Economist John Adams and Analyst Martin North discuss the latest trends in mortgage lending. Have the taps been loosened, and what are the implications?

Category: Economics and Banking

Winter Is Coming – The Property Imperative Weekly To 01 June 2019

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

The Credit Monster Still Stalks The Halls!

We look at the latest stats from RBA and APRA on credit growth. Home lending is STILL growing at 3.9% per annum – yet we are about to stir up the monster some more – “you cannot be serious!”

https://www.rba.gov.au/statistics/frequency/stmt-liabilities-assets.html

https://www.apra.gov.au/publications/monthly-banking-statistics

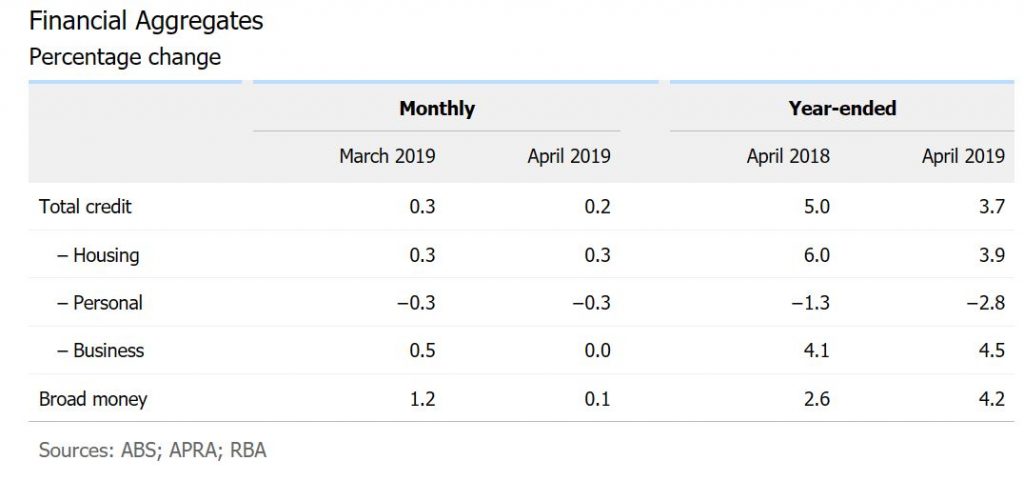

Once again on the last working day we get the latest credit data from both the RBA and APRA. And fair enough, this is before the election, and the recent spate of “unnatural acts designed to kick start credit growth, but the trends before this are clearly down. Here we are talking about the net stock of loans – rather than new loan flows (so we see the net of old loans closed, refinanced, and new loans written). We will need to wait for the ABS series in a couple of weeks to get the flow stats.

The RBA provides an overview, and a seasonally adjusted series, including the non-bank sector. APRA provides data for the banking sector – ADI’s or authorised depository institutions.

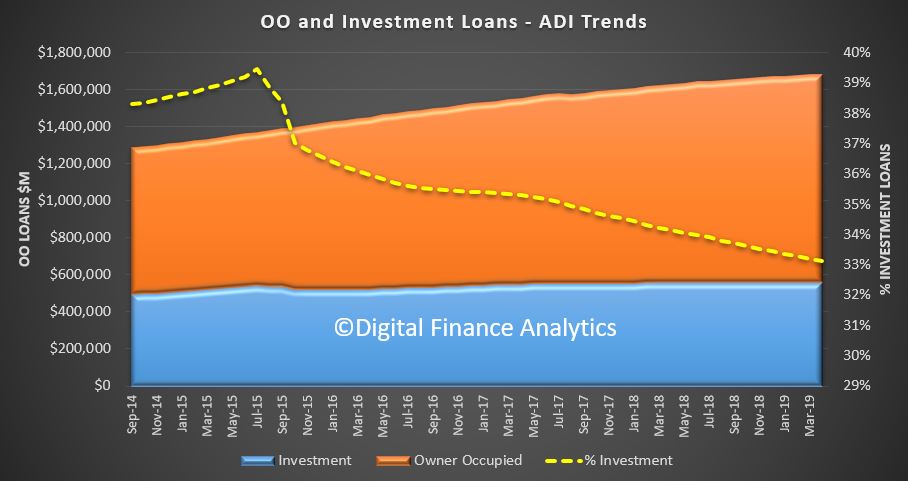

Total credit in the system, is still growing, with housing lending up to $1.83 trillion dollars, with owner occupied lending accounting for $1.23 trillion and investor loans 0.59 trillion. Business lending was 0.96 Trillion dollars and personal credit was $146 million dollars. So, you can see how significant housing credit – and yes, it is STILL growing.

Of that $1.83 trillion dollars for housing, $1.68 trillion comes from the banks, as reported by APRA. Of that $1.12 trillion dollars is for owner occupied housing, and 0.55 trillion dollars for investors. The rest is non-banks, institutions who can lend, but do not fund these loans from holding bank deposits. APRA now have responsibility for these too but is not that actively engaged. So, to the rate of change of credit growth.

We know that housing credit growth has been slowing as demand has slowed, and lending standards tightened, in response to APRA’s interventions and the Royal Commission. But the stark reality is that business lending is also flat according to the RBA.

In fact, last month, total credit grew by only 0.16% and this is the weakest since early 2013.

Overall housing credit was up by 0.28% in the month, and personal credit declined by 0.3%

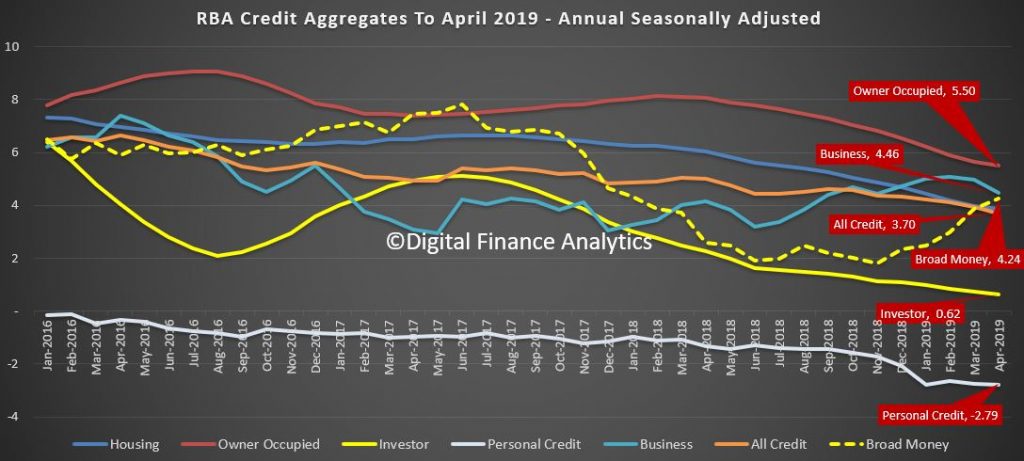

Annual credit growth slowed to 3.7%, the weakest since November 2013 and the trends are clear.

Slowing Housing credit growth is a large element in the numbers, as we have been tracking. The latest annual figure is just 3.9%, and this is the lowest ever in the series which started back in the late 1970s.

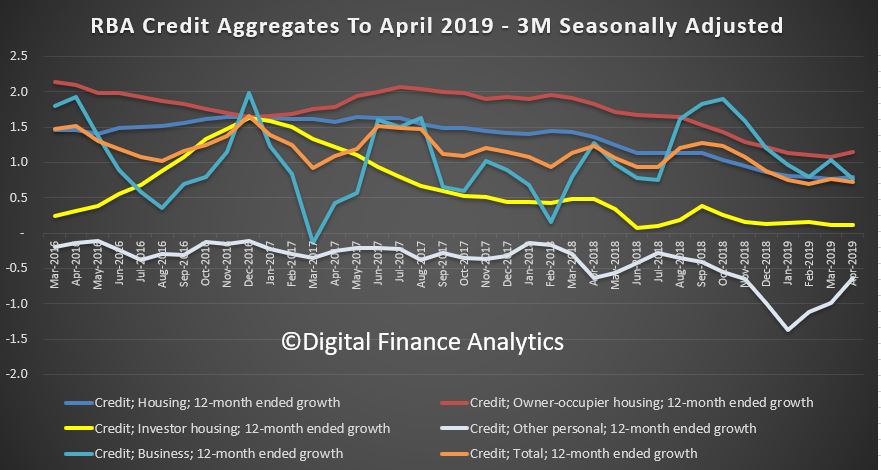

Looking at the three-month series you might argue that the rate of decline is easing just a little, there is not much here really to get excited about. Of course, most of the commentators are now looking ahead following the Coalitions return to power. The RBA I think cut rates on Tuesday, which is the first cut since August 2016. And of course, APRA is consulting on a proposal to loosen the interest rate buffer test.

I won’t repeat here the significant downside forces which will make a rebound in housing lending difficult, other than to say, the Coalition has promised a home price recovery, so they have to try and engineer it any cost – even if the debt balloon inflates further.

Investor housing momentum is still very weak, and there is little to suggest this will change soon – though some might try to sell into any more optimistic season. So, its down to first time buyers, and those seeking to trade-up.

Turning to business credit, this grew by 4.5% over the past year, up from 3.0% for 2017 but is easing back from gains of 6.4% in 2015 and 5.5% in 2016. In fact, this is an important issue, as business lending and confidence are easing back – not a good sign.

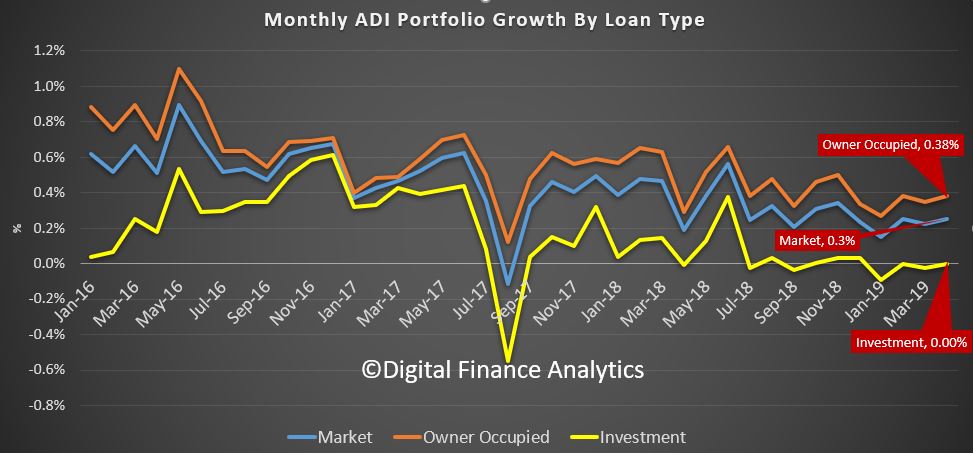

APRA’s data showed that owner occupied lending rose 0.38% in the month, investor lending was flat, and the market growth was 0.3%.

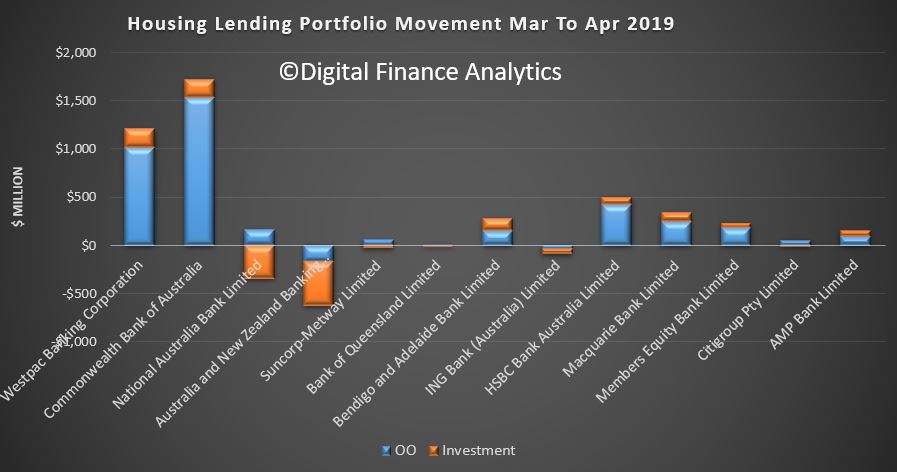

And our analysis of the individual bank data shows that housing market shares did not change that much, although CBA and Westpac were more active in net terms last month, though mainly in owner occupied lending. NAB and ANZ dropped more investor loans.

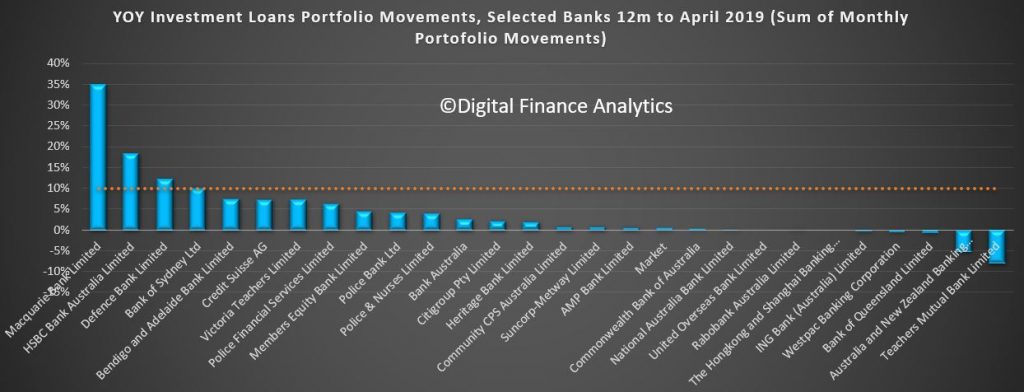

The 12-month portfolio moves for investor loans reveals the majors below the market. Macquarie and HSBC are leading the charge.

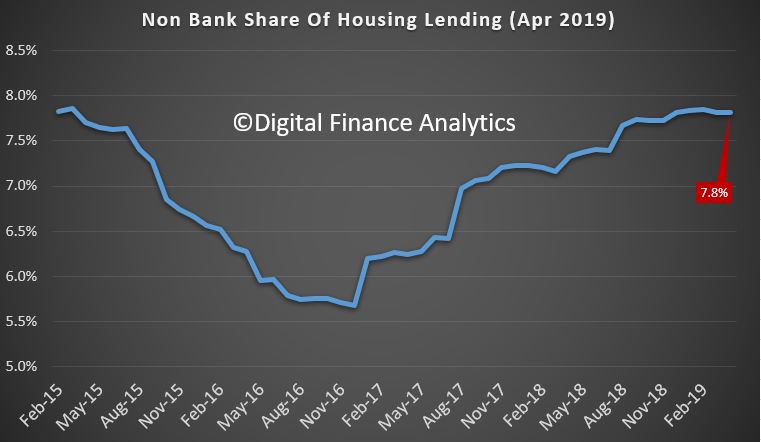

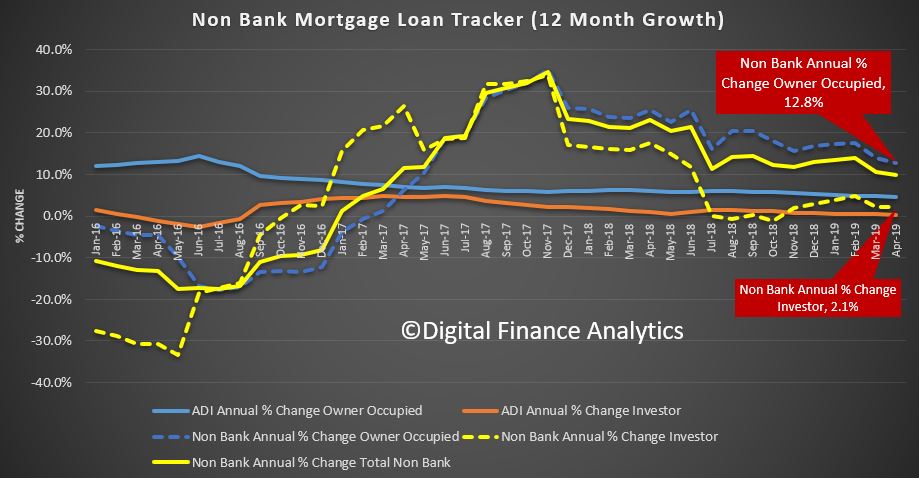

But a comparison of the gap between the Bank lending and RBA data shows the non-banks are still growing their books faster. Overall, they are running at an annualised 7.8%.

And analysis of owner-occupied lending by the non-banks shows it is still at 12.8%, compared with 2.1% for investor loans, but both above system.

So, standing back, the pre-election trends were weakening, the non-banks were making hay, and investors are still on the sidelines. Now it will be interesting to see if the so-called sentiment swing, and hype shows up in the numbers in the next couple of months. But to state the obvious, a growth rate of 3.9% for credit for households even now is way stronger than wages growth or inflation, so the debt burden is building further, and yet the policy settings are about to be shifted to encourage more of the same. Hardly sensible.

Credit Momentum Slows Some More

The RBA’s aggregates to April 2019 shows s further slowing, with housing credit over 12 months down to a growth rate of 3.9%.

We will publish more analysis on this later, but no surprise given the unnatural acts now in the pipeline to try and reverse the trend. Plus an analysis of the APRA data, which also looks pretty weak.

SMEs continue to struggle with cashflow

Australian SMEs are still suffering as 70% of brokers agree that cashflow is “definitely more” of a problem to small businesses now compared to 12 months ago. Ninety-two percent of them believe finance is “more difficult” to access after the Banking Royal Commission, according to a recent poll of the broking community commissioned by B2B finance provider Apricity Finance; via MPA.

With the increased need of finance worsened by the increased challenge of accessing it from tier one banks, the royal commission almost created a “perfect storm scenario” for small businesses, Apricity Finance CEO Linden Toll said.

Working closely with finance brokers, Toll and his team believe brokers have “a unique view on businesses”.

“Like the canary in the coalmine, the trends that brokers see across the SME sector can often be indicative of longer-term problems,” he said.

The research also revealed the broker community found businesses with a yearly turnover of less than $5m, which is the majority, are the ones likely to face cashflow problems. According to Toll, 68% of survey respondents believe that those problems are mainly caused by late invoices and long invoice payment terms.

“Small businesses are hugely important to the Australian economy and employ more than four and a half million Australians, more than those employed by the whole of the ASX 200,” he added.

The findings of the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) in their report in April 2019 echoes Toll’s sentiment. The ombudsman’s head and ex-chief minister for the ACT Kate Carnell stated in the report that they’ve “received over 2,400 surveys from small and family businesses across the country raising issues on late payments and long payment times”.

“Where large corporations delay payment to their small business suppliers, small business cash flow is unpredictable and presents significant difficulties in their ability to access and service finance. Cash flow is king to small business — poor cash flow is the primary reason for insolvency in Australia,” Carnell said.

Linden and his team recommend that small businesses that think cashflow is becoming an issue to act early and take the needed steps to make sure they don’t fall into the 40% of businesses that don’t reach their fourth year

Wanted First Time Buyers – Your Country Needs You!

Property expect Joe Wilkes and I discuss the latest New Zealand data, and consider the drive to attract first time buyers in both NZ and Australia. What does the data say?

Discussing Banking, Housing And Interest Rates On The Radio

I discuss the current economic settings and expectations for future rate cuts and home prices on 6PR Perth with Gareth Parker.

RBNZ Says Financial Risks Remain Elevated

The New Zealand Reserve Bank has released its May Financial Stability Report

The New Zealand financial system remains resilient to a broad range of economic risks. However, financial system risks remain elevated, and ongoing effort is necessary to bolster system soundness and efficiency.

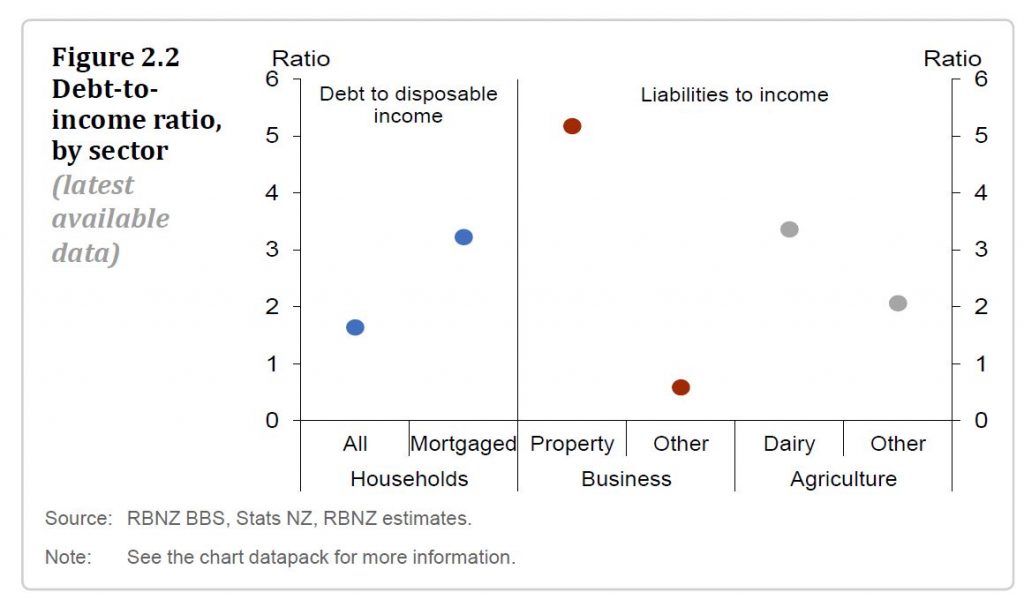

Domestically, debt levels are high in the household and dairy sectors, leaving borrowers and lenders exposed to unanticipated events. Similar challenges exist globally, given current high public and private debt levels, and stretched asset prices in many of New Zealand’s trading partners.

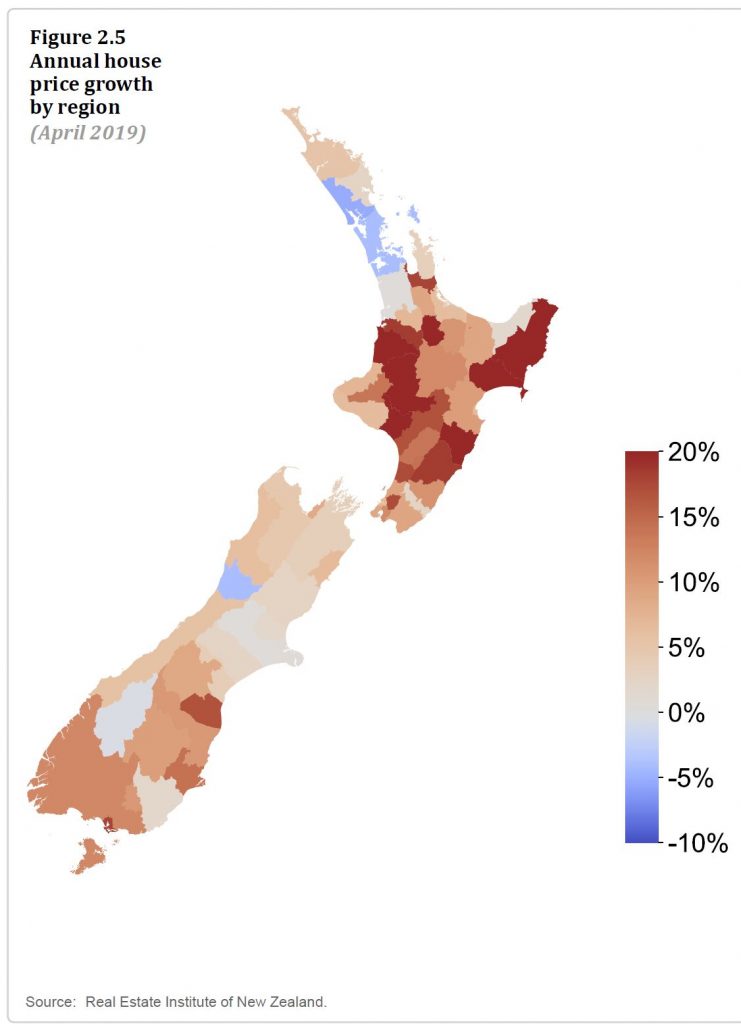

Some regions have recently had high house price growth. This is not an

immediate financial stability concern as those regions have smaller and

less stretched housing markets than Auckland. But if strong price growth

continued, the financial system would become more exposed to those

regions. The Global Financial Crisis (GFC) showed that house prices can

fall dramatically in small regions.

At a national level, the growth of household debt and house prices has

slowed, but household debt has still grown faster than income in the

past year. Housing market pressures could re-emerge if there is a strong

response to the recent decline in mortgage rates, or reduced uncertainty

about the future tax treatment of property investments.

Given this environment, the financial system’s vulnerability to risks in

the household sector remains elevated, and must continue to be closely

monitored and managed.

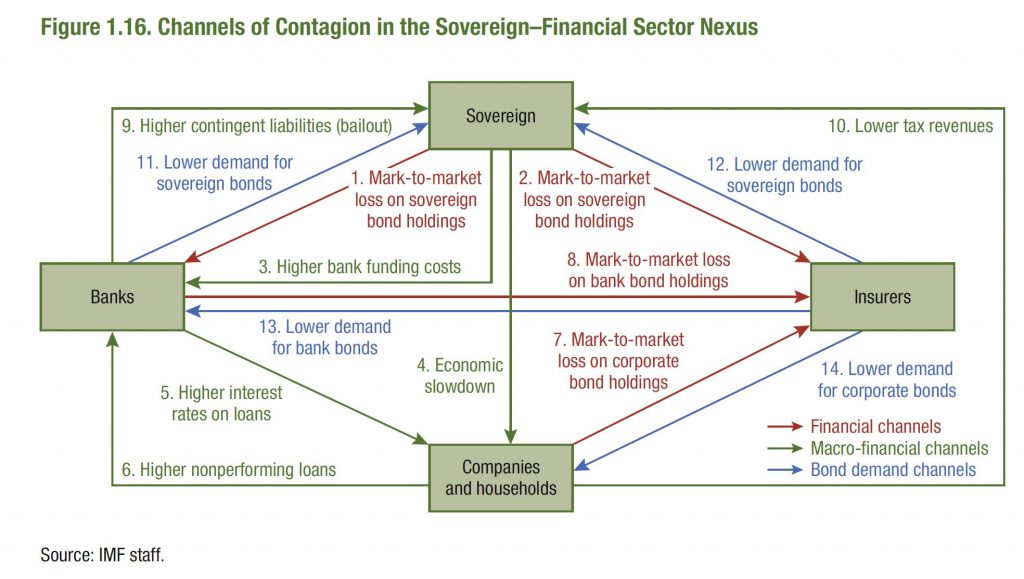

The capacity for some foreign governments and central banks to respond to unanticipated negative events is also limited by their current high government debt and low nominal interest rates. It is imperative to improve New Zealand’s financial system resilience while conditions are conducive.

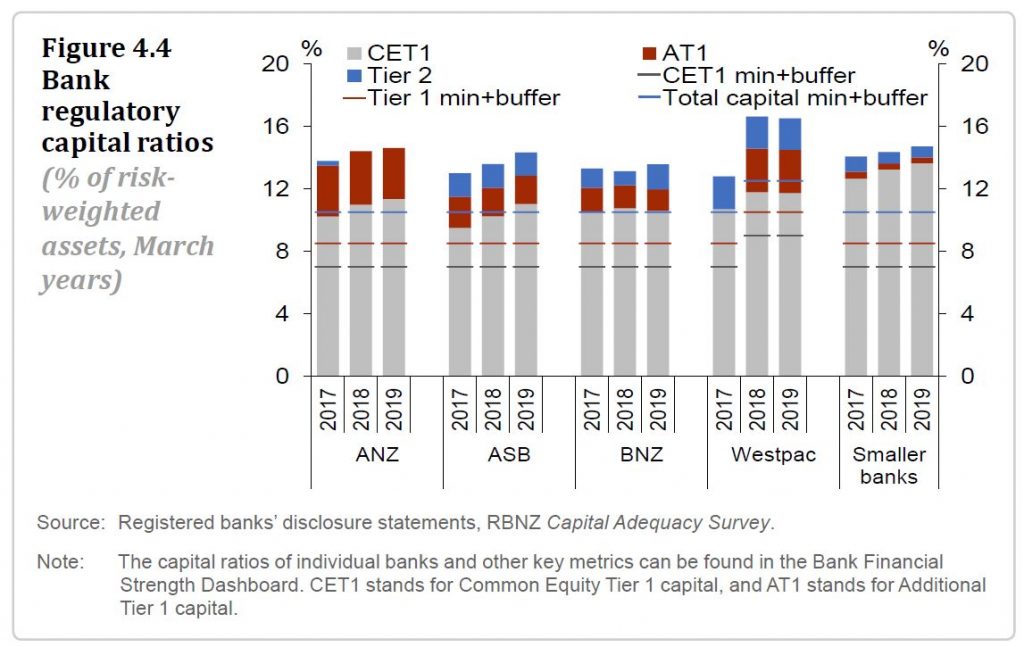

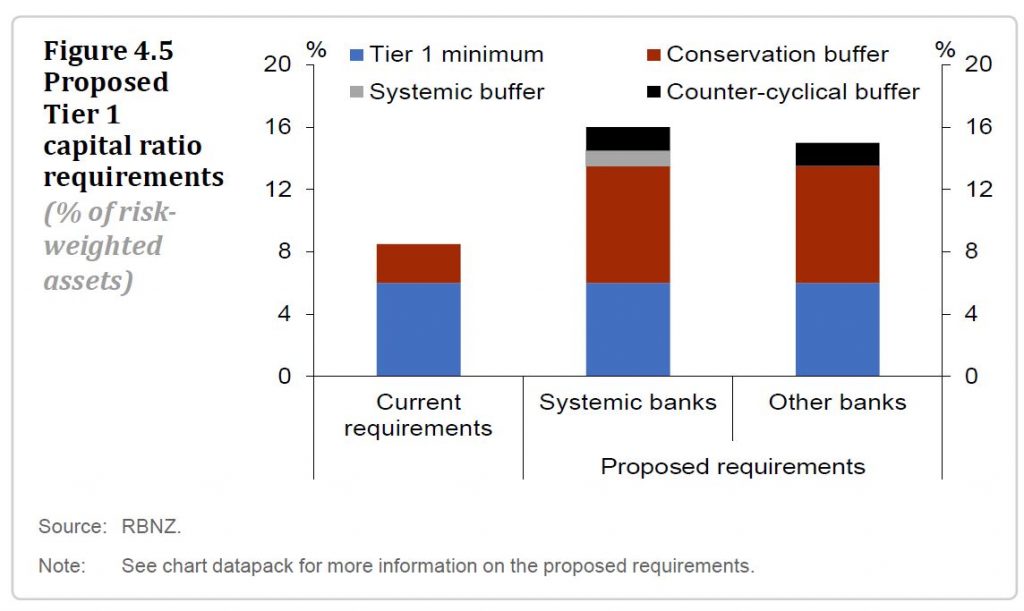

Increasing financial institutions’ capital positions is central to ensuring that they can withstand severe shocks. We have proposed higher capital requirements for banks, and are currently reviewing public submissions on this proposal.

There is also a need for some insurers and non-bank deposit takers to improve their capital buffers. We will be reviewing insurer solvency standards in the months ahead.

Financial resilience also includes service providers taking a long-term customer outcome focus, to both maintain confidence and promote sound resource allocation. We will ensure banks and insurers respond to the issues identified in our recent review of their conduct and culture.

A longer-term focus is also necessary for financial firms to adapt to the changing competitive, regulatory, and natural environment.

Insurers are changing how they manage their exposure to natural disaster events, which is altering affordability. Risks associated with climate change are also impacting on the accessibility of insurance, with potential flow-on effects on bank lending. These risks must be appropriately identified and priced, so as to best ensure a stable transition over coming years.

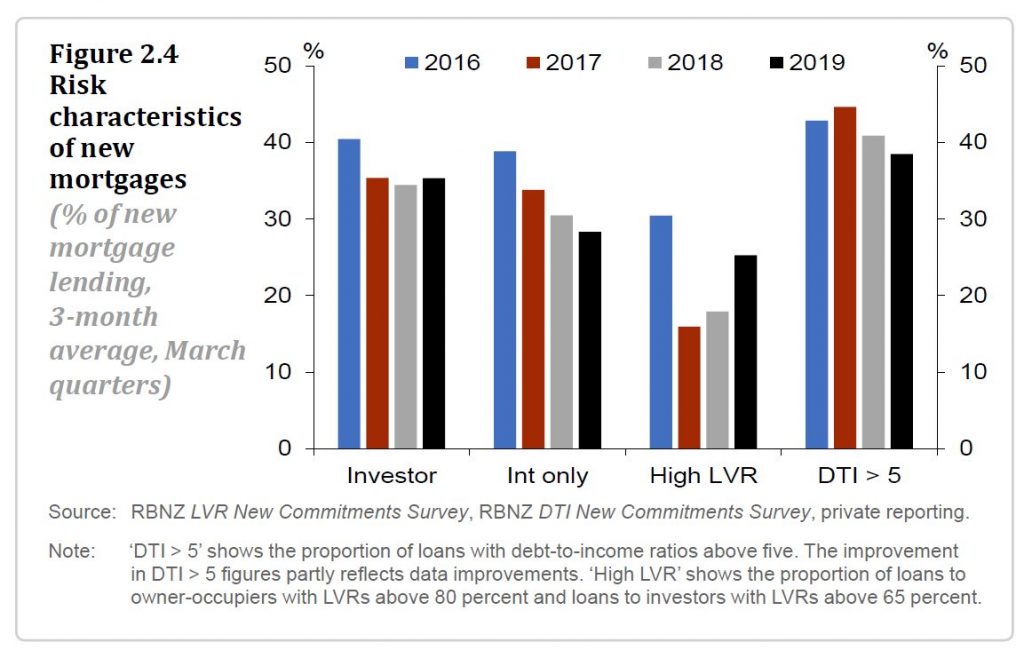

The Reserve Bank’s loan-to-value ratio (LVR) restrictions have been successful in reducing some of the risk associated with high household indebtedness. The current LVR settings remain appropriate for now, with any further easing subject to continuing subdued growth in credit and house prices and banks maintaining prudent lending standards.

When The Music Stops, Who’s Going To Be Left Holding The Baby?

Investment banks face cartel class action lawsuit

Five global investment banks are facing a cartel class action lawsuit after a suit was filed at the Federal Court yesterday, via InvestorDaily.

Maurice Blackburn Lawyers, who is also taking on AMP in a class action, have launched the suit against UBS, Barclays, Citibank, Royal Bank of Scotland and JP Morgan, claiming the banks colluded to rig foreign exchange rates.

The suit alleges that between January 2008 and 15 October 2013, traders in chat rooms bearing names such as ‘The Cartel’ and ‘The Mafia’ communicated directly with each other to coordinate the manipulation of FX benchmark rates.

“The chat rooms included those named ‘The Cartel’, ‘The Mafia’, ‘One Team’, ‘One Dream’, ‘The Players’, ‘The Three Musketeers’, ‘A Co-Operative’, ‘The A-Team’, ‘The Sterling Lads’, ‘The Essex Express’ and ‘The Three Way Banana Split’,” according to Maurice Blackburn’s statement of claim.

It is alleged that the actions resulted in the pricing of ‘spreads’ and the triggering of client stop loss orders and limit orders.

“Sharing with each, alternatively one or more, of the other respondents, and/or one or more of the other cartel participants, information in relation to trade in FX Instruments with respect to one or more of the affected currencies, including in relation to trade volumes and/or trade strategy,” said the statement of claim.

The alleged conduct has been the subject of extensive regulatory and private enforcement action worldwide including settlements in the US and Canada resulting in the payment of US$2.3 billion and CA$107 million respectively.

Some of the allegedly affected currencies include the Australia, Canadian, New Zealand and US dollar as well as the Russian ruble, Indian rupee, the Euro and the British pound.

Maurice Blackburns principal lawyer Kimi Nishimura said that the cartel behaviour could have affected a number of Australian business and investors.

“Australian businesses and investors – particularly medium to large importers, exporters, institutional investors and businesses with operations overseas – have been affected by the distortion of the FX market by these banks.

“Such cartel behaviour cheats Australian businesses in circumstances where they may already have been vulnerable to currency fluctuations,” she said.

The class action will be represented by lead plaintiff J.Wisbey and Associates, a medical equipment importer, but is open to any customers that brought or sold currency during the period where total value of transactions exceeded over $500,000.

Spokespeople for the banks involved did not issue a statement at time of writing.