ASIC has highlighted that some consumers are taking out home loans when cheaper alternatives may well exist. Brokers do not come out that well!

Today ASIC has released a report Looking for a mortgage: Consumer experiences and expectations in getting a home loan. As part of this research, ASIC followed over 300 consumers in the process of taking out a home loan and surveyed another 2,000 consumers.

This research examines consumer decision-making in relation to home loans to identify what factors influence their journey.

Key findings from our research include:

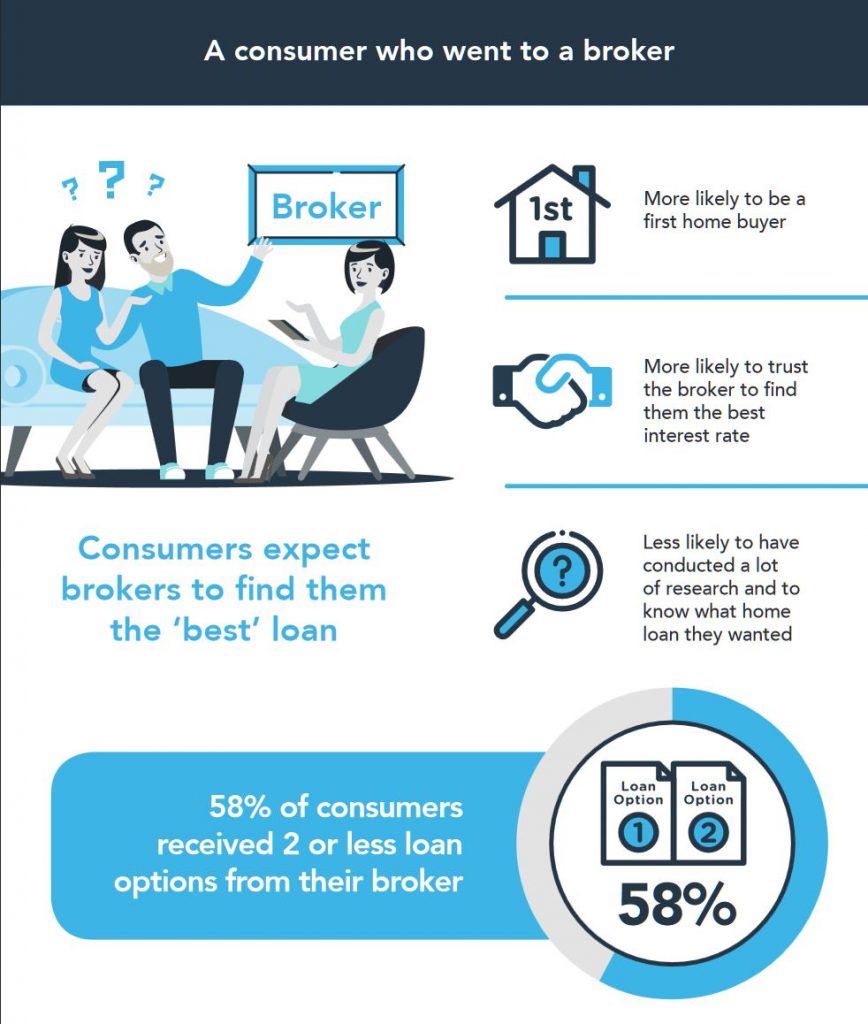

- consumers who visit a mortgage broker expect the broker to find them the ‘best’ home loan

- mortgage brokers were inconsistent in the ways they presented home loan options to consumers, sometimes offering little (if any) explanation of the options considered or reasons for their recommendation

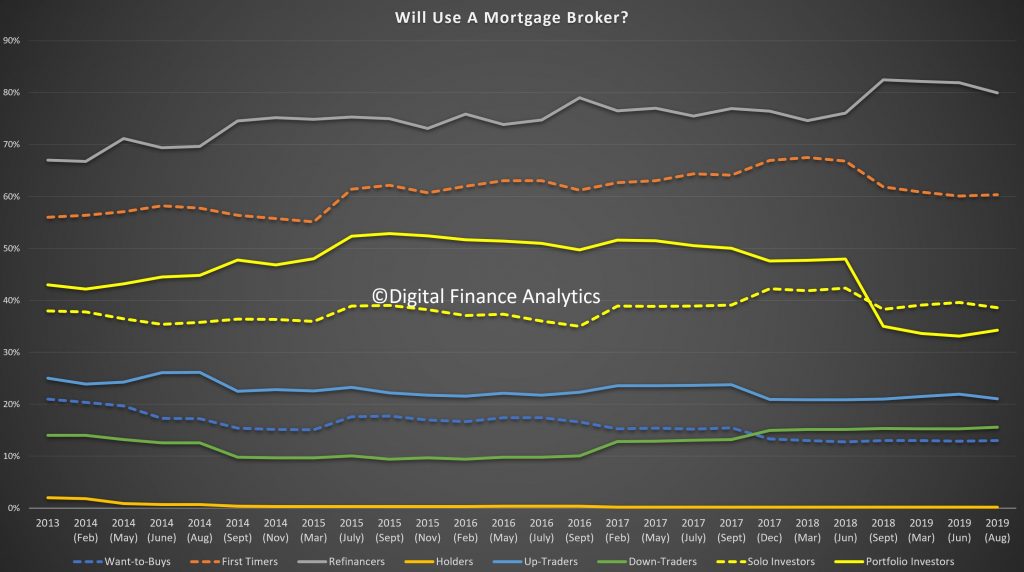

- first home buyers were more likely to take out their loan with a mortgage broker.

The report shows that consumers taking out a loan directly through a lender were more likely to be a refinancer or have had previous experience taking out home loans. Consumers who went directly to a lender valued convenience, with 69% taking out their loan with a lender they had an existing relationship with.

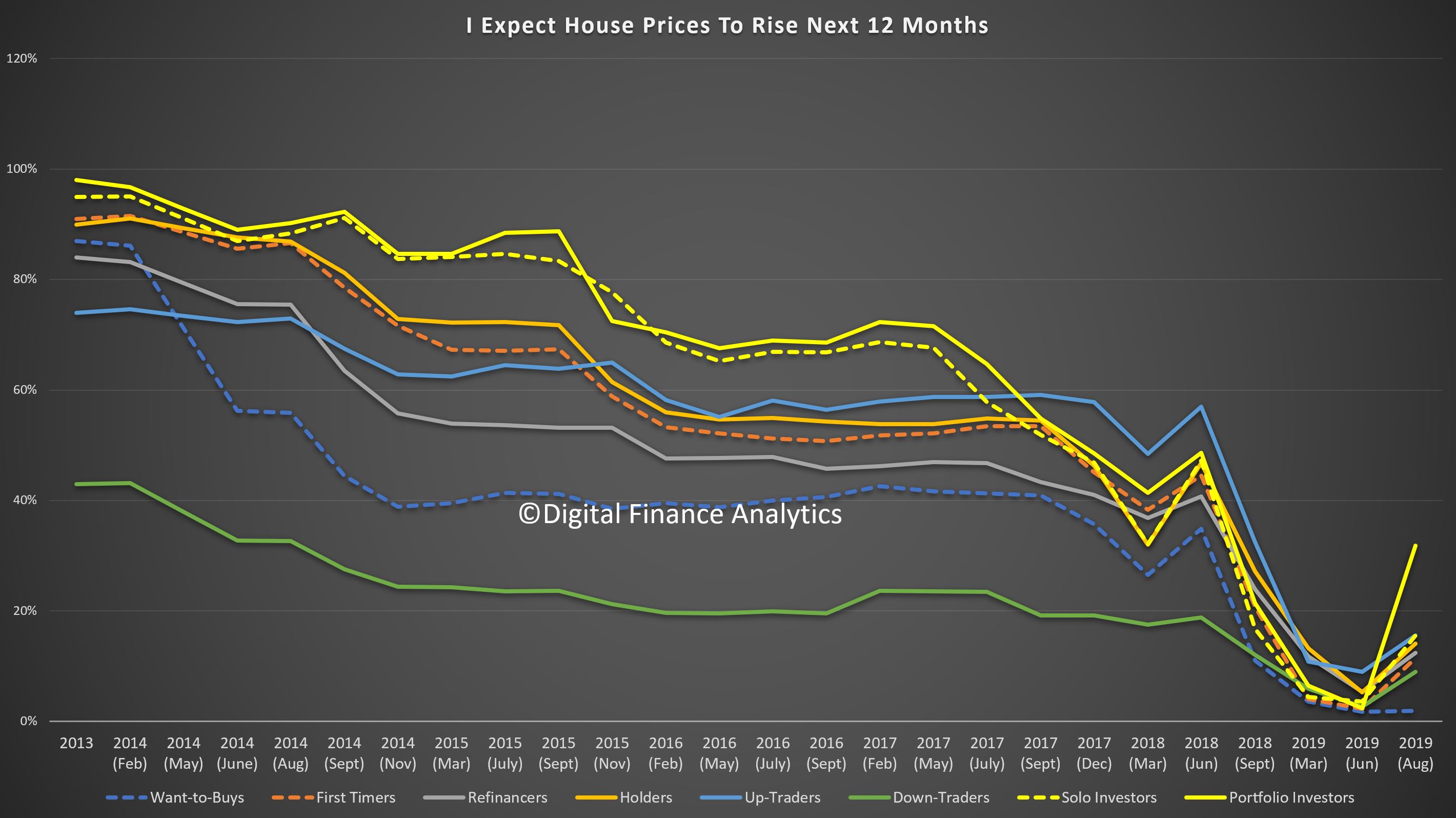

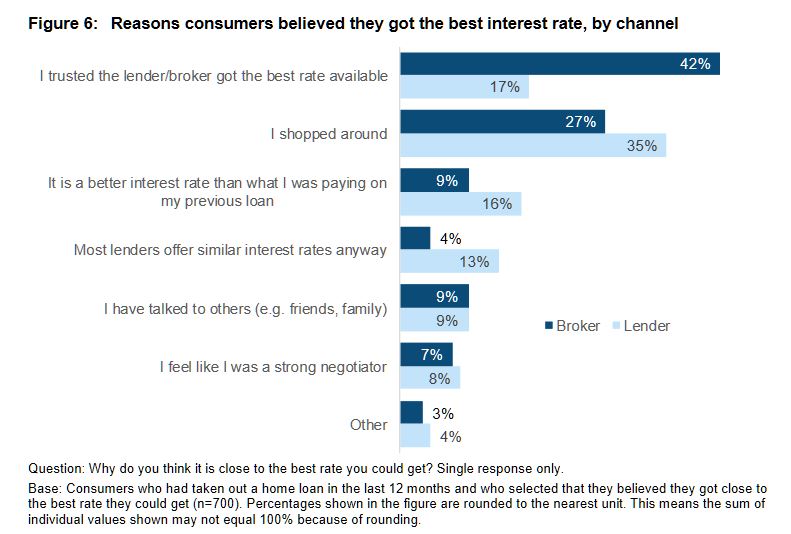

Taking out a home loan is a complex process and consumers told us it can be an ‘overwhelming’ experience. Although most consumers set out to find the best loan they could, 1 in 5 consumers believed that they could have got a better interest rate on their home loan or were not sure whether they had even got a good rate.

In launching ASIC’s report, Commissioner Sean Hughes said, ‘A home loan is one of the most important financial commitments a consumer will make. Lenders, brokers and aggregators must step up to make it easier for consumers to meaningfully compare loan options and for brokers to communicate how a home loan option has been selected for them.’

‘ASIC strongly supports the recent Government announcement to enact a best interests duty for mortgage brokers. Importantly, the implementation of such a duty will align the role of brokers to the reasonable expectations of consumers.’

‘Our research also suggests that some consumers are taking out home loans when cheaper alternatives may well exist. We are working with other regulators to develop a new home loan interest rate tool to improve price transparency for consumers to compare options. We expect this tool will be made available on ASIC’s MoneySmart website next year.’

Background

In March 2017, ASIC published the findings of our review into the effect of remuneration structures in the mortgage broking market on the quality of consumer outcomes: see Report 516 Review of mortgage broker remuneration (REP 516). We found that current remuneration practices create conflicts of interest that may contribute to poor consumer outcomes.

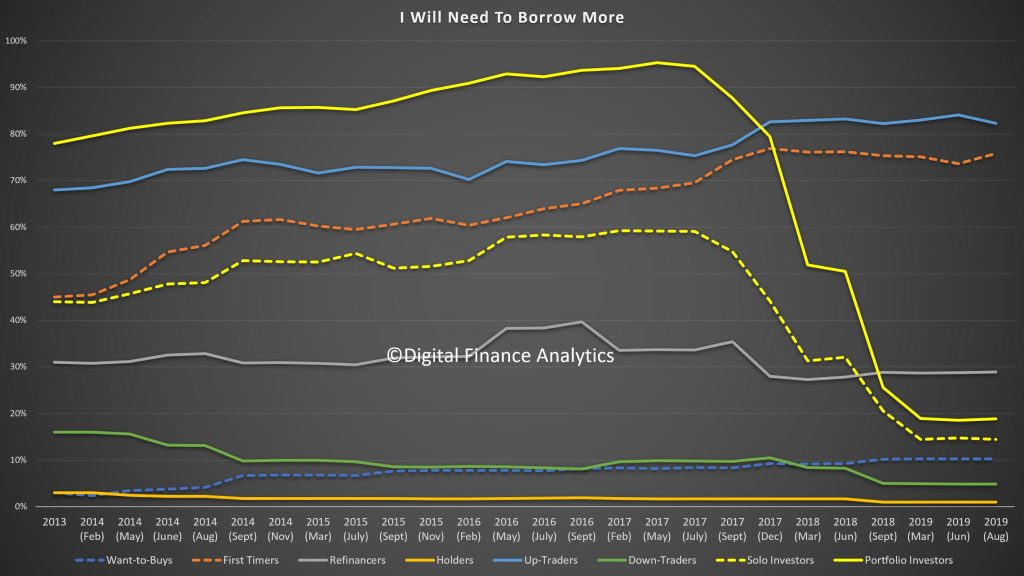

As part of this review we also found that consumers who obtained their loan through a broker:

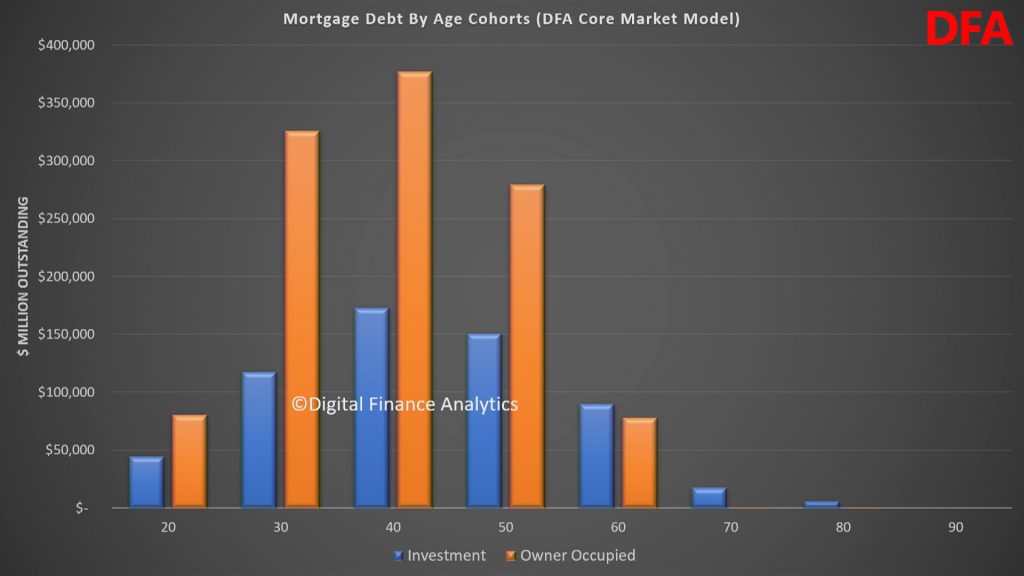

- borrow more

- have higher loan to valuation ratios

- spend more of their wage on a mortgage

- take out more interest-only loans

- get the same rate as customers that go directly to a lender.

ASIC’s MoneySmart website has information for consumers about choosing a home loan and using a broker.

Consumers can also use MoneySmart’s mortgage calculator to compare home loans and work out whether they can save money by switching to another mortgage.