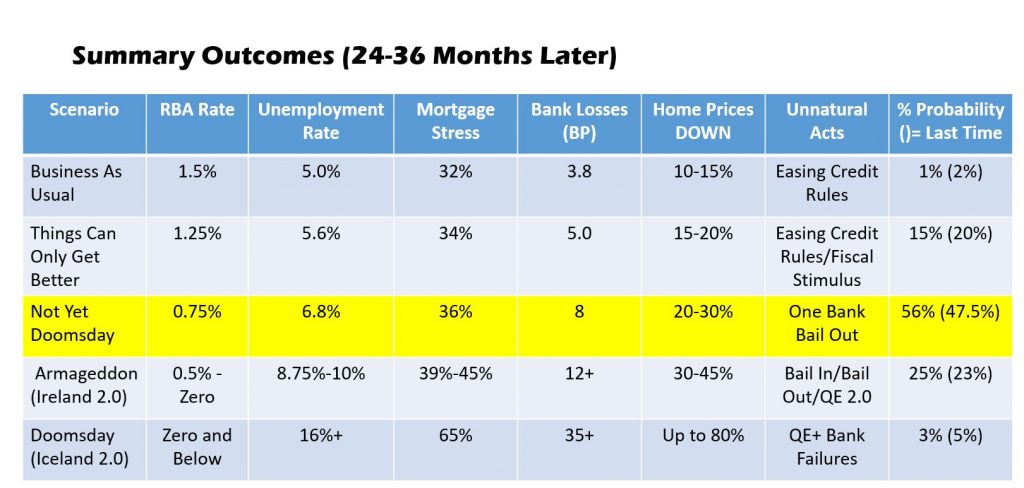

We have updated our scenarios to take account of a range of new data, and the latest input from our household surveys. A peak to trough fall of 20-30% over 2-3 years remains our base case, but with risks to the downside. On the other hand the RBA’s base case gets only a 1% probability now.

The factors we have taken into account include:

- Lower inflation and growth rates ahead according to the RBA

- Fed future rate hikes on hold

- Potential for more QE (Euro Zone, Japan, others)

- Recent home price falls in Australia driven by weaker credit impulse

- Underemployment still a significant issue and wages flat

We also have used updated households intention to transaction data, mortgage stress and affordability metrics.

ANZ yesterday revealed their mortgage underwriting standards are now ~20% tighter. Others are even tighter. “Mortgage Power” has been significantly curtailed.

Here are the results from our Core Market Model, with a probability rating.

Business As Usual: RBA driven scenario

Things Can Only Get Better: Economy is weaker, as wages continue to grow only slowly, costs rise, and RBA cuts later in the year. Some Government tax stimulation either before or after the election, or both. Some easing of credit rules so lending growth accelerates.

Not Yet Doomsday: A locally driven downturn, as wages are flat, despite some mortgage rate repricing. RBA cuts significantly. Employment rises, and one Bank requires assistance. Fiscal stimulus does not have significant impact as household consumption falls.

Ireland 2.0: International crisis overlaid on scenario 2, with QE and lower rates, in response. May be from Europe (Brexit), China, or US, or some combination as global growth falls. In response cash rate is cut hard to zero bounds, QE in Australia commences, and banks are rescued/restructured via bail in and bail out.

Iceland 2.0: As above, but no bank rescues, so banks fail. RBA moves to negative interest rates (see Japan).

We discussed these scenarios during our live stream Q&A event last night. Here is the edited version of the event:

The podcast edition:

You can also watch the full live version of our stream, complete with live chat, and a couple of system errors, due to a camera overheating!