A special show in which we address the question sent in before our live stream event last Tuesday. We had so many live via the chat, but now we answer those sent in before the show.

Original live event here:

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

A special show in which we address the question sent in before our live stream event last Tuesday. We had so many live via the chat, but now we answer those sent in before the show.

Original live event here:

The re-election of the Liberal Party-led coalition government (Coalition) in Australian federal elections on 18 May signals broad policy continuity in line with the fiscal priorities announced in April’s pre-election budget, says Fitch Ratings. The Coalition campaigned, among other things, on prudent fiscal management and a goal of achieving an underlying cash surplus next fiscal year, which is consistent with our fiscal assumptions when we affirmed Australia’s ‘AAA’ rating in April.

As such, Fitch continues to expect a return to an underlying cash surplus for the fiscal year ending June 2020 (FY20), marking the first time the federal government has achieved this in 11 years. On a Government Finance Statistics basis, we forecast a federal government deficit of 0.2% of GDP in FY19 followed by a surplus of 0.1% in FY20. General government debt/GDP should fall to 40.8% in FY20 after remaining flat at 41.2% of GDP in FY19.

A commitment to fiscal prudence across the political spectrum is a supporting factor for the country’s ‘AAA’ rating. Nevertheless, a 22pp increase in government debt/GDP since 2010, due to sustained fiscal deficits, has eroded what was once a strength for Australia’s credit profile relative to peers.

Slowing growth remains a key risk to the fiscal outlook. We forecast real GDP growth to decline to 2.0% in 2019 from 2.8% in 2018 amid spillovers from a slowing housing market on dwelling investment and consumption, and sluggish income growth. External risks from rising trade tensions and the potential indirect effects on commodities demand also remain. A sharper-than-expected economic slowdown would affect revenues beyond our current base case and could add to political pressures for more fiscal stimulus.

Positively, the unemployment rate remains low and the labour market has proven resilient, though labour market indicators have softened slightly in recent months in line with our forecasts. A large pipeline of public infrastructure mitigates risks of a sharper slowdown. The implementation of limited personal income tax cuts, as included in the April budget, could also provide some support to growth. However, using some of the recent upswing in revenues makes the fiscal trajectory more sensitive to commodity prices, and GDP and wage growth. Commodity prices have remained buoyant, lifting exports and corporate profits, despite US-China trade ructions and the slowdown in Chinese economic growth.

High household debt remains a risk for both the overall economy and the financial sector. Fitch expects the ongoing house-price correction to remain orderly, with prices declining 5% in 2019, but a sharper correction could exacerbate risks from high household debt. Debt service is low at current interest rates, but households remain vulnerable to a labour market or interest rate shock, although neither is expected in Fitch’s base case. We revised our monetary policy forecast in March and expect the Reserve Bank of Australia to cut its policy rate by 25bp to 1.25% in 2019. We forecast Australian growth to rebound to 2.5% in 2020.

The Coalition will likely continue to require cross-bench support in the Senate to pass legislation, and this could add to risks to the budget outlook and affect policymaking capacity particularly with regards to deeper, productivity-enhancing, medium-term economic reforms.

Australia’s ‘AAA’ rating remains underpinned by robust structural factors including strong governance, high income, proven economic resilience and credible policymaking institutions. The country retains a strong banking sector that is well positioned to handle shocks and a potential growth rate of 2.4%, which is above the ‘AAA’ median.

Deutsche Bank’s share price continues to fall, as the company wrestles with shrinking revenues, cost cutting and the prospect of reducing its investment banking arm following the collapse of merger talks with domestic rival Commerzbank.

The share price has dropped nearly 39% over the past year, and is way down from 2010. During the previous financial crisis, Deutsche Bank received $354 billion in revolving loans from the U.S. Federal Reserve. Plus, according to a recent Financial Times piece “Germany’s federal and state governments have spent €70bn on bailing out banks since the financial crisis”. This includes Deutsche.

On Monday, UBS downgraded its stock to a “sell” rating from “neutral” and cut its target price from 7.80 euros ($7.45) to 5.70 euros. Deutsche Bank trades at all-time lows and at a price to net asset multiple (0.25x) rarely seen in bank shares outside of insolvency situations.

Deutsche Bank has been plagued by failed regulatory tests, ratings downgrades, big fines and management reshuffles in recent years and posted its first profit in four years in 2018. It has also been linked to President Trump, and indeed, Trump sued the bank last month to block its compliance with congressional subpoenas seeking access to his financial records.

Investment banks revenue is forecast to fall to 12.5 billion euros this year, according to consensus estimates. That would mark a fourth consecutive year of decline, down 34% from 2015. The investment bank generates about half of Deutsche Bank’s revenue but is also considered its Achilles heel, with European regulators fearful that it will fail the next round of stress tests in the United States.

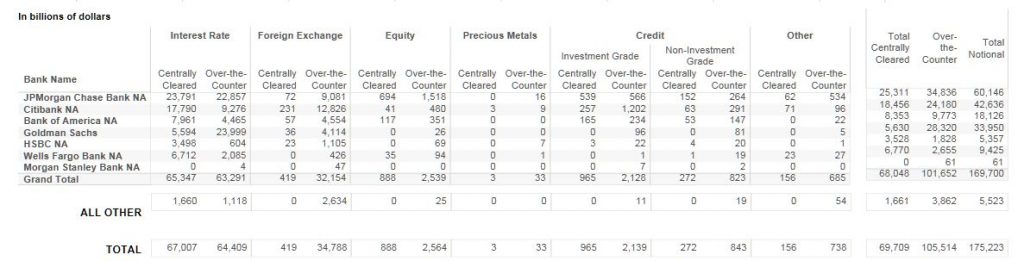

Deutsche could well be the source of wider financial stress, bearing in mind its large derivatives exposure~$46 trillion extend into most of the major Wall Street banks, including JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as other mega banks in Europe.

According to data from the OCC to q4 2018 (released March 2019), this puts the German giant behind JPMorgan Chase ($60.1 trillion, but ahead of Goldman Sachs $33.9 trillion) and Citibank ($42.6 trillion) all nominal.

The IMF concluded that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections – and that was when its market capitalization was tens of billions of dollars larger than it is today.

A capital raising would likely be a next step, to fund further cost cutting (which they cannot currently afford to fund). But shrinking revenue against a high cost base is the root cause issue. And the derivative risks extensive.

This one is worth watching.

Economist John Adams explores the post election environment in a discussion with Martin North, including the various strategies which are now in train to entice home buyers back into the market – the ponzi scheme continues…. the debt mounts.

Property insider Edwin Almeida recorded a show with me, post the election and the APRA loosening. He also wrote a companion piece, below.

SUMMARY OF MY THOUGHTS MOVING FORWARD POST ELECTION 2019

@justthink1 Edwin Almeida ‘Ribbon Property Specialist’

Thumb on the scale

If property owners ever needed a thumb on the scale to give people a false sense of ‘property price increase and rebound,’ the outcome of this election was timed perfectly for them. It will be short lived however.

Nonetheless, many NEW buyers will fall for the false sense of economic security, value growth in property and like sheep to the slaughter, will jump right in and get a “mortgage.” Their very own voluntary life sentence which may well end up under water and at 20,000 leagues.

The savvy owners

Smart property owners will now take this opportunity to list their property and bail out, a welcomed relief for many. They will do so to take advantage of the new found sentiment of prosperity post the election. The smart sellers will jump on the newly revived ‘property prosperity (bubble)’ which many property-pundits will be preaching.

Nonetheless, this revival will only create and turn out to be a short lived slowdown to the prop-market drop, in ‘real time’ that is. CoreLogic daily numbers will continue to show a downward trend for the time, as it catches up with live data.

But hell, make hay whilst the sun shines and get on the market. Why you say? Read on and see.

Buyers will jump the gates and take on anything and everything on offer as the MSM puts out upbeat propaganda of a market turnaround and stability under the elected government.

I believe there will also be a quick run to the Property Portals by vendors that withdrew their listings from the market as they couldn’t pallet further drops in prices and long days on market and all due to the pre-election uncertainty. Keep an eye on Domain and REA Numbers over the next 2-4 weeks and see if I’m on the money or not.

Personally, I can already see the emails hitting agent’s in-boxes with highlighted and bold text: Relist, re-advertise and place my property back on the market; we’re back in business.

In the short term, it will be a small run and good for the owners that hit the market quickly, BUT in the medium to long term, it will only add more stock on the market as the majority of buyers still have to navigate through banking restrictions.

However, the fever may hit enough of the cashed up buyers that have been waiting on the sidelines. Enough numbers to make the mainstream property analysts declare victory over the doomsayers.

Interest Only Investors

If there was a time for the IO investors to bail out and not lose more than what they have been, now is it. I dare say many will take opportunity and list. Well, the smarter ones that is and the ones that are not so much into debt and so deeply under water with mortgages.

After all, the mainstream analysts and property-pundits have rang the bell, the real estate hounds are out and the starter’s gun has fired. First Home Buyers are on the grounds once more with newly found HOPE, and the selling agents smell blood and are on the hunt.

Will the Banks bend over for the Government and loosen their grip on credit?

Maybe they will, maybe they won’t. I’ll leave this to John Adams and Lindsay David to enlighten us on the subject. I personally don’t believe they want to and particularly not when they can see the storm ahead.

Most of my internal banking sources tell me, the landscape of economic pain still remains and the ship will take a while to turn around.

The Achilles Heel

Our weakest link continues to be OVERSUPPLY, yet no party policy addressed it before the election, rather both were more focused on building more.

Lending more to build more, will only make this worse. More property equals less rent and so on but heck, we just see things on the front line, what do I know right?

Truth be told, the savvy investors aren’t interested in NG, they want; high yields, growth & to add value to make a gain.

Besides, would you buy a newly built, badly engineered apartment or home now and after the fiasco of Opal Tower and the issues around Private Certification? Didn’t think so.

Cost of living & employment

Will cost of living lessen all of a sudden under the elected Morrison government? Like you, I don’t believe it will.

Just because the Liberal party are back in, doesn’t mean we receive a $5K bonus in our accounts next time we go to the teller. Hold on, I better run and check maybe I did get a bonus. Just checked online banking and nope, didn’t get the bonus.

Yes, the mainstream noise says ‘brighter times ahead.’ Let’s see how bright they really are as we navigate the next quarter. Will there be announcements of new FULL time jobs being created? Jobs to actually help pay a mortgage? Or will we have more part-time job numbers?

My overall opinion

In my personal opinion, I just see what transpired on the weekend and what will happened in the next quarter as the last bastion of the property demigods to keep the property bubble inflated. The property analysts that once say drops of up to -25% may well have a change of heart. Others will begin to call the trough and the revival.

However, I still believe and feel there are way too many holes in this economy and property market. Frankly, not the Libs nor Labor were and are going to stop it from hitting my predicted 2004-2005 property prices in most parts of Sydney.

Call what I see on the ground and at firsthand experience ‘the vibe,’ or call it what you will. Most definitely, don’t call it ‘delusional economics’ nor mix my thoughts with those of the mainstream that propagate and preach a rebound.

A brief overview of what I see that will transpire over the next few months. But please don’t stone me, as I say it’s just ‘the vibe’ on the ground and what we see on the property front line.

While APRA’s proposed changes to serviceability assessments for ADIs have been broadly celebrated, others have expressed doubt that the regulatory revisions will stimulate the housing market in as meaningful a way as is hoped. Via Australian Broker.

“While these changes are welcome and will help some borrowers that can’t quite access a mortgage currently to get one, it is unlikely to result in a rebound in the housing market,” said CoreLogic research analyst Cameron Kusher.

Kusher referred to ANZ’s recent investor update to the market to elaborate on his stance.

The update from ANZ attributed reduced borrowing capacity to three factors: changes to HEM accounting for 60%, the servicing rate floor responsible for 30%, and income haircuts causing the remaining 10%.

Kusher pointed out that, according to this data, 70% of the reduction in borrowing capacity is unrelated to the current serviceability assessment model. Even if APRA were to change its current guidelines, it will likely continue to be much more challenging to get a mortgage than in the past.

Roger Ward, director of Champion Mortgage Brokers, agrees that the current 7.25% assessment rate is just one of six lending standards that have contributed to the credit squeeze.

Drawing from his 25 years in the banking and finance industry, Ward outlined the remaining five challenges to lending as:

While allowing lenders to review and set their own minimum interest rate floor will undoubtedly help some borrowers access previously unreachable mortgages, the housing market will require stimulation from elsewhere in order for dwelling values to begin their rise.

According to Kusher, “[APRA’s] proposed changes, in conjunction with the uncertainty of the election now behind, will potentially provide additional positives for the housing market. [They] would potentially slow the declines further and may result in an earlier bottoming of the housing market.

“Despite that prospect, it will remain more difficult to obtain a mortgage than it has done in the past and we would expect that if or when the market bottoms, a rapid re-inflation of dwelling values is unlikely,” he concluded.

Brokers should be applying new credit card assessment rules to their loan applications, the solicitor director of The Fold Legal has suggested. Via The Adviser.

The Australian Securities and Investments Commission (ASIC) last year announced new assessment criteria that is to be used by banks and credit providers when assessing new credit card contracts or credit limit increase for consumers.

Under the changes, credit licensees are required to assess whether a credit card contract or credit limit increase is “unsuitable” for a consumer based on whether the consumer could repay the full amount of the credit limit within the period prescribed by ASIC.

ASIC outlined last year that, as part of the new measures, credit licensees undertaking responsible lending assessments for “other credit products”, including mortgages, should ensure that the consumer “continues to have the capacity to repay their full financial obligations” under an existing credit card contract, within a “reasonable period”.

Speaking of the new rules, Jaime Lumsden Kelly, solicitor director of The Fold Legal, has suggested that, while it is not mandatory for brokers, both lenders and brokers should apply the same rules to their loan applications.

Writing in a blog post for The Fold Legal, Ms Lumsden Kelly elaborated: “In the past, credit card contracts were assessed as unsuitable if the applicant couldn’t repay the minimum monthly repayment for that limit. Under the new rules, credit card providers must make their assessment based on whether the applicant can repay the entire credit card limit within three years.

“If a credit card applicant cannot repay the full credit limit in three years, it’s assumed that they will be in substantial hardship. This is because a consumer who cannot afford to repay the limit within three years will probably pay a staggering amount of interest that will take an extraordinarily long time to repay.

“If the applicant is in substantial hardship, the credit card provider must decline the application as being unsuitable,” she said.

While the rule doesn’t “technically” apply to other lenders or brokers, the lawyer added that “all lenders and brokers have an obligation to reject a credit contract if it would place the consumer into substantial hardship”.

“If the inability to repay a credit card within three years is considered to be a substantial hardship when assessing a credit card application, how can it also not be substantial hardship, if a consumer will no longer be able to repay their credit card within three years because they’re meeting new repayment obligations on a car or home loan?” she said.

Ms Lumsden Kelly gave the following scenarios as an example to illustrate the point.

In the first scenario, an applicant with a $500,000 mortgage applies for a $15,000 credit card. When assessing the credit card, the provider determines that the applicant is “unsuitable” because they won’t have enough income to repay their credit card limit in full within three years. So the credit card provider declines the application.

However, if the same applicant already has a $15,000 credit card and then applies for a $500,000 mortgage (on identical terms as in the first scenario). The licensee is only required to consider whether the applicant can make the minimum monthly repayment on their credit card when determining if they will suffer substantial hardship. On this basis, the licensee approves the mortgage.

“The end result for the applicant is the same in both scenarios,” she said. “They have a $500,000 mortgage and a $15,000 credit card limit. So how can we say that they are in substantial hardship in one scenario but not in the other?

“It’s an absurd outcome that the same person could be approved or declined for a credit product just because they applied for them in a particular order.”

The Fold Legal solicitor concluded: “Over time, the courts and AFCA may seek to align the obligations of all credit providers and brokers. In the meantime, ASIC has said it expects all credit licensees to apply the rule to existing credit cards by 1 July 2019.

“This means credit providers and brokers should consider the implications of this situation when determining how they will assess a credit card holder’s capacity to pay and substantial hardship for other loan applications.”

She urged any brokers unsure of how the rules affect their business or credit obligations to contact a lawyer.

Via Moody’s. On 21 May, the Australian Prudential Regulation Authority (APRA) announced a proposal to remove its requirement that banks use an interest rate floor of at least 7% in their assessment of mortgage serviceability. The proposal will help support credit growth and could stem falling house prices. The announcement also has the potential to increase household leverage. However, banks have progressively tightened mortgage underwriting practices, which will mitigate the risk of a resurgence in excessive credit growth and another house price boom.

Since December 2014, APRA has required banks to assess loan serviceability using the higher of either an interest rate floor of at least 7% or a 2% cent buffer over the loan’s interest rate. APRA also recommended that banks should operate above these minimum requirements, which resulted in most banks using a 7.25% floor and 2.25% buffer. Under APRA’s proposal, banks will be allowed to set their own interest rate floor, but will need to incorporate a buffer of at least 2.5%.

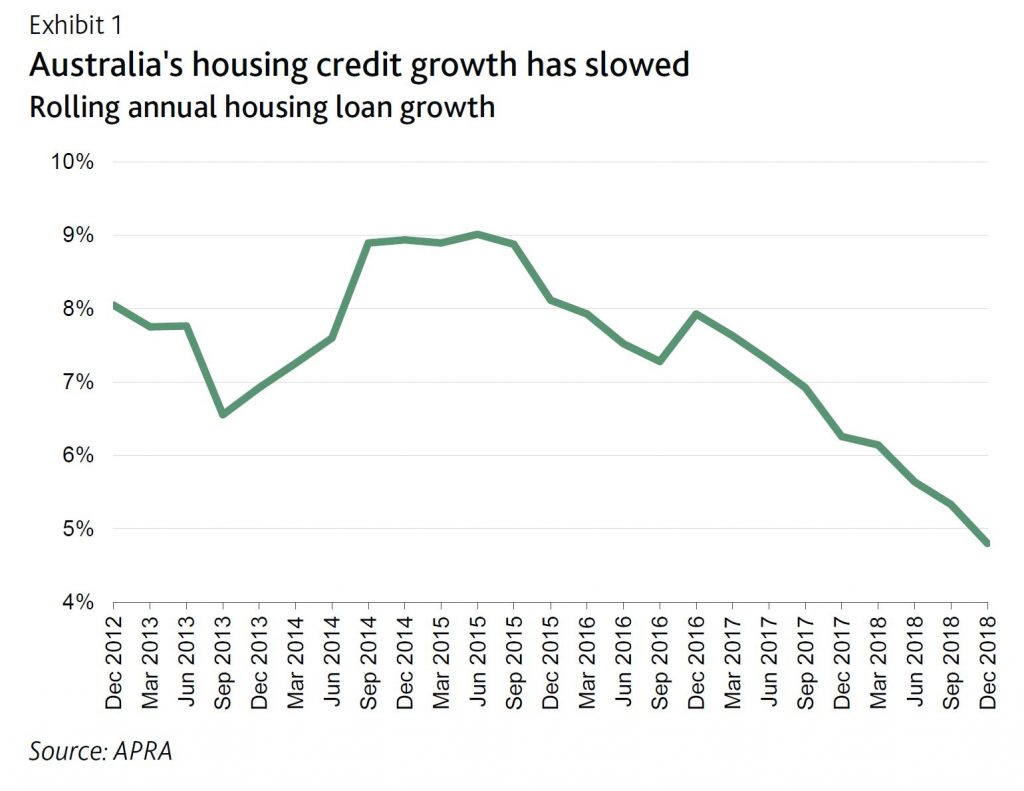

The proposal is likely to increase borrowing capacity, with some banks reporting that the interest rate floor has been a key contributor to the decline in borrowing capacity in recent years1. Improving access to credit will support credit growth for the banks, which has declined significantly from its peak in 2014 …

… and, in turn, stem the fall in house prices.

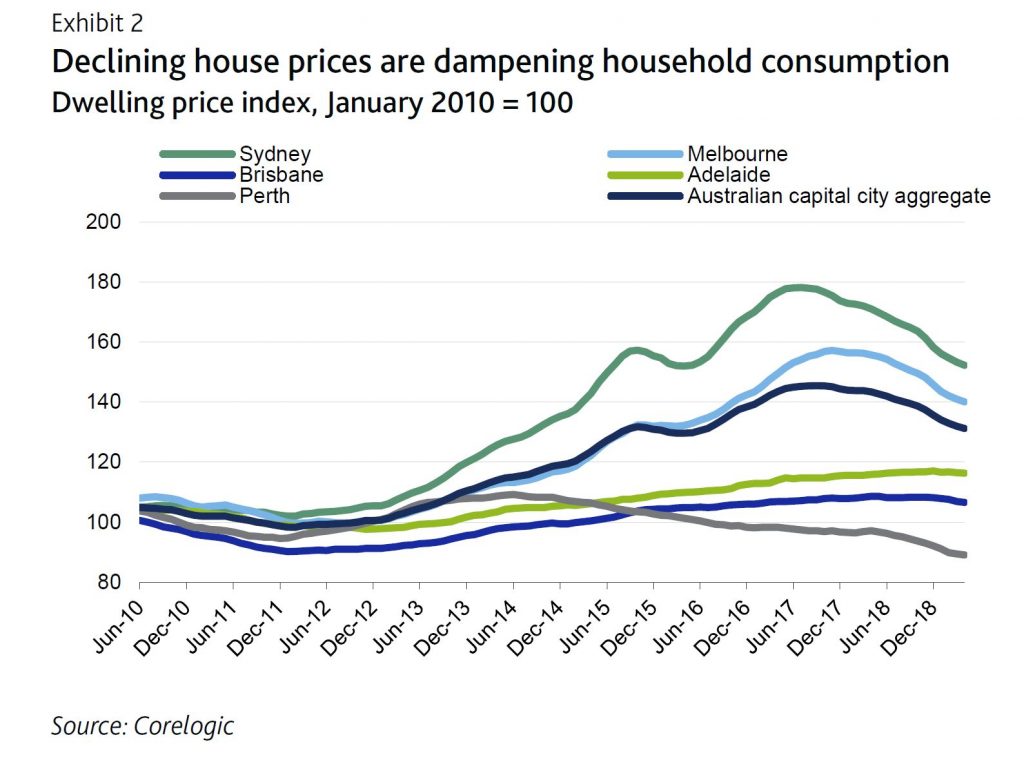

Falling house prices are dampening household consumption and contributing to a weaker growth outlook for Australia.

APRA said that a review of the interest rate floor was necessary because interest rates have declined since 2014 and are likely to remain at historically low levels for some time, which means that the gap between the 7% floor and actual rates paid on home loans may become unnecessarily wide. Furthermore, since the introduction of a single rate floor, banks have introduced differentiated pricing for mortgage products. This has resulted in the highest interest-rate buffer being applied on lower-priced and less-risky owner-occupier principle and interest loans, while the smallest buffer was being applied to investors with interest-only loans. Interest-only loans are generally more risky and attract a higher interest rate.

This proposal reflects the unwinding of APRA’s macroprucential policies that were progressively introduced from 2014, during a period of rapid growth in credit and housing prices. Such policies included interest-only lending restrictions that were removed in December 2018 and the removal of investor lending restrictions in April 2018. These restrictions had been in place since March 2017 and December 2014, respectively.

Despite declining house prices, high household leverage remains a key risk to Australian banks. And there is a risk that the lowering of the interest rate floor, in combination with the potential for the Reserve Bank of Australia to lower the cash rate later this year, could drive a resurgence in excessive credit growth and another house-price boom. However, banks have progressively tightened mortgage underwriting practices, which provides a strong mitigant to this risk. For example, banks have become increasingly focussed on the verification of a customer’s declared income and living expenses. This move has decreased borrower capacity and significantly

lengthened the mortgage application process. Banks have also developed limits on lending at high debt/income levels, where debt is greater than 6x a borrower’s income, and have introduced haircuts on uncertain and variable income, such as non-salary and rental income.

I discussed the recent changed market conditions on ABC Illawarra today.

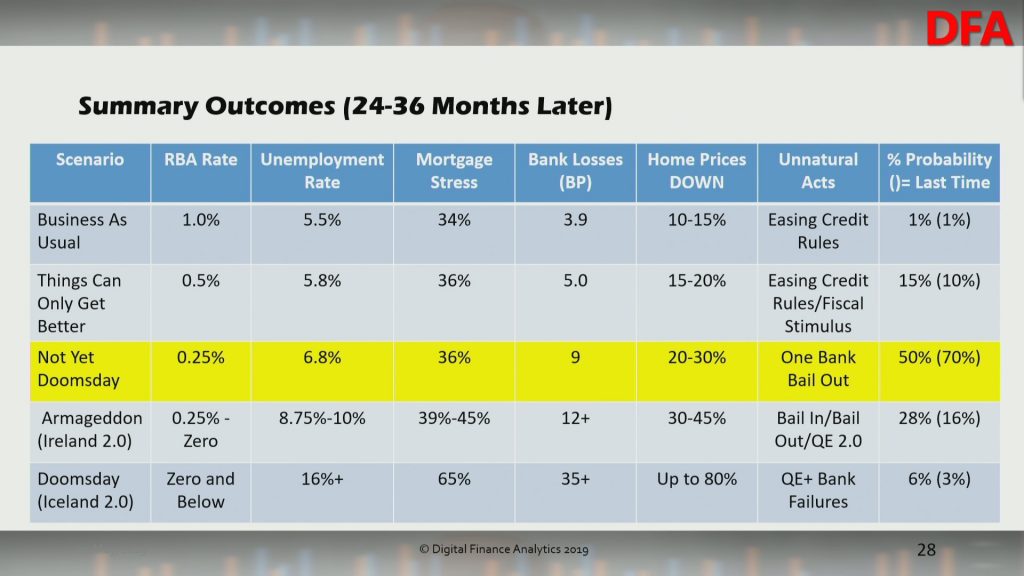

We ran the latest live Q&A session last night. One highlight was our updated scenarios. With the trade wars in play, the election results, RBA comments and APRA’s latest, the relative weighting for the scenarios have changed. Cash rates have been reduced, and bank losses adjusted.

Of course we have yet to get soundings from our household surveys as to whether buying intentions are changing; that will take a few weeks. And more unnatural acts might shift the results too.

You can watch the edited version of the event here:

Or the full show, including the live chat here: