The RBA released their credit aggregates to end January 2019 today, and the data confirms that lending growth continues to slow across home lending and personal credit.

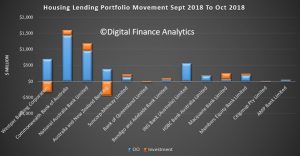

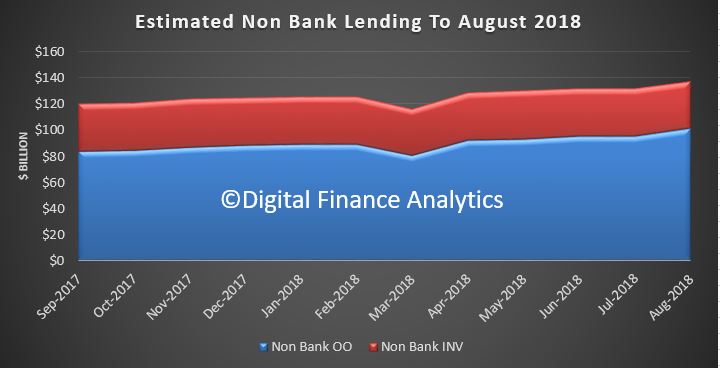

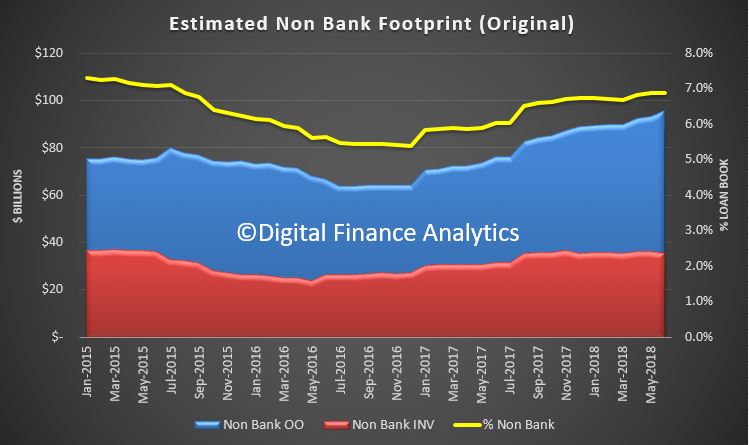

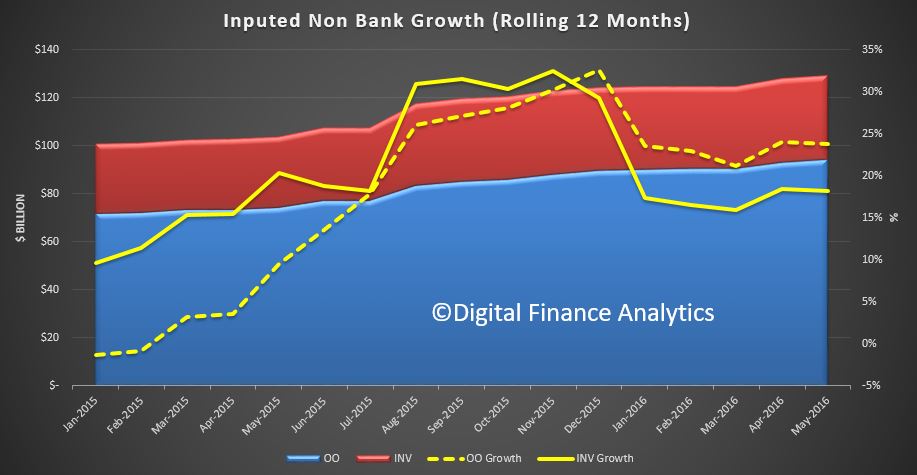

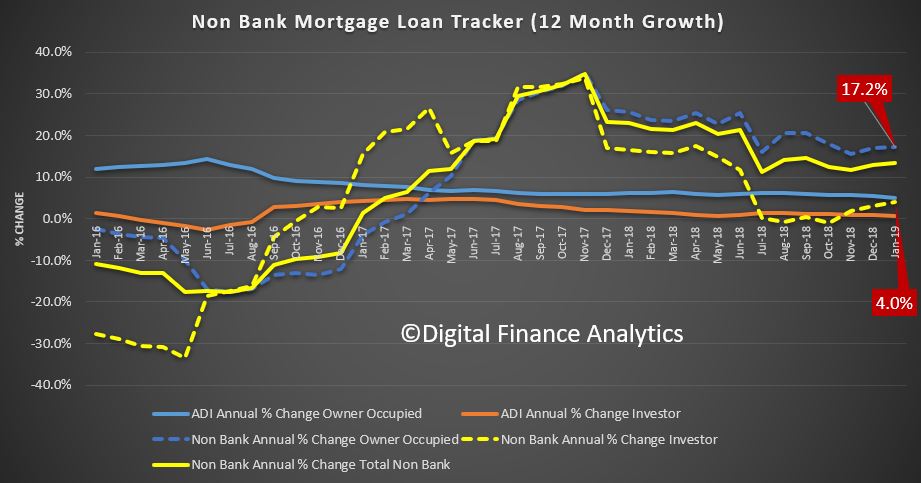

We will get to the detail shortly, but I want first to head to a comparison between the APRA data for the banks, also released today, and the total credit from the RBA.

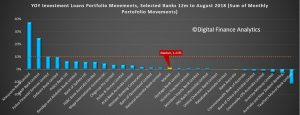

The gap between the two relates to the non-bank sector, and the fact is, despite all the funnies in the numbers, lending from the non-bank credit sector is booming. Owner occupied non-bank lending is growing at an annualised rate of 17.2% and lending for investment housing is 4%. Both well above the bank sector. This is unsurprising, given the different funding arrangements, and restrictions between the banks and non-banks. Of course both have responsible lending obligations, but evidence suggests non-banks are more willing to lend, at a price. APRA sort of has responsibility for the non-bank sector, but do not seem to be doing much to stem the tide.

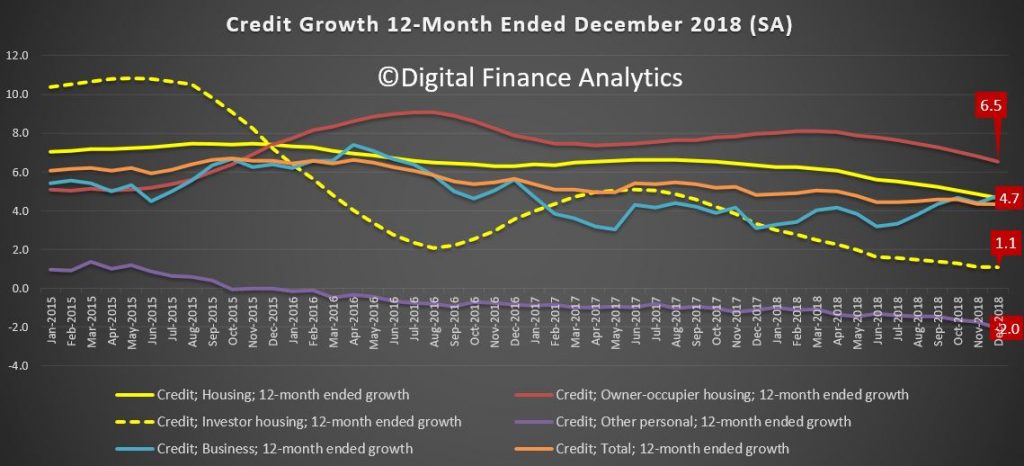

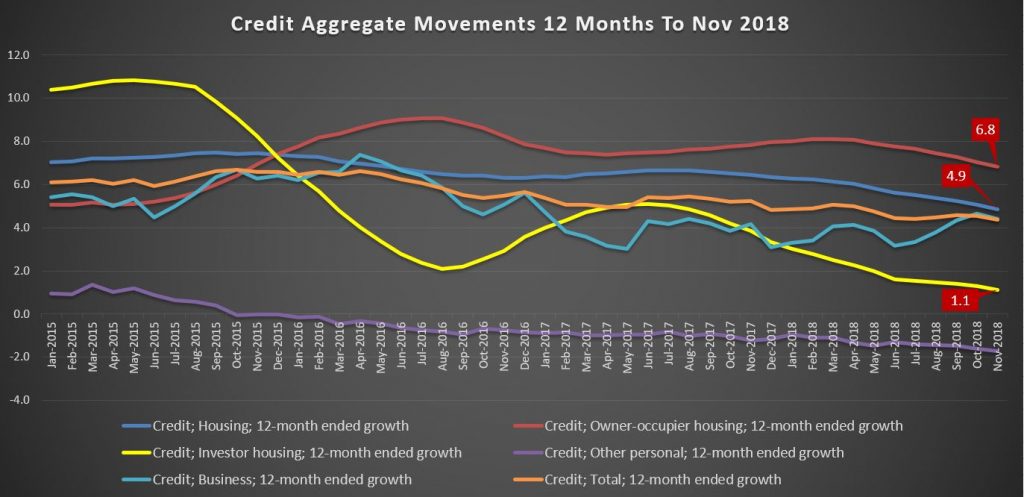

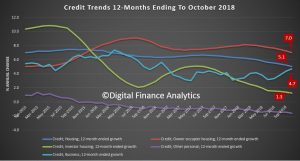

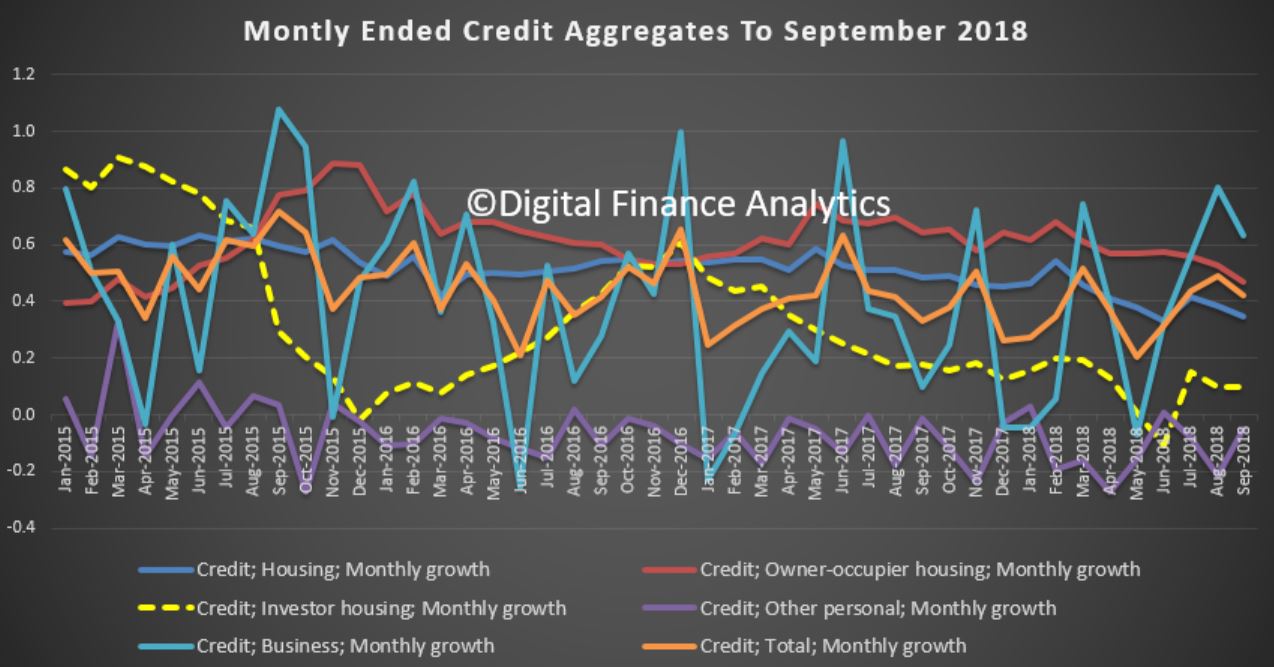

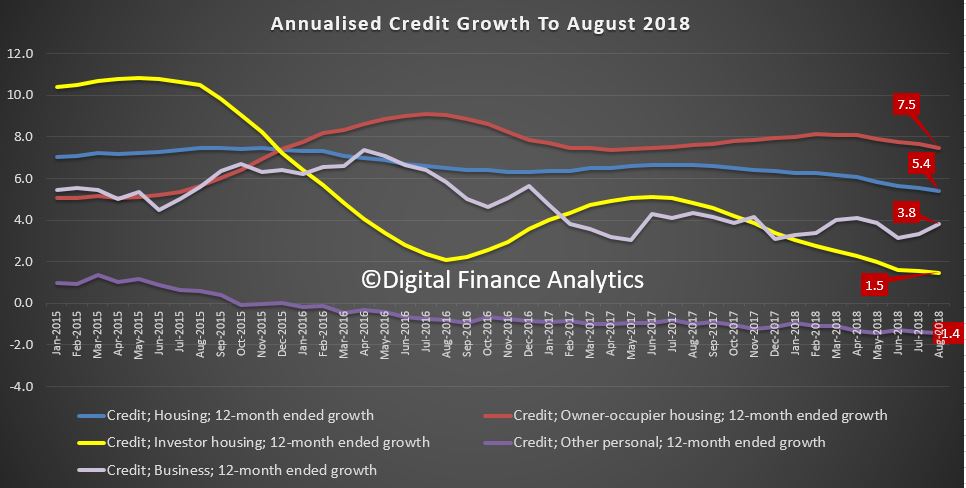

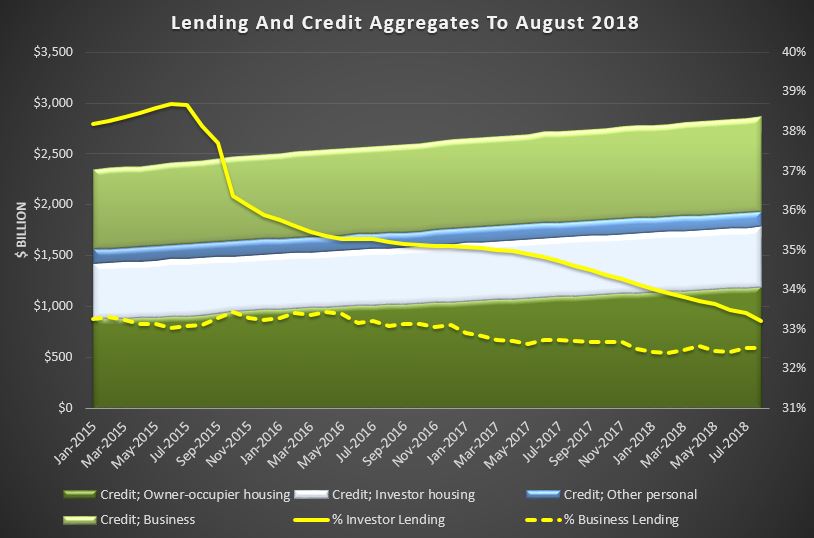

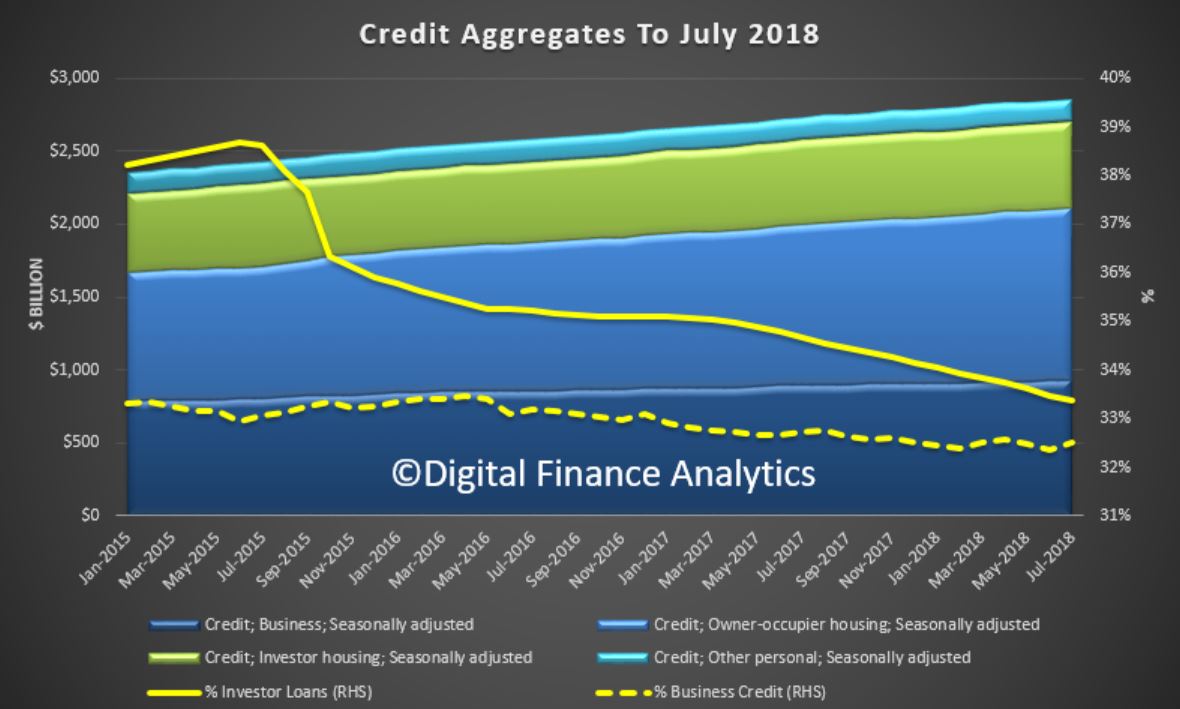

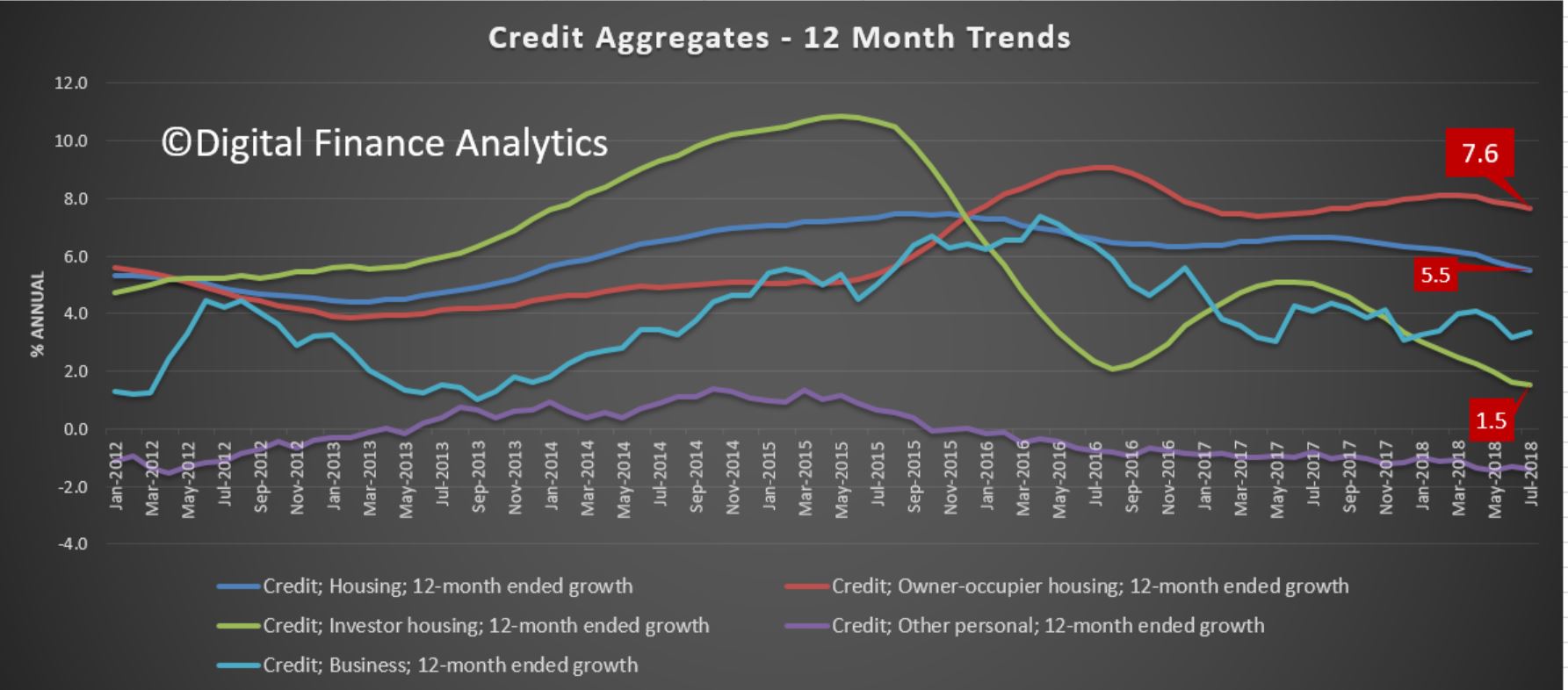

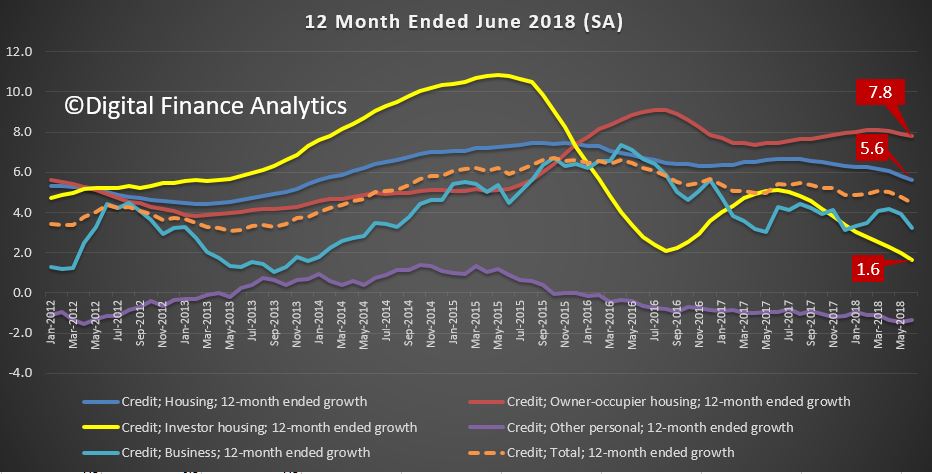

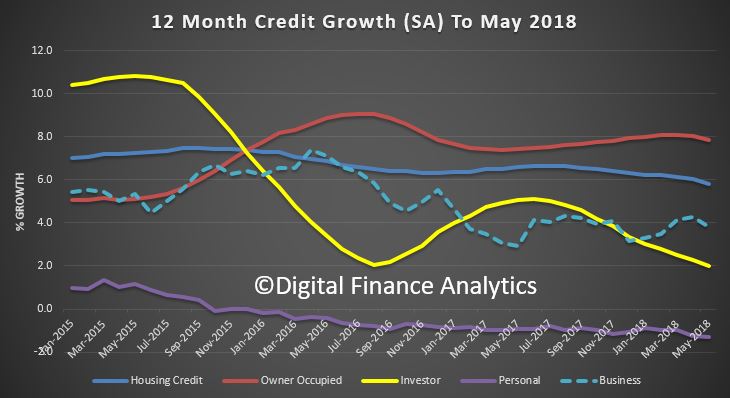

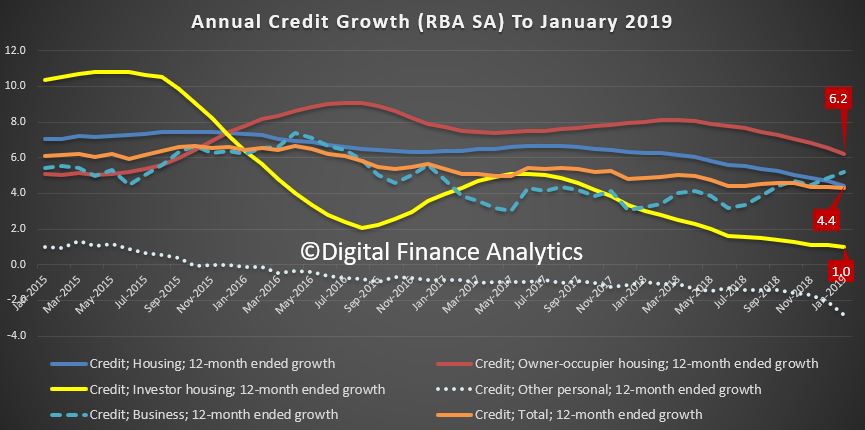

Meantime, the RBA lending aggregates shows that annual owner home lending now stands at 6.2%, investment lending at 1% and overall credit growth is 4.4%. There was a considerable drop off in personal credit, and a rise in business lending.

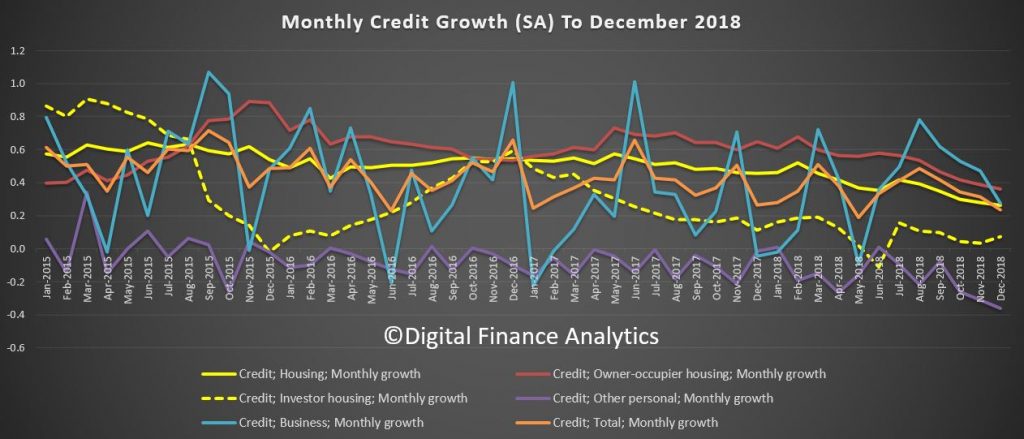

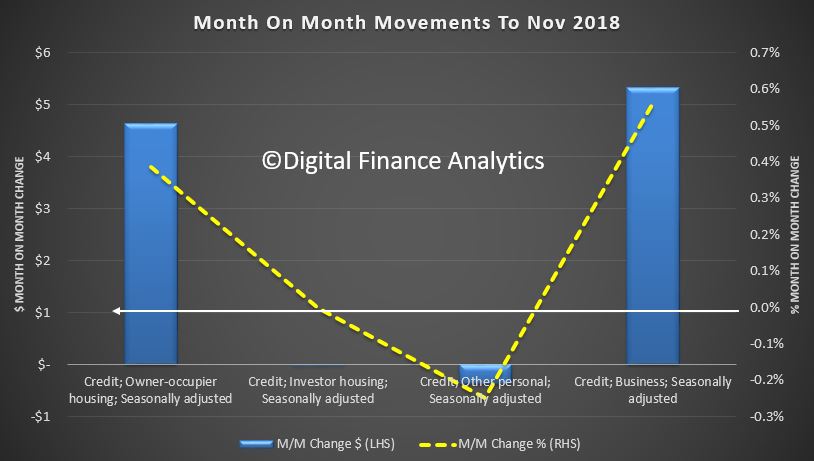

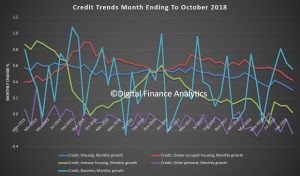

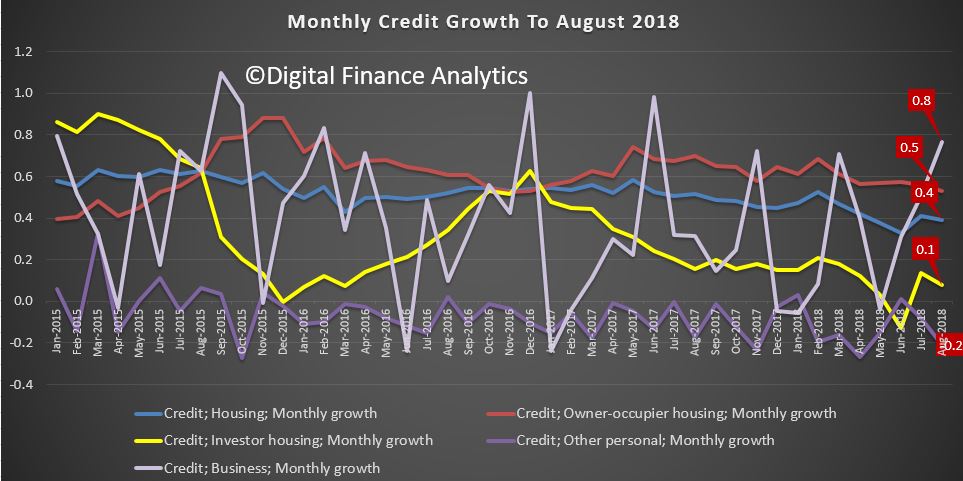

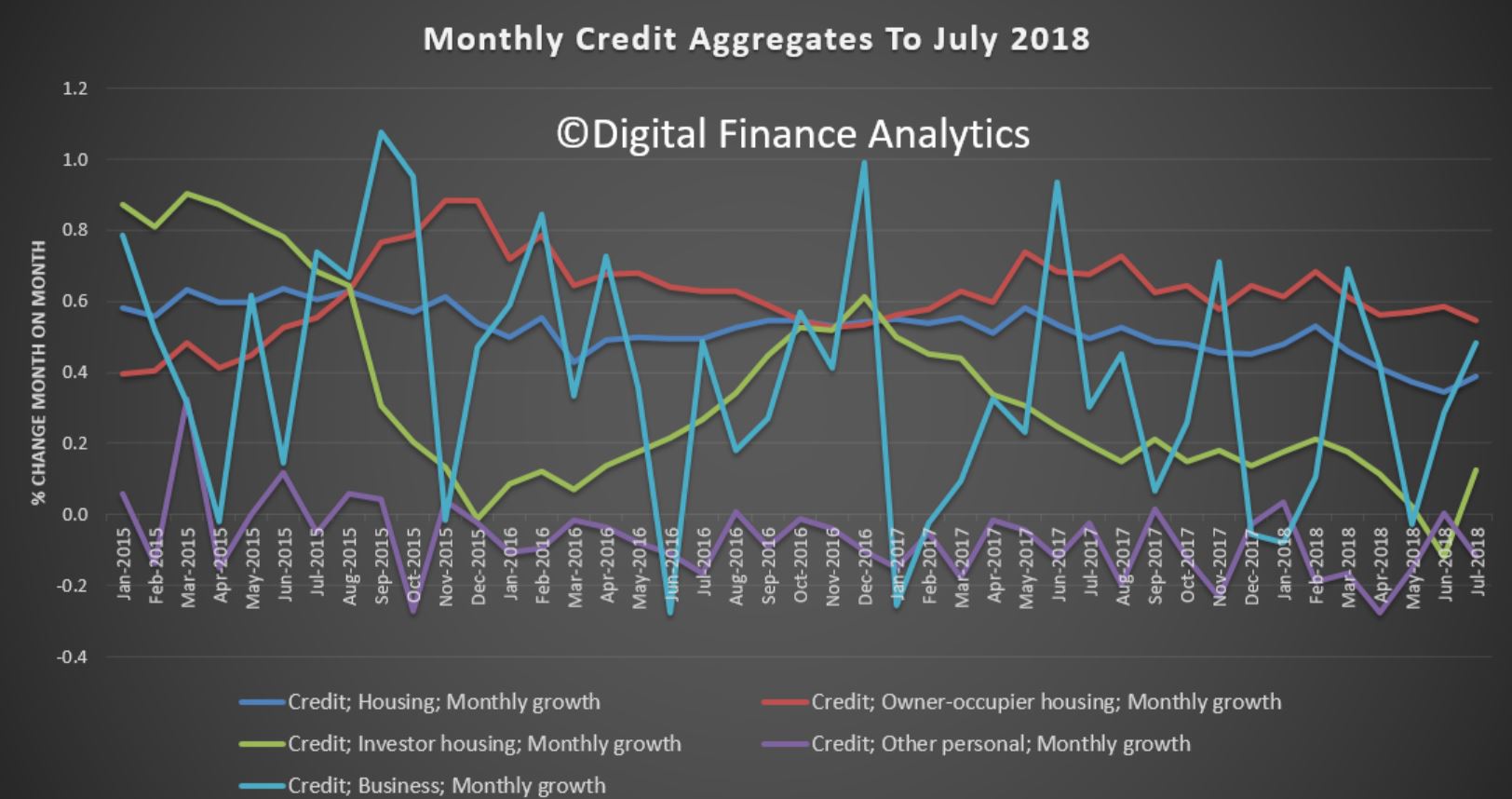

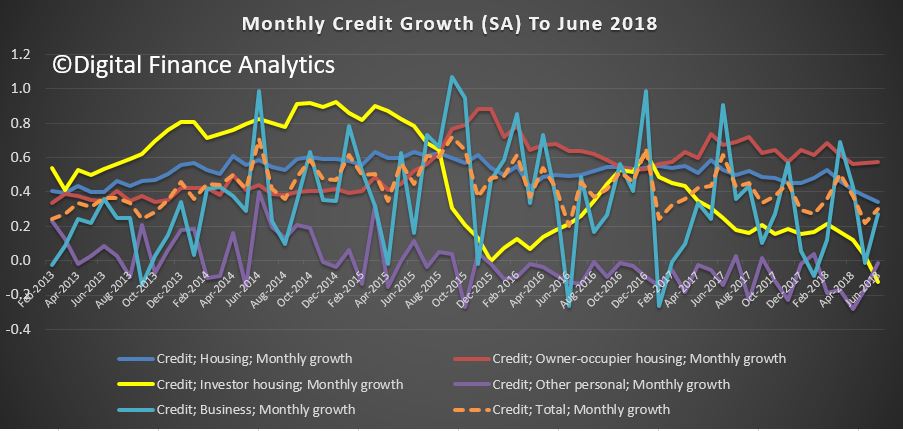

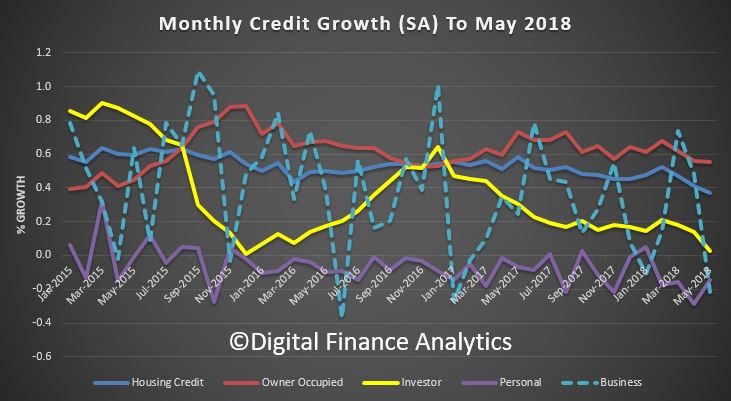

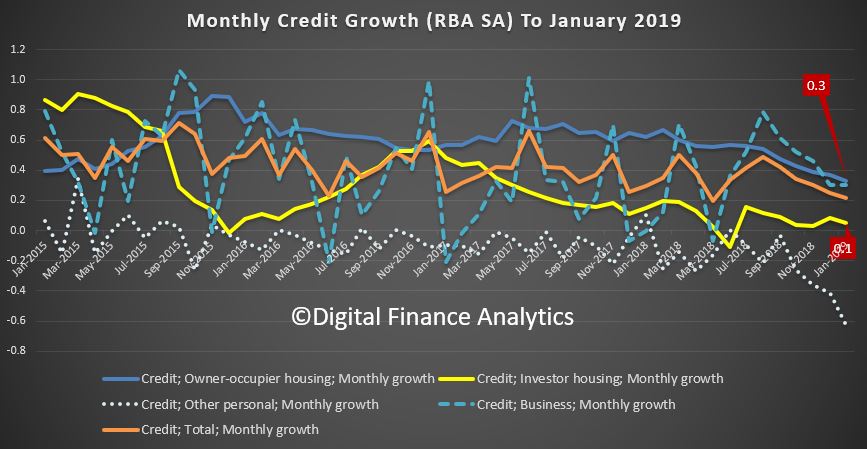

The monthly trends are more noisy, as expected.

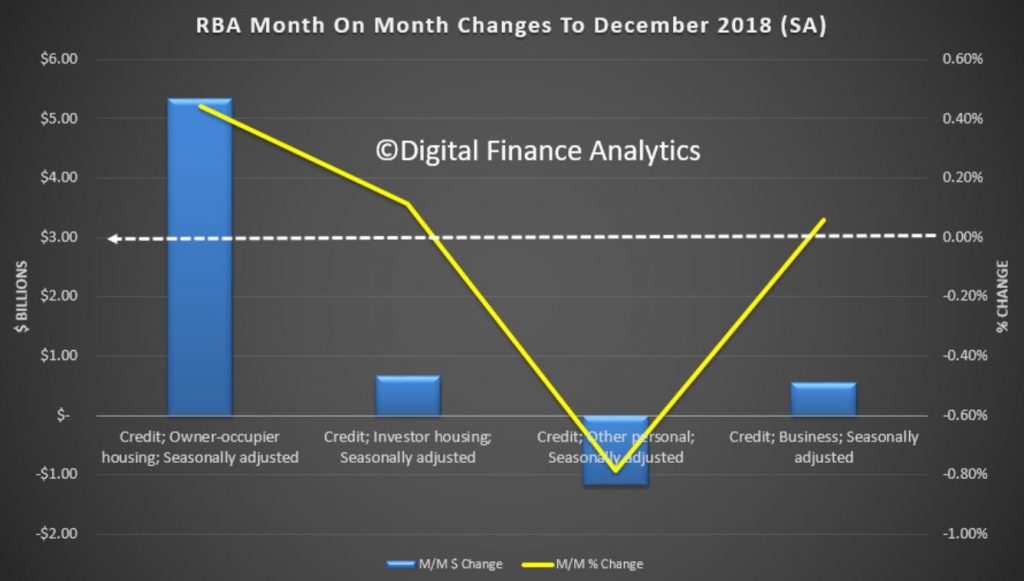

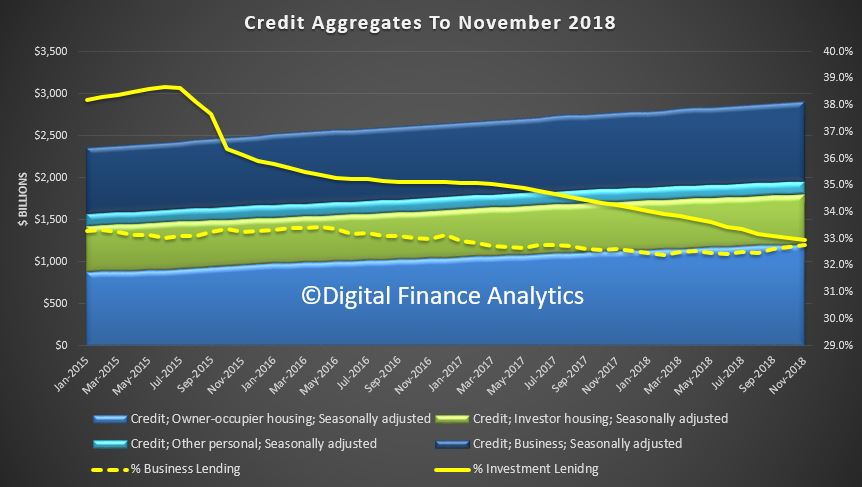

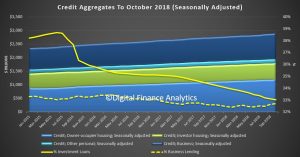

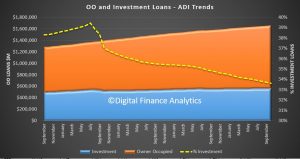

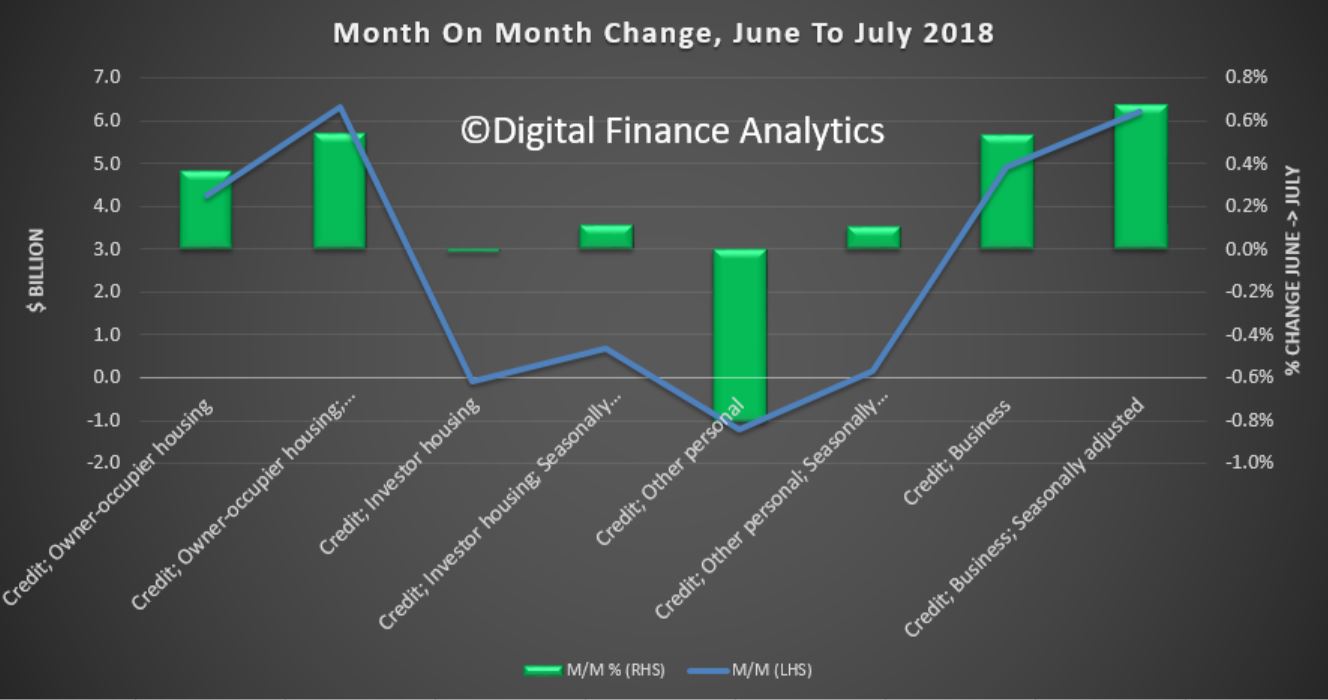

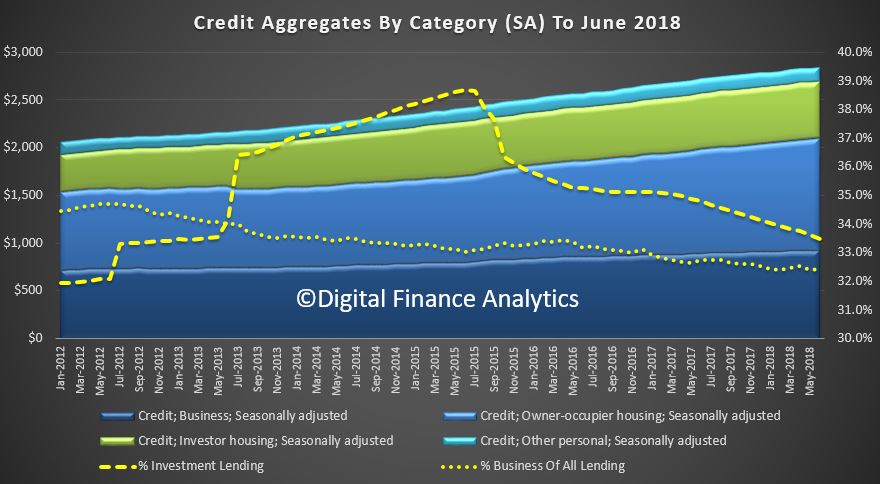

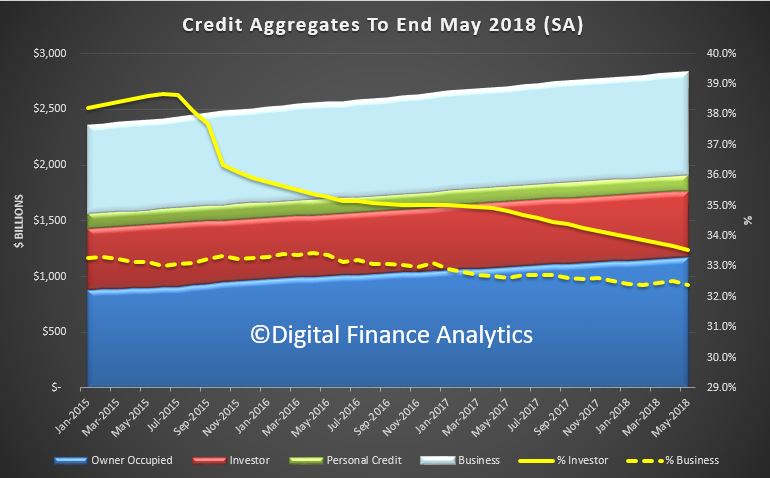

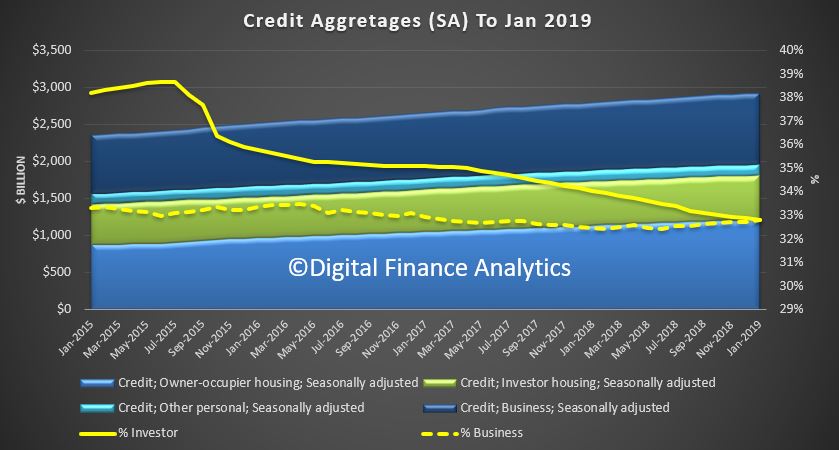

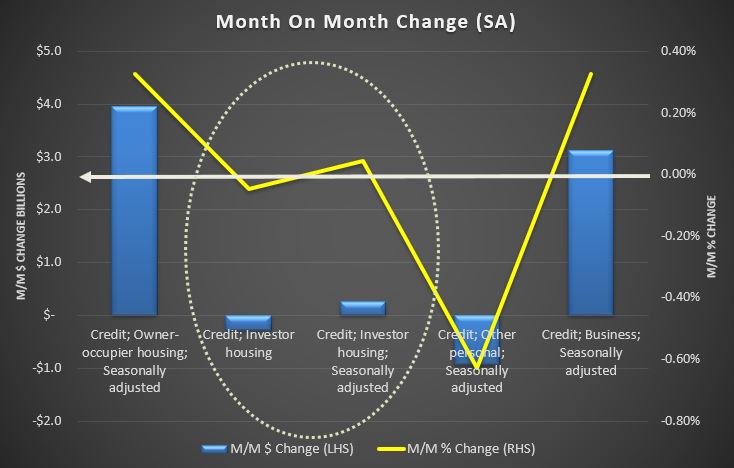

Turning to the credit stock, and using the seasonally adjusted figures, we see that overall credit still advanced. Total loans for owner occupation rose by $4 billion dollars to $1.22 trillion dollars, up 0.33% while loans for investors rose $0.3 billion seasonally adjusted to $594.6 billion dollars, up just 0.04%. Investment loans were 32.8% of the total, down slightly from last month.

Business credit rose by $3.1 billion to $956 billion, up 0.33% and comprised 32.8% of all lending, up a little from last month.

Personal credit fell by $0.9 billion dollars to $147.5 billion, down 1.15%,

Its also worth noting the seasonally adjusted figures overstates the investment lending by a net $0.6 billion dollars.

To me the slowing credit impulse is clear, as is the worrying rise in non-bank lending. Adopt the brace position!