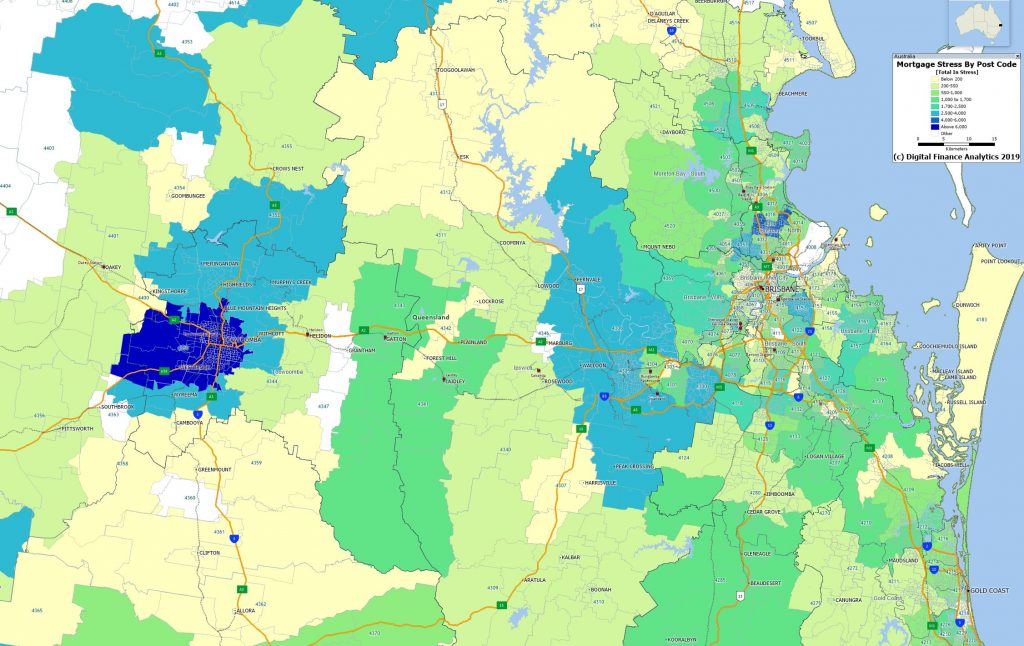

Here are the most stressed postcodes across Queensland.

As requested!

Click on the image to view full screen. Other states to follow in due course.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

Here are the most stressed postcodes across Queensland.

As requested!

Click on the image to view full screen. Other states to follow in due course.

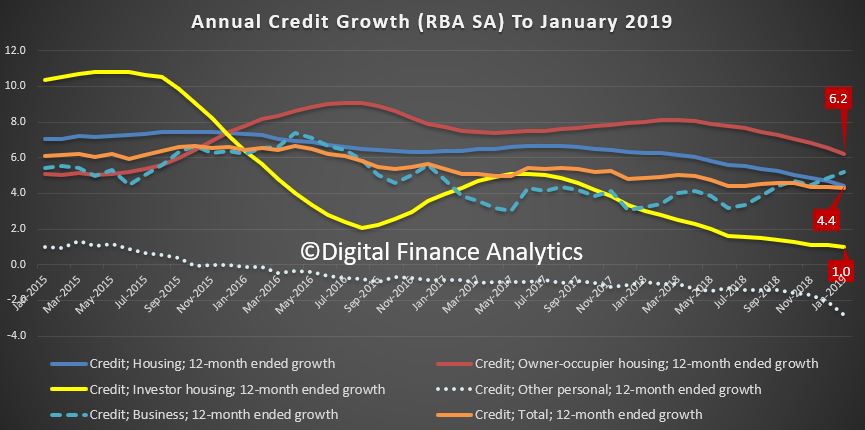

Digital Finance Analytics (DFA) has released the February 2019 mortgage stress and default analysis update. Unfortunately, the pressure on households continues to rise as weak ongoing wages growth is not offsetting costs of living, and mortgage repayments and total debt still grows. In addition, the number of households in severe stress continues to rise, suggesting a lift in potential defaults later.

The latest RBA data on household debt to income to September fell a little to 188.6[1], but still remains highly elevated. The housing debt ratio continues to climb to a new record of 139.6, according to the RBA. This shows that household debt to income is still increasing.

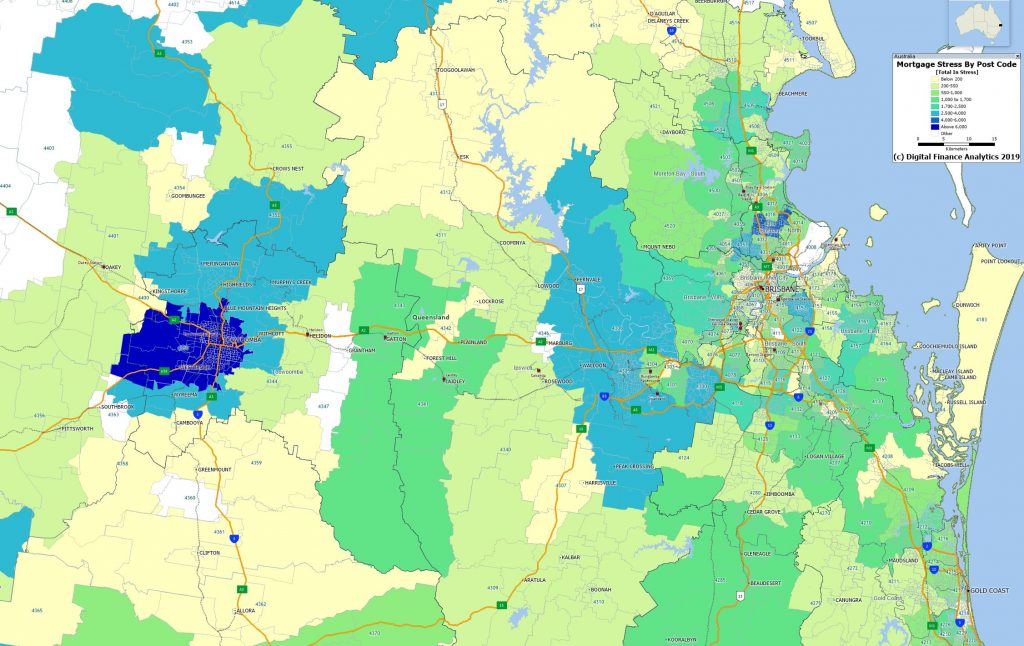

This is confirmed by the latest financial aggregates recently released by the RBA, to end January 2019, with owner occupied lending still growing significantly faster than inflation at 6.2%.

This high debt level helps to explain the fact that mortgage stress continues to rise.

Across Australia, more than 1,036,214 households are estimated to be now in mortgage stress (last month 1,026,106), another new record. This equates to more than 31% of owner occupied borrowing households. In addition, more than 28,903 of these are in severe stress (last month 25,750). We estimate that more than 66,000 households risk 30-day default in the next 12 months, up 3,000 from last month. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to the end of February 2019. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

Despite the oft repeated view that household finances are fine, the continued accumulation of larger mortgages compared to income whilst costs are rising and incomes static explains the issues we are now seeing.

Housing credit growth is running significantly faster than incomes and inflation, and continued rises in living costs – notably child care, school fees and electricity prices are causing significant pain, this despite some relief at the bowser. Many continue to dip into savings to support their finances. We are seeing a rise in households seeking help with their finances, including access to debt counsellors and other advice channels. WA is seeing very strong growth in cries for help, but pain in NSW is also on the rise.

Indeed, the fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. “More than 40% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings”.

The next question to consider is which households are being impacted. In fact, negative equity is touching “lots of different segments” of the market for different reasons, but collectively it is an “early warning sign” for what is to come.

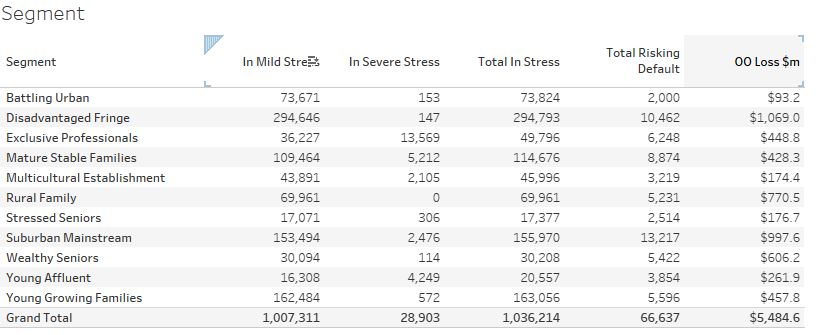

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by the numbers.

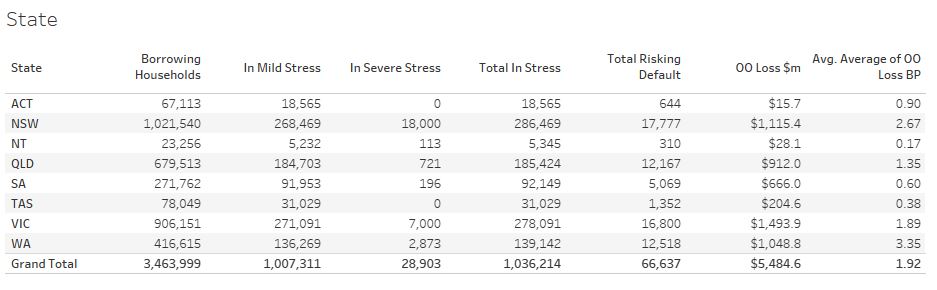

Regional analysis shows that NSW has 286,469 households in stress (282,165 last month), VIC 278,091 (278,860 last month), QLD 185,424 (185,493 last month) and WA has 139,142 (139,621 last month). The probability of default over the next 12 months rose, with around 12,500 in WA, around 12,100 in QLD, 16,800 in VIC and 17,700 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.49 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.3 basis points, which equates to $1,048 million from Owner Occupied borrowers.

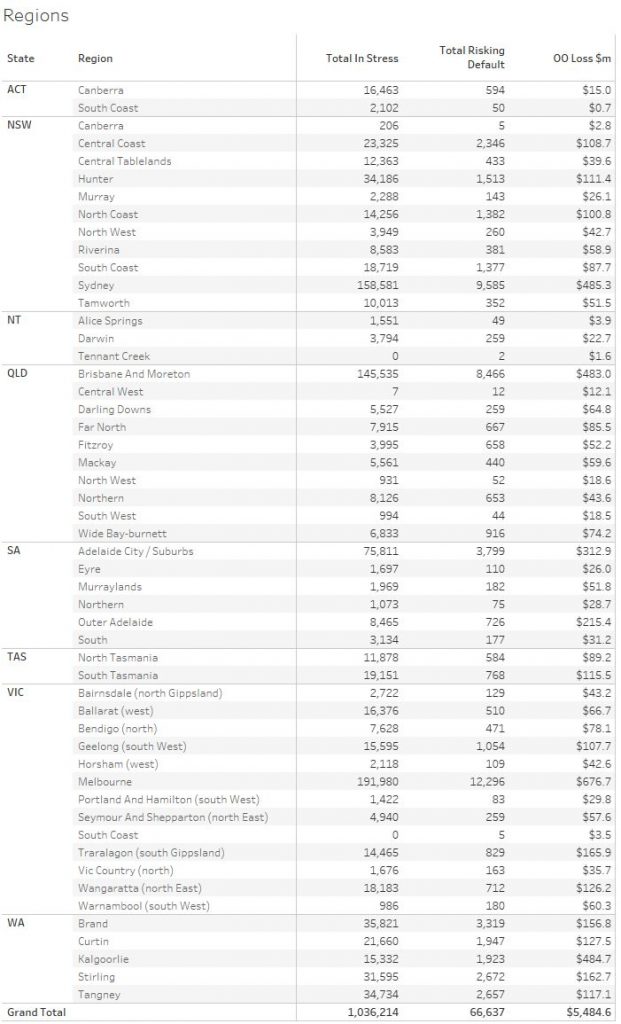

A fuller regional breakdown is set out below.

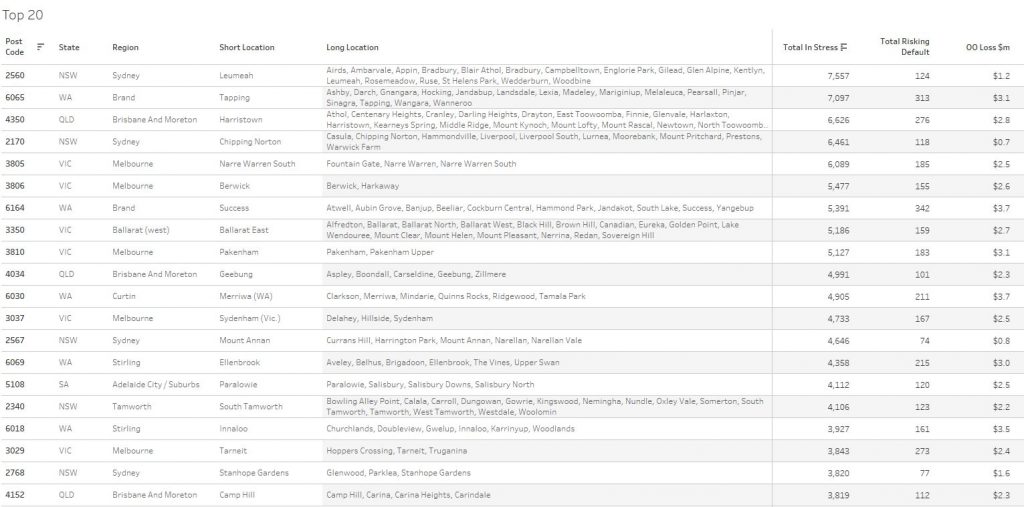

And here is a list of the highest count of stressed households by post code across the country.

Handling Mortgage Stress

Households who are in financial difficulty should not ignore the signs. Though many do. And trying to refinance to solve the problem often ends up just postponing the inevitable.

We think there are some simple steps households can take:

Step one is to draw up a budget, so you can see where the money is coming and going. From our research, only half of households have any budget. This means you can then make decisions about what is most important, and what can be foregone. Select and prioritise.

Step two is to talk with your lender, as they have a legal obligation to assist is case of hardship. Yet many households avoid having that conversation, hoping the problem will cure itself. I have to say, in the current low-income growth, high cost environment, that is unlikely. And remember rates are likely to rise at some point.

Step three. Work out what would happen if mortgage rates rose by say half or one percent. Pass that across your budget and examine the impact. Then you will really know where you stand. Then plan accordingly.

[1] RBA E2 Household Finances – Selected Ratios September 2018

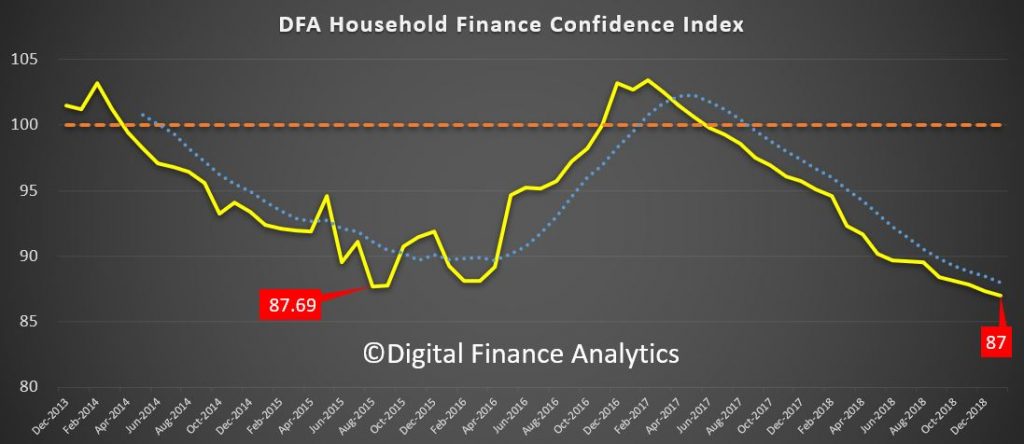

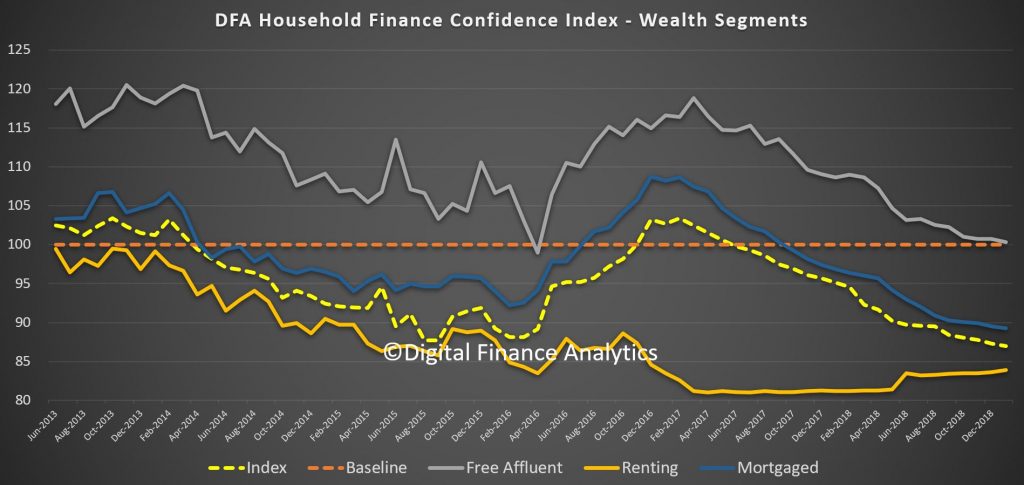

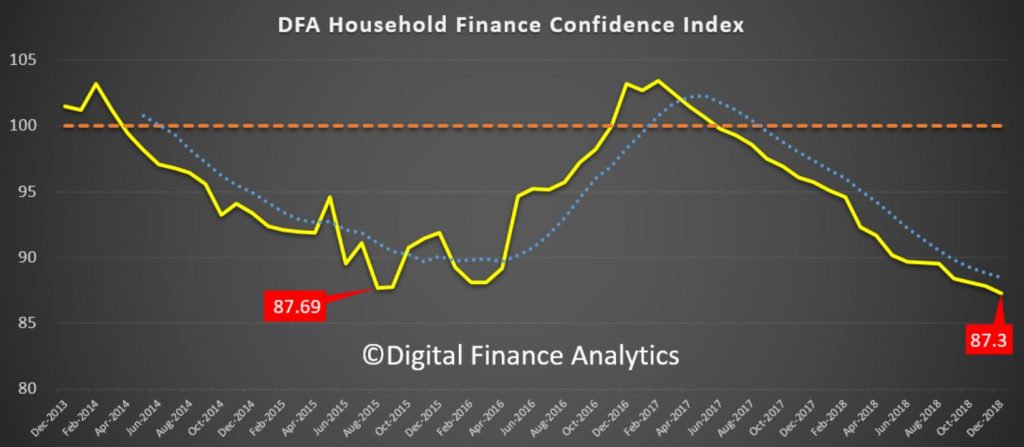

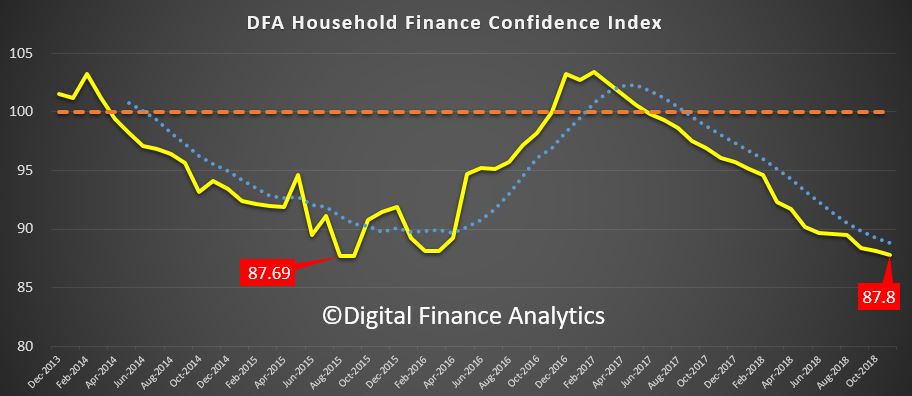

This is starting to look serious as the latest DFA household financial confidence index results for January 2019 reveals a further decline in levels of confidence.

The index fell to 87 in January, down from 87.3 in December, the lowest its been since the survey commenced, well below the neutral setting of 100.

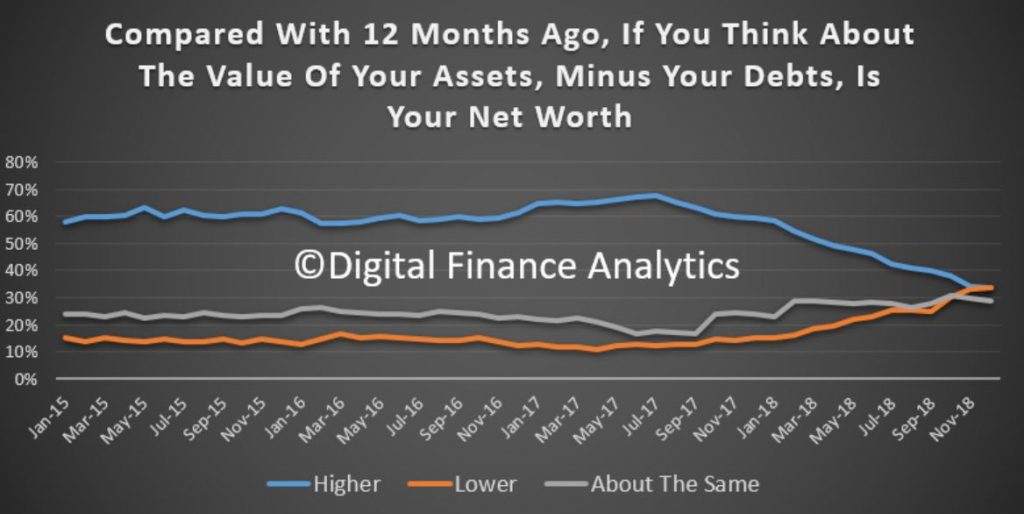

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

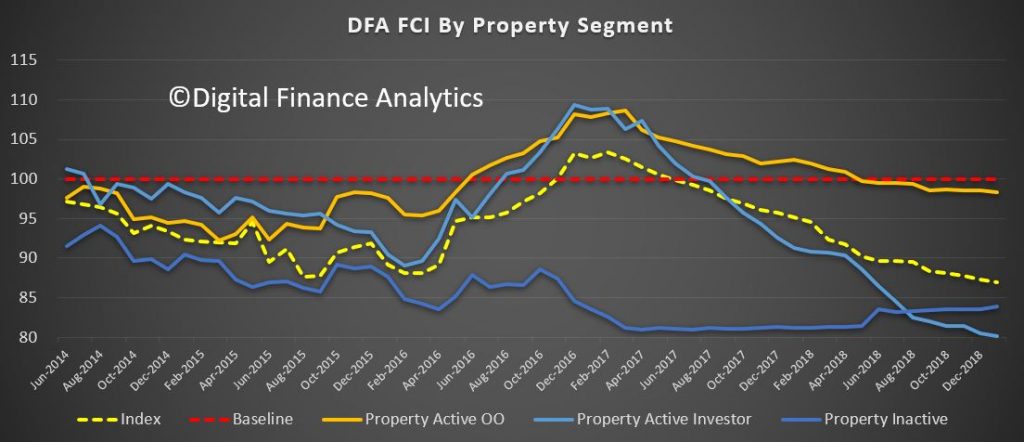

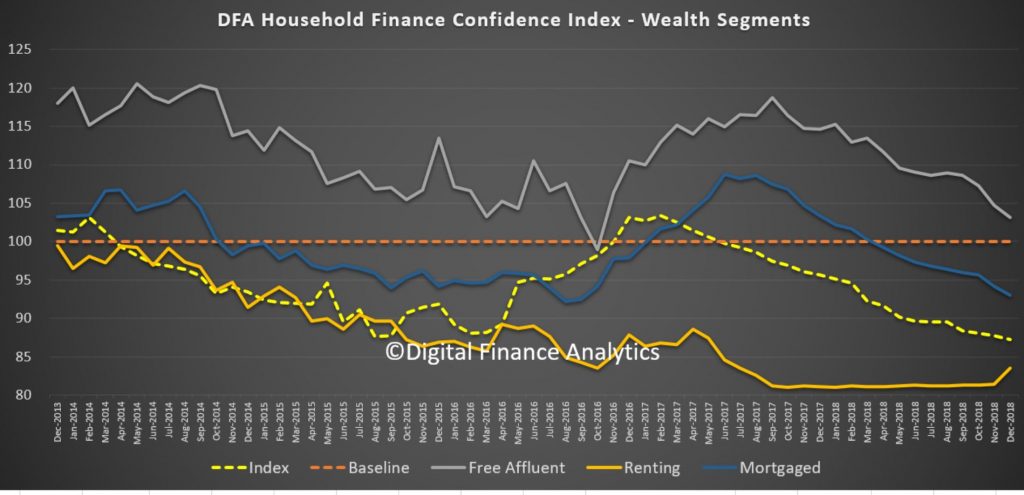

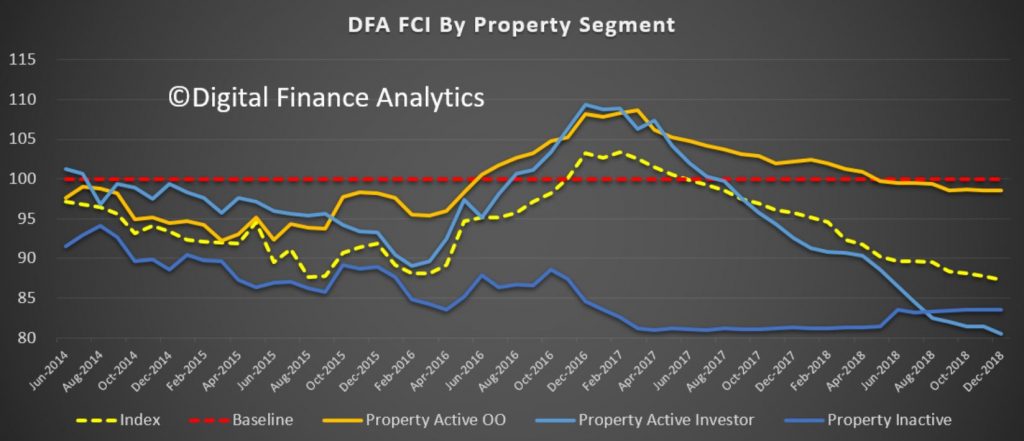

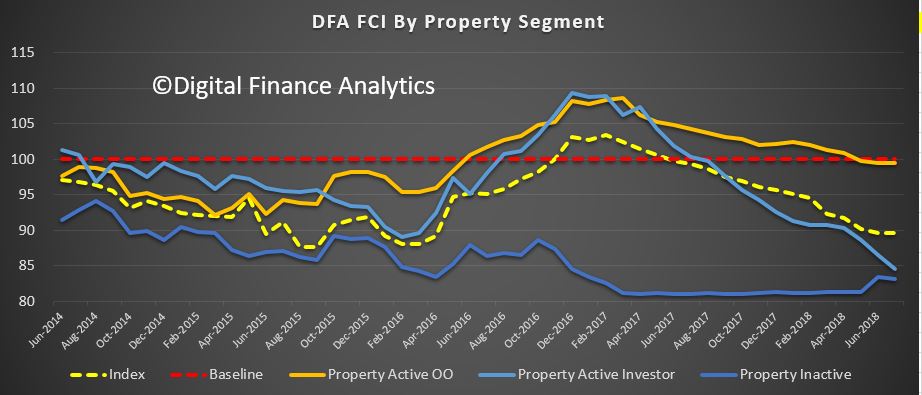

Looking at the results by property segments, we see a fall in confidence among property investors, as home prices and rental yields continue to fall, and reflecting concerns about potential changes to negative gearing and capital gains ahead. That said, purchase interest has risen a little. We will discuss this later.

Owner occupied borrowers are also feeling the heat, reflecting some mortgage price pain, as well as the basic affordability issues. Those renting however are a little more positive relatively speaking, thanks to rents being lower now and a greater choice of property for rent being available, especially in Sydney. Overall investors are the least confident now, a considerable switch from a year or so ago!

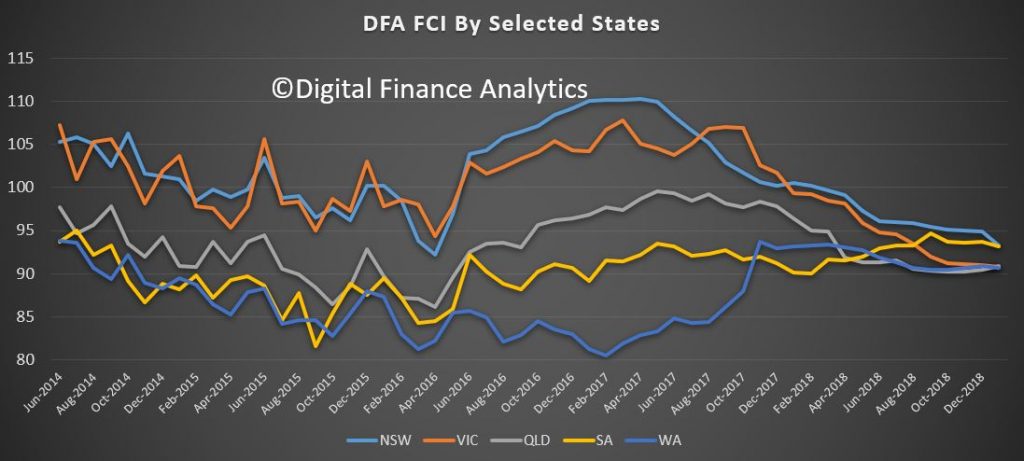

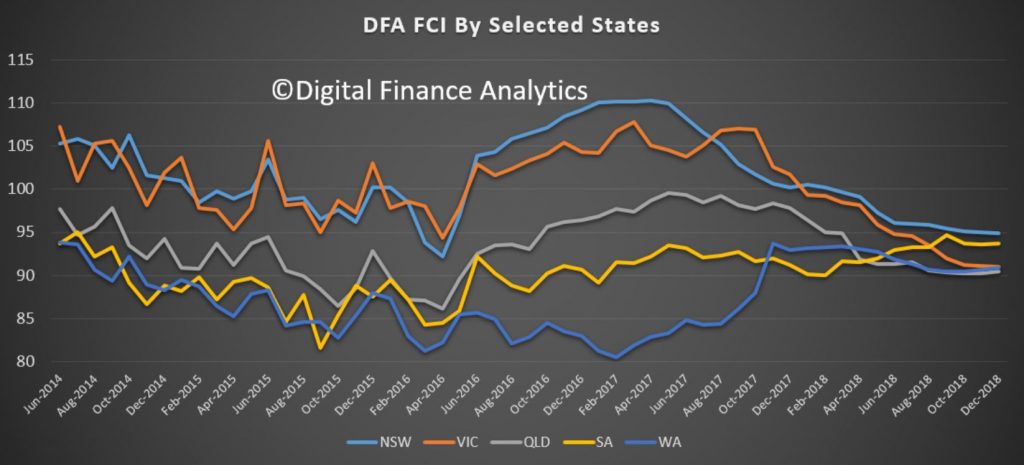

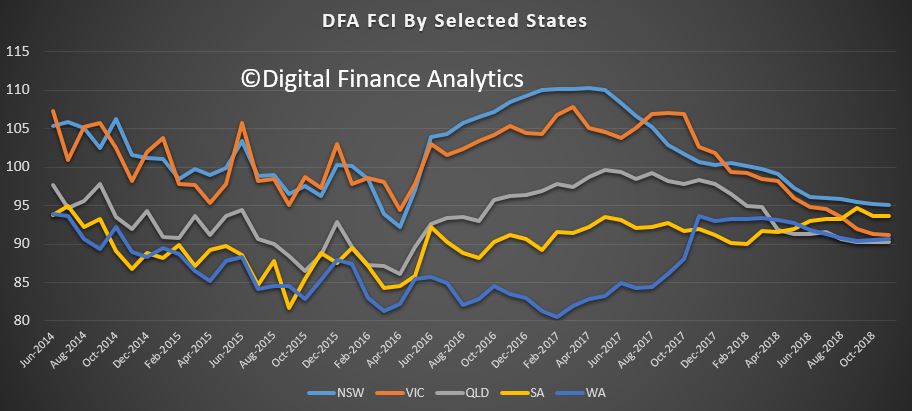

Cutting the data by states, we see that the bunching continues as property price falls in Sydney and Melbourne erode confidence there, relative to the other states. The most significant fall was in NSW, as home prices fall – and the fall out from Opal Tower had an impact more broadly on new purchases, and off the plan commitments.

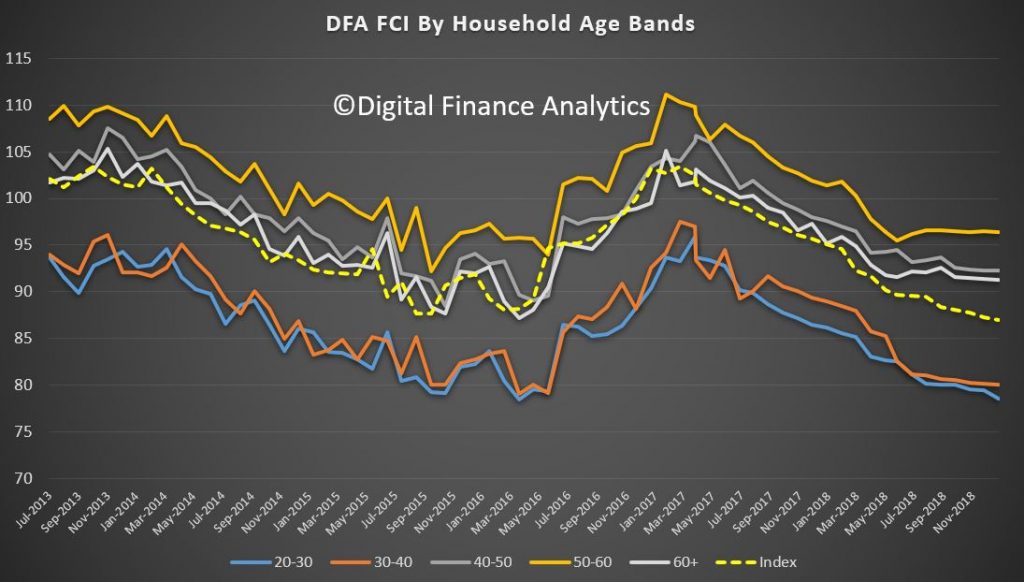

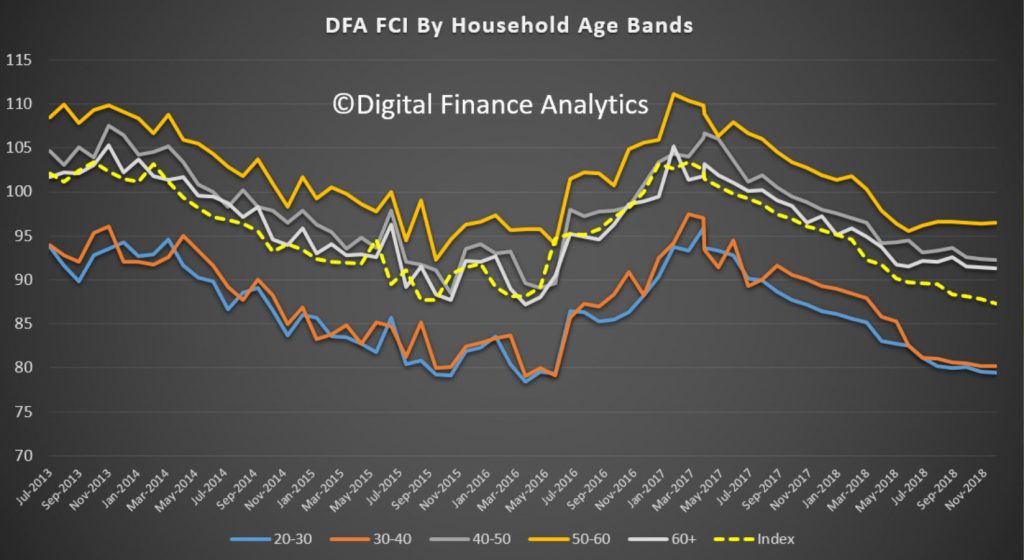

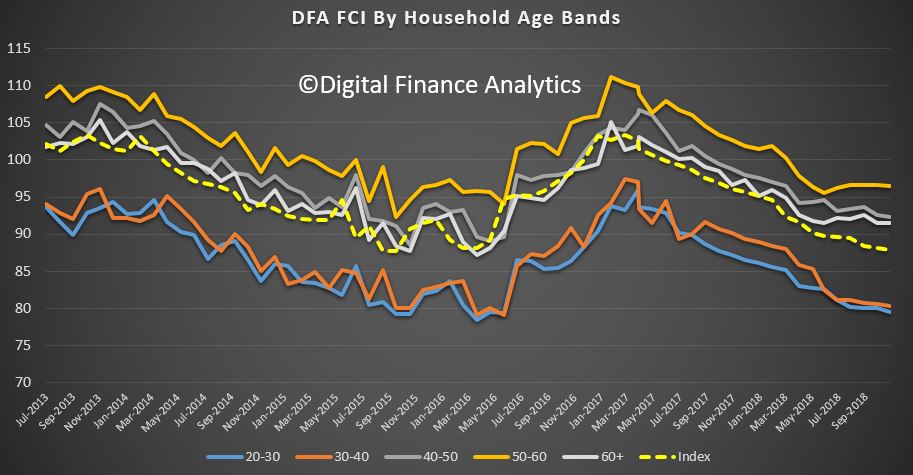

Across the age ranges we continue to see weakness, with younger households more exposed, although those older households with share market investments saw a rebound in January, which boosted their confidence a little.

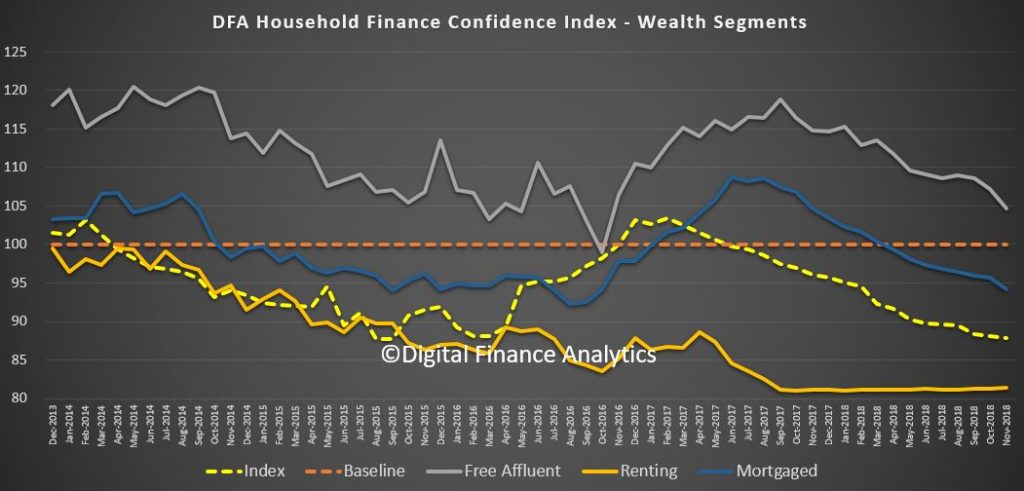

Turning to our wealth segments, we continue to see property owners without a mortgage the most confidence, though falling close to the long term neutral benchmark, while those with mortgages (either investor or owner occupied) continue to decline. Renters remain the least confident. This could become an important indicator in the run up to the next election, in that even those heartland voters supporting the incumbent Government are less positive than usual.

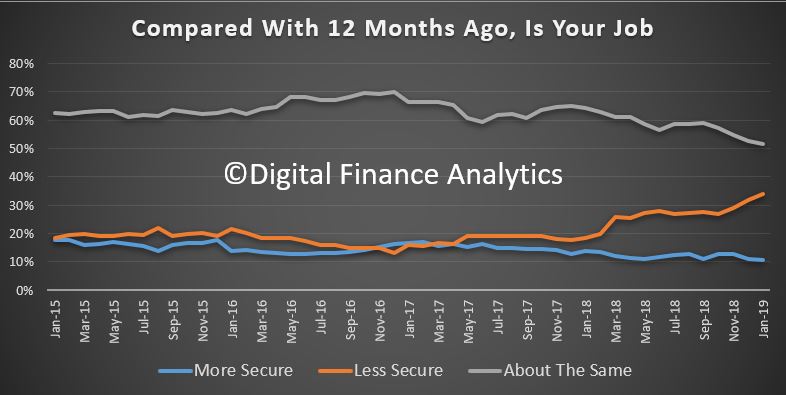

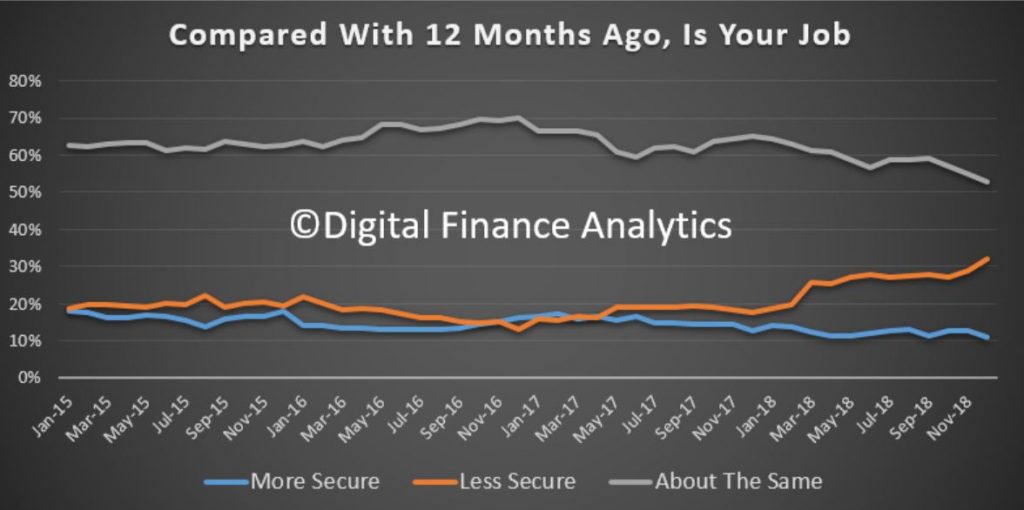

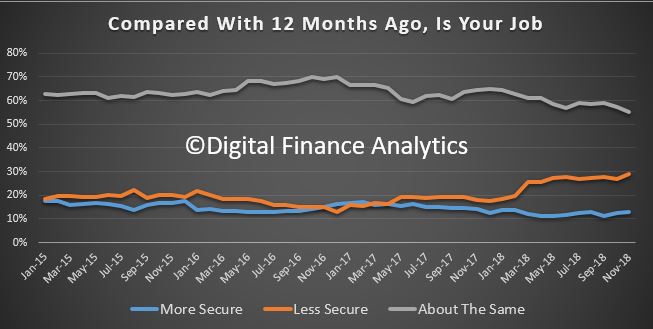

We can then examine the moving parts within the index. We start with job confidence. Those feeling more secure about their job prospects fell 2.19% to 10.57%, while those feeling less confident rose 4.84% to 33.85%. 51.68% saw no change, but that fell by 3.30%. There was a noticeable rise of concerns in the construction sector as building approval momentum falls.

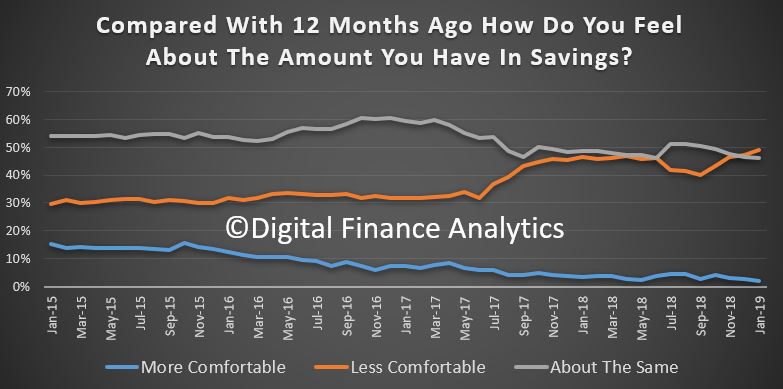

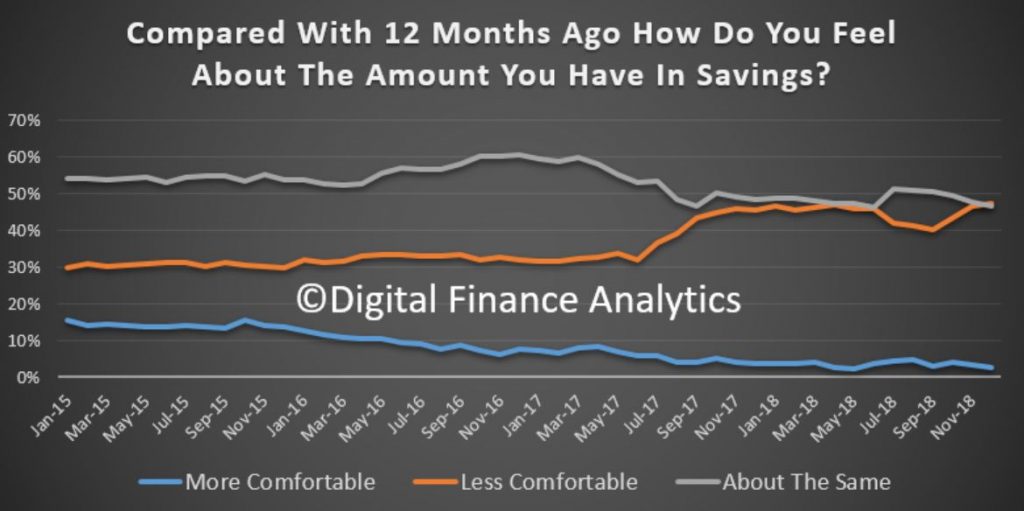

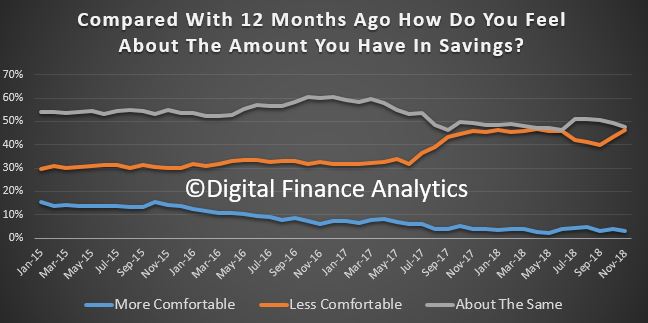

Savings rates continue to fall for many, and others are raiding what savings they have to maintain their lifestyles – something which of course cannot continue indefinably – one reason why the savings ratio continues to fall. June 1.98% of households were more comfortable than a year ago, down 1.28%, while 48.96% were less comfortable, a rise of 2.52%. 46.24% were about the same, down 1.56%.

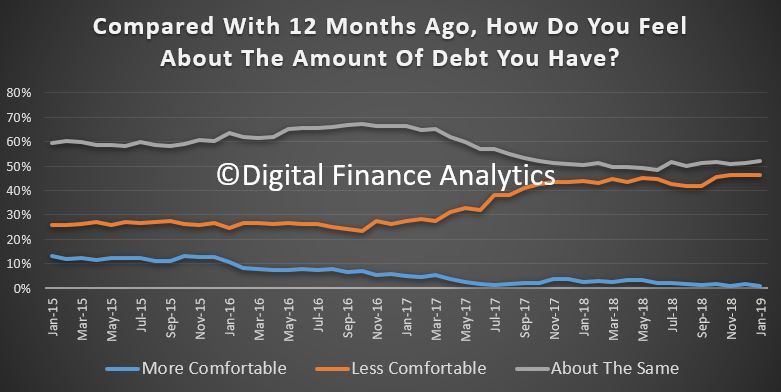

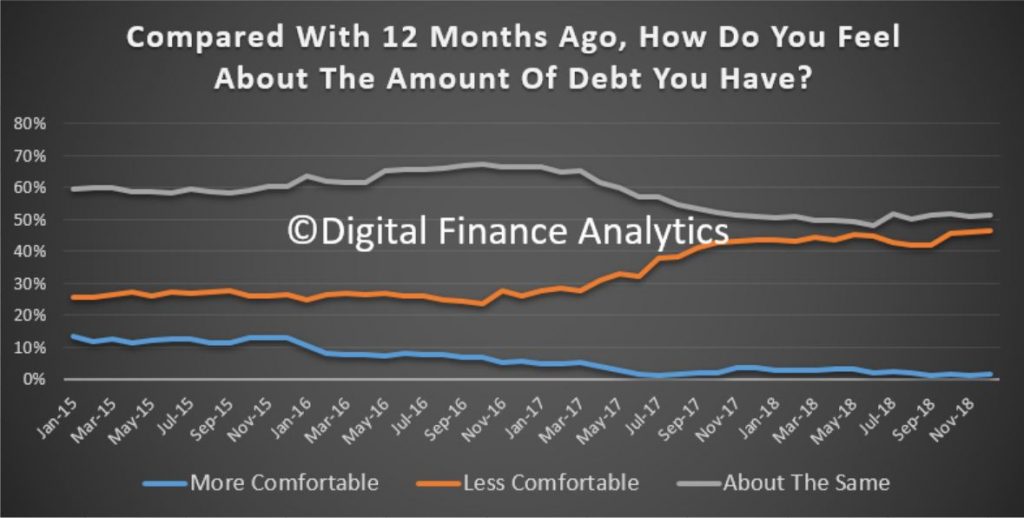

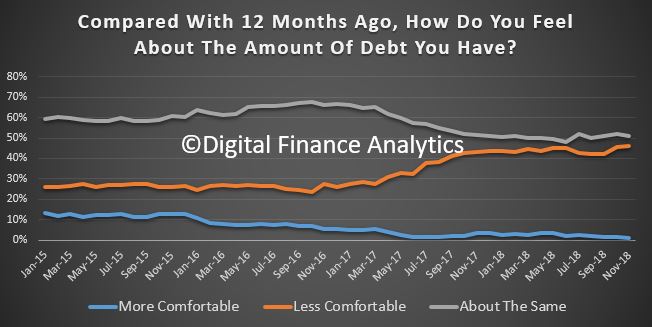

Turning to debt, 1.11% of households are more comfortable than a year ago, and 52% are about the same. 46% are less comfortable than a year back, thanks to rising rates, switches to interest and principal from interest only loans and problems in servicing the repayments. We also continue to see growth in quasi credit such as Afterpay, as well as other forms of short term credit. Household debt of course continues to rise faster than incomes or inflation.

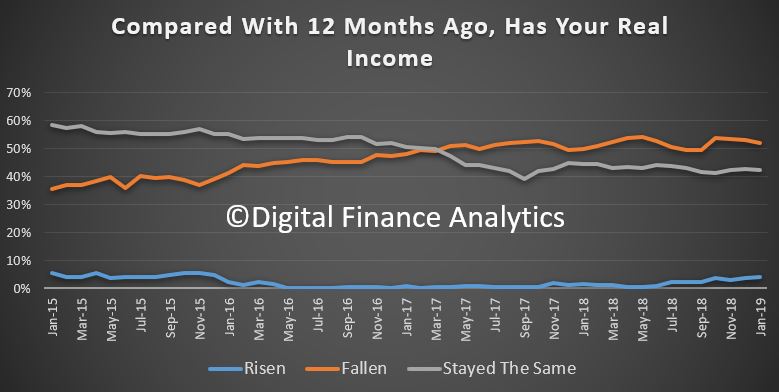

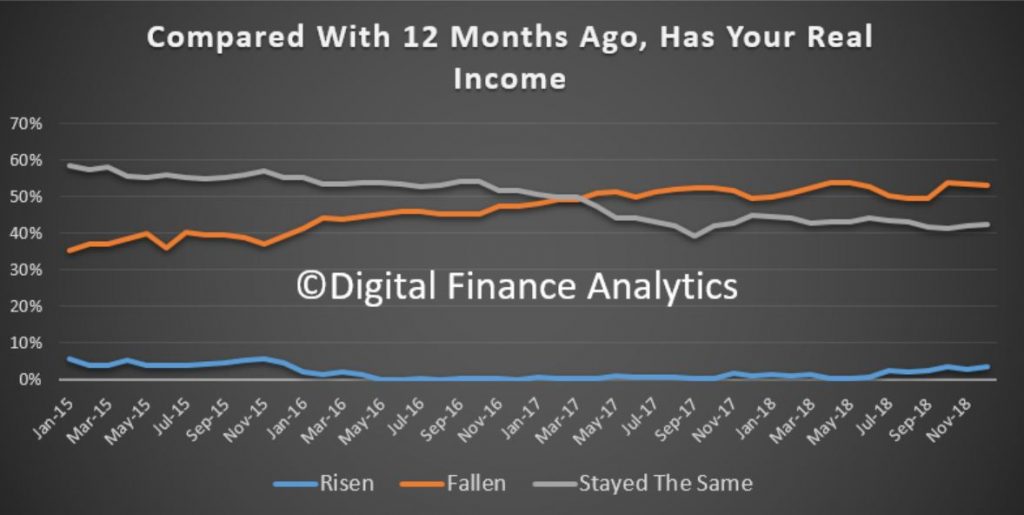

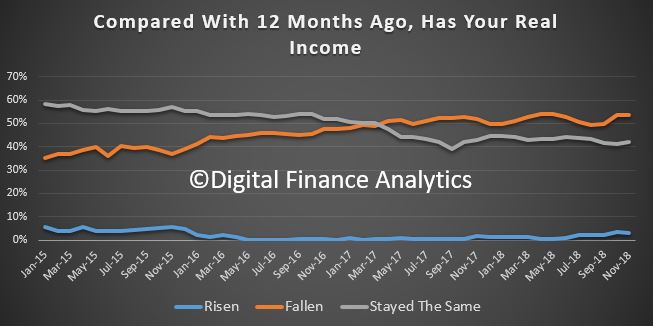

Income growth remains a real concern for many households (in real terms many have seen falls in recent years). 3.88% of households reported their real incomes had grown in the past year, 51.99% said incomes had fallen in real terms, and 42.5% said there had been no change. We continue to observe pressure on the income side of household balance sheets, despite the RBA’s expectation that wages will rise eventually. One bright spot was dividend payments which were higher, but this failed to offset the total picture.

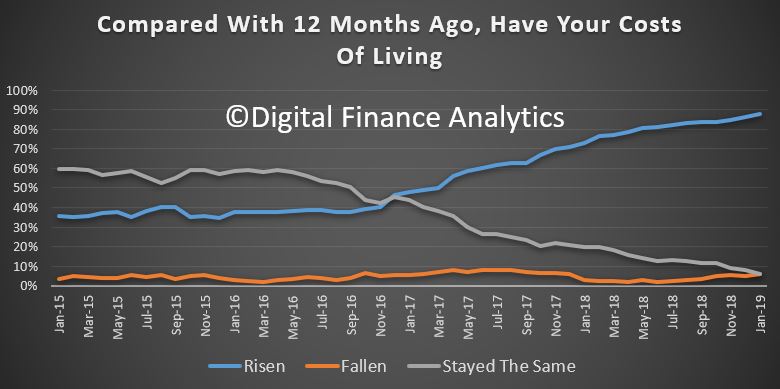

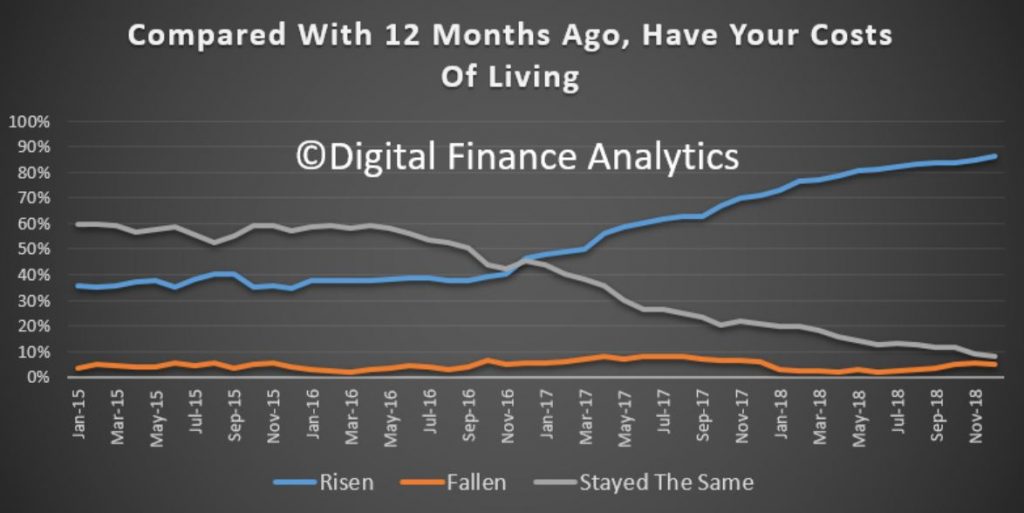

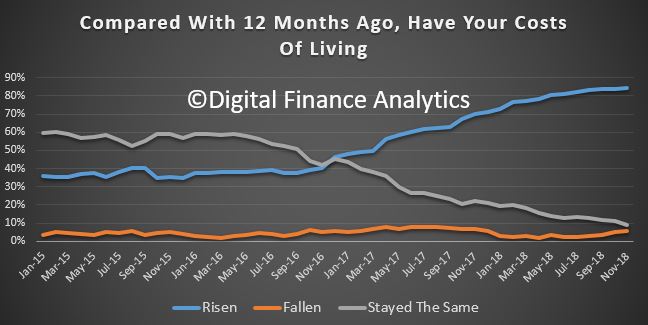

One of the killer categories is the costs of living. Once again we think the CPI figures just do not reflect the lived experience of many households. 87.75% said their costs had risen over the past year, up 3.2%. This includes the old favorites, electricity, child care, health care, and household staples, despite a fall in costs of fuel at the bowser.

And finally, household net worth continues to take a dive thanks for falling home prices – this despite recent positive share price moves. Overall 32.18% of households sand their net worth had improved, down 1.82% from last month, 37.28% said their net worth had fallen, up 4.05% and 27.42% said there had been no change, down 2.52%.

One other interesting point which came out from the analysis is that potential property investors are more active now, thanks to the falls in asking prices, and importantly, the burning fuse with regards to ending negative gearing should Labor win the next election. Thus we have seen a rise in investors considering transacting. Some lenders are offering “special” fixed rate offers, in the light of APRA’s hands off approach, and of course Hayne did not do anything on responsible lending. The tighter underwriting standards are still in play of course – for now – but I would not bee surprise to see a kick up in new investor lending in the weeks ahead, despite the lower levels of financial confidence.

In summary then, interesting times as household finances are squeezed, yet the fixation on property for many Australians remains strong. There is still a belief that falls will be limited, and they will bounce back. We are not so sure!

We will update the index next month.

Welcome to the Property Imperative weekly to the ninth of February 2019 – our digest of the latest finance and property news with a distinctively Australian flavour.

This was a mega week in which the Royal Commission reported, mortgage brokers were crushed, the RBA cut growth expectations, and we saw more confirmation of the pressures on households. And NAB lost both its Chairman and CEO. So let’s get started.

Read the transcript or watch the video.

The final report from the Royal Commission was disappointing, in that whilst 20 plus companies will be referred for potential criminal proceedings, and NAB was called out for not getting it, and the 76 recommendations may be worthy, – we discussed the recommendations in more detail in our post “A Banking Royal Commission Special Report” , the report failed to address two critical issues. Hayne has left lending practices where they are (yes, the banks have tighter standards now, at least temporarily, but he left the household expenditure measure benchmark question hanging) and failed to address the question of conflict between providing advice and selling financial services products, which was at the heart of the hearings. Too often advice let to customers buying products which maximised the income of advisors and firms, when they were not necessarily in the best interests of said customer. See our post “Why The Royal Commission Report Is A Fail”.

Paul Keeting, the architect of financial deregulation in the 1980’s was quoted as saying in the Australian “The royal commissioner should have recommended — this conflict between product and advice — be prohibited. This he monumentally failed to do. He should have acted upon the examination and the evidence of these serious conflicts of interest.”

Finance sector stocks when higher before the report was released, and some are suggesting insiders made $20 billion or so as a result. A leak was denied by The Government of course, but we are not so sure. There were massive stock movements at 11:00 am on Monday, when remember the report was made public AFTER the market had closed at four PM.

Mortgage brokers got a shock, because their business models are potentially crushed. The Commission proposes that trail commissions – payments in subsequent years to brokers by banks for loans they introduced – should be banned – as quote “they are payments for no value”. And in due course brokers need to move to a fixed fee arrangement, paid for by the borrower, which would make the arrangement more transparent, but may restrict competition, and swing momentum back to the big banks, who would be set to benefit. I discussed this with mortgage broker and financial adviser Chris Bates – see “What Does The Hayne Report Mean To Mortgage Brokers And Financial Advisers?”. They will also be given a requirement to act in the best interest of their clients, something which is assumed by many customers of brokers today, but which is not currently the case.

So, in summary, Hayne will be remembered more for the exposes in the hearings, where the bad conduct and criminal behaviour of the finance sector were revealed, rather than firm recommendations to make substantive changes. It mostly falls back to the institutions and regulators to heal themselves. I am less confident, so expect bad practice to continue. NAB lost their chairman and CEO, they were both called out as not getting the problem in the bank – and it is possible that other heads will roll as criminal proceedings commence, but I suspect most will remain unpunished.

The RBA had a big week, with Governor Lowe speaking at the National Press Club on Wednesday, and then releasing the Statement on Monetary Policy on Friday. Lowe’s view is that economic growth will slow a bit compared with previous forecasts – 3% this year and 2.75% beyond. He believes income growth will start to lift as the unemployment rate slides further. He thinks this will be enough to keep the economy ticking over. Despite this, there is now, he says equal weight to both a fall in the cash rate or a rise. And in the SMOP, there was recognition that falling home prices may have a dampening effect on consumption and growth as the “wealth effect” dissipates. Many suggest, this downside risk is still underplayed. Plus, the new headline inflation number for June 2019 came it at a low 1.25% in the statement, which is a significant reduction.

Damien Boey at Credit Suisse said “We cannot help but feel that the RBA is missing something in all of this, hence its rather shallow downgrades to consumption growth forecasts, and its optimistic forecast for only a 10% reduction in residential investment this year. … If the Bank does not understand or admit to the nature of banking and credit problems, it will always think that the economy is healthier than it is. It will always have too high a view of the potency of rate cuts, and therefore delay them until the last minute”.

Westpac’s Bill Evans said of the RBA’s move, “This move to a balanced rate outlook is significant because it clearly establishes that the Bank is prepared to contemplate rate cuts – a position that has really only emerged since the housing markets have reversed. It is also consistent with changes announced by other central banks notably the US Federal Reserve.” Of course, bond rates remain higher in the US than here, which is unusual, and signals higher bank funding costs ahead. This was something which CBA signalled in their results out this week. So, I am expecting more out of cycle mortgage rate hikes ahead.

My own view has been for some time that cash rate cuts won’t have much impact, but thanks to the budget trends, there is capacity for quite big tax cuts to try and stimulate consumption. I expect the upcoming budget to start that trend, and there will be more fiscal loosening later in the year as the economy weakens.

The latest news on home prices is more of the same. Down, down, prices are down. CoreLogic’s 5-city dwelling price index slide another 0.24%. The quarterly declines are rising to 3.57% and values have fallen by 8.5% since their most recent peak, with Sydney down 12.5%, Melbourne down 9.0% and Perth down 16.7%. Remember these are averages, and in some areas, prices are down more than 20%; with more to come. And the auction results remain in the doldrums, on low volumes and clearance rates the national auction clearance rate dropped 5.0% to 42.8%. In Sydney auction clearance rate fell by 4.2% to 49.5% though in Melbourne it rose a tad to 44.3%, both well below the trends from a year ago.

And by the way CBA senior economist, Gareth Aird showed the correlation between home prices and jobs growth, which goes counter to the RBA’s view that jobs momentum will support prices. Another reason why we think prices will go on sliding.

All of this is in stark contrast to the ME Bank Household Comfort report out this week. The most shocking chart was the high proportion of households who still think prices will rise. Only 13% of homeowners and 11% of investors expect the value of their properties to fall this year, versus 38% of homeowners and 52% of investors that believe property prices will rise either a “little” or a “lot”. Clearly more should be watching our shows. But then price growth expectations, are wired in – many have never seen falls – and the real estate sector, still are saying things are on the turn, and she’ll be right. Sorry, to disappoint, but there are more falls to come. And by the way that same report said it was the renting sector who are felling more bullish as rents slide.

The ANU, as reported in the Australian, said that the average household has seen no gains in their after-tax income since the end of 2010, which was when the economy was emerging from the global financial crisis. According to ANU’s Centre for Social Research and Methods, the fall in the past three years was greater than during the last recession in 1991-92. In fact, living standards peaked in 2011. There was no improvement for the next four years, but incomes started falling behind rising living costs from late 2015 onwards. Many will not be surprised, and it helps to explain why we think household consumption will continue to fall.

NABs surveys this week also highlighted concerns among households. They said that anxiety increased most over the cost of living, and despite a healthy labour market, concerns over job security also climbed to its highest level since mid-2016.

“In terms of household finances, retirement remains the big worry, followed by providing for the family’s future, raising $2,000 for an emergency, and medical and healthcare costs”.

“Against this background, almost four in 10 Australians said they had experienced some form of financial hardship last quarter, the highest in two years.” And importantly spending plans are being curtailed, which will flow on to lower growth of course.

And our own mortgage stress data for January underscored the pressure on households. The long grind in WA continues, with more households under financial pressure, but we are seeing further deterioration in other states too. The number of households in severe stress continues to rise. The latest RBA data on household debt to income to September fell a little to 188.6, but remains highly elevated. The housing debt ratio continues to climb to a new record of 139.6, according to the RBA. This shows that household debt to income is still increasing. This high debt level helps to explain the fact that mortgage stress continues to rise. Across Australia, more than 1,026,106 households are estimated to be now in mortgage stress (last month 1,023,906), another new record. This equates to more than 31% of owner-occupied borrowing households. In addition, more than 25,750 of these are in severe stress (last month 22,000). We estimate that more than 63,000 households risk 30-day default in the next 12 months, up 1,000 from last month. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead. See our Video “Mortgage Stress Exists – Believe It!”

Despite the popular view that household finances are fine, in fact the continued accumulation of larger mortgages compared to income whilst costs are rising, and incomes static explains the issues we are now seeing. Housing credit growth is running significantly faster than incomes and inflation and continued rises in living costs – notably child care, school fees and electricity prices are causing significant pain, this despite some relief at the bowser. Many continue to dip into savings to support their finances. We are seeing a rise in households seeking help with their finances, including access to debt counsellors and other advice channels. WA is seeing very strong growth in cries for help!

Indeed, the ABC reported that the National Debt Helpline said calls had skyrocketed in Western Australia amid epidemic of financial stress. And we note that the Treasurer just announced a review of financial counselling: “ It will consider gaps and overlaps in current services and the adequacy of appropriate delivery models for future funding”. Last week John Adams and I highlighted the possible link between mortgage stress and family violence, as suggested by the police.

And finally in our local round up, Business Confidence is also tanking according to Roy Morgan Research who released their Survey for January. They say that confidence has dropped to its lowest level since August 2015 and it was the worst January result ever. “The decline in Business Confidence to begin 2019 comes amidst a slew of poor economic news with significant declines in house prices in Sydney and Melbourne over the last 12 months now joined by lower than expected retail trade figures for December”. This is consistent with the NAB results we reported last week.

So, to the markets. Locally, the ASX 100 had a good run, as the Hayne effect dissipated. The index slid a little on Friday though thanks to the RBA’s downgrades, slipping 0.3% to end at 5,006.4, territory not seen since October, and up 3.56% on a year ago. The local volatility index was down 0.29% to 12.90, and 30.48% lower than a year back, reflecting a “risk on” peak back then.

Since the FED turned turtle on its interest rate policy, the markets confidence is roaring back. Not surprisingly, the ASX Financials Index was up this week, as banks were back in favour, despite a small fall on Friday, to end at 5,911.90, still 5.71% lower than a year ago. Individual banks moved round a bit with ANZ up 0.11% on Friday to end at 26.89, down 2.79% from a year back. CBA also rose, up 0.93% on their results, which revealed strong capital but weaker margins and profit below expectation and ended at 74.75, which is 2.58% lower than a year back. NAB fell following the resignation of the CEO and Chairman, to end at 24.75. In fact, this is not the first time NAB has lost leadership after a crisis. Their shares are down 12.27% lower than a year ago, suggesting that relative to peers they have a lot to do to regain market confidence. Their quarter disclosure which came out on Friday, would have not lifted expectations, as again margin is under pressure, and capital fell. It will be interesting to see if the proposed divestments of NABs and CBA wealth businesses continue given Haynes weak recommendations. Strategy may yet be reversed. Westpac fell 0.33% on Friday to end at 26.79, and down 10.84% from a year back. They still have their wealth businesses.

Among the regionals, Bank of Queensland rose 0.09% to 10.66, but is still 10.56% down from a year ago. Suncorp fell 0.22% to 13.61, up 3.73% from last year, and Bendigo and Adelaide Bank fell 1.59% to 11.15, up 0.36%. They may be more impacted by the proposals to charge customers for mortgage advice. AMP was down 1.21% on Friday, having had a small bounce from the Royal Commission report, because it will allow them to continue to run their advice and product businesses in tandem. AMP ended at 2.44 and remains 51.49% lower than a year ago. Macquarie fell 1.23% to 121.57, but is up 19.5% from a year back, benefitting from its international businesses.

Lenders Mortgage Insurer Genworth was up 1.62% on the latest results, which showed a strong capital position, even if mortgage delinquencies were a little higher, especially in NSW. They ended at 2.51 and is 10.58% lower than 12 months ago. Given lower mortgage volumes, their growth appears limited and if household pressures continue, we must expect more defaults ahead. Mortgage Choice, the aggregator, was hit by the Hayne recommendations on mortgage brokers this week, but rose on Friday, up 2.44% to 84 cents, down 62.61% from a year ago. Given they have advice businesses in their portfolio, I suspect they might do quite well from the changes, if they can morph their business effectively.

The Aussie ended the week at 70.91, up 0.04%, having been above 72 earlier in the week after the Hayne report came out. But the RBA’s neutral stance on future interest rates – signalling more trouble in the economy, dragged it back. We still expect further falls ahead. It is still 9.89% lower than a year ago.

The Aussie Gold Cross rate rose 0.49% to end at 1,853.59, up 9.97% on a year ago, while the Aussie Bitcoin Cross rose 4.88% to 4,672.3, down 53.42% on a year back.

Overseas, at the close, the Dow Jones Industrial Average declined 0.25%, to 25,106.33 and is 1.11% up from a year back. The S&P 500 index gained 0.07%, to 2,707.88 and is up 0.91% from a year ago, It has risen more than 15 percent from 20-month lows in December, spurred by a dovish Federal Reserve and largely positive fourth-quarter earnings, as well as hopes for an eventual U.S.-China trade deal, despite lingering scepticism over the United States and China reaching a trade deal before the March 1 deadline. Of the S&P 500 companies that have reported quarterly results, 71.5 percent have beaten profit estimates but analysts now expect current-quarter profit to dip 0.1 percent from the year before, not grow the 5.3 percent estimated at the start of the year. The S&P 100 was down a little to end at 1.190.16, up 0.28% over the year. The CBOE Volatility Index, which measures the implied volatility of S&P 500 options, was down 3.97% to 15.72 and is down 40.97% form 12 months ago. The S&P Financials index was down 0.94% on Friday to 427.88 and remains 8.02% down from a year back. Bellwether Goldman Sachs fell 0.73% on Friday to 191.67 and is 24.89% lower than last year.

The NASDAQ Composite index climbed 0.14% to 7,298.20 on Friday and is up 3.35% from last year at this time. Apple was up 0.12% to 170.41 and is 7.15% higher than last year. Google’s Alphabet fell 0.32% to 1.102.38 and is 4.78% than a year back. Amazon fell 1.62% to 1,588.22 but is 13.95% higher than 12 months ago and Facebook is up 0.57% to 167.33, down 7.66% from a year back. Intel fell 0.79% to 48.84 and is up 8.52% from last year.

Investors remain jittery about trade tensions between the U.S and China, which have been the catalyst for the global trade war that rocked equity markets. Although the sides met for talks last week in Washington, there have been no signs of progress. On Thursday, U.S. stock markets fell after President Trump said that he had no plans to meet with Chinese President Xi before March 2, when further U.S. tariffs are scheduled to be imposed.

The Feds pussy cat approach to future rate rises has seen the 10-year bond rate come back, and on Friday it was at 2.63, down 0.76%. The 3-month rate was at 2.42, up 0.41%. The US Dollar index was up 0.13% to 96.64, up 7.04% from last year, while the British Pound USD slid a little to 1.2945 and is 6.71% lower than 12 months back.

The UK Footsie was down 0.32% to 7.071.18 as the Brexit discussions continue, and the deadline looms. Its down 2.55% from a year back. The Footsie Financials Index was down 0.84% to 646.19, down 3.85% from last year. The Euro USD was at 1.1331, down 7.53% from 12 months back. The European Commission has projected moderate growth in the EU in 2019, but economic uncertainty has dampened confidence. The forecast lowered its growth forecast for the eurozone to 1.9% in 2018, down from 2.1% in the November forecast. The report highlighted Brexit and the slowdown in China as key sources of uncertainty for European economies, adding that the projections were subject to downside risks.

Deutsche bank was down 2.56% on Friday, to 7.223 and is 40.09% down from this time last year. The Chinese Yuan US Dollar ended at 0.1483 and is 7.02% lower than last year. Crude Oil Futures rose a little, up 0.11% to 52.70 but remains 15.08% lower than last year at this time.

Gold futures were higher, up 0.32% to 1,318.35, down 2.48% from a year ago, Silver was up 0.73% to 15.83 and is 3.04% lower than last year, while Copper was down 0.55% to 2.81, down 8.29% from 12 months ago. And finally, the Bitcoin USD ended the week at 3.716.9, up 8.17% but is still 54.69% lower than a year ago. The total capitalization of the derivatives markets at BTC/USD was $156 million US Dollars. Worth bearing in mind how small the market truly is!

So, we see the change in the wind which the Fed triggered earlier in the month flowing on to strong markets, despite the uncertainties around global growth ahead. Locally as the dust settles on the Hayne report, we expect bank stocks to remain volatile – remember there are still more criminal cases in the works – eventually. But meantime the focus will be on the Australia economy, as the leading indicators signal more trouble ahead, and the RBA plays catch up.

In this context, there can be little expectation of a rebound in home prices, nor a resurgence of lending for mortgages, I think the current settings will mean falls continue, and may accelerate. The next thing to watch for are “unnatural acts” fiscally speaking when the budget comes down in April, before a May election. Unless something unexpected resets the timetable.

Meantime, my advice remains be very cautious about property. There is no hurry to buy. Falling prices may offer opportunity later, but buying into a falling market, even at these low interest rates is tricky, and as I have indicated I expect more out of cycle hikes to come. So, caution is the watch word. But the good news/bad news is the risk of a financial apocalypse has abated in favour of another round of debt creation – which postpones what may well be eventually a significant reset. We will update our scenarios soon.

And before I go, a quick reminder that our next live stream event is now scheduled for Tuesday 19th February at 8:00 PM Sydney – here is the link to the reminder. You can ask a question live or send them in beforehand. I look forward to seeing you there.

And by the way, if you value the content we produce, please do consider supporting our efforts. You can make a one off donation via PayPal, or consider joining our Patreon programme. We really appreciate your support to help us continue to make great content.

From the property market front line, Edwin Almeida and I discuss the latest trends, and consider how best to prepare a property for sale, something which it appears many will be doing now the summer break is over.

https://www.ribbonproperty.com.au/

Edwin’s videos:

https://www.youtube.com/watch?v=rmNpIJieUi4

https://www.youtube.com/watch?v=0Z8u5qTArxg

https://www.youtube.com/watch?v=jV0awuAIGLo

Please consider supporting our work via Patreon:

Or make a one off contribution to help cover our costs via PayPal

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

Following on from our mortgage stress report for December 2018, which we released yesterday, we complete our monthly data series with the release of the December Household Financial Confidence Index, our gauge of how households are feeling about their financial situation.

The overall index fell again in December to an all-time low of 87.3 (which is strange given the Government’s assertion the economy is in fine fettle!

The DFA index can be segmented a number of different ways, to home in on which households are most concerned about the state of their finances. A significant factor is whether households are property owning, and whether they are mortgaged. Households who hold property, but no mortgage are the most confident and above the 100 neutral setting, although confidence in this group is falling. Those with a mortgage are well below the neutral measure, and confidence for this group continues to fall. Those in the rental sector, or living with friends or family are less confident, though recent wage rises and falling rents have had a slightly positive impact this month.

Within the property holding segment, we can also separate property investors from owner occupied households. Significantly property investors have gone very negative now, thanks to falling property prices, rising mortgage costs and issues with mortgage refinancing. The threats to negative gearing are also in play. Concerns about rising mortgage rates are building (Bank of Queensland moved yesterday!). Owner occupied property holders are more positive, those with mortgages and those mortgage free are both within this segment. Property inactive households – those with no exposure to property – are slightly more confident than property investors.

We can also examine the data across the main states. When we do that we find a “bunching” of scores, as NSW and VIC come off their highs (the main centres in which property prices are falling).

South Australian households have remained more positive, while Victorian households have taken something of a dive -as prices are moving south at a faster clip. And we can also look at the age band data.

Here, younger households remain the least confident, and the general slide continues across the age bands, other than those aged 50-60 – who are less likely to hold mortgages, so more likely to reside in the “Free Affluent” segment.

We can then look at the data drivers for the index.

Job security shows a spike in those feeling less secure, up 3% – and workers in the construction and real estate sectors have become more concerned. There was a fall of 1.7% in those feeling more secure than a year ago, at 11%. 53% of households reported no change than a year ago, down 2%.

Savings are taking a beating, with more households tapping to savings to sustain their budgets, and also being hit by falls in interest rates on deposits and falls/volatility in the share markets. 2% only, are more comfortable than a year ago, 46% less comfortable, and 51% about the same.

Debt remains a major source of concern for many households. Whilst overall personal credit (other than for mortgages) is falling there are credit hot spots where households under pressure are putting more on credit cards, using staged repayment products like Afterpay, or even Payday loans. Many households are finding their large mortgages more difficult to handle (as reflected in our stress reports). Around 1.5% of households are feeling more comfortable than a year ago, 46% less comfortable and 51% about the same.

Household income remains under pressure, with many reporting no increase in real incomes in the past 5 years. Many households are working multiple jobs, and are still underemployed. In addition, the interest on deposits held with the banks have fallen significantly, as they trim their interest rates to protect their margins. 4% said their income in real terms had risen, 53% said it had fallen and 43% said there was no change.

Households reported continued rising living costs in December with and additional 1.5%, or a total of 86% saying costs, in real terms had risen. 5% said they had fallen and 8% said there was no change. As well as the usual suspects – higher electricity costs, health care, child care and some food costs, a number of households reported rises in land tax as a concern. Once again the official CPI seems disconnected from the true experiences of many households, costs continue to rise and fast!

Finally, we look at Net Worth – Assets less loans owning. We see a rise in those reporting a fall, directly associated with the fall in home prices, 34% said their net worth had dropped in the past year, 33% said it had improved, and 29% said it was about the same. So whilst for some the “wealth effect” is intact, one third are feeling the effects of a reduction in wealth on paper, and as a result they are more cautious on their planned spending. This is sufficient to slow consumption ahead, and may well impact GDP as a result.

In summary then, we continue to see the same forces in play, in that as home prices slide and costs rise, household finances are under pressure. But the effects are not uniform, those with mortgages, and younger are most impacted. But the recent stock market ructions and lower returns on deposits are also biting.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

We will update the index next month.

DFA has released the final dimension from our household surveys to end November 2018, zeroing in on financial confidence. As is perhaps predicable, the overall index fell again, down to 87.8, well below the neutral setting, and close to the record low we measured in 2015.

Property owning household segments continue to react to the changed environment, as prices weaken, and mortgage availability tightens. Around half of all mortgage applications are being rejected due to the tighter conditions. Property investors are now very concerned about their financial status, and owner occupied households confidence continues to drift lower. That said, those not owning property – who are renting or living with family or fields are still even less confident so it is still true that property ownership bolsters financial confidence.

One way to understand the confidence dynamic is to look at households in terms of their mortgage commitments. Property owing households without a mortgage – about one third of all households – remain more positive than those with a mortgage and those renting. These more confident households are more affluent, often with market investments, and multiple income sources. Nevertheless, even these households are becoming more disenchanted with the state of things.

Across the states (we select the most populated in this analysis), we see a bunching of confidence scores with Victoria slipping towards Western Australia and Queensland, although New South Wales continues to slide a little too. South Australian households are sitting between New South Wales and Victorian households in terms of average confidence.

The age bands continue to show significant separation, with younger households more concerned (thanks to costs of living and large mortgages) relative to older households, many of who have smaller mortgages or no mortgages and larger asset bases. That said, those moving into retirement are less confident compared with those who are still working.

We can then dive into the elements which drive the survey. Looking at job security first, there was a 2% rise in those feeling less secure about their employment prospects, to 29%, and an offsetting fall of 2% in those who are felling about the same as a year ago at 55%. We continue to see many households employed in multiple part-time jobs to maintain income, and many are still seeing more employable hours, suggesting that underemployment remains a considerable issue. We also noted that significant numbers of workers were being “encouraged” to extend their leave over the upcoming holiday period.

Turning to income, 2.87% reported a rise in real incomes in the past year (allowing for inflation) a fall of 0.81% on last month. There was a small rise in those saying their incomes had not changed in real terms at 42% but 53% said their incomes have fallen in the past year.

Living costs are still rising for many. Once again electricity costs, health care costs, child care costs and food costs all registered. 85% of households say their costs have rise, 9% said there has been no change and and 5% said their costs have fallen. There was small relief from lower petrol prices.

Given the high debt levels which exist in Australia (thanks to poor policy settings and lax lending standards), many households are concerned about their current debt levels. Just 1% were more comfortable than a year ago, and this was often associated with those who sold property and paid down their mortgages. 51% were as comfortable as a year ago, and 46% were more concerned, up 0.76% in the month. We continue to see debt levels rising among those with mortgages as they try to balance their finances, and turn to short term solutions, such as credit cards, personal loans, or installment payment options. Whilst overall levels of personal debt other than mortgages are falling, there is a concentration among those with property loans.

Savings are taking a beating at the moment, firstly because many are raiding savings to maintain lifestyle (which explains the falling savings ratio) and they are also receiving significantly less on deposits at the bank as financial institutions seek to recover margin in the higher cost environment. The fact is, it is the soft underbelly of savers who are taking the brunt of the pain, yet many are very reliant on bank deposits for income, and the media hardly ever focuses on this significant group. All the attention is on the mortgage rate. Banks are in my view taking advantage of this, and it is the easy way out to protect their margins. 46% of households are less comfortable than a year ago, up 3%, and just 3% are more comfortable, down 0.8% on last month.

So putting all this together, net worth is under pressure for many households. 34% of households said their net worth had improved in the past 12 months down 4% on last month, while 33% said their net worth had fallen, up 3% on the previous month. Falls in home prices, share prices and other investments all hit home. This underscore the fading “wealth effect” we are seeing as more react to this new environment.

We also observed one other significant fact. Despite the tighter conditions, and falling confidence, most households say they will still spend over the Christmas season, and will simply pick up the bill in the new year. This may be good news for retailers, but bad news for households down the track.

Slow wages growth, falling home prices and rising costs are combining to drag wealth and household confidence lower, and there is no end in sight. Another reason why we think the RBA will not be lifting the cash rate any time soon.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

We will update the index next month.

DFA has released the November 2018 mortgage stress and default analysis update. Across Australia, more than 1,015,600 households are estimated to be now in mortgage stress (last month 1,008,000). This equates to 30.9% of owner occupied borrowing households. In addition, more than 22,500 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months.

We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. The latest RBA data on household debt to income to June reached a new high of 190.5[1]. This high debt level helps to explain the fact that mortgage stress continues to rise. Bank losses are likely to rise a little ahead.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to the end of November 2018. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

Martin North, Principal of Digital Finance Analytics says this rise in stress, which has continued for the past 6 years, should be of no surprise at all. “Continued rises in living costs – notably child care, school fees and food – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances.” The latest ABS GDP numbers confirmed the falling savings ratio.

Indeed, the fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. More than 49% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings”.

In addition, negative equity is now rearing its head. Data from APRA, the Property Exposures figures – showed that banks wrote nearly 26,000 new mortgages with a loan to value ratio of more than 90%, and a further 51,000 with an LVR of between 80 and 90 percent. That is 20% of all loans written in the same period. I would expect these numbers to fall significantly, as lenders tighten their standards further.

But it’s also worth remembering that in some cases existing borrowers have pulled more equity out to allow them to pass funds to their kids – the so called bank of Mum and Dad, and in the case of a forced sale, the market value may well overstate the true recovery value of the property. Using a property as an ATM does not work in a falling market.

Last month, a Roy Morgan survey of 10,000 borrowers found 8.9 per cent were slipping into negative equity — up from 8 per cent 12 months prior — which would work out to around 386,000 Australians.

We have run our own analysis with data to the end of November and on my modelling currently there are around 400,000 households across the country in negative equity, both owner-occupiers and investors. There are about 3.25 million owner-occupier borrowers and at least 1.25 million investors, so around 10 per cent of properties are currently underwater.

We run a range of potential scenarios, but if our central case works out, with an average fall of 20-25 per cent, our modelling suggests that around 650,000 households would fall into negative equity. My more severe case, if an international crisis hits is for a 40 per cent price fall. Then you’re getting close to one million households. That would be catastrophic for the economy. That’s analogous to what happened in Ireland where prices dropped 40 per cent. A decade later, there are still people in negative equity who’ve never recovered.

The next question to consider is which households are being impacted. In fact, negative equity is touching “lots of different segments” of the market for different reasons, but collectively it is an “early warning sign” for what is to come.

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by the numbers.

Regional analysis shows that NSW has 281,275 households in stress (272,536 last month), VIC 283,395 (281,922 last month), QLD 181,156 (178,015 last month) and WA has 132,135 (132,827 last month). The probability of default over the next 12 months rose, with around 11,560 in WA, around 11,300 in QLD, 15,300 in VIC and 16,200 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.47 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.6 basis points, which equates to $1,000 million from Owner Occupied borrowers.

A fuller regional breakdown is set out below

Here are the top postcodes sorted by number of households in mortgage stress.

[1] RBA E2 Household Finances – Selected Ratios June 2018

You can request our media release. Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The November 2018 Stress Release’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The November 2018 Media Release’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=”Comment If You Like” type=”textarea”/][/contact-form]

Note that the detailed results from our surveys and analysis are made available to our paying clients.

The latest DFA Live Stream was broadcast tonight. The replay version is now available.

Welcome to the Property Imperative weekly to 17th November 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Watch the video, listen to the podcast or read the transcript.

It has been a roller coaster ride on all fronts this week, with more market gyrations, larger predicted falls in home prices locally, and the first “unnatural act” from the Government to try and sustain the finance sector, ahead of next year’s election, expect more ahead.

And by the way you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

We start with the markets this week the Dow closed lower for the week, despite a rally on Friday that came despite the White House reportedly walked backed President Donald Trump’s upbeat comments on trade.

The Dow Jones Industrial Average rose 0.49% to 25,413 at the end of the week, the S&P 500 rose 0.22% to 2,736, but the Nasdaq Composite fell 0.15%.

After the falls earlier in the week, Wall Street went into rally mode Friday after Trump said he was hopeful the U.S. and China will reach a consensus on trade deal. Later the White House, however, peddled a more sombre narrative on trade in the wake of Trump’s comments, telling CNBC that a deal was not coming soon. Still, the broader averages held their gains, but that did little to avert a weekly loss following a rout in tech. The fear index, the VIX eased a little on Friday, down 9.21% to 18.14, but is still elevated, signalling uncertainty ahead.

In tech, Facebook fell 3% amid the fallout from a New York Times article detailing how the company conspired to cover up warnings that Russia had used the social media platform to disrupt the U.S. election in 2016. Apple moved higher after recent falls, up 1.11% to 193.53, while Alphabet fell 0.26% to 1,068. Intel was up 1.5% to 48.53.

Financials were mixed, with the S&P 500 Financials index up 0.06% on Friday to 443.45 but Goldman Sachs Group was down 0.8% to 202.12.

Sentiment on stocks were also lifted by easing concerns about steeper U.S. rate increases after Federal Reserve Vice Chairman Richard Clarida indicated that the U.S. central bank may stop at the neutral rate, rather than continue hiking beyond the neutral rate, which might be interpreted as an effective “rate cut,” JPMorgan said in a note to clients. The 3m bond rate slid 0.67% to 2.35, and the 10-year was 1.71% down on Friday to 3.065. Clarida does not expect a big increase in inflation this year. With that in mind, both central bankers are still confident enough in the domestic economy to proceed with a December rate hike, but there’s a good chance that it will be accompanied by a less hawkish outlook.

Energy added steel to the rally on Friday as oil prices settled flat, but slumped 6% for the week on concerns about a global glut in supplies. The WTI futures was up 0.66% to 56.83. Oil bears are back to taunting Saudi Arabia by pressuring the market again, just two days after giving a reprieve to the record sell off in crude.

In fact, West Texas Intermediate and Brent crude futures settled steady to slightly higher on Friday after rallying more than 2% earlier in the day on fears that the oil-rich kingdom and the OPEC cartel it leads could cut supplies substantially at a December 6-7 meeting. Friday’s s rebound didn’t help crude’s weekly loss of 6%, making it the sixth-straight week in the red.

Prices initially rose on an analysis from tanker-tracking firm ClipperData that showed Saudi Arabia was already loading fewer barrels on ships bound for the United States this month, continuing a trend that began in September. By sending fewer barrels to the United States, the Saudis hope to starve U.S. crude stockpiles, which have swelled by nearly 50 million barrels the past eight weeks. It’s a strategy the kingdom used last year while working alongside OPEC members, Russia and other producers to rescue oil prices from lows under $50 a barrel. But after the morning highs in New York trade, prices turned volatile before returning to positive territory just before the close. Adding pressure to the market was weekly U.S. oil rig data showing drilling activity at its highest in over three years, after an addition of two rigs this week.

In an extreme turn of events, the fire from Bitcoin Cash’s hardfork war has spread wildly across the entire crypto market, burning through virtually every cryptocurrency and leaving many investors burnt too. Bitcoin had more than $28 billion stripped from the market, as it fell beyond the support of its long-standing safety net at $5,800.

Gold was higher, up 1.9% to 1,222 on Friday, with some suggesting that the US$ bull run might be ending, as economic outperformance, rising interest rates, equity market pressure and trade policy all look suspect, and a switch to metals might make sense. But more likely it is the risks around Brexit, Theresa May could be fighting for her political survival, but the Brexit crisis she’s in has thrown gold bulls a lifeline. Initially resigned to losing the market’s $1,200 support level as the week began, fans of the yellow metal not only got to stay in their comfort zone but also saw their best weekly gain in five as hedgers rushed to the relative safely of bullion after the pounding taken by sterling from Britain’s EU-exit woes. Tory MPs may have enough votes – 48 are needed – for a letter of no confidence that would force a vote in Parliament. If the rebels within her ranks really do have the votes to force a no-confidence motion UK politics will be thrown into an even greater existential crisis.

Not that a change in leadership there would make much difference. U.K. Prime May on Friday reshuffled her minister team and took personal charge of the divorce talks with the European Union. The moves came at the end of an extraordinary week in which seven members of her government resigned and a push to force her from power gained momentum.

The pound gained 0.4% against the U.S. dollar on Friday, rebounding a bit from Thursday’s plunge. But sterling still suffered a loss for the week and volatility soared to a two-year high. The British Pound Dollar was up 0.48% on Friday to 1.2835, while the Euro USD rose 0.76% to 1.1414. The US Dollar index fell 0.51% to 96.43. Deutsche Bank, was down 0.06% to 8.59, not helped by recent Eurozone bank stress test results.

All 3 of the commodity currencies traded higher on Friday with the Australian hitting a 2-month high and the New Zealand dollar hitting a 4-month high. AUD and NZD ripped higher on the hope that President Trump will forgo another round of tariffs on China. Ever since the mid-term elections, his tone toward China has been softening. The Aussie ended up 0.76% to 73.32, helped by strong jobs numbers in October and bullish noises from both the treasurer and the RBA.

In the local market, the ASX 100 fell 0.17% to 4,711, reflecting similar weakness in US stocks. The ASX Financials was also down, 0.09% to 5,635.60 in bearish territory. Regional Bendigo bank was up 0.99% to 10.20, while Suncorp fell 0.15% to 13.54 and the Bank of Queensland was higher up 0.82% to 9.78. Macquarie who generates more than half of its business offshore, rose 0.16% to 119.00 whilst the majors were softer, with NAB down 0.46% to 23.77, Westpac down 0.28% to 25.27, then went ex. Dividend this week, ANZ was down 0.12% on Friday to 25.36 while CBA was up a tad to 68.90. Lenders Mortgage Insurer Genworth tracked lower down 0.91% to 2.18, not least because they are exposed to the housing sector and the investment markets, both of which look weaker. AMP continues in weak territory, although up 1.98% to 2.58. The Australian VIX index eased back, down 3.33% to 16.80, still will in the nervous zone. The Aussie Bitcoin dropped 2.76% to 7,492 and the Aussie Gold slid 0.06% to 1,666.43.

The property news continues south, with the latest CoreLogic average clearance rate down again last week, with only 42.7 per cent of homes successful at auction. And that excludes the large number of unreported results, so the true numbers in even worse. There were 1,541 auctions held across the combined capital cities, having decreased from the 2,928 auctions held over the week prior when a higher 47 per cent cleared. Both volumes and clearance rates continue to track lower each week when compared to the same period last year (2,046 auctions, 61.5 per cent).

In Melbourne, final results saw the clearance rate fall last week, with 45.7 per cent of the 266 auctions successful, down from the 48.6 per cent across a significantly higher 1,709 auctions over the week prior. Across Sydney, the final auction clearance rate came in at 42.6 per cent across a slightly higher volume of auctions week-on-week, with 813 held, up from 798 the previous week when 45.3 per cent cleared. Sydney’s final clearance rate last week was not only the lowest seen this year, but the lowest the city has seen since December 2008.

The only capital city to see more than 50 per cent of auctions successful last week was Adelaide (50.8 per cent), however this was lower than the prior week’s 57.6 per cent. Brisbane saw the lowest clearance rate, with only 30 per cent of homes selling.

Geelong recorded the highest clearance rate of all the non-capital city regions, with 57.1 per cent of auctions reporting as successful, while the Sunshine Coast region had the highest volume of auctions (55).

CoreLogic are expecting more auctions today, so we will see if this eventuate.

I discussed the latest household data at a UBS forum on Monday, other members of the Panel were included Tim Lawless from CoreLogic and Christopher Joye Coolabah Capital as well as Jon Mott Head of Banks at UBS and George Tharenou their Chief economist. You can watch my segment of the discussion “Some Thoughts About The Housing Market” via a scratch recording I made. Frankly demand for property continues to weaken, as supply rises, and sales volumes fall. First time buyers and investors are becoming more cautious. Jon Mott has been negative on the sector for some time and his new note proposes a worst case scenario in which Aussie house prices crash 30%, the RBA cuts rate to zero and launches quantitative easing, and banks are crushed by cascading bad debts, cut dividends and class actions. Smartly he has developed a range of different scenarios (scenarios will sound familiar to anyone following DFA, as we have been doing this for years, it’s the best way to communicate the intrinsic uncertainty in the system.

He thinks that his scenario 3 – housing correction is most likely, with a 10% drop in prices, and that the banks will be challenged in this environment. But if prices fall further, the banks get hit with class actions, and bad debts they will have to cut dividends.

SQM’s Louis Christopher also issued their latest Boom-to-Bust report, and guess what, he also used scenarios. SQM’s base case forecast is for dwelling prices to fall between -6% to -3%, which is a continuation of the current falls of 4.5% over the past 12 months. Sydney and Melbourne will drive the falls. Other cities will record mixed results with Hobart expected to have a third year of strong price rises of 5% to 9%. The base case forecasts assume no changes in interest rates, a Labor win at the next Federal Election with Negative Gearing repeal and CGT changes coming into effect 1 July 2020. If SQM Research is correct on the Sydney and Melbourne forecasts, it will mean by the end of 2019, the peak to trough declines will be at least in the order of 12% to 17% for these two cities. SQM Research believes that, presuming the RBA does not intervene in the market, 2020 could also record price declines due in part to the repeal of Negative Gearing which is a firmly stated Labor party objective. As such there is a risk that the total peak to trough declines could be in the order of 20% to 30% for our two largest capital cities. The range is dependent on: When, if and how the RBA responds to the downturn; How the economy responds to the downturn; Will the banks be required to lift rates out of cycle; Will negative gearing and capital gains tax concessions be repealed as per the Labor Party’s policy. Christopher said, “If the RBA does not respond and/or the bank lift interest rates again in 2019, it is possible the peak to trough falls in Sydney and Melbourne could be even more than this negative range. But we do take the view that the downturn in Sydney and Melbourne will be a significant negative for the overall economy, and so the central bank will eventually respond at some point and cut interest rates.”

Gareth Aird the senior economist at CBA discussed the drivers of dwelling prices, and identified four leading indicators that capture the momentum in the property market well. They are: (i) the flow of credit (i.e. housing finance); (ii) auction clearance rates; (iii) foreign residential demand; and (iv) the house price expectations index from the WBC/MI Consumer Sentiment survey. Presently all of these indicators are pointing to dwelling prices continuing to deflate over the near term (up to six months).

Indeed, credit and prices are strongly correlated, as we have discussed before. From a dwelling price perspective, the flow of credit matters more than changes in the stock. The annual change in housing finance has a close leading relationship with the annual change in dwelling prices by around six months. New lending is driven by the supply and demand for credit. The latest housing finance data indicates that the flow of housing credit continues to fall. And the pace of the decline has accelerated (chart 3). Credit to investors has been trending down for the past 1½ years. But it’s the shift downwards in lending to owner-occupiers that is behind the recent acceleration in the decline of credit.

Generally, auction clearance rates are a leading indicator of prices. Auction clearance rates tend to lead prices on average by two months. Auctions are more popular in Sydney and Melbourne as a means of selling a property. As such, the link between auction clearance rates and property prices is very much a Sydney and Melbourne story. As a rough rule of thumb, the annual change in dwelling prices tends to be negative when the auction clearance rate is below 55%.

Over the past two years, foreign investment in Australian property has waned. This is primarily due to a lift in state government stamp duties levied to foreign investors as well as tighter capital controls out of China. There is a decent relationship between the annual change in property prices against the share of sales going to foreign investors. Generally foreign purchases have led prices on average by around four months, although that lead time has shrunk more recently.

And finally on consumer sentiment, Aird says it has proved a very useful near term indicator of the annual change in dwelling prices. There is of course a self-fulfilling aspect at work. If households expect prices to weaken then demand for credit will fall and prices will correct lower. The reverse is also true when households expect price growth to accelerate. The WBC/MI house price expectations index is pointing to dwelling prices continuing to deflate over the near term.

The RBA’s Deputy Governor Guy Debelle summarised the Bank’s assessment of the various measures put in place to address the risks around housing lending. He argued risks are under control, though external shocks could still hit household balance sheets. Loose lending is not seen as a risk…. Hmmmm! Whilst the regulatory measures have significantly reduced the riskiness of new housing lending, we have masses of loans written under weaker regulation, which are still exposed.

He also again illustrated the fall in investor borrowing, the shift away from interest only loans, and a significant decrease in the maximum loan sizes now on offer – on average down 20%, though we think for some households the fall is significantly larger. He also showed some households were now paying higher rates, thanks to larger spreads over the P&I loan benchmark.

The trend unemployment moved a little lower according to the data from the ABS, from 5.2 per cent to 5.1 per cent in the month of October 2018. This is the lowest unemployment rate since early 2012 and the 25th consecutive monthly increase in employed full-time persons with an average increase of 20,300 employed per month. The trend underutilisation rate decreased 0.1 percentage points to 13.4 per cent and the trend participation rate remained steady at 65.6 per cent in October 2018.

But wages growth remains sluggish with the seasonally adjusted Wage Price Index (WPI) up 0.6 per cent in September quarter 2018 and 2.3 per cent through the year. The more reliable trend was 0.5% in the September quarter. Private sector wages grew by 0.55% over the quarter, whereas public sector wages grew by 0.61%. So Public Sector wages are growing more strongly, whilst the private sector continues to struggle. The weak wages growth will dent the budget projections and household budgets. Western Australia recorded the lowest through the year wage growth of 1.8 per cent while Tasmania recorded the highest of 2.6 per cent.

So no surprise that our household financial confidence index was lower in October The index measures households overall comfort level with their finances across a number of key dimensions. Recent home price trends, lower returns on deposits and share market gyrations have combined to take the index lower, despite strong employment trends. The wealth effect is now working in reverse, with a potential impact on future consumption. The index returned a result of 88.1, down from 88.4 last month. This continues the decline since late 2016, and is now approaching the lowest ratings from 2015. The convergence across the states continue as home price falls in NSW and VIC take a toll, with the southern state showing a significant slide. WA and QLD appear to be tracking quite closely. Across the age bands, younger households are under the most pressure (thanks to large mortgages, or renting) while those aged 50-60 years remain the most confident, thanks to lower net borrowing, and more savings and investments. For those aged 40-50 recent falls in property prices swamp any benefit from stock market performance. Those holding property for owner occupation remain the most positive, despite falls in paper values of their homes, but property investors are now registering significant concerns, thanks to flat or falling net income from rentals, falling capital values and concerns about the future of negative gearing and capital gains tax relief. More property investors signalled an intention to seek to sell property, as the switch from interest only to principal and interest loans continues. More than 41% of mortgage applications were rejected, compared with 5% last year, as more rigorous underwriting standards bare down. In fact those renting are in many cases more confident than property investors, significant turnaround. The great property investor decade in passing. You can watch our show “Household Financial Confidence Is In The Gutter”.

The use of the Household Expenditure Measure HEM may well be back in play, following the latest from the Westpac ASIC case. Given that at some banks HEM is still being used for around half of applications, and the Royal Commission commented specifically in the use of HEM, perhaps the law needs to be changed. The core of the argument is whether the loans were unsuitable, and that it seems would depend of the ultimate progress of the loan subsequently. In other words, it cannot be proved to be unsuitable until it falls over. ASIC would need to prove the loan was unsuitable! Actually we think the law says lenders have to verify expenses, and in other cases, for example in pay day lending specific inquiries are required as part of the assessment. But it’s as clear as mud at the moment! When is unsuitable lending to be demonstrated? This will have a significant impact on any potential class actions. And of course next week the Royal Commission start they next round, with senior bank executives and regulators on the stand. This should at very least be entertaining, and will perhaps get to the heart of the cultural issues in banking and finance. In this regard you should watch our recent show with John Dahlsen, business man and ex. ANZ Director, who has some important things to say about what has driven the poor outcomes from the sector and what needs to change. It’s a long piece, but highly relevant – “Thinking About Banking From The Inside”.

But for now, banks want more data on expenses, and the latest was ANZ who outlined new tighter rules from 20th November, where mortgage applicants will need to provide much more evidence, and history on income and expenditure. Any income from bonuses will be ignored and income shaded to 80% and evidence of continuous employment is needed. As well as more granularity and evidence on expenditure, they also will want more detail on potential changes to personal circumstances.

And finally, this week we saw the first “unnatural act” from the Government to support the banking sector, in an attempt to alleviate the home price falls and lending freeze ahead of the election next year. The proposed $2 billion funding pool is small beer in the estimated $300 billion SME lending sector. There is precedent a decade ago when the government’s $15 billion co-investment with the private sector into the residential mortgage-backed securities market during the GFC. So the federal government announced a new, $2 billion Australian Business Securitisation Fund to help provide additional funding to small business lenders. But this is lipstick on a pig in my view, and does not get to the heart of the matter at all. But I expect more such measures in the run up to the next election.

And if you want to understand what is ahead, then watch my recent interview with Harry Dent, as we discuss the limitations of central banks, and how QE has really created a monster which is still running rampant. And we are also extending our reach into the New Zealand market with the help of Joe Wilkes, see our latest Ireland V New Zealand – A Passion For Rugby & Property.

But to sum up the state of play, the Bears are indeed in town, and we should prepare ourselves for more falls ahead. Our scenarios continue to play out as expected.

Finally, a quick reminder, our next live Q&A session is now scheduled for November 20th at 8 pm Sydney time. You can schedule a reminder by using the YouTube Link and join in the live discussion, or send in questions beforehand. If previous sessions are any guide, it should be a lively event!