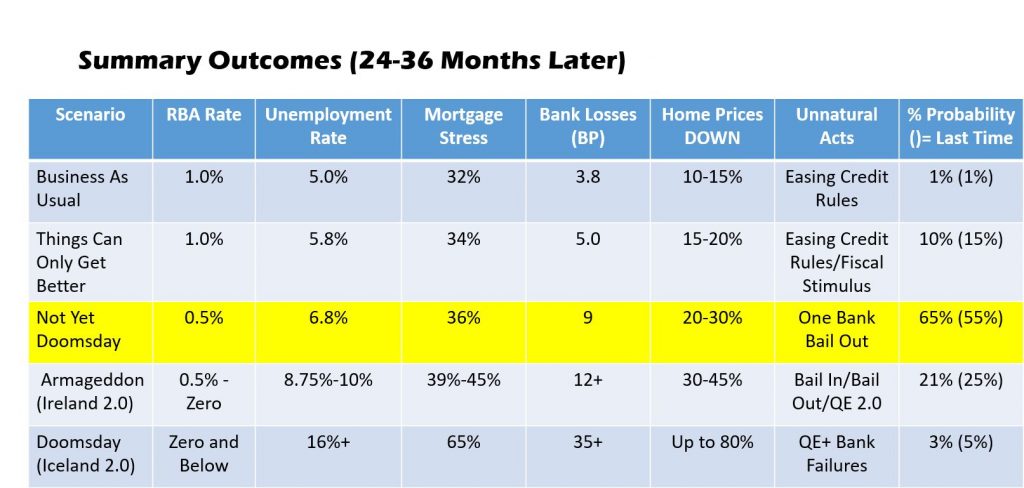

We have updated our home price and mortgage risk scenarios, based on our household surveys, and other data sources. While the risk from a global financial crisis is being pushed out temporally, as central banks do QE again, the risks of a local property crash continue to play out as expected.

As price falls pass 20%, the second order impacts on the economy also play in. We think a 20-30% fall in property values in the major markets is all but baked in now, with the risk still on the downside. The next leading indicator will be an uptick in the unemployment rate (in about 6 months time?)

We discussed the rationale for this analysis, which is driven from our Core Market Model in our live stream last night. We also answer a range of questions from viewers.

You can watch the edited edition.

Or the original live event, including the pre-show, and chat replay.

Main Show Starts here 2