An interesting research paper from the Economic Research Department RBA “The Effect of Zoning on Housing Prices” is worth reading.

Overall, they suggest that development restrictions (interacting with increasing demand) have contributed materially to the significant rise in housing prices in Australia’s largest cities since the late 1990s, pushing prices substantially above the supply costs of their physical inputs.

Overall, they suggest that development restrictions (interacting with increasing demand) have contributed materially to the significant rise in housing prices in Australia’s largest cities since the late 1990s, pushing prices substantially above the supply costs of their physical inputs.

Although differences in the value of dwelling structures and the physical value of land account for some of the variation in average housing prices across the four cities, zoning effect estimates account for the majority of the differences.

There is also a large gap opening up between apartment sale prices and construction costs over recent years, especially in Sydney. This suggests that zoning constraints are also important in the market for high-density dwellings.

They estimate that zoning restrictions raise detached house prices by 73 per cent of marginal costs in Sydney, 69 per cent in Melbourne, 42 per cent in Brisbane and 54 per cent in Perth.

This is not the amount that house prices would fall in the absence of zoning. Physical land costs are higher in Australian cities (particularly Sydney) than overseas. So even if zoning restrictions were relaxed, housing in Australia would remain expensive relative to cities where zoning is permissive and land is less physically scarce.

Using data from CoreLogic and some supply/dremand modelling they track the difference between the average (or market) price and the marginal (or physical) value of land. Some government policies, – “zoning”, restrict the supply of housing.

Examples include minimum lot sizes, maximum building heights and planning approval processes. Although these restrictions may confer benefits, they also raise the price of housing. This paper attempts to quantify the effect of zoning on housing prices in Australia’s four largest cities.

Anecdotal evidence suggests that zoning can have a huge effect on land values. For example, a 363 hectare site in Wyndam Vale (40 km west of Melbourne) increased in value from $120 million to $400 million following its rezoning from rural to residential (Schlesinger and Tan 2017). Examples like this are common – Appendix A provides more. Such large increases in values as a result of zoning changes are inconsistent with the view that a physical shortage of land itself is the main cause of high land values and housing prices – and instead point towards a high ‘shadow price’ of government permission to build dwellings as a likely explanation. It is difficult, however, to gauge how representative these anecdotes are, or to analyse how they change over time or place.

To estimate the effect of zoning, we consider the cost of a marginal increase in the number and density of dwellings for a given area and given population (hence a reduction in average household size). This means that we do not include the costs involved in increasing the footprint or size of a city, such as provision of extra roads and utilities, as a cost of supplying housing.

Figure 2 shows a decomposition of property prices back to 1999. To extend our estimates of structure value back in time, we adjust the estimates from Table 1 by movements in the producer price index (PPI) – output of house construction series for each city’s corresponding state, and by movements in the average floor area of houses sold in each city. To estimate the value of physical land over time, we estimate separate regressions for each year back to 1999.

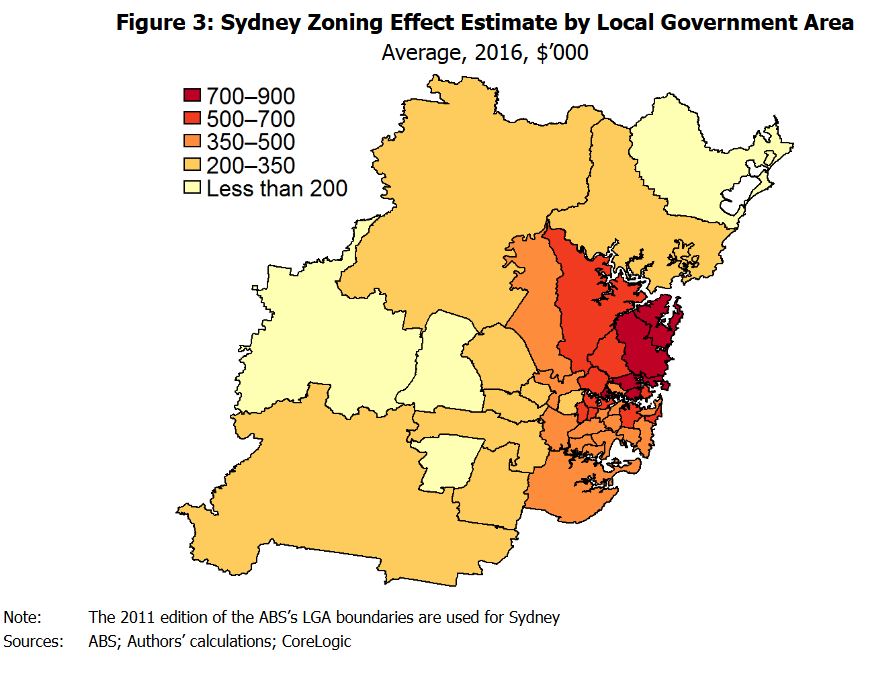

Figures 3–4 show estimates of the zoning effect for the average property in local government areas (LGAs). We split property prices into structure values and land values in each LGA, using the CoreLogic data on property prices and the valuer general estimates for land values for each LGA (as this allows structure value to vary across LGAs for reasons other than just floor area).19 We then estimate physical land values by running separate hedonic regressions for each LGA of the form of our large regression in Section 4.20 Our estimate of the zoning effect by LGA is then the remaining portion of land value not accounted for by the physical value.

If housing demand continues to grow, as seems likely, then existing zoning restrictions will bind more tightly and place continuing upward pressure on housing prices. Policy changes that make zoning restrictions less binding, whether directly (e.g. increasing building height limits) or indirectly, via reducing underlying demand for land in areas where restrictions are binding (e.g. improving transport infrastructure), could reduce this upward pressure on housing prices.