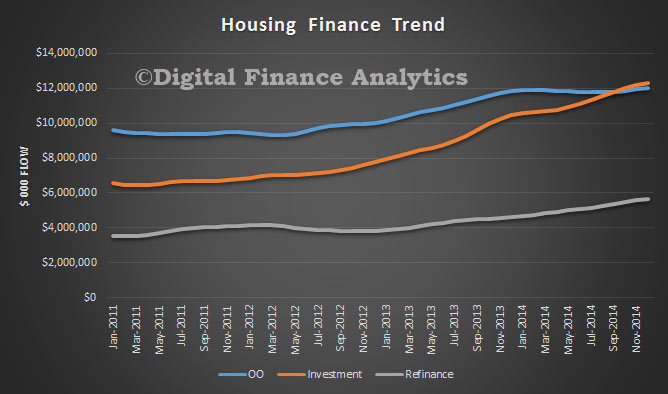

Data from the ABS today shows a further lift in home lending in December, driven hardest by the investment sector, but with owner occupation lending also in play. The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 1.0%. Investment housing commitments rose 1.2% and owner occupied housing commitments rose 0.9%. Investment lending comprised more than 50.6% of new loans, excluding refinance, another record. Refinancing remains strong in the current low rate environment. In seasonally adjusted terms, the total value of dwelling finance commitments excluding alterations and additions rose 4.7%. However, DFA is now using the trend series in our modelling, as we think the SA series are suspect (according to the ABS, trend series reduces the impact of the irregular component of the seasonally adjusted series and is derived by applying a 13-term Henderson-weighted moving average to all but the last six months of the respective seasonally adjusted series, whilst the last six months are estimated by applying surrogates of the Henderson moving average to the seasonally adjusted series.)

In trend terms, the number of commitments for owner occupied housing finance rose 0.5% in December 2014. In trend terms, the number of commitments for the purchase of established dwellings rose 0.6%, while the number of commitments for the purchase of new dwellings fell 1.1% and the number of commitments for the construction of dwellings was flat.

In trend terms, the number of commitments for owner occupied housing finance rose 0.5% in December 2014. In trend terms, the number of commitments for the purchase of established dwellings rose 0.6%, while the number of commitments for the purchase of new dwellings fell 1.1% and the number of commitments for the construction of dwellings was flat.

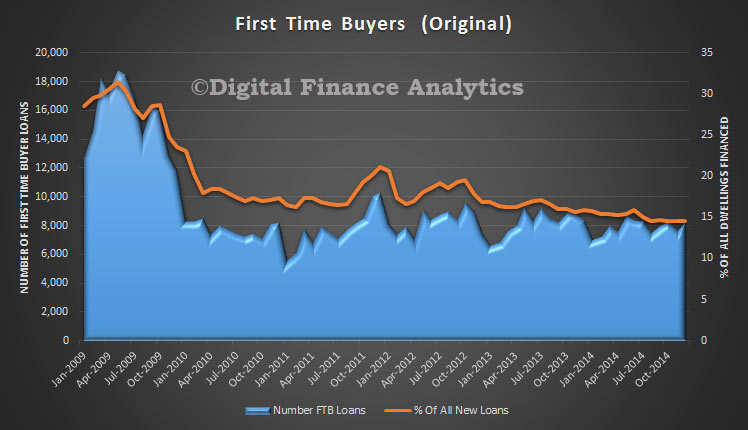

Turning to First Time Buyers, on the revised new method of calculation and in original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments fell to 14.5% in December 2014 from 14.6% in November 2014. The fall in First Time Buyer activity remains a feature in the current climate.

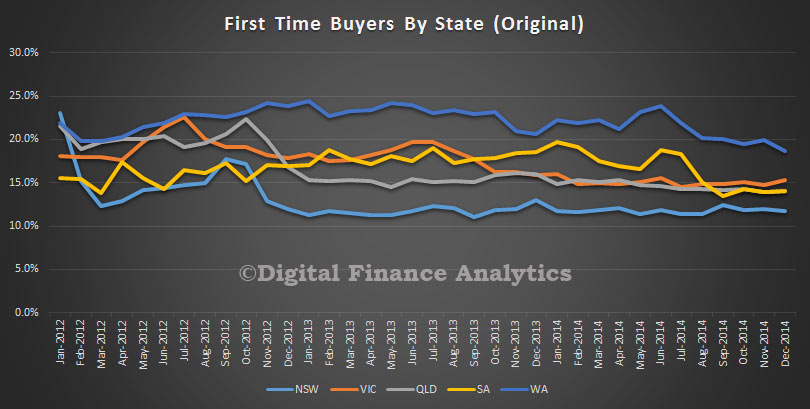

The state by state data reflects the revised First Time Buyer data, with NSW up by one third from 8% to 11% following the ABS revisions, compared with a national uplift of one quarter. We still see WA leading the way, though falling from the June 2014 peak. The other states are now more closely aligned. Given the size of the adjustment, we hypothise that at least one of the majors was not correctly recording first time buyer data.

The state by state data reflects the revised First Time Buyer data, with NSW up by one third from 8% to 11% following the ABS revisions, compared with a national uplift of one quarter. We still see WA leading the way, though falling from the June 2014 peak. The other states are now more closely aligned. Given the size of the adjustment, we hypothise that at least one of the majors was not correctly recording first time buyer data.

2 thoughts on “Housing Finance Leaps Higher”