Has the FED’s increased recent debt monetisation enabled US banks to lend out more money than they otherwise would? This is an important question, given the current round of rate tightening, and the potential impact down stream. So a recent article from the St. Louis On The Economy Blog makes interesting reading.

One can think of the government as issuing three types of nominal liabilities:

- Currency

- Central bank reserves

- Treasury debt

Historically, currency and central bank reserves are considered money, whereas Treasury debt is not. Hence, to finance the deficit—the difference between government revenue and expenditures—the government needs to borrow money. The burden of finance is reduced if the central bank transforms high-interest government debt into low-interest reserves. The act of converting debt into money is often labeled “debt monetization.”

Reserves and the Money Supply

The creation of reserves increases the supply of base money. The reserves of chartered banks are held at the central bank and play an important role in the banking system.

In particular, banks finance a variety of investments by creating their own form of money—demand deposit liabilities, such as checking accounts—which are convertible on demand for currency. Note that private banks do not lend reserves: They lend the liabilities they create, and these liabilities are then convertible into currency at the discretion of “depositors” (those who have demand deposit accounts with banks).

Banks are motivated to keep some minimum level of reserves on hand to meet everyday redemption requests for currency and to settle their obligations with other banks on the interbank market for federal funds.

Spurring Lending

But because the interest earned on reserves is typically low (historically, zero), banks are motivated to increase their lending to the point that their demand deposit liabilities can no longer be safely increased, lest they fail to meet their obligations for redemption and settlement. In this way, debt monetization can increase the total money supply, which includes currency, reserves and bank deposit liabilities.

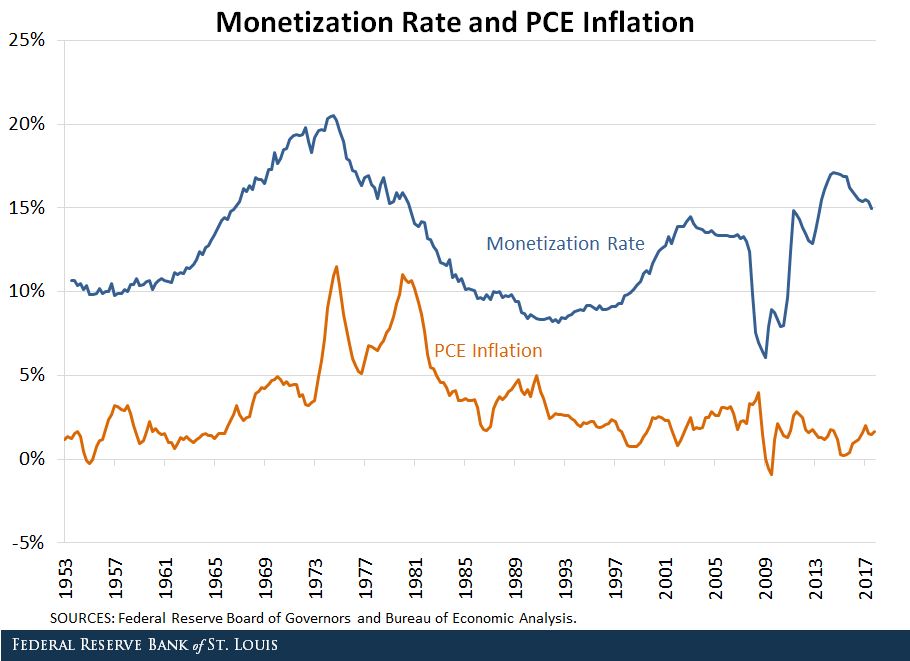

The figure below plots the percent of debt held by the Federal Reserve—the monetization rate—against personal consumption expenditures (PCE) inflation.

From 1953 to 1974, the monetization rate increased hand-in-hand with inflation, with both peaking near the end of 1974. The positive correlation between the two indicators during this span seems consistent with the expectation that debt monetization puts upward pressure on inflation.

From 2009 to 2017, the monetization spiked up at an even faster rate. However, this time the inflation rate stayed more or less constant. Why might the former episode of monetization have been inflationary while the latter was not?

The Interest Rate Spread

When the Fed buys a large amount of federal debt, as it did during these two time periods, it injects a large amount of reserves into the banking system to pay for those purchases. Commercial banks have two options of what to do with these additional reserves:

- Use them to make more loans to customers

- Hold onto them

All else equal, banks will pick whichever option is more profitable, which depends on (among other things) the spread between the interest rate it can charge on consumer/business loans and the interest rate it earns by holding reserves. The larger the spread, the more profitable it is for a bank to lend, and the more likely that a bank increases its lending.

Monetization of the Debt: Then

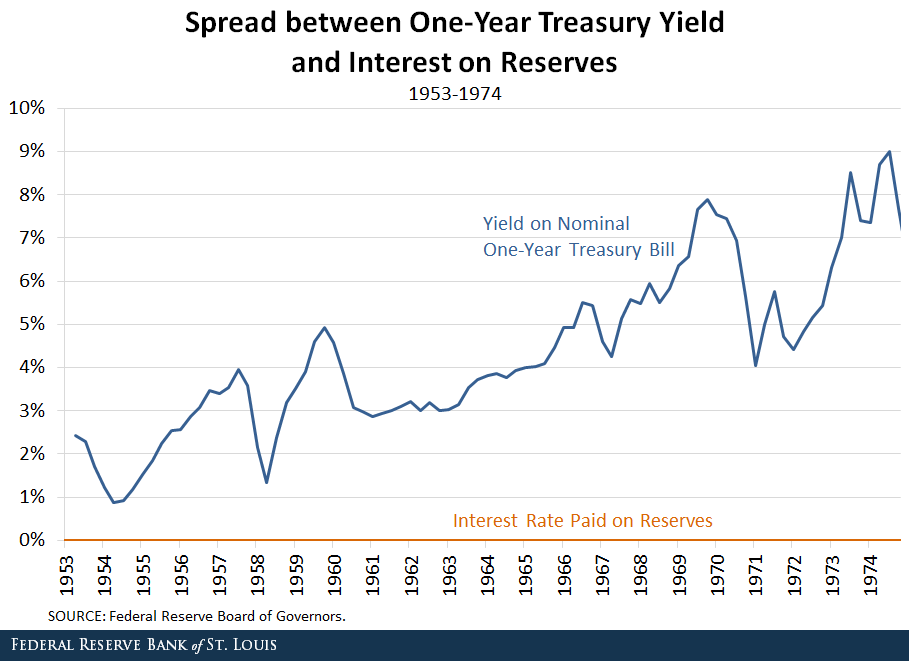

The figure below plots the spread between the yield on a one-year Treasury bill (a measure of short-term interest rates) and the interest rate paid on reserves from 1953 to 1974.

As the Fed ramped up its debt monetization during this span, the average rate of interest on a one-year Treasury bill was about 5 percent, and the interest rate paid on reserves was literally zero.

With the spread between interest rates so large, banks had more incentive to use their newfound reserves to make loans than to hold onto them. These loans would then create money, which would boost the money supply and have inflationary effects. While several factors led to the Great Inflation of the 1970s, the gradual rise in the monetization rate was likely a significant one.

Tightening of the Spread

However, the interest rate spread has narrowed significantly in recent years for several reasons:

- Since the financial crisis of 2007-08, the federal funds rate target has been near zero, keeping short-term interest rates low throughout the economy.

- The demand for federal debt rose greatly after the start of the crisis, pushing bond prices up and bond yields down.

- Beginning in 2008, the Fed began to pay interest on reserves held by its member banks.

Monetization of the Debt: Now

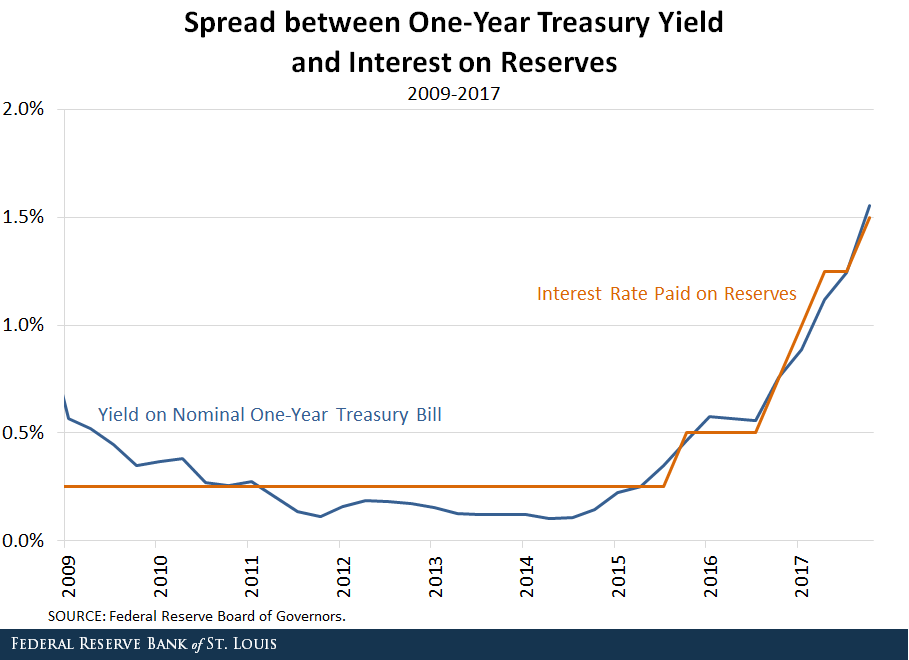

As shown in the next figure, during the spike in debt monetization from 2009 to 2017, the spread between short-term interest rates and the interest paid on reserves was essentially zero.

Unlike during the first scenario, banks now had no incentive to use their newfound reserves to increase their lending. After all, it would be just as profitable to hold onto those reserves. In fact, at times the spread was even negative, making it more profitable to hold reserves.

As such, there was little to no upward pressure on prices. The Fed’s increased debt monetization didn’t lead banks to lend out more money than they otherwise would. Contrary to the episode from 1953 to 1974, banks could make a profit holding onto reserves, which doesn’t create new money and ultimately doesn’t have the same inflationary effects as increased lending does

But the article also highlights a fundamental fallacy, namely that deposits leads loans. Actually, we now know this is incorrect, and that banks can create loans first, which flow TO deposits. So the fundamental assumption they make seems incorrect. Therefore, their conclusions may be suspect! In addition, we know US consumer debt is still very high now at 80% of US GDP! More importantly, it reduces the potential impact central bank have on the economy in terms of credit availability.