Lenders are facing a dilemma, do they chase mortgage lending growth, and embed more risks into their portfolios, or accept the consequences of lower growth and returns as household debt explodes and we join the 200% Club!

Welcome to the Property Imperative weekly to 20 January 2018. We offer two versions of the update, the first a free form summary edition in response to requests from members of our community:

Welcome to the Property Imperative weekly to 20 January 2018. We offer two versions of the update, the first a free form summary edition in response to requests from members of our community:

Alternatively, you can watch our more detailed version, with lots of numbers and charts, which some may find overwhelming, but was the original intent of the DFA Blog – getting behind the numbers.

Tell us which you prefer. You can watch the video, or read the transcript.

In our latest digest of finance and property news, we start with news from the ABS who revised housing debt upward, to include mortgage borrowing within Superannuation, so total Household Liabilities have been increased by approximately 3% to $2,466bn. The change, which required the accurate measurement of property investment by self-managed superannuation funds, brought the figure up from 194 per cent so we are now at 200% of income. A record which no-one should be proud of. It also again highlights the risks in the system. Australian households are in the 200% club.

The final set of data from the ABS – Lending Finance to November 2017 which also highlights again the changes underway in the property sector. Within the housing series, owner occupied lending for construction fell 0.88% compared with the previous month, down $17m; lending for the purchase of new dwellings rose 0.25%, up $3m; and loans for purchase of existing dwellings rose 0.11%, up $12m.

Refinance of existing owner occupied dwellings rose 0.28%, up $16m.

Looking at investors, borrowing for new investment construction rose 5%, up $65m; while purchase of existing property by investors fell $74m for individuals, down 0.75%; and for other investors, down $21m or 2.28%.

Overall there was a fall of $16m across all categories.

We see a fall in investment lending overall, but it is still 36% of new lending flows, so hardly a startling decline. Those calling for weakening of credit lending rules to support home price growth would do well to reflect that 36% is a big number – double that identified as risky by the Bank of England, who became twitchy at 16%!

Looking then across all lending categories, personal fixed credit (personal loans rose $70m, up 1.74%; while revolving credit (credit cards) fell $4m down 0.18%. Fixed commercial lending, other than for property investment rose $231m or 1.12%; while lending for investment purposes fell 0.25% or $30m. The share of fixed business lending for housing investment fell to 36.7% of business lending flows, compared with 41% in 2015. Revolving business credit rose $6m up 0.06%.

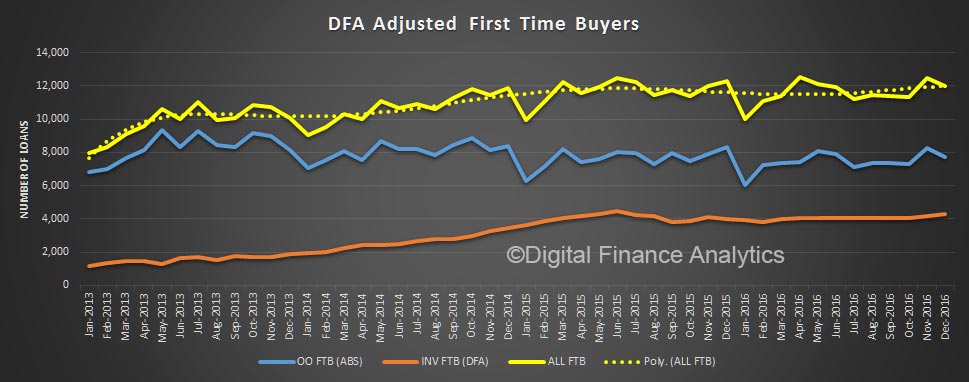

A highlight was the rise in first time buyer owner occupied loans, up by around 1,030 on the prior month, as buyers reacted to the incentives available, and attractor rates. This equates to 18% of all transactions. Non-first time buyers fell 0.5%. The average first time buyer loan rose again to $327,000, up 1% from last month. We do not think the data gives any support for the notion that regulators should loosen the lending rules, as some are suggesting. That said the “incentives” for first time buyers are having an effect – in essence, persuading people to buy in at the top, even as prices slide. I think people should be really careful, as the increased incentives are there to try and keep the balloon in the air for longer.

So, what can we conclude? Investment lending momentum is on the turn, though there is still lots of action in the funding of new property construction for investment – mostly in the high rise blocks around our major centres. But in fact momentum appears to be slowing in Brisbane, Sydney and Melbourne. This does not bode well for the construction sector in 2018, as we posit a fall in residential development, only partly offset by a rise in commercial and engineering construction (much of which is state and federal funded). What I’m noticing is that those in the construction sector – from small builders to sub-contractors – have significantly lower confidence levels than they did six months ago, based on our surveys.

Whilst lending to first time buyers is up, there are risks attached to this, as we will discuss later.

The good news is lending to business, other than for housing investment is rising a little, but businesses are still looking to hold costs down, and borrow carefully. This means economic growth will be slow, and potential wages growth will remain contained.

Fitch Ratings says Australian banks’ profit growth is likely to slow in 2018 as global monetary tightening pushes up funding costs, loan-impairment charges rise, and tighter regulation has an impact on business volumes and compliance costs from the 15 or so inquiries or reviews across the sector (according to UBS). They say Australian banks are more reliant on offshore wholesale funding than global peers, as the superannuation scheme here has created a lack of domestic customer deposits. Global monetary tightening could therefore push up banks’ funding costs. Indeed, The 10-Year US Bond yield is moving higher, and whilst the US Mortgage rates were only moderately higher today, the move was enough to officially bring them to the highest levels since the (Northern) Spring of 2017.

The main risks to banks’ performance stem from high property prices and household debt. Australian banks are more highly exposed to residential mortgages than international peers, while households could be sensitive to an eventual increase in interest rates or a rise in unemployment, given that their debt is nearly 200% of disposable income. Indeed, Tribeca Investment Partners said this week that local equities may be hurt by troughs in the domestic property market. “A heavily indebted household sector that is experiencing flat to negative real income growth, as well as dealing with higher energy and healthcare costs, and which has drawn down its savings rate, is unlikely to fill the gap in growth”

In local economic news, the latest ABS data on employment to December 2017, shows the trend unemployment rate decreased slightly to 5.4 per cent in December 2017, after the November 2017 figure was revised up to 5.5 per cent. The trend unemployment rate was 0.3 percentage points lower than a year ago, and is at its lowest point since January 2013.

The seasonally adjusted number of persons employed increased by 35,000 in December 2017. The seasonally adjusted unemployment rate increased by 0.1 percentage points to 5.5 per cent and the labour force participation rate increased to 65.7 per cent. The number of hours worked fell. By state, trend employment rose in NT, WA and SA. Over the past year, all states and territories recorded a decrease in their trend unemployment rates, except the Northern Territory (which increased 1.6 percentage points). The states and territories with the strongest annual growth in trend employment were Queensland and the ACT (both 4.6 per cent), followed by New South Wales (3.5 per cent).

The ABA released new research – The Edelman Intelligence research conducted late last year which tracks community trust and confidence in banks. Whilst progress may be being made, the research shows Australian banks are behind the global benchmark in terms of trust. Based on the Annual Edelman Trust Barometer study released in January 2017, Australia remains 4 points behind the global average.

The Australian Financial Review featured some of our recent research on the problem of refinancing interest only loans (IO). Many IO loan holders simply assume they can roll their loan on the same terms when it comes up for periodic review. Many will get a nasty surprise thanks to now tighter lending standards, and higher interest rates. Others may not even realise they have an IO loan!

Thousands of home owners face a looming financial crunch as $60 billion of interest-only loans written at the height of the property boom reset at higher rates and terms, over the next four years.

Monthly repayments on a typical $1 million mortgage could increase by more than 50 per cent as borrowers start repaying the principal on their loans, stretching budgets and increasing the risk of financial distress.

DFA analysis shows that over the next few years a considerable number of interest only loans (IO) which come up for review, will fail current underwriting standards. So households will be forced to switch to more expensive P&I loans, assuming they find a lender, or even sell. The same drama played out in the UK a couple of years ago when they brought in tighter restrictions on IO loans. The value of loans is significant. And may be understated.

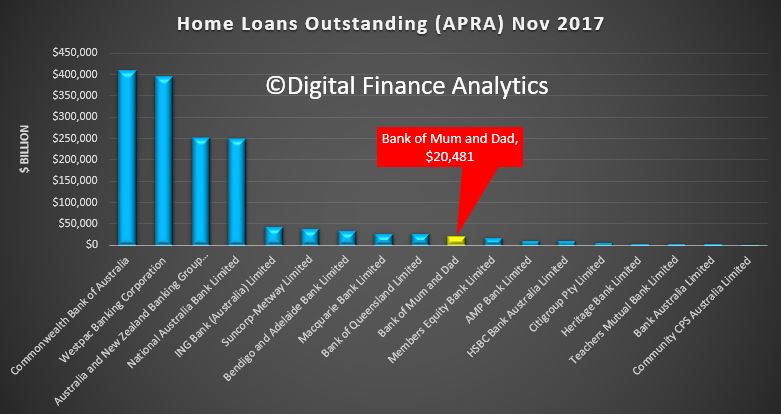

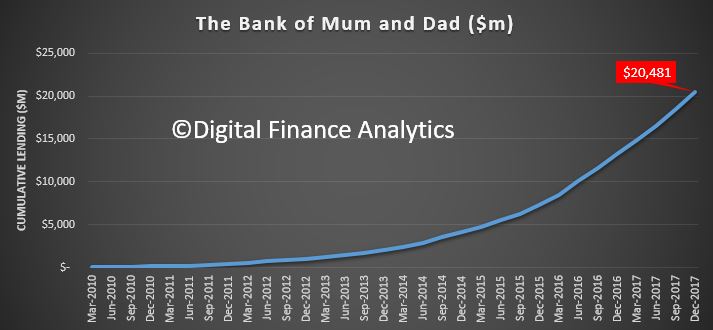

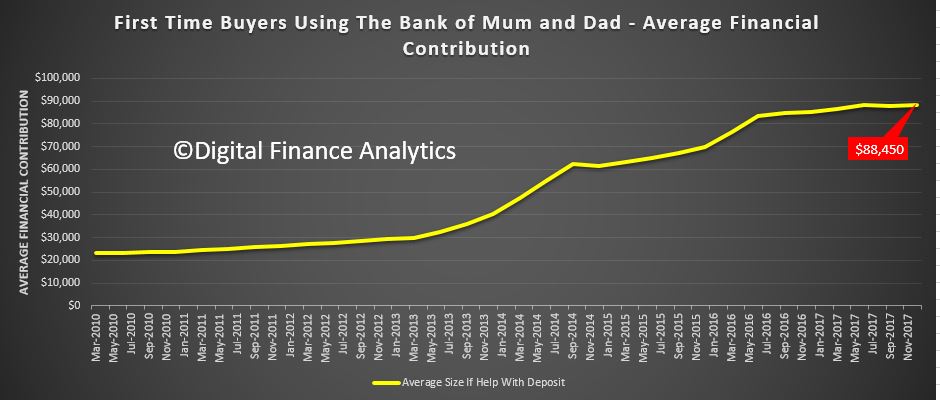

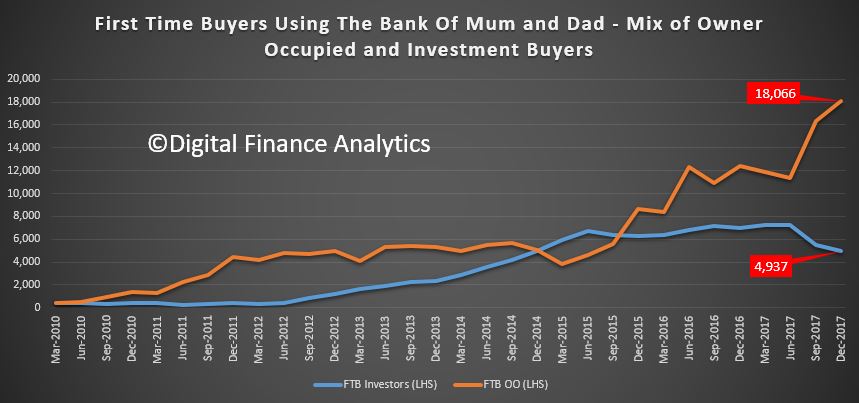

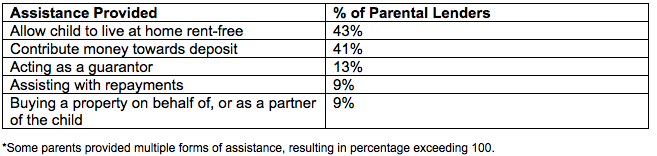

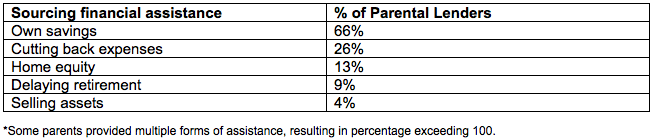

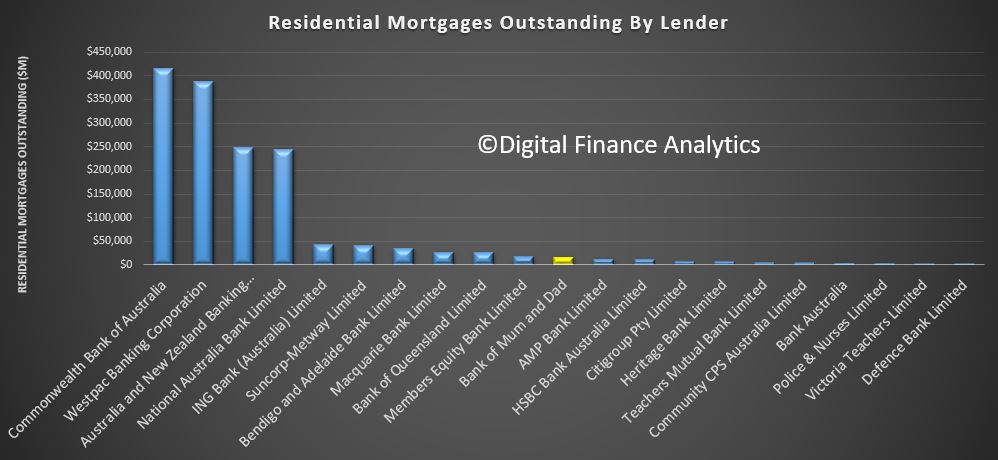

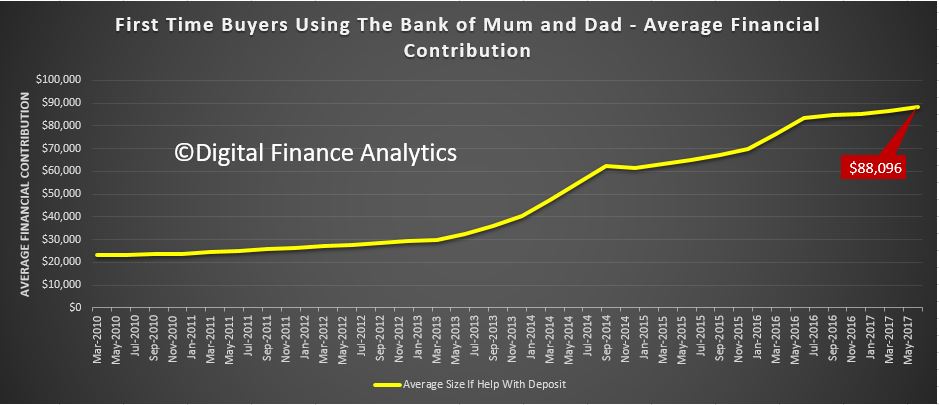

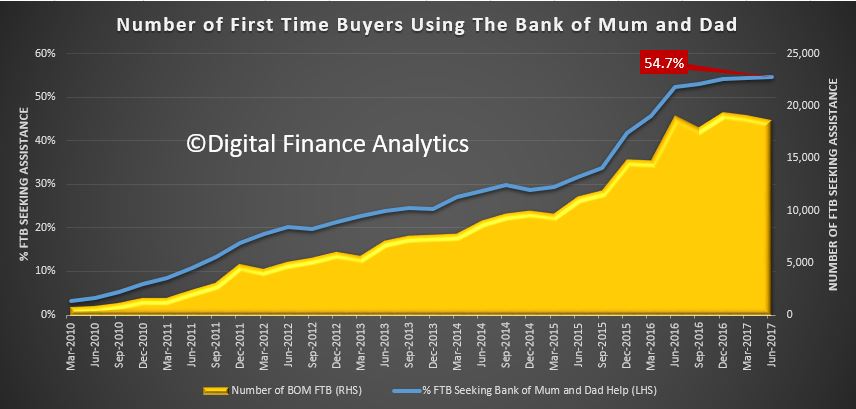

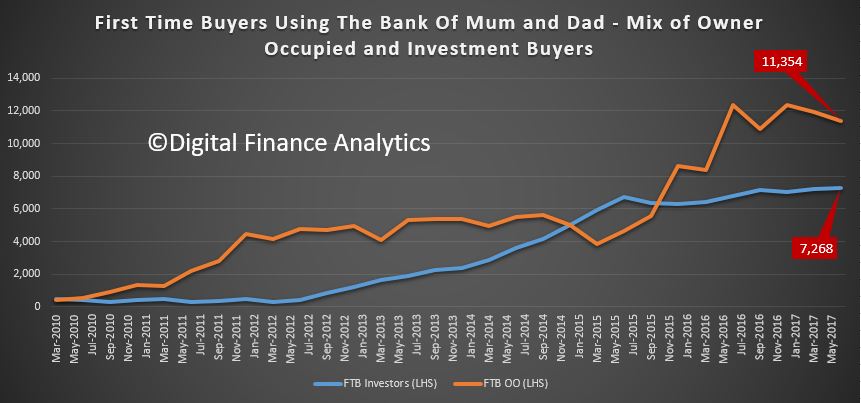

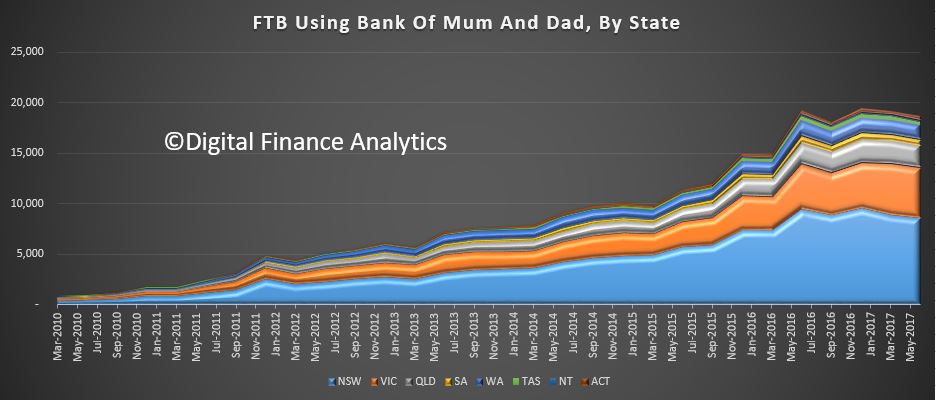

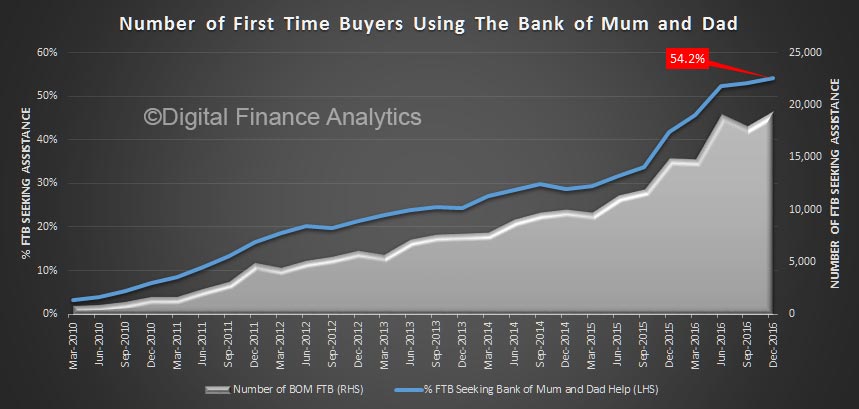

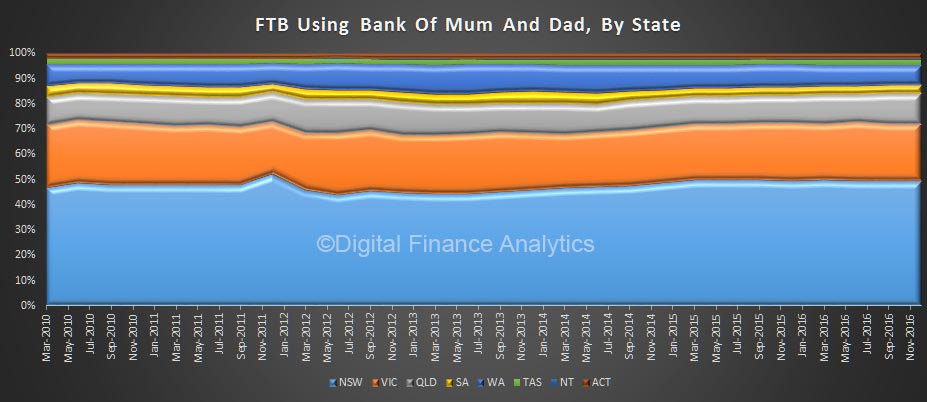

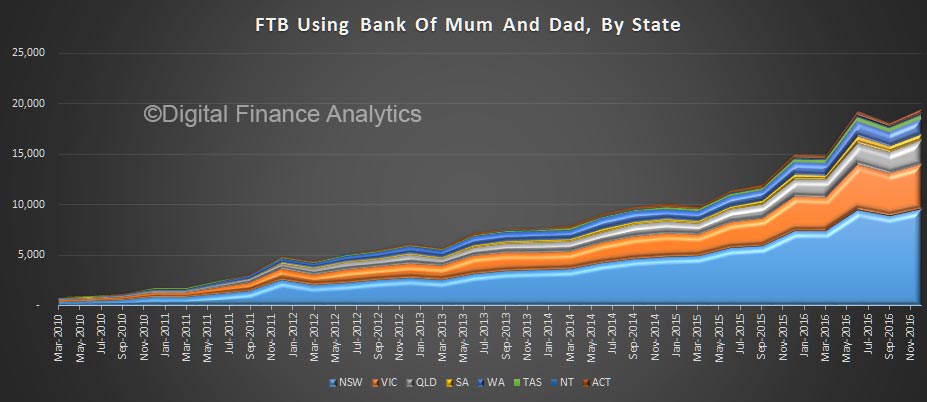

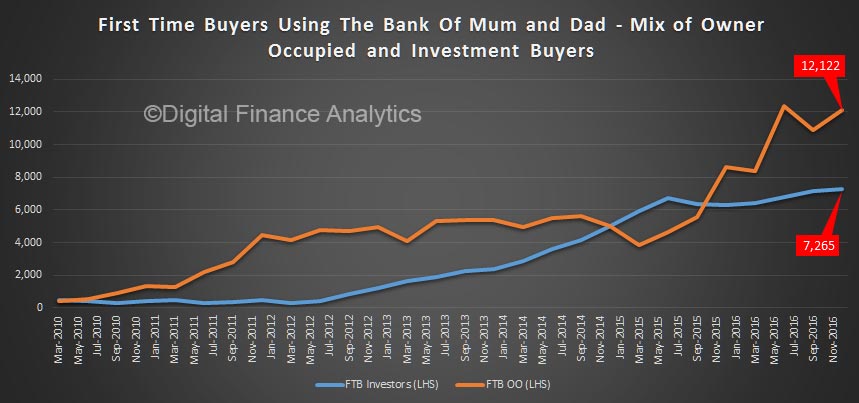

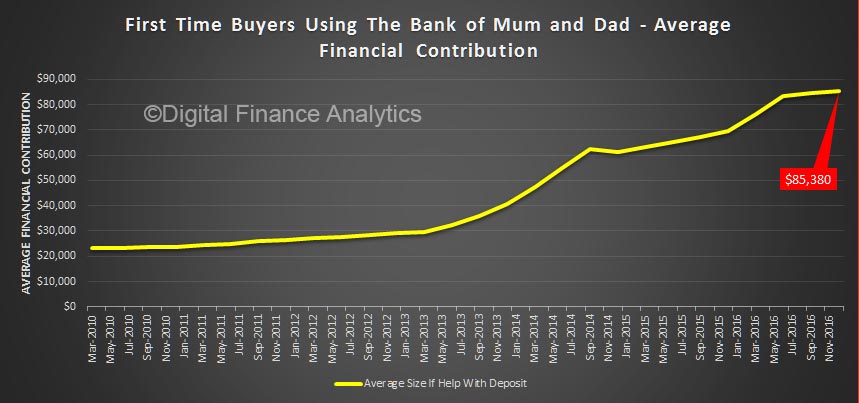

We also featured research on the Bank of Mum and Dad, now a “Top 10” Lender in Australia. Our analysis shows that the number and value of loans made to First Time Buyers by the “Bank of Mum and Dad” has increased, to a total estimated at more than $20 billion, which places it among the top 10 mortgage lenders in Australia. Savings for a deposit is very difficult, at a time when many lenders are requiring a larger deposit as loan to value rules are tightened. The rise of the important of the Bank of Mum and Dad is a response to rising home prices, against flat incomes, and the equity growth which those already in the market have enjoyed. This enables an inter-generational cash switch, which those fortunate First Time Buyers with wealthy parents can enjoy. In turn, this enables them also to gain from the more generous First Home Owner Grants which are also available. Those who do not have wealthy parents are at a significant disadvantage. Whilst help comes in a number of ways, from a loan to a gift, or ongoing help with mortgage repayments or other expenses, where a cash injection is involved, the average is around $88,000. It does vary across the states. But overall, around 55% of First Time Buyers are getting assistance from parents, with around 23,000 in the last quarter.

There was also research this week LF Economics which showed that some major lenders are willing to accept a 20% “Deposit” for a mortgage from the equity in an existing property, and in so doing, avoided the need for expensive Lenders Mortgage Insurance.

Both arrangements are essentially cross leveraging property from existing equity, and is risky behaviour in a potentially falling market. More evidence of the lengths banks are willing to go to, to keep their mortgage books growing. We think these portfolio risks are not adequately understood.

So, we conclude that banks are caught between trying to grow their books, in a fading market, by offering cheap rates to target new borrowers, and accept equity from existing properties, thus piling on the risk; while dealing with rising overseas funding, and in a flat income environment, facing heightened risks from borrowers as they join the 200% club.

That’s the Property Imperative Weekly to 20 January 2018. If you found this useful, do leave a comment, subscribe to receive future updates and check back for our latest posts. Many thanks for watching.