I discuss the budget outcomes with journalist Tarric Brooker. He is @Avidcommentator on Twitter.

Inflation, Deflation, Confusion – With Steve Van Metre

My latest discussion with Steve Van Metre delves further into the deflation question.

He is a Certified Financial Planner™ Professional, (CA Insurance License #0D45202 & Investment Advisory Representative with Atlas Financial Advisors, Inc

His YouTube channel is at https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw – do subscribe to his shows…

Goodbye Australia! 1788-2020

Economist John Adams and Analyst Martin North review the budget statement and unpack the true motivations behind it. Its not pretty!

September Stress Eases A Tad (But Still Close To Record High)

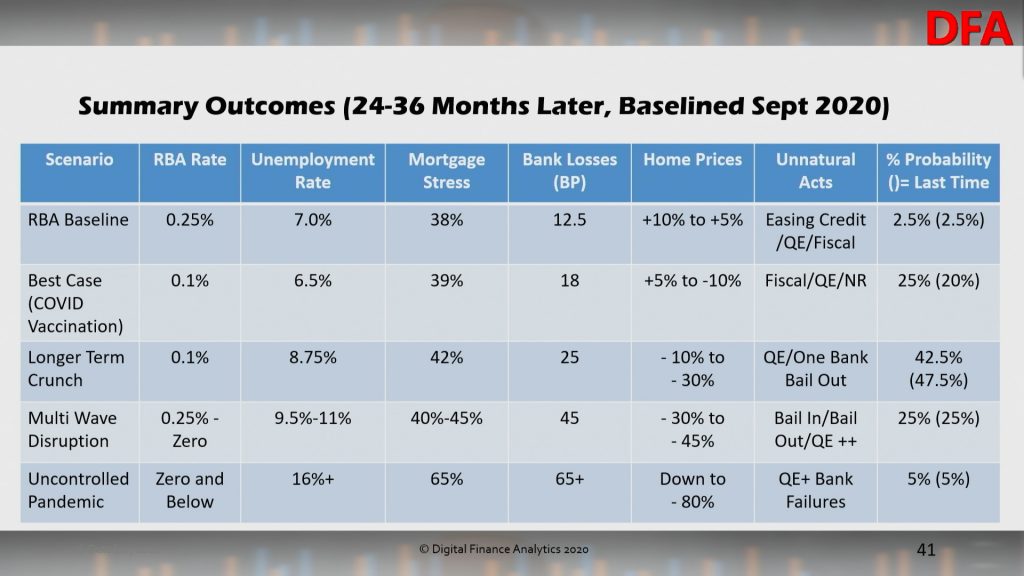

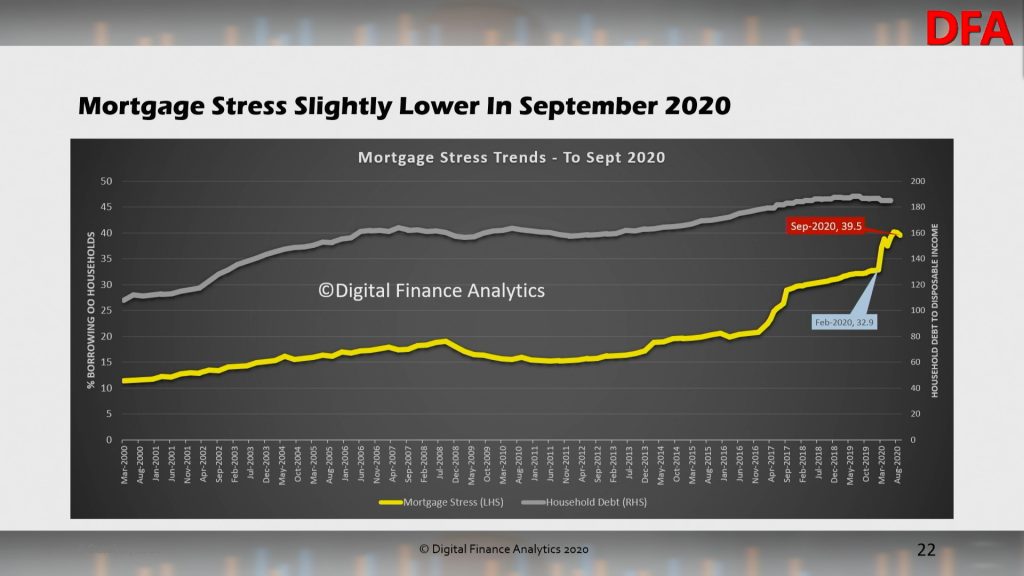

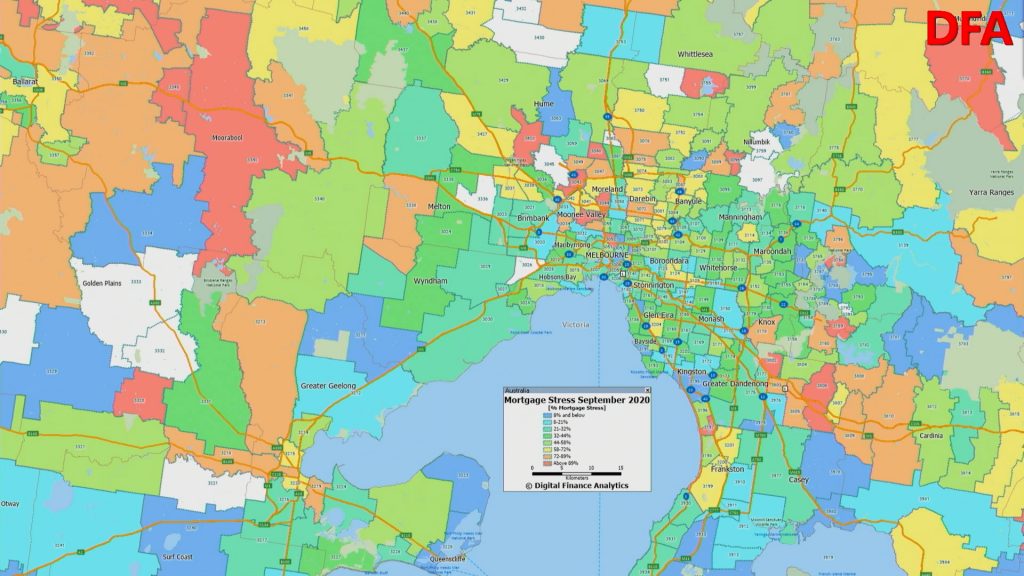

We have updated our Core Market Models and scenarios with the latest household financial stress data to the end of September 2020.

We discussed this in our live show last night:

Overall mortgage stress eased back to below 40% of borrowing households at 39.5%. But it remains very high. This is measured in net cashflow terms.

The RBA household debt to income ratio eased back as loans are paid down.

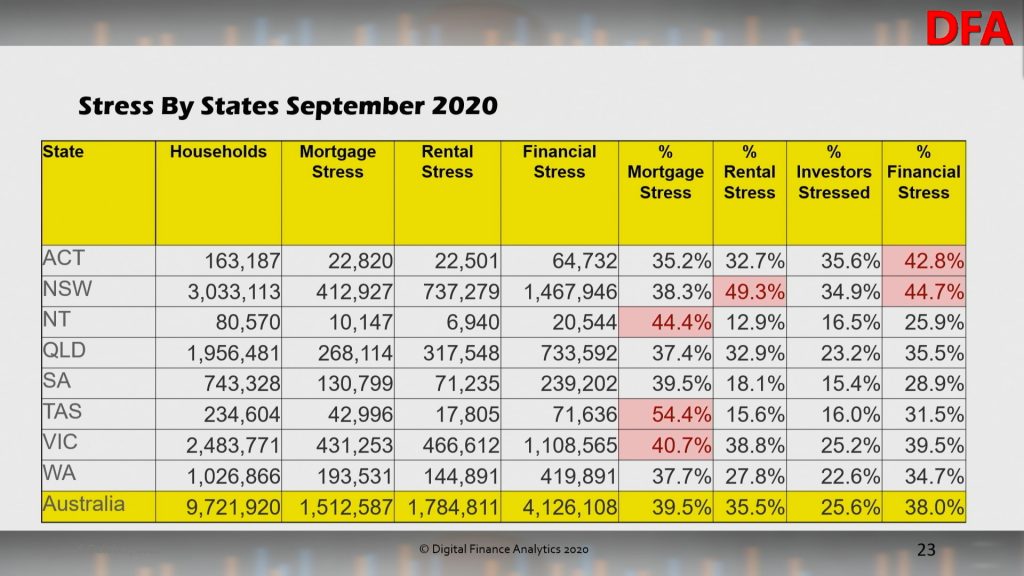

Across the states, mortgage stress is highest (in percentage terms) in Tasmania, NT and Victoria. Rental stress is highest in New South Wales. Overall financial stress (including mortgage, rental and investor stress) is highest in ACT and NSW.

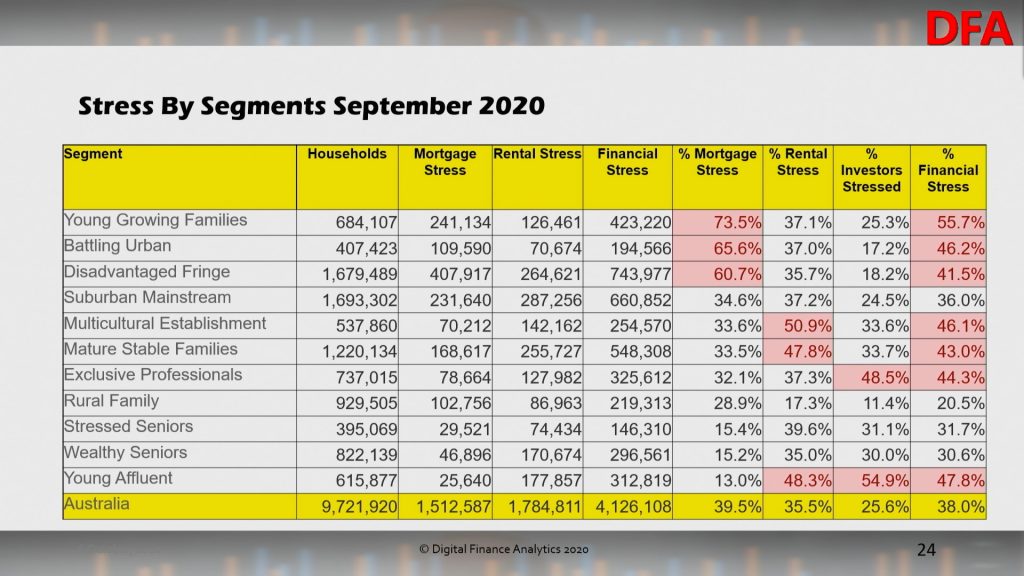

Across our household segments, young growing families (which include first time buyers) are most exposed, together with households on new estates on the edges of our towns and cities. Rental stress is highest among first generation migrants, while investor stress is highest among most affluent households who are highly leveraged into investment property.

As a result aggregate financial stress is dispersed across many of our segments, indicating this is a real structural problem.

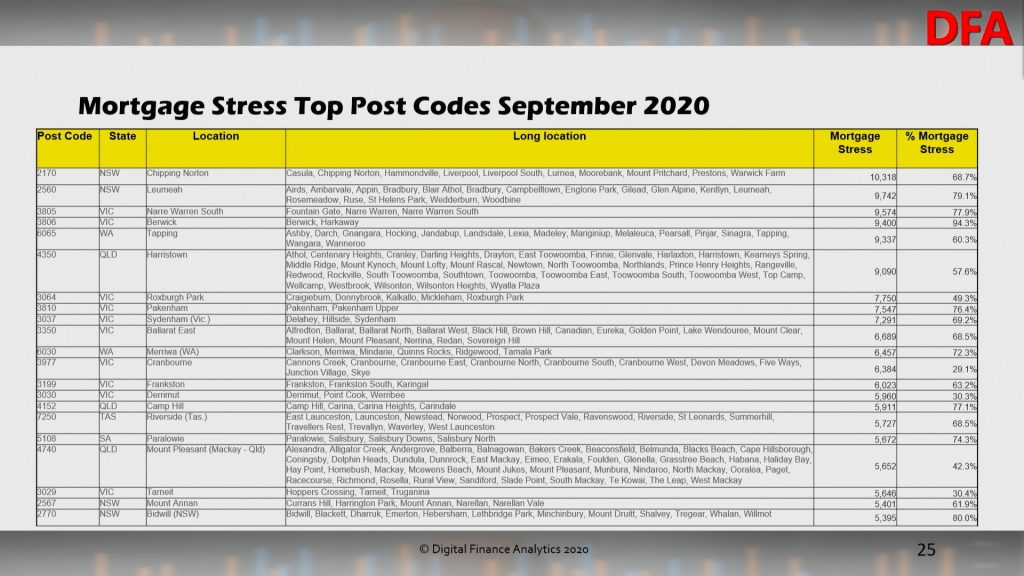

Top post codes by mortgage stress:

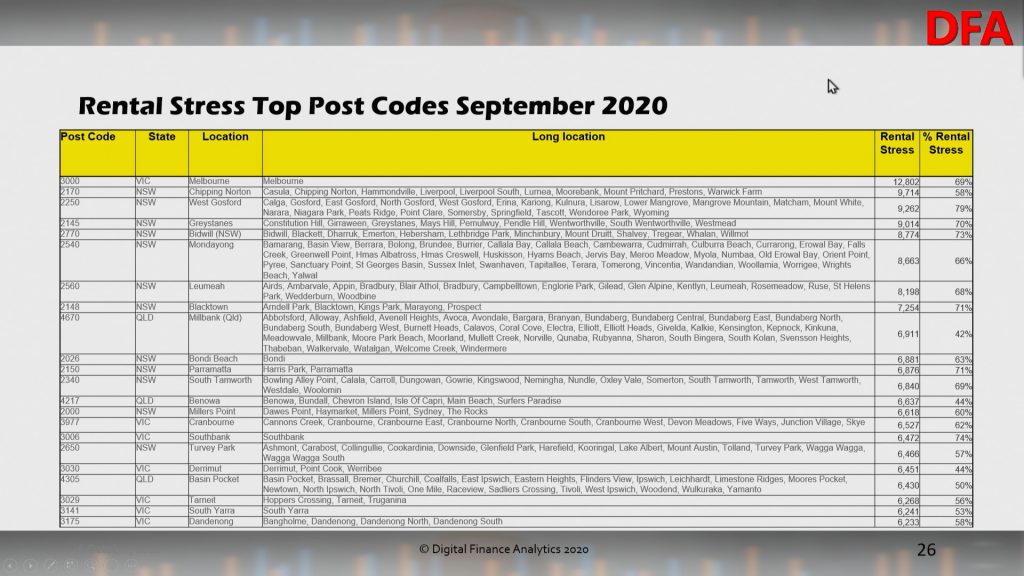

Top post codes by rental stress:

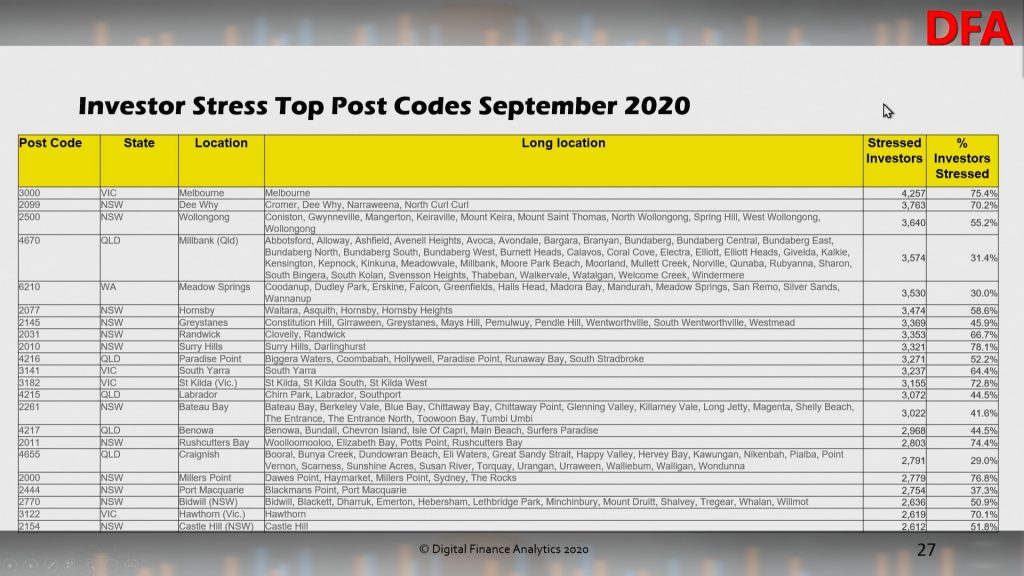

Top post codes by property investor stress:

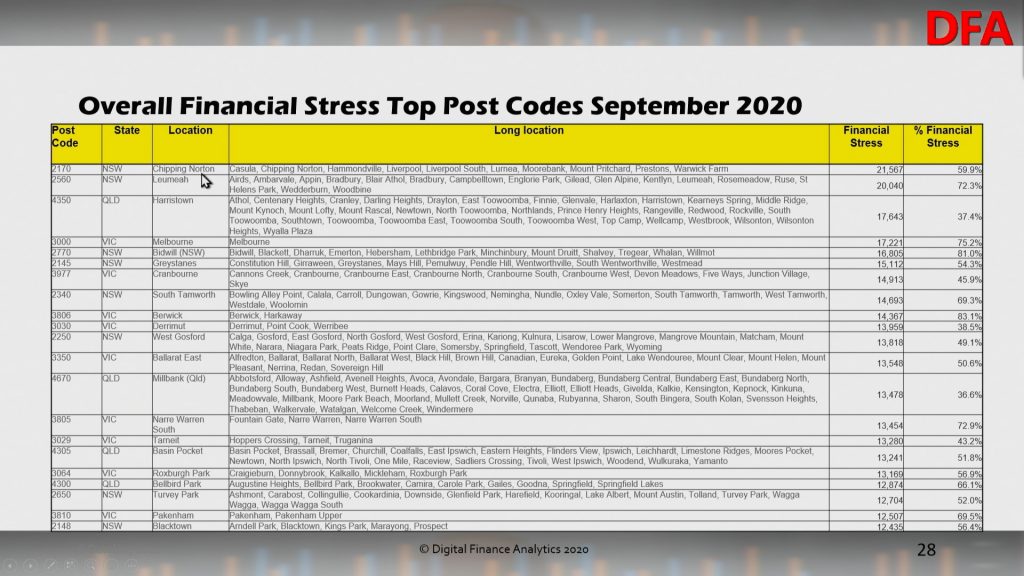

Top post codes by overall financial stress:

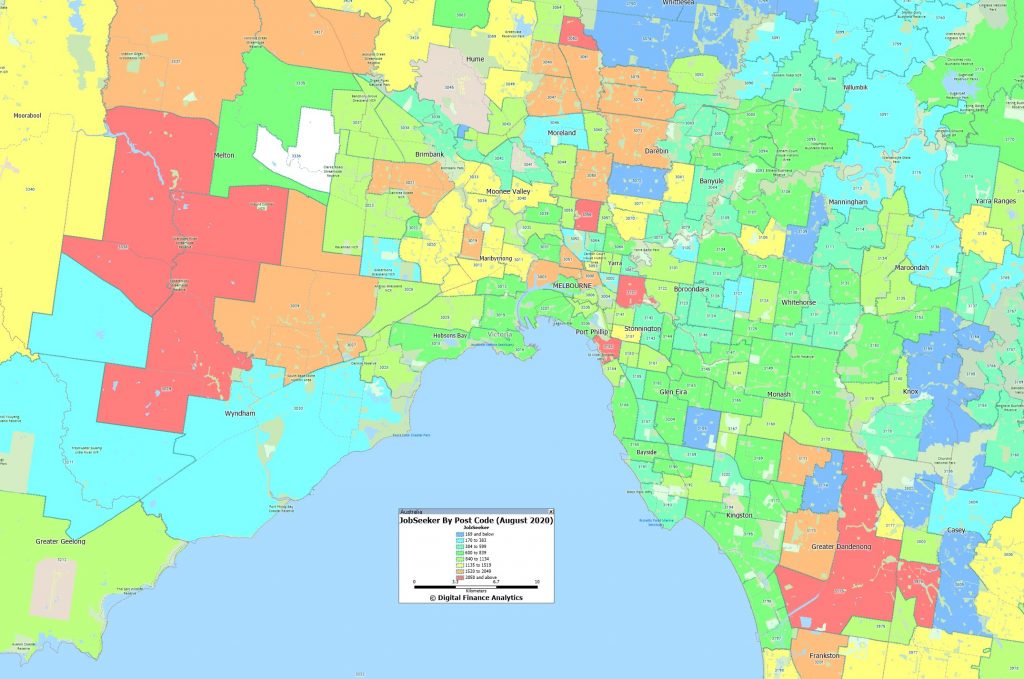

As we discussed in our post last night there is a strong correlation between mortgage stress and high counts of JobSeeker claims. Melbourne is an example:

As the mortgage repayment holidays dry up we expect stress to remain high even if job growth recovers. This is a structural issue which will not be solved with more generous lending standards. Only real income growth would assist, but this seems unlikely for some time to come.

FINAL REMINDER – DFA Live Q&A Tonight – Latest Stress And Scenarios 8pm Sydney

Join us tonight at 20:00 Sydney for a live discussion on our latest research and analysis. You will be able to ask a question live via the YouTube chat. We will also have our post code tool online.

It’s Edwin’s Monday Evening Rant #6

The RBA’s “Confusion Driven Paralysis”

We discuss a recent RBA FOI.

https://www.rba.gov.au/information/foi/disclosure-log/rbafoi-202107.html

A Spotlight On Wollongong Property

We look at the latest property data for 2500.

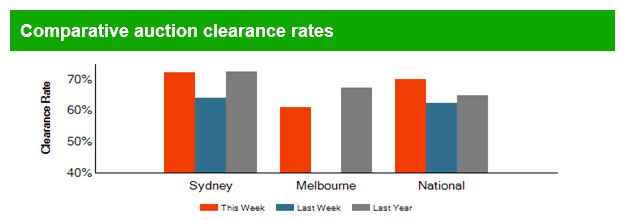

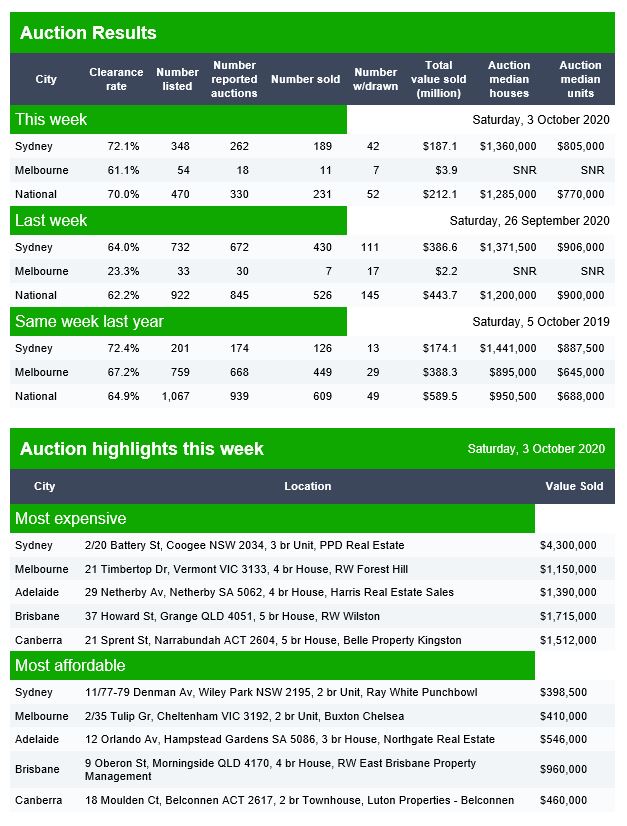

Auction Results 3rd October 2020

Domain released their preliminary results for today. They note that “From Thursday July 9 the Victorian government placed a ban on public real estate auctions as part of social distancing measures to slow the spread of COVID-19. The number of auctions withdrawn in the immediate weeks following the ban are likely to be higher than normal”.

Canberra listed 24 auctions, reported 19 with 16 sales, and 3 passed in to give a Domain clearance of 84%.

Brisbane listed 31 auctions, reported 22 with 8 sold, 2 withdrawn and 12 passed in to give a Domain clearance of 36%.

Adelaide listed 13 auctions, reported 9 with 1 withdrawn and 1 passed in to give a Domain clearance of 0%.

Double Trouble Housing Bubble With Joseph Noel Walker (The Jolly Swagman Podcast)

We discuss the underlying drivers of house prices, and reflect on what might be causing the bubble and what policy responses would be appropriate.