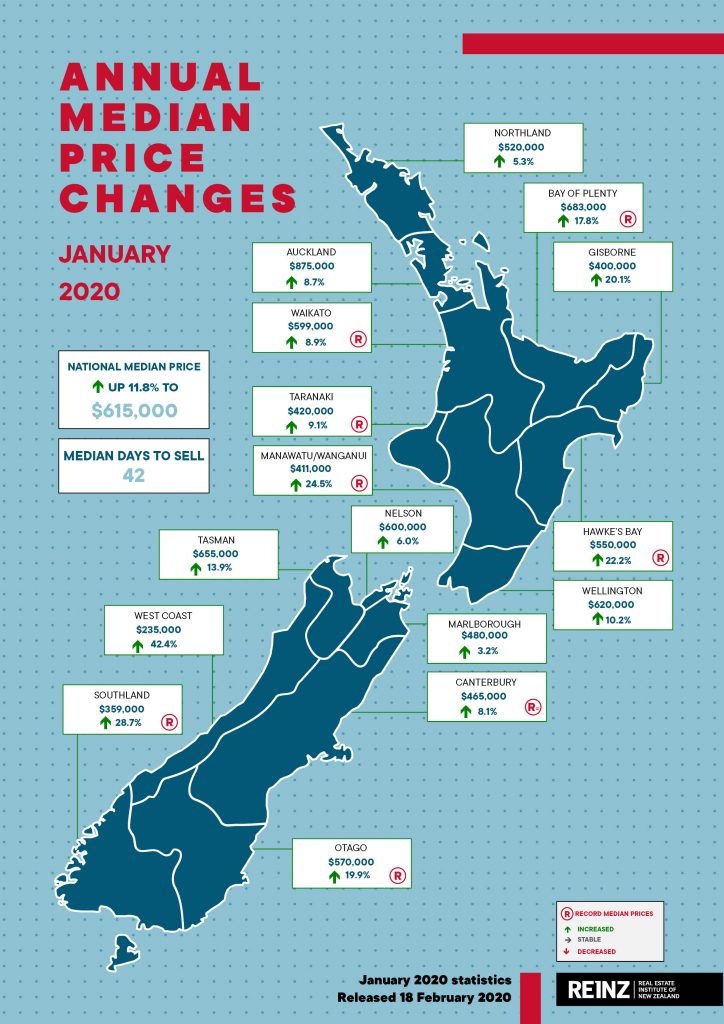

REINZ has released their January 2020 residential report today, and they reported the busiest January in 4 years. The annual average rise across New Zealand was 7%, with Auckland at 4.4% and other areas up 9.1%. Auckland is actually now among the faster-rising regions. Prices in Canterbury are rising, although to date this has been slower than many other regions.

In January the median number of days to sell a property nationally decreased by 6 days from 48 to 42 when compared to January 2019 – the lowest days to sell for the month of January in 3 years.

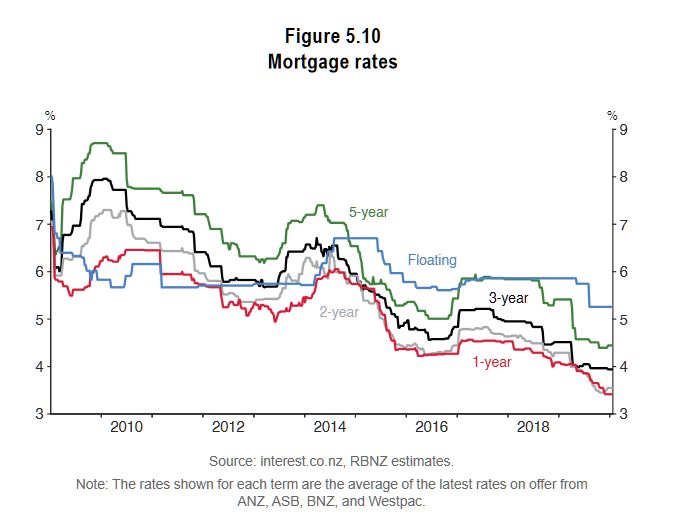

Low interest rates and lighter regulation are driving the market. Over 2019, the RBNZ cut the OCR from 1.75 percent to 1 percent and they indicate that the OCR will remain at 1 percent for some time. In response, household debt continues to rise. Lower debt servicing costs enables higher household spending on consumption, although returns from savings will be lower as well.

Over the past year New Zealand construction activity has ramped up substantially while net migration has steadily declined. The cancellation of earlier plans to introduce a capital gains tax has also helped to drive the market.

For New Zealand excluding Auckland, the number of properties sold increased by 0.9% when compared to the same time last year (from 3,279 to 3,308) – also the highest for the month of January in 4 years.

In Auckland, the number of properties sold in January increased by 9.7% year-on-year (from 1,180 to 1,295) – the highest number of residential properties sold in the month of January since January 2016.

Sales in Auckland were the highest for the month of January in four years, with particularly strong uplifts in sales volumes in North Shore City (+29.0%), Waitakere City (+28.6%) and Rodney District (+21.1%).

Regions outside Auckland with the highest percentage increase in annual sales volumes during January were:

• Nelson: +42.6% (from 54 to 77 – 23 more houses)

• Manawatu/Wanganui: +15.3% (from 281 to 324 – 43 more houses) – the highest for the month of January in 3 years

• Bay of Plenty: +11.5% (from 340 to 379 – 39 more houses) – the highest for the month of January in 4 years

• Marlborough: +11.3% (from 62 to 69 – 7 more houses).

Regions with the largest decrease in annual sales volumes during January were:

• Tasman: -29.3% (from 58 to 41 – 17 fewer houses) – the lowest since January 2017

• Southland: -27.2% (from 151 to 110 – 41 fewer houses) – the lowest for the month of January in 6 years

• Otago: -17.1% (from 269 to 223 – 46 fewer houses) – the lowest for the month of January in 9 years.

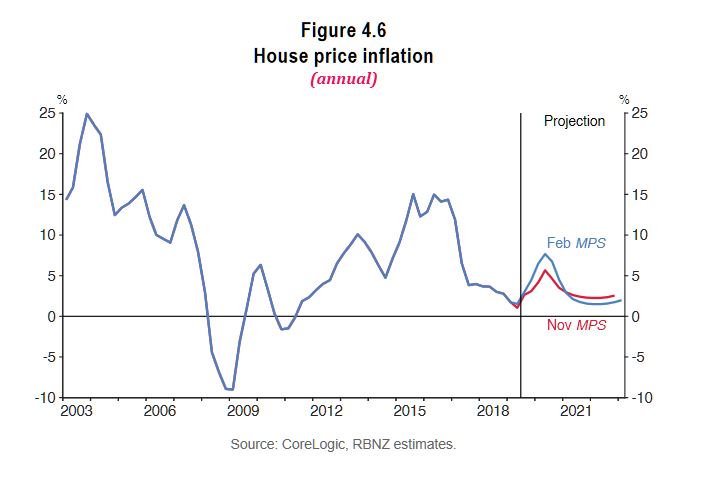

In the recent Reserve Bank NZ Monetary Policy Statement, they indicated that over the medium term, annual house price inflation is expected to slow as net immigration moderates, residential construction activity remains high, and the effects of past lower mortgage rates fade.

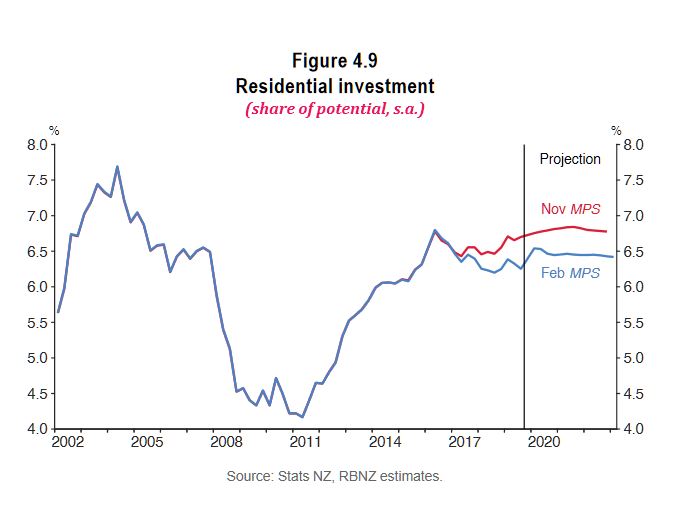

However, they expect residential investment growth is expected to pick up over the next six months, in line with recent high levels of residential building consent issuance. That said, residential investment is forecast to decline very gradually as a share of GDP later in the projection period, reflecting ongoing capacity constraints in the construction sector.

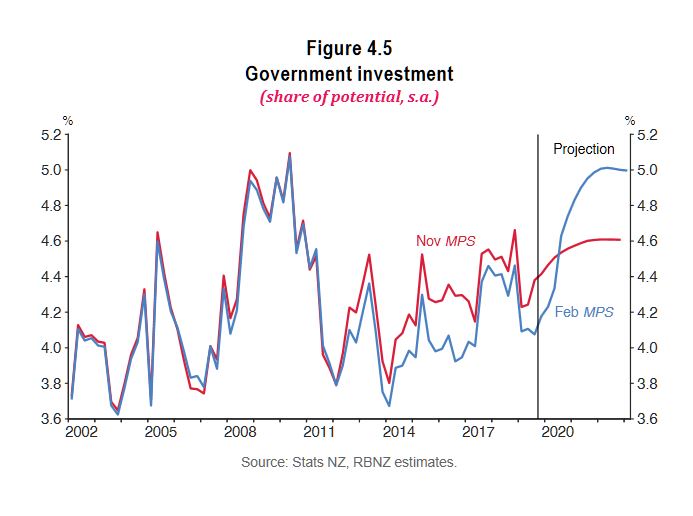

In December 2019, the Government announced a substantial investment package of $12bn, equivalent to around 4 percent of annual nominal GDP. The Treasury forecasts that $8.1bn will be spent between June 2020 and June 2024, mainly on infrastructure projects

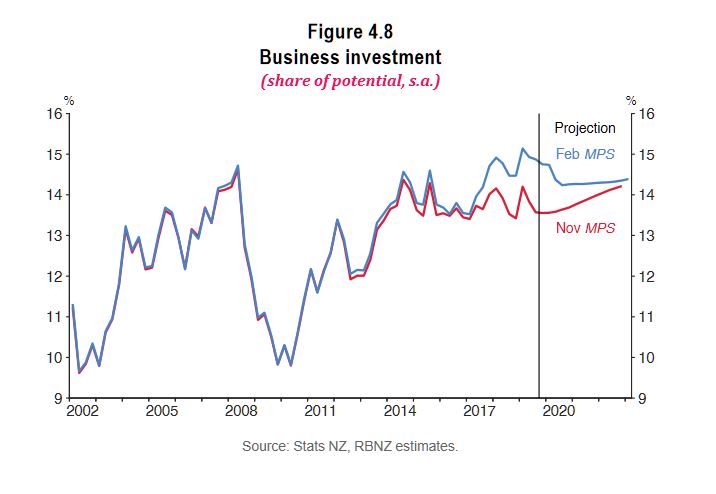

Which is probably just as well, given that business investment is forecast to fall ahead.

– How reliable is the REINZ ? Are these guys not the NZ equivalent of the aussie property spruikers ?

Same issues I believe…