International Economic Conditions

Members commenced their discussion of the global economy by noting that growth in global industrial production was likely to have increased further in October. The pick-up had been broadly based geographically. Survey measures suggested that conditions in the manufacturing sectors of Australia’s largest trading partners had continued to improve; conditions in the services sectors of the major advanced economies had remained favourable. The strength of industrial production in the high-income economies of east Asia had been associated with very strong growth in exports of electronics, specifically of semiconductors. The strength of demand in electronics-related industries had supported business investment and GDP growth in the region, particularly in South Korea.

GDP growth in the major advanced economies had been above potential, supported by accommodative monetary policies. Members noted that recent growth outcomes for the euro area had been stronger than expected. Growth in business investment had picked up in the major advanced economies over the prior year and further solid growth was anticipated over coming quarters. Consumption growth had remained above average, supported by robust growth in employment.

Conditions in labour markets in a number of major advanced economies had continued to tighten. Employment-to-population ratios had increased and unemployment rates had declined to low levels in Japan, Germany and the United States, among other advanced economies. Members noted that this implied there was limited spare capacity in these economies, based on conventional measures of full employment. However, wage growth had picked up only slightly. While observing that there were typically lags between labour markets tightening and wage pressures emerging, members noted that the wage data might suggest these economies had more spare capacity than implied by conventional measures. More generally, members noted that the nature of work was evolving, driven partly by technological change, and that not everyone was benefiting equally from the recent strength in labour demand. Low wage outcomes had contributed to core inflation in the major advanced economies remaining low, even though producer price inflation had been noticeably higher.

In China, GDP growth had been stronger than expected over the first three quarters of 2017, but more recently growth looked to have eased. This was particularly true of residential construction activity in cities where the authorities had implemented policies to address buoyant housing market conditions. The output of some sectors producing inputs for the construction sector, such as glass and steel products, had fallen in preceding months. Production shutdowns designed to deal with environmental concerns had also affected crude steel production. In combination, these factors had led to some levelling off of Chinese bulk commodity imports, including from Australia. Despite this, spot prices for iron ore had increased over the previous month and Chinese producer price inflation had remained elevated, partly reflecting stronger commodity prices. Although consumer price inflation in China had edged higher, it remained below the authorities’ objective of 3 per cent in 2017.

Domestic Economic Conditions

Members commenced their discussion of the domestic economy by noting that the wage price index continued to suggest that wage growth had been stable at a low rate. The outcome for the September quarter had been slightly lower than expected, despite the 3.3 per cent increase in award and minimum wages in the quarter, as previously determined by the Fair Work Commission. (The award system directly covers around one-quarter of the workforce.) Wage growth in the health and education sectors remained above the national average and a number of sectors had seen an increase in year-ended wage growth compared with a year prior. This had occurred at the same time as spare capacity appeared to have declined and more firms had been reporting difficulty finding suitable labour. The forecast was still for wage growth to increase gradually over the next year or so.

Labour market conditions had remained positive and had been stronger than expected over the previous year. Employment had increased a little in October and growth over the previous year had been well above average. Full-time employment had risen sharply and was growing at around its fastest pace in a decade. The participation rate was notably higher than a year earlier, particularly for women and older workers, who had been staying in the labour force for longer. The unemployment rate had edged lower to be 5.4 per cent in October, which was its lowest level since 2013, and unemployment rates had been on a downward trend in most states. Forward-looking indicators of labour demand suggested employment growth would be somewhat above average over the next few quarters.

Members noted that the September quarter national accounts would be released the day after the meeting and that recent data suggested GDP growth over the year to the September quarter was likely to have picked up to around the economy’s potential growth rate.

Information on components of household consumption indicated that growth in aggregate household consumption had moderated in the September quarter; growth in retail sales volumes and motor vehicle sales to households had been subdued. The growth in the value of retail sales in October was consistent with reports from the Bank’s liaison suggesting that moderate growth in consumption had continued into the December quarter.

Dwelling investment was expected to have fallen marginally in the September quarter. Dwelling investment had fallen over the preceding year in Queensland and Western Australia, but had remained at a high level in New South Wales and Victoria. Residential building approvals had picked up in preceding months, but remained below the levels of a few years earlier. Together with data on the pipeline of work yet to be done, this suggested that dwelling investment would remain at a high level for the following year or so, but that it was not likely to add materially to GDP growth.

Conditions had eased in the established housing market, most noticeably in Sydney, where housing prices had declined in prior months and auction clearance rates had fallen. Housing price growth had also eased in Melbourne, but remained relatively strong, supported by high population growth. Housing prices in Perth and Brisbane had been little changed in preceding months.

Members observed that business conditions in the non-mining sector had been above average for most industries over the preceding year or so and that non-mining profits had been increasing. Non-mining business investment looked to have risen further in the September quarter and the prospects for continued growth were positive: investment intentions had been revised higher, particularly for the business services sector; survey measures of capacity utilisation had remained well above average; and private non-residential building approvals had remained strong. Mining investment looked to have been little changed in the September quarter, although declines were still anticipated over the next few quarters.

Growth in public investment had picked up over the preceding few years, driven by infrastructure investment. Further growth was expected over the following couple of years, based on projections in state and federal budgets. Members considered macroeconomic modelling of a scenario under which public investment was higher than forecast for the following three years. The demand effects of this scenario included the direct contribution to GDP growth of higher public investment, as well as the multiplier effects through higher profits earned by private sector firms and the higher incomes earned by workers on these projects. Members noted the possibility of ‘crowding out’ of other forms of demand, but did not consider this a major risk given that the economy was currently operating with a degree of spare capacity and inflation was low. Indeed, a sustained pick-up in spending on public infrastructure could even ‘crowd in’ additional investment by the private sector firms undertaking those projects on the public sector’s behalf. Members also noted that the higher level of infrastructure investment could boost productivity in the economy.

Financial Markets

Members noted that conditions in financial markets generally had been little changed over the previous month, with volatility having remained at a low level throughout 2017. Financial conditions generally remained very accommodative, despite the gradual withdrawal of monetary stimulus in some economies over 2017. However, there had been a noticeable tightening in financial market conditions in China over the year, including in response to regulatory measures.

Market pricing suggested that market participants expected the US Federal Open Market Committee (FOMC) to increase the federal funds rate at its December meeting, consistent with the median of FOMC members’ projections. However, market pricing continued to suggest a more modest increase in the federal funds rate over 2018 than implied by the median FOMC projection. Members noted that previously announced changes to the composition of the FOMC had not affected market analysts’ expectations regarding the stance of US monetary policy. Regulations – particularly on smaller financial institutions – were under review, although members noted that core reforms relevant to capital, liquidity, stress testing and resolution planning were likely to be preserved.

Members observed that the yield on long-term US government bonds had been little changed over preceding months, whereas the yield on shorter-term US government bonds had increased. This in part reflected expectations for an increase in the federal funds rate and the US Treasury shifting its issuance towards securities at shorter maturities. Long-term government bond yields in other major financial markets had also generally remained little changed at low levels.

Members noted that while yields on Australian 10-year government bonds had been little changed, their spread to US Treasury bond yields had declined to a low level over preceding months.

Financing conditions remained favourable for corporations across major markets. Although spreads of high-yield corporate bonds to government bonds had increased a little in November, they remained at very low levels. Also, equity valuations remained high, having risen over 2017, although there had been small declines in some markets over November.

There had been little change in most major exchange rates over November. The US dollar had appreciated a little since early September on a trade-weighted basis, reflecting increased prospects for both future increases in the federal funds rate and US fiscal stimulus. Members noted that while the Australian dollar had depreciated by around 5 per cent in trade-weighted terms over this period, it had moved within a relatively narrow range over the previous two and a half years and was a little higher than the level of early 2016.

In China, a broad range of policy actions had contributed to a tightening in financial market conditions since late 2016 and a reduction in leverage within the financial system. Recent regulatory announcements had been directed towards managing risks in the shadow banking sector. Members noted that Chinese equity valuations had risen strongly over 2017, but had fallen somewhat in November after the authorities had signalled their concern that some stocks were overvalued.

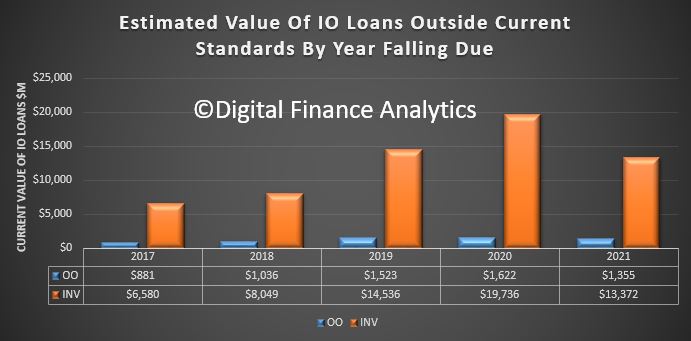

In Australia, housing credit growth had eased a little over the second half of 2017, as growth in lending to owner-occupiers had slowed somewhat and growth in lending to investors had stabilised at a lower level than in the first half of the year. The easing in housing credit growth had been accounted for by the major banks, which had been more affected by the need to restrain interest-only lending to comply with the supervisory measures announced earlier in the year. Growth in housing lending by non-authorised deposit-taking institutions (non-ADIs) had picked up, although these institutions’ share of overall housing lending remained small. Members noted that these lenders charged higher interest rates on average than ADIs, which is likely to reflect both the borrower risk profile and higher funding costs of non-ADIs.

Issuance of residential mortgage-backed securities, which are an important source of funding for non-ADIs, had been strong in 2017 and pricing of these securities had declined a little. Major banks’ funding costs had declined a little over 2017 and long-term debt funding had grown relatively strongly in the second half of the year.

Members observed that the Australian equity market (on an accumulation basis) had risen in line with global markets over the previous couple of years and that volatility had remained low over the prior year. Australian share prices had been little changed over the preceding month, although banks’ share prices had declined, partly in response to lower-than-expected profit increases.

Financial market prices continued to imply that the cash rate was expected to remain unchanged over the following year or so.

Members concluded their review of developments in financial markets with a detailed discussion of Australian businesses’ access to finance. They noted that external finance had become available on increasingly favourable terms for large businesses over recent years, with foreign banks having added to competition for large business lending. Nevertheless, business borrowing had grown only moderately, reflecting subdued mergers and acquisitions activity, with investment having been funded largely from internal sources of funds. In contrast, many small businesses continued to find it challenging to obtain finance, particularly in their start-up or expansion phases. Members noted that this was likely to reflect the riskier nature of such lending, but also the less competitive market for small business lending. Participants on the Bank’s Small Business Finance Advisory Panel, convened annually, had confirmed the challenges of accessing bank lending. Members observed that equity funding was often more appropriate for the risk profile of start-up businesses, but that there are relatively few avenues for such financing in Australia compared with some other markets. Members were encouraged by the potential for innovations to improve access to finance for small businesses and the willingness of regulators to facilitate these developments, including in the areas of comprehensive credit reporting, open banking and alternative funding platforms.

Considerations for Monetary Policy

In considering the stance of monetary policy, members noted that conditions in the global economy had improved over 2017 and that the outlook had also been upgraded. This improvement had been supported by expansionary financial conditions, notwithstanding some withdrawal of monetary stimulus in a number of economies. In the major advanced economies, labour market conditions had continued to tighten, but wage growth and core inflation had remained low. Members recognised that this combination of strength in economic activity and low inflation was a central issue in the global economy. It was possible that this combination could continue for a while yet, but it was also possible that inflation could pick up by more than expected as spare capacity diminished.

Although the global growth outlook had improved, commodity prices and Australia’s terms of trade were expected to decline in the period ahead, but to remain at relatively high levels. The Australian dollar had continued to fluctuate within its range of the preceding two and a half years. An appreciating exchange rate would be expected to result in a slower pick-up in domestic economic activity and inflation than currently forecast.

Members noted that the low level of interest rates had been supporting the Australian economy. Recent data suggested that GDP growth had been around its trend rate over the year to the September quarter. Output growth was still expected to pick up gradually over the forecast period. Business conditions were positive and capacity utilisation had remained high. The outlook for non-mining business investment had improved further and the pick-up in public infrastructure investment was also supporting overall growth. However, growth in consumption was expected to have slowed in the September quarter and the outlook for household consumption continued to be a significant risk, given that household incomes were growing slowly and debt levels were high.

Growth in employment, particularly full-time employment, had increased and the unemployment rate had fallen to a four-year low. Although wage growth had been a little lower than expected in the September quarter, it appeared to have stabilised at a low rate. Leading indicators of labour demand had been broadly consistent with continuing strength in the labour market. In these circumstances, spare capacity in the labour market was expected to be absorbed gradually and wage growth was expected to pick up over time.

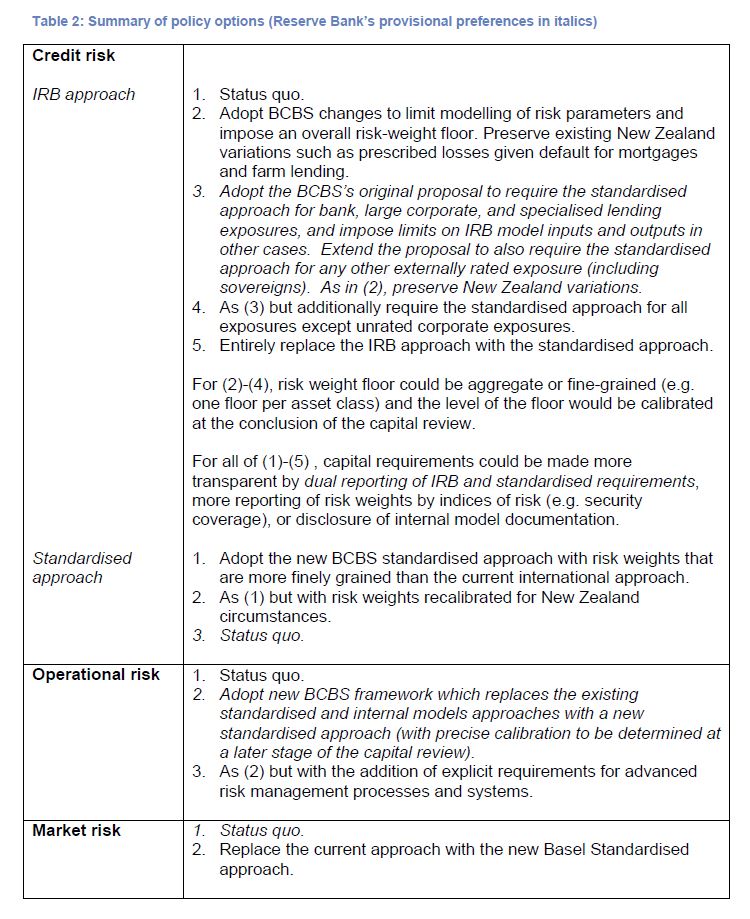

Housing market conditions had generally eased, especially in Sydney. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. To address the medium-term risks associated with high and rising household indebtedness, the Australian Prudential Regulation Authority had introduced a number of supervisory measures earlier in the year and credit standards had been tightened to lower the risk profile of borrowers. Growth in household credit had slowed somewhat, but members agreed that household balance sheets still warranted careful monitoring.

Over the prior year or so, the unemployment rate had fallen and inflation had moved closer to target. Members noted that this had occurred at the same time as risks in household balance sheets had lessened. Recent data had increased confidence that there would be further progress on these fronts over the following year. How far and when stronger conditions in the economy and labour market might feed through into higher wage growth and inflation remained important considerations shaping the outlook. Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

The Decision

The Board decided to leave the cash rate unchanged at 1.5 per cent.