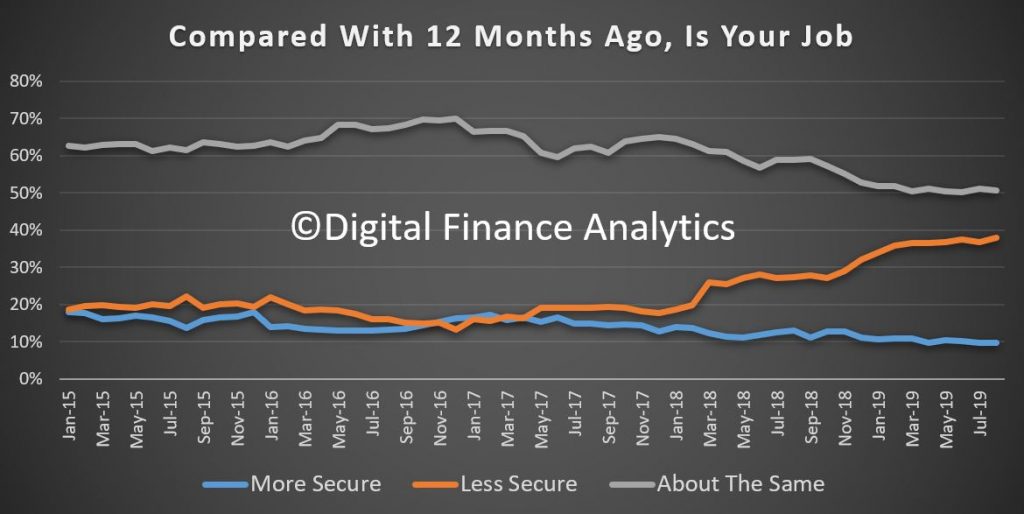

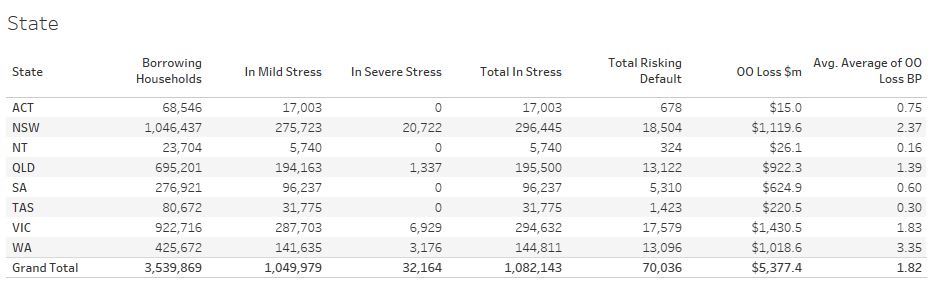

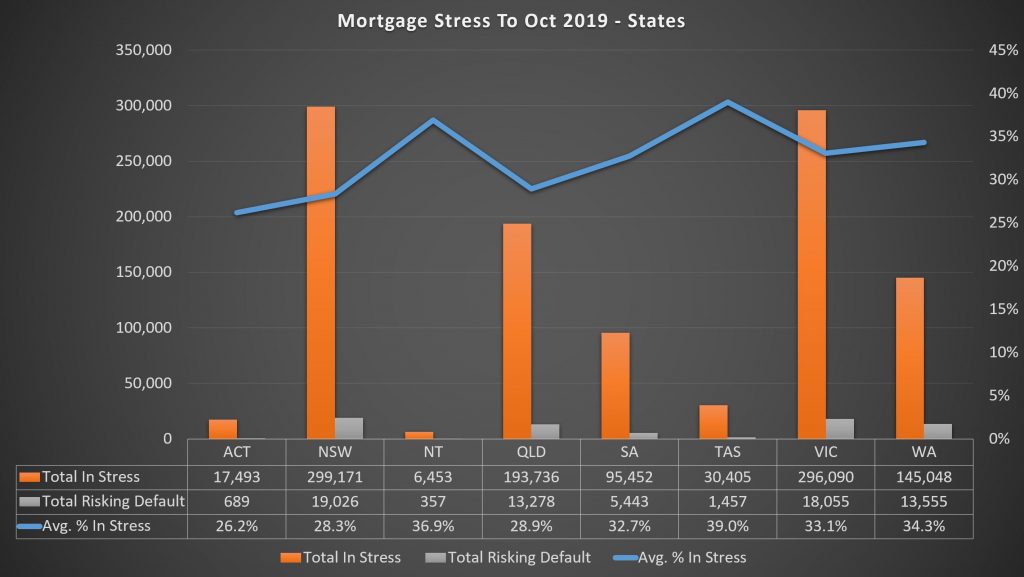

We also model the probability of default ahead over the next 12 months, which is a predictive estimate and we expect defaults to continue to rise – we are seeing worrying signs in both New South Wales and Victoria now as economic conditions in these states weaken. Job losses in retail and construction are leading the downturn. But underemployment is widespread. On the other hand, Canberra, with higher public sector wages, is more insulated from the reality elsewhere.

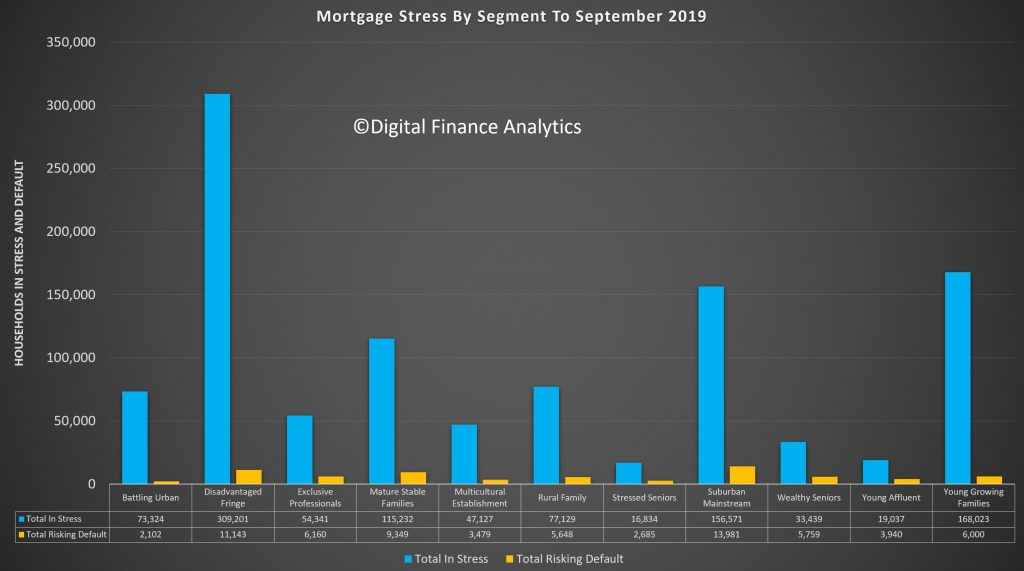

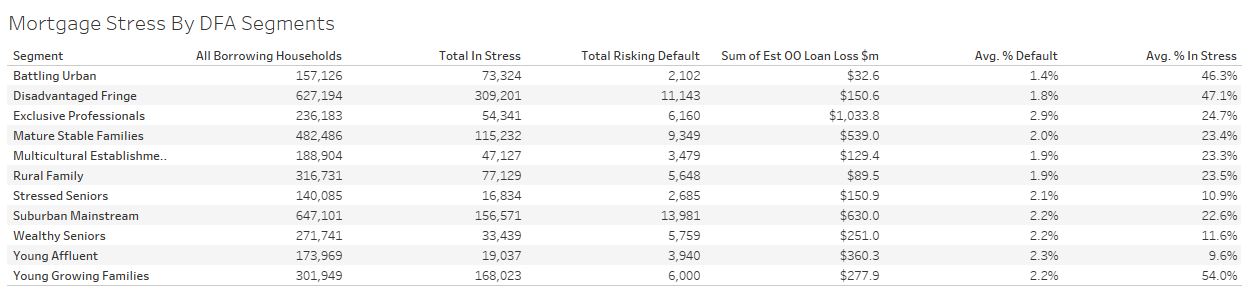

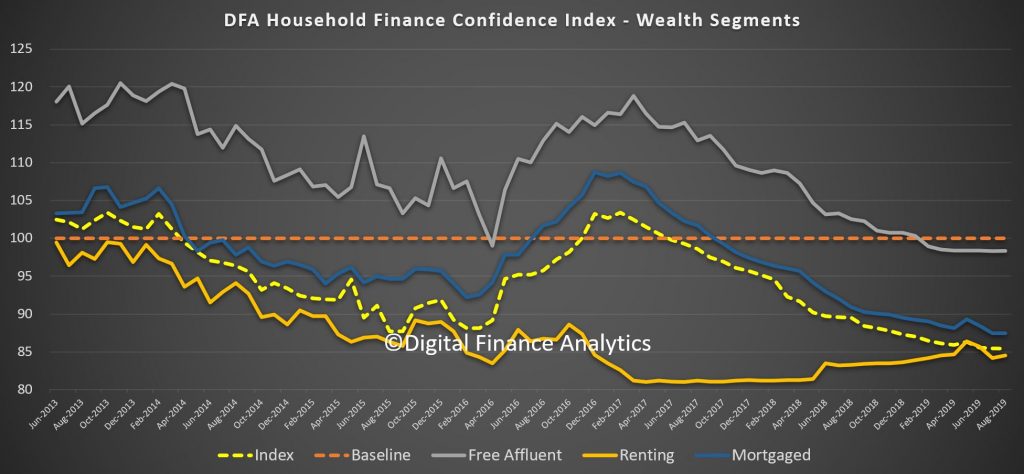

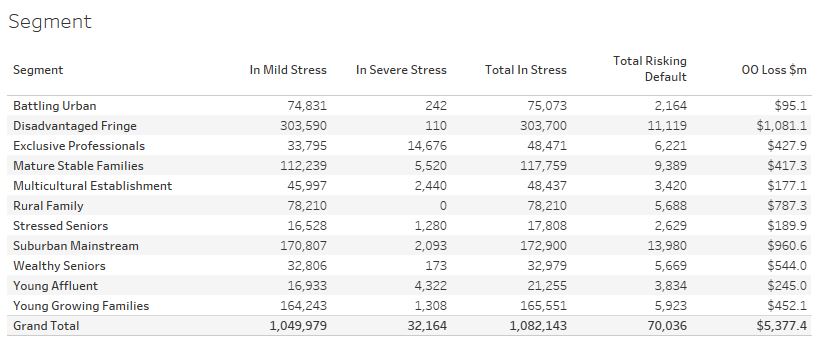

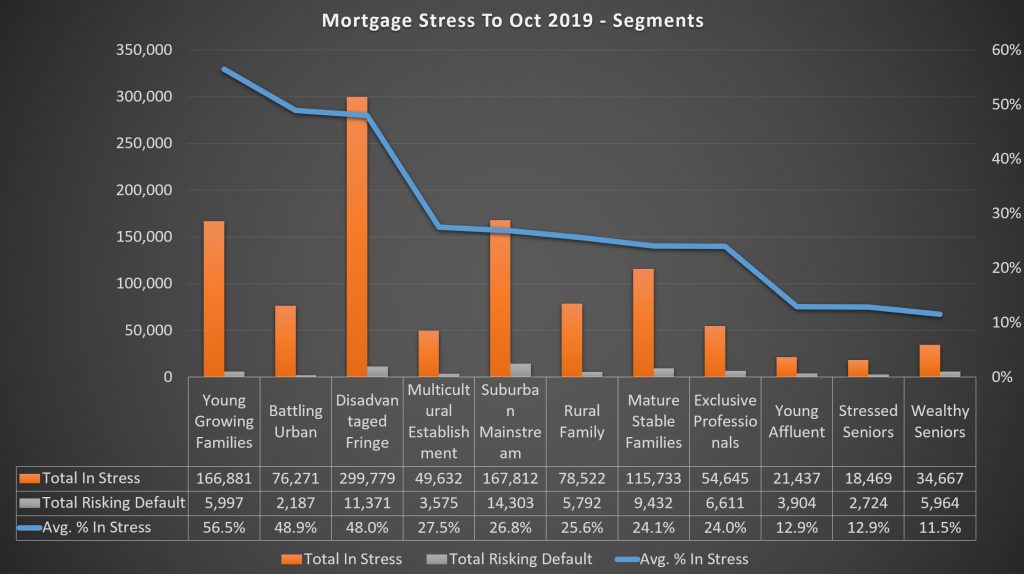

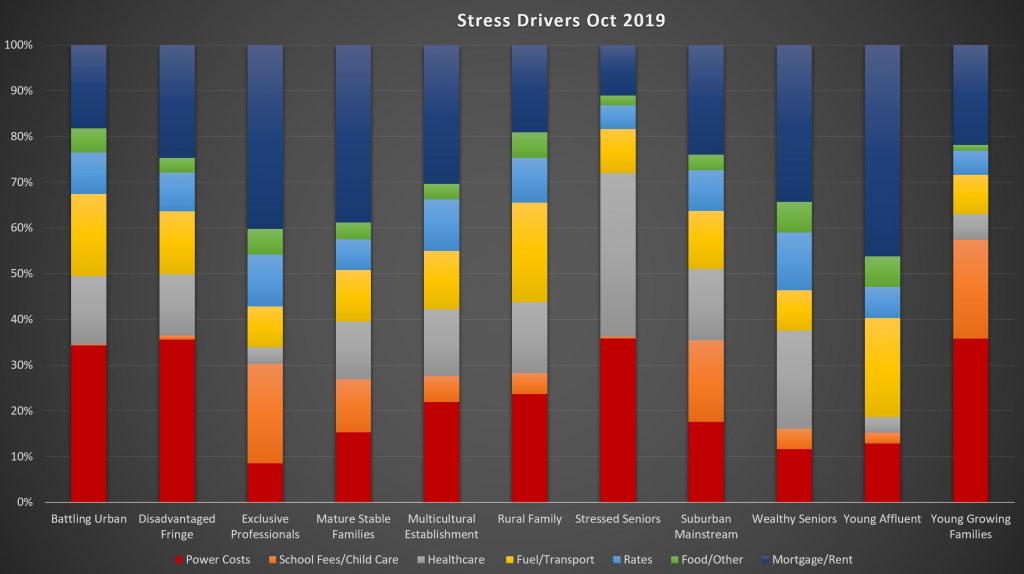

Across our household segments more than half (56.5%) of Young Growing Families are in stress, accounting for more than 166,000 households; followed by Battling Urban at 48.9% or 76,000 households and Disadvantaged Fringe at 48%, with nearly 300,000 household. Rural households are under pressure thanks also to the drought, with 25.6% in mortgage stress, or 78,500 households and even the most affluent segment – Exclusive Professionals are 24% in stress with 54,600 households. In other words mortgage stress is appearing in every sector of society.

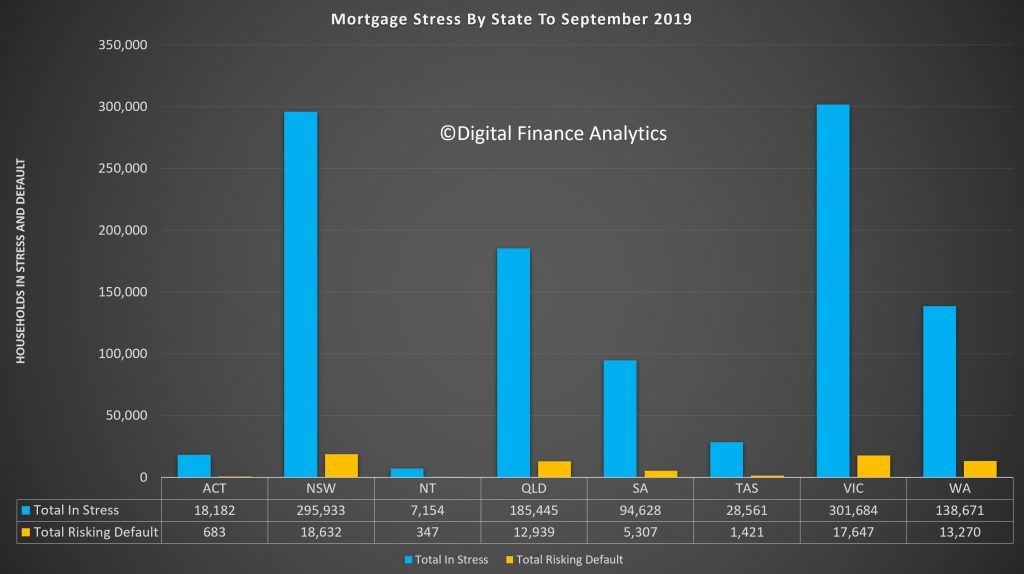

Across the states the highest proportion of households in stress are located in Tasmania (39%) and Northern Territories (36.9%), although the number of households is relatively low. New South Wales now has nearly 300,000 households in difficulty or 28.3% of households, and Victoria has 296,000 households in stress or 33.1%. We have been tracking the spike in Victoria in recent months. However, Western Australia has 34.3% of households in stress, or 145,000 households and conditions continue to deteriorate there with more foreclosures in train, as banks speed up their resolution processes.

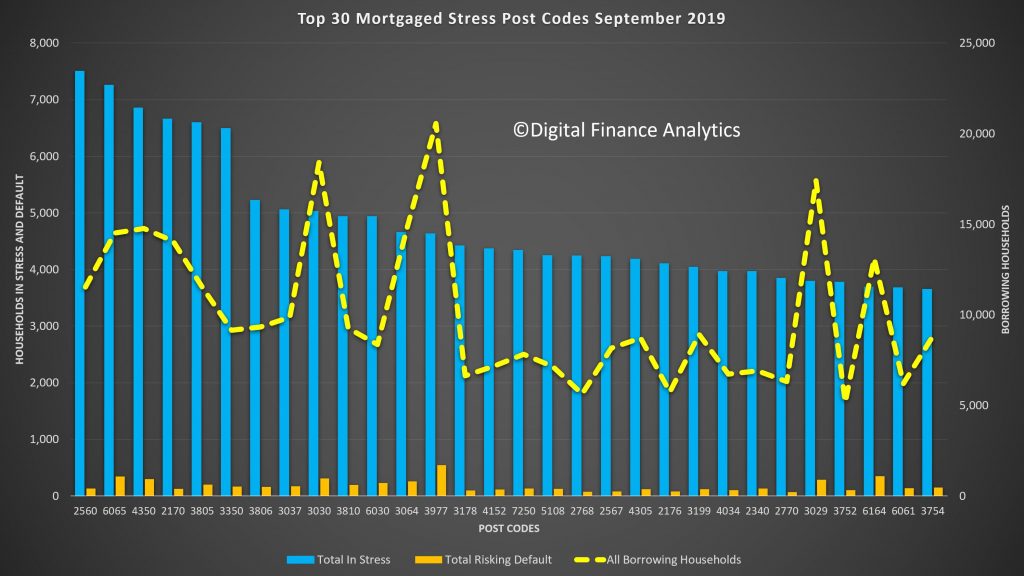

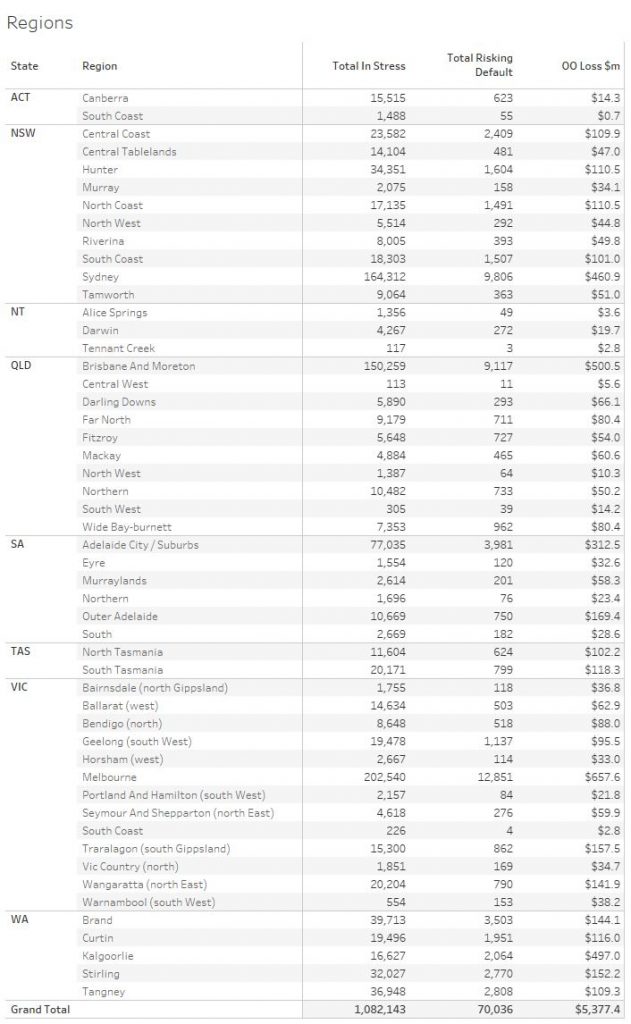

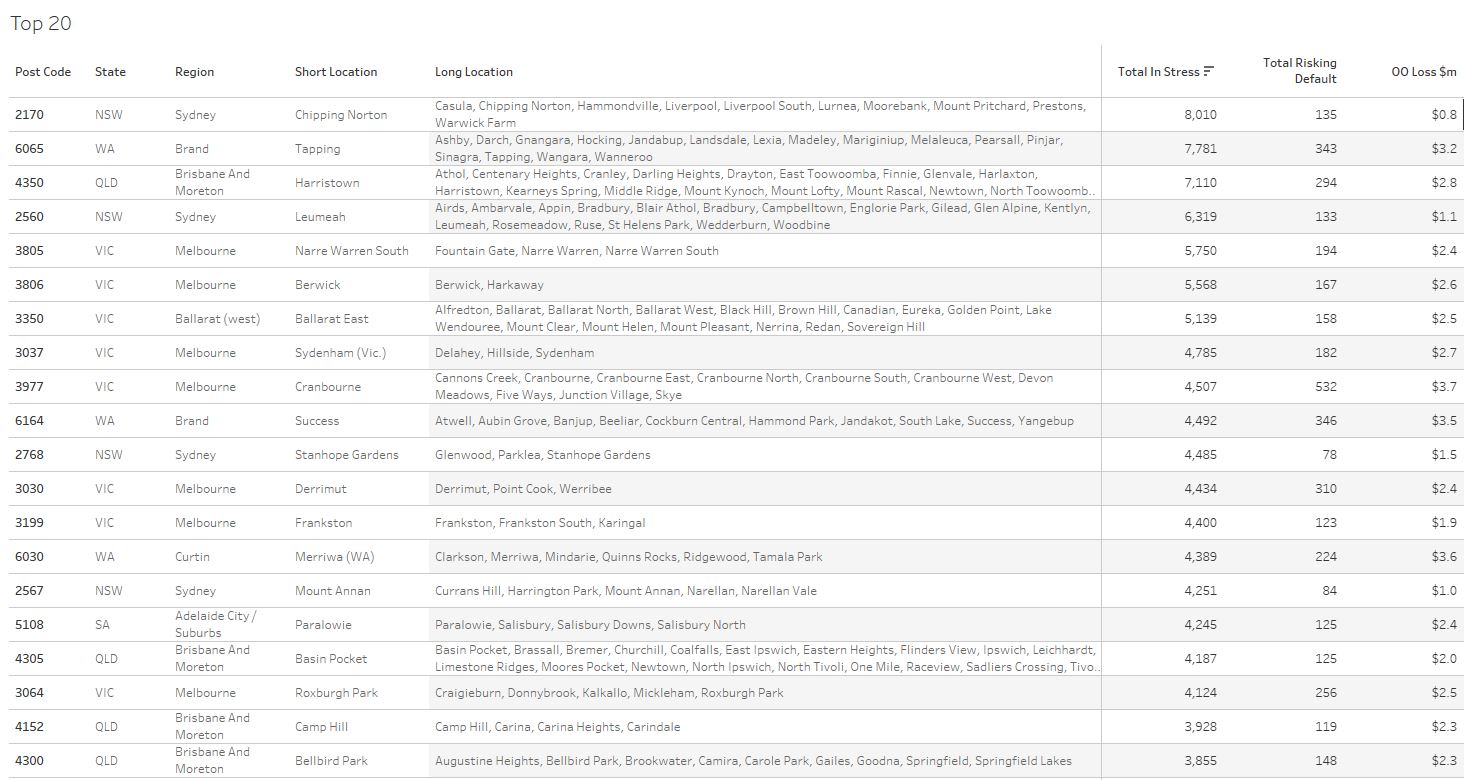

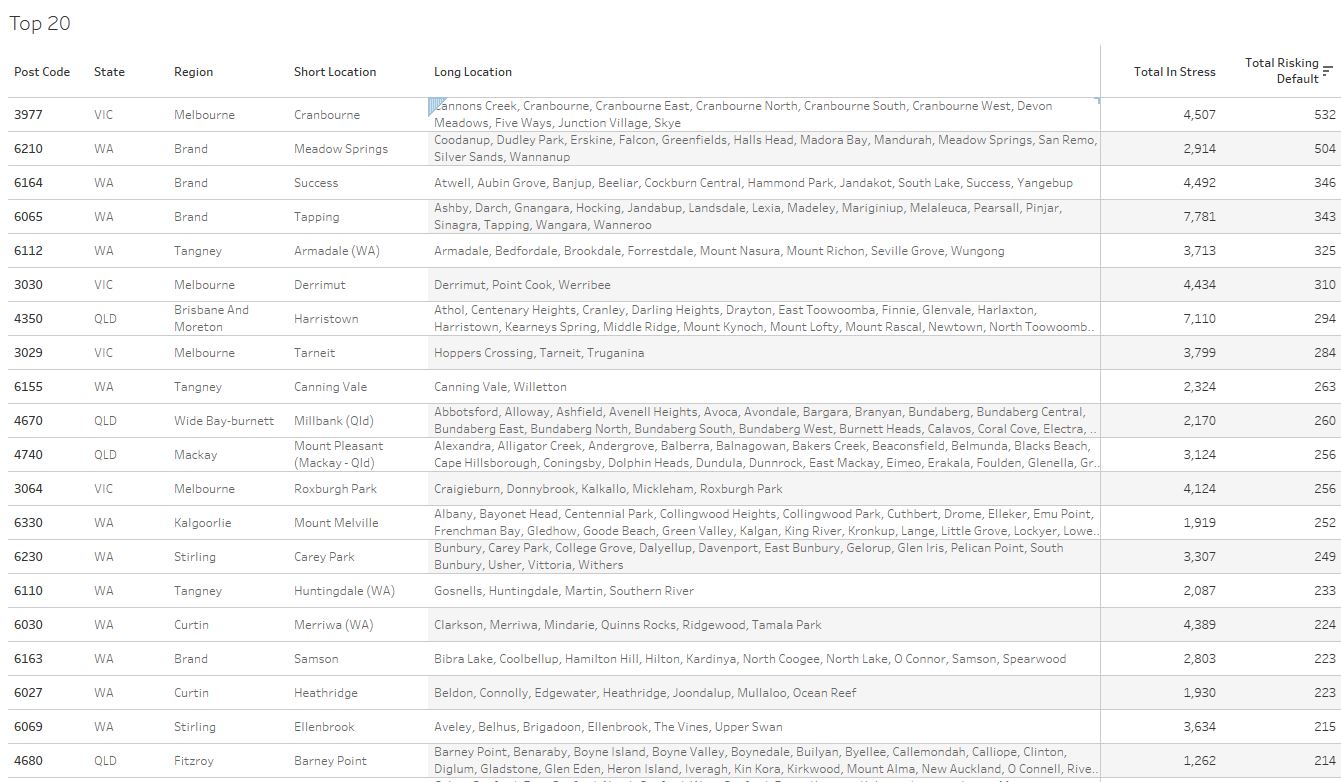

We analyse stress to post code level, and can identify those postcodes with the largest count of stressed households. Post code 2560 – the area around Campbelltown has the highest count, with 7,300 in stress or 63% of households. Next is Melbourne post code 3805, including Fountain Gate and Narre Warren with 6,600 stressed households representing 57.8% of households. Third is Toowoomba in Queensland with 6,500 households, representing 44% of households in the district, and fourth is 2170 around Liverpool in New South Wales with 6,300 in stress or 44.8% of households. A common characteristic are areas of high urban expansion on the fringe, with many new builds competing with existing property, and many recently purchased. That said, stress can take several years to emerge, and there are pockets of pain from purchases made several years ago.

Finally, we also examined the expense drivers of stress from our surveys. These vary across the segments with power prices, school fees and child care, all significant, as well as housing costs overall.

This is likely to drive stress higher unless real wages start to improve, but given the current economic outlook that appears unlikely for now.