The latest edition of our finance and property news digest with a distinctively Australian flavour.

Harry Dent, Robert Kiyosaki and I will all be participating in an online forum on 24th May 2020. Details here: http://harrydentlive.com/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Harry Dent, Robert Kiyosaki and I will all be participating in an online forum on 24th May 2020. Details here: http://harrydentlive.com/

The latest edition of our finance and property news digest with a distinctively Australian flavour. We had a power cut last evening, so this is a few hours later than normal. Thanks Endeavour Energy!!

Local property insider Joe Wilkes and I discuss the upcoming NZ budget. Will it step up. or just support property some more?

This is the edited and optimized version of the show we broadcast live yesterday. Alex Saunders from Nugget’s News and I discussed the state of play.

The full version with live chat replay is also available:

Clive’s controversial new book, Silent Invasion: China’s Influence in Australia, almost went unpublished after three publishers pulled out citing fears of reprisals from Beijing. His warning that the Chinese Communist Party is engaged in a systematic campaign to exert political influence in Australia seemed vindicated before the book appeared. Published in February, Silent Invasion quickly became a best-seller and is being read in countries around the world that face a similar threat from a rising China under an increasingly authoritarian state.

The Elephant In The Room Property Podcast is run by Veronica Morgan & Chris Bates. I had a chat with them the other week. Now released as Episode 123 | To buy, or not to buy: that is the question.

Their introduction:

Sensationalist media, conflicting reports and anecdotal evidence, but what does the data say?

After Chris’s numerous appearances on Martin North’s ‘Walk The World’ Youtube channel we finally have brought Martin to our own turf. Martin is the founder of Digital Finance Analytics, a boutique research, analysis and consulting firm, he is one of the most regarded authorities in the research space with several media contributions such as ABC new, AFR and 60 minutes. In this data driven episode, we get down to the question at hand: do you buy or do you sell, what is the data showing, and is it reliable? Find out if people are borrowing too much, what properties are beating the downturn and how are individuals discovering the opportunity.

Here’s what we covered:

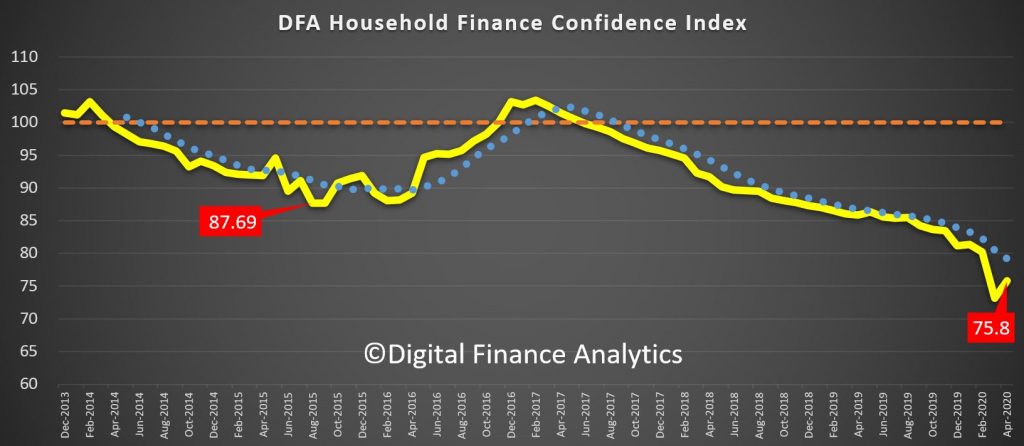

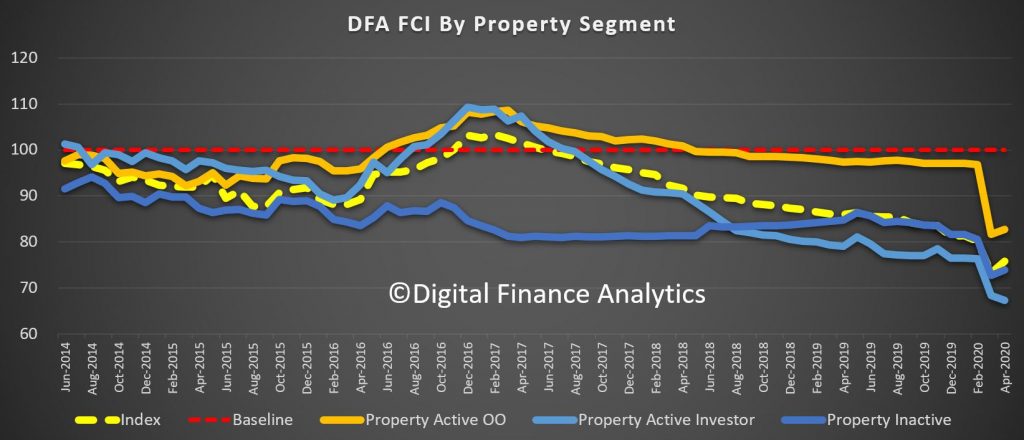

Our latest household financial confidence index improved a little in April, up from 73.2 in March to 75.8 in April. That said, it is still well below the 100 which is a neutral setting, meaning that households are extremely cautious about their finances.

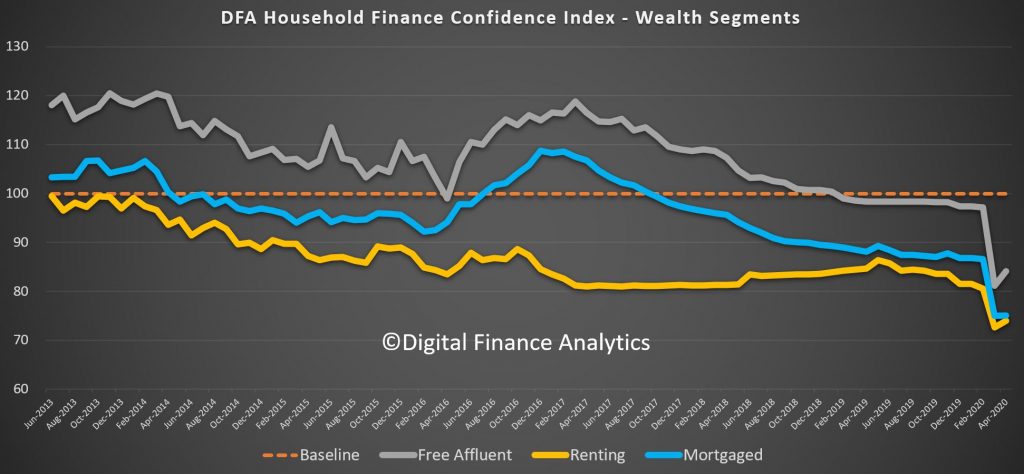

Across our wealth segments, those free affluent households recovered the most mainly thanks to the recovery in stock markets over the past month. Those renting are benefiting from falling rents (though many have income shocks to deal with) while those with a mortgage showed little evidence of a recovery in confidence, thanks to rising debt concerns.

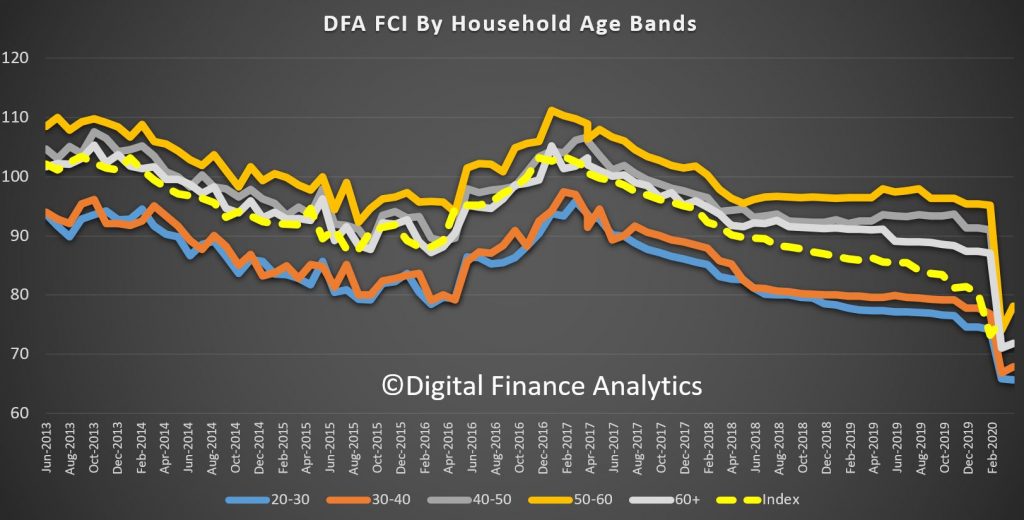

Across the age bands, those aged 50-60 showed the strongest bounce, while those aged 20-30 reported a further fall – not least because younger households tend to be more exposed to zero hour contracts, and part time employment not supported by JobKeeper.

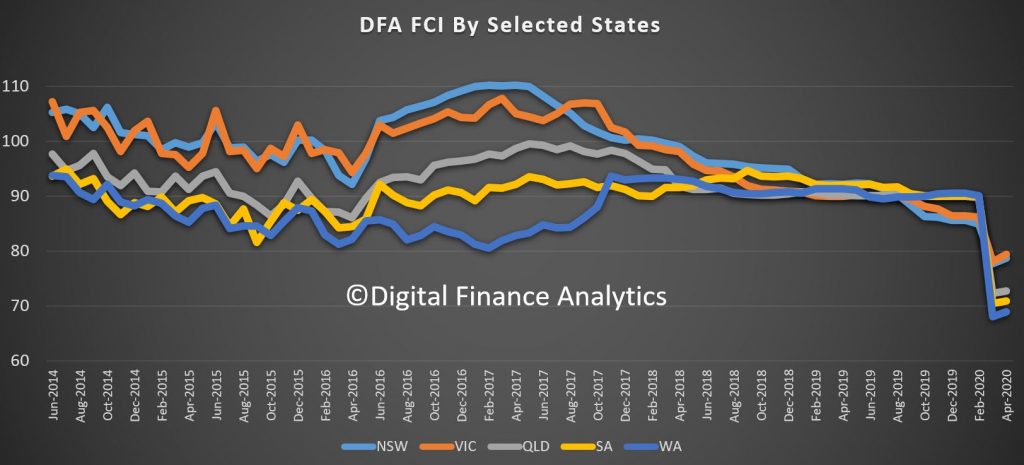

The recovery in confidence was evident across all the states, with NSW and VIC on average more positive relatively speaking than SA and WA.

Across our property segmentation, owner occupied households improved, as did those not holding property, but property investors fell again, thanks to less support from banks in terms of mortgage repayment holidays and falling rents and occupancy. Around 8% of property investors are seriously looking to sell their property if they can. More on that in a future post.

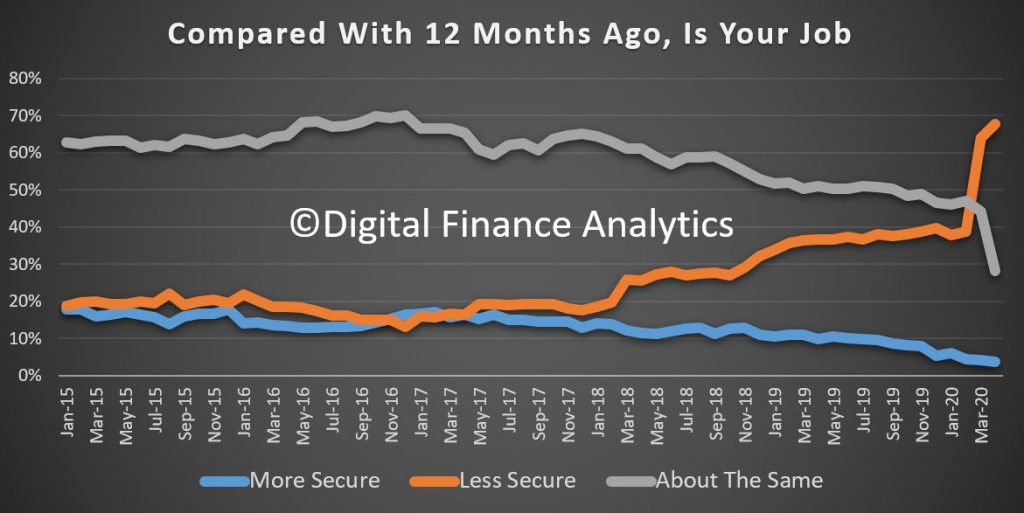

The true state of play is best shown when we look at the moving parts of the index. 67% of households now feel less secure regarding their job prospects than a year ago, a rise of 28% from last month.

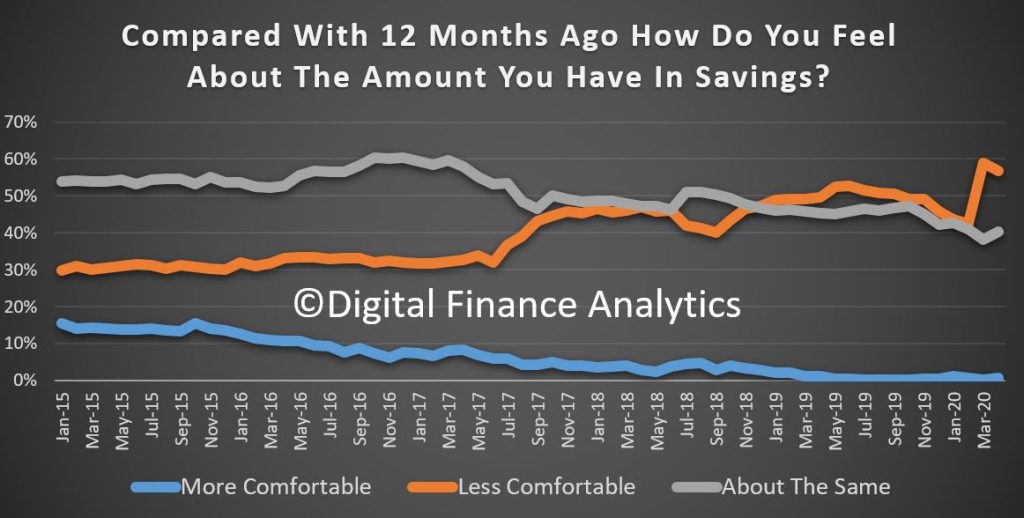

There was a 14% rise in those feeling less comfortable with their savings, to 56% of households. There was a clear intent to try to save more in the months ahead, given current economic uncertainties.

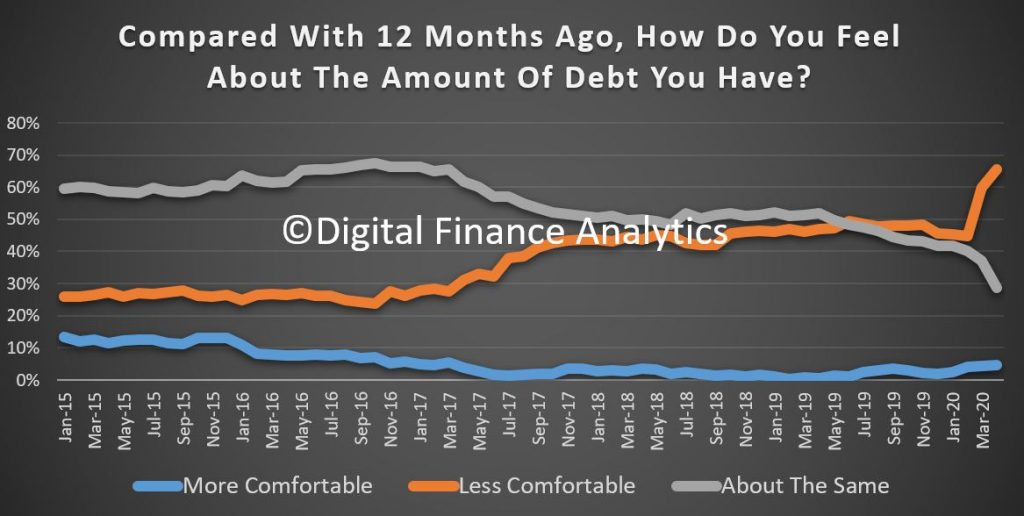

65% of households are less comfortable with their ability to service debt, a rise of more than 20% of households, this despite falling interest rates and bank support schemes. Around $160 billion of loans received some leniency from the banks, but that is a small share of the $1.7 trillion mortgage sector and the $280 billion SME sector.

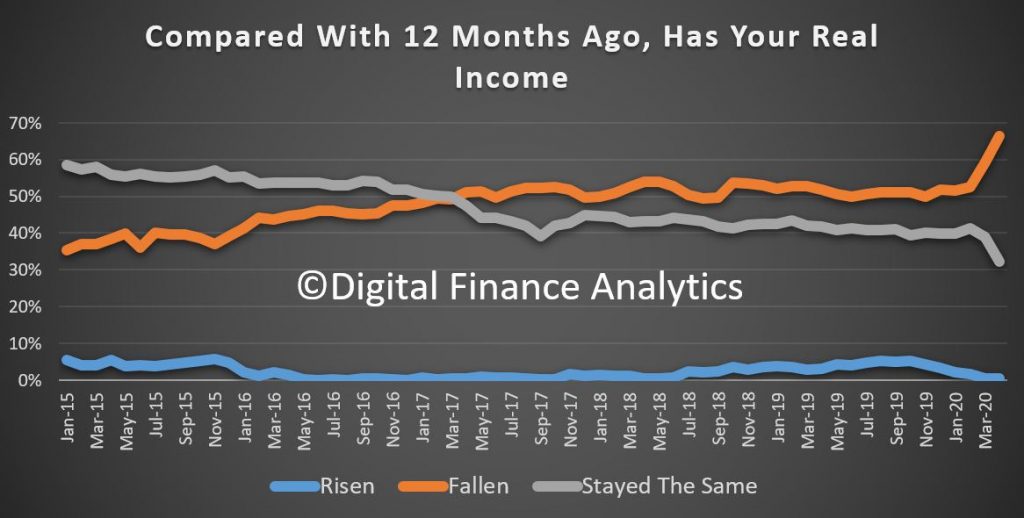

Income pressures are mounting, with 14% saying their incomes had fallen – to 66% of households, while under 1% saw any rise in income – including some who will benefit from higher incomes under JobKeeper than they would normally receive.

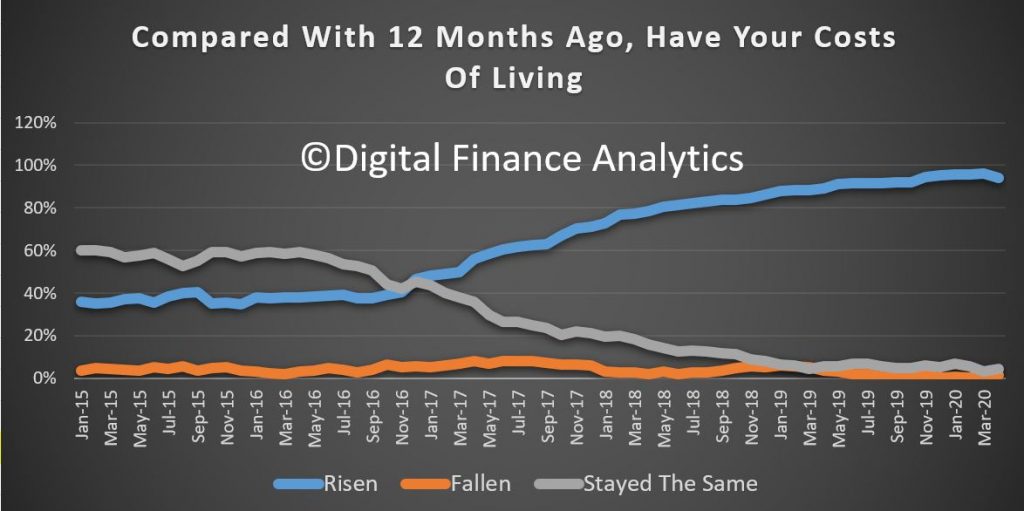

Costs of living continue to drive higher – despite the fall in oil prices – with many households incurring greater costs because they are spending more time at home. 94% said their costs were higher than a year ago.

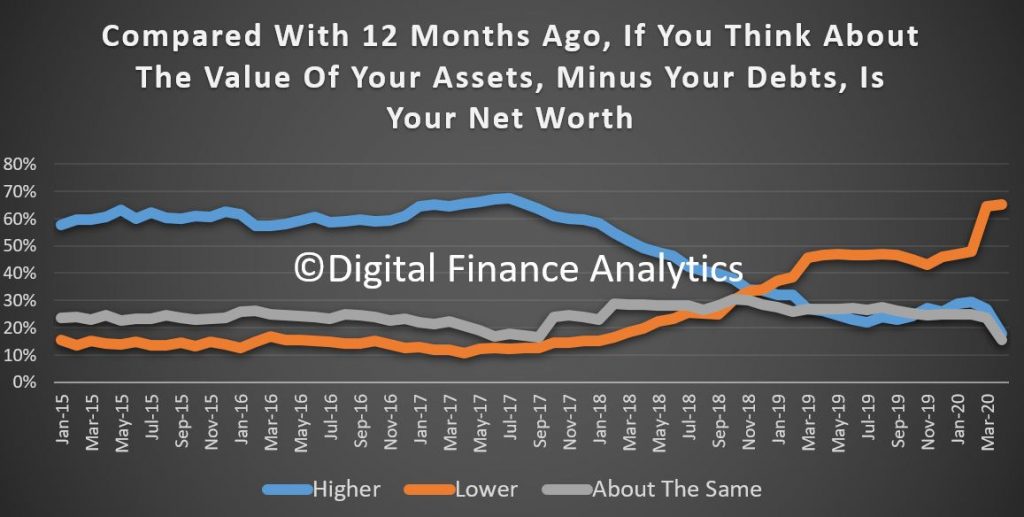

Finally, household net worth was lower for 65% of households, reflecting stock market and property price adjustments, and rising debt levels. There was a drop of 11% in households claiming net worth had risen over the past year to 18%.

So we think the longer terms impacts on households are yet to be fully understood. Certainly, our data suggests households will be cautious, as income pressures, costs of living and rising debts bite. If home prices slide further as we expect they will, then household net worth will put a further brake on the wealth effect and will also adversely impact many households. This does not suggest a V shaped recovery to me.

The latest edition of our finance and property news digest with a distinctively Australian flavour.

The latest from NZ with our resident property insider.

Salvatore Babones, Associate Professor University of Sydney joins me to discuss the question of the China U.S relationship. He suggests it is not what is being reported.

https://policy.bristoluniversitypress.co.uk/american-tianxia