Deutsche Bank’s share price continues to fall, as the company wrestles with shrinking revenues, cost cutting and the prospect of reducing its investment banking arm following the collapse of merger talks with domestic rival Commerzbank.

The share price has dropped nearly 39% over the past year, and is way down from 2010. During the previous financial crisis, Deutsche Bank received $354 billion in revolving loans from the U.S. Federal Reserve. Plus, according to a recent Financial Times piece “Germany’s federal and state governments have spent €70bn on bailing out banks since the financial crisis”. This includes Deutsche.

On Monday, UBS downgraded its stock to a “sell” rating from “neutral” and cut its target price from 7.80 euros ($7.45) to 5.70 euros. Deutsche Bank trades at all-time lows and at a price to net asset multiple (0.25x) rarely seen in bank shares outside of insolvency situations.

Deutsche Bank has been plagued by failed regulatory tests, ratings downgrades, big fines and management reshuffles in recent years and posted its first profit in four years in 2018. It has also been linked to President Trump, and indeed, Trump sued the bank last month to block its compliance with congressional subpoenas seeking access to his financial records.

Investment banks revenue is forecast to fall to 12.5 billion euros this year, according to consensus estimates. That would mark a fourth consecutive year of decline, down 34% from 2015. The investment bank generates about half of Deutsche Bank’s revenue but is also considered its Achilles heel, with European regulators fearful that it will fail the next round of stress tests in the United States.

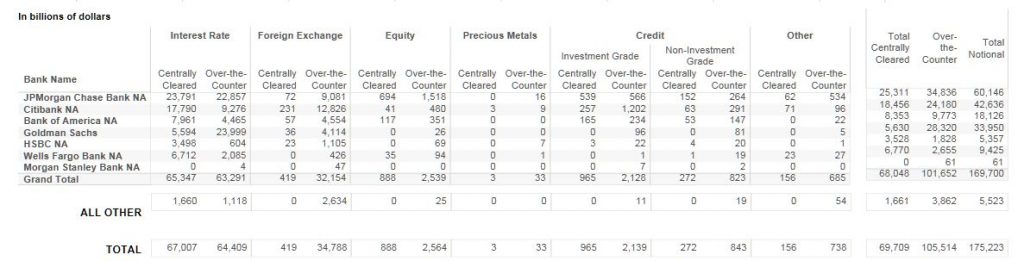

Deutsche could well be the source of wider financial stress, bearing in mind its large derivatives exposure~$46 trillion extend into most of the major Wall Street banks, including JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as other mega banks in Europe.

According to data from the OCC to q4 2018 (released March 2019), this puts the German giant behind JPMorgan Chase ($60.1 trillion, but ahead of Goldman Sachs $33.9 trillion) and Citibank ($42.6 trillion) all nominal.

The IMF concluded that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections – and that was when its market capitalization was tens of billions of dollars larger than it is today.

A capital raising would likely be a next step, to fund further cost cutting (which they cannot currently afford to fund). But shrinking revenue against a high cost base is the root cause issue. And the derivative risks extensive.

This one is worth watching.