We look at the latest credit stats from the RBA and APRA. The credit impulse is slowing. Its at the slowest rate since 1974. So what does that really mean?

Tag: APRA

ADI Home Lending Growth Slows Again in January 2019

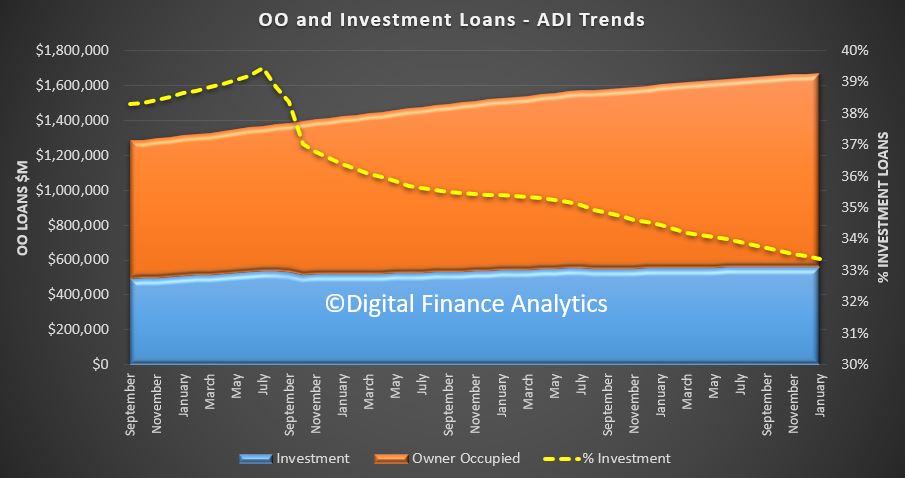

APRA released the monthly banking statistics to end January 2019, and they show a further moderation in home finance lending to both owner occupiers and investors. In fact investment lending balances fell a little.

Its worth highlighting these are raw numbers, no seasonal adjustment, and are based on the returns sent from the banks (possibly data is late thanks to the holidays?).

Nevertheless, it appears to show the credit impulse continues to slow, and this will translate into further home price falls ahead.

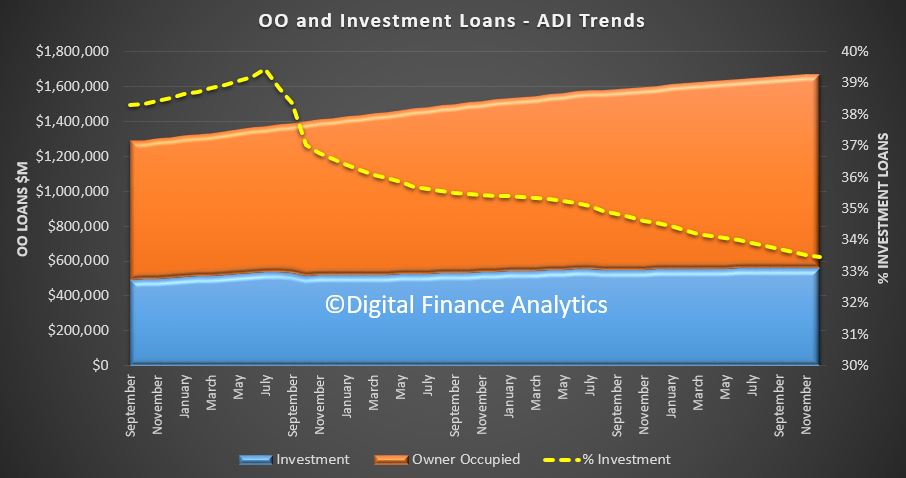

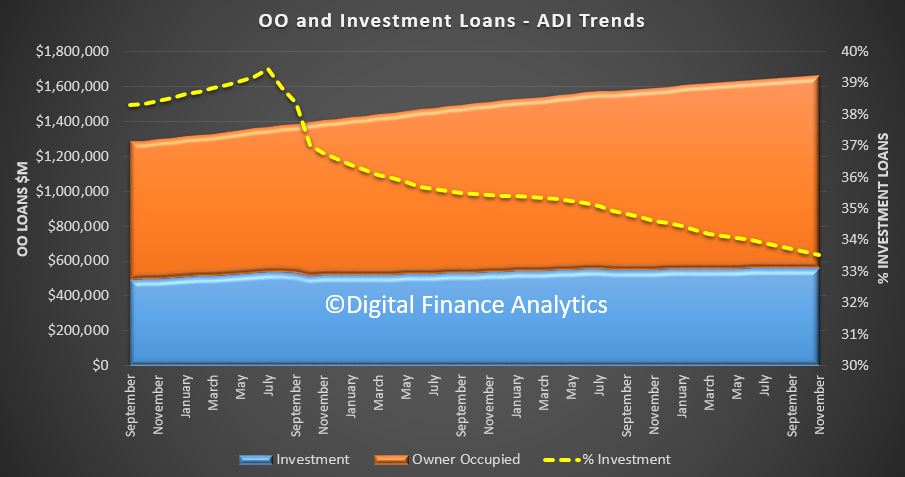

Overall the value of home lending from the banks rose 0.15% in the month, to $1.67 trillion dollars. This be be equivalent to an annual rate of just 1.8%. This is the lowest growth rate for years. Within that lending for owner occupation rose by 0.27% to $1.11 trillion dollars and lending for investment purposes FELL 0.09% to $557 billion. Investment loans comprise 33.37% of all loans on book.

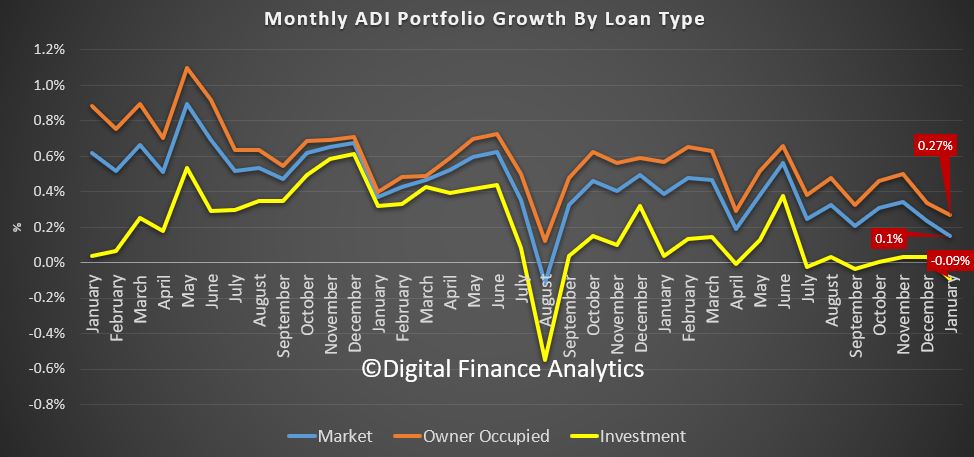

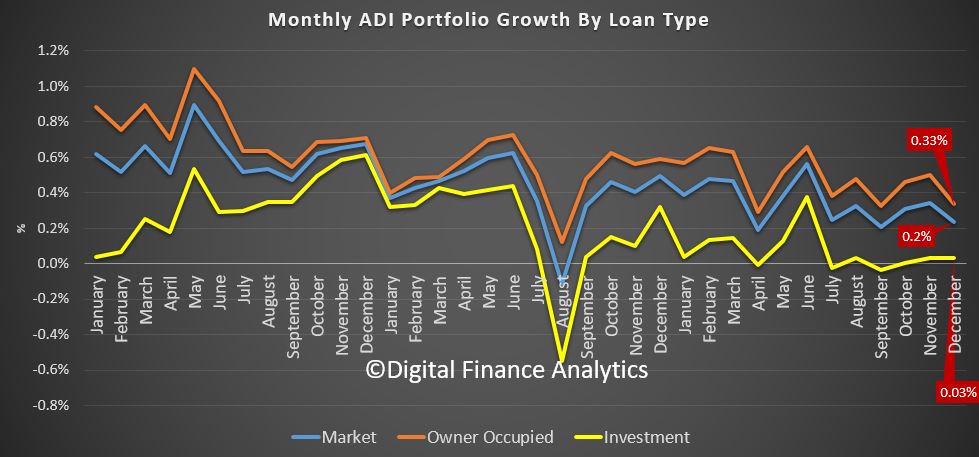

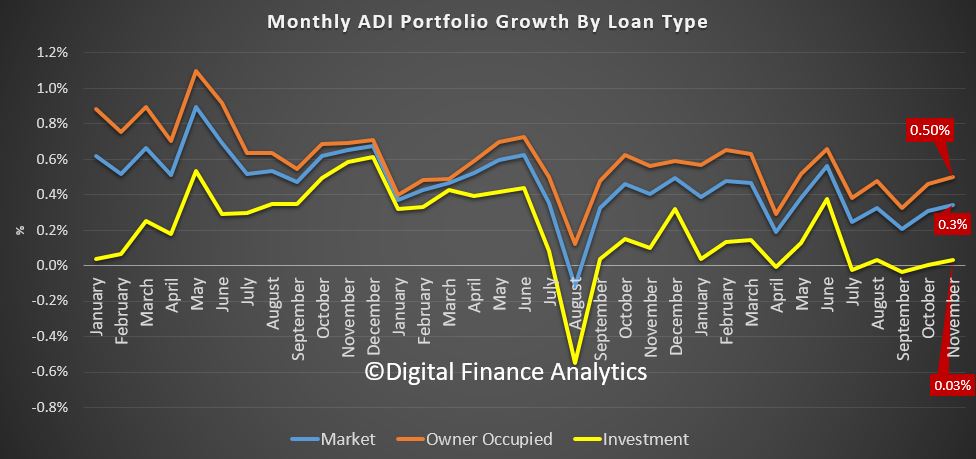

We can track the growth rates by category. Overall growth rates continue to fall across the board.

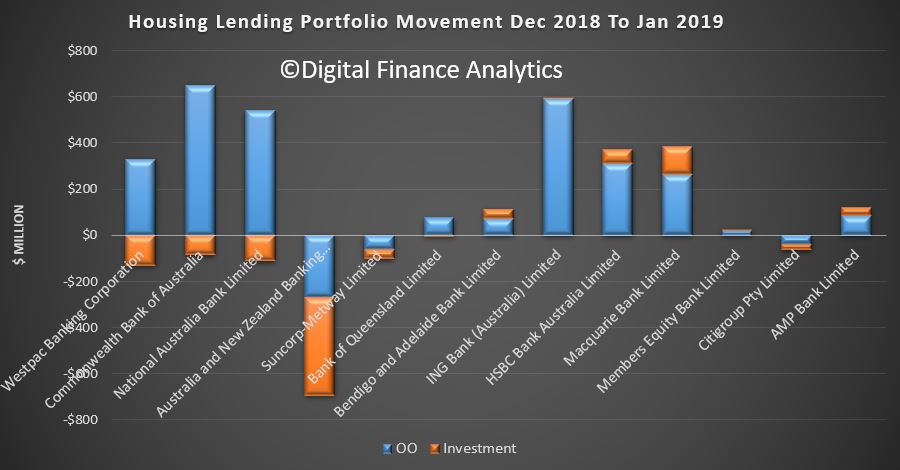

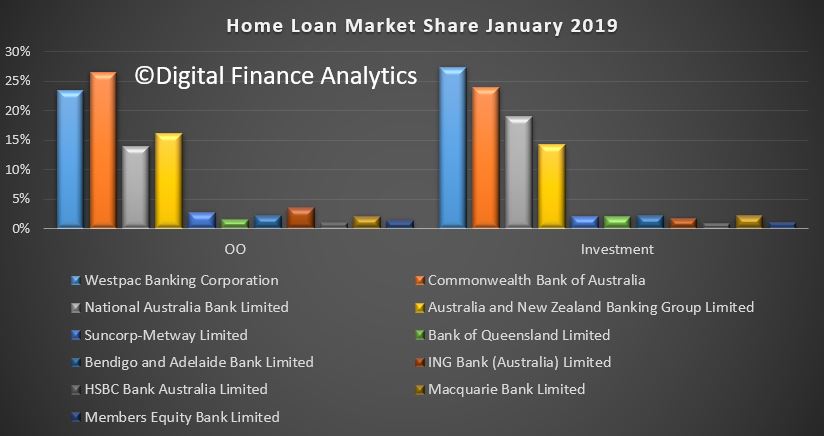

The individual movements within the banks makes interesting reading, with all the large banks seeing their investment lending pools shrinking, while Macquarie, HSBC and Bendigo/Adelaide Bank, plus AMP are taking up the slack. We hope they have adequate underwriting standards in place!

The portfolio movements remain pretty much the same, with CBA the largest owner occupied lender, and Westpac the largest investment loan lender.

Whilst the 10% APRA speed cap is obsolete now, the annual movements show that the majors are well off the pace compared with some of the smaller lenders, and the market grew (based on monthly averages) by just 0.73%, with below zero growth rates in 4 of the past 12 months.

The investment lending party is well and truly over, but the hangover, in terms of big loans, interest only loans, and falling returns will be with us for years. The credit impulse is dying – prices will continue to fall as lending standards are normalised. Lets be clear, freely available credit inflated home prices, the reverse is also true. Short of breaking the responsible lending rules again, there is no way out.

APRA Gives APRA A Good Wrap

Wayne Byres, APRA Chairman spoke at the Financial Stability Institute (FSI) Executives’ Meeting of East Asia-Pacific Central Banks (EMEAP) – Basel Committee on Banking Supervision (BCBS) High Level Meeting, Sydney in Sydney.

He gave APRA a good wrap for is progress on the Basel based supervisory framework. His comments on their mortgage sector interventions were, well, interesting (I would say, too little too late!).

In 2014, we initiated a quite intensive supervisory effort to lift and reinforce lending standards. Our concern was that due to strong competitive pressures, policies were not suitably calibrated to the Australian environment at the time – one of high and rising house prices, high household debt, subdued household income growth and historically low interest rates. We issued additional supervisory guidance, and allocated significant resources to ensure lending policies were suitably aligned with it. Unfortunately, this provided evidence that strong incentives to grow profit and market share often saw lenders weaken and/or override policies in order to generate sales. Moreover, the dangers did not seem to be strongly called out by compliance and audit functions.

To me, the perspective he paints is still far too narrow in terms of really tacking financial stability, Basel is but one element, not the universe!

Here is his introduction…

Translating prudential policy into prudent practice

I’ve been asked to speak this morning about the challenge of translating prudential policy into prudent practice. From a global perspective, that’s an important issue to focus on because policy reform will mean little if it does not translate into improved practices and behaviours.

Translating global reform proposals to improved banking practice is a four-step process:

- global reforms have to be agreed as international standards;

- agreed international standards then need to be translated into domestic regulation;

- bank policies, systems and frameworks then have to be modified to comply with new regulations; and

- actual banking behaviours and practices need to adjust to a new set of constraints on the way business is done.

The first of these steps is pretty much complete. A decade on from the financial crisis, the marathon international policy-making efforts to restore and protect the resilience of the global banking system have, by and large, reached the finish line. Greatly strengthened risk-based capital requirements, a supplementary leverage ratio, with additional buffers for systemically important banks, liquidity and funding requirements in the form of the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR), tighter large exposure limits and new margining requirements for OTC derivatives, and an enhanced disclosure regime provide a comprehensive package of prudential policy reforms. The Basel Committee has worked long and hard, and should be commended for the final product.

The Basel Committee’s output – besides lots of paper! – are agreements on the design and calibration of minimum standards. Those agreements are critical to global financial stability. Unfortunately, they are not worth the paper they are written on if they are not translated into domestic regulation by member jurisdictions – the second step in the process I referred to earlier. To repeat the frequent exhortations of the G20 leaders, to achieve the desired objective of a resilient global financial system the reforms need to be implemented in a “full, timely and consistent manner”.

A quick look at the Basel Committee’s latest implementation monitoring report shows something of a mixed scorecard. While the core Basel III risk-based capital requirements and the LCR are largely in force around the world, there has been less progress in some other areas: many requirements are subject to lengthy transitional periods, implementation of the NSFR has been disappointingly slow in a number of jurisdictions, and margining and disclosure requirements can be described as a little patchy.

In short, not all commitments to act have been met by action. That is disappointing. While some delays and trade-offs are valid, on occasion it appears to reflect a regulatory version of the “first mover disadvantage” that supervisors often criticise the industry for – jurisdictions not wanting to do the right thing and move promptly because of a concern that other jurisdictions may not follow suit. This reveals a disappointing penchant to put the interests of banks and their shareholders above that of their depositors and the broader community – something that prudential supervisors must constantly guard against.

For our part, we’ve made good progress on the financial reform agenda in Australia. While the banking sector here escaped the worst of the crisis a decade ago, that didn’t mean APRA was complacent about the importance of building resilience. The core capital, liquidity and funding reforms of Basel III are all in place, with a conservative overlay in many areas. Moreover, we have done this without the extensive transitional periods that have been necessary in other parts of the world. I acknowledge, though, that we don’t have a perfect record and still have a few gaps to close, such as the enhanced Pillar III disclosure requirements. We are committed to addressing these as soon as we can.

APRA Capability Review Launched

The government has announced the panel that will lead the capability review of the Australian Prudential Regulation Authority as recommended by the Hayne royal commission; via InvestorDaily.

One of Commissioner Hayne’s recommendations in his final report on the royal commission was to conduct regular capability reviews into both ASIC and APRA with a review to be undertaken immediately for APRA.

In Mr Hayne’s report he noted that ASIC had recently undergone a review while APRA had not and therefore recommended it be the first to undergo one.

“I recommend that a formal capability review be undertaken of APRA, with that review being completed as soon as is reasonably practicable after the publication of this report,” he said.

Treasurer Josh Frydenberg as part of his response to the royal commission accepted the need for regular reviews and recently announced the independent panel that would lead the APRA review.

Former chairman of the ACCC Graeme Samuel will be chairman of the review and will be joined by Diane Smith-Gander a former senior executive at Westpac and Grant Spencer a former acting governor of the Reserve Bank of New Zealand.

Mr Frydenberg said the review would look into APRA’s ability to promote financial stability, as well as its capabilities to regulate superannuation entities and its enforcement activities.

“The APRA capability review will provide a forward-looking assessment of APRA’s ability to respond to an environment of growing complexity and emerging risks for APRA’s regulated sectors,” he said.

APRA and ASIC were found by the royal commission to be too soft on misconduct and prone to negotiate settlements and part of the panel’s role will be to review the authority’s readiness to respond to issues as raised in the commission.

APRA recently appointed John Lonsdale to lead a review into the authority’s enforcement policies, stating that it would be completed by the end of March this year.

The government has yet to respond to the recommendations that the APRA-administered BEAR be extended to insurers and super funds or that the principles of the BEAR regime be applied to the regulators as well.

APRA recently released a statement saying it was committed to implementing the recommendations with a plan to implement by the end of 2020.

“There are 10 recommendations requiring APRA’s direct attention. Of the 10, it is expected that nine will be completed by the end of 2020; of those, four are expected to be completed in 2019,” a press release from APRA said.

APRA also said it is examining 12 matters in relation to individual entities that were referred by the royal commission and is working with ASIC to address those.

APRA also said it would work with Treasury, ASIC and other stakeholders to implement the extension of BEAR and strengthening of trustee duties.

The panel will commence in March 2019 to report to the government by the end of June.

ADI Credit Growth Continues To Slow

APRA released their monthly banking statistics to end December 2018 today. Total loan stock for housing was $1.67 trillion dollars, up 0.23% from last month (equivalent to 2.8% if annualized). Another record.

Within that loans for owner occupied housing rose to $1.11 trillion dollars, up 0.33% from November, or $3.7 billion dollars, while investment loans rose $173 million. Overall investment loans fell to 33.45% of portfolio.

The movements show a steady decline in owner occupied loans, and a slight rebound in investor loans, from a very low base.

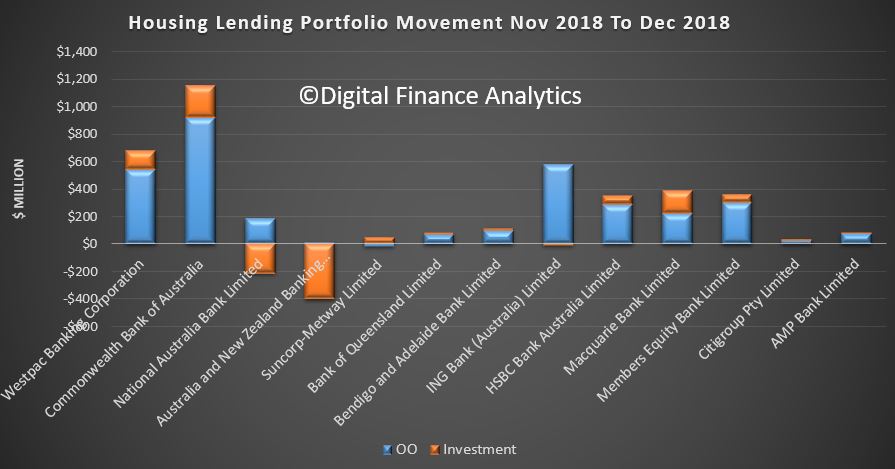

Looking at the banks’ portfolio movements, we see significant variations in strategy, with Westpac and CBA still lending, especially on owner occupied loans, alongside ING, HSBC and Members Equity. But NAB and ANZ have slowed their growth, and in fact dropped their share of investment loans a little in December.

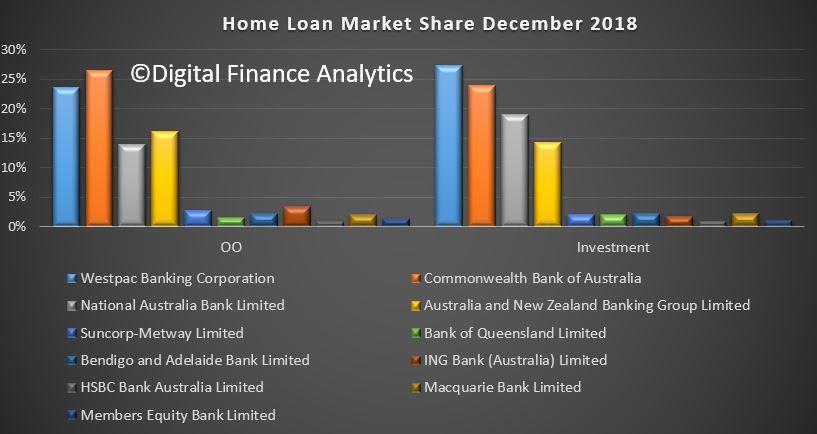

That said the portfolio moves are at the margin, with CBA and Westpac maintaining their leading positions in owner occupied and investment loans respectability.

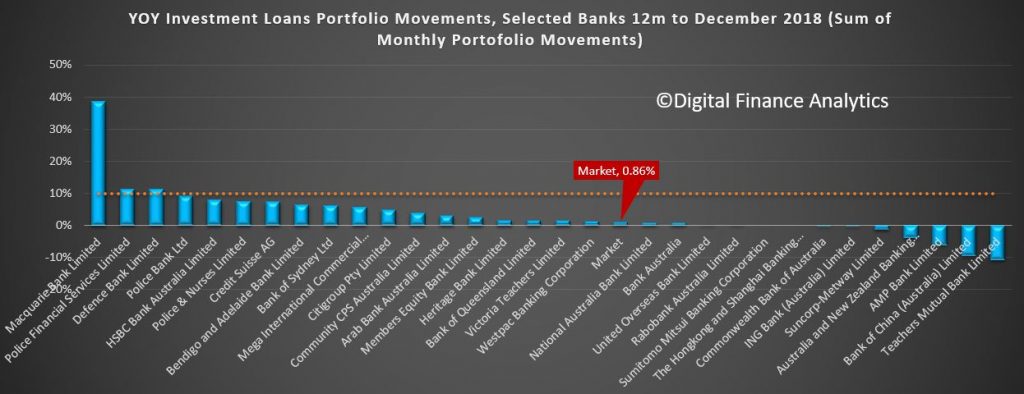

For completeness, we show the growth in investor loans by lender, despite the APRA speed limit is now removed. Macquarie holds the prize for portfolio growth. Investor loan growth has slowed to a crawl.

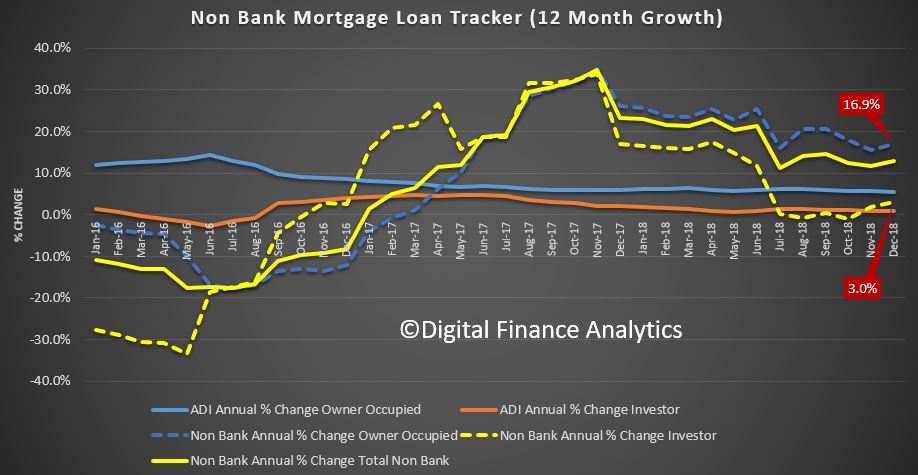

Finally, we can estimate the relative growth of the banks and non-banks by combining the RBA and APRA data. It is approximate, but clear the non-banks are growing their portfolios faster than the ADI’s because although they have the same responsible lending rules, they are not constrained by APRA’s capital rules.

It is clear the non-banks, growing on an annualized 16.9% basis for owner occupied loans and 3.06% for investment loans are taking up the slack. But this should be a warning to regulators, as risks here are rising, as households who fail the stricter bank underwriting standards turn to the non-banks; even if they have to pay a higher rate of interest!

APRA needs to wake up, on this one. In fact the story is one of loan flow being deflected away from the big four, to some smaller banks, and non-banks. It will be interesting to see if the Royal Commission report changes the game when it is released.

APRA Holds Countercyclical Capital Buffer; Releases Assessment Of Measures To Lift Home Lending Standards

APRA has provided a justifying summary of their actions relating to home lending regulation, but warns that “many of the underlying structural risks associated with high household debt remain and will do so for some time”.

Despite this, they have chosen to keep the countercyclical capital buffer at zero. Housing credit growth is slowing, but there is nothing in this document to suggest APRA intends to loosen the requirements relating to home lending further – (unlike some of the commentators have been suggesting they should reduce the 7% floor rate).

So, as credit availability drives home prices, as we recently discussed, and underwriting is now in a new normal, we should expect more home price falls ahead. We discussed this is our recent video. And this before the Royal Commission reports!

The Australian Prudential Regulation Authority (APRA) has announced its decision to keep the countercyclical capital buffer (CCyB) for authorised deposit-taking institutions (ADIs) on hold at zero per cent.

The CCyB is an additional amount of capital that APRA can require ADIs to hold at certain points in the economic cycle to bolster the resilience of the banking sector during periods of heightened systemic risk. APRA reviews the buffer quarterly. It has been set at zero per cent of risk-weighted assets since it was introduced in 2016.

In its annual information paper on the CCyB released today, APRA outlined the core economic indicators that contributed to the decision, including:

- moderate growth in housing and business credit over 2018;

- a decline in higher-risk categories of new housing lending, including interest-only loans, investor loans and lending at high loan-to-value ratio (LVR) levels; and

- continued strengthening in ADIs’ capital positions as they move to implement the requirements of “unquestionably strong” capital ratios.

Also influencing APRA’s judgement that a zero per cent CCyB setting remained appropriate has been the impact of measures that APRA has taken since 2014 to address systemic risks related to residential mortgage lending standards.

In a separate but related information paper also released today, APRA detailed its objectives for its interventions in the residential mortgage lending market in recent years, which were aimed at reinforcing sound mortgage lending standards and increasing the resilience of the banking sector in the face of heightened risks. These risks included an environment of rising household debt, subdued wage growth, rising house prices, and an erosion of bank lending standards at a time of historically low interest rates. Concerned that the banking sector may be increasing its vulnerability to future shocks, APRA’s response was to undertake a program of work to strengthen and embed sound lending policies and practices, particularly in relation to borrower serviceability, supported by temporary benchmarks to incentivise lenders to moderate the growth in lending to investors and the volume of interest-only lending.

Some of the key findings within the paper include:

- ADIs have lifted the quality of their lending standards, with improvements in policies and practices across the industry;

- During the period in which the adjustments were occurring (2015-2018), the growth in total credit for housing was stable;

- The composition of credit for housing, however, changed notably: the rate of growth of lending to investors fell considerably, and the proportion of loans written on an interest only basis roughly halved (although, given the high starting point, one in five loans is still made on an interest-only basis);

- Although APRA did not introduce measures to specifically target lending with high loan-to-value (LVR) ratios, there has been a moderation in high LVR lending in recent years;

- Initially, ADIs sought to adjust lending practices without resorting to interest rate increases. Ultimately, however, interest rates were used to help manage demand for credit. The pricing differential that has emerged between owner-occupied and investor loans, and between amortising and interest-only loans, is often seen to be a product of the APRA benchmarks, but is also reflective of changes to capital requirements that will likely see differential pricing for higher risk lending continue into the future; and

- APRA’s actions revealed a number of system and data deficiencies within ADIs that constrained their ability to adjust their practices. In addition, smaller ADIs tended to find it more difficult to manage quantitative-based constraints. That said, the period in which the benchmarks were in place saw small ADIs increase their market share slightly, partly reflecting APRA’s approach, which provided more flexibility for smaller ADIs.

Chairman Wayne Byres said that after the announcement of the removal of the investor and interest-only benchmarks last year, it was appropriate for APRA to review the impact of its regulatory actions, and reflect on whether their objectives had been achieved.

“APRA could have chosen to utilise the countercyclical capital buffer as a means of building resilience in the banking system. However, APRA took the view that the better course of action was to address, through targeted measures, the underlying concern – the erosion in lending standards driven by strong competitive pressures amongst housing lenders.

“APRA’s assessment is that, collectively, its interventions achieved the necessary objective of strengthening lending standards and reducing a build-up of systemic risk in residential mortgage lending. The review provides some valuable insights on the impact of the measures, which have necessarily involved some trade-offs and judgement in the process of strengthening the resilience of the banking sector.

“Importantly, while the temporary lending benchmarks are being removed, the changes we have made to lift lending standards are designed to be permanent, continuing to support the resilience of the banking system and ultimately the protection of bank deposits,” Mr Byres said.

In conjunction with the other agencies on the Council of Financial Regulators, APRA will continue to closely monitor economic conditions, and will adjust the CCyB if future circumstances warrant it. Separately, APRA is also considering setting the buffer at a non-zero default rate as part of its ongoing review of the ADI capital framework.

The countercyclical capital buffer information paper, and the review of APRA’s prudential measures for residential mortgage lending risks can be viewed on the APRA website at https://www.apra.gov.au/information-papers-released-apra.

Non Banks Out-Lending The Banks In Terms Of Mortgage Book Growth

APRA belatedly released their monthly banking statistics to the end of November today. Only a couple of days after the month end, but then who’s counting… (I am!!)

These statistics give us the monthly stock of assets and liabilities by the banks, and as normal we will focus in on the residential mortgage section of the data. We can of course compare this data with that from the RBA, which did come out on the last working day of December, and which we already discussed. See The Debt Machine Is Alive And Well

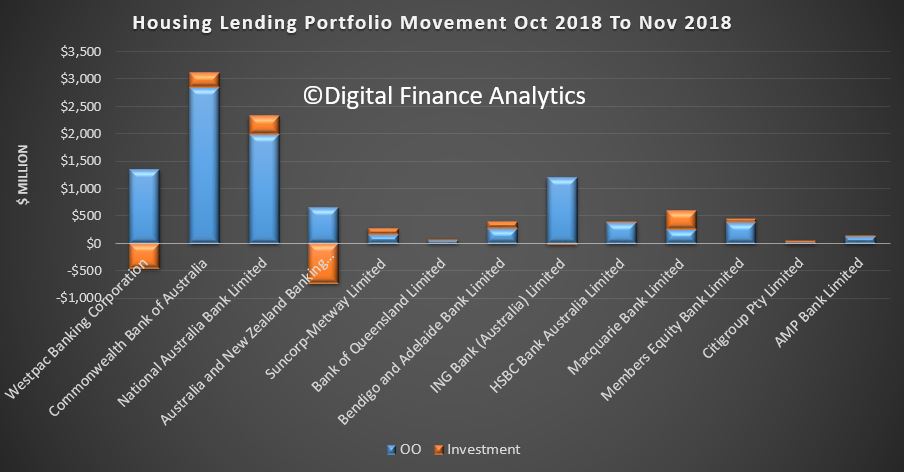

According to APRA, the original mortgage loan portfolios for the banks rose by 0.344%, or $5.69 billion over the month to a new record of $1.664 trillion dollars. Within that, owner occupied loans rose by 0.5% or $5.5 billion dollars to $1.1 trillion dollars, while loans for property investment rose 0.034%, or $188 million to $557.6 billion. 33.52% of all loans are for investment purposes, and this continues to slide, given the new market conditions.

The monthly trend tracker highlights that owner occupied loans are growing significantly faster than investment loans.

Looking at the monthly portfolio movements among the banks, we see that among the big four, Westpac and ANZ saw a significant fall in the value of their investment loan portfolio, while CBA and NAB grew theirs. Macquarie continues to stand out as a lender writing a significant share of investment loans. CBA wrote the largest share of owner occupied loans, and we also see ING also focussing on owner occupied loans.

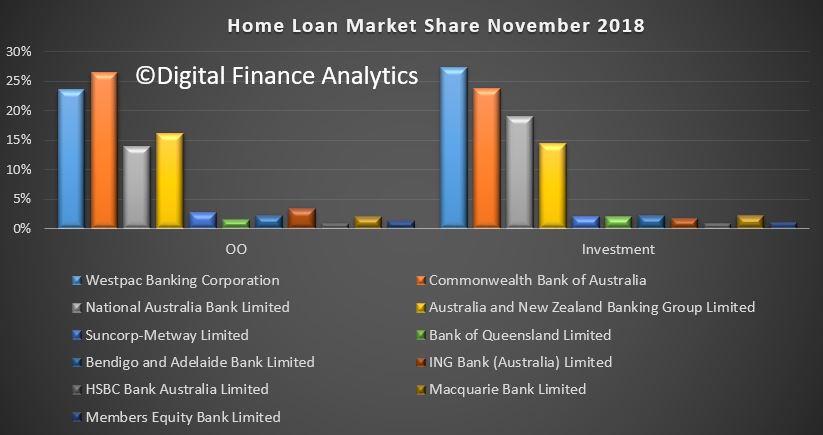

Overall, the banks portfolios are only moving at the margin, with CBA maintaining its position as the largest owner occupied lender, and Westpac the largest investor lender.

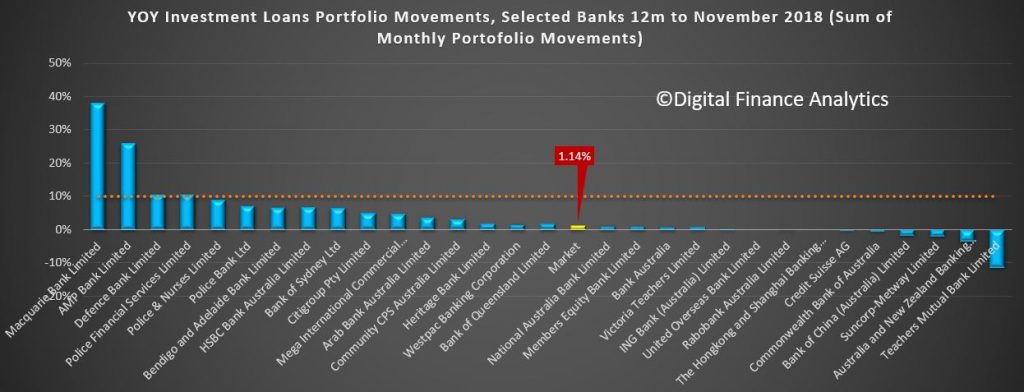

One other interesting (if obsolete) view is the relative growth in investor lending over the past 12 months. This was a focus of APRA but of course is now not being actively used as a control tool. Nevertheless, the data shows that AMP and Macquarie stand out with the largest portfolio growth, to November, while some of the majors are now in negative territory, including ANZ and CBA. Bendigo and Adelaide Bank are writing a greater relative share than the majors now. The market average across the year (sum of the monthly movements now stands at 1.14%. What a difference from a couple of years ago, APRA’s macroprudential intervention has certainly had an effect, despite being several years too late!).

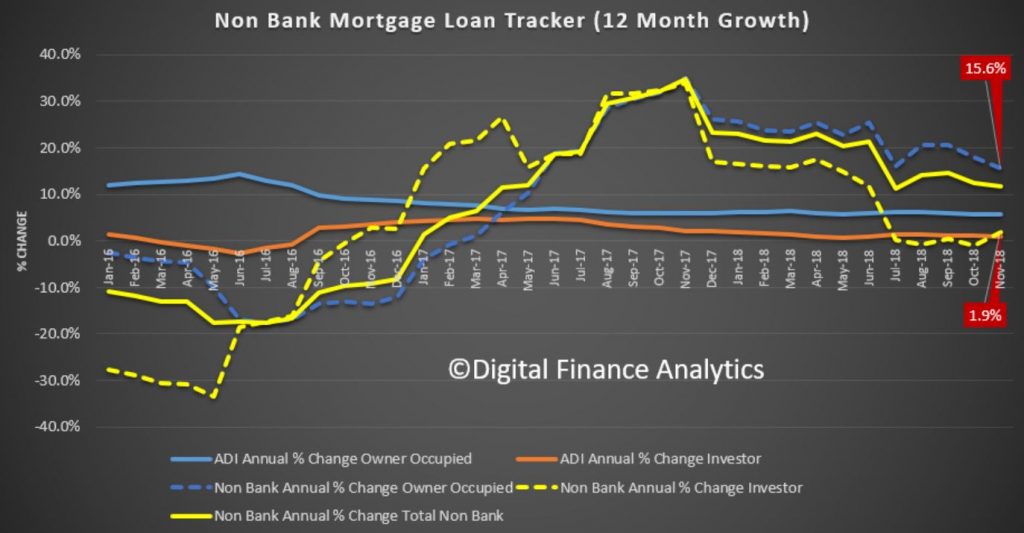

One final data point, we can estimate the relative share of non-bank lending by comparing the RBA data and the APRA data. As discussed before this is tricky, given the delays in the non-bank data, and the fact that not all the non-banks are included in the dataset. That said, we can use the DFA tracker to show the relative movement between the banks and non-banks.

This makes interesting reading, and underscores that fact that the non-banks have been growing faster than the ADI’s in recent times. Non-Bank owner occupied annual lending is running at around 15.6% compared with a year ago, while investor lending grew around 1.9%. This compares with the market average from the RBA of 0.9% for investor lending and 6.4% for owner occupied lending. Its fair to conclude therefore than non-banks are lending like fury, compared with the ADI’s, a symptom of easy non-bank funding, different capital requirements, and a greater willingness to lead.

This is a sure sign of more trouble ahead, as we know that some borrowers rejected by the banks, because of their not meeting the tighter lending standards now in force are being swept up by the non-banks, where they often will pay a higher mortgage rate! This is something I discussed with Tony Locantro in our recent video – from first hand experience!.

Australia’s Interest-Only Cap Removal Won’t Spur Lending

The Australian Prudential Regulation Authority’s (APRA) macro-prudential easing on interest-only residential mortgages is unlikely to meaningfully affect loan growth, as tighter underwriting standards have become the most effective constraint on riskier types of lending, says Fitch Ratings.

The restriction that interest-only loans cannot exceed 30% of new mortgages, which APRA will remove from 1 January 2019 for most banks, was put in place in March 2017 as part of the regulator’s efforts to contain banking-sector risk amid rising house prices and high and increasing household debt. The cap initially had a strong impact, but banks have collectively been operating well below the limit over the previous year due to stronger underwriting standards. This partly reflects the regulatory focus on risk control and mortgage underwriting – with APRA strengthening serviceability testing, for example – while banks have also become more cautious as market conditions have toughened.

The benchmark will be removed for banks that have provided assurances on maintaining the strength of their underwriting standards, which was also a requirement for the removal of a cap on investor loan growth in April 2018. Most banks have provided these assurances.

Some banks could take advantage of the cap removal to gain market share in a slow credit-growth environment, but we expect no more than a small uptick in overall interest-only lending. Lending standards should continue to curb the pace at which interest-only loans are made available by banks. The weak housing market, especially in Sydney and Melbourne, is also a headwind to interest-only lending, as it will dampen investor demand and speculative buying. We forecast nationwide house prices to drop by 5% yoy in 2019.

Fitch expects Australian banks to continue tightening control frameworks and underwriting standards, especially around expense testing and income verification, which should support the quality of new mortgages. APRA plans to review banks’ risk controls and interest-only lending as part of a broader assessment of lending standards next year.

The interest-only lending cap is the last macro-prudential measure outstanding. Fitch maintains a negative outlook on Australia’s banking sector, as bank returns are likely to fall further in the near term on slowing mortgage credit growth – especially in the residential mortgage segment – further remediation and compliance costs associated with inquiries into the financial sector, higher wholesale funding costs and rising loan-impairment charges.

The Establishment’s New Attempts To Escape Blame For Economic Armageddon

Economist John Adams and I discuss the moves by APRA and the RBA to loosen credit. What is really going on?

The John Adams And Martin North DFA Page

Please consider supporting our work via Patreon

Or make a one off contribution to help cover our costs via PayPal

Please share this post to help to spread the word about the state of things….

Caveat Emptor! Note: this is NOT financial or property advice!!

HIA Argues For MORE Credit

The Housing Industry Association (HIA) welcomed APRA’s removal of the 30% IO limit, but argues that banks are tightening beyond the APRA limits and still more credit is needed.

Actually, this is not really the case, rather it is reversion to more normal lending standards as defined by suitable lending.

The HIA are therefore advocating a loosening of standards back to the pre-royal commission and APRA conditions, where people got loans they could not afford and the industry was rife with poor practice and fraud. We should not aspire to return to such conditions again.

This is what they said:

“The removal of the restriction on interest-only lending is essential to addressing the concerning decline in credit growth for new housing,” said Tim Reardon, HIA Principal Economist.

“Credit growth across the market is the lowest it has been since the 1983 recession.

“Credit growth to investors is the lowest on record.

“Today APRA announced it is lifting its 30 per cent cap on banks’ interest-only lending. This is a welcome development in Australia’s mortgage market, but much more needs to be done to ease the current credit squeeze.

“APRA’s restrictions were designed to curb high-risk lending practices. Over the past 12 months ordinary home buyers have experienced significant constraints in accessing the appropriate level of finance to buy a home.

“The credit squeeze is happening at the behest of the banks’ own lending practices which have been tightened above and beyond APRA’s requirements.

“HIA research has found that the time taken to gain approval for a loan to build a new home has blown out from around two weeks to more than two months.

“HIA members are also reporting that almost half of loan applications are being rejected.

“APRA’s announcement sends an important message about the overall health and stability of the mortgage market which should be heeded by policy makers and lenders alike.

“With the Royal Commission scheduled to release recommendations early next year there is a risk that the credit squeeze may drag on into 2019. The residential construction sector is already cooling. Policy makers will need to proceed cautiously when responding to the Commission’s recommendations,” concluded Mr Reardon.