The ABS has released the first in its new combined series of household and business finance – “ 5601.0 – Lending to households and businesses, Australia, Dec 2018″.

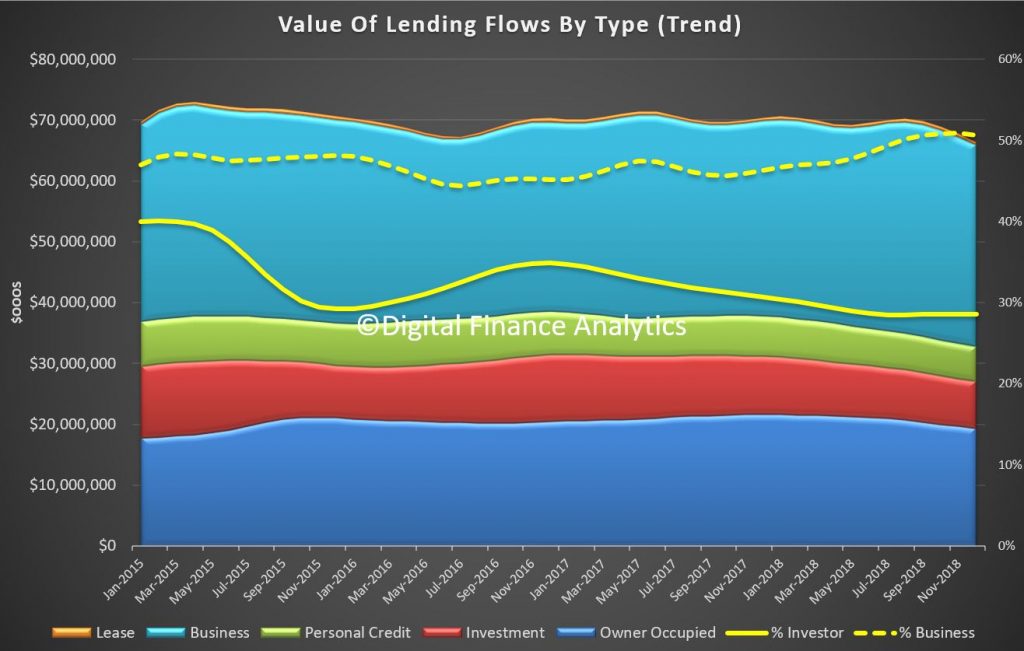

The new data required a rebuild of our analytics, but it is very clear that the rate of growth of new credit continues to ease across the board. The focus of the release is credit flows, the rate of new loans being written. The RBA of course reports the stock at the economy level, and APRA the Bank (ADI) stock. Today we look at the flow data.

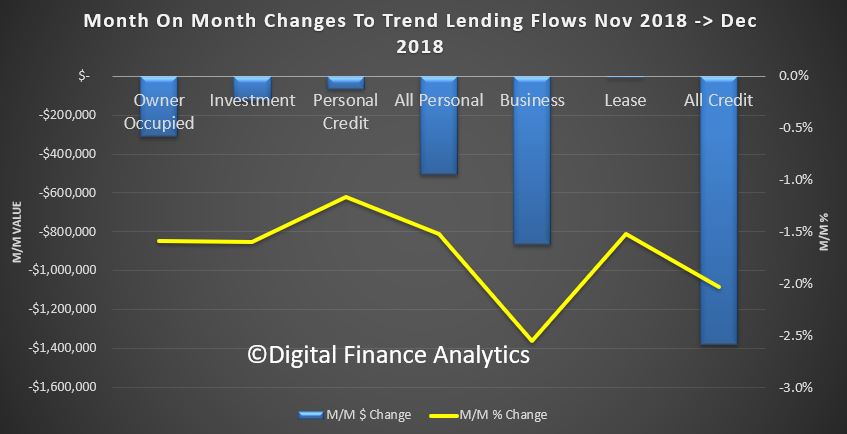

Owner Occupied lending flows fell by 1.59% from November to December, down $310 million dollars. Investment lending fell 1.6%, down $125 million dollars and personal credit fell 1.17%, down $68 million dollars. Total credit flows to households fell 1.52% down $506 million dollars. Business credit flows fell 2.55%, down $866 million dollars and total credit flows dropped 2.03% by $1.38 billion dollars, to $66.5 billion dollars.

The share of investment loan flows for residential property was 28.5% of housing flows, and lending for business fell to 50.6% of all credit flows.

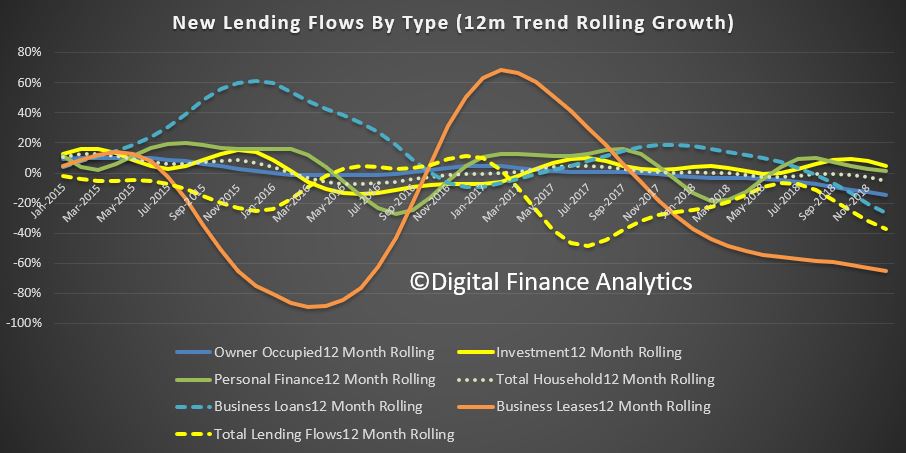

The credit impulse (the rate of change of credit growth) continues to ease, which signals a weaker economy, and lower home prices ahead. Significantly, owner occupied lending is slowing faster than investor lending now.

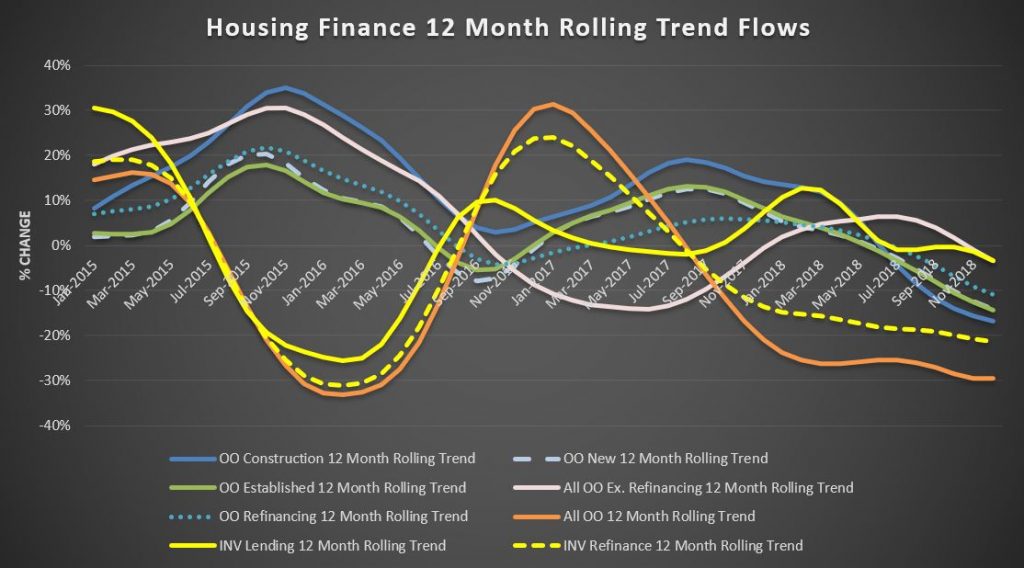

Within the housing categories the rolling 12 month growth rates in credit flows shows that owner occupied construction are down 16.7%, finance for new builds is down 14,2%, finance for established property is down 14.3% and refinanced loans is down 10.9% over 12 months. New investment loan flows fell 3.4% and refinanced investor loans was down 21.3%, which is a significant drop. These are the factors which feed into my overall home price models, and this downward momentum of the credit impulse is highly significant, and why I am looking for more home price falls ahead. Note again, its the owner occupied sector on the slide, not just property investors!

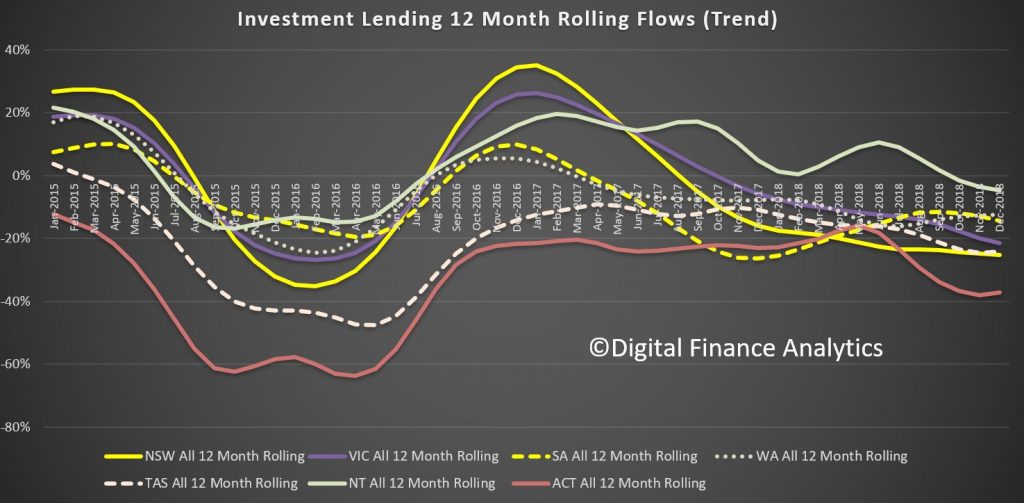

We can look at credit flows for investor purposes across the states. NSW is down more than 25%, VIC down 21.5%, SA down 14%, WA down 12% TAS down 24%, NT down 4.7% and ACT down a massive 37%; all over the past 12 months.

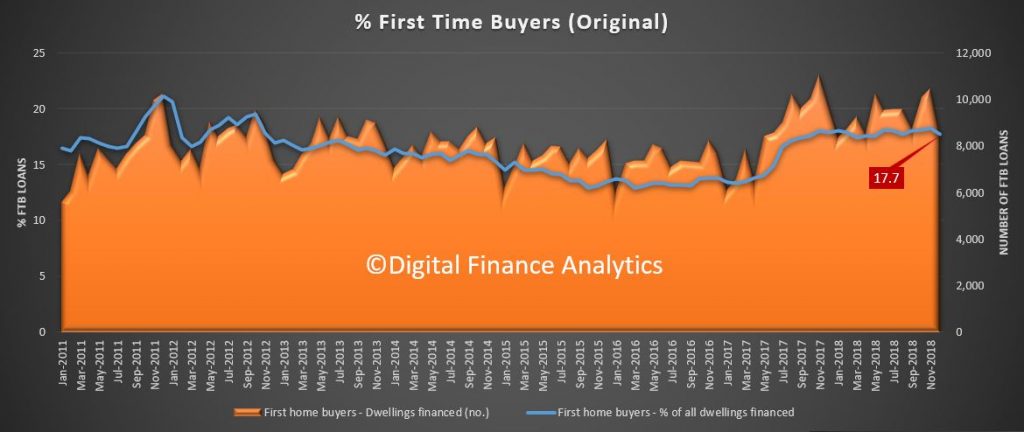

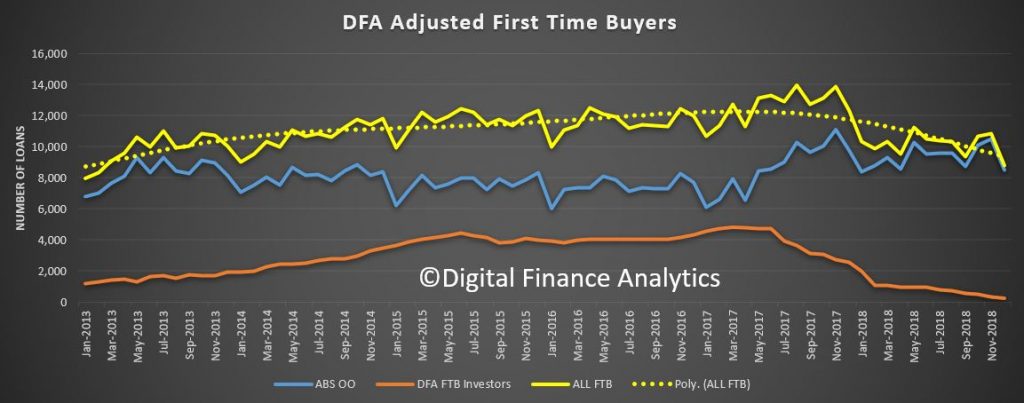

First time buyers continue at a lower rate as our tracker shows, with 17.7% of new loans for first time buyers, down from 18.3% last month, a drop of 1,976 transactions compared with last month, to 8,517.

In addition the number of first time property investor buyers dropped again.

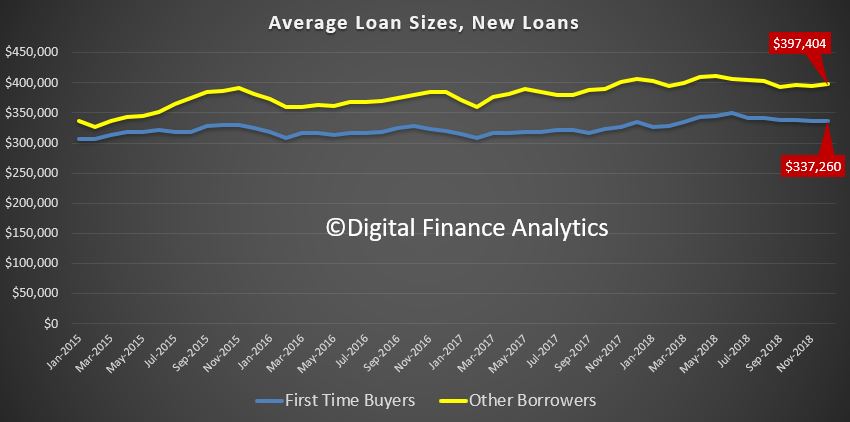

The average loan size for a first time buyer fell to $337,260, indicating tighter lending standards, while other loans were bigger at $397,404.

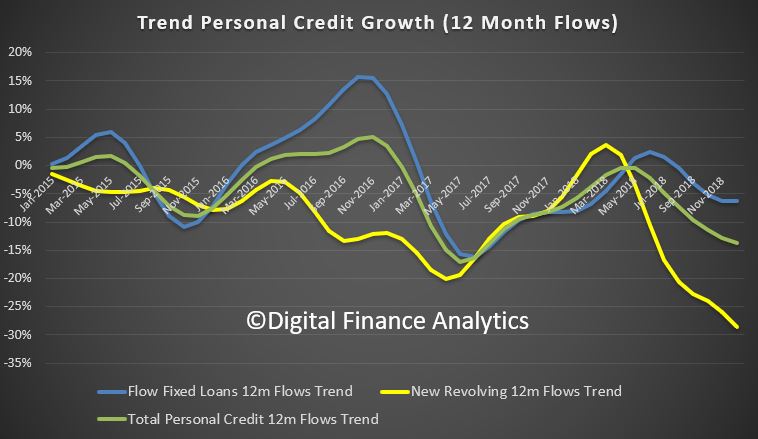

Finally, personal credit flows were down again, with new revolving loans especially hard hit.

The Credit Tide Is Receding

In conclusion, there is nothing in this data to suggest increased momentum in credit, but then this is in December, and before the APRA statement that lending standards will remain tight (7% hurdle rate applies) and the Royal Commission left responsible lending rules where they were.

My conclusion is that the credit impulse will continue to slow. This will have a flow on effect to home prices and household consumption. The decade of credit driven expansion looks to be over for now. The problem is of course this will lead to weaker economic out-turns ahead, and falling home prices.

That said, credit is still growing unsustainably faster than income or inflation with housing credit at 4.9% growth over 12 month. But the rate of growth, as we showed here is easing back.

And I do not think the credit tap will be opened up “to 11” again anytime soon. Welcome to a new, but uncomfortable normal. One in which those with loans they should never have had in the first place continue to struggle with them, and new borrowers, should they chose to borrow, will need to jump through a whole series of higher hoops.

20-30% peak to trough falls in home prices anyone?