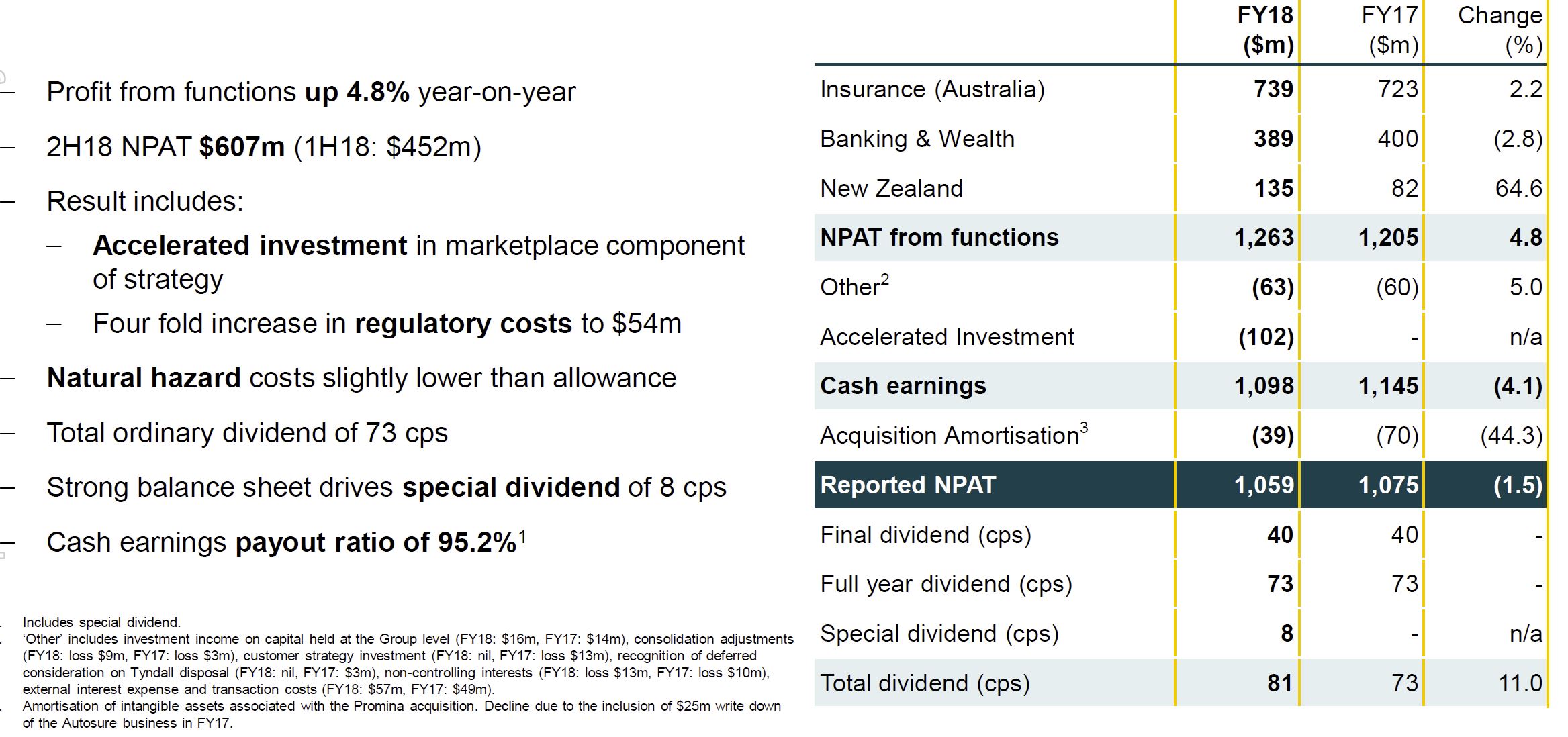

Suncorp has announced a net profit after tax (NPAT) of $1,059 million, a 34 per cent uplift on the first half of 2018.

However, this is 1.5% lower than the FY17 result, which they say was driven by the accelerated investment in the strategy. Actually, given the complexity of the market, and their business, I think they are doing rather well!

However, this is 1.5% lower than the FY17 result, which they say was driven by the accelerated investment in the strategy. Actually, given the complexity of the market, and their business, I think they are doing rather well!

The Board has declared a final ordinary dividend of 40 cents per share and a special dividend of 8 cents per share. This brings the total dividend for 2017-18 to 81 cents per share, fully franked. Total dividend to investors in FY18 is up 11 per cent on the prior year.

The Board has declared a final ordinary dividend of 40 cents per share and a special dividend of 8 cents per share. This brings the total dividend for 2017-18 to 81 cents per share, fully franked. Total dividend to investors in FY18 is up 11 per cent on the prior year.

Suncorp said the result was driven by stronger second half performance, reflecting the early benefits of the strategy. The Business Improvement Program exceeded target by $30m. Digitisation of the business continues apace.

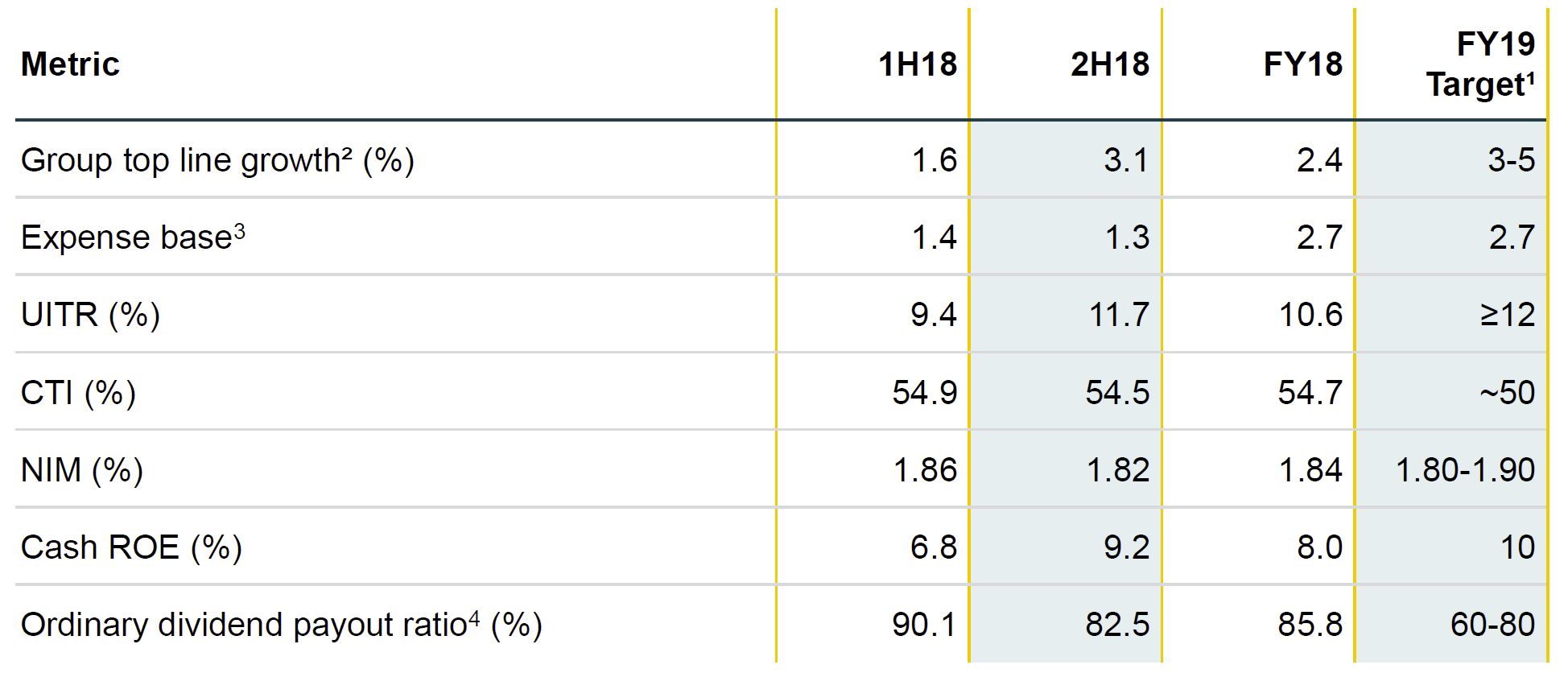

Key numbers

Insurance (Australia) delivered NPAT of $739 million. Motor and Home portfolios have performed strongly with GWP growth of 4.7 per cent, and claims performance at better than industry levels.

Banking & Wealth delivered NPAT of $389 million, with above system growth in lending (1.2x system or 6.2%) and deposits (up 4.7%). A strong profit increase in Wealth was driven by improved investment income and reduced project costs.

New Zealand achieved NPAT of A$135 million, reflecting premium growth, unit growth, good claims management and expense control.

The Group NIM was 1.84 in FY18, but fell in the second half, from 1.86 to 1.82, reflecting the funding costs mix. They suggest BBSW rates will “moderate”.

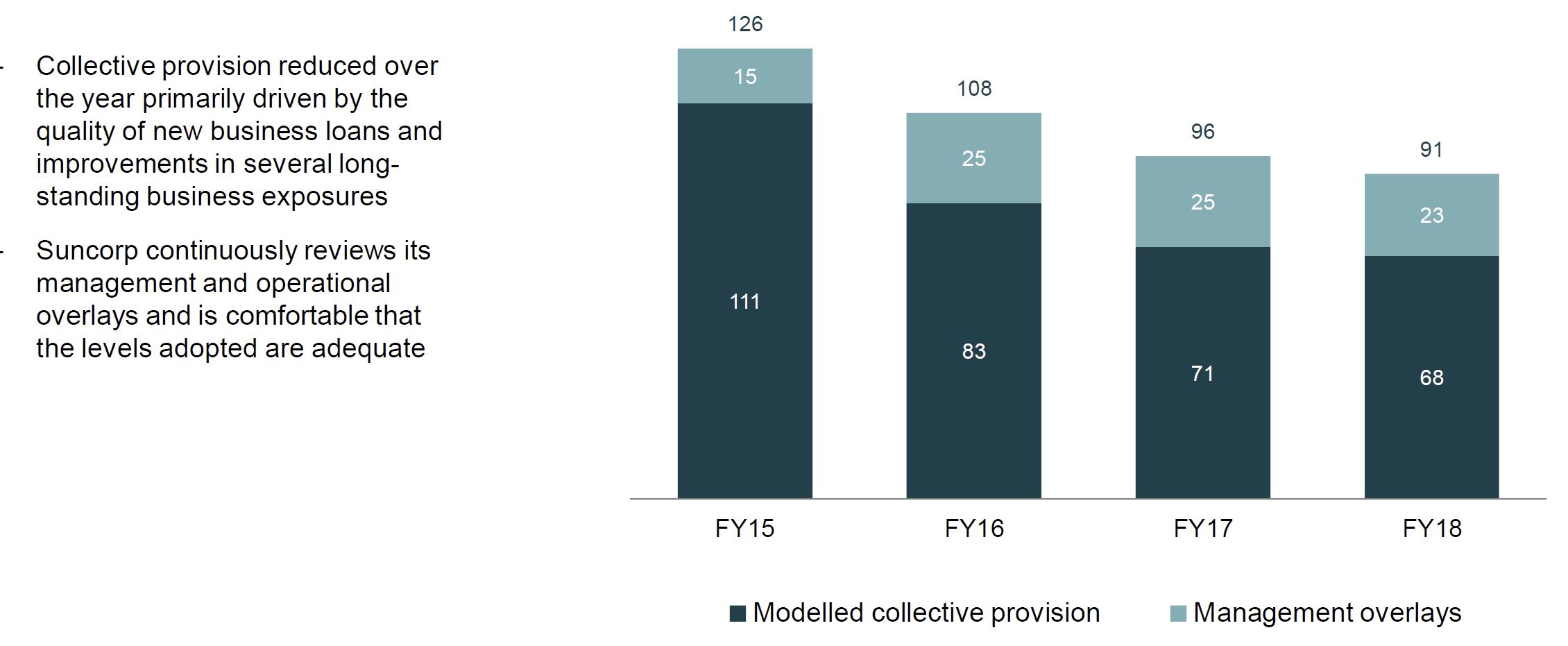

Overall provisions fell.

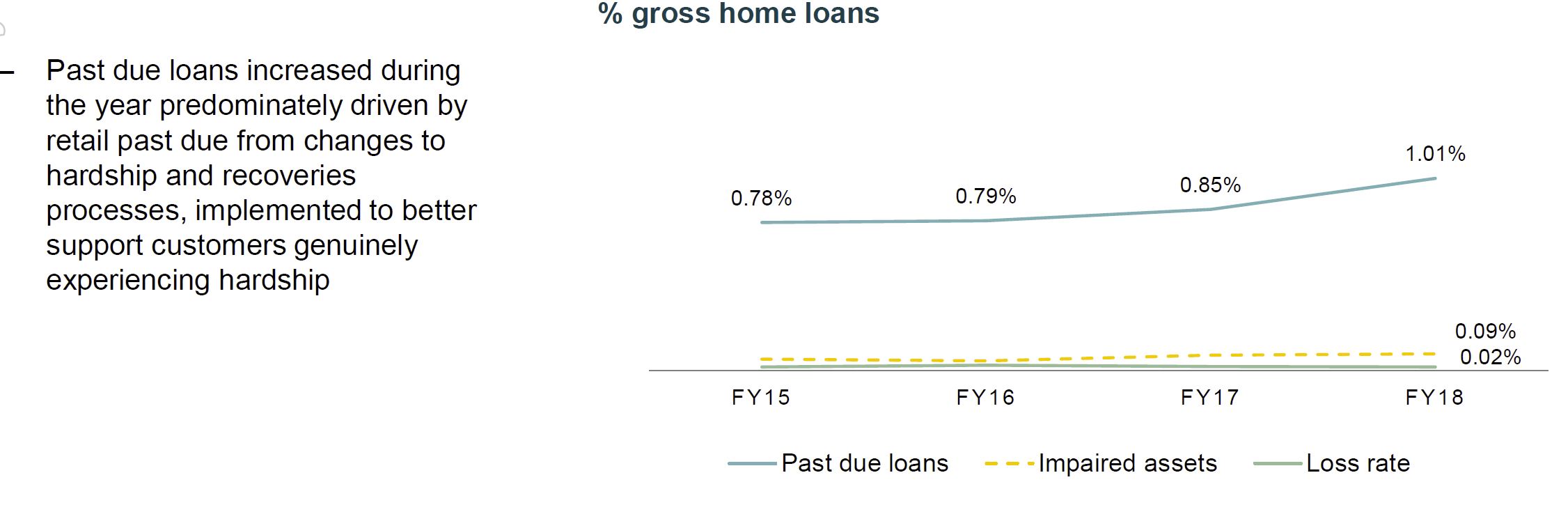

But past due on the home loans portfolio rose, consistent with other lenders.

But past due on the home loans portfolio rose, consistent with other lenders.

Sale of Australian Life insurance business

Sale of Australian Life insurance business

Following the completion of a strategic review, Suncorp has entered into a non-binding Heads of Agreement with TAL Dai-ichi Life Australia to sell the Australian Life insurance business.

As part of the proposed transaction, Suncorp will enter into a 20-year strategic alliance agreement with TAL to provide life insurance products through Suncorp’s direct channels, including its digital channels, contact centres and store network. Completion of the transaction is expected to occur by the end of 2018, subject to regulatory approvals and conditions.

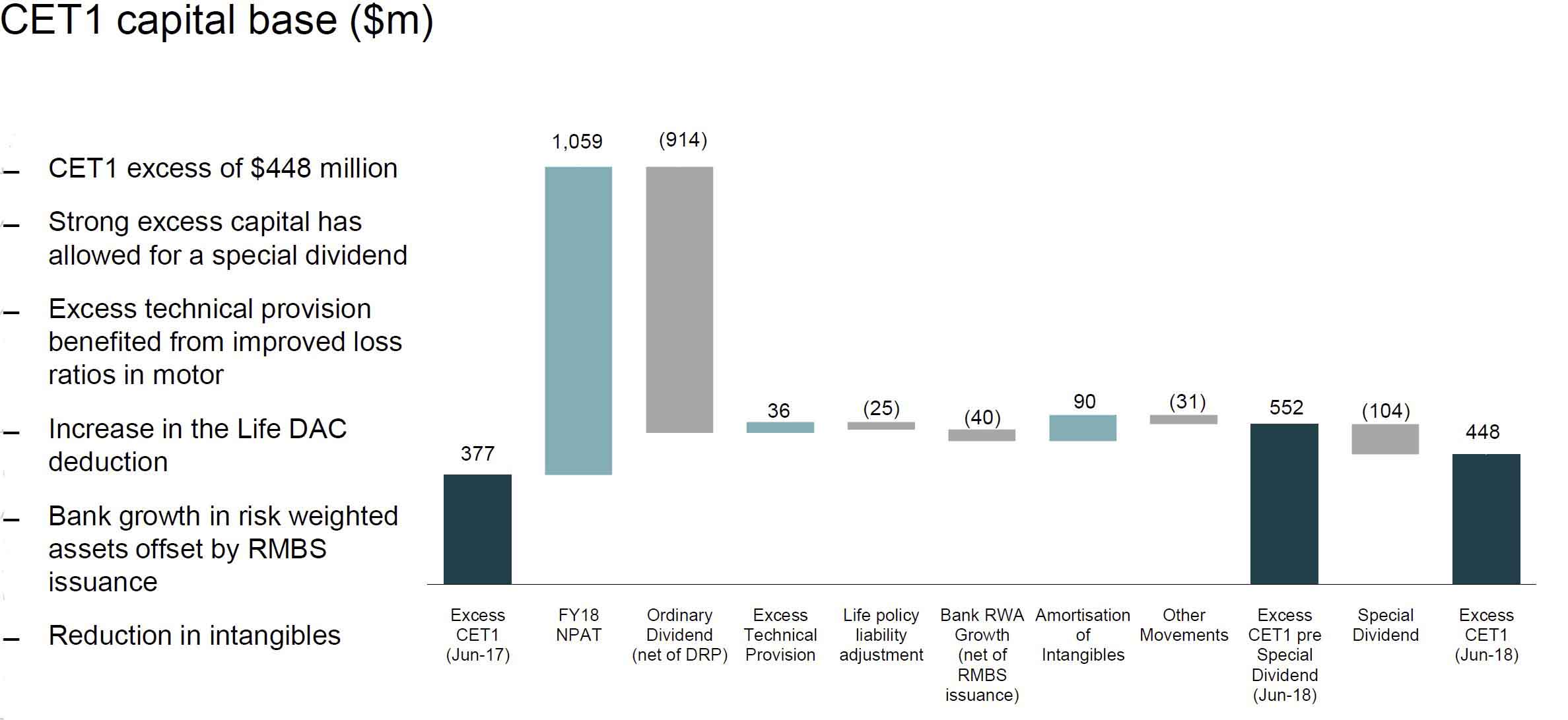

Capital

Suncorp CEO & Managing Director Michael Cameron said that the strong performance in the second half is driving momentum for FY19.

“Six months ago, we committed to a stronger second half, as the benefits of our strategy begin to flow through, and I’m pleased to report a 34 per cent uplift on NPAT on the first half. This result is a direct outcome of the repositioning programs we have implemented over the past two years. We are now beginning to see momentum, to deliver a further uplift in shareholder returns in FY19,” he said.