Calculating how much capital banks should hold is often a bone of contention between regulators and banks. While there has been considerable progress on reaching consensus on an international standard, one key issue remains unresolved. This is a proposal to establish a “floor,” or minimum, for the level of capital the largest banks must maintain.

Some financial institutions and national authorities question the need for a “floor,’’ arguing either that differences in business models or other elements of the global regulatory framework—notably limits on the amount of leverage banks may take on—make them redundant. We disagree. The floor reduces the chances that banks can game the system to reduce their capital buffers to levels that aren’t aligned with their risks. It is an essential element of global efforts to create a level playing field for banks operating across countries by strengthening common standards for regulation, supervision and risk management.

Why is the issue of calculating capital levels so important? Bank capital serves as a buffer available to absorb losses. When capital is depleted, deposits and other borrowed funds are put at risk, and this can lead to bank runs, bank failures and wider systemic distress. Banks should hold capital commensurate with the business risks they take and the risks they pose to the wider system.

Key element

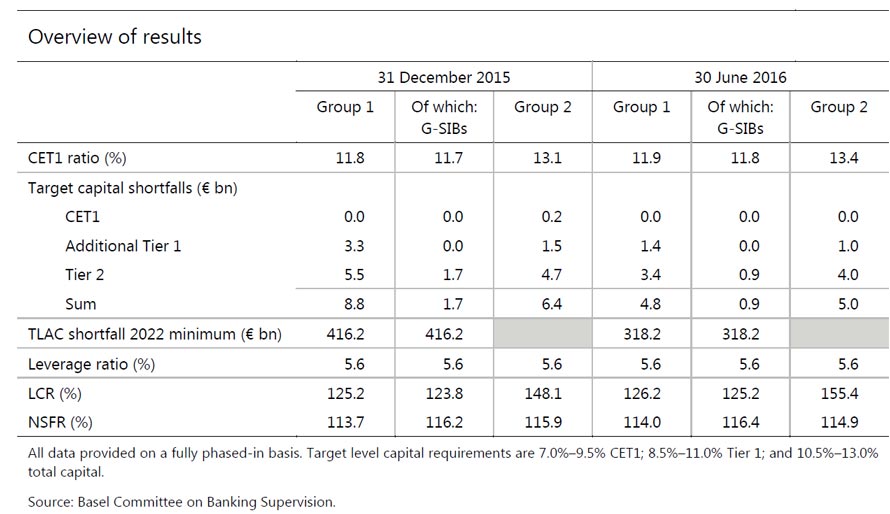

The Basel Committee on Banking Supervision, which brings together regulators from 28 countries, establishes rules governing the appropriate level of capital. The current version of these rules, known as Basel III, is a key element of the international regulatory reform agenda put in motion following the global financial crisis of 2008.

Adopted in late 2010 for implementation over a seven-year period, Basel III has led to a significantly safer financial system. Not only are banks capitalized with more and higher-quality capital than before, they also meet new standards for liquidity risk (ensuring banks hold enough liquid assets to meet maturing liabilities in times of stress) and limits on leverage (how much banks can borrow relative to their capital.)

The largest global banks have been gradually allowed to use their own internal models to calculate capital needed for different types of risk. The Basel Accord of 1988, known as Basel I, used only standard risk weights provided by supervisors. In 1996, some banks were allowed to develop their own, internal models for evaluating market risk.

Safety net

Basel II, adopted in 2004, introduced both a standardized approach (similar to Basel I but using risk weights based on external credit ratings) and an internal ratings-based approach (based on banks’ own internal models). But it added a wrinkle: banks had to apply both approaches for a period of two to three years before being fully reliant on their internal models. And, in addition, capital levels had to be at least as conservative as a “floor” equivalent to 80 percent of the level calculated from standard risk weights.

The floor serves as a safety net to internal risk-based approaches. It gives banks and their supervisors time to intervene should changes be needed before signing off on the use of full-fledged internal models. Basel III kept the internal models from Basel II, but it did not keep the floor. The Basel committee now seeks to reintroduce the floor.

Why is the issue contentious? In testing whether the new method was being applied consistently across institutions in different countries, the Basel Committee found that banks with similar portfolios came up with very different capital requirements when they used internal models. This raised the possibility that some banks were underestimating the risks or gaming the models to deliver outcomes that required less capital. Hence addressing risk weight variability became a top priority.

To solve this problem, the Basel Committee considered several proposals:

- Revising the standardized approach to better capture the riskiness of bank assets, making it a better complement to the internal risk-based approach;

- limiting the use of the internal risk-based approach; and

- implementing a floor to mitigate internal model risk and to make it easier to compare outcomes across banks.

The floor—though not new—would become a more permanent feature of the enhanced Basel III capital framework, based on the revised standardized approach. This approach offers the best of both worlds: the flexibility of the internal models combined with the minimum standard represented by the floor.

The discussion raging now is whether there is a need for a floor, given that the leverage ratio established under Basel III serves already as backstop. And if there is a floor, should it be set at 80 percent, as specified in Basel II, or some other level?

Banks’ concerns

Some banks using internal models worry that their capital requirements could go up if these floors were applied, which would reduce their profitability. The governing body of the Basel Committee, however, has emphasized that the enhancements to Basel III should not lead to a significant, overall increase in capital requirements across banks.

It is our view that the risk-weighted capital adequacy ratio, leverage ratio and output floors are all essential elements of a robust capital framework:

- The capital adequacy ratio relates risk to capital, but it is complex and makes it difficult to compare capital outcomes among banks.

- The leverage ratio constrains the overall ability of the bank to grow its balance sheet out of proportion to capital. It is not risk sensitive but is simple to calculate and provides a backstop to the risk-weighted capital ratio.

The floor addresses the risk that a model may not perform as expected when banks use it to calculate capital. It allows banks to continue using more risk-sensitive approaches but constraints any unwarranted capital relief, while also making it easier to compare institutions through disclosure of the standardized approach outputs.

While we welcome the additional risk sensitivity that internal models bring, we remain cautious about their unconstrained use. Supervisory capacity to ensure effective prudential oversight of internal models remains a work in progress. At the same time, banks will always have incentives to game the models and reduce the amount of capital they hold. Indeed, a recent study by Federal Reserve economists finds manipulation of risk weights to be widespread.

Well-capitalized banks are more likely to lend to the real economy and less likely to indulge in excessive risk-taking that could threaten the stability of the financial system. This only strengthens the case for a robust capital framework.

Properly calibrated and carefully phased, the Basel III enhancements of a floor on risk models can help prevent excessive variability in capital outcomes and allow for meaningful comparison across institutions and countries, while still permitting for risk sensitive approaches to take hold. The capital floor is a linchpin of this system.

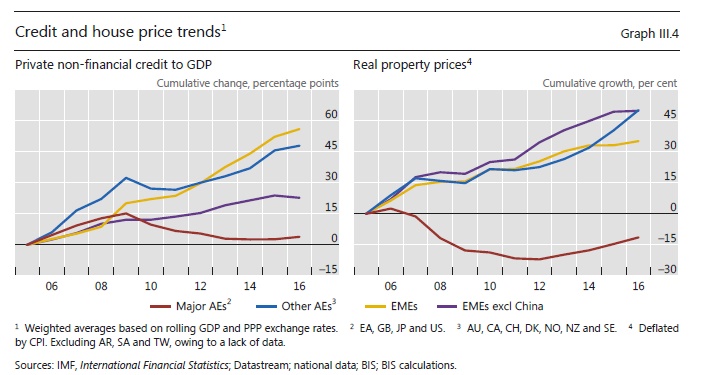

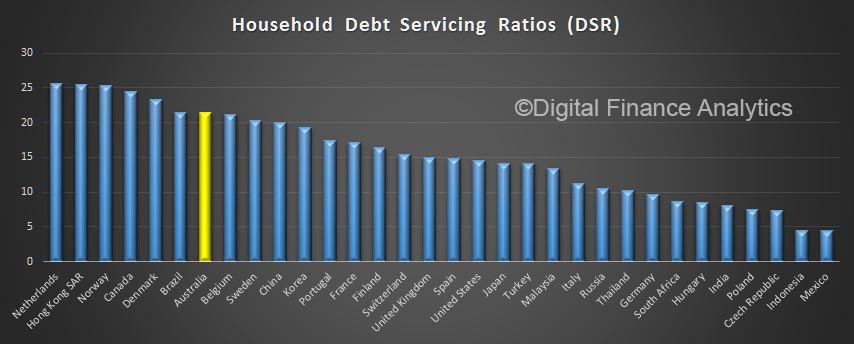

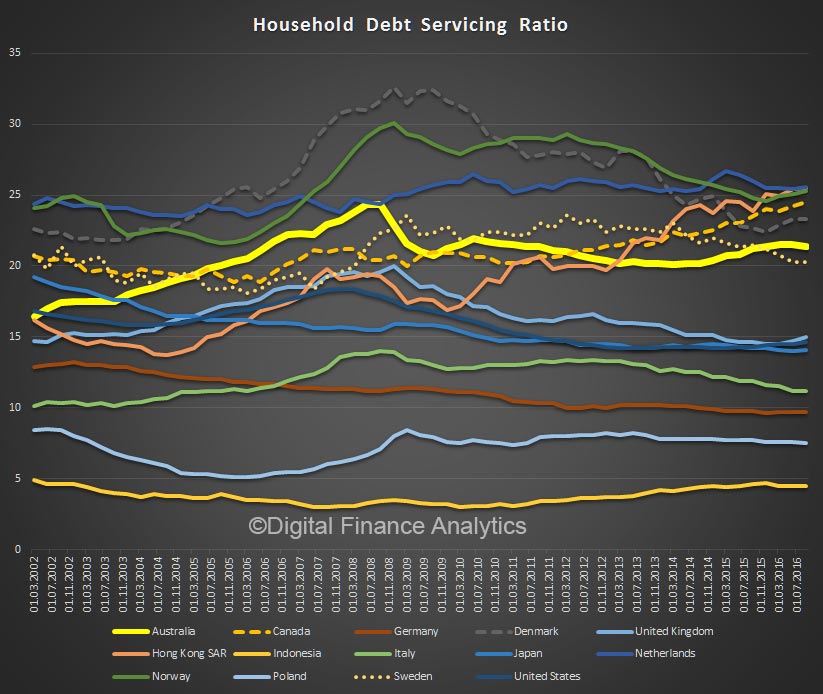

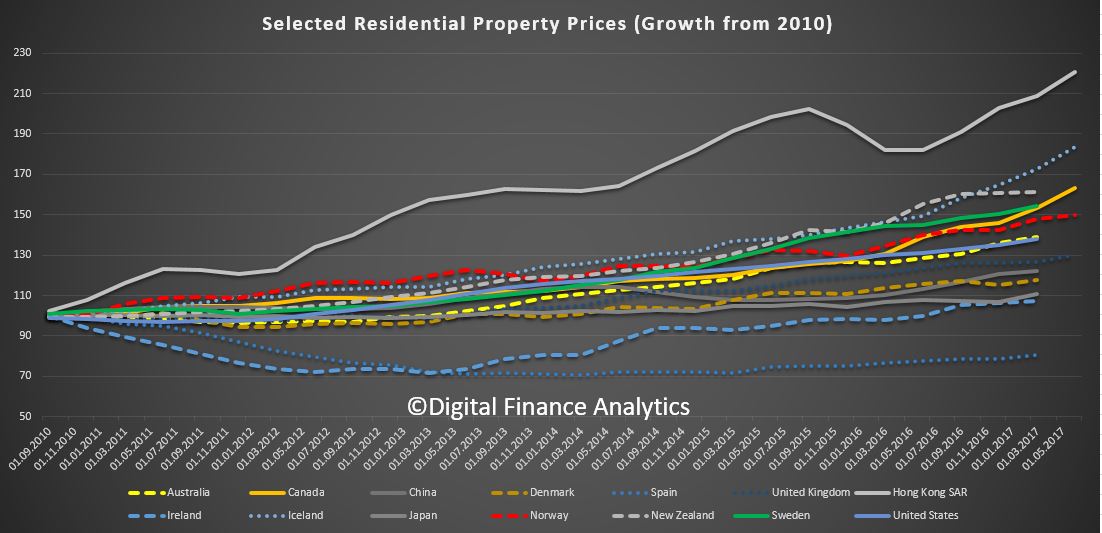

Hong Kong has the strongest growth, and New Zealand and Canada are both well ahead of Australia. We track quite closely with the USA. Spain sits at the bottom of the selected series.

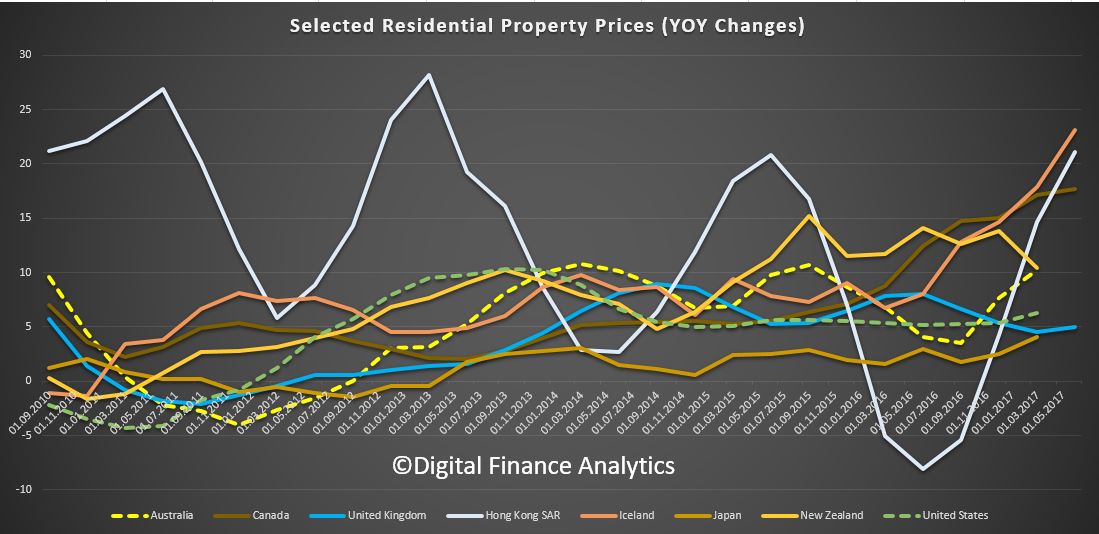

Hong Kong has the strongest growth, and New Zealand and Canada are both well ahead of Australia. We track quite closely with the USA. Spain sits at the bottom of the selected series. Two observations. First home price growth is not just a local issue – as we discussed recently there are a range of complex factors driving asset prices higher.

Two observations. First home price growth is not just a local issue – as we discussed recently there are a range of complex factors driving asset prices higher.