AFG has today released Competition index figures for the final quarter

of 2017. Whilst this is a skewed result, reflecting traffic through AFG only, it is a reasonable bellwether.

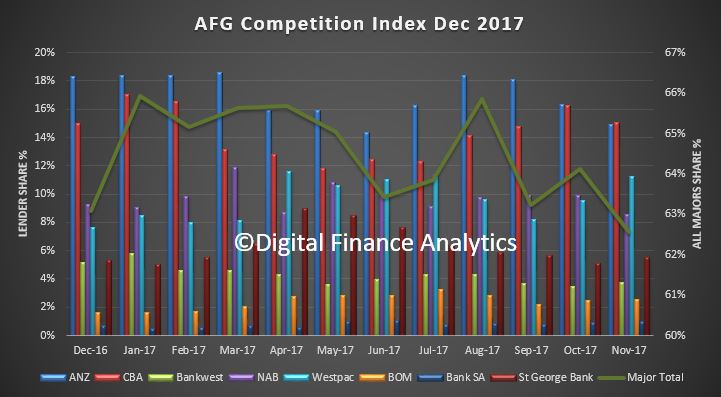

Once again, Australia’s major lenders have taken a hit with their market share now down to a post-GFC low of 62.57% of the mortgage market. The majors lost ground in all categories since the time of the last AFG Competition Index, including a drop of more than 3% in refinancing and more than 2% in fixed rates.

AFG General Manager – Broker and Residential Mark Hewitt explained the results: “The major banks have been under intense scrutiny by government and the regulators and it is probably no wonder if they have been distracted,” he said.

“With the recently announced Royal Commission into the banking sector we all hope lenders can respond whilst still maintaining a focus on their customers.

The Royal Commission, and the industry need to focus on how competition can be further improved and this should include the impact the government guarantee has on competition.

“The Westpac group as a whole were the only ones to make up any ground, up from 19.19% at the time of the last AFG Competition Index to finish the quarter at 20.33%.

ANZ lost the most ground amongst the major banks, down 3.5% for the quarter.

The non-majors now enjoy a market share of 37.43%.

“The non-majors picking up market share were Macquarie, with an increase from 2.91% to 4.70% and AFG Home Loans with a lift from 8.88% to 10.15%,” concluded Mr Hewitt.