Channel Nine asked us to run some analysis in and around the Gold Coast, and also included some other post codes in the analysis. The story it tells is an interesting one and also gives us some clues about financial resilience, continuing our last discussion. In particular, we mapped in some of our master household segments, which show how uneven mortgage stress is in practice.

This is based on our household mortgage stress analysis for Queensland to the end of June, and in the past three months’ stress has been rising. When we talk about mortgage stress we are looking at household income and expenditure on a cash flow basis. Those with a shortfall are deemed to be in stress. Today around 27% of households across the state are having difficulty managing their repayment, which is slightly below the national average of 30%.

This is based on our household mortgage stress analysis for Queensland to the end of June, and in the past three months’ stress has been rising. When we talk about mortgage stress we are looking at household income and expenditure on a cash flow basis. Those with a shortfall are deemed to be in stress. Today around 27% of households across the state are having difficulty managing their repayment, which is slightly below the national average of 30%.

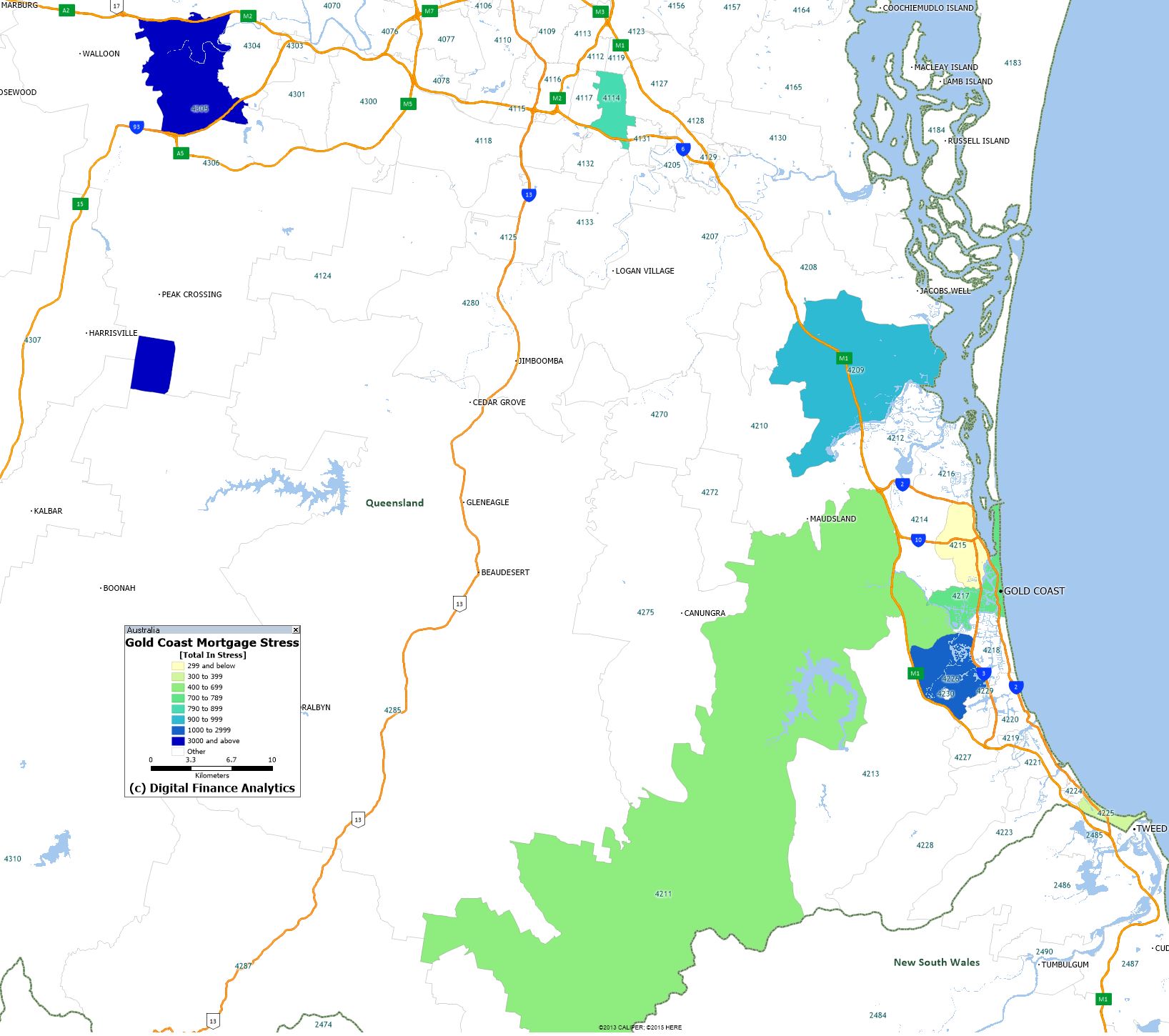

However, looking first in detail at the Gold Coast, we also see mortgage stress rising but only in some post codes.

The post code with the largest number of households in in 4226 Robina where 1,200 households are in mortgage stress, which is 28% of all borrowing households in the area. Most households here are relatively mature suburban families, with high expenses and contained incomes.

Coomera, 4209 has just 16% of households in mortgage stress and most of these are older, more wealthy households who are finding costs rising and their incomes severely under pressure.

Turning to Surfers Paradise 4217, 18% or 770 households there are in mortgage stress and these are mainly younger affluent households who have brought expensive places, often apartments now the costs of their mortgages have risen, while their incomes are constrained. This is a recipe for disaster later.

The post code with the largest number of borrowing households is 4211 Narang, with more than 10,000 in the district, only 4.1% are in mortgage stress and most of these are older households nearing retirement, when income is more constrained. However, we see a higher risk of default here should mortgage rates rise, because of these income constraints.

Turning to Coolangatta and the surrounding areas in 4225, here we see a larger number of households under pressure, due to lower incomes and high costs – we call then Battling Urban households. As a result, we estimate that more than 50%, or 332 households are in mortgage stress.

And in Southport 4215, where more than 4,800 households are borrowing, only 6% are in difficulty. Here many households are relatively affluent, and many are planning to, or have retired in recent years. However, as a result of this their incomes may become more constrained down the track so there are around 80 risking default over the next year or so.

So now looking across some of the other areas, in Brisbane, post code 4000, around 22% of borrowing households, or 320 households are in mortgage stress. Most of these are young affluent households, with large mortgages and often on high rise apartments. They paid up big for these, but now their incomes are constrained and costs are rising. This is a real problem.

Over in Logan, 4114, around 33% of households are in mortgage stress, that’s higher than the Queensland average, and that’s about 800 households in the area. Households here are in the mortgage belt, mostly with families, and high living costs as well as their mortgages. Once again incomes are constrained. We think more than 30 might default in the next 12 months.

Finally, in Ipswich, 4305, there are more than 8,000 borrowing households in what we classify as the disadvantaged fringe. Many here are battlers, with limited incomes, but still have mortgage repayments to meet. As a result, more than 40% are in mortgage stress which equates to more than 3,200 households, and around 95 may default over the next 12 months.

So you can see how mortgage stress varies across the region and across household segments. My point is, stress is not just confined to the battlers, it is alive and well in more affluent households too. This of course chimes with our national research as we reported last week – see the link here.

Given the fact that incomes are flat, the costs of living continue to rise – especially electricity, council rates, child care costs and school fees, we expect mortgage stress to continue to build. And the prospect of higher mortgage rates down the track makes it even more of a problem.

My advice for those in difficulty is first draw up a budget so you know what you are actually spending, and second remember that banks have an obligation to assist in times of hardship, so talk to them, do not ignore the problem, it is unlikely to go away on its own. Take action early.