A welcome move, the shadowy Council Of Financial Regulators has started publishing minutes of its quarterly meetings. However, group think, and self-interest is all over it. Specifically the comments about tighter credit, and the need to continue to lend (to keep the debt bomb ticking a bit longer! Also how does independence of the RBA work in this context?

They noted that non-ADI lending for housing has been growing significantly faster than ADI housing lending and there is some evidence that non-ADI lending for property development is also increasing quickly.

As part of its commitment to transparency, the Council of Financial Regulators (the Council) has decided to publish a statement following each of its regular quarterly meetings. This is the first such statement.

The statement will outline the main issues discussed at each meeting. From time to time the Council discusses confidential issues that relate to an individual entity or to policies still in formulation. These issues will only be included in the statement where it is appropriate to do so.

The Council of Financial Regulators (the Council) is the coordinating body for Australia’s main financial regulatory agencies. There are four members: the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), the Australian Treasury and the Reserve Bank of Australia (RBA). The Reserve Bank Governor chairs the Council and the RBA provides secretariat support. It is a non-statutory body, without regulatory or policy decision-making powers. Those powers reside with its members. The Council’s objectives are to contribute to the efficiency and effectiveness of financial regulation, and to promote stability of the Australian financial system. The Council operates as a forum for cooperation and coordination among member agencies. It meets each quarter, or more often if required.

At each meeting, the Council discusses the main sources of systemic risk facing the Australian financial system, as well as regulatory issues and developments relevant to its members. Topics discussed at its meeting on 10 December 2018 included the following:

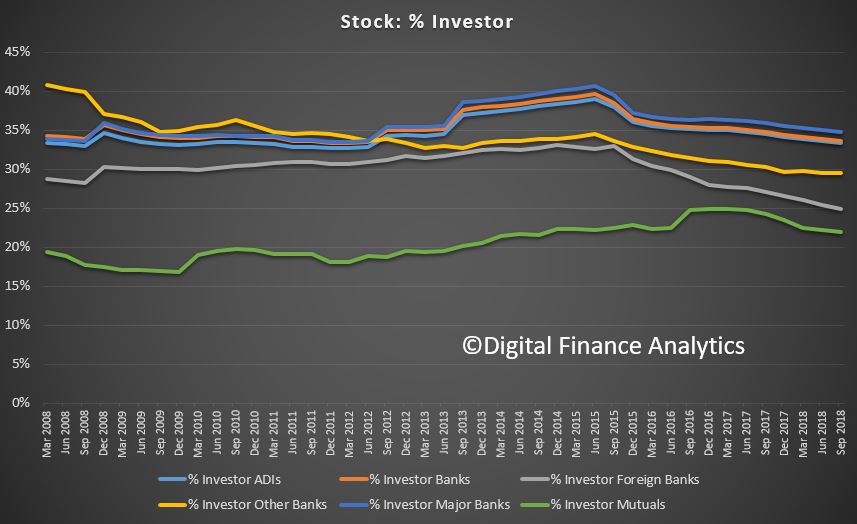

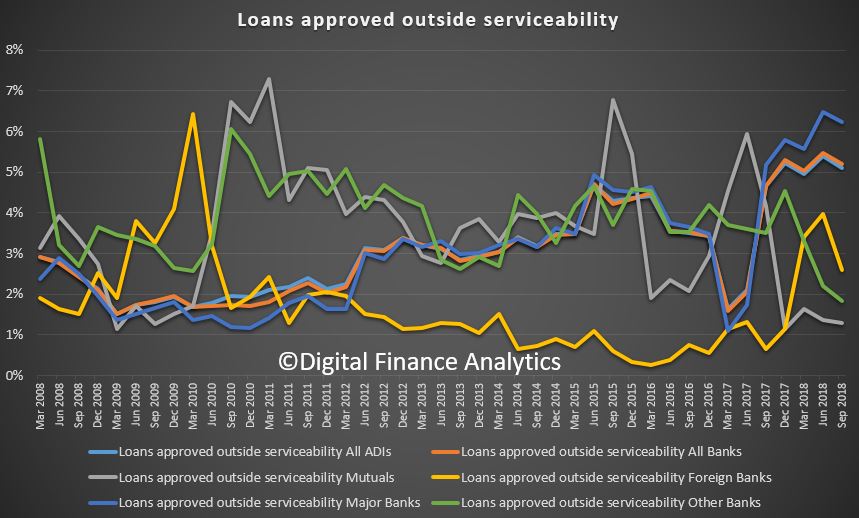

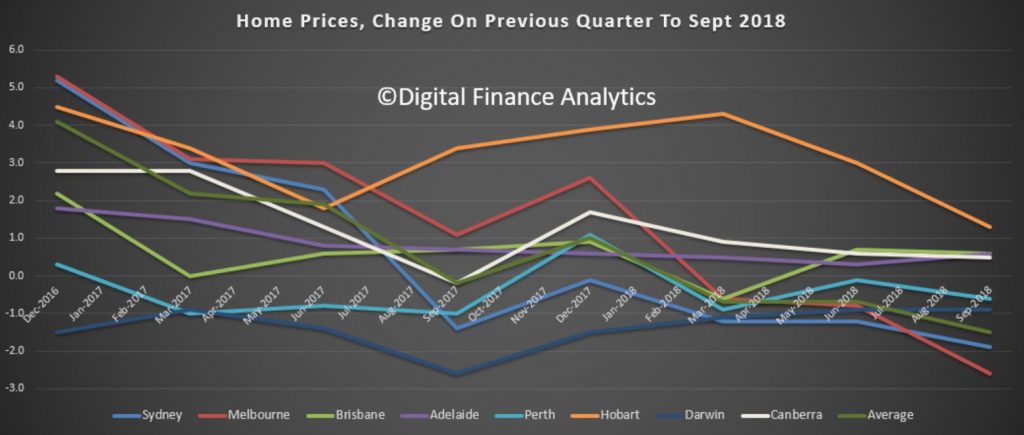

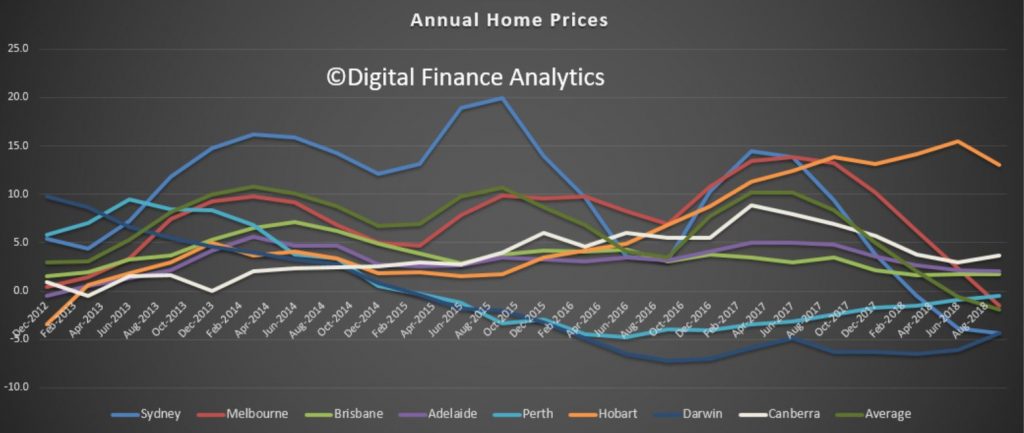

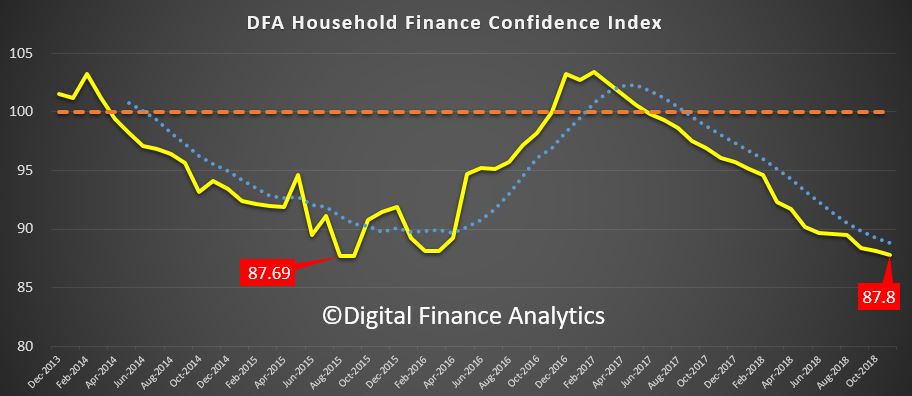

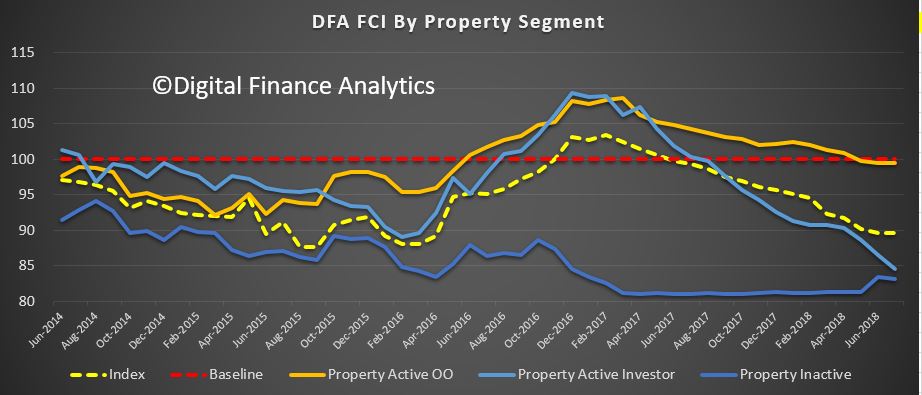

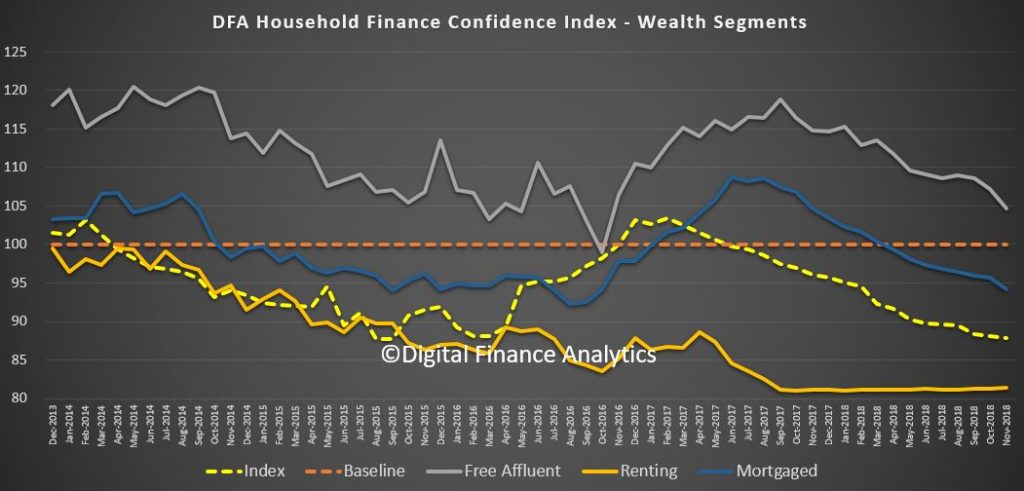

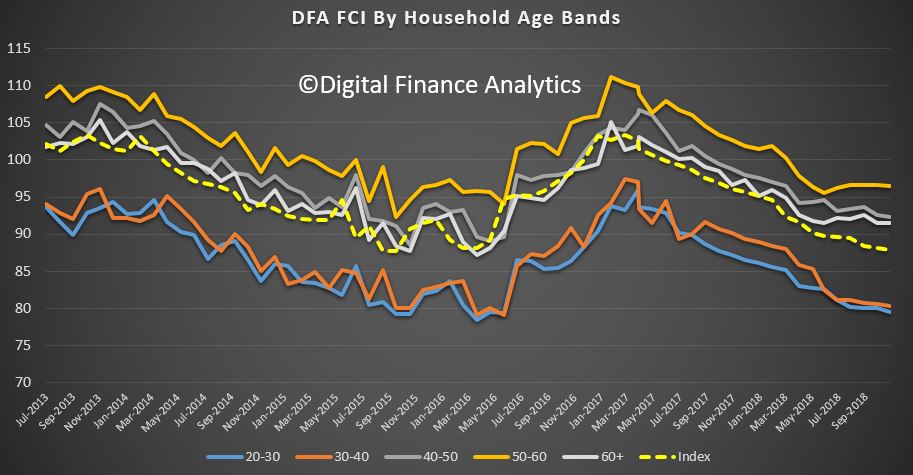

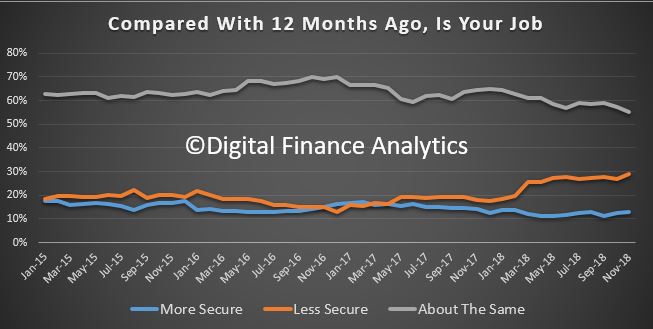

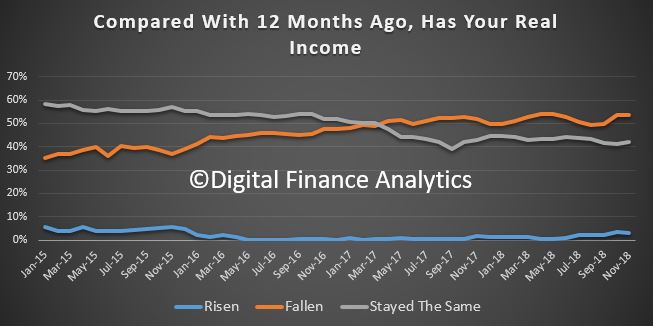

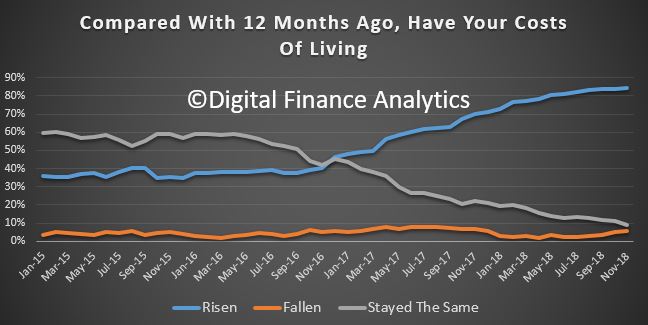

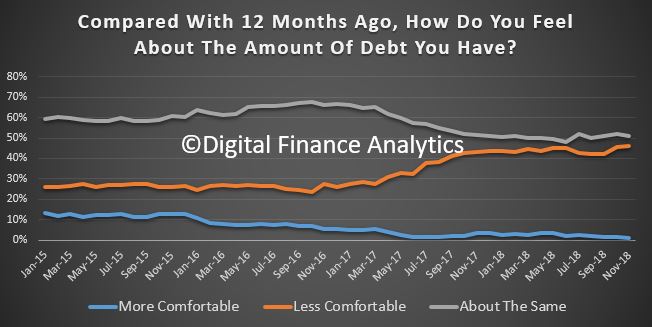

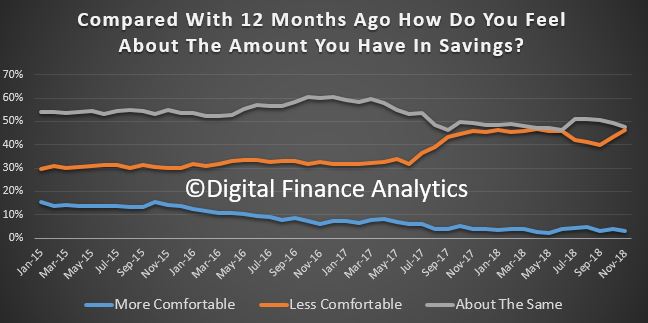

- Financing conditions. Members discussed the tightening of credit conditions for households and small businesses. A tightening of lending standards over recent years has been appropriate and has strengthened the resilience of the system. At the same time, members agreed on the importance of lenders continuing to supply credit to the economy while they adjust their lending practices, including in response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Members discussed how an overly cautious approach by some lenders to incorporating relevant laws and standards into loan approval processes may be affecting lending decisions. Members observed that housing credit growth has moderated since mid-2017, with both demand and supply factors playing a role. The demand for credit by investors has slowed noticeably, largely reflecting the change in the dynamics of the housing market. In an environment of tighter lending standards, the decline in average interest rates for owner-occupier and principal and interest loans suggests that there is relatively strong competition for borrowers of low credit risk. Credit to owner-occupiers is continuing to grow at 5 to 6 per cent.

- Non-ADI lending. The Council undertook its annual review of non-bank financial intermediation. Overall, lending by non-ADIs remains a small share of all lending. However, non-ADI lending for housing has been growing significantly faster than ADI housing lending and there is some evidence that non-ADI lending for property development is also increasing quickly. The Council supported efforts to expand the coverage of data on non-ADI lenders, drawing on new data collection powers recently granted to APRA.

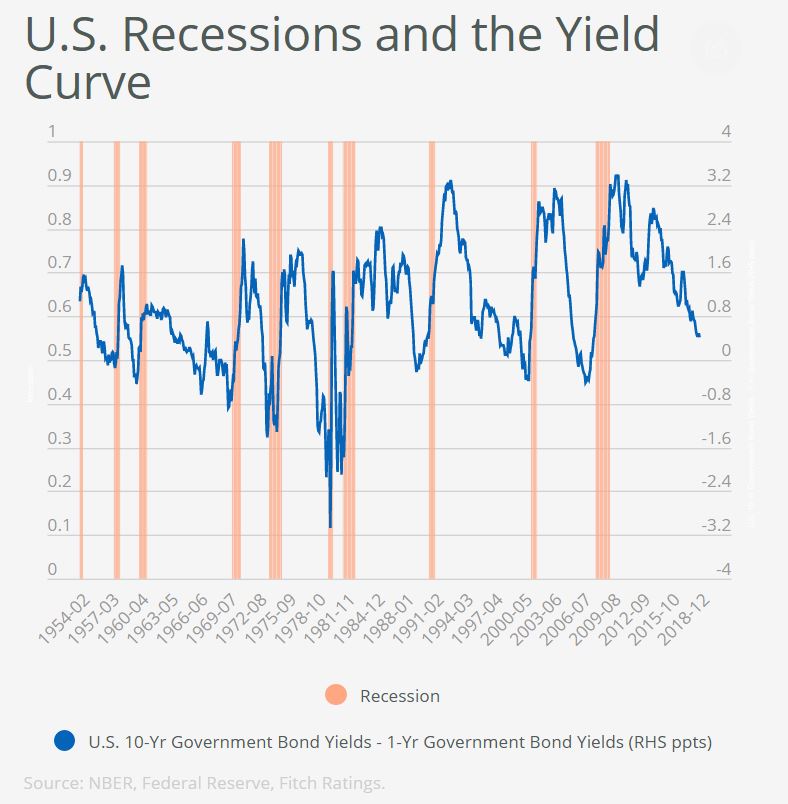

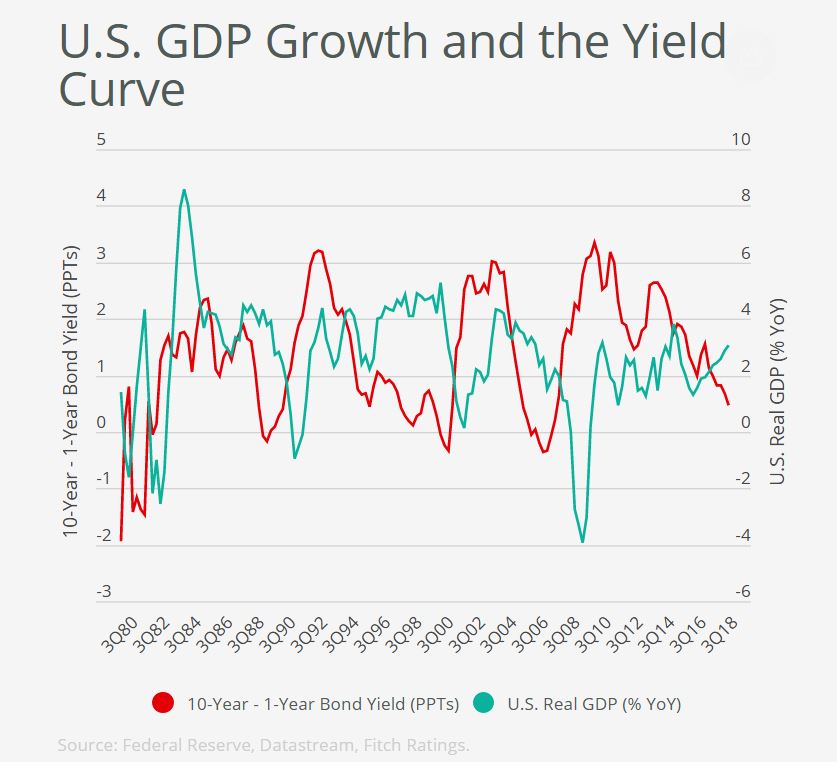

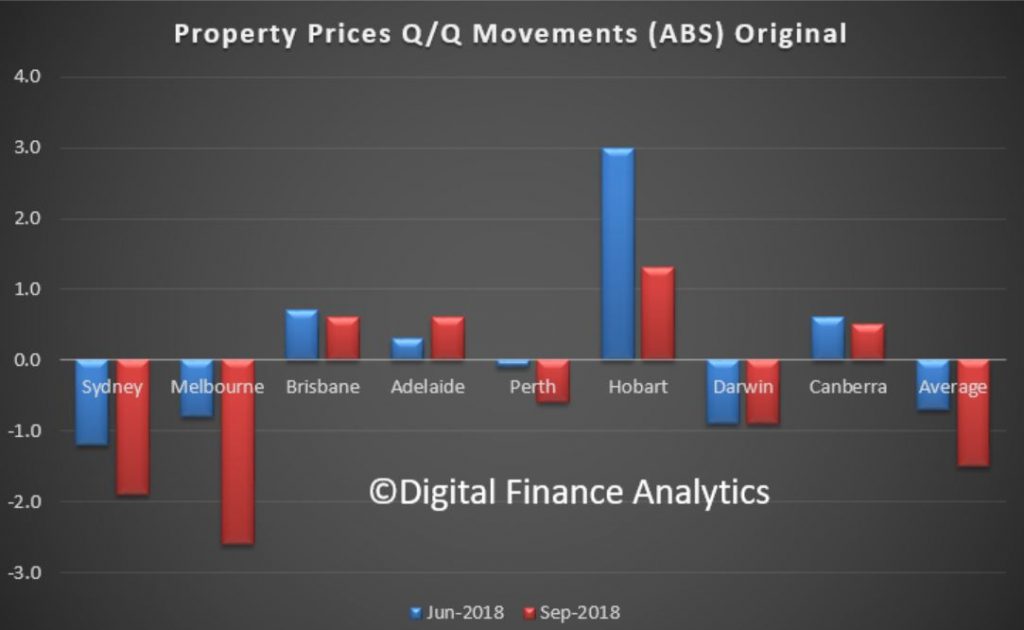

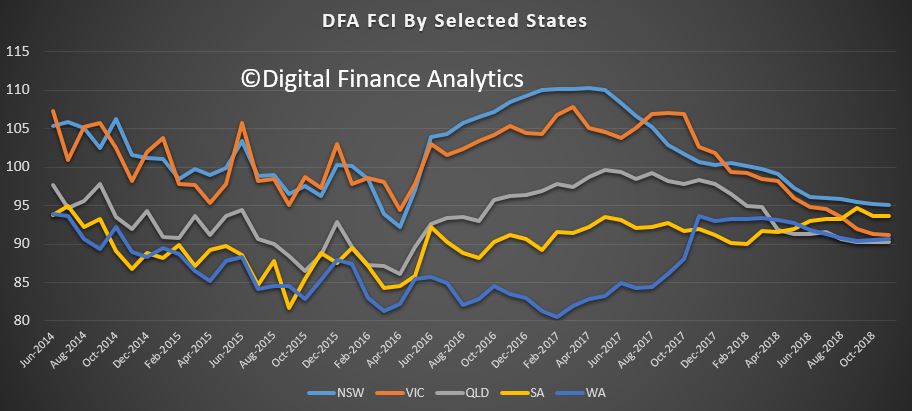

- Housing market. Members discussed recent developments in the housing market. Conditions have eased, but this follows a period of considerable strength in the market. Housing prices have been declining in Sydney, Melbourne and Perth, but are stable or rising in most other locations. The easing in the housing market is occurring in a period of favourable economic conditions, with low domestic unemployment and interest rates and a supportive global economy. The Council will continue to closely monitor developments.

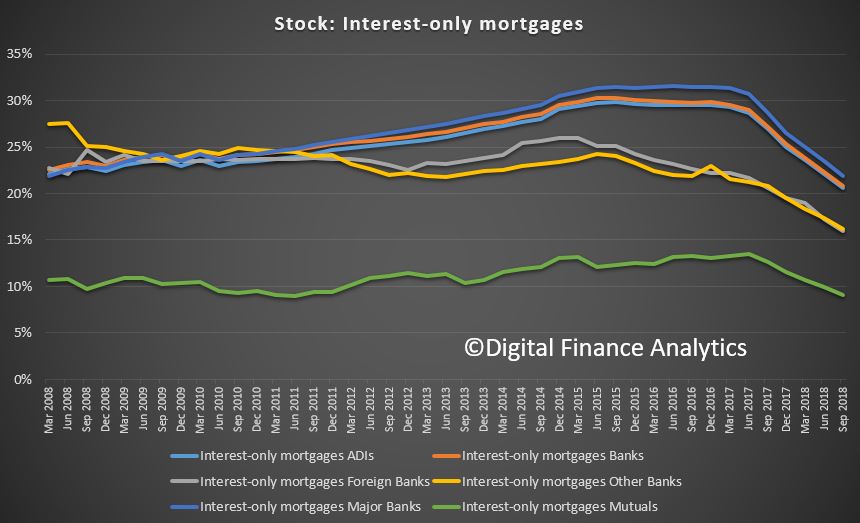

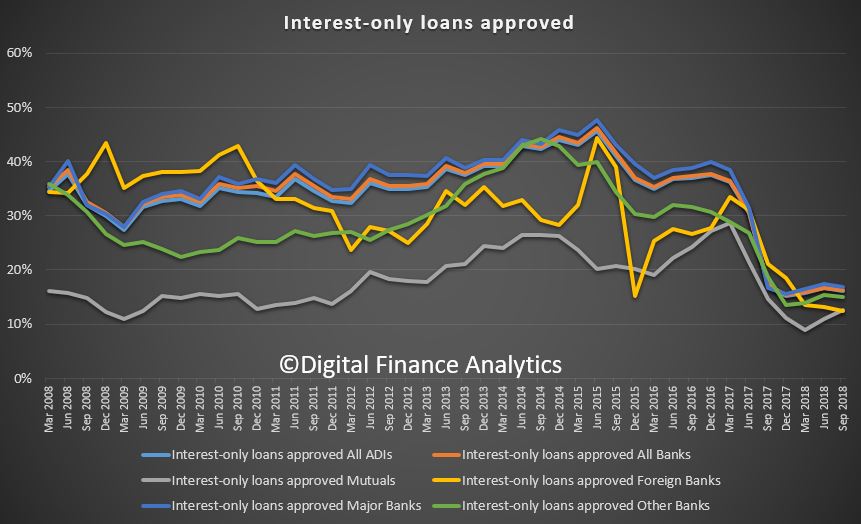

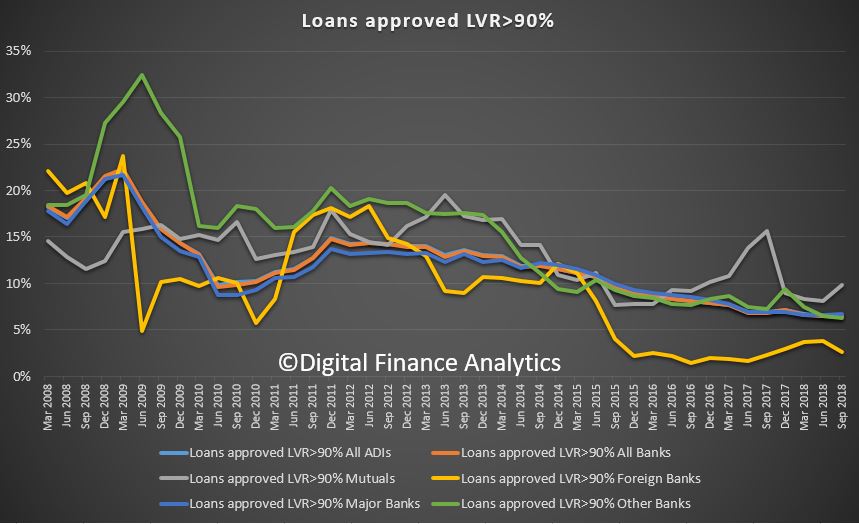

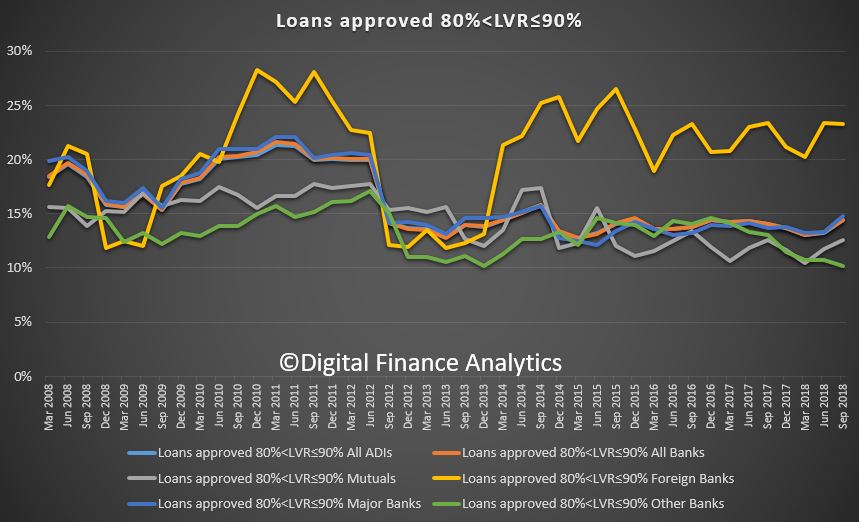

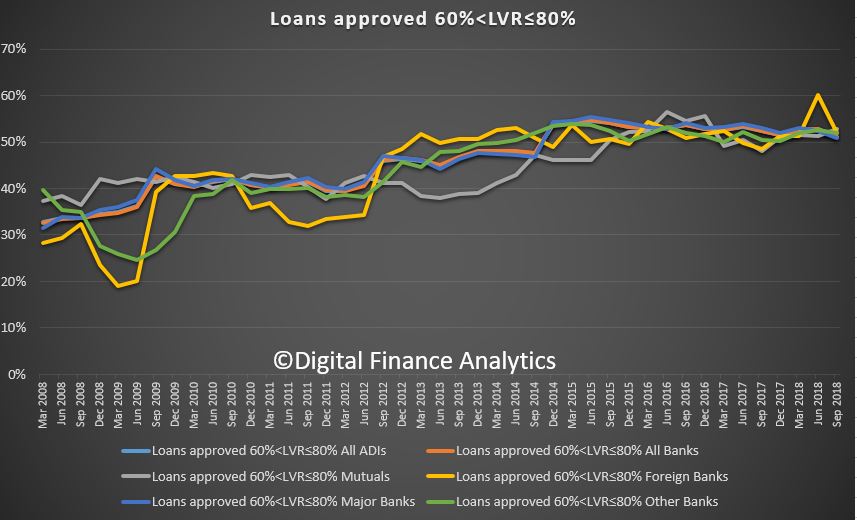

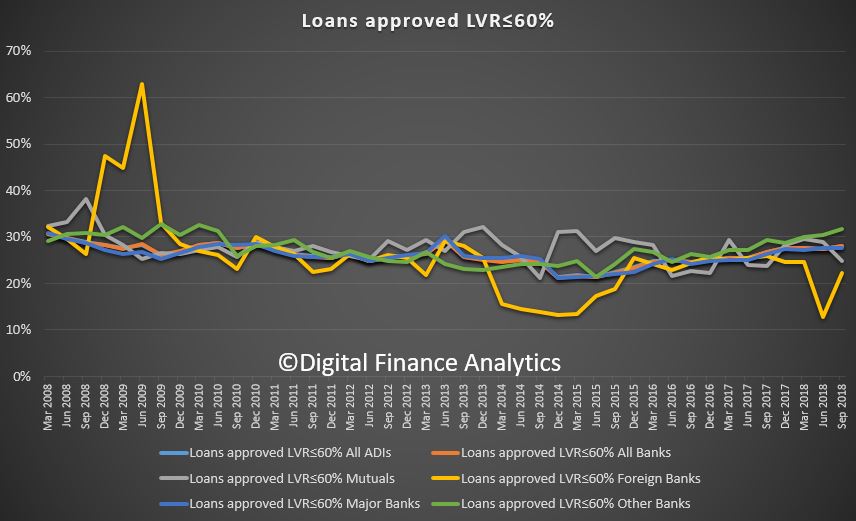

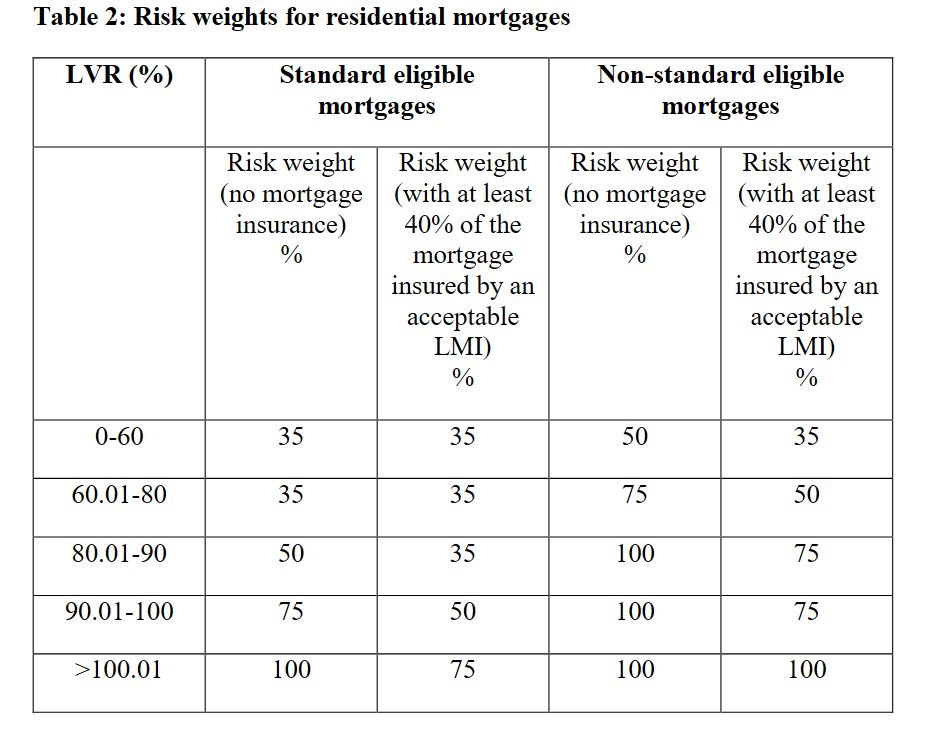

- Prudential measures. APRA briefed the Council on its latest review of the countercyclical capital buffer, the results of which will be published in the new year. It also provided an update on its residential mortgage measures, including the investor lending and interest-only lending benchmarks. In line with APRA’s announcement in April 2018 that it would remove the investor lending benchmark subject to assurances of the strength of lending standards, the benchmark has now been removed for the majority of ADIs. The interest-only lending benchmark, introduced in 2017, has resulted in a reduction in the share of new interest-only lending, along with the share of interest-only lending that occurs at high loan-to-valuation ratios.

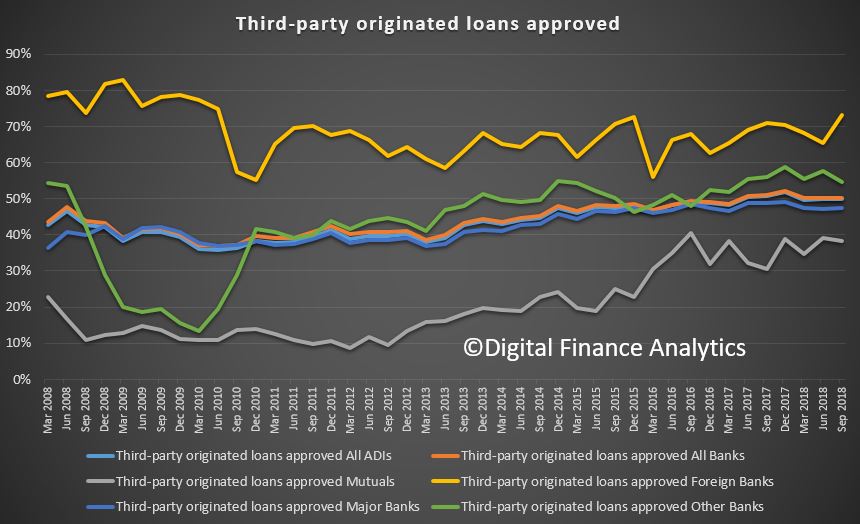

- Financial sector competition. The Council discussed work by its member agencies in response to the Productivity Commission’s Final Report of its Inquiry into Competition in the Australian Financial System. The Council strongly supports improved transparency of mortgage interest rates and a working group is examining a number of options. The Council also discussed the Productivity Commission’s recommendations relating to lenders mortgage insurance and remuneration of mortgage brokers. Both the Productivity Commission and the Financial System Inquiry recommended a review of the regulation of payments providers that hold stored value – referred to in legislation as purchased payment facilities (PPFs). The Council released an issues paper in September and held an industry roundtable in November. Members considered the feedback received from these processes and received an update on progress with the review.

- Limited recourse borrowing by superannuation funds. Members discussed a report to Government on leverage and risk in the superannuation system, as requested in the Government’s response to the Financial System Inquiry. The use of limited recourse borrowing arrangements remains relatively small, but has risen over time. Leverage by superannuation funds can increase vulnerabilities in the financial system, though near-term risks have reduced with the shift in dynamics in the housing market.

- International Monetary Fund’s Financial Sector Assessment Program (FSAP). The FSAP review of Australia was conducted during the course of 2018; preliminary findings were presented to the Australian authorities in November. The Council held an initial discussion of the main FSAP recommendations and how they could be addressed. The FSAP will be finalised in early 2019, at which time summary documents will be published. (Further information on the FSAP review was published in the Reserve Bank’s October 2018 Financial Stability Review.)

Representatives of the Australian Competition and Consumer Commission and the Australian Taxation Office attended the meeting for discussions relevant to their responsibilities.