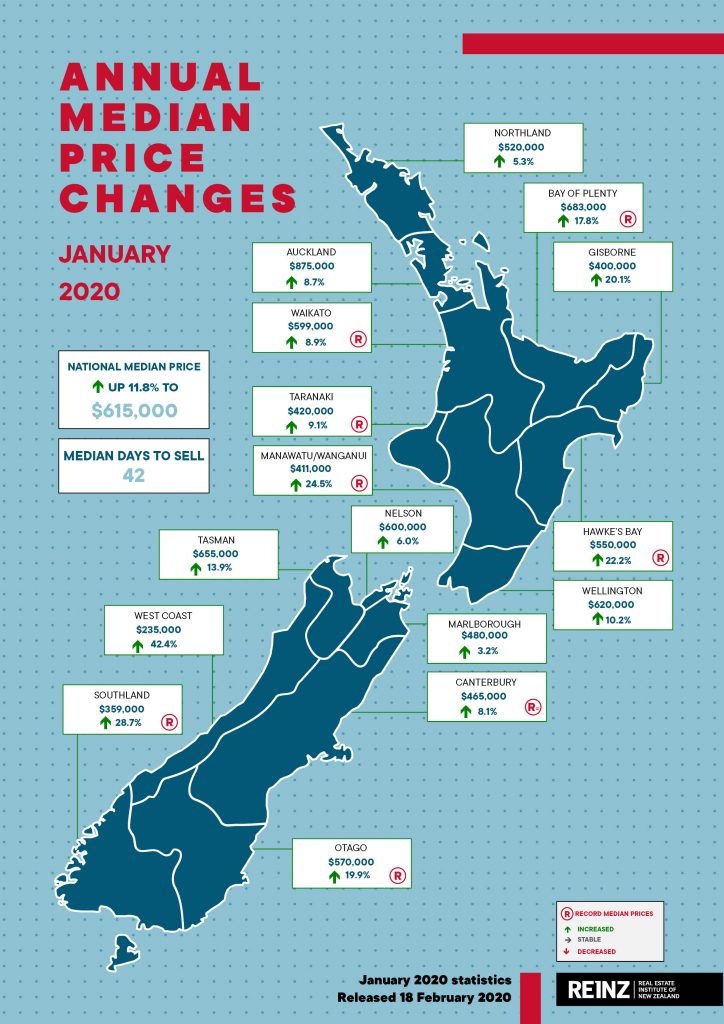

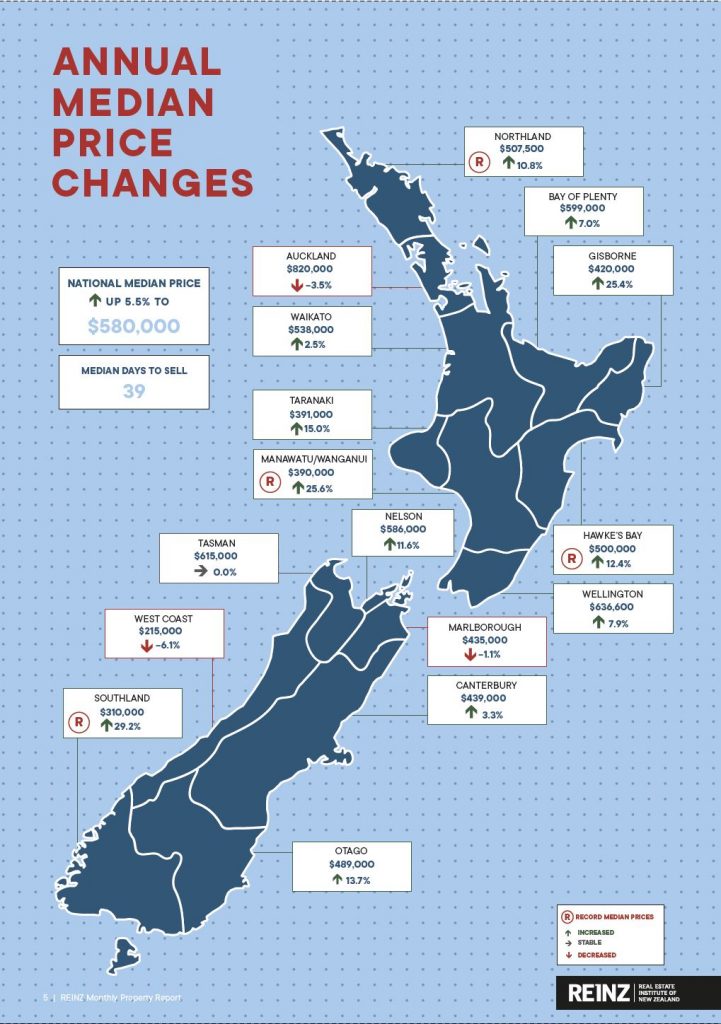

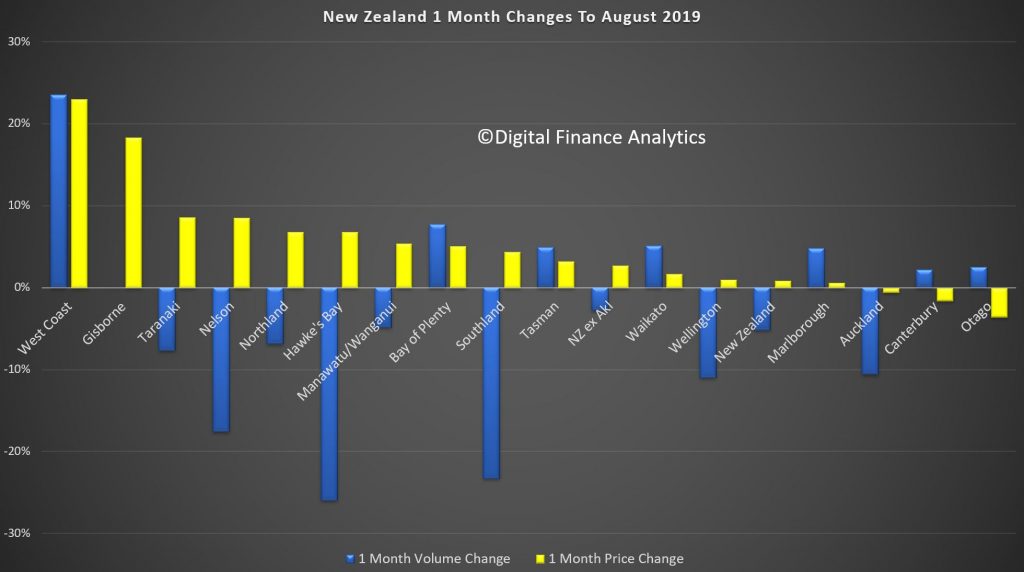

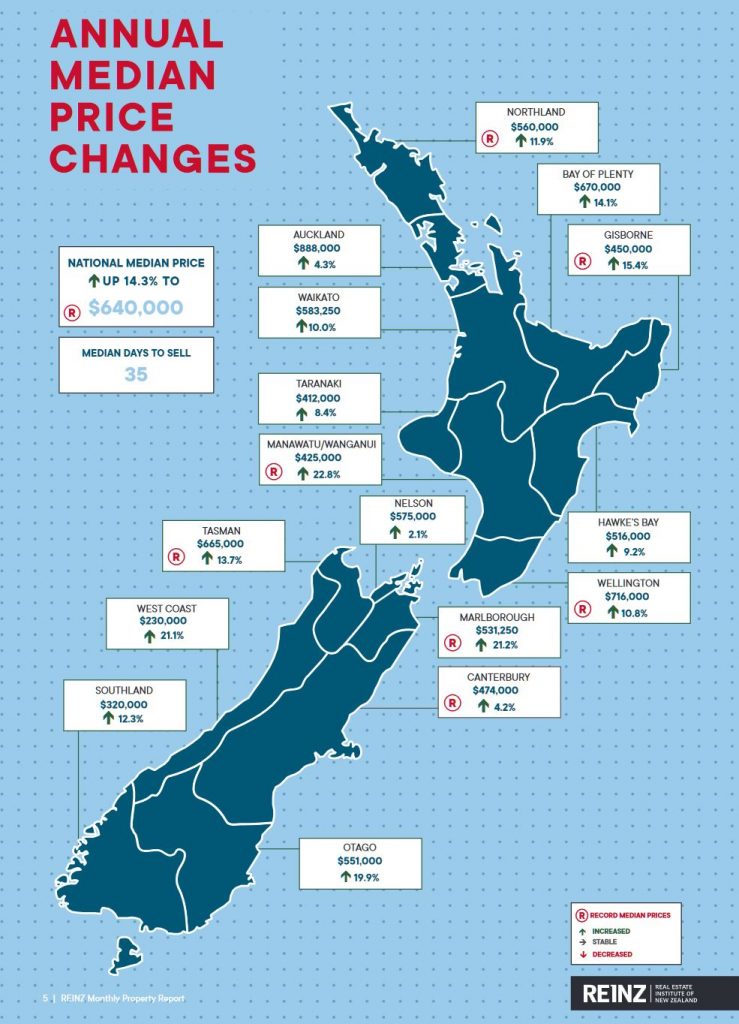

Median house prices across New Zealand increased by 14.3% in February to a new record median price of $640,000, up from $560,000 in February 2019. This was the largest percentage increase in 53 months according to the latest data from the Real Estate Institute of New Zealand (REINZ).

The number of properties sold in February across New Zealand increased by 9.2% from the same time last year (from 6,132 to 6,694) making it the highest number of properties sold in the month of February in 4 years.

For New Zealand excluding Auckland, the number of properties sold decreased by a marginal -0.3% when compared to the same time last year (from 4,742 to 4,726) – 16 fewer properties.

In Auckland, the number of properties sold in February increased by 41.6% year-on-year (from 1,390 to 1,968) – the highest number of residential properties sold in the month of February in 5 years.

The REINZ House Price Index for New Zealand, which measures the changing value of property in the market, increased 8.7% year-on-year to 3,013 – a new record high.

The HPI for New Zealand excluding Auckland increased 10.2% from February 2019 to 2,995 another new record high.

The Auckland HPI increased by 6.9% year-on-year to 3,035 – the highest annual percentage increase in 35 months and the first time the Auckland region crossed the 3,000 mark.

In February the median number of days to sell a property nationally decreased by 12 days from 47 to 35 when compared to February 2019 – the lowest days to sell for the month of February in 13 years.

The total number of properties available for sale nationally decreased by -22.3% in February to 20,875 down from 26,850 in February 2019 – a decrease of 5,975 properties compared to 12 months ago and the lowest level of inventory for the month of February ever. However, this was an uplift on January’s figure of 19,488.