We have updated our home price scenarios using the latest available data, and discussed them during our live event which was streamed on Tuesday evening.

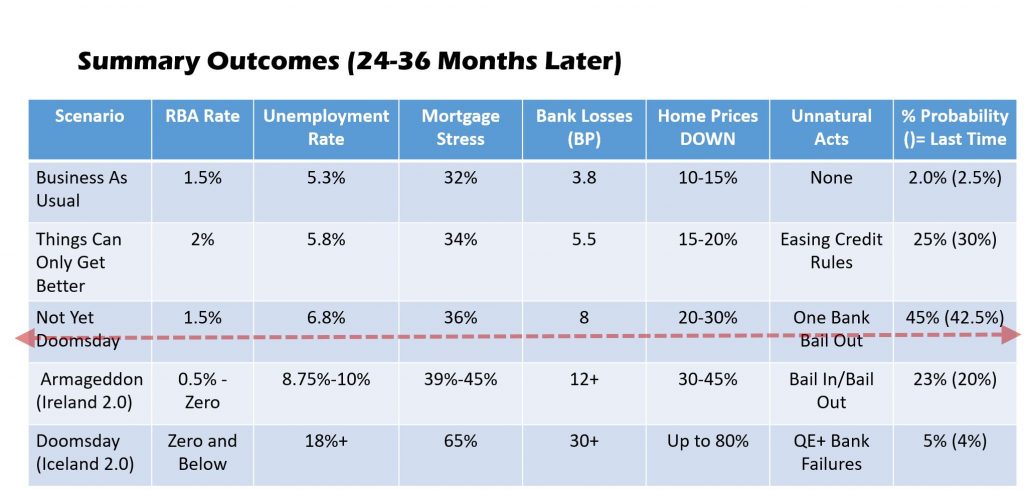

Most probable case is a peak to trough fall of between 20 and 30%, but risks continue to accumulate on the downside. We do not think recent “unnatural acts” from RBA and APRA will have much effect, given the legal obligations which currently exist relating to responsible lending (which were clearly not respected in recent years as the Royal Commission highlighted).

This version has been trimmed and does not include the pre-show or live show chat.

The alternative version, as streamed on the night is still available, complete with the chat room comments (some of which people may find concerning).

Mr. North,

– I think a drop of property prices of (some) 40% is already baked into the cake. Chris Bates told you in a video, in november 2018 (??) that, as a result of the reset from IO to P&I, mortgage payments would rise some 60% to 70%. Assuming a rise in mortgage costs of 60%, and doing some fairly simple math, I draw the conclusion that property prices have to drop – at least – 40%. Then a new buyer, with the same income, is able to buy the same property with a brand new P&I mortgage.

– And then I am not including (more) credit tightning. In that regard, I find a prediction of a 40% drop to be (very) “optimistic”. I fear it will be (much) more. But only time will tell who is right.