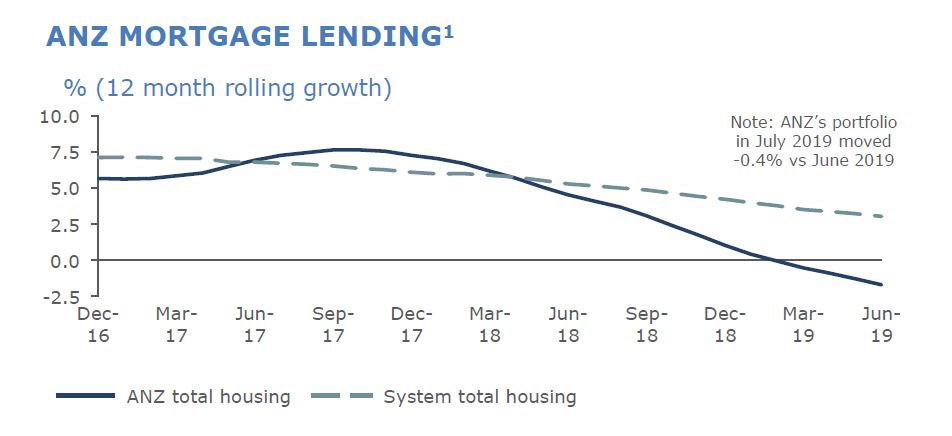

ANZ today provided an update on credit quality, capital and Australian housing mortgage flows as part of the scheduled release of its Pillar 3 disclosure statement for quarter ending 30 June 2019 and associated chart pack. Given the strategy was to shed a portfolio of businesses and focus on the Australian retail market, we need to give attention to their shrinking mortgage book and rising delinquencies.

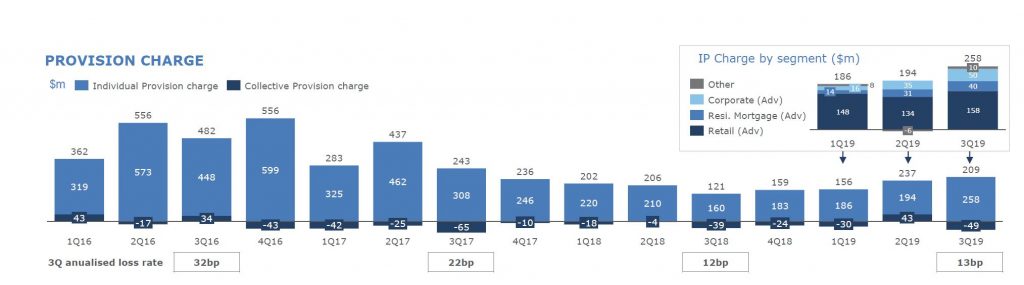

Total provision charge of $209m for the June quarter remained broadly flat compared with the 1H19 quarterly average, while the individual provision increased $68m to $258m. Total loss rate was 13bp (consistent with the 1H19 loss rate of 13bp).

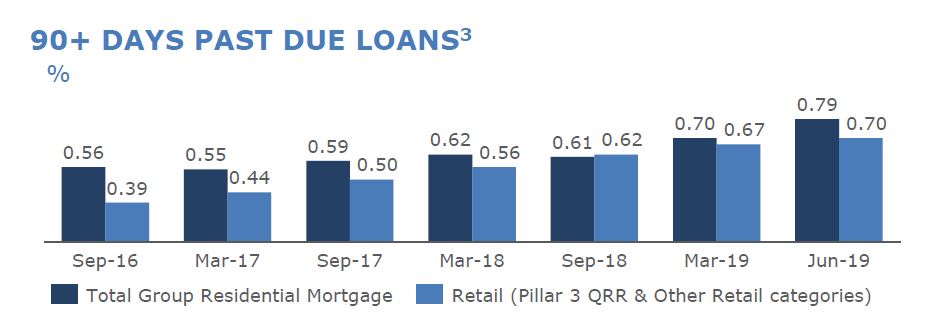

90+ Days Past Due Loans rose in the quarter.

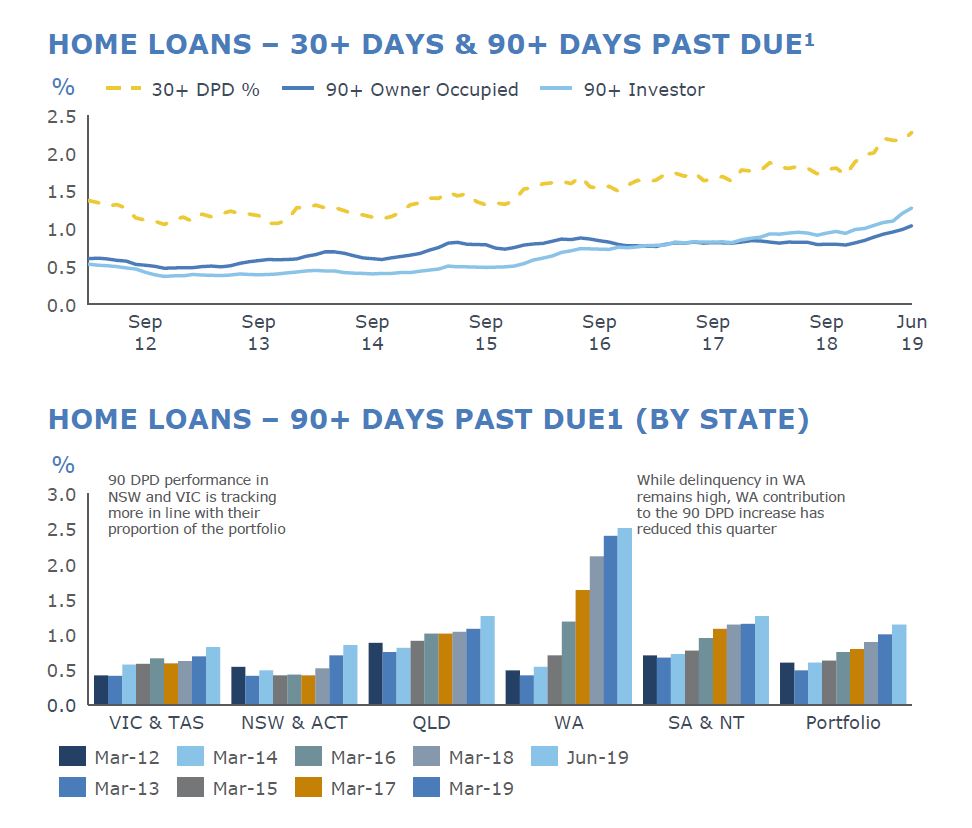

Mortgage delinquency rose in 3Q19, with 90 day increasing 14bp to 114bp. On a geographic basis, ~9bp of the movement came from NSW and VIC in aggregate. On a product basis, ~1/3 of the movement came from Interest Only home loan conversion to Principal & Interest.

WA still leads the way, but delinquencies are also rising in other states. FY17 & FY18 vintages continue to perform better than FY15 & FY16 (when of course lending standards were at their most loose, plus as we know from our mortgage stress work, it can take 2-3 years for households in financial stress to go delinquent). ANZ’s performance is likely to be biased higher given its shrinking mortgage portfolio, as we discuss below.

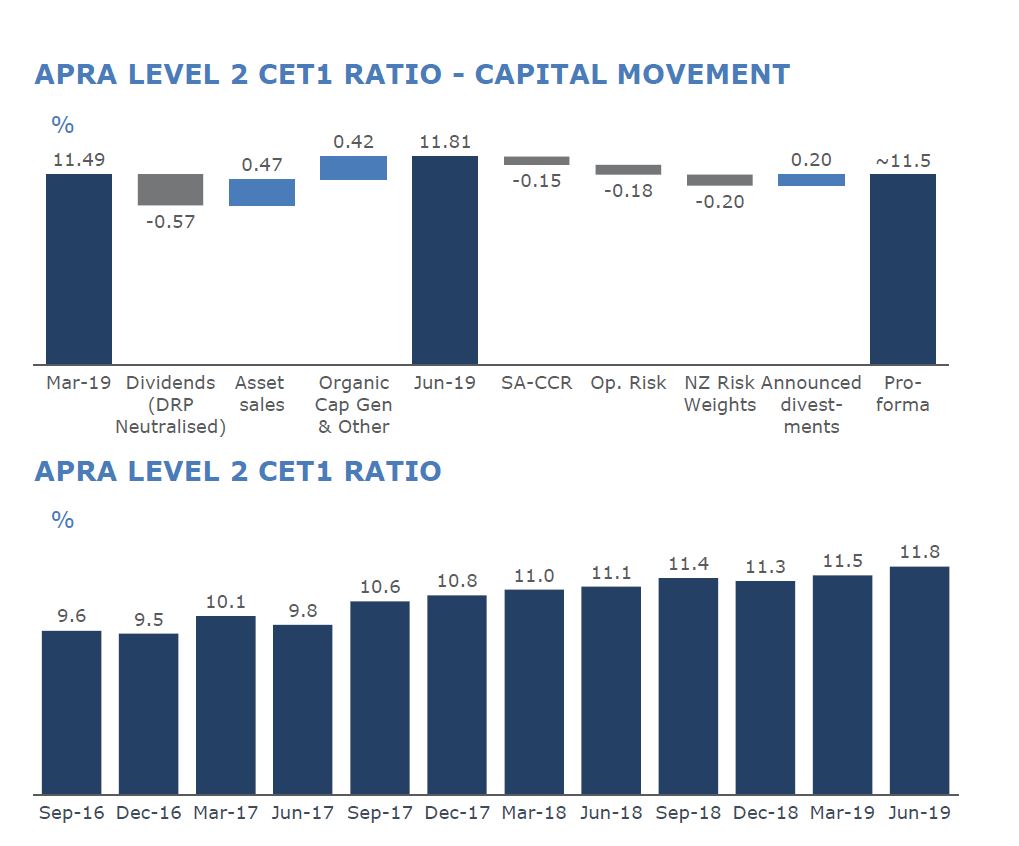

Group Common Equity Tier 1 ratio (APRA Level 2) was 11.8% at the end of June 2019, a ~30bp increase for the June quarter. On a pro-forma basis, inclusive of announced divestments and the recently announced capital changes, ANZ’s Level 2 CET1 ratio is 11.5%.

As indicated at ANZ’s first half result presentation, expectation was for home loan volumes in Australia to decline during the June quarter, with Owner Occupied down 0.2% and Investor down 1.8% (June 2019 compared with March 2019).

They say that home loan applications improved in July 2019 with actions taken in recent months to clarify credit policy and reduce approval turnaround times having a positive impact.