Another big week of finance and property news, so we pick over the bones and try to make sense of what’s going on. And we ask were the Regulators asleep at the wheel?

Welcome to the Property Imperative weekly to 28th October 2017. Watch the video or read the transcript.

Welcome to the Property Imperative weekly to 28th October 2017. Watch the video or read the transcript.

We start this week’s review with a look at the latest economic data. The latest GDP read from the US, at 3.1% annualised, in Q2 and 3.0% in Q3, provides more support to the view the FED will lift their benchmark rate again before the end of the year. This is likely to have a flow on effect by rising rates in the international capital markets, which will mean higher bank funding costs here, as well as putting downward pressure on the toppy stock market. To confirm this view, we saw the benchmark 10-year Treasury Bond Yield in the USA rose to its highest rate in several months.

In Australia, the ABS said the CPI was 0.6 per cent in the September quarter 2017 following a rise of 0.2 per cent in June. The most significant price rises were electricity (+8.9%), tobacco (+4.1%), international holiday travel and accommodation (+4.1%) and new dwelling purchase by owner-occupiers (+0.8%). These rises were partially offset by falls in vegetables (-10.9%), automotive fuel (-2.3%) and telecommunication equipment and services (-1.5%). The CPI rose 1.8 per cent through the year to September quarter 2017 having increased to 1.9 per cent in the June quarter 2017, below the RBA’s 2-3% target band.

The RBA’s Guy Debelle spoke about some of the uncertainties in taking the economic temperature in Australia. He homed in on the CPI data from the ABS, making the point that our belated quarterly CPI reports are out of kilter with the monthly data now provided in many other western countries. In addition, the ABS will be revising their expenditure weightings in the CPI series, which means that CPI may currently be over stated by perhaps a quarter of a percent. These revisions are made every 5 or 6 years, although there are plans afoot to make them more frequently. The ABS is under tremendous funding pressure, and there are risks their critical data series may be compromised.

The National Accounts data from the ABS for the year 2016-17 really brought home how much of the growth in the economy was thanks to household consumption, as opposed on business or government investment. This helps to explain why the RBA was willing to let household debt escalate to their current astronomical levels, why rates are so low, and why the property sector is so important. In summary, overall growth was 2%, the lowest since 2008-9; wages rose 2.1%, the weakest since 1991-2; growth in household expenditure as measured in current price terms was 3.0%, the lowest on record; the household saving ratio was at its lowest point (4.6%) in nine years and yet household consumption was the strongest growth driver at 1.22 percentage points.

This was because households borrowed an additional $990 billion over the 10 year period from 2006-07, mainly in mortgages. The value of land and dwellings owned by households increased by $2.9 trillion over the same period and increased by $621 billion through 2016-17 and despite slow wage growth, household gross disposable income plus other changes in real net wealth increased $456.6 billion, or 32.6%, in 2016-17, largely due to a $306.5 billion appreciation in the value of land held by households.

But of course, such high debt and high property prices are now creating fault lines in the property market and household finances.

We are seeing more risks in the property investment sector. Traditionally, in the Australian context, loans to property investors have tended to perform better than loans to owner occupiers. This is because investors receive rental income streams to help pay for the mortgage costs, they are willing to carry the costs of the property against future capital gains, and many will be able to offset costs against tax, especially when negatively geared. In addition, occupancy rates in most states have been stellar.

But things are changing, as the costs of borrowing for investment purposes have risen (thanks to the banks’ out of cycle rises), while rental returns are flat, or falling and the costs of managing the property are rising. In addition, the supply of investment property is rising, and occupancy rates are declining in a number of key markets. As a result, more investors are seeing net rental yields – after mortgage payments and other costs drifting into negative territory, especially in VIC and NSW. Our Core Market Model, and recent data from ANZ suggests defaults from the property investment sector are now running at similar levels to owner occupied borrowers, and are set to rise further.

In fact, the ANZ full year result, which superficially looked strong – up 18% on the prior comparable period – contained a number of negative trends, as they focus more on the retail business in Australia and New Zealand. Yes, they have a strong balance sheet, as capital is released from their assets sales, and provisions were down; but the underlying net interest margin fell, down 8 basis points on last year to 1.99%, with a fall of 2 basis points in 2H, despite the mortgage book repricing and loan switching. In addition, 90-Day mortgage defaults overall remained similar to last year, but with a spike in WA and a fall in VIC/TAS. Investment loan delinquencies are rising, whereas they have traditionally been lower than OO loans. They have recently tightened underwriting standards, but of course loans already on their books have looser standards. They warn “household debt and savings have both increased, however the ability for households to withstand economic shocks has diminished a little”. “In 2018 we expect the revenue growth environment for banking will continue to be constrained as a result of intense competition and the effect of regulation including a full year of impact of the Australian bank tax.”

Our own analysis of default probability, from our Core Market Model, now includes 90-day default risk modelling. We measure mortgage stress on a cash flow basis – the October data will be out next week – and we also overlay economic data at a post code level to estimate the 30-day risk of default (PD30). But now we have added in 90-day default estimates (PD90) and the potential value which might be written off, measured in basis points against the mortgage portfolio. We also calibrated these measures against lender portfolios. Granular analysis can provide a rich understanding of the real risks in the portfolio. Risks though are not where you may expect them! If we look at the results by state, WA leads the way with the highest measurement, then followed by VIC, SA and QLD. The ACT is the least risky area. In WA, we estimate the 30-day probability of default in the next 12 months will be 2.5%, 90-day default will be 0.75% and the risk of loss will be around 4 basis points. This is about twice the current national portfolio loss, which is sitting circa 2 basis points.

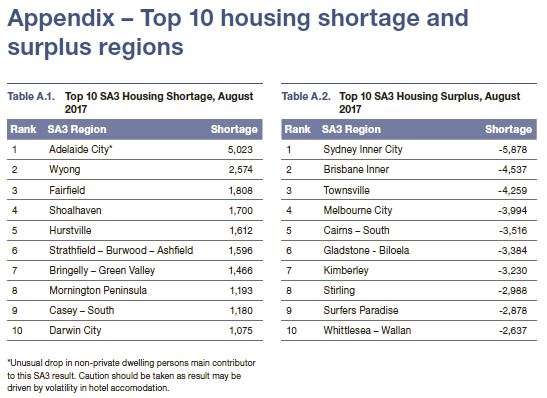

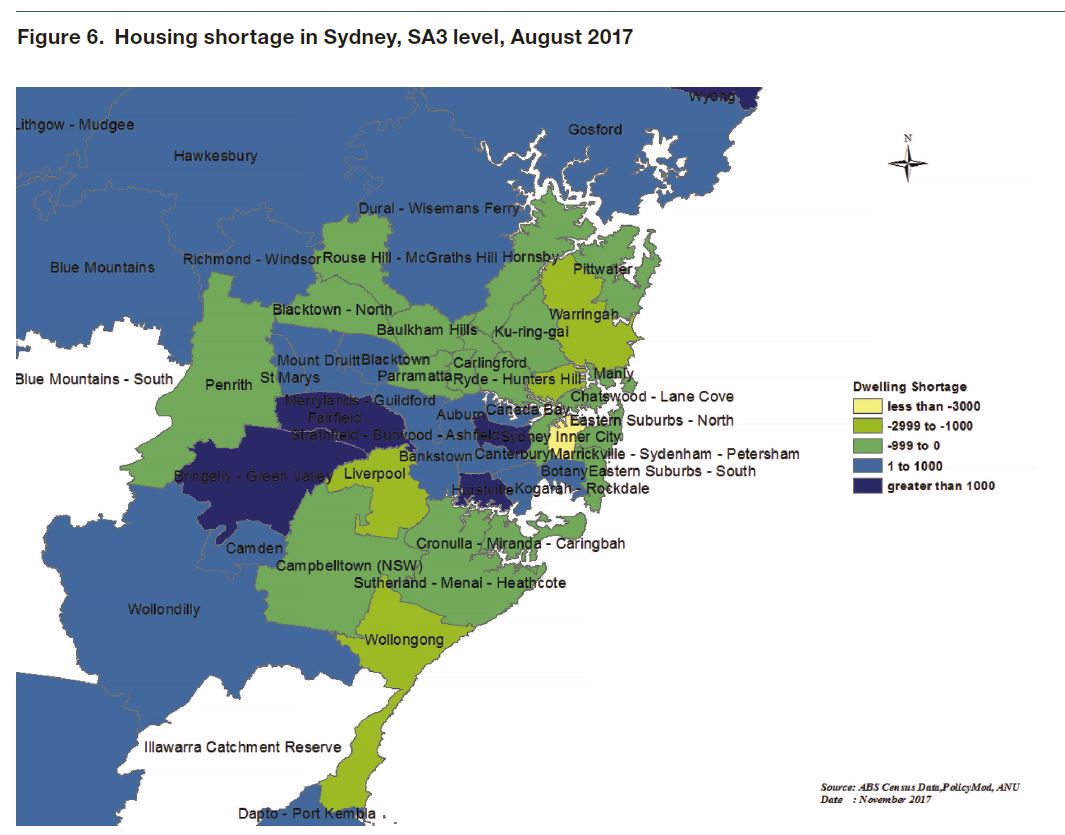

Banks are cracking down on loans to borrowers buying into Brisbane’s over-supplied apartment market, with a number of risky postcodes identified, which require bigger deposits. The four major banks – Westpac, Suncorp, Australia and New Zealand Banking Group (ANZ), and National Australia Bank (NAB) – are restricting lending for certain Brisbane postcodes, where apartment buyers will now be required to have a deposit of up to 20% to qualify for a home loan. Suncorp has blacklisted nearly 40 postcodes in the Queensland capital, including Inner Brisbane, Teneriffe, Fortitude Valley, Bowen Hills, and Herston. The banks are refusing to loan more than 80% of the cost of a unit due to “[weaknesses] in the investment market” as well as the current oversupply in inner-city apartments. Prices for apartments in Inner-Brisbane have dropped to their lowest level in three years.

QBE’s Housing Outlook, published this week, suggests home price growth will slow further in the years ahead. We continue to see appetite from property investors easing, as property price growth stalls or in some states reverse. Banks on the other hand are chasing new business with deep discounts on new loans. For example, Teachers Mutual cut their rate for new loans by 30 basis point, to 3.84%. Westpac, St George, BankSA and Bank of Melbourne all introduced promotional discount rates, with rates down by up to 20 basis points. Bank West also offered discounts to both new owner occupied and investor borrowers. So, the war chests created by the back book repricing earlier in the year – especially investor and interest loans are being used to target new business. As a result, we expect to see a hike in refinancing, especially in the lower LVR owner-occupied sector, as borrowers seek to reduce their monthly outgoings.

We also showed that more households seeking a mortgage are generating multiple applications, sometimes direct to a bank, and sometimes via mortgage brokers, as they seek to find the best deals. More applications are made via online systems, which make the process easier, but the net result of all this is that mortgage conversation rates have fallen from around 80% to 50%, creating more noise, and costs in the system. We think this is a direct results of the banks’ so called omni-channel approach to distribution, which will turn out to be quite costly.

Following the concerns expressed recently by RBA and ASIC on the risks to household finances, finally, we got an admission from APRA that mortgage lending standards have decayed over the last decade, and that they needed to take action to reverse the trend. And now they are looking at debt-to-income. Poor lending standards, they say are systemic, driven by completion, and poor bank practices. They recently intervened (a little). And late to the piece (now) debt-to-income is important. Did you hear the door slamming after the horse has bolted?

The Treasury added their voice this week, when John Fraser, Secretary to the Treasury, gave an update on household finances and housing as part of his opening statement to the October 2017 Senate Estimates. He expressed the view that debt is born by those with the greater capacity to repay but this belies the leverage effect of larger loans in a rising interest rate environment. He said that “while banks’ progress against these measures has been positive, regulators will need to think carefully about whether future efforts to maintain financial stability should lean against cyclical excesses or address structural risks within the financial system”.

So, we have the full Monty, with all four members of the shadowy “Council of Financial Regulators” expressing concerns about household debt and home price risks. A completed change of tune from the declarations of 2015 when everything was said to be just dandy!

Now those following this blog over the past few years will know we have been flagging these concerns, especially as the cash rate was brought to its all-time low. We said DTI was critical, that standards should be tightened, and the growth of debt to income was unsustainable.

All members of the “Council of Financial Regulators” which is chaired by the RBA are culpable. This body, which works behind the scenes, is referred to when hard decisions need to be take. If you look back at recent APRA and RBA statements, the Council gets a Guernsey! The problem is there has been group-think for year, driven by the need to use households as a growth proxy for the failing mining and resource sector. And no clear accountability. But too little has been done, too late. And it is poor old households who, one way or the other will pick up the pieces – not the banks who have enjoyed massive profit and balance sheet growth. Even now, lending for housing is growing three time faster than incomes or cpi. Regulators are now lining up to call out the problems. Managing the risk going forwards is a real challenge. It’s time to review the regulatory structure and remember that the Financial System Inquiry recommended the creation of a new Financial Regulator Assessment Board to assess the performance of the regulatory framework, but this was rejected by the Government! That could prove to be a costly mistake.

And that’s the Property Imperative Weekly to 28th October 2017. If you found this useful, do leave a comment below, subscribe to receive future updates and check back next week for the next installment.

You can listen to the discussion.

You can listen to the discussion.