On 1 October, Greece (B3 positive) further relaxed capital controls that had been in place since June 2015 following an announcement by the Ministry of Finance in the government gazette. The country’s improving economic prospects and an increase in private-sector deposits in recent months allowed for the easing of capital controls, which will likely strengthen depositors’ confidence and help banks further improve their funding profiles, a credit positive.

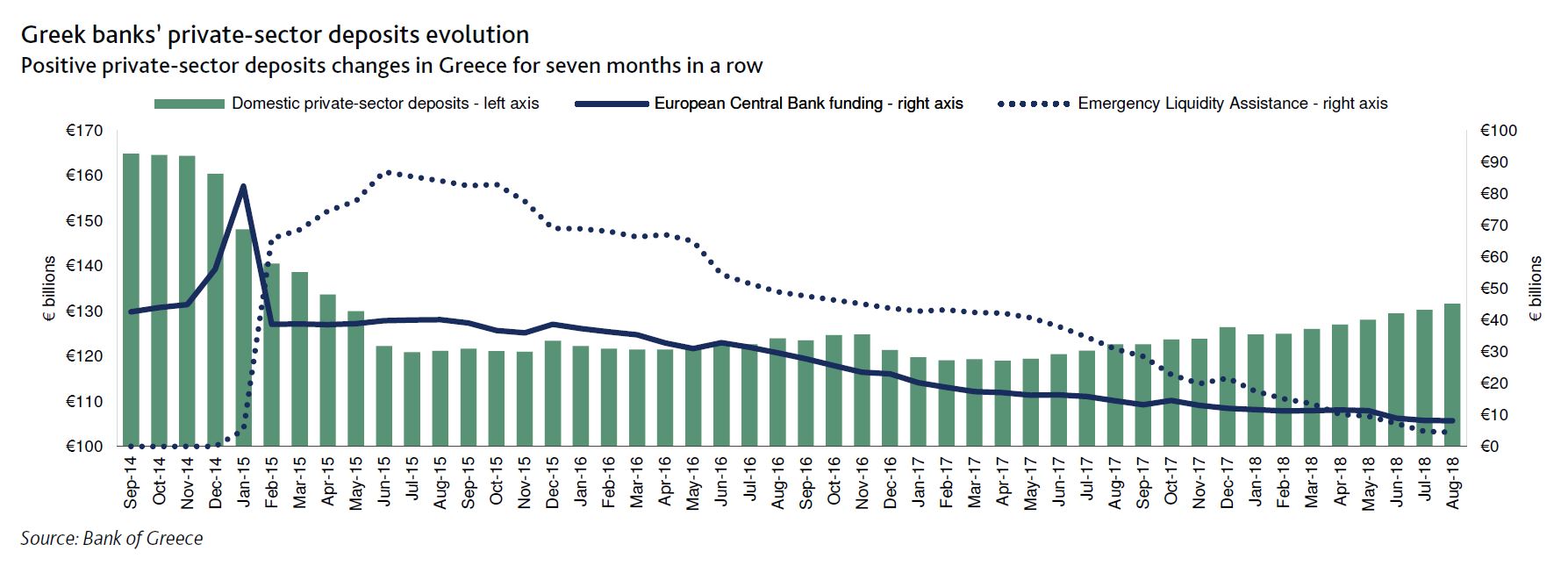

The gradual return of deposits to the banking system over the past seven months and greater optimism following Greece’s successful exit from its economic adjustment programme are the key drivers behind the Ministry of Finance and the Bank of Greece’s decision to significantly loosen capital controls. In addition, a material reduction in banks’ dependence on central bank funding through the Bank of Greece’s Emergency Liquidity Assistance (ELA) mechanism signifies banks’ liquidity improvement in recent quarters.

As part of the relaxation of capital controls, the new measures include unlimited cash withdrawal for domestic deposits either through banks’ branches or ATMs; cash withdrawals from a credit and prepaid cards abroad of up to €600 per day and up to €5,000 per month; an increase in the limit on fund transfers abroad by companies to €100,000 per customer per day from €40,000 previously; and the ability for check payments in cash.

The easing of restrictions will likely encourage households and companies to return to local banks any money held outside of Greece’s banking system. An increase in customer deposits in recent years has helped Greek banks reduce their ELA balance, which totalled approximately €4.5 billion, or 2% of total banking assets at the end of August 2018, versus 21% in August 2015.

Also driving the ELA decrease was an increase in interbank lending transactions/repos as international investors’ appetite for Greek risk increased and they accepted a wider range of Greek assets as collateral for such repos. The ELA reduction supports Greek banks’ net interest margins because both the repo transactions and the new deposits carry a lower interest rate than the more expensive ELA, which costs around 1.5%.

Three of six rated Greek banks have fully repaid their ELA balances: National Bank of Greece S.A. , Piraeus Bank S.A. and Pancretan Cooperative Bank Ltd . We also expect Eurobank Ergasias S.A. and Alpha Bank AE to repay their ELA balance over the next few months, while Attica Bank S.A. will likely take a bit longer to fully eliminate its ELA.

The relaxation measures gradually ease capital controls put in place in June 2015 to stem deposit outflows from Greek banks during the first half of that year (see exhibit). However, the successful implementation of Greece’s economic adjustment programme, which concluded in August this year, and prospects of a gradual return to economic growthare already driving higher private-sector customer deposits, which grew by 4.1%, or €5.2 billion, during the first eight months of 2018.

Following the political and economic turmoil in 2015, tensions have eased over the past two years. The current government has managed to legislate a large number of reform measures, despite its slim majority in parliament and without triggering large-scale protests, as had been the case during the previous two adjustment programs. However, domestic politics and social instability remain the main risks to policy implementation and economic recovery. A potential prolonged political uncertainty, combined with looser capital controls, could cause significant deposit outflows, as was the case in the first half of 2015.