Suncorp released their APS 330 report for the quarter ended September 2018. Like the majors, funding pressure and slow loan growth are impacting the results. There was a rise in 90-day plus past due. They expect the moderation of home lending growth to continue. Sustained pressure from price competition and elevated funding costs is expected to result in a FY19 net interest margin at the low end of the 1.80% to 1.90% target range.

During the September quarter, total lending growth was $265 million or 0.5%. The home lending portfolio grew $361 million, up 0.8% over the quarter, within a competitive and slowing mortgage market. The home lending portfolio remains comfortably within macroprudential limit settings as Suncorp continues to be selective in its target markets. The business lending portfolio contracted $90m or 0.8% over the quarter, with moderate growth in the commercial and small business portfolios offset by a reduction in agribusiness lending following customers repayment of debt.

During the September quarter, total lending growth was $265 million or 0.5%. The home lending portfolio grew $361 million, up 0.8% over the quarter, within a competitive and slowing mortgage market. The home lending portfolio remains comfortably within macroprudential limit settings as Suncorp continues to be selective in its target markets. The business lending portfolio contracted $90m or 0.8% over the quarter, with moderate growth in the commercial and small business portfolios offset by a reduction in agribusiness lending following customers repayment of debt.

The transition to AASB 9 Financial Instruments (AASB 9) increased the collective provision in the balance sheet by $20 million on 1 July 2018. Following the adoption of AASB 9, provisions are expected to be more variable from period to period reflecting the increased sensitivity of the modelling to changes in economic conditions and the risk profile of Suncorp’s lending portfolio; and the movement of exposures across credit stages.

A net positive movement in impairment losses was driven by a small number of one-off customer recoveries and an improvement in the risk profile of the lending portfolio, as assessed under AASB 9.

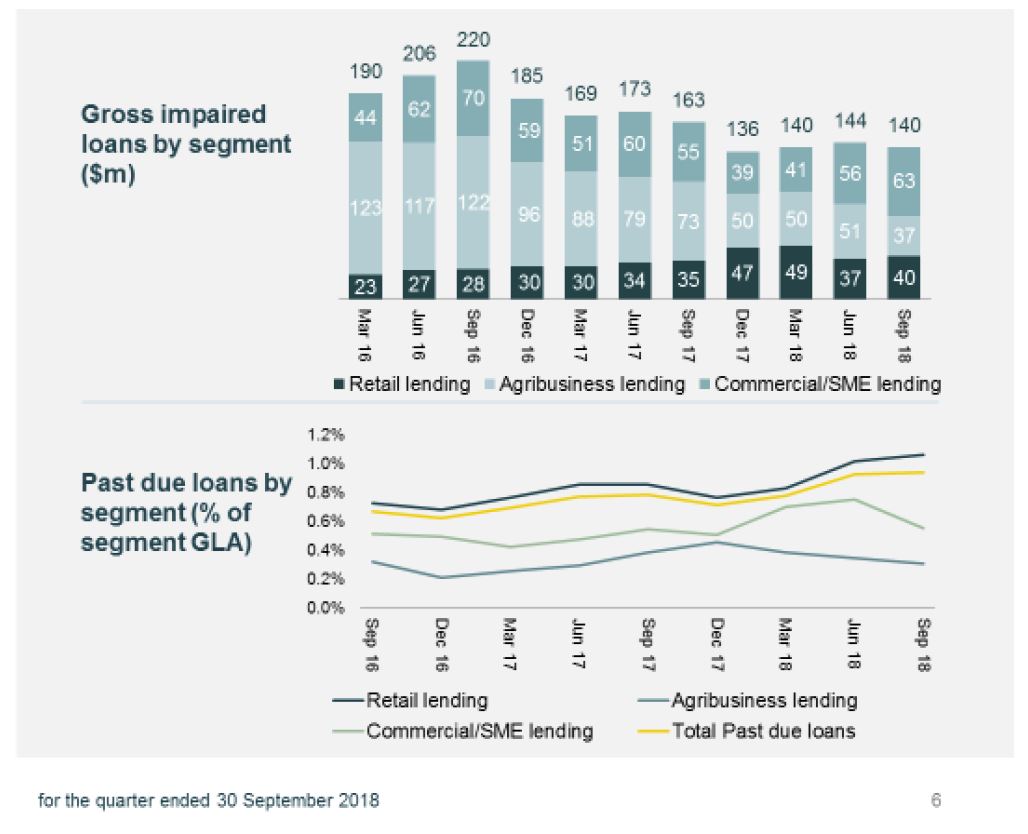

Gross impaired assets of $140 million remained broadly stable over the quarter. Past due retail loans grew by 5.2% to $510 million over the quarter, primarily driven by an increase in customer tenure in late stage arrears. Suncorp’s approach to management of arrears is continually reviewed to improve outcomes for all stakeholders.

Wholesale funding costs continue to be impacted by the elevated Bank Bill Swap Rate (BBSW). During the quarter, Suncorp continued to support its sustainable and diversified funding base by issuing a five-year $750m covered bond. Suncorp also achieved a strong increase in at-call deposits, growing 4.7 times system over the quarter. The Net Stable Funding Ratio (NSFR) was 111% as at 30 September 2018. The LCR was 128%.

Wholesale funding costs continue to be impacted by the elevated Bank Bill Swap Rate (BBSW). During the quarter, Suncorp continued to support its sustainable and diversified funding base by issuing a five-year $750m covered bond. Suncorp also achieved a strong increase in at-call deposits, growing 4.7 times system over the quarter. The Net Stable Funding Ratio (NSFR) was 111% as at 30 September 2018. The LCR was 128%.

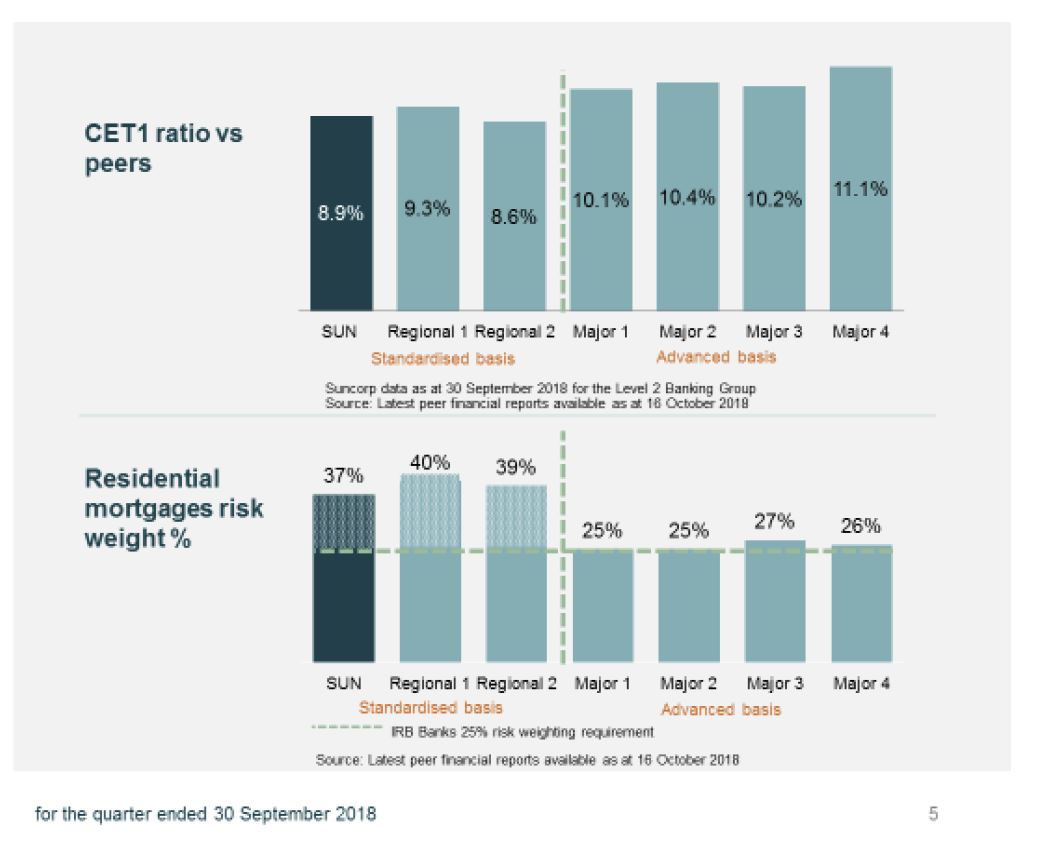

Following payment of the 2018 financial year final dividend to Suncorp Group, Banking’s Common Equity Tier 1 (CET1) ratio of 8.9% reflects a sound capital position towards the upper end of the target operating range of 8.5% to 9.0%.

The moderation of home lending growth is expected to continue, driven by a slowing market and impacts associated with regulatory reforms. Balances of vanilla housing loans dropped by 1.7% compared with the previous quarter, but this was offset by a rise in securitised housing loans and covered bonds, up 16.3%. They grew more in Queensland than outside the state.

The moderation of home lending growth is expected to continue, driven by a slowing market and impacts associated with regulatory reforms. Balances of vanilla housing loans dropped by 1.7% compared with the previous quarter, but this was offset by a rise in securitised housing loans and covered bonds, up 16.3%. They grew more in Queensland than outside the state.

They said they will target above system growth in both home lending and business lending for the financial year, provided that pricing and lending criteria remain within the portfolio tolerance settings, noting the impact that ongoing drought conditions may have on the agribusiness portfolio.

Suncorp will continue to maintain a conservative risk appetite, with no material changes in any segment. While impairments could be impacted by economic factors and ongoing drought conditions, they are expected to remain below the bottom end of the through-the-cycle operating range of 10 to 20 basis points of gross loans and advances.

Suncorp continues to target above system growth in at-call customer deposits, leveraging the investments made in enhanced digital and payment capabilities. Sustained pressure from price competition and elevated funding costs is expected to result in a FY19 net interest margin at the low end of the 1.80% to 1.90% target range.

They say the expected impacts of the Basel III reforms and APRA’s roll-out of unquestionably strong benchmarks cannot be confirmed until APRA releases the draft standards, which is assumed to be in early 2019.