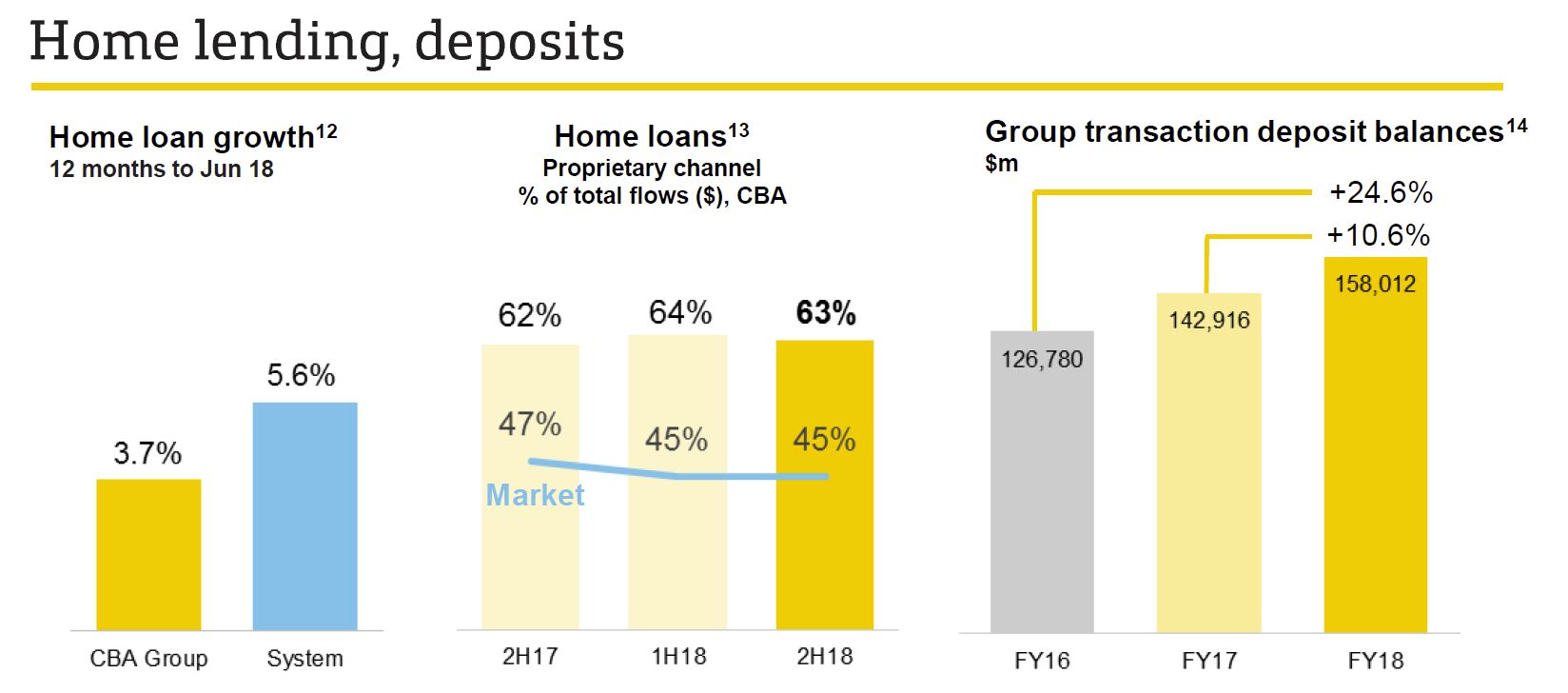

In the CBA’s full-year 2018 (FY19) financial results, released yesterday, the share of new home loans originated by brokers dropped from 43 per cent in FY17 to 41 per cent in FY18, as they focus on “their core market”.

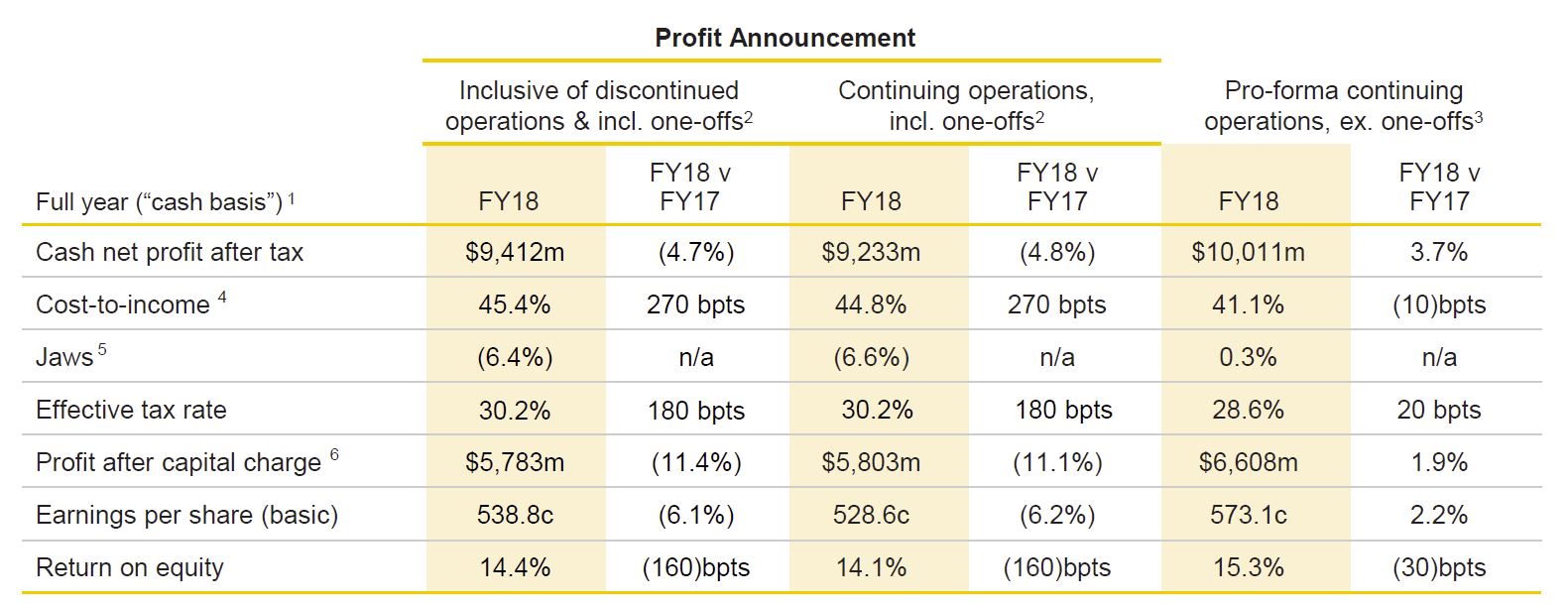

CBA’s net profit after tax (NPAT) also took a hit over FY18, falling by 4.8 per cent to $9.23 billion, the first profit decline in 9 years. NIM was lower in the second half.

CBA’s net profit after tax (NPAT) also took a hit over FY18, falling by 4.8 per cent to $9.23 billion, the first profit decline in 9 years. NIM was lower in the second half.

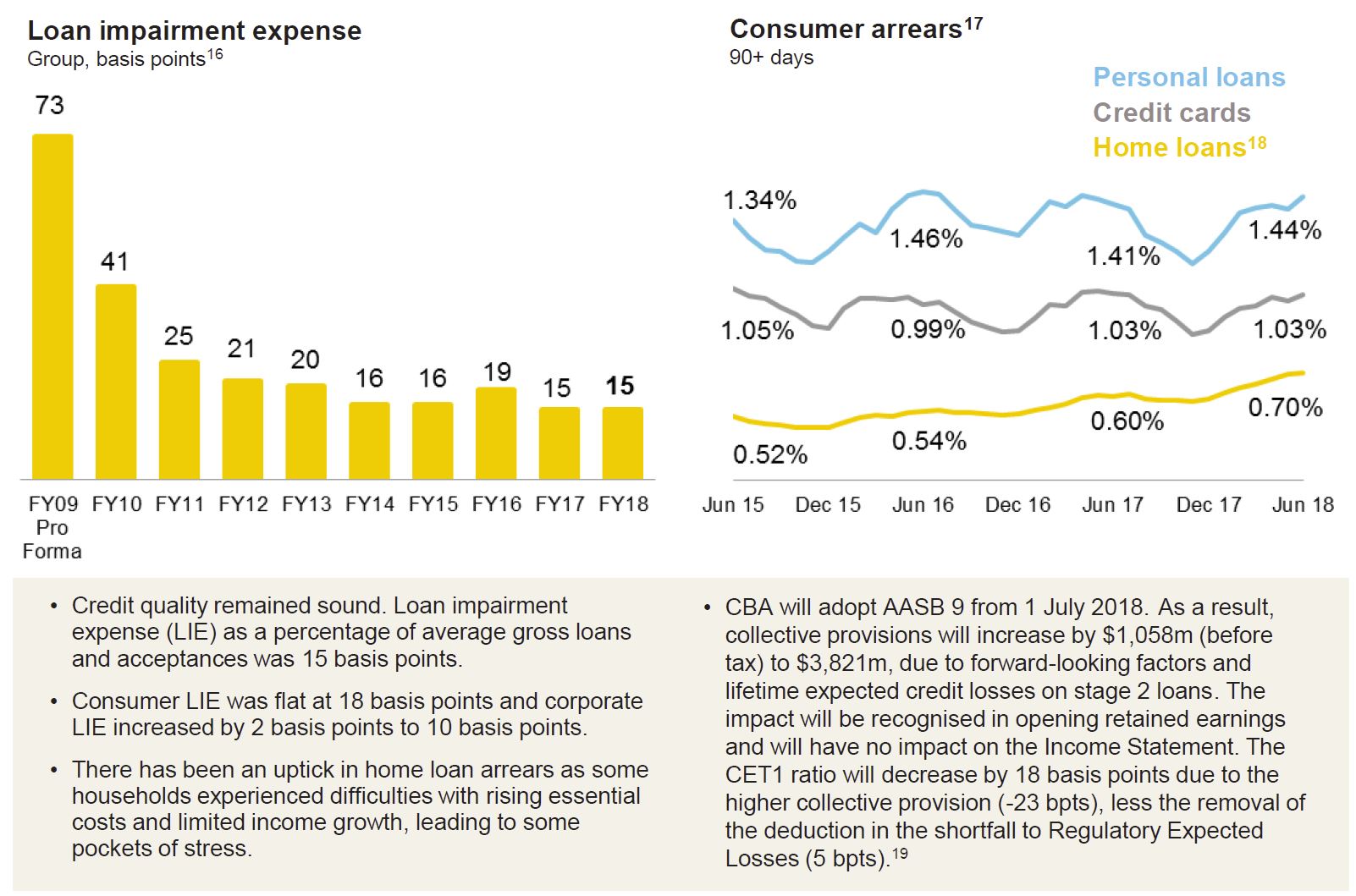

They warned of higher home loan defaults “as some households experienced difficulties with rising essential costs and limited income, leading to some pockets of stress”.

CEO Matt Comyn attributed the decline in profit growth to “one-off” payments, which included CBA’s $700 million AUSTRAC penalty, the $20 million settlement paid to ASIC for alleged bank bill swap rate (BBSW) rigging, and $155 million in regulatory costs incurred from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

CEO Matt Comyn attributed the decline in profit growth to “one-off” payments, which included CBA’s $700 million AUSTRAC penalty, the $20 million settlement paid to ASIC for alleged bank bill swap rate (BBSW) rigging, and $155 million in regulatory costs incurred from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

“There has been a number of one-off items that have impacted the result, including a couple of large penalties that we have resolved. If you strip some of those out, actually the result looks more from an underlying perspective up 3.7 per cent,” Mr Comyn said.

We discussed the results in our latest video.

The number of broker-originated loans as a proportion of all new business settled by the major bank has dropped alongside a fall in residential lending.

Over the same period, the total number of home loans settled by CBA also dropped from $49 billion in FY17 to $45 billion in FY18.

The bank’s overall mortgage portfolio now totals $451 billion, with the share of broker-originated loans slipping from 46 per cent in FY17 to 45 per cent in FY18.

In its presentation notes, CBA made specific reference to the bank’s focus on its “core market” of owner-occupied lending through its propriety channel, with the number of loans settled through its direct channel rising from 57 per cent to 59 per cent in FY18, and the share of new owner-occupied mortgages also growing from 67 per cent to 70 per cent.

In its presentation notes, CBA made specific reference to the bank’s focus on its “core market” of owner-occupied lending through its propriety channel, with the number of loans settled through its direct channel rising from 57 per cent to 59 per cent in FY18, and the share of new owner-occupied mortgages also growing from 67 per cent to 70 per cent.

The share of investor loans settled by CBA over FY18 declined from 33 per cent to 29 per cent, now making up 32 per cent of the major bank’s mortgage portfolio.

Interest-only lending fell sharply over FY18, falling by 18 per cent from 41 per cent of new loans settled in FY17 to 23 per cent in FY18.

The proportion of new loans settled with variable rates increased in FY18, from 85 per cent to 86 per cent (81 per cent of CBA’s portfolio).

CBA CEO Matt Comyn attributed the fall in the bank’s home lending to risk and pricing adjustments introduced by the lender over the financial year.

“[We] have been prepared to make some choices from both a risk and pricing perspective, which has seen us grow below system in home lending,” the CEO said.

“We will continue to make the right choices from volume and margin as we think about our home lending business. But overall, the core franchise of the retail bank has continued to perform well.”

Mr Comyn also claimed that despite slowing credit and housing conditions, he expects the bank to generate 4 per cent credit growth in FY19 and noted that CBA would not be looking to make any further changes to its lending policy.

“Consistent with the remarks from the chair of APRA, we see that the majority of the tightening work has been done, certainly at the margin, and there’s certainly some potential in the application of those policy changes,” the CEO continued.

“[We] certainly don’t see any big policy adjustments on the horizon. We feel like that 4 per cent credit growth, given what we’re seeing at the moment in the system, is about right, and of course, it’ll be a function of our performance against that system.”