We review the latest data from the ABS, and the 19,000 FALL in jobs, the first for some time.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6202.0Oct%202019?OpenDocument

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We review the latest data from the ABS, and the 19,000 FALL in jobs, the first for some time.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6202.0Oct%202019?OpenDocument

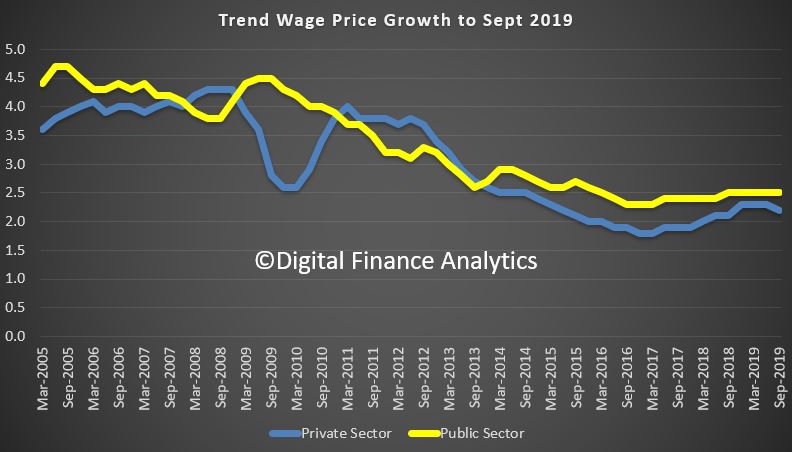

The ABS released the latest wages index data today to September 2019.

The trend and seasonally adjusted indexes for Australia both rose 2.2% through the year to the September quarter 2019. The public sector did better than the private sector.

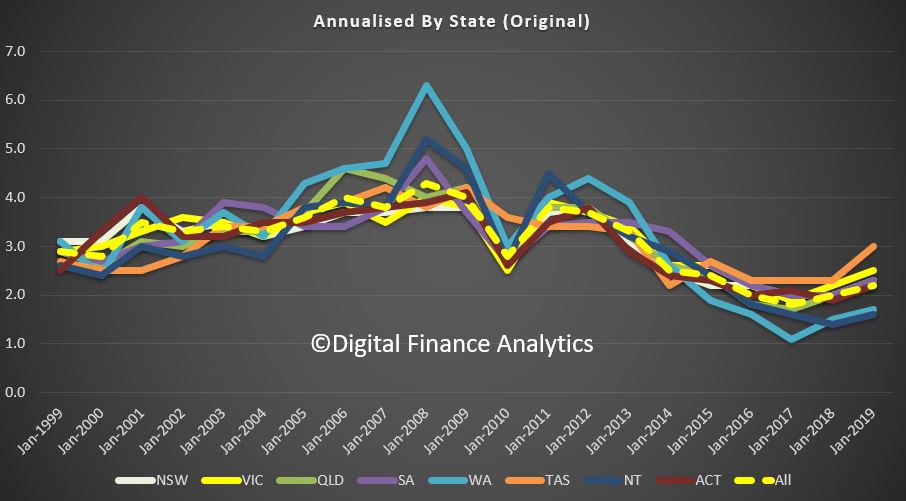

The original data by state shows TAS and VIC doing better than average, while WA and NT are below average.

In original terms, rises through the year to September quarter 2019 at the industry level ranged from 1.7% for Information, media and telecommunications services to 3.2% for Health care and social assistance.

We look at the latest finance data from the ABS. Are the lending trends as strong as many are claiming?

The September data was better than expected – lets celebrate the good news!

https://www.abs.gov.au/ausstats/abs@.nsf/mf/5368.0?OpenDocument

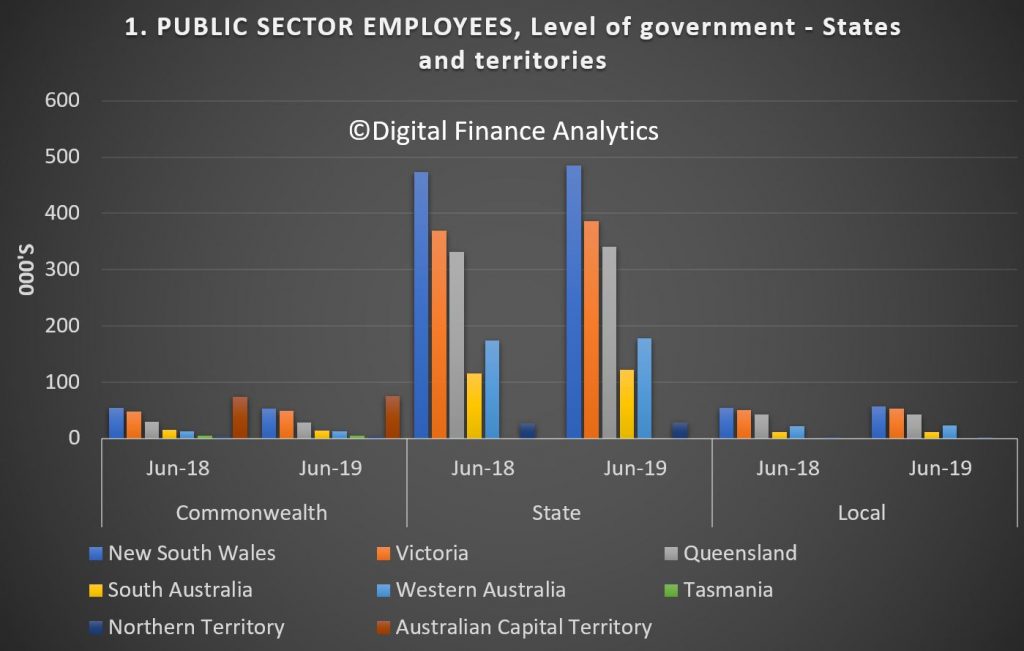

In June 2019, the public sector employed 2,047,000 people, 3.0 per cent higher than in June 2018, according to new figures released from the Australian Bureau of Statistics (ABS).

Head of labour statistics at the ABS, Bjorn Jarvis, said: “Most public sector employment was in state and territory government organisations, with around 1.6 million employees. A further 242,000 people were employed in Commonwealth organisations and 194,000 in local government.”

“The industries with the highest public sector employment were education and training (649,000 employees), public administration and safety (637,000) and healthcare and social assistance (527,000),” said Mr Jarvis. “These industries include teachers, police officers and nurses who are employed by state and territory governments.”

This collection covers public sector organisations, including Commonwealth and state/territory government organisations, local government authorities, public corporations, universities, non-profit institutions controlled by the government, government marketing boards, legislative courts, municipal authorities and other statutory authorities.

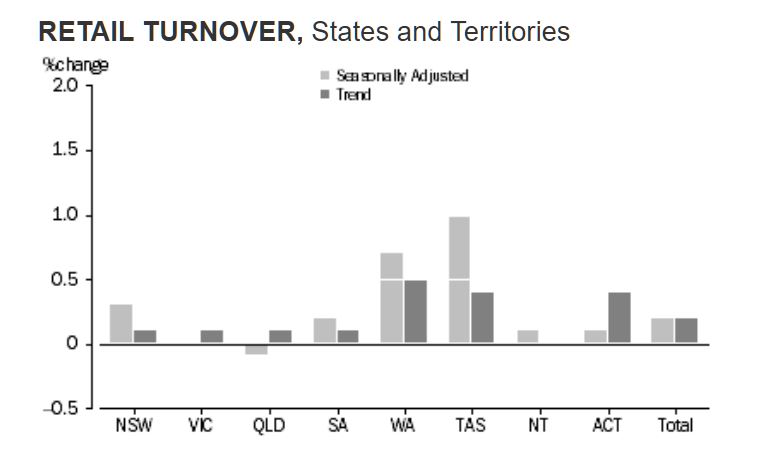

Australian retail turnover rose 0.2 per cent in September 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. In line with our expectations, and continuing to show the pressure on households, and the limited impact of the tax cuts, and even lower interest rates.

This follows a 0.4 per cent rise in August 2019.

Rises were seen in other retailing (0.8 per cent), cafes, restaurants and takeaway services (0.6 per cent), and food retailing (0.1 per cent). These rises were slightly offset by a fall in clothing, footwear and personal accessory retailing (-0.5 per cent) and department stores (-0.2 per cent). Household goods (0.0 per cent) was relatively unchanged.

In seasonally adjusted terms, there were rises in New South Wales (0.3 per cent), Western Australia (0.7 per cent), Tasmania (1.0 per cent), South Australia (0.2 per cent), the Australian Capital Territory (0.1 per cent), and the Northern Territory (0.1 per cent). Victoria (0.0 per cent ) was relatively unchanged. Queensland (-0.1 per cent) fell in seasonally adjusted terms in September 2019.

The trend estimate for Australian retail turnover rose 0.2 per cent in September 2019, following a rise of 0.2 per cent in August 2019. Compared to September 2018, the trend estimate rose 2.4 per cent.

Online retail turnover contributed 6.3 per cent to total retail turnover in original terms in September 2019. In September 2018 online retail turnover contributed 5.6 per cent to total retail.

Quarterly volumes fall 0.1 per cent

For the September quarter 2019, there was a fall of 0.1 per cent in seasonally adjusted volume terms. This follows a rise of 0.1 per cent in the June quarter 2019.

The quarterly fall in volumes was led by cafes, restaurants and takeaway food services (-1.0 per cent), and department stores (-0.1 per cent). Food retailing (0.0 per cent) was relatively unchanged. Household goods (0.9 per cent), other retailing (0.3 per cent), and clothing, footwear and personal accessories retailing (0.3 per cent) rose in seasonally adjusted volume terms.

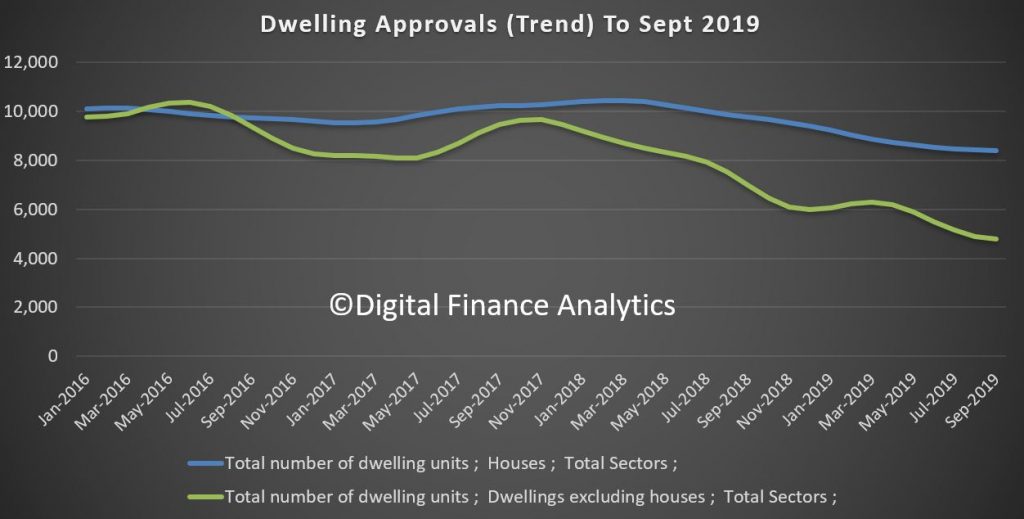

The number of dwellings approved fell 0.8 per cent in September 2019, in trend terms, and has fallen for 22 months, according to data released by the Australian Bureau of Statistics (ABS) today.

“The fall in trend dwelling approvals for September was the smallest monthly decline in six months,” said Daniel Rossi, Director of Construction Statistics at the ABS. “However, the number of dwellings approved remains 21.1 per cent lower than at the same time last year.”

Across the states and territories, dwelling approvals fell in the Northern Territory (9.3 per cent), Western Australia (2.4 per cent), Australian Capital Territory (1.8 per cent), New South Wales (1.2 per cent), Queensland (0.5 per cent) and Victoria (0.4 per cent). Tasmania (1.6 per cent) and South Australia (0.4 per cent) recorded increases, in trend terms.

In trend terms, approvals for private sector houses fell in Western Australia (2.7 per cent) and South Australia (1.3 per cent). Victoria rose 0.1 per cent, while private house approvals in New South Wales and Queensland were flat.

The seasonally adjusted estimate for total dwellings approved rose 7.6 per cent in September, driven by a 16.6 per cent increase in private dwellings excluding houses. Private sector houses rose 2.8 per cent.

The value of total building approved rose 1.4 per cent in September, in trend terms, and has risen for nine months. The value of residential building rose 0.5 per cent, while non-residential building rose 2.5 per cent.

We examine the latest ABS CPI data – but how believable is it?

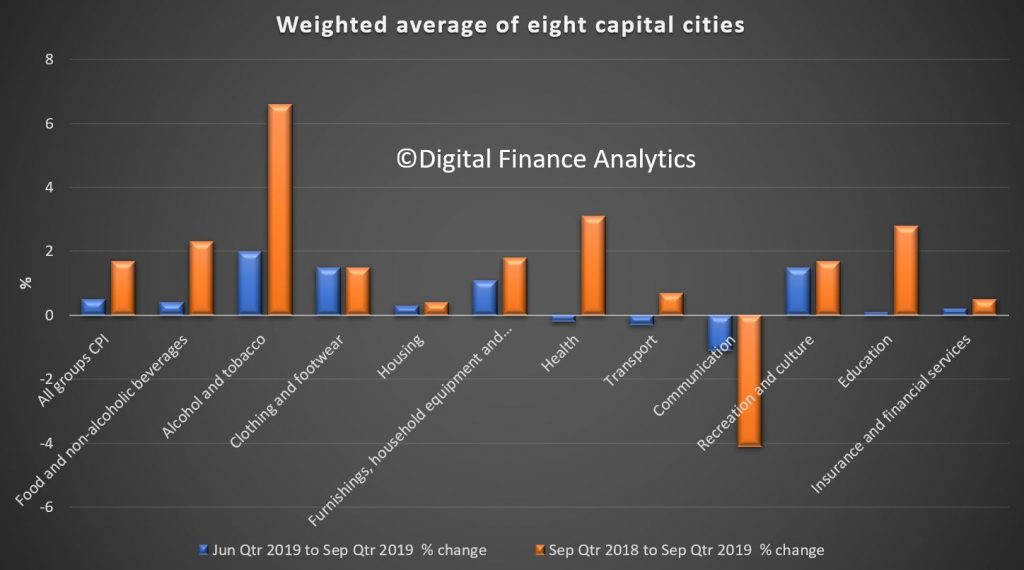

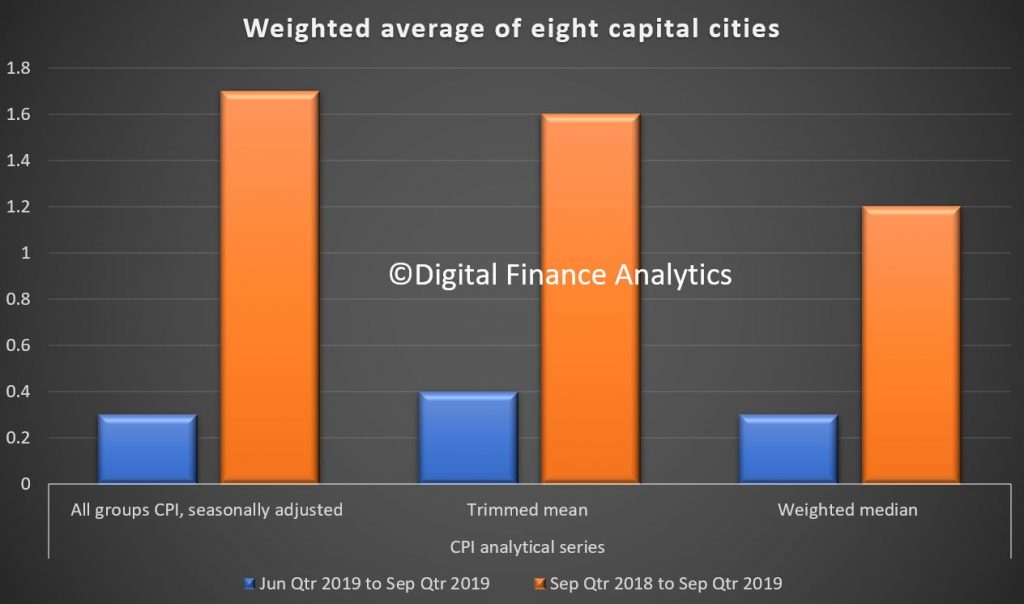

The Consumer Price Index (CPI) rose 0.5 per cent in the September 2019 quarter, according to the latest Australian Bureau of Statistics (ABS) figures. This follows a rise of 0.6 per cent in the June 2019 quarter.

All groups CPI seasonally adjusted rose 0.3%.

The trimmed mean rose 0.4%, following a rise of 0.4% in the June 2019 quarter. Over the twelve months to the September 2019 quarter, the trimmed mean rose 1.6%, following a rise of 1.6% over the twelve months to the June 2019 quarter.

The weighted median rose 0.3%, following a rise of 0.4% in the June 2019 quarter. Over the twelve months, the weighted median rose 1.2%, following a rise of 1.3% over the twelve months to the June 2019 quarter.

This is well below the RBA target.

The most significant price rises in the September 2019 quarter were international holiday, travel and accommodation (+6.1 per cent), tobacco (+3.4 per cent), property rates and charges (+2.5 per cent) and child care (+2.5 per cent).

The most significant price falls this quarter were automotive fuel (-2.0 per cent), fruit (-3.1 per cent) and vegetables (-2.5 per cent).

ABS Chief Economist, Bruce Hockman said: “Despite the price falls for fruit and vegetables this quarter, the drought is impacting on the prices for a range of food products. Prices rose this quarter for meat and seafood (+1.7 per cent), dairy and related products (+2.2 per cent) and bread and cereal products (+1.3 per cent).”

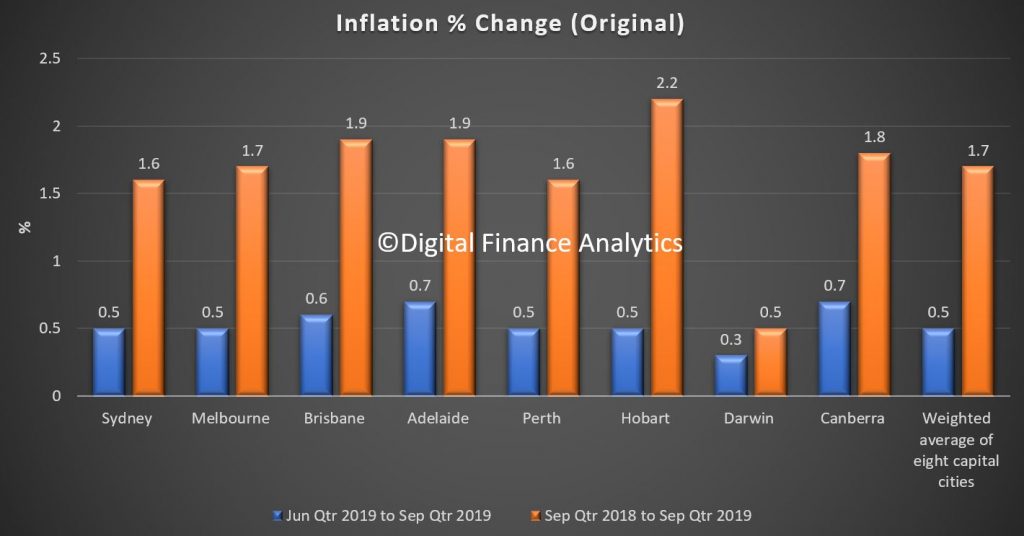

The CPI rose 1.7 per cent through the year to the September 2019 quarter. This follows a through the year rise of 1.6 per cent to the June 2019 quarter.

“Annual inflation remains subdued partly due to price rises for housing related expenses remaining low, and in some cases falling in annual terms. Prices for utilities (-0.3 per cent) and new dwelling purchase by owner-occupiers (-0.1 per cent) both fell slightly through the year to the September 2019 quarter, while rents (0.4 per cent) recorded only a small rise,” said Mr Hockman.

Main contributors by city:

Sydney (+0.5%)

The rise was partially offset by:

Melbourne (+0.5%)

The rise was partially offset by:

Brisbane (+0.6%)

The rise was partially offset by:

Adelaide (+0.7%)

The rise was partially offset by:

Perth (+0.5%)

The rise was partially offset by:

Hobart (+0.5%)

The rise was partially offset by:

Darwin (+0.3%)

The rise was partially offset by:

Canberra (+0.7%)

The rise was partially offset by:

The ABS published a scorecard on the Australian economy and we discuss the results.