Property in the UK is reeling from the Brexit uncertainty, creating a buyers market, even in the expensive London sector, according to the latest report from LonRes, a London based estate agent.

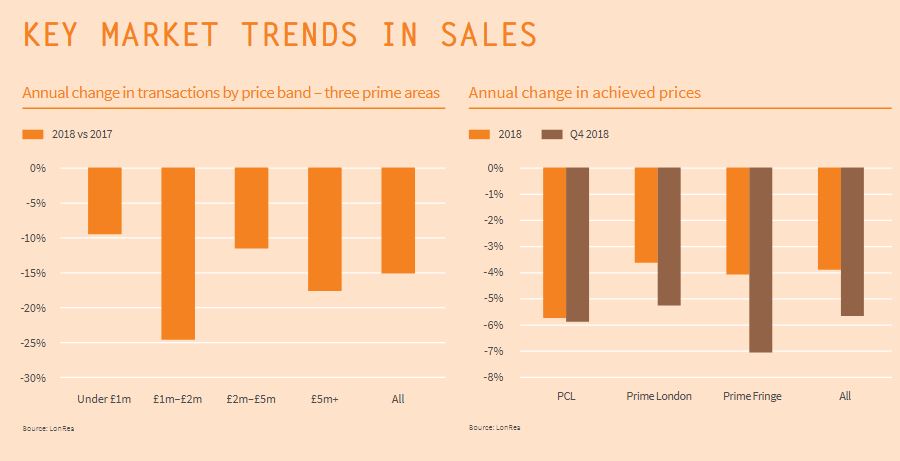

- In Prime Central London: -6% in Q4 2018; and -14% from their 2014 peak.

- In slightly cheaper Prime London districts: -5% in 2018.

- In Prime Fringe districts, i.e. prime sectors further removed from the city center: -7% in 2018.

We appear to be watching a fall in home prices across multiple markets, including the UK, Canada, Australia and New Zealand. This is more than a coincidence as years of too loose lending are coming to an end as the debt burden grows.

LonRes, said that 63% of the agents said they had seen prices in their market plummet by 10% or more from peak levels as sales ground to a standstill. In London transactions slumped by 9% between 2017-2018 for properties under 1 million, by 25% for properties between £1 million and £2 million and by 12% for properties between £2 million and £5 million.

Another indicator flashing red is the Royal Institution of Chartered Surveyors’ house prices balance, which measures the gap between the number of estate agents and property surveyors expecting increases and those anticipating decreases. It crashed to -22% in January, its lowest level since March 2009. The sales expectations balance for the next three months reached its lowest level since the survey began in 1999, dropping from -28% to -32%. Here are some more standouts from Rics’ report:

- Agreed sales dropped further in January, with the pace of decline “seemingly gathering momentum compared to December results.”

- The average time taken to sell a property, from listing to completion, reached 19.4 weeks.

- Northern Ireland and Scotland enjoyed the strongest price expectations for the next twelve months, followed by the North West of England and Wales.

- Contributors in London still see house prices falling over the next year.

Acute uncertainty over Brexit and the UK’s political future is taking its toll on an already weak market sentiment, putting many prospective buyers off taking the plunge and leaving frustrated sellers facing three unappetizing choices: drop the price, sit tight in the hope the general mood will soon change, or take the house off the market altogether. With many opting for the latter, more homes were removed from the London market due to a withdrawal than a sale in 2018, according to LonRes.

– Look at what happened with the Euro and the USD against the GBP since 2014/2015. Both currencies went up some 30% against the GBP, making all imports (much) more expensive.

– A rising USD/GBP makes all oil (priced in USD) products much more expensive. The rising Euro makes all food imports (the UK imports some 60% of its food from the eurozone) more expensive.

– Ask yourself: Did all british consumers receive a 30% increase of their wages to compensate for the falling GBP ?