I discuss the latest mortgage rates with Sally Tindall from RateCity.

Category: Economics and Banking

On The Mortgage Industry Front Line

I had the chance to discuss the current state of the mortgage industry with Founder and CEO of Hashching Mandeep Sodhi.

Our conversation covered the recent underwriting tightening, mortgage prisoners, how brokers are helping borrowers navigate the new rules, and the rise of digital channels.

Broker ‘misstatements’ drop but still ‘concerning’: UBS

A substantial reduction in reported “misstatements” was primarily due to a “material improvement” in the quality of loan applications submitted via the broker channel, according to a new UBS report; via The Adviser.

According to the investment bank’s latest Australian Banking Sector Update, which involved an anonymous survey of 1,008 consumers, there was a “sharp fall” in the number of “misstatements” reported in mortgage applications over the fourth quarter of 2018 (4Q18).

The survey revealed that 76 per cent of respondents reported that the mortgage applications were “completely factual and accurate”, up from 65 per cent throughout the first three quarters of 2018.

According to UBS, the improvement in lending standards was largely driven by the scrutiny placed on the industry by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, and not off the back of regulatory intervention.

“We believe this implies that despite the efforts of the regulators and banks to tighten underwriting standards from 2015 onwards, these appear largely ineffective,” UBS noted.

“Our survey suggests that improvements in factual accuracy in mortgage applications have only come in response to the royal commission.”

The bank stated that the improvement was spurred by a “material improvement” in quality of mortgages submitted through the broker channel.

The research found that 26 per cent of borrowers who applied for a mortgage via the broker channel in 4Q18 “misstated” their loan application, down from 41 per cent in previous quarters.

However, UBS noted that fewer borrowers reported misstatements in loans submitted via the propriety channel (19 per cent).

Despite the improvement, UBS claimed that it’s concerned about the 10 per cent of respondents that reported that their broker-originated applications were “partially factual and accurate”, which it considers a “low benchmark”.

Moreover, UBS stated that it continues to find that a “substantial number of applicants state that their mortgage consultant suggested that they misrepresent on their mortgage applications”.

According to the figures, of those who misstated their broker-originated loan applications, 40 per cent said that their broker suggested that they misrepresent their application, which UBS claimed implies that 15 per cent of all mortgages secured via the broker channel were “factually inaccurate following the suggestion of their broker”.

“This is concerning given the heightened scrutiny on the industry, in particular following findings of broker misconduct and broker fraud in the royal commission,” UBS added.

Additionally, the report noted that 15 per cent of respondents who misrepresented information in a broker-originated application said that they exaggerated their household income, and 31 per cent said that they under-represented their living costs.

Turnaround times

The UBS research also revealed that 63 per cent of respondents who submitted a loan application via the direct channel received approval for the mortgage in one week or less, compared to 48 per cent of respondents who submitted via the broker channel.

Further, UBS stated that 31 per cent of direct-channel applicants received approval for a mortgage in two to four weeks, compared to 43 per cent of those who applied for a loan through the broker channel.

However, the investment bank added that when examining the approval duration between those who were completely factual and accurate on their application and those that misstated, “there was no statistically significant difference in mortgage approval duration”.

Fees for no service: ASIC commences Federal Court action against NAB companies

ASIC has today commenced proceedings in the Federal Court of Australia against two entities in NAB’s wealth management division, NULIS Nominees (Australia) Limited (NULIS) and MLC Nominees Pty Ltd (MLC Nominees). The court proceedings relate to fees charged by both entities to a significant number of their superannuation members for services not provided.

ASIC alleges that NULIS and MLC Nominees (as the current and former superannuation trustee of NAB) misled members of MLC MasterKey Super products.

ASIC also alleges NULIS and MLC Nominees deducted approximately $33m Plan Service Fees from 220,000 members of MLC MasterKey Business and MLC MasterKey Personal Super who did not have Plan Adviser (No-Adviser Members). NAB also deducted approximately $67m Plan Service Fees from 300,000 members of MLC MasterKey Personal Super where Plan Advisers were not required to provide services and members did not receive services (or any services they could not otherwise obtain for free).

ASIC seeks from the Federal Court declarations of contravention and a civil penalty.

The commencement of this civil penalty action is part of ASIC’s broad-ranging and significant investigations currently underway into fee for no service failures in the financial services industry. Alongside these investigations ASIC is obtaining considerable remediation for impacted customers, currently estimated to exceed $850m.

ASIC alleges that MLC Nominees and NULIS:

- contravened s912A(1)(a) of the Corporations Act 2001 (Corporations Act) by failing to ensure that its financial services were provided efficiently, honestly and fairly when it deducted approximately $33m Plan Service Fees from 220,000 No-Adviser Members;

- made false or misleading representations to No-Adviser Members in contravention of ss 12DB, 12DA of the Australian Securities and Investments Commission Act 2001 (ASIC Act) and s1041H of the Corporations Act by representing that it was entitled to deduct the Plan Service Fee and the No-Adviser Member was obliged to pay it when there was no such obligation;

- contravened s912A(1)(a) of the Corporations Act when deducting approximately $67.1m Plan Service Fees from 300,000 members of MLC MasterKey Personal Super (Linked Members) in circumstances where it did not oblige Plan Advisers to provide services and members did not receive services;

- made false or misleading representations in contravention of s12DB and s12DA of the ASIC Act by not disclosing that Linked Members in MLC Masterkey Personal Super had the right to turn off the Plan Service Fee; and

- contravened s912A(1)(c) of the Corporations Act by failing to comply with financial services laws, including issuing defective disclosure documents within the meaning of s1022A of the Corporations Act and failing to exercise the degree of skill, care and diligence as a prudent trustee would exercise and failing to act in the best interests of members in breach of its general law duties and the Superannuation Industry (Supervision) Act 1993 when making the fee deductions and alleged misrepresentations to members.

Download

Background

Between October 2016 and June 2017, NULIS remediated No-Adviser Members approximately $35.9m (including interest and less fund tax of $6m).

NULIS also announced on 26 July 2018 that it would refund Linked Members with the total remediation expected to be approximately $87.1m (including interest and less fund tax of $15m).

ASIC also imposed, by consent, additional licence obligations on NULIS in January 2017 following its inquires in relation to several breach reports, including the Plan Services Fee.

ASIC has ongoing investigation in relation to Adviser Service Fees charged by NAB entities in relation to personal advice services.

Commonwealth Bank Dances The Same Tune By Upping Mortgage Rates

Commonwealth Bank of Australia has today announced it will increase its variable home loan rates, following a sustained increase in funding costs. All variable home loan rates will increase by 15 basis points from 4 October 2018.

- For owner occupiers, the standard variable home loan rate will increase to 5.37% per annum for customers with principal and interest repayments, and 5.92% per annum for customers with interest only repayments.

- For investors, the standard variable home loan rate will increase to 5.95% per annum for customers with principal and interest repayments, and 6.39% per annum for customers with interest only repayments.

Angus Sullivan, Group Executive Retail Banking Services Commonwealth Bank, said: “We have made this decision after careful consideration. We are very conscious of the impact that increasing interest rates will have on our customers, however it is important that we price our home loan products in a way that reflects underlying costs.

“Over the past six months, we have seen funding costs increase significantly, driven primarily by a rise in the 90 day Bank Bill Swap Rate. These changes have increased the cost of providing loans to our customers.

“We have absorbed these higher funding costs over the past six months in the hope that they would ease. Unfortunately, the costs have remained high and it is now expected that they will remain elevated for the foreseeable future.

“As a result of this, we have made the decision to raise our variable home loan rates to partially offset the increased costs. We understand this will have an impact on household budgets. To allow our customers time to prepare, this change will not take effect for four weeks, giving homeowners an opportunity to look at their options.

“For customers looking for more certainty around their mortgage repayments, we continue to offer a range of fixed rate options that may be suitable. These include a 3.79% per annum two year fixed rate for owner occupier customers, with principal and interest repayments, on our wealth package.

“We also encourage customers with interest only repayments to consider whether a lower rate principal and interest home loan would better meet their needs. Customers can switch online, in-branch or over the phone at no cost.

“Our customers can speak with one of our home lending specialists, who can review their home loan options free of charge, to ensure that their arrangements remain appropriate for their circumstances.”

The increase to our variable home loan rates will come into effect on 4 October 2018

ANZ Hikes Mortgage Rates

The music continues with ANZ announcing it will increase its variable interest home loan rates. This of course is the second of the big four banks to raise mortgages in response to higher funding costs.

Variable interest rates for home and residential investment loans will rise by 16 basis points (Westpac’s was 14 basis points), effective September 27. This means the declared rate for a principal and interest loan will now be 5.36%. That said, NO rise for ANZ home loan customers in drought-declared regional Australia are planned.

Fred Ohlsson, ANZ Group Executive Australia, says the decision to lift was a difficult one.

“We know the impact rising interest rates have on family budgets,” he says.

“The reality is it is more expensive for us to fund our home loans on wholesale markets and we also needed to balance the needs of all stakeholders.

“There is no change to the effective rates of our home loan customers in drought declared regional Australia benefiting more than 70,000 of our customers.

“We wanted to play our part in keeping cash in regional towns impacted by the drought and we hope this will also assist both families and small businesses in these areas.”

The new rates:

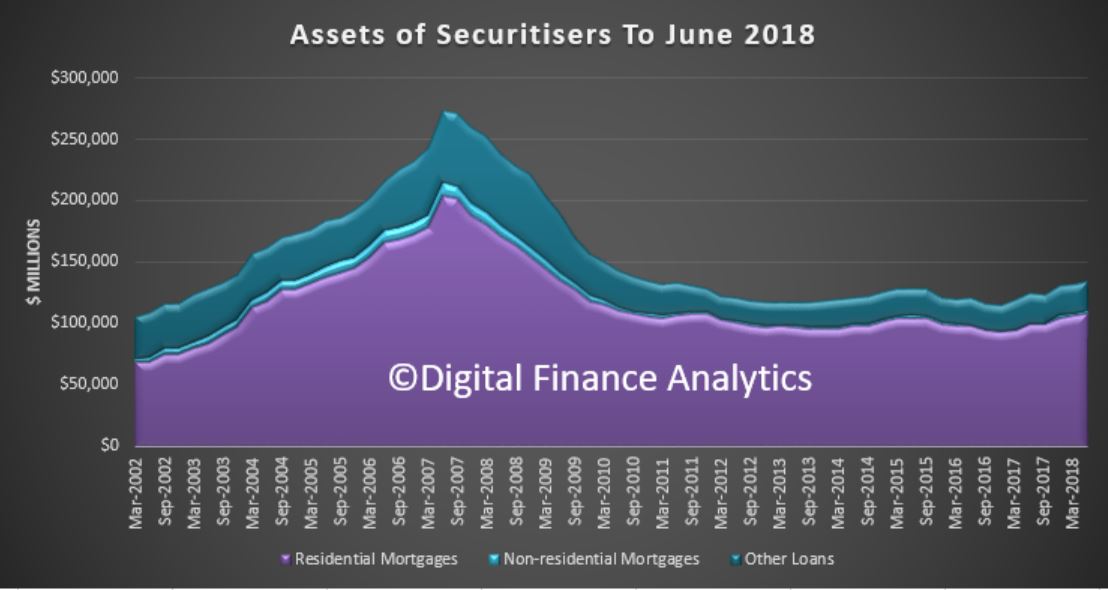

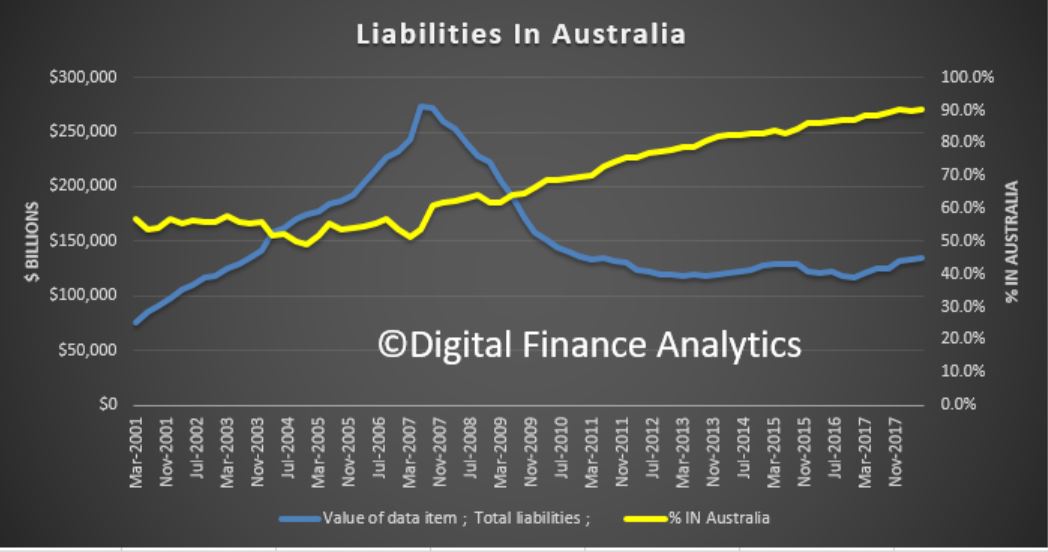

Securitised Mortgage Assets Rising

The ABS released their June 2018 data today relating the securitised loans in Australia “Assets and Liabilities of Australian Securitisers“.

In the past year residential mortgages securitised rose by 8.9% to $108.8 billion. Overall securitised assets rose by 8.2%, which shows mortgage assets grew stronger than system.

This reflects what we have seen in the market with non-bank and some bank lenders using this funding channel. The rise of non-bank securitisation is a significant element in the structure of the market. As major lenders throttle back their lending standards, more higher risk loans are moving into the non-bank and securitised sectors. Of course a decade ago it was the securitised loans which took lenders down in the US and Europe.

This reflects what we have seen in the market with non-bank and some bank lenders using this funding channel. The rise of non-bank securitisation is a significant element in the structure of the market. As major lenders throttle back their lending standards, more higher risk loans are moving into the non-bank and securitised sectors. Of course a decade ago it was the securitised loans which took lenders down in the US and Europe.

The growth we are seeing here is in our view concerning, bearing in mind the more limited regulatory oversight. Plus. on the liabilities side of the balance sheet, around 90% of the securities are held by Australian investors, a record.

This includes a range of sophisticated investors, including super funds, wealth managers, banks, and high-net worth individuals. But the point to make is that if home price falls continue, the risks in the securitised pools will grow, and this risk is fed back to the investor pools.

This includes a range of sophisticated investors, including super funds, wealth managers, banks, and high-net worth individuals. But the point to make is that if home price falls continue, the risks in the securitised pools will grow, and this risk is fed back to the investor pools.

Another risk-laden feedback loop linked to the housing sector, and one which is not fully disclosed nor widely understood. The fact that the securitised pools are rated by the agencies does not fill me with great confidence either!

Getting To Grips With Responsible Lending

Given all the interest in the lending practices across the sector, we have launched a series of DFA video shows on the critical issues surrounding Responsible Lending.

In the series we will look at why responsible lending is so important (for households, industry players and the broader economy), what lessons we did – or should have learnt following the GFC, how changes are likely to play out ahead, and how advice for lending services compares with wealth advice.

Principal at DFA Professor Gill North will lead the shows. The first is an overview of the series and the key themes we will address.

Gill has written widely in this area, and you can access her work via SSRN or though Deakin University

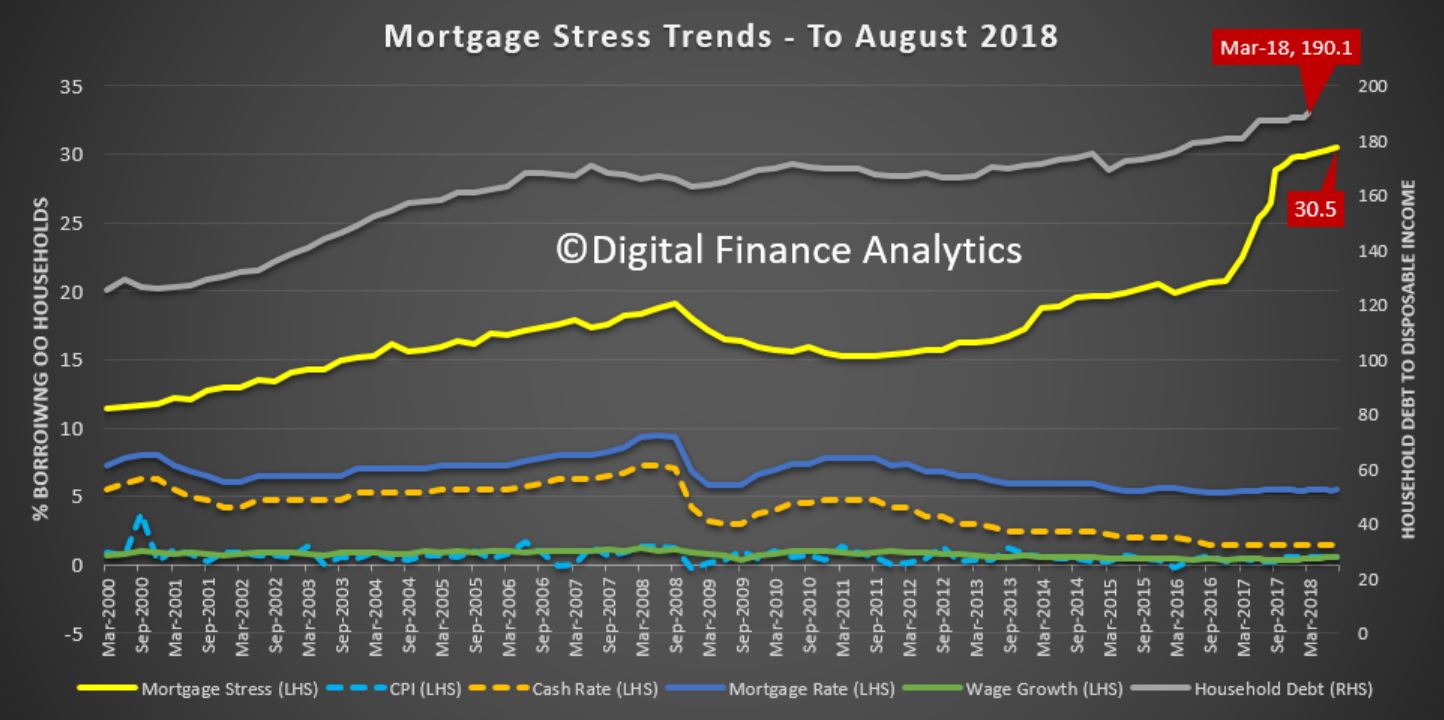

Mortgage Stress Continues To Build In August 2018

Despite the “good news” from the GDP numbers yesterday, our latest mortgage stress report, to end August 2018 continues to track higher.

The latest RBA data on household debt to income to March reached a new high of 190.1[1]. On Tuesday, the RBA said ”One continuing source of uncertainty is the outlook for household consumption. Household income has been growing slowly and debt levels are high”; and last week “the main risks to financial stability will most likely continue to relate to credit quality. Notably, banks’ large exposure to a potential deterioration in housing loan performance is expected to remain a key issue”.

The latest RBA data on household debt to income to March reached a new high of 190.1[1]. On Tuesday, the RBA said ”One continuing source of uncertainty is the outlook for household consumption. Household income has been growing slowly and debt levels are high”; and last week “the main risks to financial stability will most likely continue to relate to credit quality. Notably, banks’ large exposure to a potential deterioration in housing loan performance is expected to remain a key issue”.

Our analysis of household finance confirms this and the latest responsible lending determinations also highlight the issues.

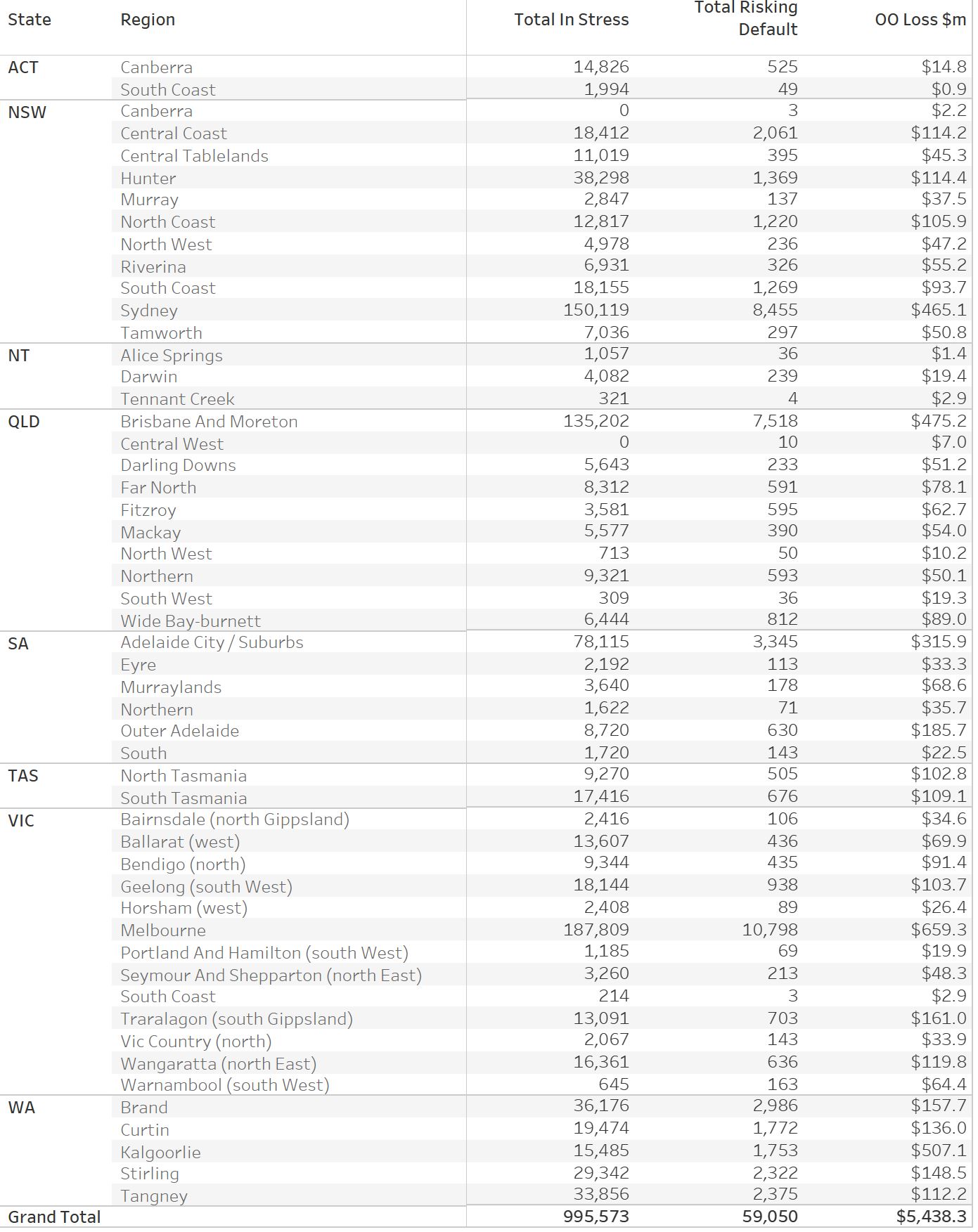

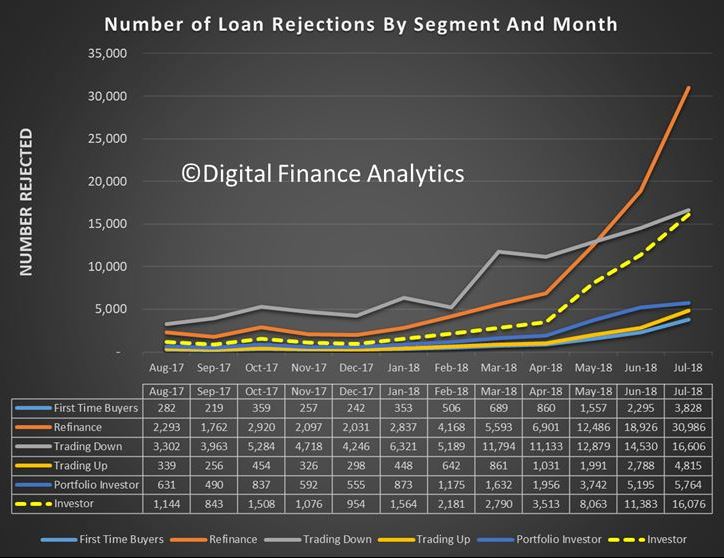

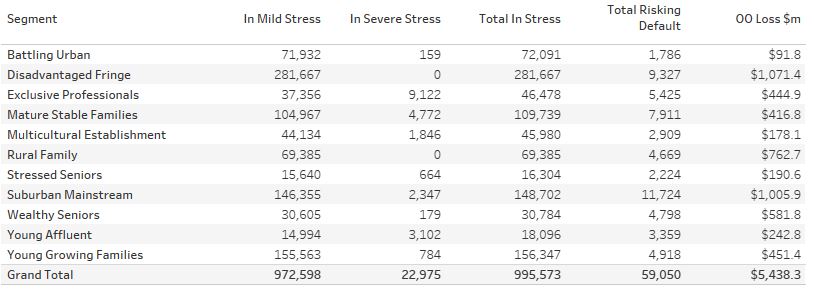

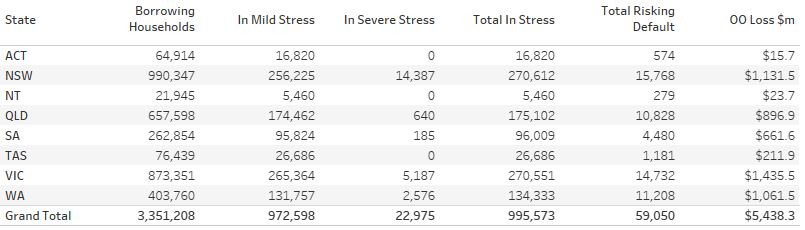

So no surprise to see mortgage stress continuing to rise. Across Australia, more than 996,000 households are estimated to be now in mortgage stress (last month 990,000). This equates to 30.5% of owner occupied borrowing households. In addition, more than 23,000 of these are in severe stress. We estimate that more than 59,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Recent events, such as the lift in some mortgage rates, the latest council rate demands, rising fuel costs and flat incomes continue to hit home”. In addition, as home prices are falling in some post codes, the threat of negative equity is now rearing its ugly head.

The fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. As we reported recently, up to 40% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings.

Continued rises in living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances. The June 2018 household savings ratio, just reported, shows a further fall, at 1%. The ABS says [2] “moderate growth in household disposable income coupled with strength in household consumption resulted in a decline in the household saving ratio to 1.0 per cent, recording its lowest rate since December 2007”.

Continued rises in living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances. The June 2018 household savings ratio, just reported, shows a further fall, at 1%. The ABS says [2] “moderate growth in household disposable income coupled with strength in household consumption resulted in a decline in the household saving ratio to 1.0 per cent, recording its lowest rate since December 2007”.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to end August 2018. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by The Numbers.

Stress by The Numbers.

Regional analysis shows that NSW has 270,612 households in stress (267,298 last month), VIC 270,551 (279,207 last month), QLD 175,102 (174,137 last month) and WA has 134,333 (132,035 last month). The probability of default over the next 12 months rose, with around 11,200 in WA, around 10,800 in QLD, 14,700 in VIC and 15,800 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.43 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 5.1 basis points, which equates to $744 million from Owner Occupied borrowers.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.43 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 5.1 basis points, which equates to $744 million from Owner Occupied borrowers.

The Numbers in Context (Responsible Lending).

As indicated in our report last month, mortgage stress does not occur in a vacuum. The revelations from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (the Commission) have highlighted deep issues in the regulatory environment that have contributed to the household debt “stress bomb”. The Commission will report on an interim basis this month and its commentary on the finance sector and the regulatory structure are likely to be scathing.

Gill North, a principal of DFA and a professor of law at Deakin University “does not expect the Commission to propose major reforms to the responsible lending rules. Instead, she predicts the Commission will consider a range of mechanism to enhance compliance with the existing rules. Conversely, Gill expects the Commission will recommend significant reforms to the law governing mortgage brokers, including some form of best interest duty that requires credit intermediaries to prioritise the interests of the customer when potential conflicts arise.”

The Commission is unlikely to change the responsible lending rules because these regimes have been successfully enforced by ASIC, including actions against the largest banks. For example, in early 2018, a case against the Australia and New Zealand Banking Group was successful, and on the 4th September an action against Westpac was settled prior to the commencement of the court hearing.

In the case against ANZ, the Federal Court found that in respect of 12 car loan applications from three brokers, ANZ failed to take reasonable steps to verify the income of the consumer and relied solely on purported pay slips in circumstances where ANZ knew that the pay slips were a type of document that was easily falsified. The Court indicated that ‘income is one of the most important parts of information about the consumer’s financial situation in the assessment of unsuitability, as it will govern the consumer’s ability to repay the loan’.

The litigation against Westpac concerned the use of an automated decision system to assess home loans during the period December 2011 and March 2015. Under this automated system, Westpac used a benchmark Household Expenditure Measure when assessing approximately 50,000 home loans, instead of actual expense information, and in these instances, the actual expenses were higher than the benchmark estimate. In addition, for approximately 50,000 home loans, Westpac used the incorrect method when assessing a consumer’s capacity to repay a home loan at the end of the interest-only period. Westpac has admitted contraventions of the National Consumer Credit Protection Act 2009 (Cth) and the parties have submitted a statement of agreed facts to the Federal Court.

These cases and other responsible lending actions consistently confirm the need for all lenders to collect and verify a customer’s actual income and expenses. The nature and scope of these obligations are highlighted in ASIC’s Regulatory Guide 209 on responsible lending conduct. This regulatory guide indicates that the obligation for lenders to make reasonable inquiries is scalable and the steps required will vary. For example, more extensive inquiries are necessary when potential negative consequences for the consumer are great, the credit contract has complex terms, the consumer has limited capacity to understand the contract, or when the consumer is a new customer.

A Fuller Regional Breakdown is Set out Below.

[2] 5206.0 Australian National Accounts: National Income, Expenditure and Product

[1] RBA E2 Household Finances – Selected Ratios March 2018

You can request our media release. Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The August 2018 Stress Release’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The August 2018 Media Release’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=”Comment If You Like” type=”textarea”/][/contact-form]

Note that the detailed results from our surveys and analysis are made available to our paying clients.

ASIC prescribes three-year period for credit card responsible lending assessments

Following consultation, ASIC has set a three-year period to be used by banks and credit providers when assessing a new credit card contract or credit limit increase for consumers.

ASIC has prescribed a three-year period to strike an appropriate balance between:

- preventing consumers from being in unsuitable credit card contracts, and

- ensuring that consumers continue to have reasonable access to credit through credit card contracts.

In July 2018 ASIC released Consultation Paper 303 Credit cards: Responsible lending assessments (CP 303), which outlined the proposal to prescribe a period of three years for responsible lending assessments. The consultation paper suggested this period would apply to all classes of credit card contracts.

Today ASIC published a feedback report (REP 590) which outlines the submissions received and ASIC’s responses. ASIC Credit (Unsuitability-Credit Cards) Instrument 2018/753 has also been created.

In REP 590 ASIC provides further guidance on the assumptions that should be made when assessing whether a consumer can repay the credit limit within three years. This includes guidance on:

- fees on credit card accounts

- interest rates charged on credit card contracts held with other credit providers, and

- the effect of the reform on responsible lending assessments for other credit products.

The new legal requirement commences on 1 January 2019. Credit providers are expected to have systems in place to ensure that that they can meet the new obligations.

The revised obligations will apply to licensees that provide credit assistance and licensees that are credit providers for both new credit card contracts and credit limit increases under existing credit card contracts. ASIC will monitor the prescribed period and our guidance to ensure that it is achieving the goals of the reform.

Background

In March 2018 the Government implemented reforms in response to the Senate Economics References Committee report relating to credit card interest rates. As part of the reforms, responsible lending obligations were amended to require that a credit card contract or credit limit increase must be assessed as unsuitable if it is likely that the consumer would be unable to repay the credit limit within a period prescribed by ASIC.

The purpose of this reform is to make sure that consumers can afford to repay their credit card debts within a reasonable period. Consumers will still retain the flexibility to make low minimum repayments on credit cards.

In July 2018 ASIC released Report 580 Credit card lending in Australia (REP 580), which contained our findings that more than one in six consumers are struggling with credit card debt, and that lenders could do more to take proactive steps to address persistent debt, low repayments or poorly suited products. We also found that in the 12 months to June 2017, $621 million could have been saved if consumers who regularly incur interest charges had used a lower rate card.

In REP 580 ASIC flagged that it would publicly report on the credit providers who do and don’t respond to the findings and this will occur later in 2018.

ASIC received 15 submissions in response to CP 303. ASIC thanks the people, businesses and associations that took the time to provide comments on our proposal.