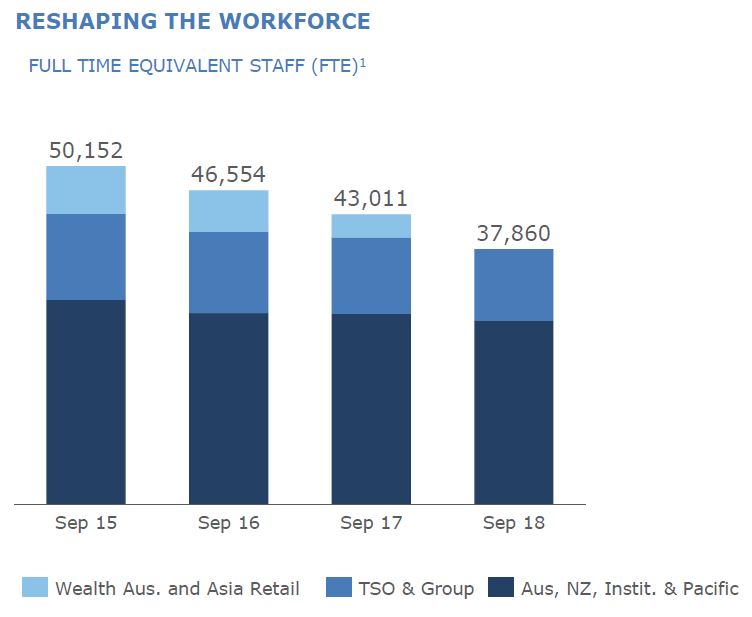

ANZ chief executive Shayne Elliott has conceded that branches are losing their lustre as cash becomes a niche payment solution and consumers opt to bank online, via InvestorDaily.

Counsel assisting Rowena Orr asked why the major bank has been reducing its retail footprint during Mr Elliott’s time on the stand at the royal commission this week.

Mr Elliott estimated 35 ANZ branches closed this year and up to 50 had ceased operating last year.

ANZ has closed around 110 branches in the past decade: 55 in inner regional Australia, 44 in outer regional areas, six in remote locations and four in very remote areas.

Mr Elliott noted that some branches had also opened in that time, describing it as a redistribution of its network.

“Why so many branches this year, Mr Elliot?” Ms Orr asked.

“Well, consumer behaviour is changing very quickly. And not that it has changed just this year but over the last few years we’re seeing a number of fundamental changes,” Mr Elliott said.

“The Reserve Bank governor the other day referred to the fact that the usage of cash is almost becoming a niche payment solution.”

Mr Elliott added that most of what people are doing in branches is cash related, in deposits and withdrawals. He also noted a decrease in retail traffic of around 20 to 30 per cent over the last couple of years in areas where the bank had closed shops.

However, small business usage was said to remain reasonably solid.

“So essentially, we are confronted with a dilemma where we have shops and a distribution network with less and less people in it, and therefore, at some point they become uneconomic,” he said.

“At the same time, what we have seen is a rapid increase in the use of technology for people who prefer to do their banking on their phone or at home, or even in some cases, on the phone.”

Ms Orr asked if people still go into branches to inquire about loans.

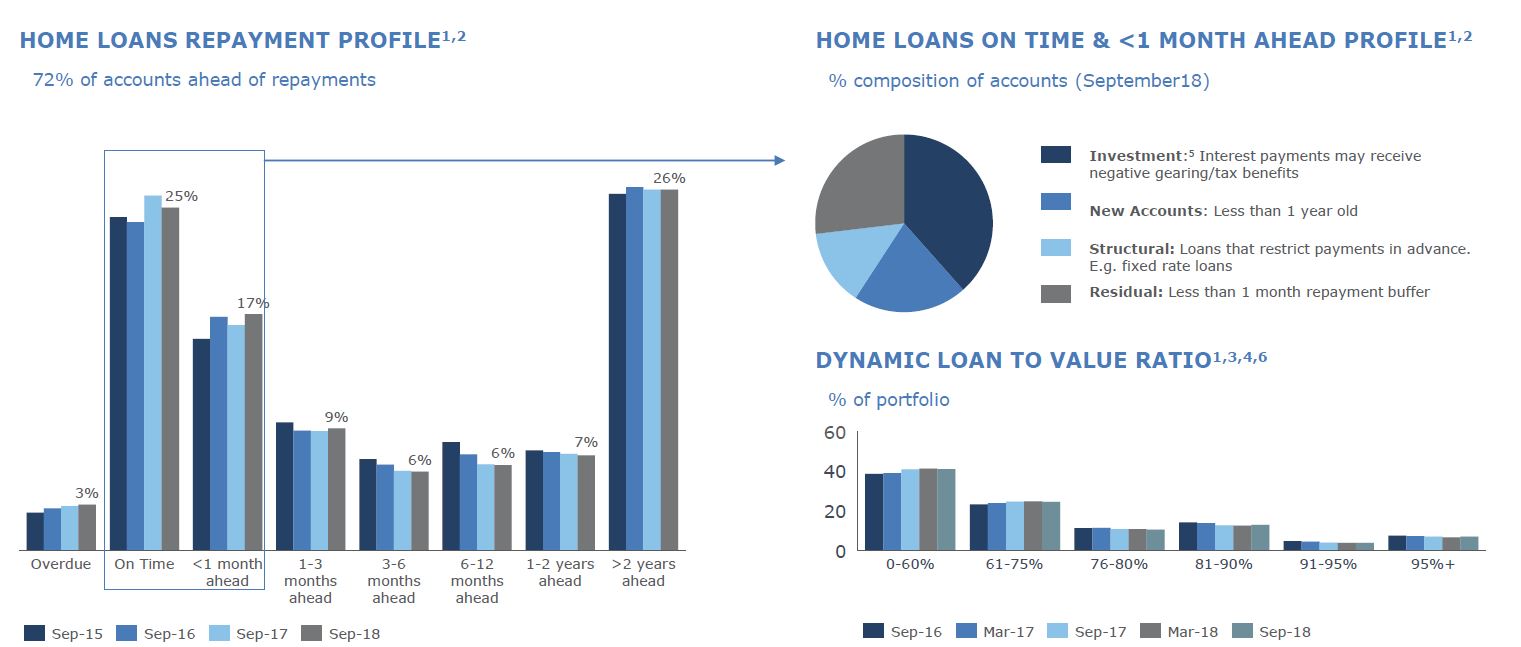

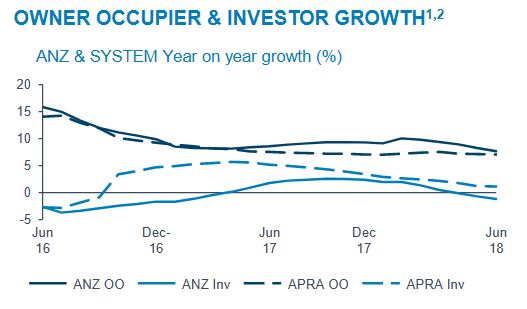

“Yes, perhaps, although I would say for ANZ – and we may be different from our peer group – our home loan book only – less than a third of home loans are originated through a branch,” Mr Elliott said.

“Around 55 per cent come through brokers and another roughly 15 per cent come through our mobile banking network, ie, we send somebody to you. So the branch network is not a terribly efficient or well-used avenue for home loans.”

ANZ had considered two proposals with closing branches, one to sell and the other to continue with a branch by branch closure program. Mr Elliott said the organisation had chosen to continue with closures based on customer behaviour and impact data.

Mr Elliott was also asked about the considerations that ANZ takes into account during branch closures. He responded by saying the bank does not consider the financials of the branch, rather the transactions that are available in the area and local alternatives in close by branches and ATMs.

“There’s very little correlation between what happens in the branch and the economic outcome to the bank. What most people do in a branch drives very little value,” he said.

“We don’t charge fees for most of what they do. It is a service that is not necessarily correlated to where we generate our profits or earnings.”

He added that delinkage is accelerating, with more people using brokers.

ANZ’s attitude towards its retail banking division is in stark contrast to that of its largest competitor, CBA.

When CBA boss Matt Comyn gave evidence before the Hayne inquiry last week he made clear the group’s preference for consumers to use its extensive branch network.

Mr Comyn revealed that CBA had sought to introduce a “flat fee” commission-based model in January 2018, before choosing not to go ahead with the change in fear that the rest of the sector would not follow suit.

MFAA CEO Mike Felton said that CBA’s position was “not surprising”, but was “entirely self-serving” and was “designed to destroy competition and reduce the bank’s reliance on the broker channel”.

Commenting on CBA’s attempt to introduce a flat-fee remuneration model, Mr Felton said: “CBA’s model is anti-competitive and designed to drive consumers back into their branch network, which is the largest branch network of the major lenders.

“Mr Comyn’s solution for better customer outcomes is a new fee of several thousand dollars to be paid by consumers to CBA for the privilege of becoming a CBA customer.”

Mr Felton added: “Cutting what brokers earn by two-thirds would save CBA $197 million, which is good for CBA’s shareholders. However, it would destroy competition, leaving millions of customers without access to credit outside of major lenders.”