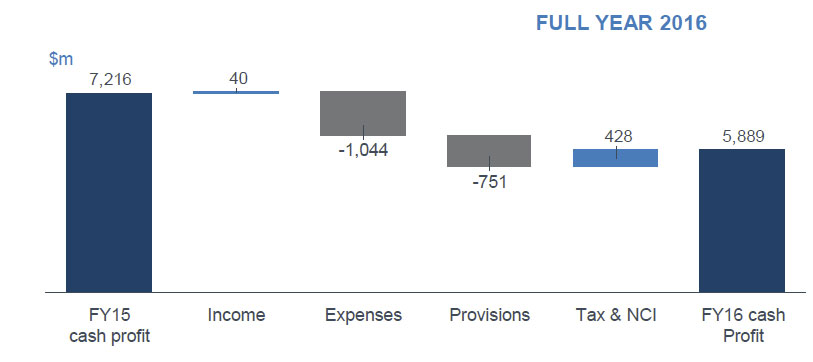

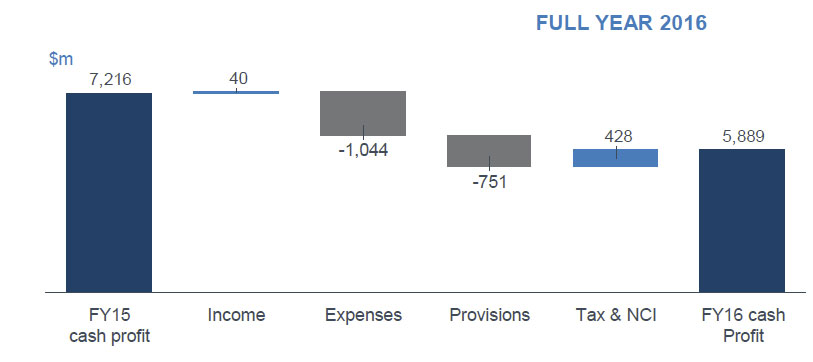

ANZ today announced a Statutory Profit after tax for the Financial Year ended 30 September 2016 of $5.7 billion down 24% and a Cash Profit of $5.9 billion down 18%. It is a complex picture thanks to restructuring, re-balancing and rising provisions.

They are betting the bank on growing the Australian business, which now comprises 62% mortgage lending, as they exit areas of business in Asia, and restructure, to a simpler, and perhaps more profitable enterprise.

They say the FY16 result reflects a good performance in ANZ’s core domestic franchises and significant reshaping of the business driven by ANZ’s strategic focus to create a simpler, better capitalised and more balanced bank that produces better outcomes for customers and shareholders.

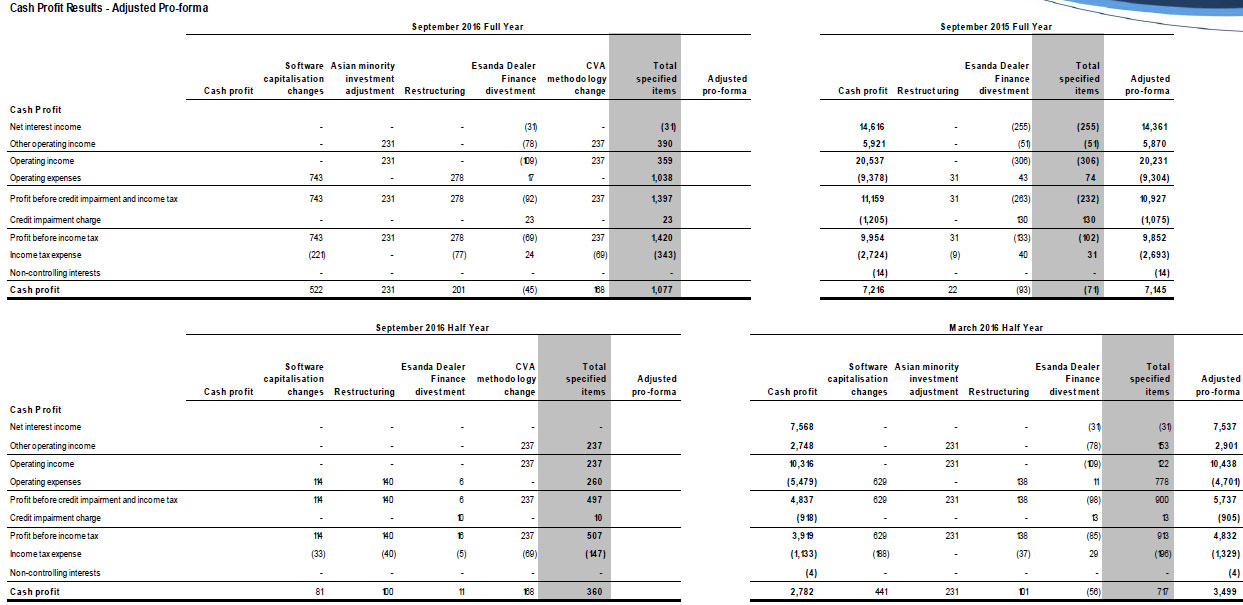

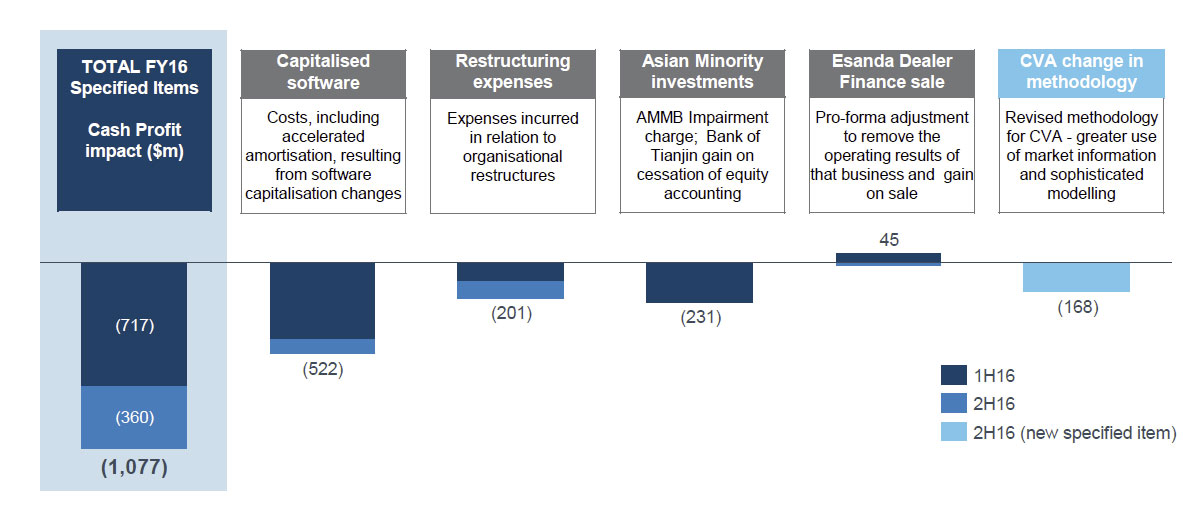

The result reflects an emphasis on delivering strong capital and cost management outcomes together with $1,077 million of charges (after tax) for specified items primarily related to reshaping the Group to position it for improved performance in future years.

Adjusted Pro-Forma Cash Profit was $7.0 billion down 3%, while Profit before Provisions increased 6% as the benefits of simplification and re-balancing initiatives began to emerge.

Return on equity was stable in the second half of the financial year at 12.2% (adjusted Pro-forma Cash Profit basis). The Final Dividend of 80 cents per share is consistent with guidance provided at the Interim Profit announcement. The Total Dividend for FY16 is 160 cents per share fully franked down 12%.

At the 2016 Interim Result, ANZ advised that it was conducting strategic reviews of the Group’s Retail and Wealth business in Asia, and its Wealth businesses in Australia and New Zealand. The reviews considered each business within the context of the overall Group strategy including capital efficiency.

ANZ announced on 31 October 2016 that it had entered into an agreement with DBS to sell the Retail and Wealth businesses in Singapore, Hong Kong, China, Taiwan and Indonesia. ANZ intends to clarify plans for the remaining businesses in Retail and Wealth in Asia during FY17.

The strategic review of ANZ’s Wealth businesses in Australia and New Zealand concluded that while the distribution of high quality Wealth products and services should remain a core component of the Group’s overall customer proposition, ANZ does not need to be a manufacturer of Life and Investments products.

The initial focus will be on the Australian Wealth business where ANZ is exploring a range of possible strategic and capital market options that will maintain strong outcomes for customers. This includes the possible sale of the life insurance, advice and superannuation and investments businesses in Australia.

ANZ will pursue a disciplined approach to this process and will update the market as appropriate. The Wealth business in New Zealand will be considered separately during 2017.

Net Interest income was up 3%, to $15,095m from FY15, whilst other operating income fell 16% to $5,434m, so combined, operating income was down 3%.

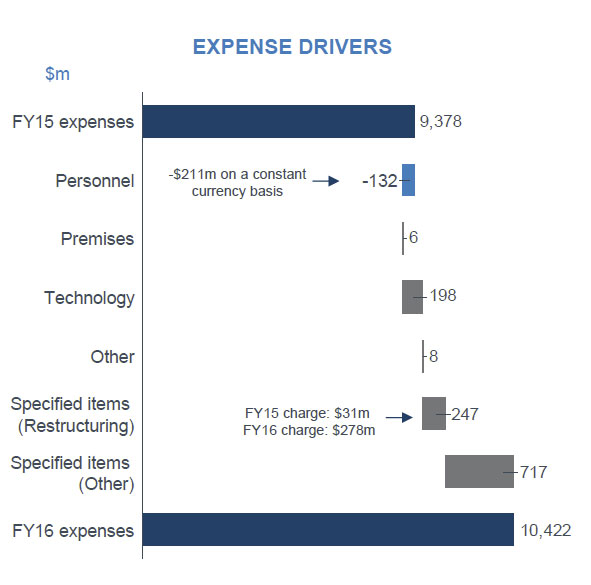

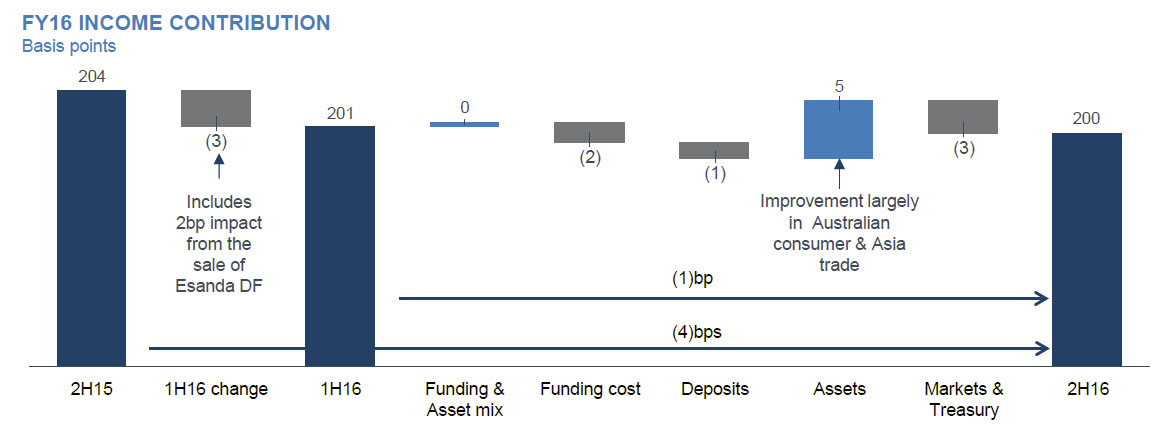

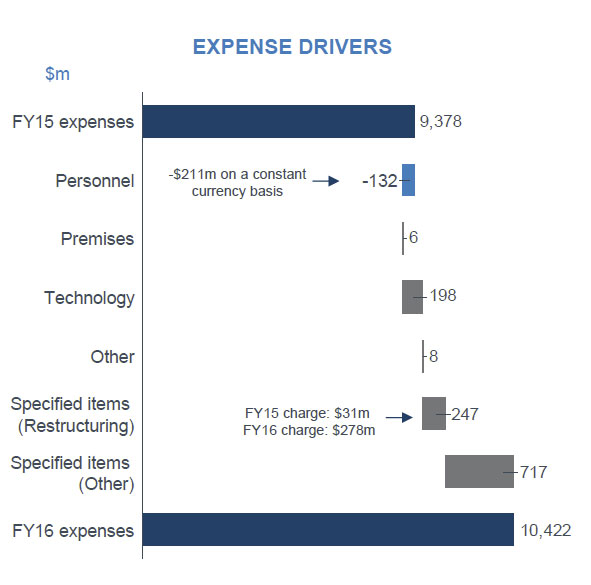

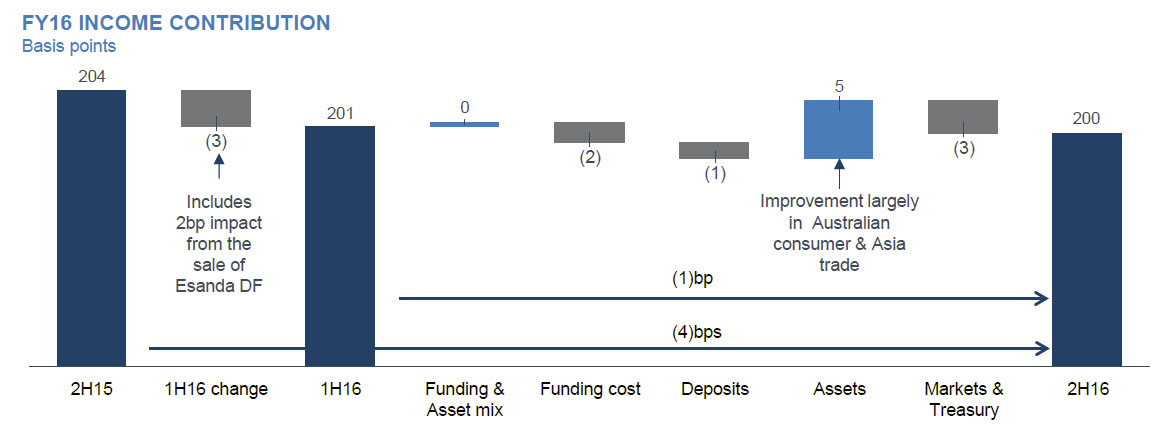

Operating expenses rose 11% to $10,422m, whilst credit impairment charges rose 64% to $1,929m.  Group net interest income fell 4 basis points, and whilst there were falls in NZ, (down 9 basis points), Institutional rose 14 basis points and Australian nim was static, thanks to repricing in the book.

Group net interest income fell 4 basis points, and whilst there were falls in NZ, (down 9 basis points), Institutional rose 14 basis points and Australian nim was static, thanks to repricing in the book.

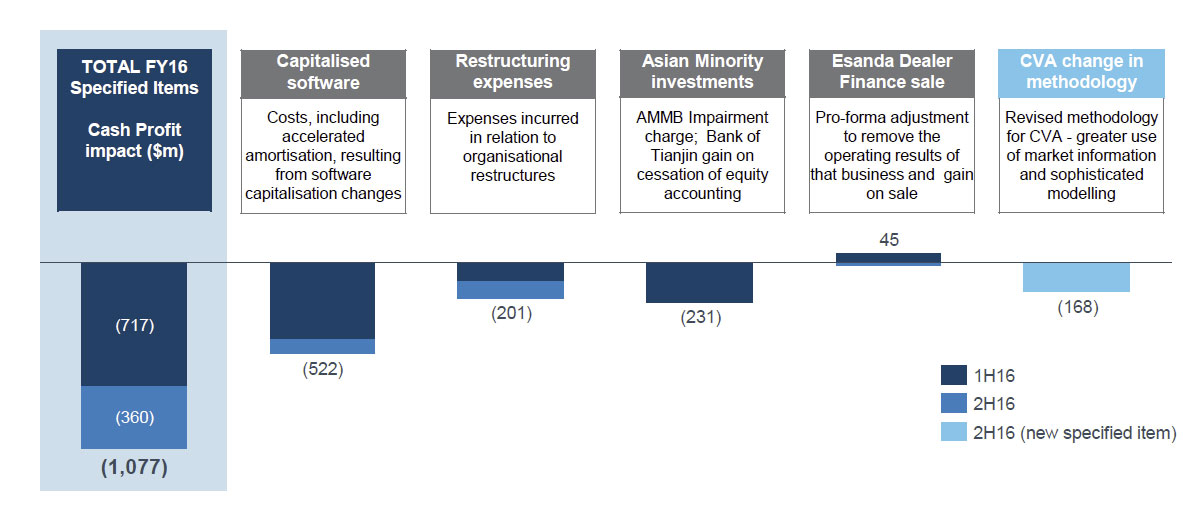

In FY16 ANZ recognised the impact of a number of items collectively referred to as Specified Items which form part of the Group’s Cash Profit. The items are primarily related to initiatives undertaken to re-position the Group for stronger profit before provisions growth in the future.

In FY16 ANZ recognised the impact of a number of items collectively referred to as Specified Items which form part of the Group’s Cash Profit. The items are primarily related to initiatives undertaken to re-position the Group for stronger profit before provisions growth in the future.

ANZ recorded $1,077 million (after tax) of specified items charges in Cash Profit during the Financial Year, of which almost half ($522 million) related to a change in the application of the software capitalisation policy. This change in policy effected a 24% reduction in the Capitalised Software

ANZ recorded $1,077 million (after tax) of specified items charges in Cash Profit during the Financial Year, of which almost half ($522 million) related to a change in the application of the software capitalisation policy. This change in policy effected a 24% reduction in the Capitalised Software

balance year on year.

One third of the specified items charges occurred in the second half, including an additional restructuring charge of $100 million (post tax) and a derivative credit valuation adjustment (CVA) of $168 million (after tax).

The restructuring charge supports the evolution of the Group’s strategy and will underpin further productivity through reshaping of the workforce to reduce complexity and duplication, and to align with the changing emphasis in Institutional. ANZ has refined the methodology for the calculation of CVA, a component of valuing derivative instruments in the Markets business. The updated methodology makes greater use of market credit information and more sophisticated exposure modelling and is in line with leading market practice.

Adjusted Pro-Forma Cash Profit information has also been provided to allow the market to better analyse the ongoing operations of the Group. Looking at a cash result basis (which excludes non-core items included in statutory profit), operating income was flat compared with last year at $20,577m, whilst expenses rose 11% to $10,422m and impairments rose 62% to 1,956m. This translated to a cash profit down 18% to $5,889m.

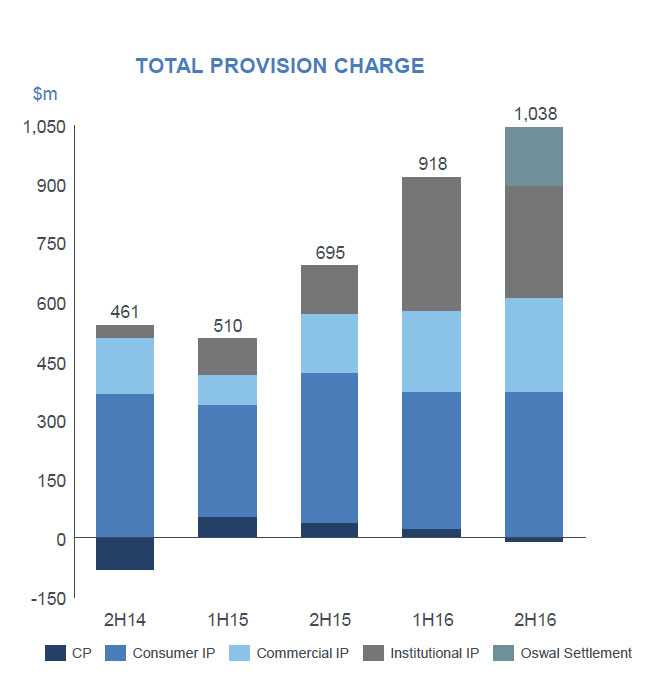

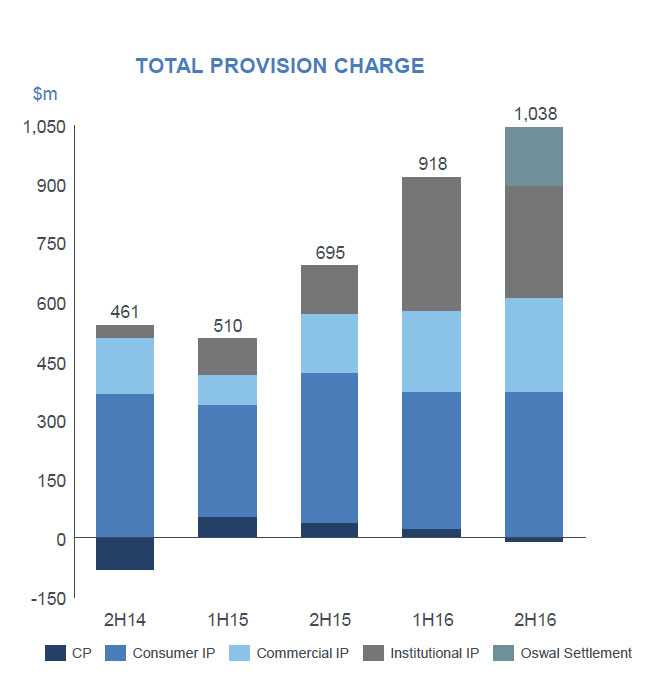

The total provision charge of $1.96 billion ($1.94 billion individual provision charge and a $17 million collective provision charge) equates to a loss rate of 34 basis point of which 3 bps is attributable to the recently announced settlement of the Oswal case. Gross impaired assets increased to $3.17 billion with new impaired assets up 3% compared to the prior half.

The total provision charge of $1.96 billion ($1.94 billion individual provision charge and a $17 million collective provision charge) equates to a loss rate of 34 basis point of which 3 bps is attributable to the recently announced settlement of the Oswal case. Gross impaired assets increased to $3.17 billion with new impaired assets up 3% compared to the prior half. While in aggregate the credit environment is broadly stable, pockets of weakness continue to work their way through the economy, largely reflecting stress moving through the resources and resources related sectors. The stress appears to have now largely passed through the Institutional market and is progressively moving through the Commercial and Retail sectors. ANZ therefore expects provision charges to remain broadly the same in the 2017 Financial Year as a percentage of

While in aggregate the credit environment is broadly stable, pockets of weakness continue to work their way through the economy, largely reflecting stress moving through the resources and resources related sectors. The stress appears to have now largely passed through the Institutional market and is progressively moving through the Commercial and Retail sectors. ANZ therefore expects provision charges to remain broadly the same in the 2017 Financial Year as a percentage of

gross lending assets.

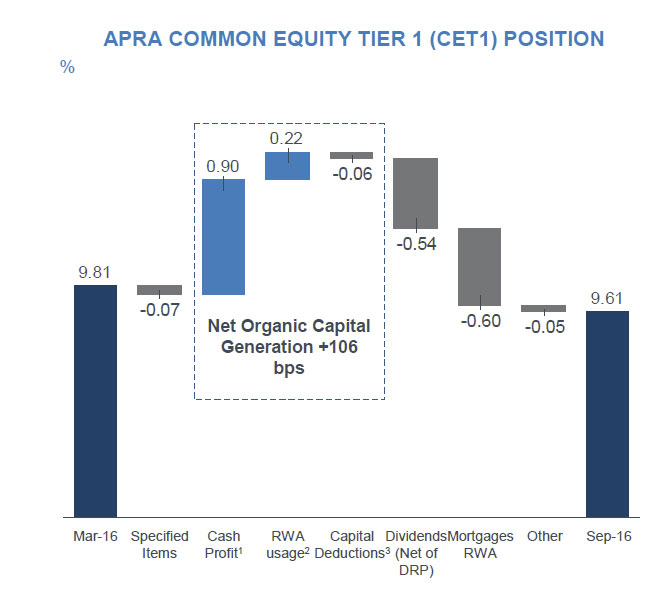

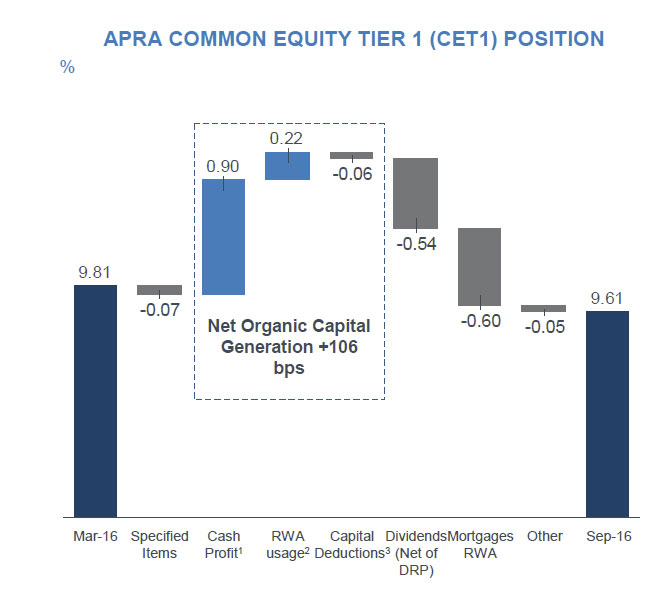

The APRA CET1 capital ratio at 30 September was 9.6% (14.5% on an Internationally Comparable basis). Organic capital generation of 106 basis points in the second half was 33 basis points higherthan the second half average of the past 4 years, primarily driven by Credit RWA reduction (excluding foreign exchange impacts) of $12 billion in the Institutional business.

The Final Dividend of 80 cents per share is the same as for the first half and is in line with guidance. The total dividend for FY16 of 160 cents per share represents a Dividend Payout Ratio of 81.9% on a Statutory Profit basis and 79.4%on a Cash Profit basis.

The Final Dividend of 80 cents per share is the same as for the first half and is in line with guidance. The total dividend for FY16 of 160 cents per share represents a Dividend Payout Ratio of 81.9% on a Statutory Profit basis and 79.4%on a Cash Profit basis.

ANZ is gradually consolidating to its historical payout range of 60-65% of annual Cash Profit which ANZ believes provides a more sustainable base reflecting the greater demands for capital arising from increased regulatory requirements. On an Adjusted Pro-forma Cash Profit basis the Dividend Payout Ratio was 67.1%.

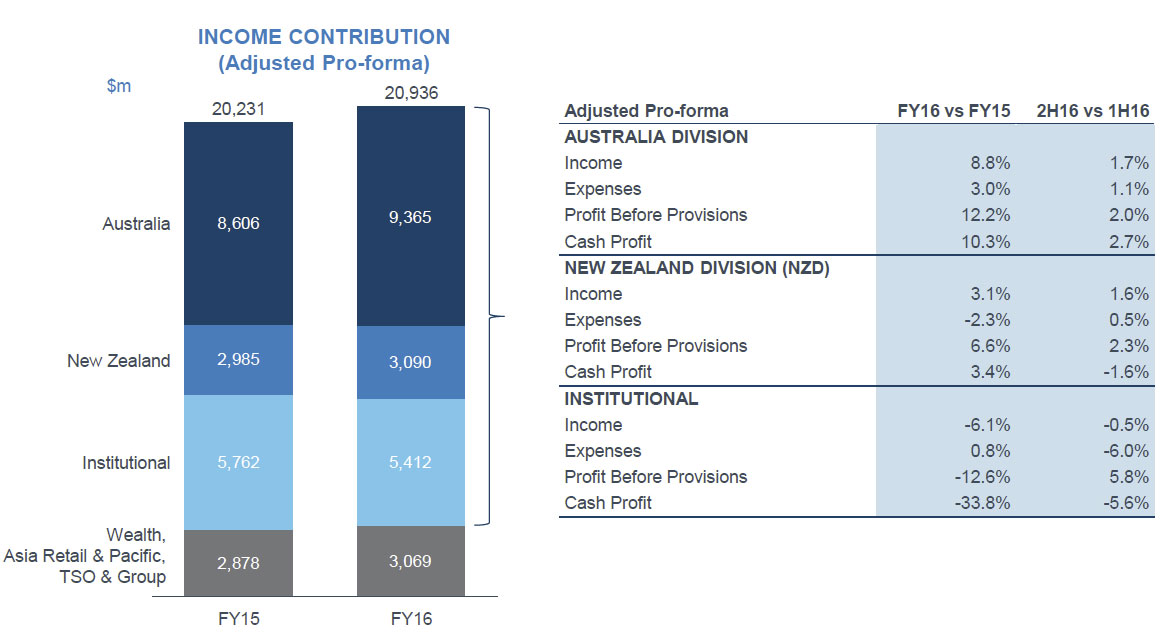

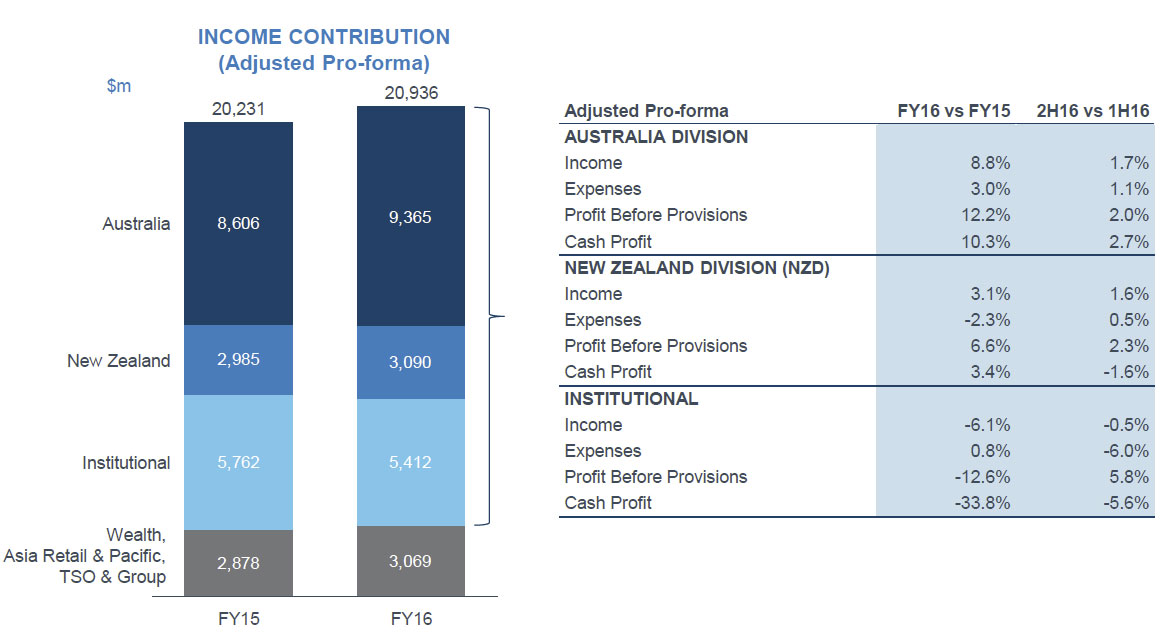

Looking at the segmentals, the Australian business grew income 8.8% to $9,365m, NZ 3.1% whilst the Institutional Bank income fell 6.1%.

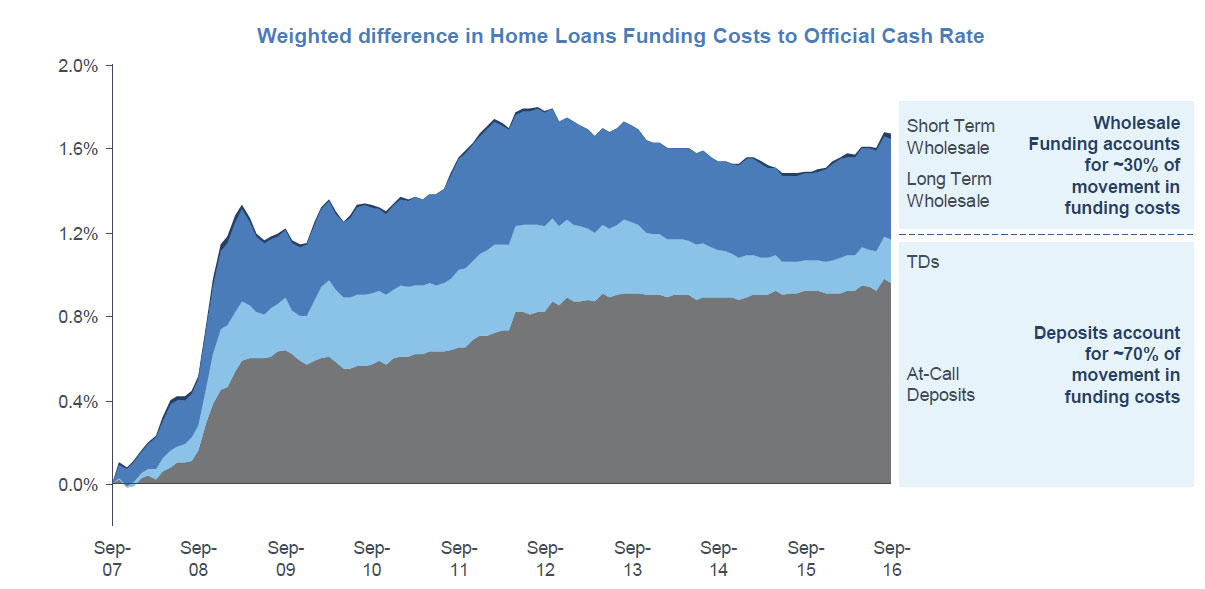

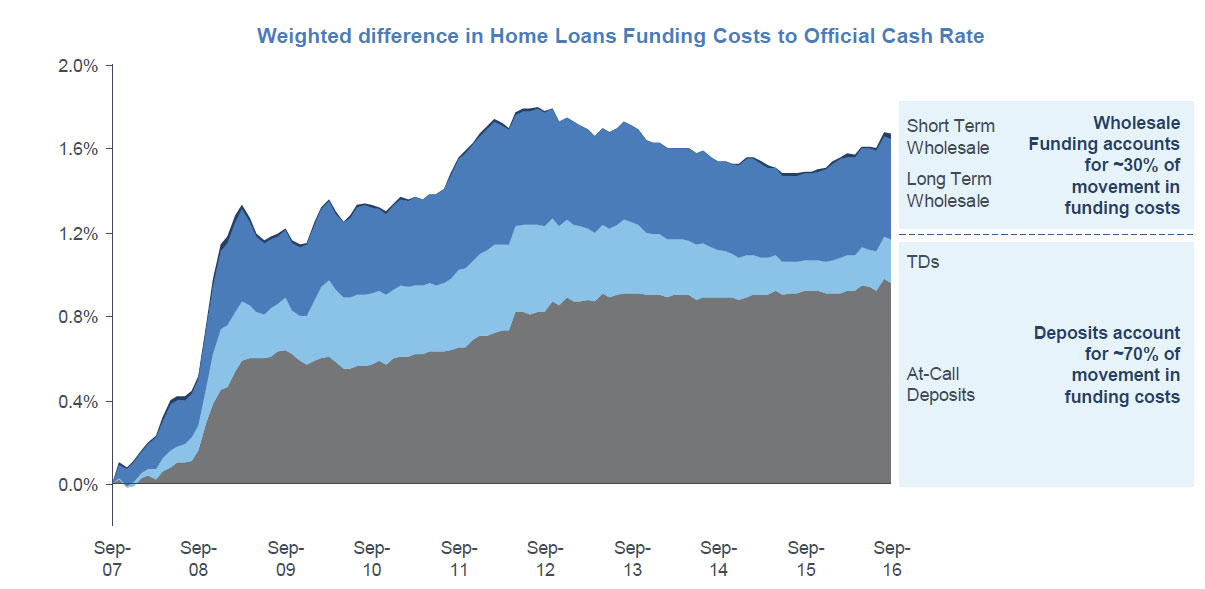

They highlight that mortgage funding costs rose, relative to the RBA cash rate, mainly thanks to increased competition for deposits.

They highlight that mortgage funding costs rose, relative to the RBA cash rate, mainly thanks to increased competition for deposits.

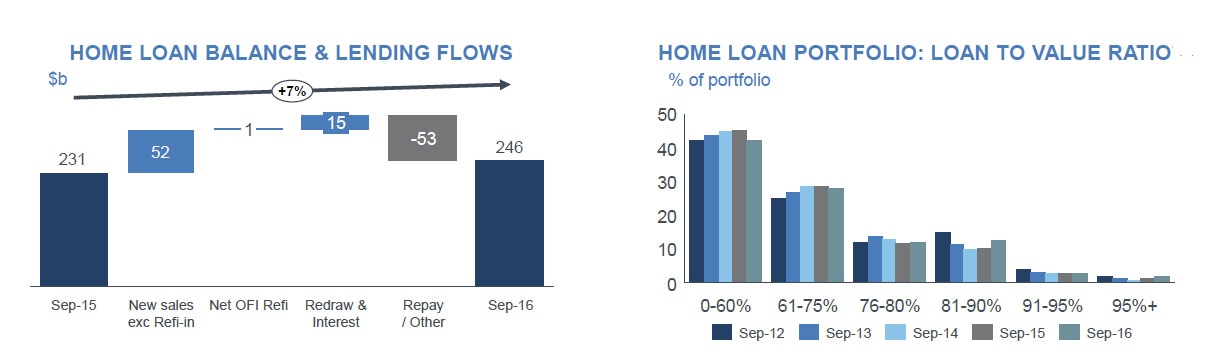

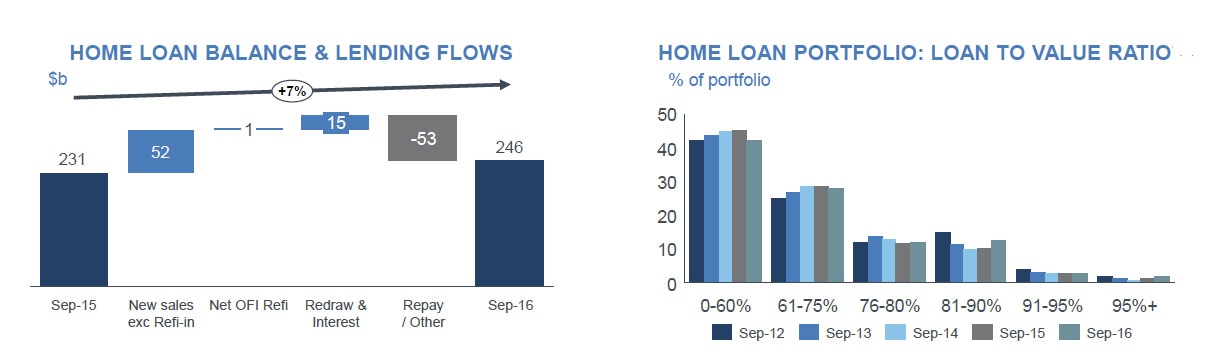

The Australian mortgage book grew 7%, but below system from $231bn in FY15 to $246bn in FY16. They increased their footprint in NSW and VIC, relative to WA and QLD. The mix of investor loans however fell, from 37% to 29% in FY16. 52% of loans are broker originated, up from 48% last year. Mortgage lending now accounts for 62% of all Australian lending, up form 60% last year.

The Australian mortgage book grew 7%, but below system from $231bn in FY15 to $246bn in FY16. They increased their footprint in NSW and VIC, relative to WA and QLD. The mix of investor loans however fell, from 37% to 29% in FY16. 52% of loans are broker originated, up from 48% last year. Mortgage lending now accounts for 62% of all Australian lending, up form 60% last year.

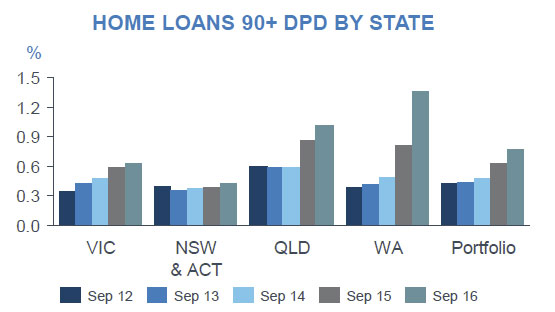

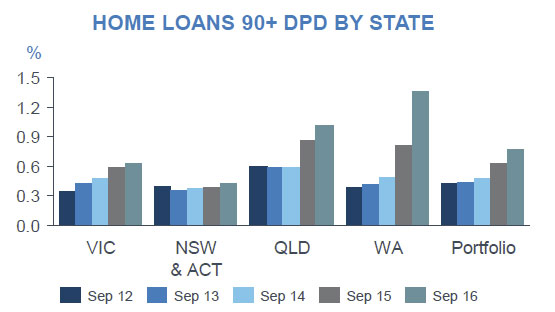

Looking at the mortgage portfolio, 39% of households are ahead with repayment, down from 42% last year. 37% are interest only loans (same as last year). Delinquencies vary by state, with a significant spike in WA and QLD.

Looking at the mortgage portfolio, 39% of households are ahead with repayment, down from 42% last year. 37% are interest only loans (same as last year). Delinquencies vary by state, with a significant spike in WA and QLD.

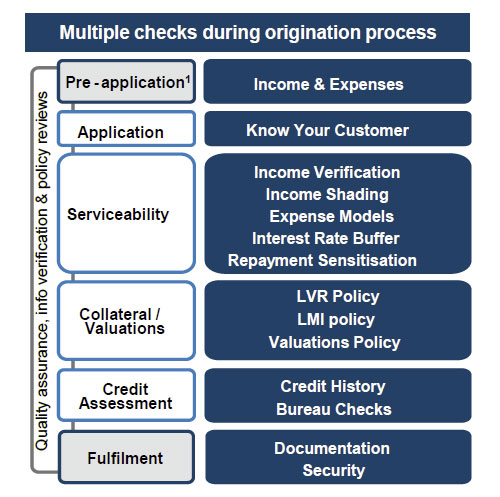

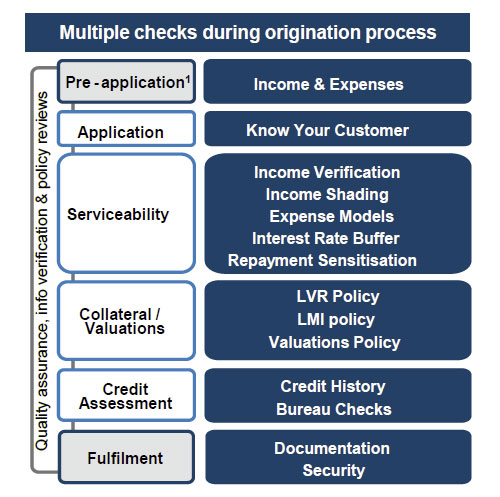

They have made changes to their lending standards. In terms of serviceability, they now apply an interest rate floor to new and existing mortgage lending introduced at 7.25%. They introduced of an income adjusted living expense floor (HEM) and a 20% haircut for overtime and commission income, as well as increasing income discount factor for residential rental income from 20% to 25%

They have made changes to their lending standards. In terms of serviceability, they now apply an interest rate floor to new and existing mortgage lending introduced at 7.25%. They introduced of an income adjusted living expense floor (HEM) and a 20% haircut for overtime and commission income, as well as increasing income discount factor for residential rental income from 20% to 25%

They changed their lending policy to include a LVR cap reduced to 90% for investment loans, LVR cap reduced to 70% in high risk mining towns, decreased maximum interest only term of owner occupied interest only loans to 5 years, withdrawal of lending to non-residents, limited acceptance of foreign income to demonstrate serviceability and tightened controls on verification and tightening of acceptances for guarantees.

[This of course won’t necessarily apply to loans already on book].

They say the end-to-end home lending responsibility managed within ANZ, they have effective hardship & collections processes, and ANZ assessment process apply across all channels.

They say the end-to-end home lending responsibility managed within ANZ, they have effective hardship & collections processes, and ANZ assessment process apply across all channels.

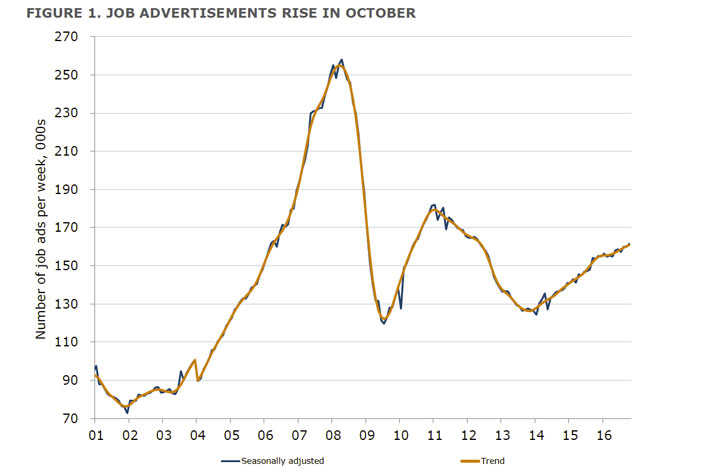

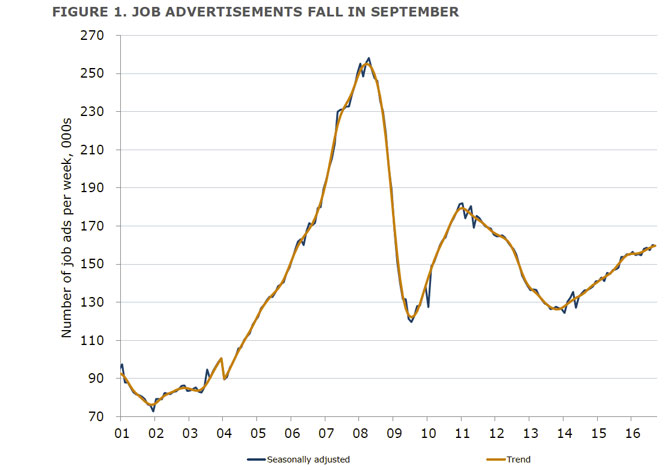

“The rise in ANZ job ads over the past four months is quite encouraging given the recent softness in the employment data. It is consistent with our view that although the pace of improvement in the labour market has slowed, conditions remain supportive of ongoing recovery.