The return of a 3% 10-year Treasury yield is making itself known in the housing industry. Markets have already priced in a loss of housing activity to the highest mortgage yields since 2011, according to Moody’s. They conclude that just as it is overly presumptuous to predict the nearness of a 4% 10-year Treasury yield, it is premature to declare an impending top for the benchmark Treasury yield.

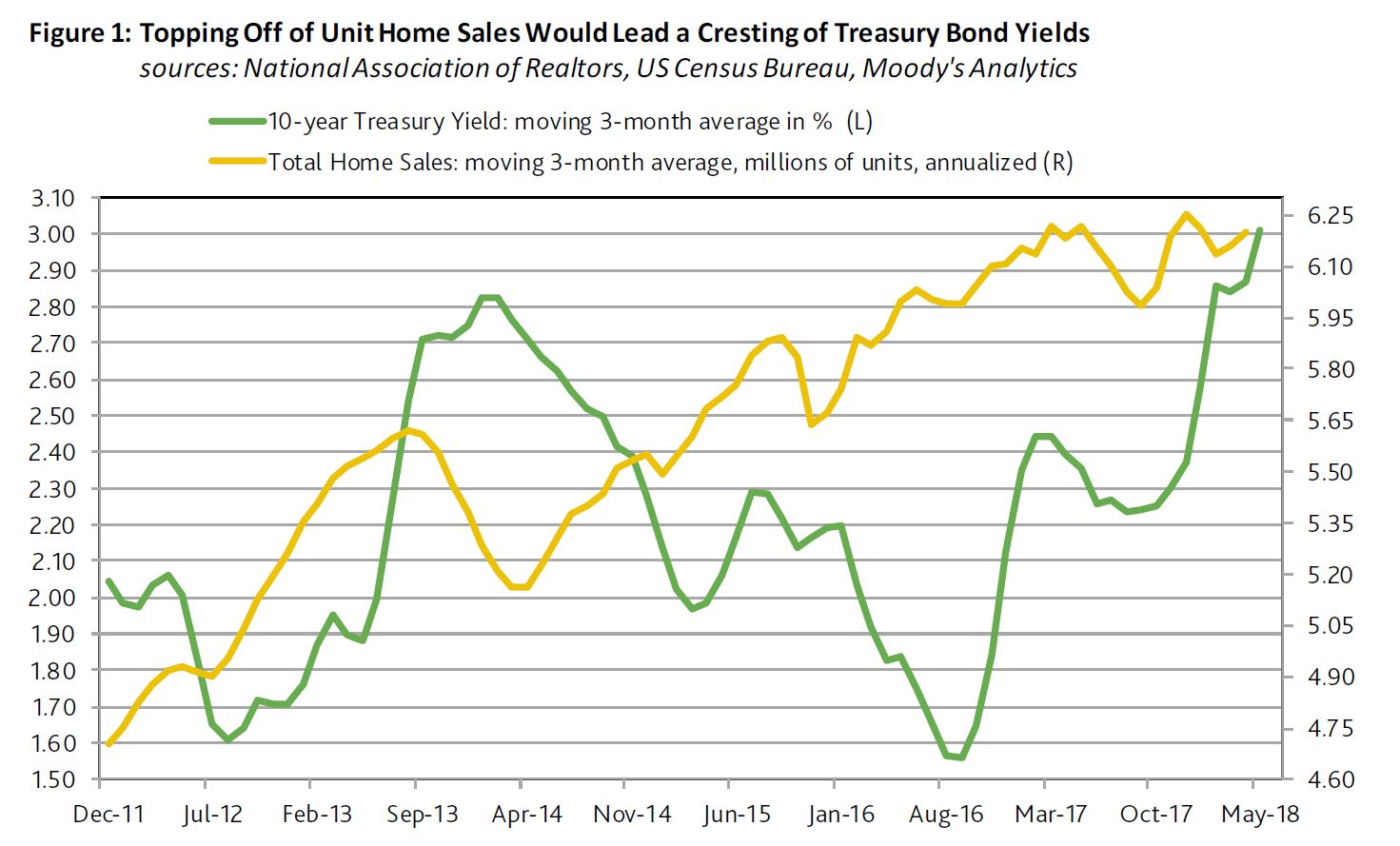

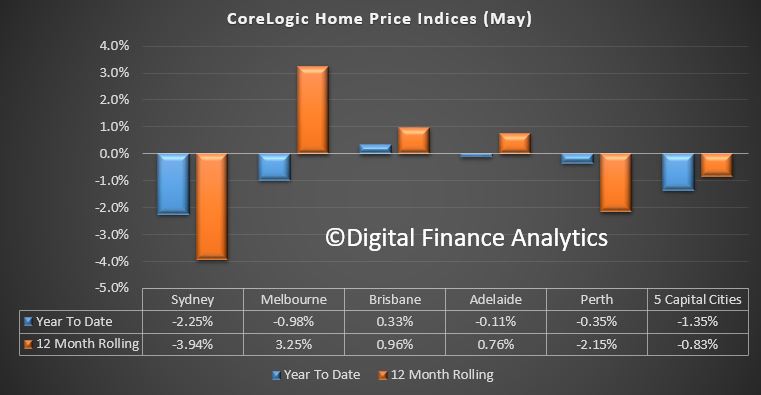

Thus far in 2018, the 11% drop by the PHLX index of housing-sector share prices differs drastically from the accompanying 3% rise by the market value of U.S. common stock. In addition, the CDS spreads of housing-related issuers show a median increase of 78 bp for 2018-to-date, which is greater than the overall market’s increase of roughly 23 bp. Finally, 2018-to-date’s -1.97% return from high-yield bonds is worse than the -0.13% return from the U.S.’ overall high-yield bond market. Despite the lowest unemployment rate since 2000, the sum of new and existing home sales dipped by 0.7% year-over-year during January-April 2018. Unit home sales may not soon accelerate by enough to strengthen the case for higher Treasury yields. First-quarter 2018’s average index of pending sales of existing homes contracted by 11.5% annualized from 2017’s final quarter on a seasonally-adjusted basis, while shrinking by 3.7% year-over-year before seasonal adjustment. The recent record suggests that the 10-year Treasury yield will ultimately follow home sales.

March 2018’s 7% yearly drop by the NAR’s index of home affordability showed that the growth of after tax income was not rapid enough to overcome the combination of higher home prices and costlier mortgage yields. March incurred the 17th consecutive yearly decline by the home affordability index. The moving three-month average of home affordability now trails its current cycle high of the span-ended January 2013 by 23%.

Fewest Applications for Mortgage Refinancings since 2000

The highest effective 30-year mortgage yield in seven years has depressed applications for mortgage refinancings. For the week-ended May 18, the MBA’s effective 30-year mortgage yield reached 5.01% for its highest reading since the 5.04% of April 15, 2011. The effective 30-year mortgage yield’s latest fourweek average of 4.95% was up by 63 bp from the 4.32% of a year earlier.

The yearly increase by the effective 30-year mortgage yield’s moving four-week average last swelled by at least 63 bp during the span-ended July 12, 2013. The 10-year Treasury yield’s month-long average would climb from July 2013’s 2.56% to a December 2013 peak of 2.89%. Thereafter, a decline by unit home sales had helped to lower the 10-year Treasury yield to 2.53% by July 2014.

As of May 18, 2018, the Mortgage Bankers Association’s seasonally-adjusted weekly index of applications for mortgage refinancings sank to its lowest reading since December 29, 2000. Nevertheless, it should be noted that the MBA commenced a new sample on September 16, 2011. During the four-weeks-ended May 18, applications for mortgage refinancings sank by 19.6% year-overyear.

Moreover, the latest moving 13-week average of applications for mortgage refinancings is a very deep 77.8% under its current cycle high of October 12, 2012. By contrast, mortgage applications from prospective homebuyers are holding up much better. During the four weeks ended May 18, the MBA’s average index for homebuyer mortgage applications dipped by 0.9% from the contiguous four-weeks-ended April 20, 2018, as the year-over-year increase slowed from April 20’s 6.6% to May 18’s 3.5%.

The sum of new and existing sales of single-family homes sank annually in only nine of the calendar years since 1988. In eight of those nine years, the 10-year Treasury yield’s yearlong average fell in the following calendar year. For the nine years following a drop by single-family home sales, the median annual change for the 10-year Treasury yield’s yearlong average was -41 bp.

In summary, the longer that higher interest rates weigh on business activity and financial markets, the closer is a peak for bond yields. Nonetheless, just as it is overly presumptuous to predict the nearness of a 4% 10-year Treasury yield, it is premature to declare an impending top for the benchmark Treasury yield.